Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

The comeback kid

I think we can all agree that NFTs won’t undergo the same explosion we saw last cycle.

That’s not, of course, to say that NFTs can’t make a comeback of any sort. But it looks like we won’t see CryptoPunk #5822 fetch another $23 million (8,000 ETH at the time) like it did a few years ago.

(For reference, in the past 24 hours, CryptoPunk #8135 sold for a cool 29 ETH, or $71,000, per CryptoSlam.)

OpenSea CEO Devin Finzer told me at Permissionless that this time will be a little different. And part of that, he said, is the utility behind NFTs.

“The technology has just been getting better and better,” since the last boom, he said on a panel.

The previous cycle caused some issues, even with the demand. Gas fees, among other things, were pain points for consumers who wanted to simply purchase an NFT. Finzer said that they’ve “solved” a lot of those problems since 2021.

“Now you can build all of the cool stuff that we’ve always dreamed of building because…scaling is here on Ethereum, for example,” he explained. Though OpenSea continues to work on onboarding and user experience, he said.

Admittedly, it seems already that any sort of NFT comeback is going to appear vastly removed from what we saw in 2021. Not just anyone is going to be able to create and successfully sell off an NFT.

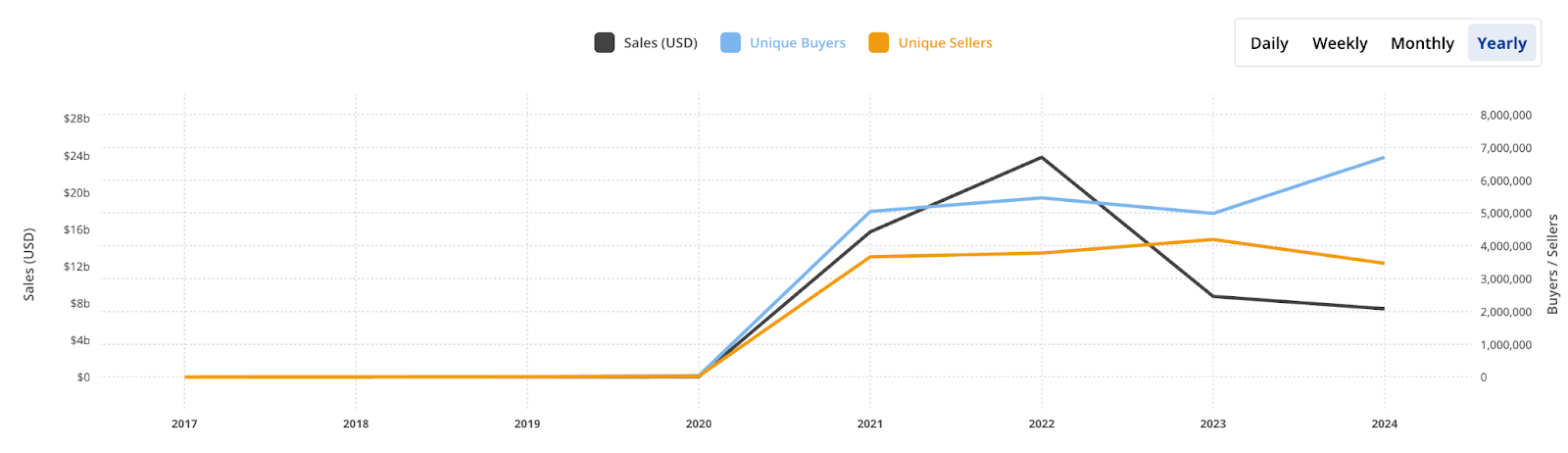

Source: CryptoSlam!

Finzer said that he’s looking at transaction and user counts to monitor momentum, putting transaction volume to the side. Overall, Finzer said the space is showing a lot of “momentum.”

For example, three use cases are becoming abundantly clear this time around: gaming, physical collectibles tied to a digital collectible, and tokenizing real-life objects (like Galaxy tokenizing a famous violin).

“Gaming’s probably the [use case] I’m most bullish on,” Finzer told the crowd at Permissionless. In a close follow-up, Finzer said he’s keeping an eye on physical assets, which encompasses both tokenized real-life items and digitizing certain things such as tickets.

Ubisoft’s announcement of a crypto game — Champions Tactics — that’ll launch later this month shows that perhaps gaming, a segment that didn’t flourish when Bored Apes were selling for millions, shows how demand has shifted. The page for the game notes that 75,000 playable characters, or Champions, have been minted.

Not to mention that Off the Grid, another crypto game, which climbed to the top of the charts in the Epic Games store.

But there’s one other storm cloud over NFTs right now, and that’s the Securities and Exchange Commission, which sent OpenSea a Wells notice a few months ago, though no lawsuit’s been filed yet.

Finzer hopes that the momentum isn’t stymied by any potential regulatory action, given that OpenSea, among others, is “ready to go and fight if push comes to shove.”

“No news on that,” Finzer told me when I asked if they’d heard from the regulator since the notice.

As for where we end up over the mid-term, Finzer said that he expects a “wild” few years. “In five years, I think we’ll all be living in the metaverse potentially,” he said.

If that’s the case, I just hope my mortgage is cheaper.

— Katherine Ross

Data Center

- BTC and ETH have broken upwards this morning, climbing over 3% to monthly highs of $64,800 and $2,530 apiece.

- SUI set a new price record of $2.35 on Sunday evening, having gained 15% in the past week. It has since retraced slightly to $2.24 (mcap: $6.19 billion).

- Base transaction counts have also hit a new peak, per Blockworks Research data: 40.82 million in the past week, up over 17% from the previous period. Trading bots including Banana Gun are leading gas consumption on the network, alongside AMM Aerodrome.

- Base’s TVL has hit a new record of $2.455 billion, up 54% in the past month.

- Bitcoin is the second-most popular venue for NFT trading in the past month after Ethereum: $67.2 million volume vs. $107.8 million.

Off the Grid, on the chain

Off the Grid — one of the first true AAA games infused with crypto — is a ballsy experiment worthy of your attention.

I spent the weekend (and some of this morning) blasting through as many rounds as I could, earning what appears to be a stand-in tester cryptocurrency for every kill.

And yes, it’s actually fun.

The third-person shooter, from Ukrainian-German studio Gunzilla Games, throws the player into a battle royale set in a world ripped straight from dystopian action thrillers Elysium, Chappie and District 9.

Which is to be expected: Director Neill Blomkamp co-founded the studio and serves as its creative chief.

It’s a cool twist on the genre made big by PUBG, Fortnite and Warzone. The lore goes that players have their limbs surgically removed to compete on the hyper-violent Teardrop Island — to be replaced by mechanized arms and legs fitted with all sorts of weaponry, from swords and shields to drones and poison gas.

Freedom of movement is where Off the Grid really shines. Jetpacks are standard — so lots of zooming between buildings, cranes and other climbables — while legs can come loaded with ultra-speed or mega-jump capabilities.

It’s super fast-paced and smooth, although the PS5 beta does suffer from some optimization issues in the current version.

As for the crypto stuff: It’s not totally live just yet.

Weapons and other items like skins and clothing can be optionally minted NFTs and traded on the in-game marketplace for a native token, GUN. Just like a crypto version of the Steam marketplace.

Those mechanics run on an Avalanche subnet (through which transactions don’t eventually settle via the main Avalanche chain, as is the case with Ethereum rollups and mainnet).

Avalanche’s Blizzard Fund co-led a $30 million funding round in March for Gunzilla Games, alongside CoinFund.

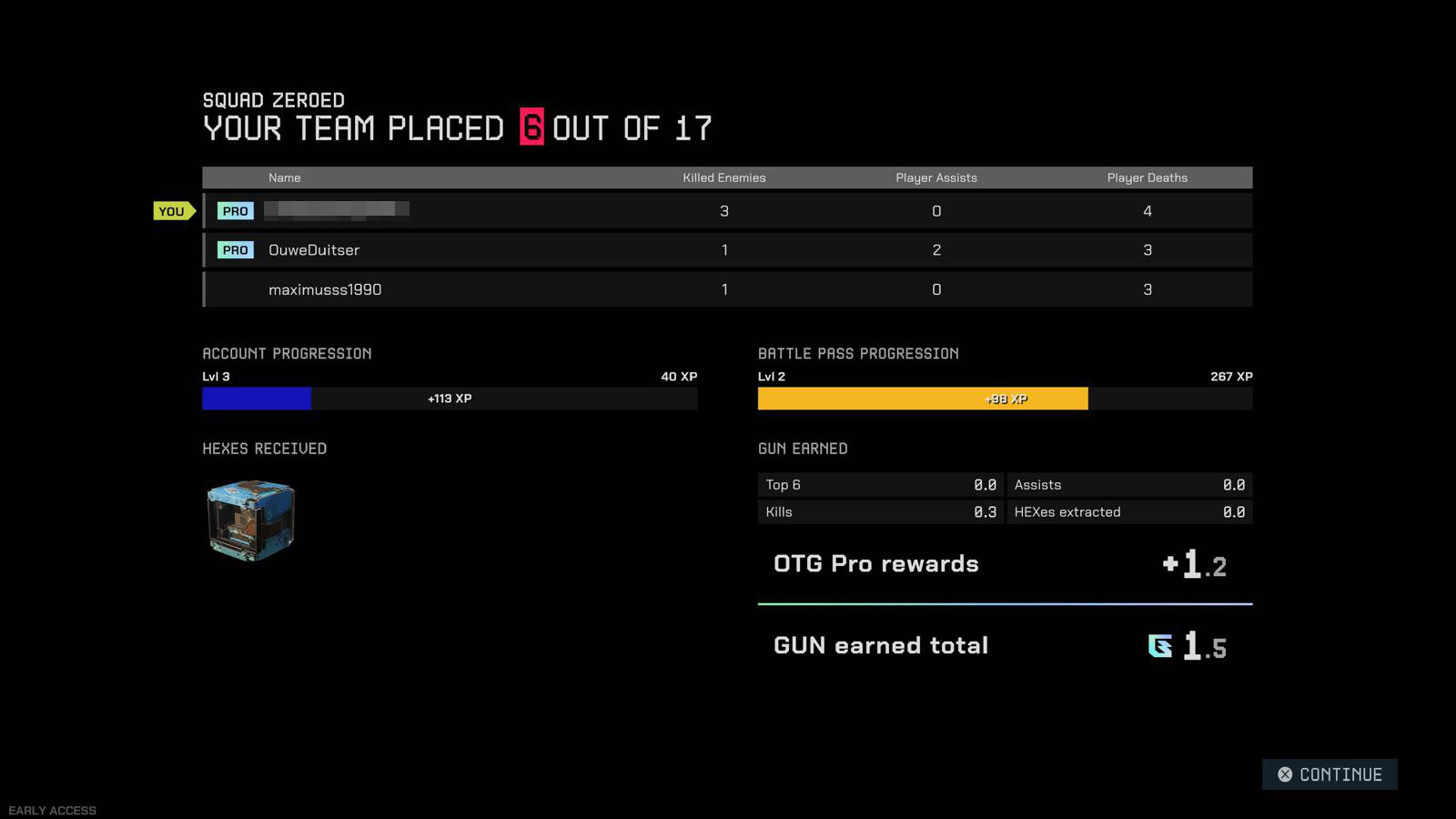

And you can indeed earn GUN for killing enemies, ranking highly in matches and extracting what’s known as HEX cubes — loot boxes that you can then sell for more GUN. Above average items go for around 80 to 100 GUN at the moment.

Three kills earned me 0.3 GUN, with an additional 1.2 GUN coming from the monthly battle pass subscription

For now, the GUN token payouts and NFT minting appear to still be occurring on a testnet version of Gunzilla Games’ subnet, GUNZ, although all early access progress is set to carry over to the full release. I reached out to the team to confirm and I’ll drop a note in a future edition with their answer.

Either way, the testnet has seen over three million transactions per day for the past three days running with 5.5 million wallet addresses — positively humming along. And in the future, items will be tradable as NFTs on OpenSea, denominated in the GUN token, which the team previously said it plans to list on centralized crypto exchanges.

Aside from maintaining Twitch attention, the real keys to success will be whether Off the Grid can stave off cheaters while maintaining balance in its crypto-economy as it ramps up.

In the meantime, who can argue with pwning noobs to earn crypto.

— David Canellis

The Works

- Avalanche Foundation struck a deal to repurchase nearly two million tokens sold to Terra’s Luna Foundation Guard, pending court approval.

- Arkham Intelligence is reportedly plotting to launch a derivatives exchange.

- Samara Asset Holdings is planning to issue a $30 million bond to buy up some bitcoin.

- Copper tapped former Goldman Sachs and SEC employee Amar Kuchinad as its new CEO.

- Horst Jicha, a German national accused of running a $150 million crypto scam, went poof from his New York City home while on a $5 million bond.

The Riff

Q: Are gamers coming around to crypto?

Off the Grid will be the best test of that to date.

To be clear, the game is very much still in beta. But there are already a slew of posts complaining about failed transactions for in-game stuff, and blockchain is, apparently, still very easy to blame.

One Redditor wrote:

“Why the hell does it take 15 tries of 15 different items before I can purchase anything on marketplace. Right now I can even buy anything on there like I been locked out by moderators for interfering on their stupid cryptocurrency scam they got going. Like what do u get by holding onto all the rarest items and preventing others from buying them. Only a handful of market gate holders have a majority of the valuable items and what does that get then at the end of the day a couple thousand dollars worth of savings in a video game they likely don’t even play. Fricken vultures man why don’t they just not use our market place to make crypto pennies and leave the gaming to gamers …”

Make of that what you will.

— David Canellis

It’s too early to tell.

I don’t think gamers necessarily have anything really against crypto (though, understandably, I think a lot of game developers have a bad taste in their mouth from previous iterations, but that’s a whole other can of worms).

The over-monetization of games can easily burn folks out. Remember back in 2017-2018 when loot boxes became more widely used, and therefore, controversial? I think folks just want to avoid that.

I’ll be honest with you, I’m an avid Sims player so I’m well aware of how much it sucks to continually sink money into a game. And I think it’s a fair concern for games with NFT functionality. But I hope that we’ve finally struck a fair balance.

No one’s gonna care if it’s a crypto game as long as it’s good, and doesn’t require you to drain your bank account to have a fun time.

Let’s be real, at the end of the day, the gameplay is what really matters.

— Katherine Ross

can i get cheap clomiphene tablets can you get cheap clomiphene without insurance where to buy clomid no prescription order cheap clomiphene pill clomid for sale uk how can i get generic clomid pill how to buy cheap clomid without prescription

This website really has all of the bumf and facts I needed about this subject and didn’t know who to ask.

order azithromycin 250mg – buy ofloxacin pills for sale order metronidazole 400mg online cheap

buy rybelsus pills – periactin 4 mg tablet buy cyproheptadine 4 mg

buy motilium 10mg online cheap – buy generic sumycin 500mg order cyclobenzaprine 15mg online

clavulanate over the counter – atbioinfo.com ampicillin online buy

order esomeprazole 20mg generic – https://anexamate.com/ buy nexium 40mg online

coumadin order online – https://coumamide.com/ cozaar 50mg ca

mobic for sale online – https://moboxsin.com/ purchase meloxicam without prescription

buy generic prednisone 20mg – https://apreplson.com/ deltasone 5mg us

buy pills for erectile dysfunction – https://fastedtotake.com/ blue pill for ed

order generic amoxil – https://combamoxi.com/ purchase amoxil for sale

purchase forcan generic – https://gpdifluca.com/ buy generic fluconazole 100mg

escitalopram order online – https://escitapro.com/# escitalopram 10mg ca

purchase cenforce without prescription – on this site purchase cenforce online cheap

is tadalafil available in generic form – https://ciltadgn.com/ cialis manufacturer coupon free trial

buy zantac online – https://aranitidine.com/ ranitidine sale

can you buy viagra over counter uk – voguel sildenafil 100mg viagra sale us

More articles like this would remedy the blogosphere richer. https://ursxdol.com/get-metformin-pills/

More content pieces like this would make the интернет better. https://prohnrg.com/product/atenolol-50-mg-online/

I am in fact thrilled to coup d’oeil at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://aranitidine.com/fr/acheter-cenforce/

This website positively has all of the tidings and facts I needed to this thesis and didn’t comprehend who to ask. https://ondactone.com/product/domperidone/

With thanks. Loads of knowledge!

celecoxib price

I couldn’t hold back commenting. Warmly written! https://myvisualdatabase.com/forum/profile.php?id=117930

dapagliflozin 10mg generic – dapagliflozin generic buy forxiga no prescription

xenical without prescription – https://asacostat.com/ orlistat 120mg without prescription