Mining Bitcoin sounds exciting—until you see the hardware bills and electricity costs. Cloud mining skips all that. You rent a slice of industrial mining farms and get rewards without running any rigs yourself. This guide explains how cloud mining works, what it costs, and whether it can actually make you money.

What Is Cloud Mining?

Cloud mining is a form of crypto mining where you outsource the process to a provider that runs large-scale mining farms.

In short, you rent computing power instead of buying machines. The company manages the hardware, electricity, and upkeep, while you earn a share of the coins mined. Think of it like cloud storage, but for mining power. This makes cryptocurrency mining possible for beginners, especially those without technical skills, cheap energy, or space for equipment.

Cloud Mining vs. Traditional Mining

Cloud mining differs from traditional mining because in the former you don’t buy or run your own mining hardware. Instead, you rent computing power from a provider.

With traditional setups, miners must purchase mining rigs, pay for electricity, and handle the hassle of operating mining hardware. They also face the ongoing cost of maintaining mining hardware and replacing outdated mining equipment, not to mention managing noise and heat with a proper cooling system.

In cloud mining, the entire mining infrastructure—machines, cooling, and power—is managed by the provider in secure data centers. You simply pay for hash power and receive mining rewards without touching physical mining hardware.

How Cloud Mining Works

Cloud mining works by splitting the computing power of large mining operations into smaller portions that customers can rent. The provider runs powerful ASIC machines in remote data centers. Instead of giving you a physical rig, they assign you a slice of the farm’s total hash rate.

Each machine is programmed to run a specific mining algorithm. For Bitcoin, that’s SHA-256, which is designed to solve proof-of-work puzzles as efficiently as possible.

That slice connects to a mining pool, where thousands of machines combine their strength to solve new blocks. Each machine sends “shares,” proving it did valid work. The pool tracks how much work came from each slice. When the pool earns a block reward, the provider divides it based on how much computing power each customer contributed.

The pool uses a payout scheme to distribute rewards fairly. The most common are Pay-Per-Share (PPS), where you get steady daily payouts, and Pay-Per-Last-N-Shares (PPLNS), which rewards based on actual block finds but can fluctuate more.

The company then deducts electricity and upkeep costs before crediting your account with mining rewards. This system lets cloud miners benefit from industrial-scale efficiency while skipping the noise, heat, and complexity of running hardware at home.

Types of Cloud Mining Models

Cloud mining can be set up in several ways. Each model defines how your rented power connects to actual machines and what role you play in the process.

Hosted Mining (Host Mining)

In hosted mining, you buy or lease equipment, but it’s stored in the provider’s data center. The company supplies electricity, cooling, and maintenance. You technically own the hardware but avoid the hassle of running it at home. This option offers more transparency, though it requires higher upfront costs.

Virtual Hosted Mining

Here, you don’t own the machine itself. Instead, you rent a portion of a rig’s capacity through software. The provider assigns you virtual access to hash power, while still managing all the physical equipment. It feels like having a mining rig in the cloud without any hardware to touch.

Leased Hashing Power

The simplest approach is renting hash power directly. You sign a contract to rent mining power, usually measured in TH/s (terahashes per second). Your slice of computing power is connected to a mining pool, and you receive rewards proportional to that share. It’s the most beginner-friendly option and the one offered by most providers today.

Useful Metrics for Cloud Mining

When evaluating a cloud mining contract, four metrics matter most:

1. Hash Rate

Hash rate is the speed of processing power you rent. It measures how many cryptographic guesses the hardware can make each second. A higher hash rate means more chances to earn mining rewards. Contracts are usually sold in GH/s or TH/s.

2. Electricity Costs

Mining consumes huge amounts of energy. Providers recover this through daily or upfront fees. Farms with cheaper or renewable energy offer lower electricity costs, making them more attractive.

3. Mining Difficulty

Blockchains automatically adjust difficulty to keep block production steady. As more machines join, increasing mining difficulty reduces the rewards earned by a fixed hash rate.

4. Mining Progress

Many dashboards show mining progress in real time. This helps you track whether your contract is producing as expected and spot issues like downtime or misreported output.

Together, these factors decide whether cloud mining is profitable. Understanding them lets you compare providers fairly and avoid unrealistic promises.

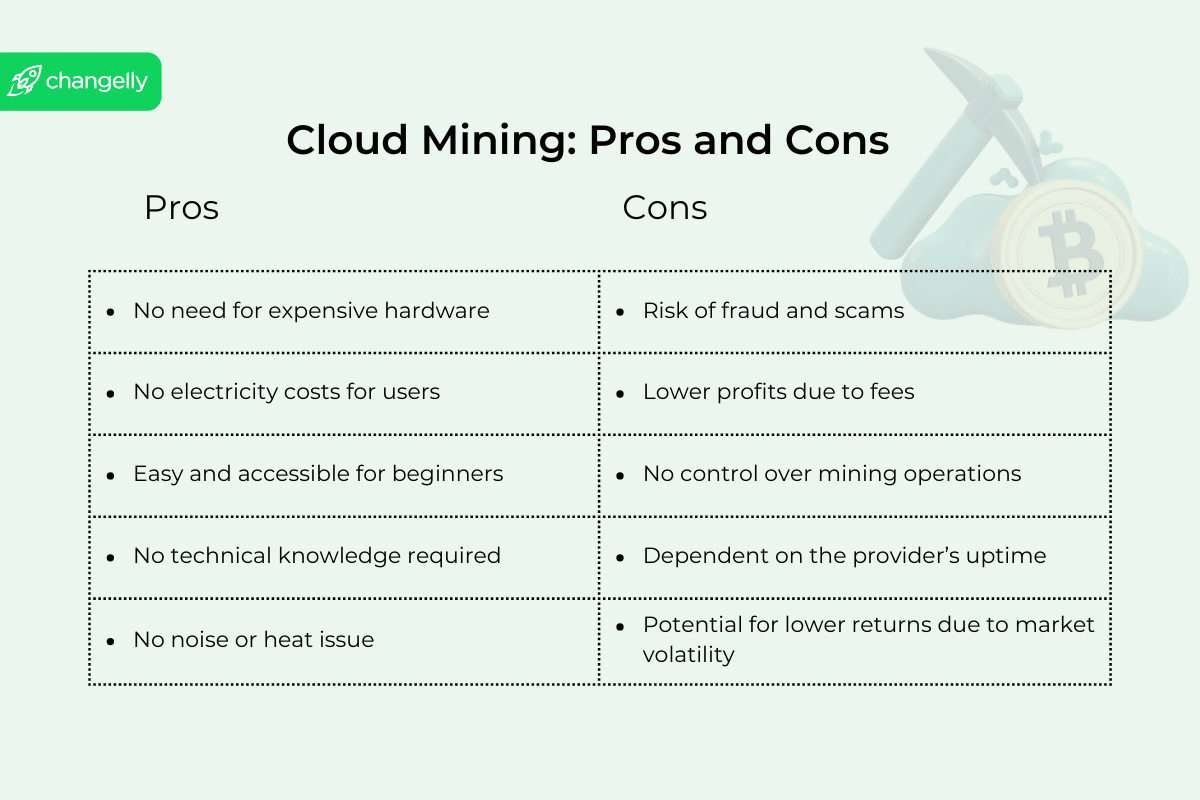

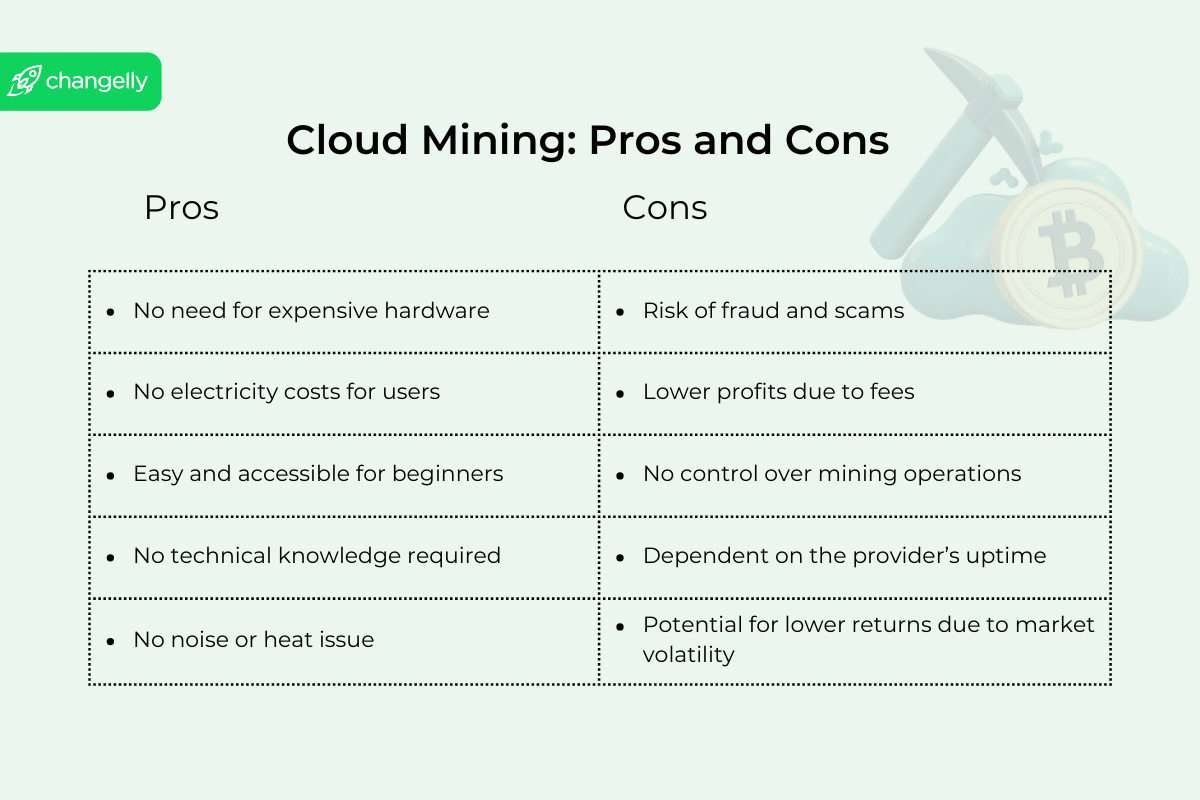

Pros and Cons of Cloud Mining

Cloud mining has clear advantages, but also serious trade-offs.

| Pros | Cons |

| Easy access to mining without hardware setup | Lower earnings compared to owning rigs |

| Generates passive income once contracts are active | Providers deduct fees that reduce returns |

| No need to manage heat, noise, or space | Risk of scams and unreliable operators |

| Professional facilities with cheaper power | No ownership of hardware after contract ends |

| Suitable for beginners with limited technical skills | Returns shrink with rising mining difficulty or high electricity prices |

Which Cryptocurrencies Can You Cloud Mine?

You can use cloud services to mine cryptocurrencies that rely on proof-of-work. The most common is bitcoin mining, since BTC remains the largest and most secure network. Providers favor bitcoin cloud mining offerings as demand is high and hardware is optimized for Bitcoin’s algorithm.

Beyond Bitcoin, some companies also support other coins like Litecoin, Dogecoin, or Bitcoin Cash. These networks use similar algorithms and can be mined with the same machines. A few platforms even experiment with Ethereum Classic or smaller proof-of-work projects, though profitability is usually lower.

Read also: Most Profitable Crypto to Mine

Not every cryptocurrency can be mined. Many popular coins today use proof-of-stake or other models instead. That means no matter what a provider advertises, you cannot mine coins like Solana or XRP.

Is Cloud Mining Profitable?

The short answer: cloud mining can be profitable, but only under the right conditions. Let’s break down the main factors.

Contract Prices

Profitability starts with the deal itself. Mining pools charge a pool fee for coordinating machines and distributing rewards. If a contract is overpriced, it’s almost impossible to keep cloud mining profitable, no matter what the market does.

Equipment Quality

The hardware behind the scenes matters. Modern ASICs squeeze out more coins per watt. Outdated machines drag down mining profitability even if you’re paying for the same hashrate.

Hashrate Dynamics

Your rented slice of power is important, but it’s relative. If the global hashrate rises, your share of rewards falls, even though you paid for the same output.

Network Difficulty

This ties directly to competition. Every time more miners join, increasing mining difficulty reduces the number of coins your contract can generate.

Electricity Costs

Energy is still king. Providers bake electricity costs into fees. If they rise, your daily payouts shrink.

Market Volatility

Even with steady output, profit depends on the coin price at payout. Here comes the wild card: cryptocurrency market fluctuations. A mined Bitcoin at $100,000 looks great. The same coin at $30,000 can turn a profit into a loss.

Regulatory Compliance

Some governments treat contracts like securities or add extra taxes, cutting returns further.

How Much Does It Cost to Cloud Mine?

Profitability only makes sense once you know the cost. So, what does it actually cost?

Cloud mining isn’t cheap. Expect to pay tens of dollars per TH/s each month. A typical cloud mining contract bundles two charges: a one-time payment for hash power and a recurring maintenance fee that covers electricity and upkeep. In 2024, Binance charged $38 for 1 TH/s over 30 days, which could earn $50 at $100k Bitcoin or just $15 at $30k.

Some providers list their deals on hashrate marketplaces, where you can compare rates across farms. But remember that contracts aren’t all equal. Contract duration plays a huge role: short terms let you adapt to market swings, while multi-year deals can lock you into losses.

On top of pricing, you need to consider custodial risk. Your rewards often sit in the provider’s dashboard before withdrawal, so delays or sudden shutdowns can put earnings at risk. Many platforms also require KYC/AML compliance, which adds a layer of security but also removes anonymity.

Getting Started with Cloud Mining

If you’re ready to start cloud mining, the process is simple but requires careful choices. Here’s how it usually works:

Step 1: Choose a Cloud Mining Company

Begin with research. A trustworthy cloud mining company should be transparent, have a solid track record, and show evidence of real operations.

Step 2: Select a Mining Package

Most cloud mining platforms offer different packages based on hash rate and contract length. Pick one that fits your budget and risk tolerance.

Providers often share profit calculators, but they’re only estimates. Real results depend on many factors, and only your actual ROI shows whether the contract paid off.

Step 3: Choose a Mining Pool

Some providers let you pick the pool your hash rate connects to. Large, established pools generally offer steadier returns.

Step 4: Pay for the Service

You’ll cover the upfront contract fee and, in some cases, daily electricity costs.

Step 5: Start Mining

Once active, the cloud mining service allocates your rented power automatically. Once your contract is live, the rigs should run nonstop. Some companies back this with an Uptime SLA, which is just a fancy way of saying they promise near-continuous service and pay you back if downtime cuts into your rewards.

Step 6: Receive Mining Rewards

Earnings appear in your account, usually daily. Withdraw them to your wallet regularly.

With many cloud mining options available, testing small contracts first is the safest way to learn without risking too much.

How to Choose a Cloud Mining Provider

Picking the right cloud mining service is the difference between steady payouts and losing money. A trustworthy cloud mining service provider should be transparent about operations and fees. Look for evidence of real facilities, including data center locations and photos.

Check reviews from independent sources, not just their own website. Reliable providers also offer responsive customer support and clear contracts. Strong security measures such as 2FA and withdrawal controls add protection.

And be cautious: cloud mining scams are everywhere. Stick with platforms that prove they are cloud mining safe, ideally using renewable energy to lower costs and impact.

Why Consider Cloud Mining?

Cloud mining lowers the barrier to entry. You don’t need deep technical knowledge or a garage full of noisy rigs to join the network. Instead, you rent computing power and let professionals handle hardware, power, and maintenance.

For many users, the appeal is simple: steady exposure to mining rewards without the headaches. It’s also a way to participate in securing blockchains, the core of decentralized financial systems.

Final Thoughts

Cloud mining offers a way to join crypto mining without the noise, heat, or upfront cost of running rigs. It can be profitable, but only if contracts are priced fairly and market conditions align. Think of cloud mining as a learning tool and a modest income stream, not a guaranteed payday.

FAQ

Can I lose money with cloud mining?

Yes, you can. Contracts often look profitable on paper, but high fees and hidden operational costs reduce earnings. If market prices fall or mining difficulty rises, payouts may not cover your investment. Since you don’t own the hardware, you can’t resell it later. Always start small, withdraw regularly, and only spend what you can afford to lose. Cloud mining carries risk like any other investment.

Is cloud mining legal?

In most countries, yes. The legal question is usually about whether providers actually run real mining infrastructure. Regulators want proof that machines exist and rewards come from real mining, not a Ponzi scheme. Some regions classify contracts as financial products, which may trigger compliance rules. Always check your local laws, and stick to providers that show evidence of hardware, facilities, and transparent operations.

What is the minimum investment for cloud mining?

It varies by provider. Some platforms let you start with as little as $50, while others require hundreds. The main trade-off is how much computational power you actually get. Smaller investments often deliver tiny payouts that take months to cover costs. If you’re testing cloud mining for the first time, a small contract is fine, but don’t expect meaningful returns unless you scale up.

Can you cloud mine on your phone?

Not really. Phones simply don’t have the technical expertise or hardware design needed to solve proof-of-work problems. Some apps claim to offer “mobile mining,” but they usually just connect you to cloud contracts or simulate results. At best, you can use a phone to monitor payouts or manage your account. Real mining requires ASIC rigs and proper infrastructure, not a smartphone CPU.

Read also: Best GPUs for Mining

How long does it take to see returns from cloud mining?

Most providers credit payouts daily or weekly, so you’ll see results quickly. But breaking even can take months. Part of the reason is that you indirectly pay direct energy costs through fees. If electricity gets more expensive or network difficulty rises, the breakeven point pushes further away. Always use calculators for estimates, and remember that timelines shift with market prices and operating expenses.

Do I need a crypto wallet for cloud mining?

Even though providers control the physical infrastructure, manage multiple miners, and maintain equipment, your coins are safer in your own wallet than on their dashboards. A wallet you control gives you ownership and security. Once payouts cross the minimum threshold, transfer them to your personal wallet address. That way, even if a provider shuts down or suspends accounts, your mined coins stay safe and accessible.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Mining Bitcoin sounds exciting—until you see the hardware bills and electricity costs. Cloud mining skips all that. You rent a slice of industrial mining farms and get rewards without running any rigs yourself. This guide explains how cloud mining works, what it costs, and whether it can actually make you money.

What Is Cloud Mining?

Cloud mining is a form of crypto mining where you outsource the process to a provider that runs large-scale mining farms.

In short, you rent computing power instead of buying machines. The company manages the hardware, electricity, and upkeep, while you earn a share of the coins mined. Think of it like cloud storage, but for mining power. This makes cryptocurrency mining possible for beginners, especially those without technical skills, cheap energy, or space for equipment.

Cloud Mining vs. Traditional Mining

Cloud mining differs from traditional mining because in the former you don’t buy or run your own mining hardware. Instead, you rent computing power from a provider.

With traditional setups, miners must purchase mining rigs, pay for electricity, and handle the hassle of operating mining hardware. They also face the ongoing cost of maintaining mining hardware and replacing outdated mining equipment, not to mention managing noise and heat with a proper cooling system.

In cloud mining, the entire mining infrastructure—machines, cooling, and power—is managed by the provider in secure data centers. You simply pay for hash power and receive mining rewards without touching physical mining hardware.

How Cloud Mining Works

Cloud mining works by splitting the computing power of large mining operations into smaller portions that customers can rent. The provider runs powerful ASIC machines in remote data centers. Instead of giving you a physical rig, they assign you a slice of the farm’s total hash rate.

Each machine is programmed to run a specific mining algorithm. For Bitcoin, that’s SHA-256, which is designed to solve proof-of-work puzzles as efficiently as possible.

That slice connects to a mining pool, where thousands of machines combine their strength to solve new blocks. Each machine sends “shares,” proving it did valid work. The pool tracks how much work came from each slice. When the pool earns a block reward, the provider divides it based on how much computing power each customer contributed.

The pool uses a payout scheme to distribute rewards fairly. The most common are Pay-Per-Share (PPS), where you get steady daily payouts, and Pay-Per-Last-N-Shares (PPLNS), which rewards based on actual block finds but can fluctuate more.

The company then deducts electricity and upkeep costs before crediting your account with mining rewards. This system lets cloud miners benefit from industrial-scale efficiency while skipping the noise, heat, and complexity of running hardware at home.

Types of Cloud Mining Models

Cloud mining can be set up in several ways. Each model defines how your rented power connects to actual machines and what role you play in the process.

Hosted Mining (Host Mining)

In hosted mining, you buy or lease equipment, but it’s stored in the provider’s data center. The company supplies electricity, cooling, and maintenance. You technically own the hardware but avoid the hassle of running it at home. This option offers more transparency, though it requires higher upfront costs.

Virtual Hosted Mining

Here, you don’t own the machine itself. Instead, you rent a portion of a rig’s capacity through software. The provider assigns you virtual access to hash power, while still managing all the physical equipment. It feels like having a mining rig in the cloud without any hardware to touch.

Leased Hashing Power

The simplest approach is renting hash power directly. You sign a contract to rent mining power, usually measured in TH/s (terahashes per second). Your slice of computing power is connected to a mining pool, and you receive rewards proportional to that share. It’s the most beginner-friendly option and the one offered by most providers today.

Useful Metrics for Cloud Mining

When evaluating a cloud mining contract, four metrics matter most:

1. Hash Rate

Hash rate is the speed of processing power you rent. It measures how many cryptographic guesses the hardware can make each second. A higher hash rate means more chances to earn mining rewards. Contracts are usually sold in GH/s or TH/s.

2. Electricity Costs

Mining consumes huge amounts of energy. Providers recover this through daily or upfront fees. Farms with cheaper or renewable energy offer lower electricity costs, making them more attractive.

3. Mining Difficulty

Blockchains automatically adjust difficulty to keep block production steady. As more machines join, increasing mining difficulty reduces the rewards earned by a fixed hash rate.

4. Mining Progress

Many dashboards show mining progress in real time. This helps you track whether your contract is producing as expected and spot issues like downtime or misreported output.

Together, these factors decide whether cloud mining is profitable. Understanding them lets you compare providers fairly and avoid unrealistic promises.

Pros and Cons of Cloud Mining

Cloud mining has clear advantages, but also serious trade-offs.

| Pros | Cons |

| Easy access to mining without hardware setup | Lower earnings compared to owning rigs |

| Generates passive income once contracts are active | Providers deduct fees that reduce returns |

| No need to manage heat, noise, or space | Risk of scams and unreliable operators |

| Professional facilities with cheaper power | No ownership of hardware after contract ends |

| Suitable for beginners with limited technical skills | Returns shrink with rising mining difficulty or high electricity prices |

Which Cryptocurrencies Can You Cloud Mine?

You can use cloud services to mine cryptocurrencies that rely on proof-of-work. The most common is bitcoin mining, since BTC remains the largest and most secure network. Providers favor bitcoin cloud mining offerings as demand is high and hardware is optimized for Bitcoin’s algorithm.

Beyond Bitcoin, some companies also support other coins like Litecoin, Dogecoin, or Bitcoin Cash. These networks use similar algorithms and can be mined with the same machines. A few platforms even experiment with Ethereum Classic or smaller proof-of-work projects, though profitability is usually lower.

Read also: Most Profitable Crypto to Mine

Not every cryptocurrency can be mined. Many popular coins today use proof-of-stake or other models instead. That means no matter what a provider advertises, you cannot mine coins like Solana or XRP.

Is Cloud Mining Profitable?

The short answer: cloud mining can be profitable, but only under the right conditions. Let’s break down the main factors.

Contract Prices

Profitability starts with the deal itself. Mining pools charge a pool fee for coordinating machines and distributing rewards. If a contract is overpriced, it’s almost impossible to keep cloud mining profitable, no matter what the market does.

Equipment Quality

The hardware behind the scenes matters. Modern ASICs squeeze out more coins per watt. Outdated machines drag down mining profitability even if you’re paying for the same hashrate.

Hashrate Dynamics

Your rented slice of power is important, but it’s relative. If the global hashrate rises, your share of rewards falls, even though you paid for the same output.

Network Difficulty

This ties directly to competition. Every time more miners join, increasing mining difficulty reduces the number of coins your contract can generate.

Electricity Costs

Energy is still king. Providers bake electricity costs into fees. If they rise, your daily payouts shrink.

Market Volatility

Even with steady output, profit depends on the coin price at payout. Here comes the wild card: cryptocurrency market fluctuations. A mined Bitcoin at $100,000 looks great. The same coin at $30,000 can turn a profit into a loss.

Regulatory Compliance

Some governments treat contracts like securities or add extra taxes, cutting returns further.

How Much Does It Cost to Cloud Mine?

Profitability only makes sense once you know the cost. So, what does it actually cost?

Cloud mining isn’t cheap. Expect to pay tens of dollars per TH/s each month. A typical cloud mining contract bundles two charges: a one-time payment for hash power and a recurring maintenance fee that covers electricity and upkeep. In 2024, Binance charged $38 for 1 TH/s over 30 days, which could earn $50 at $100k Bitcoin or just $15 at $30k.

Some providers list their deals on hashrate marketplaces, where you can compare rates across farms. But remember that contracts aren’t all equal. Contract duration plays a huge role: short terms let you adapt to market swings, while multi-year deals can lock you into losses.

On top of pricing, you need to consider custodial risk. Your rewards often sit in the provider’s dashboard before withdrawal, so delays or sudden shutdowns can put earnings at risk. Many platforms also require KYC/AML compliance, which adds a layer of security but also removes anonymity.

Getting Started with Cloud Mining

If you’re ready to start cloud mining, the process is simple but requires careful choices. Here’s how it usually works:

Step 1: Choose a Cloud Mining Company

Begin with research. A trustworthy cloud mining company should be transparent, have a solid track record, and show evidence of real operations.

Step 2: Select a Mining Package

Most cloud mining platforms offer different packages based on hash rate and contract length. Pick one that fits your budget and risk tolerance.

Providers often share profit calculators, but they’re only estimates. Real results depend on many factors, and only your actual ROI shows whether the contract paid off.

Step 3: Choose a Mining Pool

Some providers let you pick the pool your hash rate connects to. Large, established pools generally offer steadier returns.

Step 4: Pay for the Service

You’ll cover the upfront contract fee and, in some cases, daily electricity costs.

Step 5: Start Mining

Once active, the cloud mining service allocates your rented power automatically. Once your contract is live, the rigs should run nonstop. Some companies back this with an Uptime SLA, which is just a fancy way of saying they promise near-continuous service and pay you back if downtime cuts into your rewards.

Step 6: Receive Mining Rewards

Earnings appear in your account, usually daily. Withdraw them to your wallet regularly.

With many cloud mining options available, testing small contracts first is the safest way to learn without risking too much.

How to Choose a Cloud Mining Provider

Picking the right cloud mining service is the difference between steady payouts and losing money. A trustworthy cloud mining service provider should be transparent about operations and fees. Look for evidence of real facilities, including data center locations and photos.

Check reviews from independent sources, not just their own website. Reliable providers also offer responsive customer support and clear contracts. Strong security measures such as 2FA and withdrawal controls add protection.

And be cautious: cloud mining scams are everywhere. Stick with platforms that prove they are cloud mining safe, ideally using renewable energy to lower costs and impact.

Why Consider Cloud Mining?

Cloud mining lowers the barrier to entry. You don’t need deep technical knowledge or a garage full of noisy rigs to join the network. Instead, you rent computing power and let professionals handle hardware, power, and maintenance.

For many users, the appeal is simple: steady exposure to mining rewards without the headaches. It’s also a way to participate in securing blockchains, the core of decentralized financial systems.

Final Thoughts

Cloud mining offers a way to join crypto mining without the noise, heat, or upfront cost of running rigs. It can be profitable, but only if contracts are priced fairly and market conditions align. Think of cloud mining as a learning tool and a modest income stream, not a guaranteed payday.

FAQ

Can I lose money with cloud mining?

Yes, you can. Contracts often look profitable on paper, but high fees and hidden operational costs reduce earnings. If market prices fall or mining difficulty rises, payouts may not cover your investment. Since you don’t own the hardware, you can’t resell it later. Always start small, withdraw regularly, and only spend what you can afford to lose. Cloud mining carries risk like any other investment.

Is cloud mining legal?

In most countries, yes. The legal question is usually about whether providers actually run real mining infrastructure. Regulators want proof that machines exist and rewards come from real mining, not a Ponzi scheme. Some regions classify contracts as financial products, which may trigger compliance rules. Always check your local laws, and stick to providers that show evidence of hardware, facilities, and transparent operations.

What is the minimum investment for cloud mining?

It varies by provider. Some platforms let you start with as little as $50, while others require hundreds. The main trade-off is how much computational power you actually get. Smaller investments often deliver tiny payouts that take months to cover costs. If you’re testing cloud mining for the first time, a small contract is fine, but don’t expect meaningful returns unless you scale up.

Can you cloud mine on your phone?

Not really. Phones simply don’t have the technical expertise or hardware design needed to solve proof-of-work problems. Some apps claim to offer “mobile mining,” but they usually just connect you to cloud contracts or simulate results. At best, you can use a phone to monitor payouts or manage your account. Real mining requires ASIC rigs and proper infrastructure, not a smartphone CPU.

Read also: Best GPUs for Mining

How long does it take to see returns from cloud mining?

Most providers credit payouts daily or weekly, so you’ll see results quickly. But breaking even can take months. Part of the reason is that you indirectly pay direct energy costs through fees. If electricity gets more expensive or network difficulty rises, the breakeven point pushes further away. Always use calculators for estimates, and remember that timelines shift with market prices and operating expenses.

Do I need a crypto wallet for cloud mining?

Even though providers control the physical infrastructure, manage multiple miners, and maintain equipment, your coins are safer in your own wallet than on their dashboards. A wallet you control gives you ownership and security. Once payouts cross the minimum threshold, transfer them to your personal wallet address. That way, even if a provider shuts down or suspends accounts, your mined coins stay safe and accessible.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Istanbul Painting and Sculpture Museum tour Our guide gave us restaurant recommendations too. https://news-ngo.com/?p=90643

Bosphorus guided tour Every stop was picture-perfect! http://bird-dresden.de/?p=3983