Bitdeer Technologies Group priced an upsized private offering of $330 million in convertible senior notes due 2031. The Singapore-based bitcoin mining company increased the offering size from an initially announced $300 million.

Bitdeer Upsizes Convertible Note Offering

The 4.875% notes, maturing July 1, 2031, were sold to qualified institutional buyers. Initial purchasers hold a 13-day option to buy up to an additional $45 million principal amount. The sale is expected to close on June 23, 2025. The bitcoin mining company said the notes are convertible into Class A ordinary shares at an initial price of approximately $15.88 per share, representing a 25% premium over the June 17 closing price.

Bitdeer estimates net proceeds of approximately $319.6 million, or $363.3 million if the option is fully exercised. After deducting fees and expenses, the company plans three primary uses: $129.6 million to pay for a related zero-strike call option transaction, $36.1 million for cash consideration in concurrent note exchanges, and the remainder for data center expansion, ASIC-based mining rig development, manufacturing, working capital, and general corporate purposes.

Concurrently with the pricing, Bitdeer entered a zero-strike call option transaction with an affiliate of an initial purchaser. The company paid a $129.6 million premium for the right to receive approximately 10.2 million shares at expiry. This transaction facilitates hedging activities by certain note investors, which could impact the market price of Bitdeer shares or notes.

Bitdeer also completed private transactions exchanging approximately $75.7 million principal amount of its existing 8.50% notes due 2029 for $36.1 million in cash and 8.1 million Class A ordinary shares. The company noted holders of the exchanged notes unwinding hedges could significantly impact its share price.

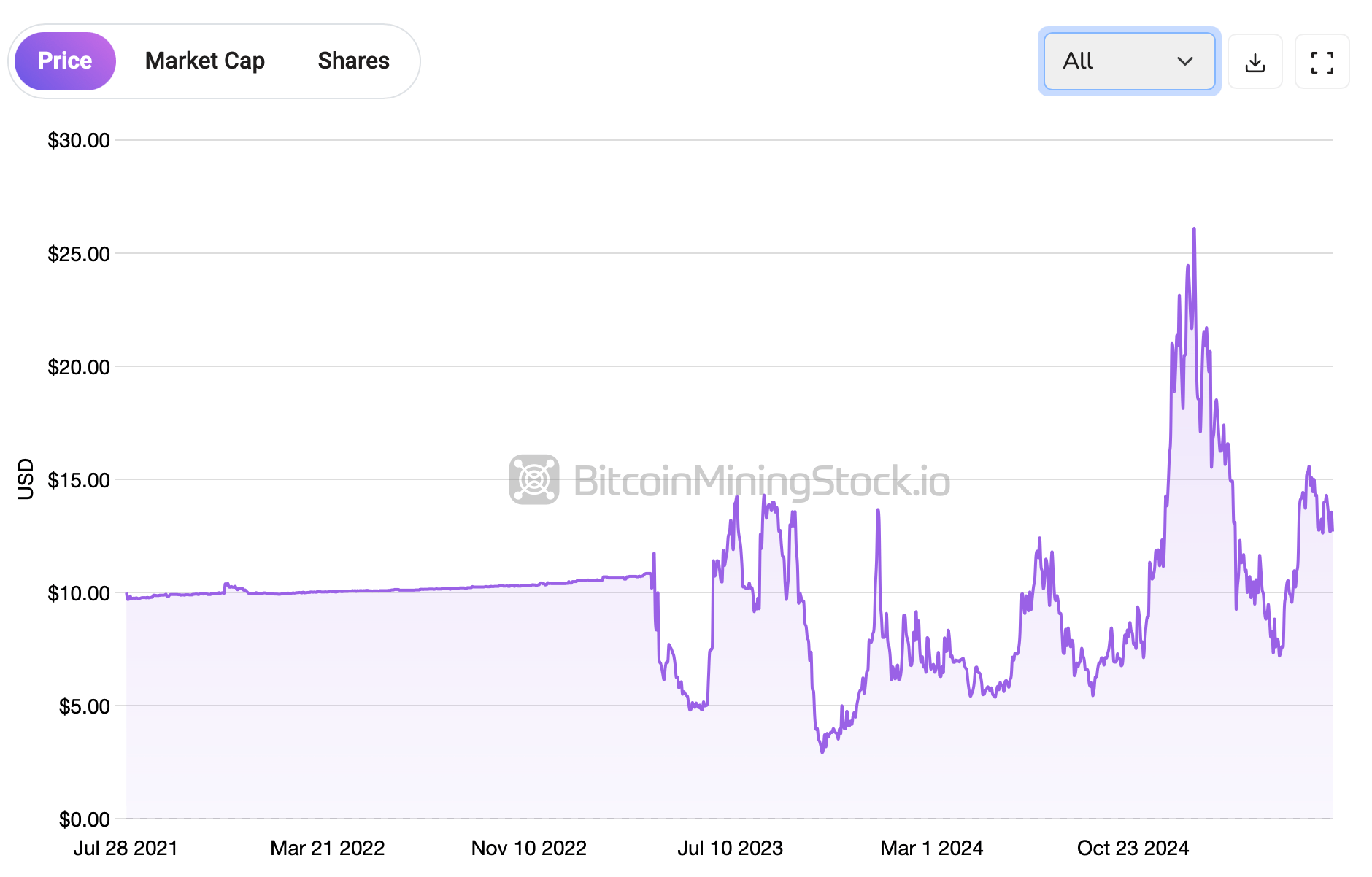

Bitdeer (Nasdaq: BTDR) has hit a rough patch this year, with shares slipping 6.5% in just the past day. Over the last five trading sessions, the bitcoin miner has seen its value drop by more than 14%, and since January, it’s taken a hit of over 45%. But here’s the twist: despite the recent slump, BTDR is still sitting pretty with a 27% gain since its market debut.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)