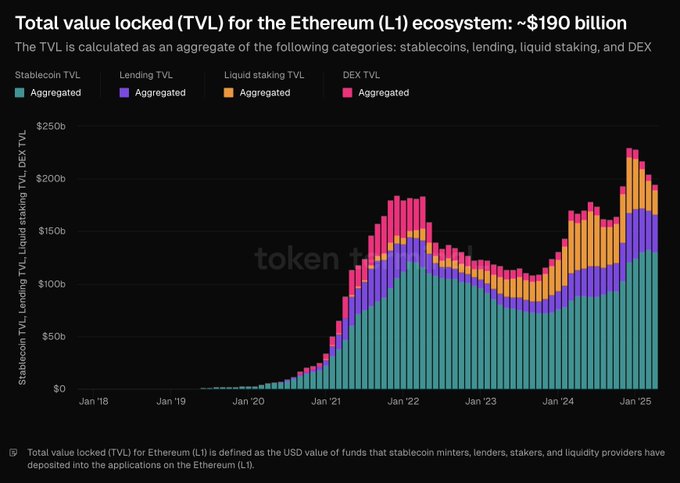

Ethereum’s Layer 1 ecosystem is showing signs of revitalization, with TVL now nearing $190 billion – the highest level since late 2022.

According to Token Terminal, the resurgence is being driven by a balanced uptick across stablecoins, lending, liquid staking, and DEX protocols.

Source: X

Notably, liquid staking and lending protocols are gaining ground, signaling investor appetite for yield-generating applications.

This shows that capital is rotating back into Ethereum’s foundational infrastructure, reinforcing bullish sentiment in parallel with ETH’s technical breakout.

What to watch for

As ETH holds above $1,600 following its recent breakout, traders are eyeing the $2,000 resistance as the next major hurdle.

A successful breach could open the path toward $2,500-$3,000 in the medium term. However, the $1,600 support remains crucial; a drop below this level might signal a potential reversal.

Upcoming macroeconomic events, particularly any indications of Federal Reserve rate cuts by June, could influence ETH’s trajectory.

Cooling inflation increases the odds of such cuts, potentially boosting risk assets like Ethereum. Notably, a wallet linked to the Ethereum Foundation recently transferred 1,000 ETH to Kraken, raising concerns about a possible sell-off.

Such movements could impact market sentiment and price stability.

Ethereum’s Layer 1 ecosystem is showing signs of revitalization, with TVL now nearing $190 billion – the highest level since late 2022.

According to Token Terminal, the resurgence is being driven by a balanced uptick across stablecoins, lending, liquid staking, and DEX protocols.

Source: X

Notably, liquid staking and lending protocols are gaining ground, signaling investor appetite for yield-generating applications.

This shows that capital is rotating back into Ethereum’s foundational infrastructure, reinforcing bullish sentiment in parallel with ETH’s technical breakout.

What to watch for

As ETH holds above $1,600 following its recent breakout, traders are eyeing the $2,000 resistance as the next major hurdle.

A successful breach could open the path toward $2,500-$3,000 in the medium term. However, the $1,600 support remains crucial; a drop below this level might signal a potential reversal.

Upcoming macroeconomic events, particularly any indications of Federal Reserve rate cuts by June, could influence ETH’s trajectory.

Cooling inflation increases the odds of such cuts, potentially boosting risk assets like Ethereum. Notably, a wallet linked to the Ethereum Foundation recently transferred 1,000 ETH to Kraken, raising concerns about a possible sell-off.

Such movements could impact market sentiment and price stability.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

sukaaa-casino-slots.ru

Обзор игровой платформы Sukaa 2025

В 2025 году Sukaa остается одной из популярных международных игровых платформ, привлекающей внимание пользователей из разных стран. На нашем сайте представлен детальный обзор особенностей данного ресурса.

Основные характеристики:

Лицензия: международная (Кюрасао)

Валюта: поддерживаются рублевые транзакции

Игровой софт: представлены слоты, настольные игры, live-дилеры

Мобильная версия: адаптирована под iOS и Android

Особенности платформы:

Бонусная программа для новых пользователей

Регулярные турниры с призовыми фондами

Система лояльности для постоянных клиентов

Важно учитывать:

Платформа не имеет российской лицензии

Доступ может быть ограничен интернет-провайдерами

Рекомендуется проверять актуальность информации на официальном сайте

Альтернативы:

Для российских пользователей доступны легальные варианты:

Официальные лотереи (Столото)

Социальные игровые приложения

Напоминание: Азартные игры могут вызывать зависимость. Играйте ответственно. 18+

Полную информацию о платформе Sukaa вы найдете на сайте по ссылке.sukaaa-casino-slots.ru

get cheap clomiphene pills can you buy cheap clomid online can i order clomid prices cost of generic clomiphene pills how can i get generic clomid pill can you buy clomiphene without a prescription clomiphene medication uk

More delight pieces like this would urge the web better.

Palatable blog you have here.. It’s hard to assign elevated status script like yours these days. I truly recognize individuals like you! Go through mindfulness!!

purchase azithromycin for sale – order ofloxacin 400mg online cheap flagyl canada

semaglutide cost – semaglutide 14 mg oral buy cyproheptadine 4 mg for sale