Bitcoin’s hashrate has bounced back impressively after dipping to 752 exahash per second (EH/s) on Feb. 25, now climbing to 819.65 EH/s, even as earnings took a notable hit in March.

Earnings Drop, Hashrate Rises

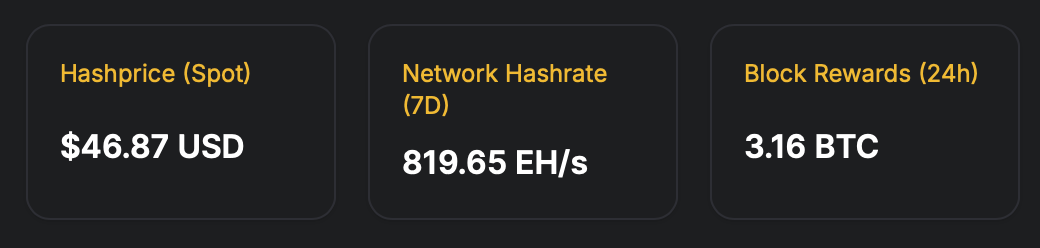

The network’s computational strength has strengthened, currently sitting over 67 EH/s above its Feb. 25 low. At that time, the hashrate hit 752 EH/s, but as of now, it’s holding steady at 819.65 EH/s, based on data tied to the seven-day simple moving average (SMA) according to hashrateindex.com. Right now, the hashrate sits about 30 EH/s below its peak high, which was hit on Feb. 8, 2025.

Source: Hashrateindex.com metrics recorded at 12:30 p.m. Eastern Time on March 17, 2025.

This upward shift is happening at a fascinating time, especially since earnings have taken a significant dip since the hashrate’s lowest point. Back on Feb. 25, the hashprice—what miners earn for 1 petahash per second (PH/s) of power each day—was $53.89 per petahash. Fast forward to March 17, and that number has slipped to $46.87 per petahash, marking a 13.03% drop in income.

Currently, Foundry leads the pack with about 264 EH/s, making it the biggest mining pool by hashrate. Antpool trails behind with 159 EH/s, and Viabtc isn’t far off with 115 EH/s. Together, these three pools account for roughly 538 EH/s, or about 65.63% of the total 819.65 EH/s. Data also reveals that between the Feb. 25 low and today, there have been two contrasting difficulty adjustments—a 3.15% drop followed by a 1.43% rise.

Even with lower earnings, Bitcoin’s hashrate recovery shows miners have found ways to keep pushing forward. Big players like Foundry, Antpool, and Viabtc control much of the network, pointing to an ongoing trend of consolidation. As difficulty levels shift and profits fluctuate, the mining world still remains lively, proving Bitcoin’s proof-of-work (PoW) system can adapt and thrive through changing times.

![[Latest] South Korea Smart Grid Networking Market: Analyzing Regional Variations and Trends](https://coininsights.com/wp-content/uploads/2025/03/L317414112_g-360x180.jpg)

![[Latest] Market Trends to Watch in the Europe Wireless Sensors Market](https://coininsights.com/wp-content/uploads/2025/03/L317853623_g-360x180.jpg)

![[Latest] North America Safety I/O Modules Market Insights: Key Drivers of Growth and Change](https://coininsights.com/wp-content/uploads/2025/03/L316986664_g-360x180.jpg)

I conceive this website holds very excellent composed written content content.