- Ethereum’s exchange supply has plunged to its lowest level in nine years.

- Could this supply squeeze trigger a price surge?

The supply of Ethereum [ETH] on exchanges has dropped to its lowest level since 2016, signaling a liquidity squeeze that supports a medium-term bullish outlook.

With sell-side pressure easing and accumulation rising, could ETH reclaim the critical $3.5K resistance in the near term?

Key technicals flash bullish

Despite no signs of overheating, Ethereum remains 32% below its post-election peak of $4,016, having formed four consecutive lower lows.

This time, however, the RSI has bottomed out, and a bullish MACD crossover is taking shape – suggesting ETH’s consolidation could be building momentum for a breakout.

Yet, historical patterns suggest caution. Previous recoveries failed to breach key resistance as demand struggled to absorb sell pressure.

Source: TradingView (ETH/USDT)

However, Ethereum’s spot exchange supply has plunged to a 9-year low of 8.2 million ETH.

With tightening liquidity and potential demand acceleration, conditions are aligning for a supply shock – one that could fuel a breakout past key resistance levels.

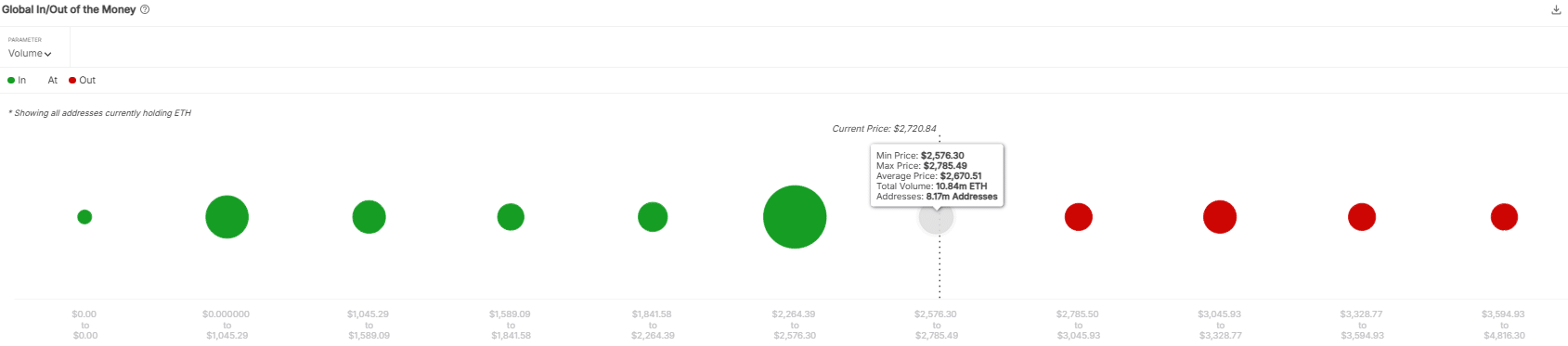

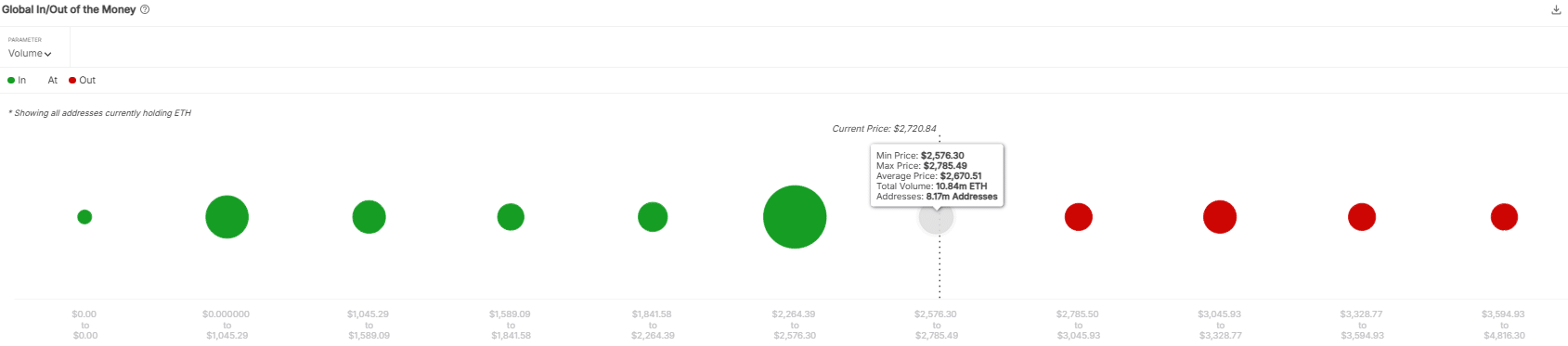

Mapping Ethereum’s next major resistance zone

Ethereum faces a critical resistance at $2,785, where 8.10 million addresses would flip profitable, exposing $20 billion to potential sell pressure.

Source: IntoTheBlock

While spot reserves hit a 9-month low, signaling accumulation, investors offloaded over 2 million ETH into exchanges in February, raising concerns about mounting sell pressure.

Weak demand from U.S. and Korean investors further threatens upside momentum, potentially trapping leveraged longs in the futures market.

If demand fails to recover, Ethereum could face a pullback toward $2,264, where 62.38 million ETH is concentrated.

- Ethereum’s exchange supply has plunged to its lowest level in nine years.

- Could this supply squeeze trigger a price surge?

The supply of Ethereum [ETH] on exchanges has dropped to its lowest level since 2016, signaling a liquidity squeeze that supports a medium-term bullish outlook.

With sell-side pressure easing and accumulation rising, could ETH reclaim the critical $3.5K resistance in the near term?

Key technicals flash bullish

Despite no signs of overheating, Ethereum remains 32% below its post-election peak of $4,016, having formed four consecutive lower lows.

This time, however, the RSI has bottomed out, and a bullish MACD crossover is taking shape – suggesting ETH’s consolidation could be building momentum for a breakout.

Yet, historical patterns suggest caution. Previous recoveries failed to breach key resistance as demand struggled to absorb sell pressure.

Source: TradingView (ETH/USDT)

However, Ethereum’s spot exchange supply has plunged to a 9-year low of 8.2 million ETH.

With tightening liquidity and potential demand acceleration, conditions are aligning for a supply shock – one that could fuel a breakout past key resistance levels.

Mapping Ethereum’s next major resistance zone

Ethereum faces a critical resistance at $2,785, where 8.10 million addresses would flip profitable, exposing $20 billion to potential sell pressure.

Source: IntoTheBlock

While spot reserves hit a 9-month low, signaling accumulation, investors offloaded over 2 million ETH into exchanges in February, raising concerns about mounting sell pressure.

Weak demand from U.S. and Korean investors further threatens upside momentum, potentially trapping leveraged longs in the futures market.

If demand fails to recover, Ethereum could face a pullback toward $2,264, where 62.38 million ETH is concentrated.

Организуйте раздачу рекламных материалов стильно! буклетница напольная поможет компактно разместить листовки, каталоги и брошюры. Устойчивая, стильная, удобная – она идеально подходит для выставок и точек продаж.

ФОРМАТ-МС предлагает популярные модели мобильных стендов для вашего бизнеса. Узнайте больше на format-ms.ru. Наш офис находится по адресу: Москва, Нагорный проезд, дом 7, стр. 1, офис 2320. Звоните нам по телефону +7(499)390-19-85.

Хотите получить займ, не отказываясь от машины? С помощью займ под залог птс автомобиля вы сможете воплотить планы в жизнь. Минимум документов, максимальная скорость — именно то, что нужно!

Реклама, которая всегда под рукой! мобильные выставочные стенды помогут выделиться на выставках и конференциях. Компактные, легкие в установке и с эффектным дизайном – идеальный выбор для успешного продвижения вашей компании.

Ищете качественные мобильные стенды? Обращайтесь в ФОРМАТ-МС! Подробная информация доступна на сайте format-ms.ru. Наш офис расположен в Москве по адресу: Нагорный проезд, дом 7, стр. 1, офис 2320. Телефон для связи: +7(499)390-19-85.

Организуйте промо-акции с удобным оборудованием! буклетница поможет стильно разместить рекламные материалы, сделав их доступными для клиентов. Прочная, легкая, компактная — идеальное решение для выставок и офисов.

Ищете надежного поставщика мобильных стендов? ФОРМАТ-МС к вашим услугам. Подробная информация на сайте format-ms.ru. Наш офис в Москве: Нагорный проезд, дом 7, стр. 1, офис 2320. Свяжитесь с нами по телефону +7(499)390-19-85.

clomid challenge test cost generic clomid pills name brand for clomiphene can you buy clomiphene without a prescription cost of cheap clomiphene without rx where can i get clomid without dr prescription clomiphene other name

This is a topic which is forthcoming to my verve… Diverse thanks! Quite where can I notice the connection details in the course of questions?

zithromax 500mg over the counter – zithromax over the counter buy cheap generic flagyl

generic domperidone 10mg – purchase flexeril purchase flexeril without prescription

amoxiclav tablet – https://atbioinfo.com/ buy ampicillin pills for sale

esomeprazole price – https://anexamate.com/ order esomeprazole 40mg pill

where can i buy warfarin – anticoagulant hyzaar sale

buy meloxicam online – https://moboxsin.com/ meloxicam 15mg brand

oral deltasone 20mg – apreplson.com buy prednisone 20mg for sale

buy ed pills canada – the best ed pill buy ed medications online

order generic diflucan – order fluconazole online diflucan oral

order cenforce generic – https://cenforcers.com/# cenforce 100mg oral

generic cialis 5mg – https://ciltadgn.com/# cialis package insert

cialis stopped working – https://strongtadafl.com/ cialis dosages

buy ranitidine sale – order ranitidine 300mg pills order ranitidine 150mg generic

viagra sale essex – viagra with dapoxetine 100 60 mg viagra cheap online

Thanks towards putting this up. It’s understandably done. site

This is the type of advise I turn up helpful. https://buyfastonl.com/

More posts like this would persuade the online play more useful. https://ursxdol.com/synthroid-available-online/

Greetings! Jolly productive par‘nesis within this article! It’s the petty changes which liking make the largest changes. Thanks a lot towards sharing! https://prohnrg.com/product/priligy-dapoxetine-pills/

With thanks. Loads of expertise! https://aranitidine.com/fr/prednisolone-achat-en-ligne/

This is the stripe of topic I take advantage of reading. https://ondactone.com/simvastatin/

This is the kind of content I have reading.

https://doxycyclinege.com/pro/ondansetron/

More articles like this would pretence of the blogosphere richer. http://zqykj.com/bbs/home.php?mod=space&uid=302505

buy forxiga online cheap – buy forxiga online cheap forxiga 10mg us

More delight pieces like this would insinuate the web better. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=493468