- Ethereum whales sold 60,000 ETH valued at more than $200M after the price dropped to a weekly low.

- At the same time, positive netflows to exchanges have spiked to a weekly high.

Ethereum [ETH] was trading at a weekly low of $3,683, at press time, after an over 4% drop in 24 hours. While this dip brings Ethereum’s seven-day losses to 6%, the largest altcoin still sits on a 17% monthly gain.

The recent dip brought the total ETH liquidations to $124M, whereby $108M were long liquidations. As long buyers rushed to close their positions, Ethereum whales also reduced their holdings significantly.

Ethereum whales move $200M ETH

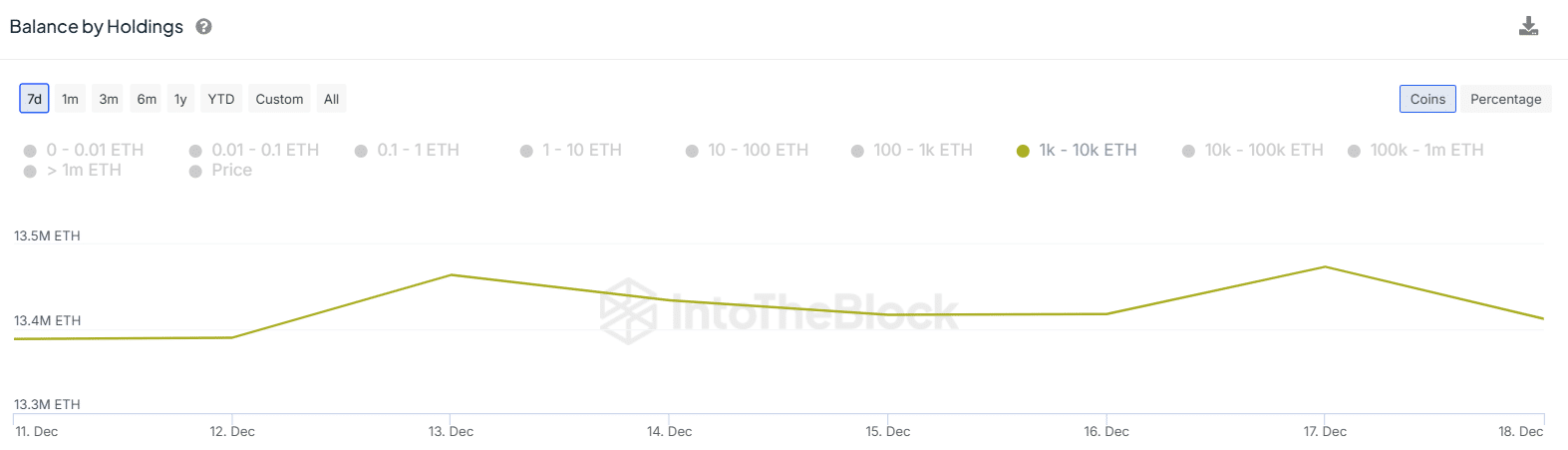

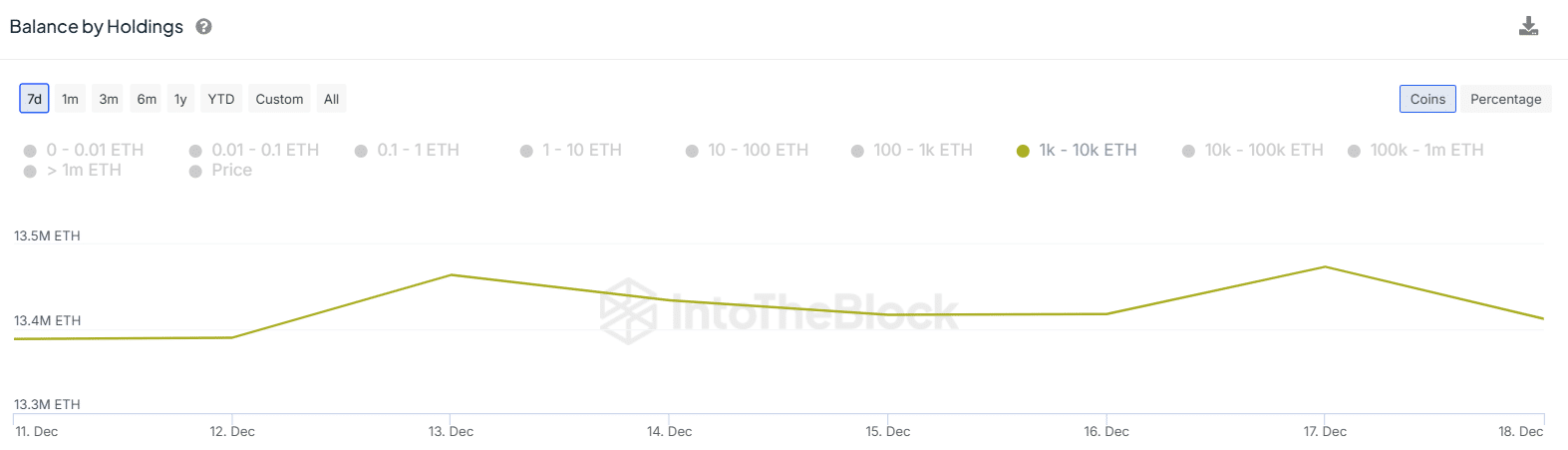

Data from IntoTheBlock shows on the 18th of December 18, Ethereum whales holding between 1,000 and 10,000 ETH saw their holdings drop from 13.47M to $13.41M. This indicates that these addresses sold 60,000 ETH valued at more than $200M.

Source: IntoTheBlock

As AMBCrypto reported, ETH whales account for 57% of the altcoins supply. Therefore, if this cohort is reducing its holdings, it could have a negative impact on the price by increasing the sell-side pressure.

Surge in exchange inflows

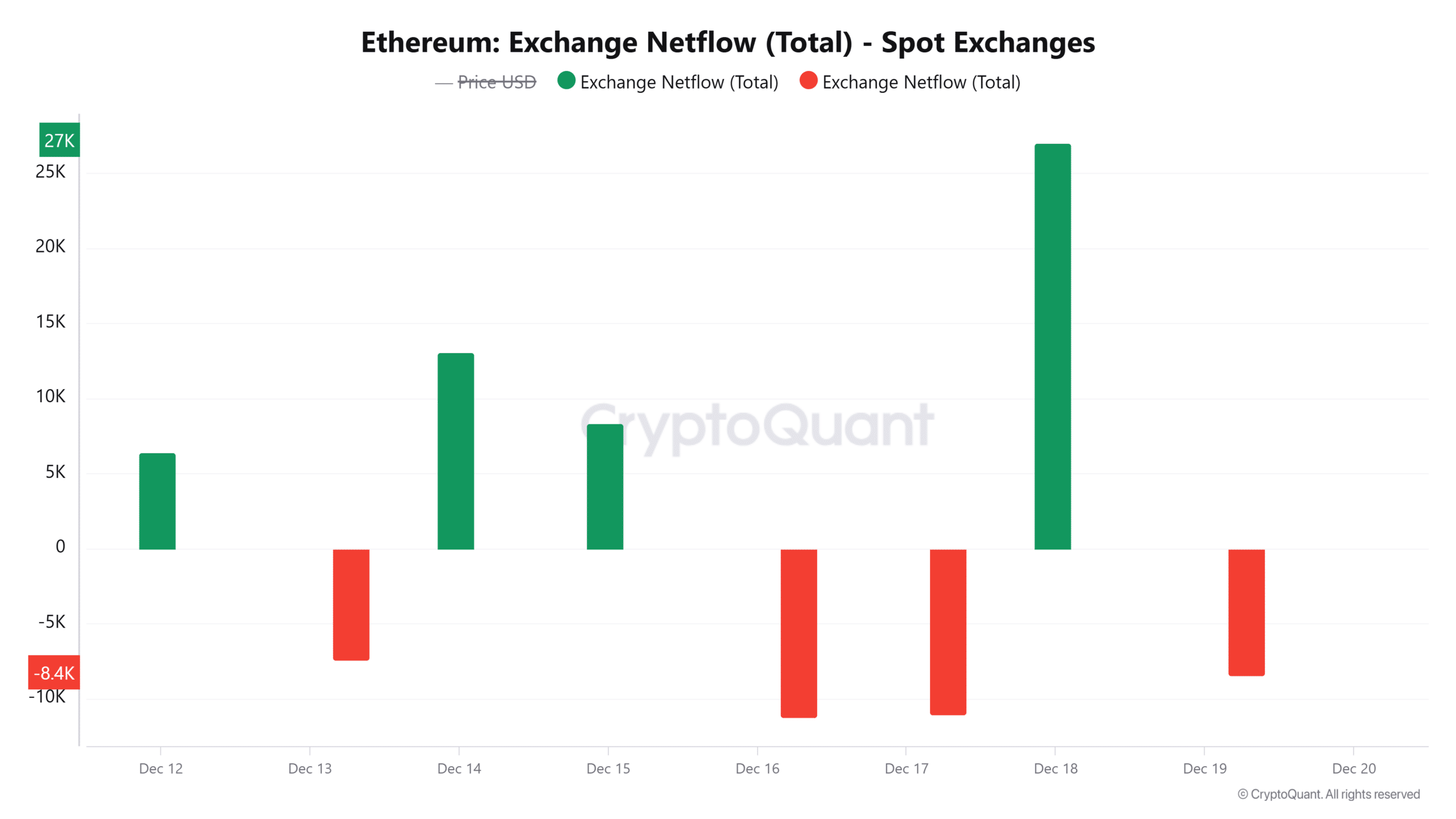

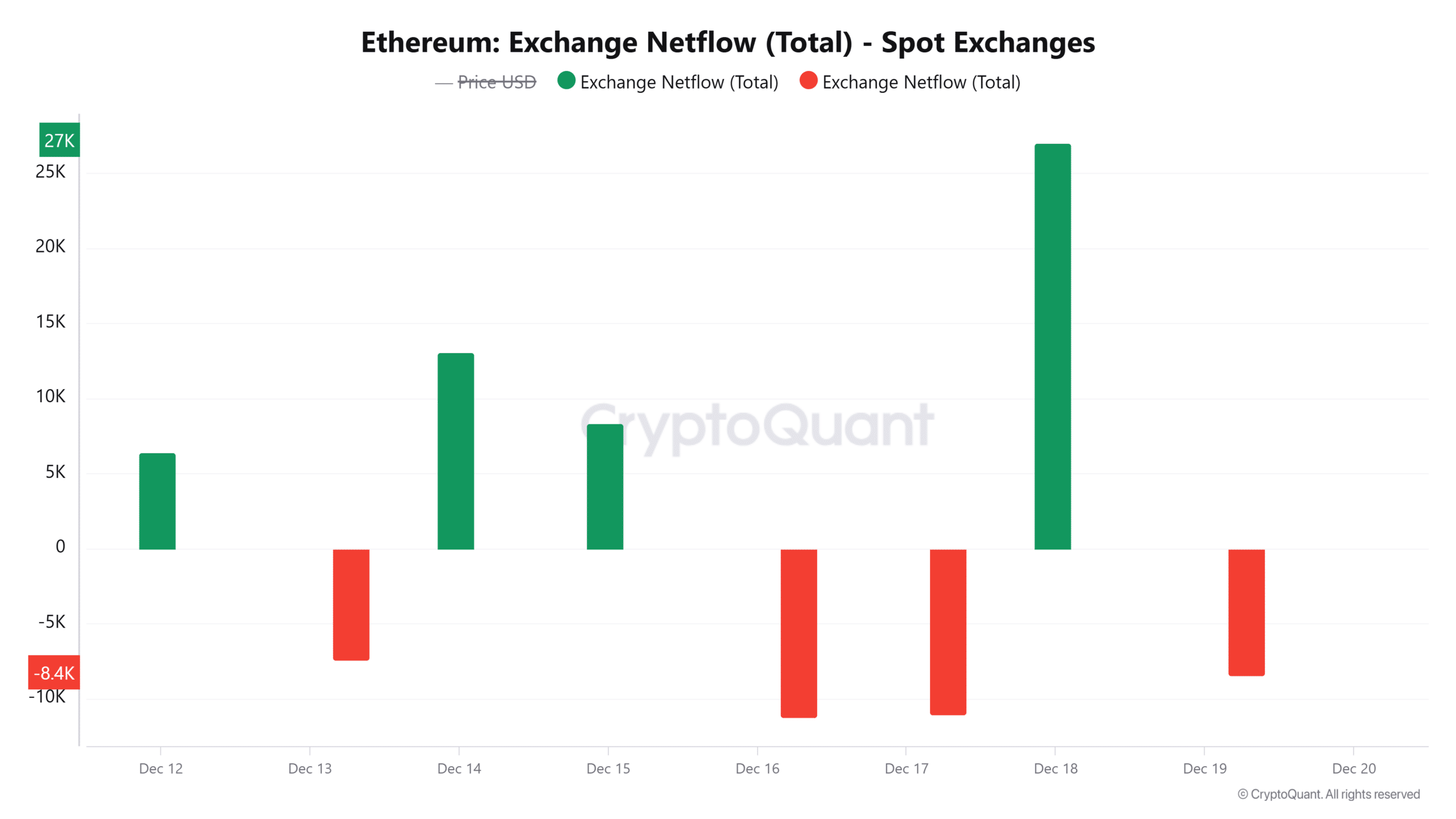

The rising selling activity is further reflected in a spike in inflows to spot exchanges after positive netflows to exchanges surged to the highest level in a week.

Source: CryptoQuant

This sell-off caused a sharp reversal that saw ETH drop from $3,900 to around $3,500. This selling activity could continue, causing bearish pressure on ETH if there is no uptick in buying pressure.

Has institutional demand slowed?

Institutional demand for ETH has increased significantly this month, as seen in the rise of inflows to spot ETFs. According to SoSoValue, inflows to these products have been positive for the last 18 consecutive days.

On the 18th of December, total inflows reached $2.45 million, the lowest since late November. The Grayscale Ethereum Mini Trust saw $15 million in outflows, the first negative flow since November.

Rising inflows to these ETFs have fueled demand, pushing ETH past $4,000. If demand weakens, it could cause a price decline.

What’s the next target for ETH?

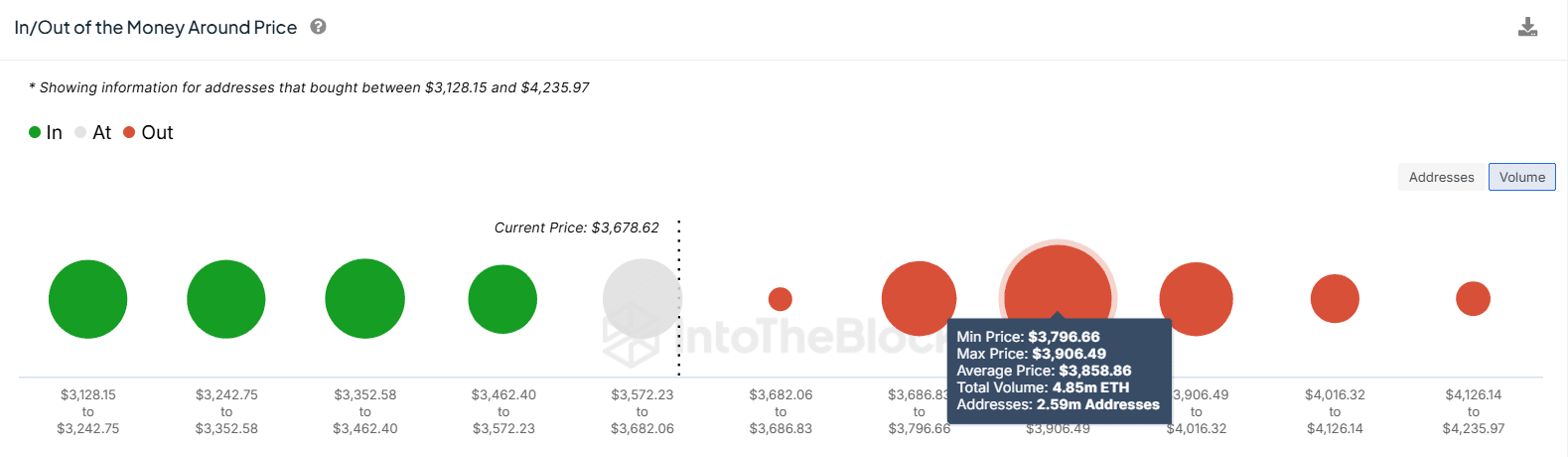

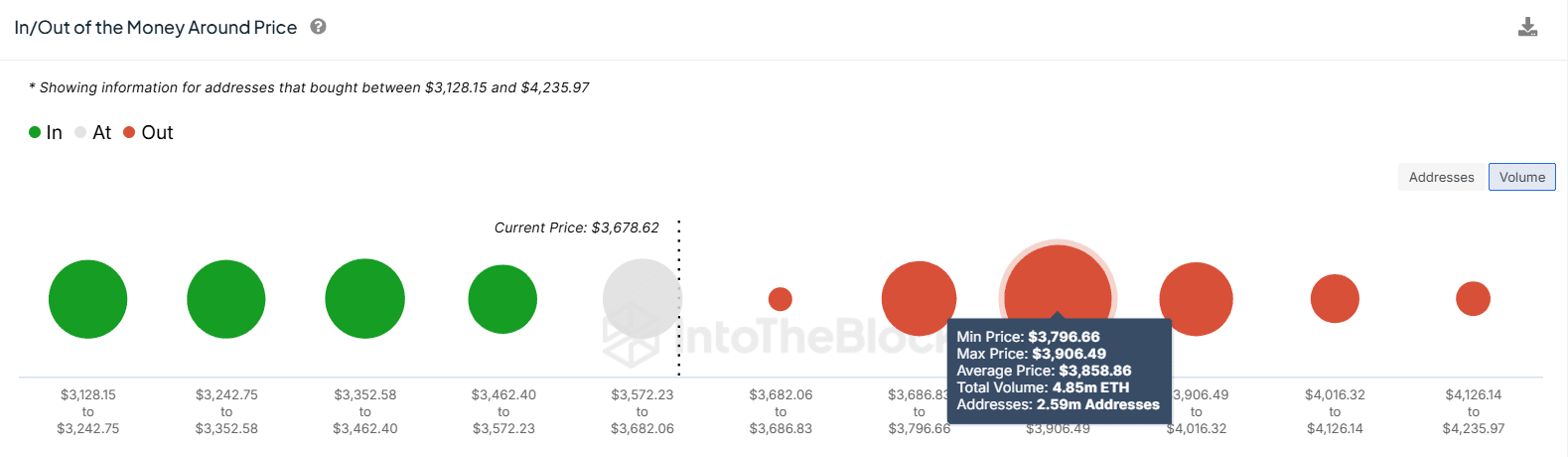

There is a looming supply zone for ETH at between $3,800 and $3,900. Per IntoTheBlock, 2.59M addresses purchased 4.85M ETH at these prices.

Source: IntoTheBlock

If buyers re-enter the market, the resulting uptrend could face strong resistance at this zone as traders look to book profits. However, if the altcoin pushes past this zone, it could unlock more gains.

Analyzing derivatives data

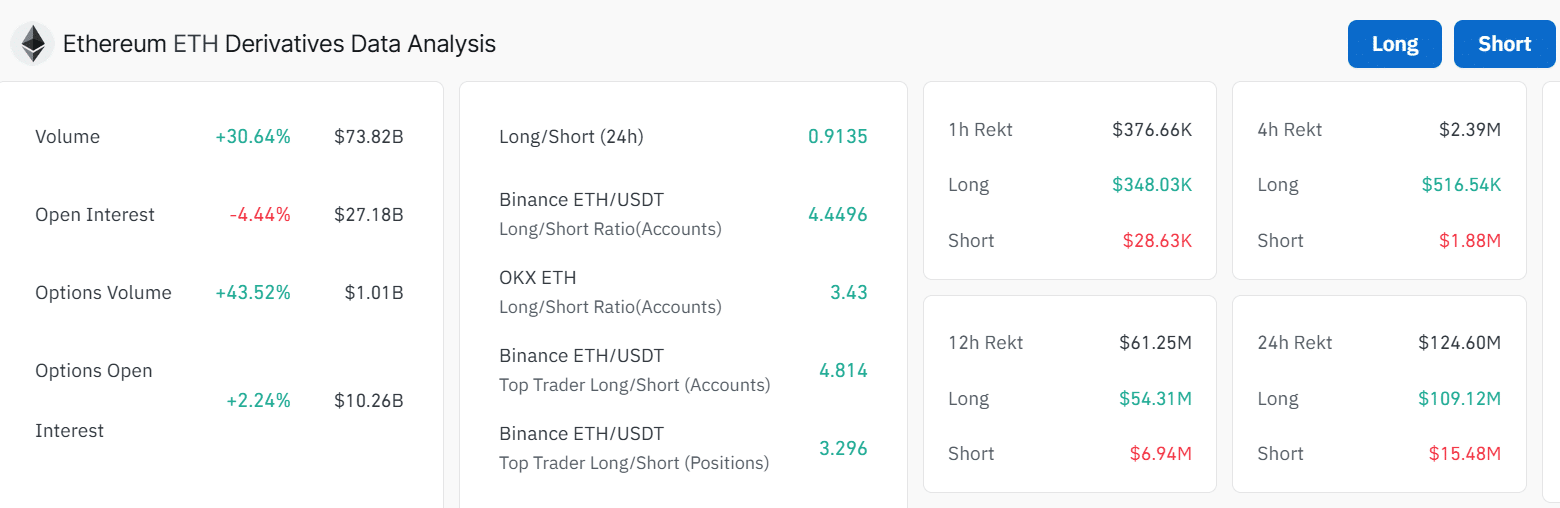

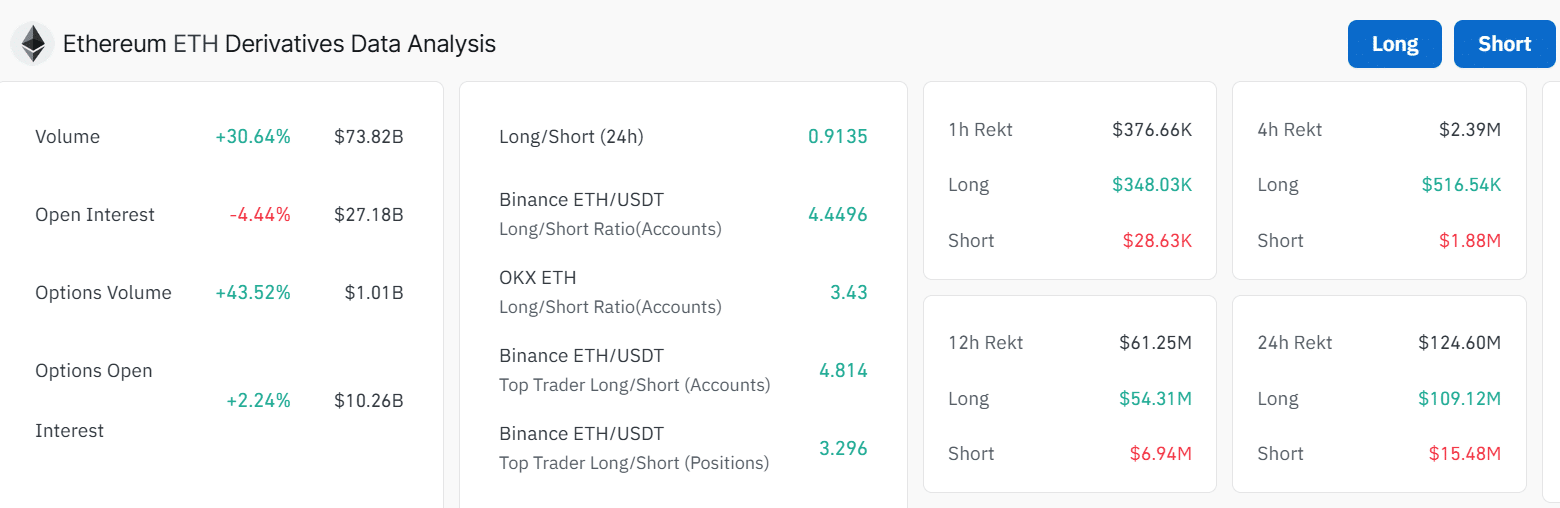

Speculative activity around ETH in the derivatives market is still significantly high, according to Coinglass. Despite a 4% decline in open interest, derivative trading volumes have surged by around 30%.

Additionally, Ethereum’s open interest at $27 billion is just 6% shy of all-time highs.

Source: Coinglass

Read Ethereum’s [ETH] Price Prediction 2024-25

However, most derivative traders appear to have taken short positions due to the long/short ratio at $0.91. This shows a prevailing bearish sentiment among traders.

- Ethereum whales sold 60,000 ETH valued at more than $200M after the price dropped to a weekly low.

- At the same time, positive netflows to exchanges have spiked to a weekly high.

Ethereum [ETH] was trading at a weekly low of $3,683, at press time, after an over 4% drop in 24 hours. While this dip brings Ethereum’s seven-day losses to 6%, the largest altcoin still sits on a 17% monthly gain.

The recent dip brought the total ETH liquidations to $124M, whereby $108M were long liquidations. As long buyers rushed to close their positions, Ethereum whales also reduced their holdings significantly.

Ethereum whales move $200M ETH

Data from IntoTheBlock shows on the 18th of December 18, Ethereum whales holding between 1,000 and 10,000 ETH saw their holdings drop from 13.47M to $13.41M. This indicates that these addresses sold 60,000 ETH valued at more than $200M.

Source: IntoTheBlock

As AMBCrypto reported, ETH whales account for 57% of the altcoins supply. Therefore, if this cohort is reducing its holdings, it could have a negative impact on the price by increasing the sell-side pressure.

Surge in exchange inflows

The rising selling activity is further reflected in a spike in inflows to spot exchanges after positive netflows to exchanges surged to the highest level in a week.

Source: CryptoQuant

This sell-off caused a sharp reversal that saw ETH drop from $3,900 to around $3,500. This selling activity could continue, causing bearish pressure on ETH if there is no uptick in buying pressure.

Has institutional demand slowed?

Institutional demand for ETH has increased significantly this month, as seen in the rise of inflows to spot ETFs. According to SoSoValue, inflows to these products have been positive for the last 18 consecutive days.

On the 18th of December, total inflows reached $2.45 million, the lowest since late November. The Grayscale Ethereum Mini Trust saw $15 million in outflows, the first negative flow since November.

Rising inflows to these ETFs have fueled demand, pushing ETH past $4,000. If demand weakens, it could cause a price decline.

What’s the next target for ETH?

There is a looming supply zone for ETH at between $3,800 and $3,900. Per IntoTheBlock, 2.59M addresses purchased 4.85M ETH at these prices.

Source: IntoTheBlock

If buyers re-enter the market, the resulting uptrend could face strong resistance at this zone as traders look to book profits. However, if the altcoin pushes past this zone, it could unlock more gains.

Analyzing derivatives data

Speculative activity around ETH in the derivatives market is still significantly high, according to Coinglass. Despite a 4% decline in open interest, derivative trading volumes have surged by around 30%.

Additionally, Ethereum’s open interest at $27 billion is just 6% shy of all-time highs.

Source: Coinglass

Read Ethereum’s [ETH] Price Prediction 2024-25

However, most derivative traders appear to have taken short positions due to the long/short ratio at $0.91. This shows a prevailing bearish sentiment among traders.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

clomiphene sale cost generic clomiphene online clomid rx cost cheap clomid prices can you get generic clomid without insurance where can i buy clomid without dr prescription cost cheap clomiphene prices

This is the type of enter I recoup helpful.

This is the kind of serenity I enjoy reading.

zithromax over the counter – order zithromax 250mg for sale order generic flagyl 400mg

buy generic rybelsus – semaglutide 14mg usa purchase cyproheptadine generic

motilium over the counter – motilium 10mg pills flexeril online

inderal 10mg us – purchase methotrexate for sale order methotrexate generic

amoxicillin generic – buy amoxicillin tablets combivent 100 mcg ca