- XRP and ETH are in a tight race to attract capital from Bitcoin as market sentiment turns cautious.

- XRP has the potential to carve out its own asset class distinct from BTC by 2025.

Once again, the crypto market’s resilience is being tested as the FOMC wraps up 2024 with a “speculative” twist. The third and final interest rate cut of the year—also the third in just four months—sparked a sharp sell-off in Bitcoin [BTC]. A long red candlestick erased five days of gains, dragging BTC’s price below the critical $100K mark.

But this might just be the start. The Fed’s “cautious” stance hinted that Trump’s conservative policies could lead to higher inflation in the months ahead.

Investors didn’t take the news well. As the market dipped, some altcoins took double-digit hits, but the top coins stood firm, suggesting a strong rebound is likely.

Here’s the interesting part: when it came to riding the “Trump pump,” Ripple [XRP] emerged as the big winner. Does this give XRP an edge in its battle against Bitcoin and Ethereum?

The game is on!

Right now, XRP is experiencing a surge in sell-offs across multiple metrics. It’s clear that XRP hasn’t stayed immune to the market turmoil. In fact, the $3 mark is slipping further out of reach, with XRP currently priced at $2.30 (at the time of writing).

But all is not lost. December began on a strong note for XRP, with the coin posting four consecutive green candles, each marking nearly a 15% gain and closing near $2.80 – a level it hasn’t reached in three years. So, distributing XRP tokens seemed like a smart move.

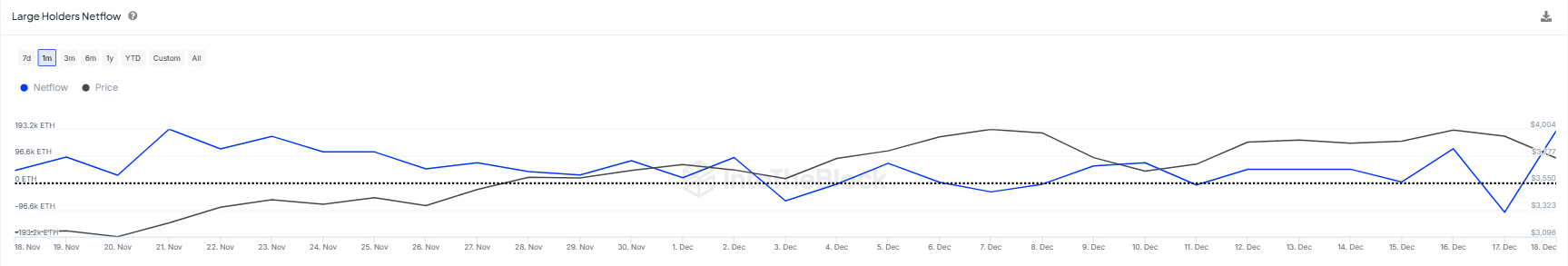

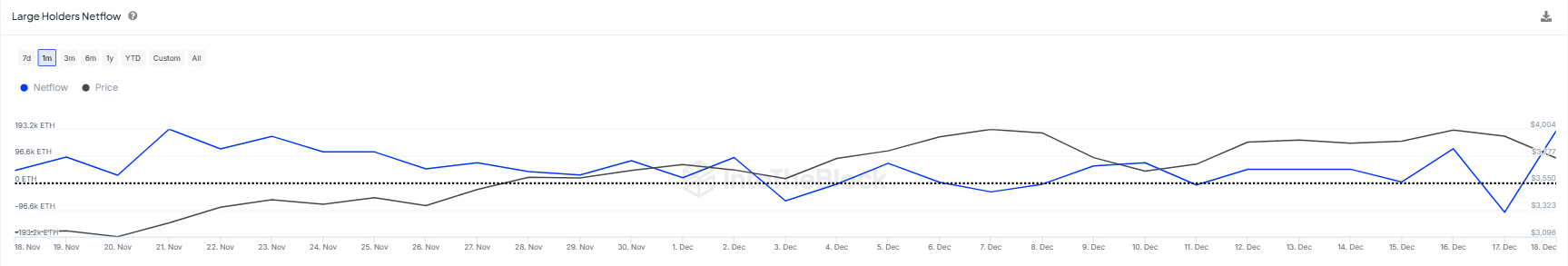

On the other hand, Ethereum’s daily chart is showcasing even more volatility, with sharp drops quickly followed by impressive rebounds.

From mid-November to mid-December, each “dip” seemed strategically timed, followed by a strong recovery. This suggests that any increase in ETH supply was quickly met with aggressive accumulation.

Now, both XRP and ETH race fiercely to break through key resistance levels. The competition is tight. But the winner will be the one that can stay strong amidst uncertainty, supported by solid fundamentals. So, which one will break first – $3 for XRP or $4K for Ethereum? Or will Bitcoin steal the spotlight, instead?

XRP or ETH, whose “dip” should you dig?

The past 24 hours have rocked the crypto market, with a mix of factors coming together to trigger a volatile chain reaction. Notably, it’s the small, retail investors who have taken the hardest hit.

In this climate, it’s clear that the FOMO may not return in the coming days. Instead, investors are rushing to adjust their portfolios, hoping to break even on their losses. The burden, it seems, is now on the big players with deep pockets.

Here’s where things get interesting: the recent dip has brought both XRP and ETH close to a critical support level. If the big players start accumulating at this price point, we might be seeing the beginnings of a local bottom. This could trigger a rebound, sparking confidence among smaller investors.

When it comes to ETH, whales have shown notably more strategy compared to XRP. They’ve been capitalizing on these dips, scooping up ETH at a discount before cashing out at a premium once the $4K mark is within sight.

Source : IntoTheBlock

Now, with whales re-accumulating ETH, it’s likely that the price will test $3.9K next, but caution is warranted.

However, the attention is shifting to Bitcoin, which recently saw a strong upward move, reclaiming $101K— a bullish signal for the market.

Still, the recent Bitcoin crash has presented altcoins with a prime opportunity to shine. It seems unlikely that we’ll see a retail surge for BTC in the immediate future, despite whales and institutions capitalizing on the dip.

So, while ETH continues to struggle with its endless loop, XRP has multiple factors supporting its growth: historical performance, whale backing, the SEC developments, and the RLUSD stablecoin initiative.

Read Ripple [XRP] Price Prediction 2024-2025

As a result, XRP’s potential to carve out a separate asset class from BTC by 2025 is a unique advantage – something Ethereum has failed to accomplish since its inception.

Should XRP succeed in this, it could be in a prime position to benefit from Bitcoin’s volatility in the year ahead.

- XRP and ETH are in a tight race to attract capital from Bitcoin as market sentiment turns cautious.

- XRP has the potential to carve out its own asset class distinct from BTC by 2025.

Once again, the crypto market’s resilience is being tested as the FOMC wraps up 2024 with a “speculative” twist. The third and final interest rate cut of the year—also the third in just four months—sparked a sharp sell-off in Bitcoin [BTC]. A long red candlestick erased five days of gains, dragging BTC’s price below the critical $100K mark.

But this might just be the start. The Fed’s “cautious” stance hinted that Trump’s conservative policies could lead to higher inflation in the months ahead.

Investors didn’t take the news well. As the market dipped, some altcoins took double-digit hits, but the top coins stood firm, suggesting a strong rebound is likely.

Here’s the interesting part: when it came to riding the “Trump pump,” Ripple [XRP] emerged as the big winner. Does this give XRP an edge in its battle against Bitcoin and Ethereum?

The game is on!

Right now, XRP is experiencing a surge in sell-offs across multiple metrics. It’s clear that XRP hasn’t stayed immune to the market turmoil. In fact, the $3 mark is slipping further out of reach, with XRP currently priced at $2.30 (at the time of writing).

But all is not lost. December began on a strong note for XRP, with the coin posting four consecutive green candles, each marking nearly a 15% gain and closing near $2.80 – a level it hasn’t reached in three years. So, distributing XRP tokens seemed like a smart move.

On the other hand, Ethereum’s daily chart is showcasing even more volatility, with sharp drops quickly followed by impressive rebounds.

From mid-November to mid-December, each “dip” seemed strategically timed, followed by a strong recovery. This suggests that any increase in ETH supply was quickly met with aggressive accumulation.

Now, both XRP and ETH race fiercely to break through key resistance levels. The competition is tight. But the winner will be the one that can stay strong amidst uncertainty, supported by solid fundamentals. So, which one will break first – $3 for XRP or $4K for Ethereum? Or will Bitcoin steal the spotlight, instead?

XRP or ETH, whose “dip” should you dig?

The past 24 hours have rocked the crypto market, with a mix of factors coming together to trigger a volatile chain reaction. Notably, it’s the small, retail investors who have taken the hardest hit.

In this climate, it’s clear that the FOMO may not return in the coming days. Instead, investors are rushing to adjust their portfolios, hoping to break even on their losses. The burden, it seems, is now on the big players with deep pockets.

Here’s where things get interesting: the recent dip has brought both XRP and ETH close to a critical support level. If the big players start accumulating at this price point, we might be seeing the beginnings of a local bottom. This could trigger a rebound, sparking confidence among smaller investors.

When it comes to ETH, whales have shown notably more strategy compared to XRP. They’ve been capitalizing on these dips, scooping up ETH at a discount before cashing out at a premium once the $4K mark is within sight.

Source : IntoTheBlock

Now, with whales re-accumulating ETH, it’s likely that the price will test $3.9K next, but caution is warranted.

However, the attention is shifting to Bitcoin, which recently saw a strong upward move, reclaiming $101K— a bullish signal for the market.

Still, the recent Bitcoin crash has presented altcoins with a prime opportunity to shine. It seems unlikely that we’ll see a retail surge for BTC in the immediate future, despite whales and institutions capitalizing on the dip.

So, while ETH continues to struggle with its endless loop, XRP has multiple factors supporting its growth: historical performance, whale backing, the SEC developments, and the RLUSD stablecoin initiative.

Read Ripple [XRP] Price Prediction 2024-2025

As a result, XRP’s potential to carve out a separate asset class from BTC by 2025 is a unique advantage – something Ethereum has failed to accomplish since its inception.

Should XRP succeed in this, it could be in a prime position to benefit from Bitcoin’s volatility in the year ahead.

clomid generic cost how to buy cheap clomid tablets cost of generic clomiphene pills where to buy cheap clomid without dr prescription clomid medication uk cost clomid pills order cheap clomid price

I’ll certainly return to review more.

This is the gentle of criticism I positively appreciate.

zithromax online buy – order generic ciprofloxacin metronidazole 200mg tablet

rybelsus 14 mg drug – purchase semaglutide pills cyproheptadine sale

generic motilium 10mg – buy cyclobenzaprine no prescription order cyclobenzaprine 15mg generic

buy generic zithromax – buy nebivolol tablets buy generic nebivolol 5mg

cost amoxiclav – atbioinfo generic ampicillin

nexium 40mg brand – https://anexamate.com/ nexium 20mg without prescription

warfarin 5mg cost – cou mamide order losartan 50mg

order meloxicam online cheap – https://moboxsin.com/ buy meloxicam 7.5mg pills

cheap deltasone 20mg – https://apreplson.com/ deltasone pills

ed pills comparison – fastedtotake fda approved over the counter ed pills

cost amoxil – amoxil pill purchase amoxil sale

diflucan over the counter – https://gpdifluca.com/# diflucan pill