- Ethereum struggled below $4,000, with Binance outflows suggesting potential long-term accumulation.

- Negative social sentiment mirrored December 2023 trends, potentially signaling a bullish recovery for ETH.

How large withdrawals could impact ETH price?

Approximately 20.8 million ETH have been withdrawn from centralized exchanges over the past two months, a trend reminiscent of the 2021 bull market. Binance has been central to this movement, accounting for over 7.8 million ETH, or 33-39% of the total outflows.

CryptoQuant analyst Crazzyblockk suggests these withdrawals may signal long-term accumulation or staking, reflecting investor confidence.

These significant outflows from Binance indicate the platform’s continued influence on the cryptocurrency market, especially in balancing supply and demand for Ethereum.

With Binance’s influence, backed by its 250 million global users and $21.6 billion in deposits, these outflows could reduce ETH’s supply on exchanges, potentially creating upward price pressure if demand remains strong.

Ethereum market performance

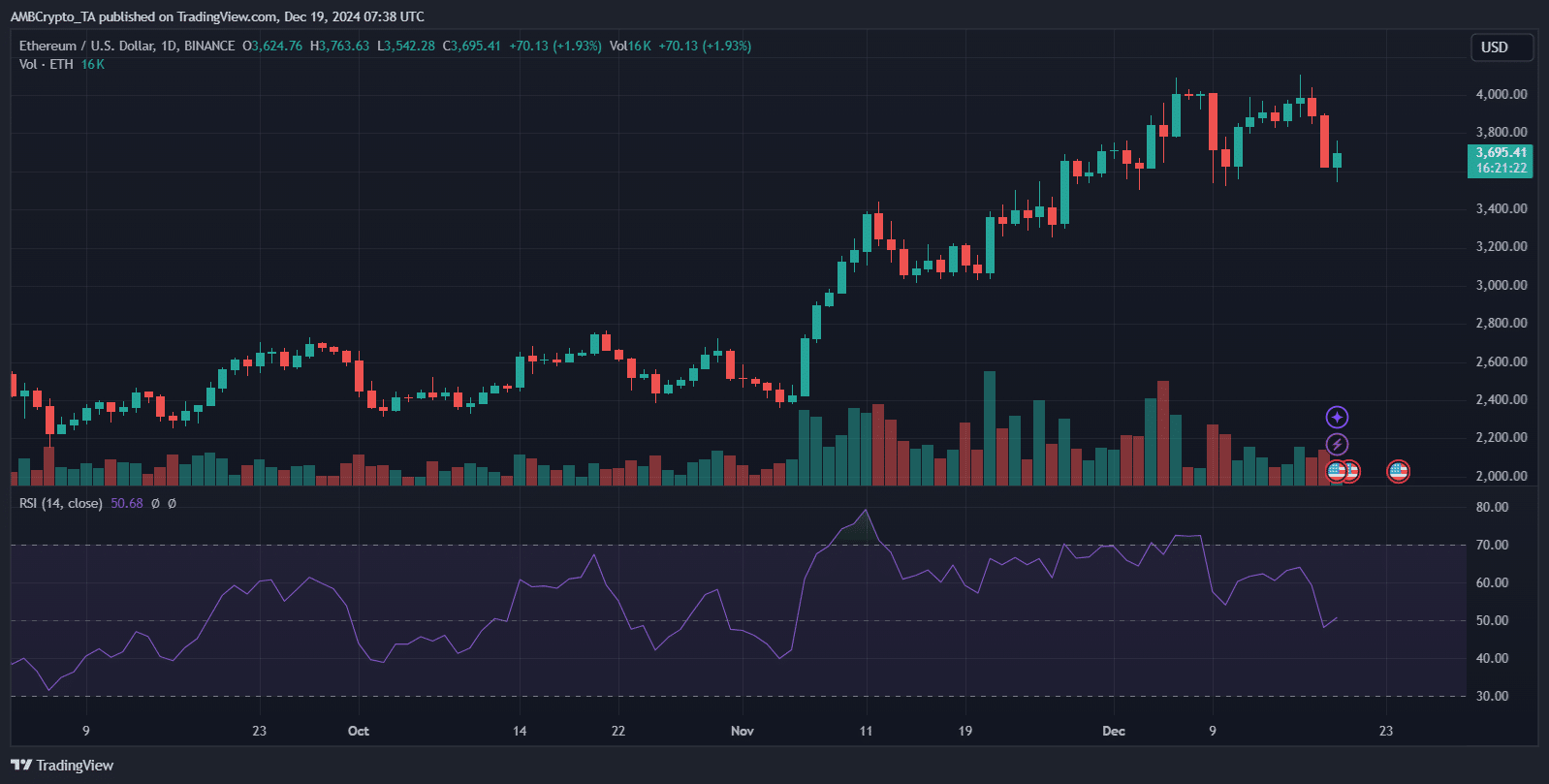

Ethereum has struggled to match Bitcoin’s bullish momentum, failing to breach the $4,000 resistance despite the broader crypto market rally.

While Bitcoin has posted new all-time highs almost monthly, Ethereum’s gains remain modest. Ethereum has seen a 2.3% weekly increase compared to Bitcoin’s 5%.

Source: TradingView

Even positive news, such as Deutsche Bank’s rumored Ethereum-based layer-2 blockchain leveraging ZKsync technology, has failed to inject upward momentum. Technical analysis suggests bearish signals, hinting at a potential price correction to $3,400.

Ethereum’s current lack of breakout potential highlights its challenges in maintaining investor confidence, despite recent outflows pointing to long-term accumulation trends.

Read Ethereum’s [ETH] Price Prediction 2024-25

- Ethereum struggled below $4,000, with Binance outflows suggesting potential long-term accumulation.

- Negative social sentiment mirrored December 2023 trends, potentially signaling a bullish recovery for ETH.

How large withdrawals could impact ETH price?

Approximately 20.8 million ETH have been withdrawn from centralized exchanges over the past two months, a trend reminiscent of the 2021 bull market. Binance has been central to this movement, accounting for over 7.8 million ETH, or 33-39% of the total outflows.

CryptoQuant analyst Crazzyblockk suggests these withdrawals may signal long-term accumulation or staking, reflecting investor confidence.

These significant outflows from Binance indicate the platform’s continued influence on the cryptocurrency market, especially in balancing supply and demand for Ethereum.

With Binance’s influence, backed by its 250 million global users and $21.6 billion in deposits, these outflows could reduce ETH’s supply on exchanges, potentially creating upward price pressure if demand remains strong.

Ethereum market performance

Ethereum has struggled to match Bitcoin’s bullish momentum, failing to breach the $4,000 resistance despite the broader crypto market rally.

While Bitcoin has posted new all-time highs almost monthly, Ethereum’s gains remain modest. Ethereum has seen a 2.3% weekly increase compared to Bitcoin’s 5%.

Source: TradingView

Even positive news, such as Deutsche Bank’s rumored Ethereum-based layer-2 blockchain leveraging ZKsync technology, has failed to inject upward momentum. Technical analysis suggests bearish signals, hinting at a potential price correction to $3,400.

Ethereum’s current lack of breakout potential highlights its challenges in maintaining investor confidence, despite recent outflows pointing to long-term accumulation trends.

Read Ethereum’s [ETH] Price Prediction 2024-25

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)