- Ethereum has shown incredible resilience, defying bearish expectations to surge near the $4K target.

- Despite its strong fundamentals, it now needs a “Secret Santa” to spark the next leap.

The crypto market has faced a tough 24 hours, with most coins pulling back after testing key psychological levels.

Ethereum [ETH] hasn’t been spared, seeing a sharp correction after briefly crossing the $4,000 mark. Weak hands seem to be cashing out, locking in gains as bearish sentiment takes hold.

However, this dip might just be a short-term detour. As the market transitions into ‘new year’ mode, Ethereum’s history of bouncing back suggests a potential rebound—especially with Bitcoin’s $200K speculation gaining steam.

So, as we look to the future, could Ethereum really surge to $16,000 in the next two years? Is this based on Ethereum’s proven resilience, or just another speculative guess?

Ethereum’s track record of defying odds

Mathematically, for Ethereum to reach $16,000, it would need a 312% surge from its current value.

However, looking at its performance over the past 30 days, Ethereum has lagged behind competitors, many of which have posted triple-digit gains.

That said, if there’s one thing the crypto market is known for, it’s defying mainstream expectations— and Ethereum has a proven track record of doing just that.

Over the years, numerous “Ethereum Killers” have come and gone, but none have come close to matching Ethereum’s market cap of over $450 billion, a testament to its resilience.

But for Ethereum to truly break through, strong fundamentals will be crucial. Altcoins like Ethereum need more than just hype to stay relevant – they need lasting value.

Since its launch in late July, the Ethereum ETF initially struggled to capture the institutional interest many had anticipated. However, a shift occurred in November, with institutional attention beginning to build.

Just four days ago, total ETF inflows surged, reaching the half-billion-dollar mark for the first time.

This surge in institutional interest could be a game-changer for Ethereum. While short-term dips are inevitable, the real catalyst for long-term growth lies with the big players – those holding for the long haul.

So, as long as institutional support holds strong, predicting an Ethereum price of $16,000 doesn’t seem too far-fetched.

Still, for Ethereum to surge, it needs Bitcoin’s backing

As the coin with the largest market share, Bitcoin leads the charge in setting the direction for the market. However, over time, Ethereum has worked hard to carve out its own identity as a distinct asset class.

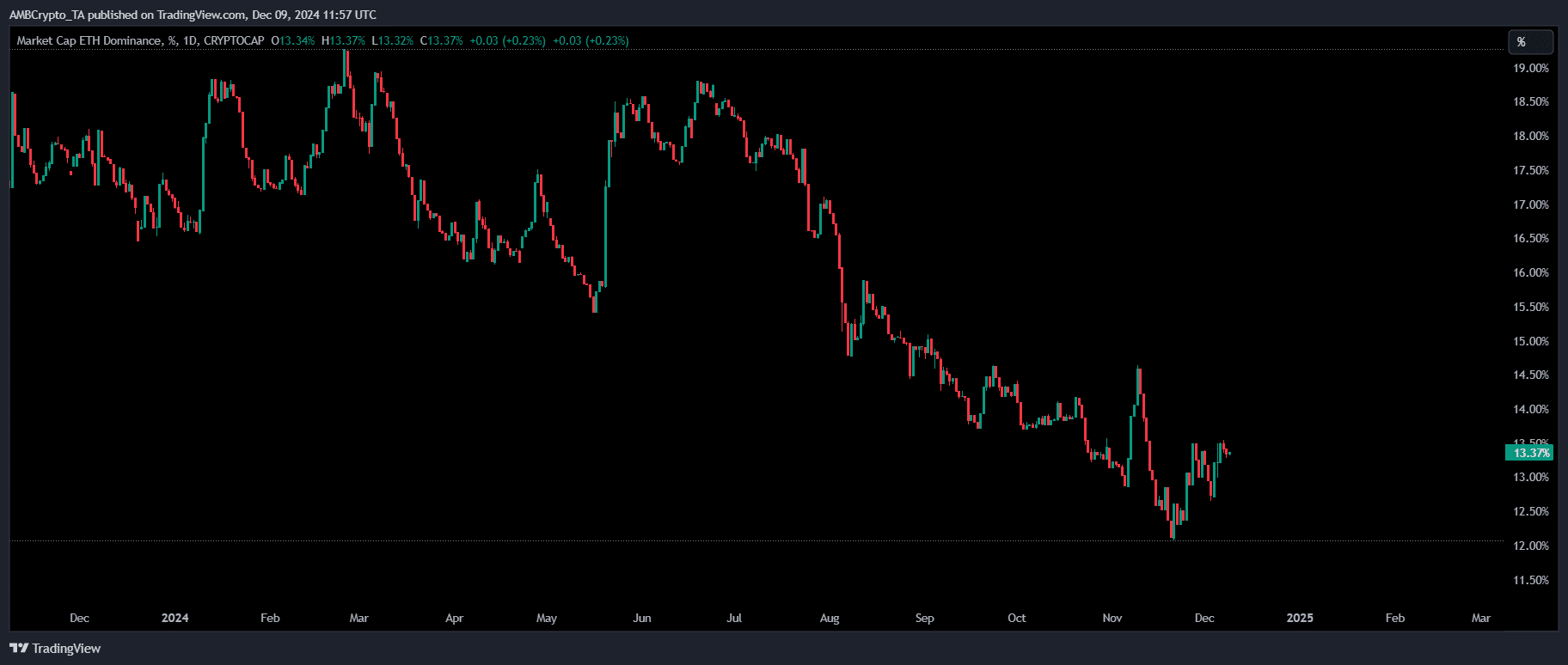

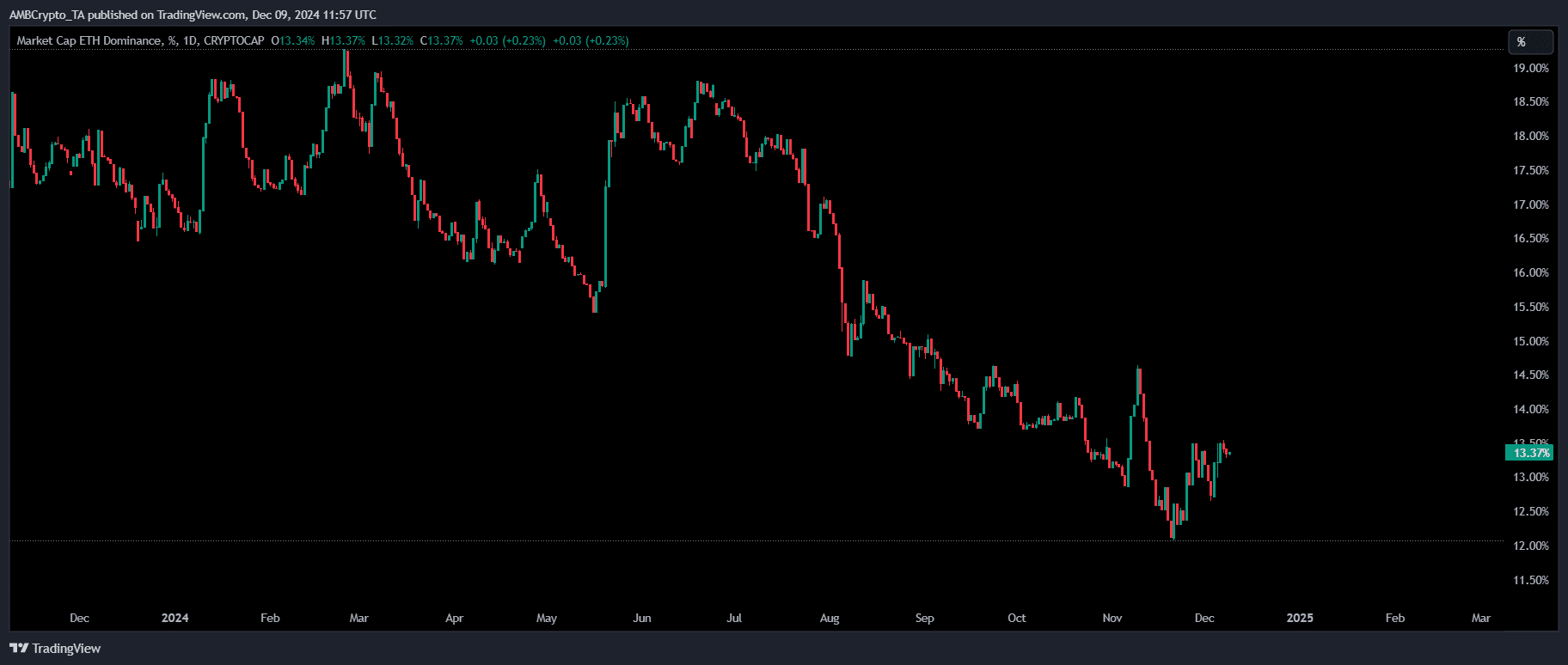

Despite these efforts, Ethereum’s dominance has recently hit a two-year low, leaving it more vulnerable to market fluctuations when Bitcoin moves, whether up or down.

Source : TradingView

Now, with market makers buzzing about Bitcoin’s next big target, its dominance is sure to peak, making Ethereum’s shot at $16K more closely tied to Bitcoin’s performance.

Here’s why: when Bitcoin performs well, big investors often pour into altcoins like ETH, driving its price up.

Without it, Ethereum’s gains could be limited to speculative interest, as investors seek safer options during Bitcoin’s peak moments.

Read Ethereum’s [ETH] Price Prediction 2024–2025

In short, for Ethereum to truly soar, Bitcoin has to lead the charge.

Even with strong fundamentals and big player support, Ethereum can’t break this major milestone alone – it needs Bitcoin to keep the momentum going, no matter the cost.

- Ethereum has shown incredible resilience, defying bearish expectations to surge near the $4K target.

- Despite its strong fundamentals, it now needs a “Secret Santa” to spark the next leap.

The crypto market has faced a tough 24 hours, with most coins pulling back after testing key psychological levels.

Ethereum [ETH] hasn’t been spared, seeing a sharp correction after briefly crossing the $4,000 mark. Weak hands seem to be cashing out, locking in gains as bearish sentiment takes hold.

However, this dip might just be a short-term detour. As the market transitions into ‘new year’ mode, Ethereum’s history of bouncing back suggests a potential rebound—especially with Bitcoin’s $200K speculation gaining steam.

So, as we look to the future, could Ethereum really surge to $16,000 in the next two years? Is this based on Ethereum’s proven resilience, or just another speculative guess?

Ethereum’s track record of defying odds

Mathematically, for Ethereum to reach $16,000, it would need a 312% surge from its current value.

However, looking at its performance over the past 30 days, Ethereum has lagged behind competitors, many of which have posted triple-digit gains.

That said, if there’s one thing the crypto market is known for, it’s defying mainstream expectations— and Ethereum has a proven track record of doing just that.

Over the years, numerous “Ethereum Killers” have come and gone, but none have come close to matching Ethereum’s market cap of over $450 billion, a testament to its resilience.

But for Ethereum to truly break through, strong fundamentals will be crucial. Altcoins like Ethereum need more than just hype to stay relevant – they need lasting value.

Since its launch in late July, the Ethereum ETF initially struggled to capture the institutional interest many had anticipated. However, a shift occurred in November, with institutional attention beginning to build.

Just four days ago, total ETF inflows surged, reaching the half-billion-dollar mark for the first time.

This surge in institutional interest could be a game-changer for Ethereum. While short-term dips are inevitable, the real catalyst for long-term growth lies with the big players – those holding for the long haul.

So, as long as institutional support holds strong, predicting an Ethereum price of $16,000 doesn’t seem too far-fetched.

Still, for Ethereum to surge, it needs Bitcoin’s backing

As the coin with the largest market share, Bitcoin leads the charge in setting the direction for the market. However, over time, Ethereum has worked hard to carve out its own identity as a distinct asset class.

Despite these efforts, Ethereum’s dominance has recently hit a two-year low, leaving it more vulnerable to market fluctuations when Bitcoin moves, whether up or down.

Source : TradingView

Now, with market makers buzzing about Bitcoin’s next big target, its dominance is sure to peak, making Ethereum’s shot at $16K more closely tied to Bitcoin’s performance.

Here’s why: when Bitcoin performs well, big investors often pour into altcoins like ETH, driving its price up.

Without it, Ethereum’s gains could be limited to speculative interest, as investors seek safer options during Bitcoin’s peak moments.

Read Ethereum’s [ETH] Price Prediction 2024–2025

In short, for Ethereum to truly soar, Bitcoin has to lead the charge.

Even with strong fundamentals and big player support, Ethereum can’t break this major milestone alone – it needs Bitcoin to keep the momentum going, no matter the cost.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

cost of clomid where can i get clomiphene pill how to buy generic clomid pill can i get cheap clomid pill can you buy clomid without insurance how to get generic clomiphene price buying cheap clomid no prescription

More posts like this would add up to the online space more useful.

semaglutide for sale online – semaglutide 14mg drug cyproheptadine brand

buy domperidone – buy motilium 10mg online cheap flexeril 15mg pills