- Ethereum’s exchange reserve was dropping, signaling high buying pressure.

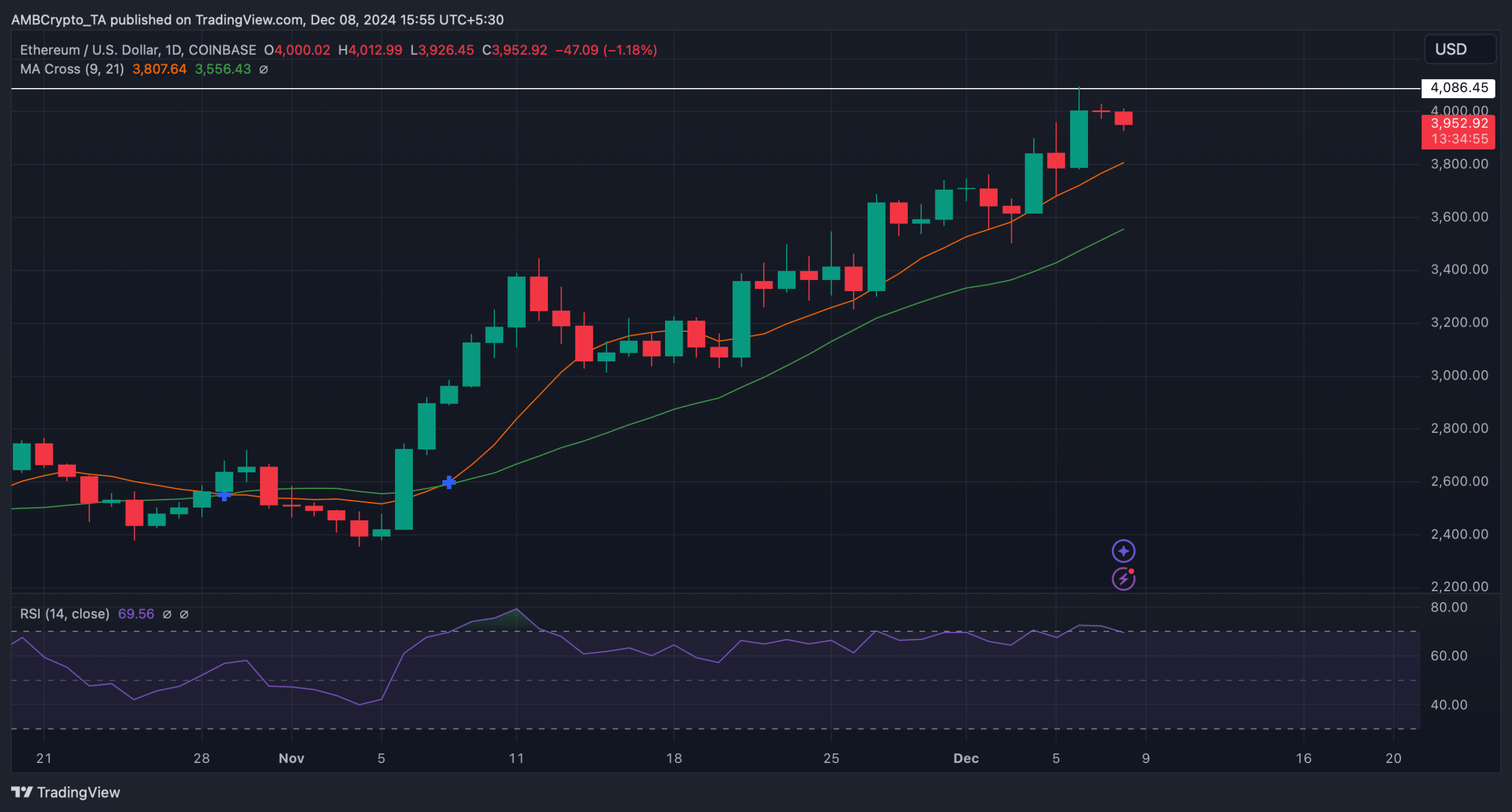

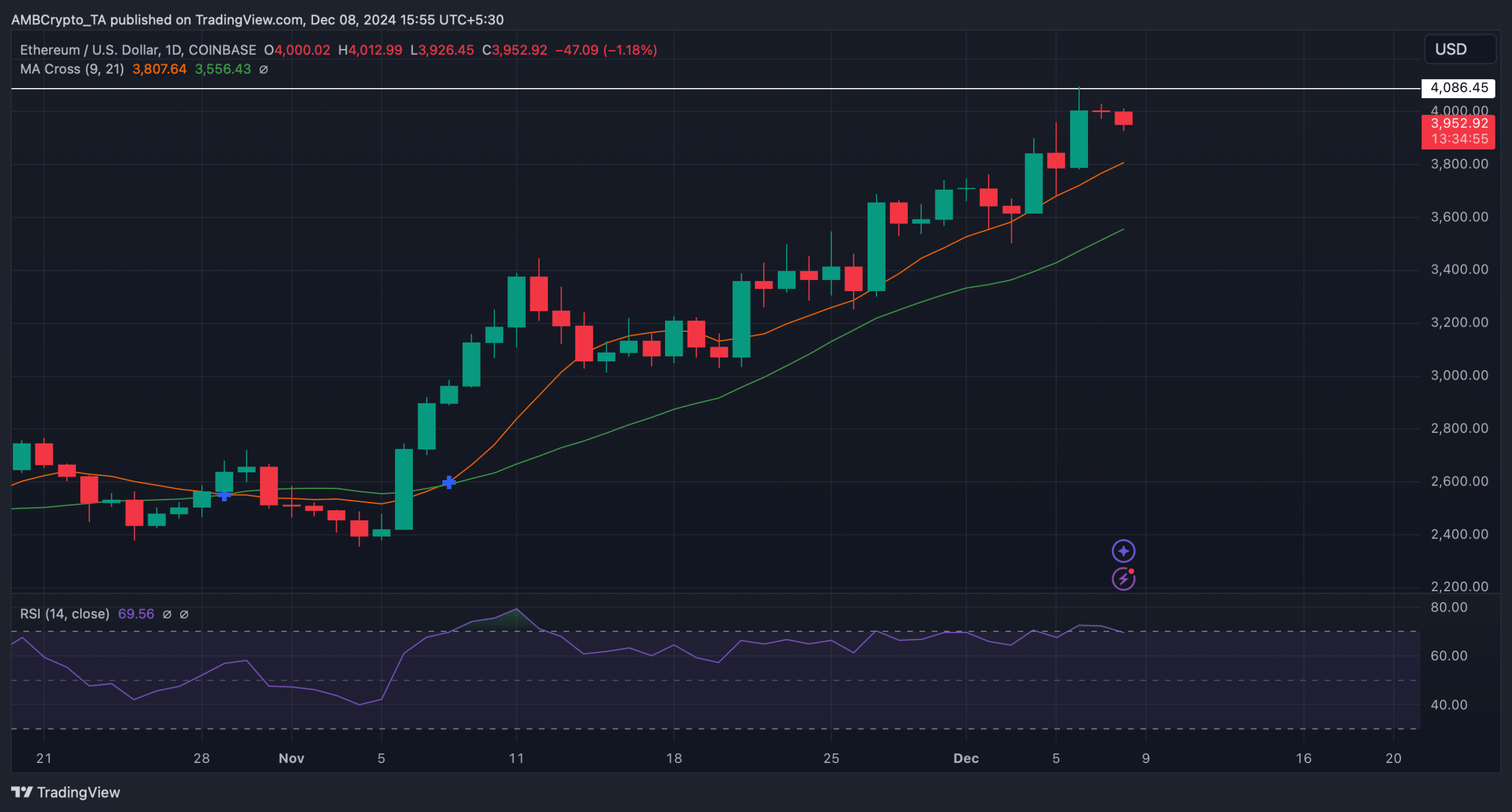

- However, the RSI was resting in the overbought zone.

Ethereum [ETH] has been struggling to breach the $4k barrier for quite some time now, as it is getting rejected near the resistance.

However, latest analysis revealed that the path for ETH moving towards a new all-time high is pretty clear. Therefore, AMBCrypto investigated further to find out whether that’s actually the case.

Ethereum is on the right track

ETH’s price registered a 7% price hike last week, pushing the token’s price near $4k. At the time of writing, ETH was trading at $3.05k with a market capitalization of over $476 billion.

In the meantime, Ali Martinez, a popular crypto analyst, posted a tweet revealing that there was nothing preventing ETH from reaching new all-time highs. The only modest resistance zone ahead was around $4,540.

But as long as the $3,560 demand zone holds, the odds favor the bulls.

Will ETH touch $4.5k soon?

Since Martinez’s tweet revealed the possibility of ETH touching $4.5k, AMBCrypto assessed the token’s on-chain metrics to find the likelihood of that happening in the short term.

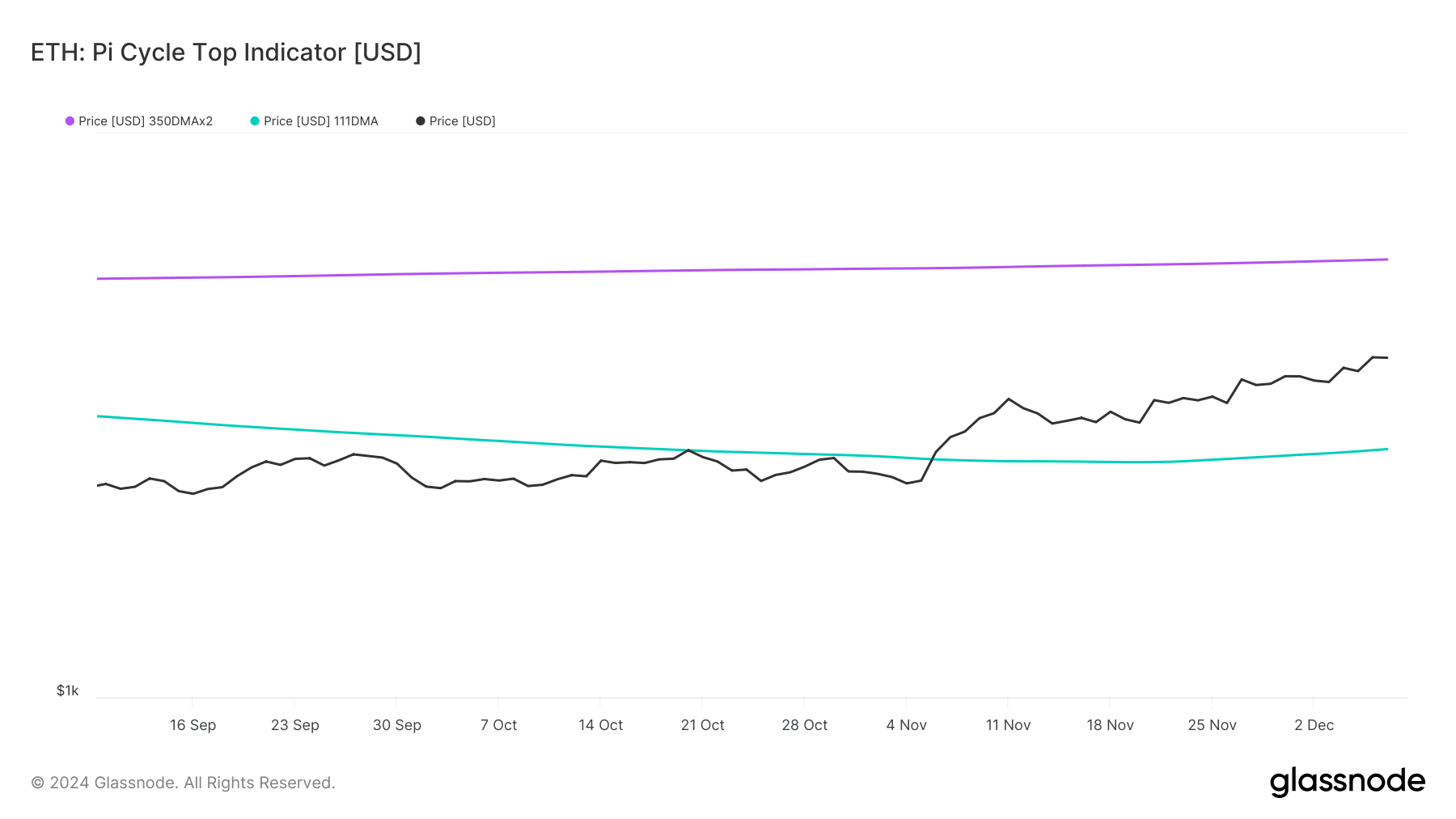

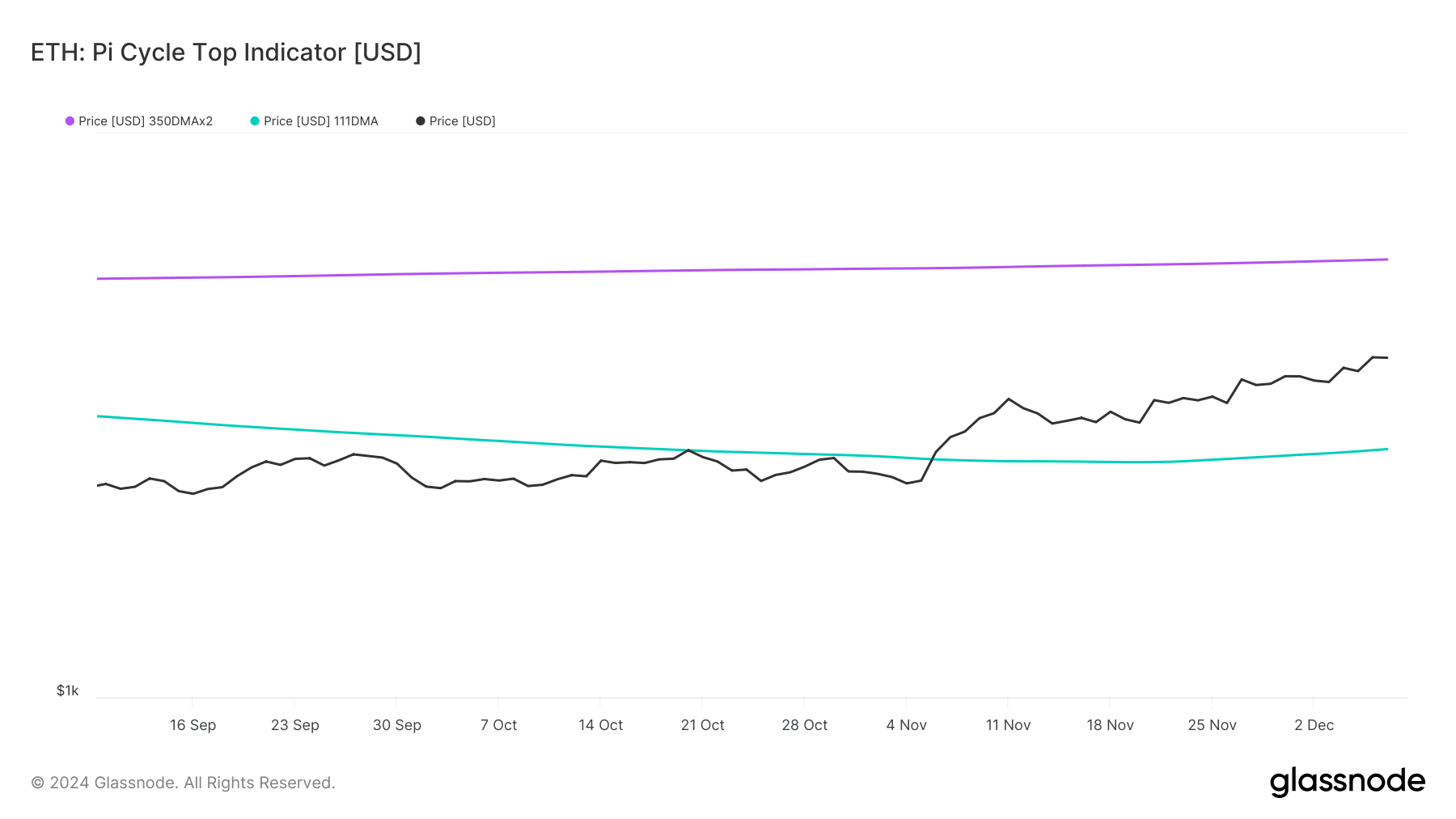

ETH’s Pi Cycle Top indicator revealed that ETH was trading well between its market top and bottom. If the metric is to be believed, ETH’s possible market top was at $5.9k.

Therefore, it seemed likely for ETH top reach $4.5k soon.

Source: Glassnode

CryptoQuant’s data revealed that buying pressure on the token was rising. This was evident from ETH’s declining exchange reserve.

Additionally, Ethereum’s Coinbase premium was green, meaning that buying sentiment among US investors was strong. However, a few metrics also looked bearish.

For instance, ETH’s taker buy/sell ratio turned red. Whenever this happens, it indicates that selling sentiment is dominant in the derivatives market. More sell orders are filled by takers.

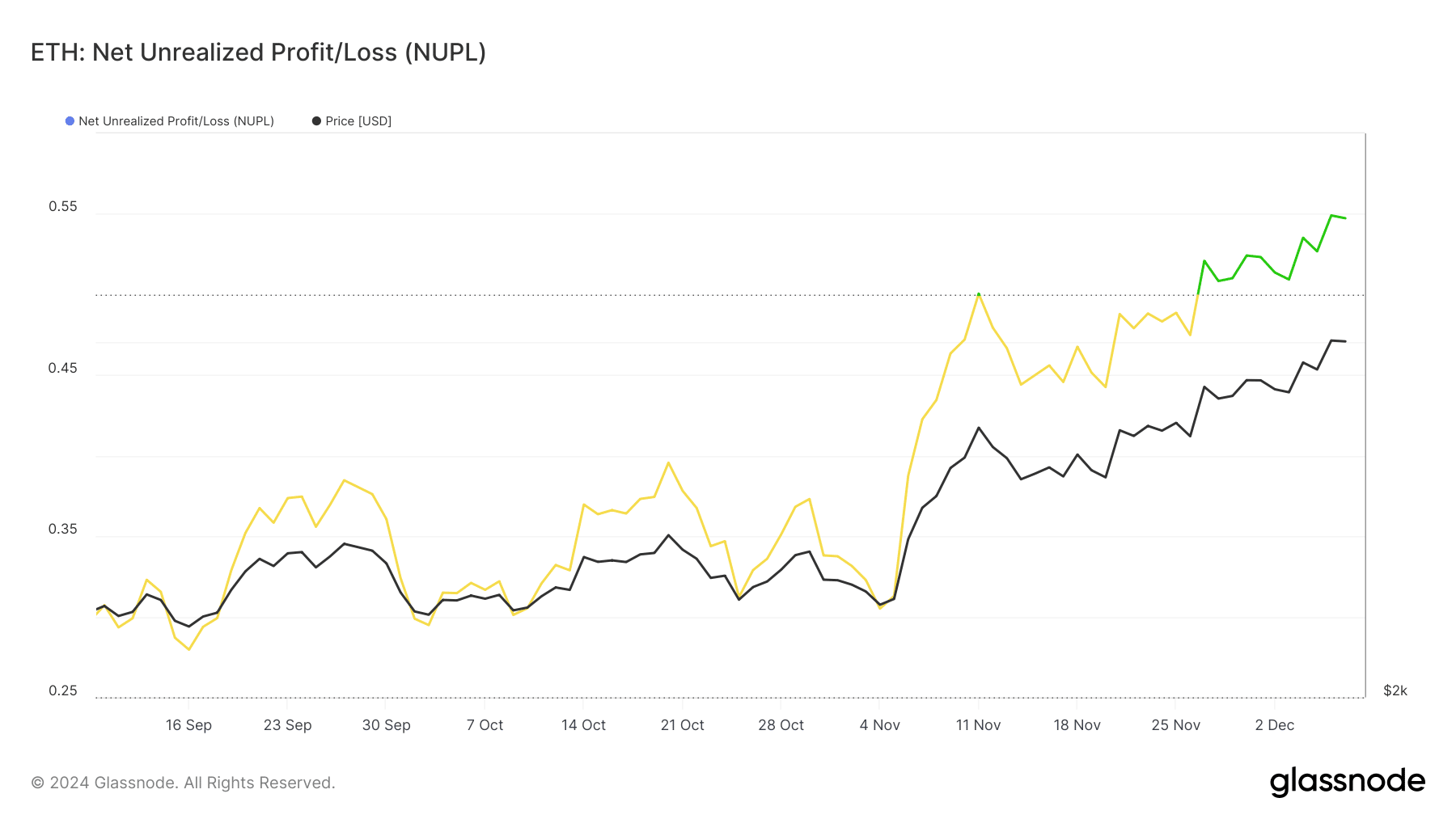

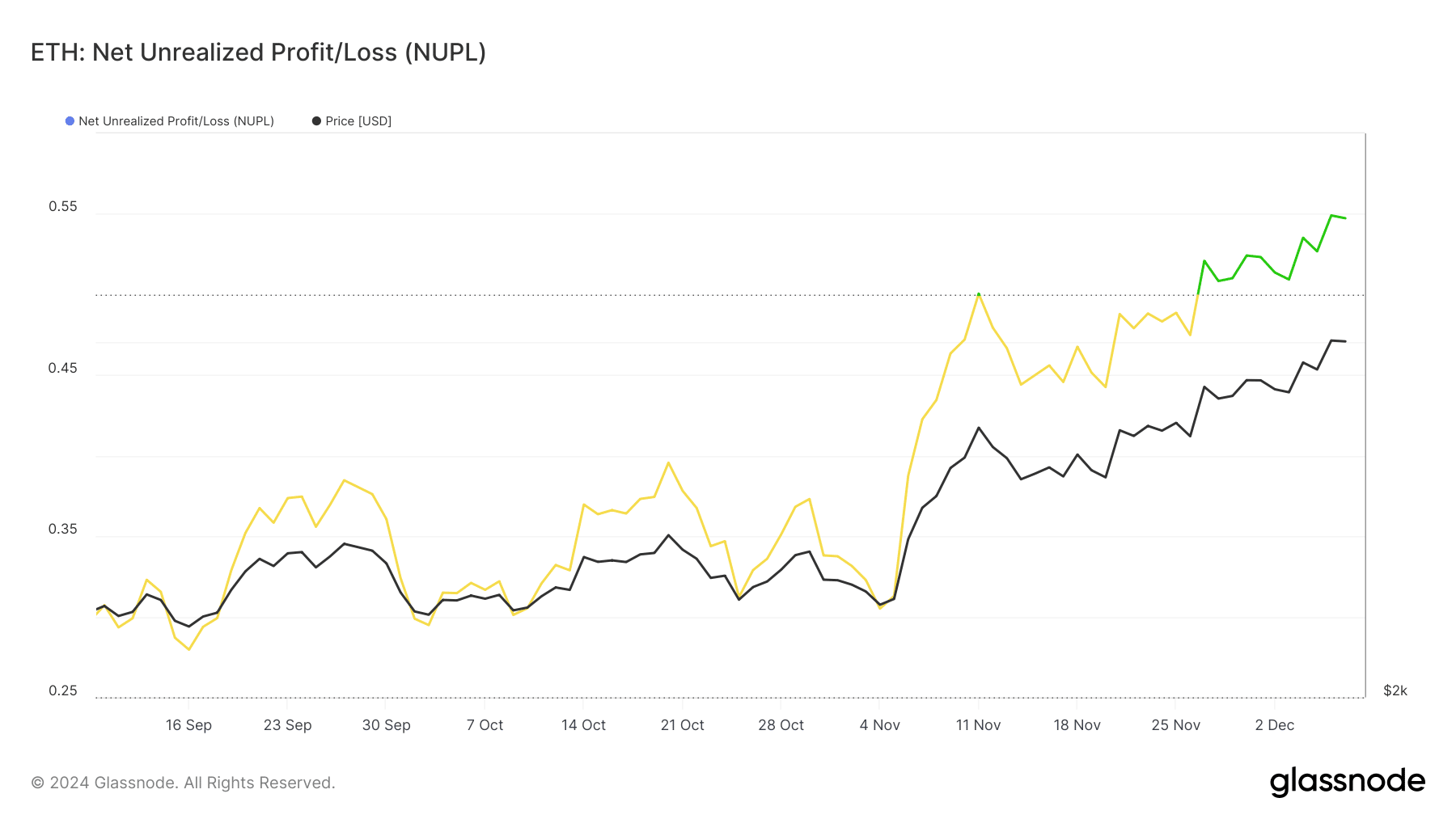

Apart from this, ETH’s Net Unrealized Profit/Loss (NUPL) entered the “belief” phase.

For starters, the NUPL is the difference between Relative Unrealized Profit and Relative Unrealized Loss. Historically, whenever the metric reached this level, it was followed by price corrections.

If history repeats, then ETH might not be able to go above $4k in the short-term.

Source: Glassnode

Trouble for ETH was far from over. The token’s Relative Strength Index (RSI) was resting in the overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024–2025

This might motivate investors to sell their holdings, which has the potential to push ETH’s price down in the coming days.

Nonetheless, the MA Cross indicator supported the bulls, as the 9-day MA was well above the 21-day MA.

Source: TradingView

- Ethereum’s exchange reserve was dropping, signaling high buying pressure.

- However, the RSI was resting in the overbought zone.

Ethereum [ETH] has been struggling to breach the $4k barrier for quite some time now, as it is getting rejected near the resistance.

However, latest analysis revealed that the path for ETH moving towards a new all-time high is pretty clear. Therefore, AMBCrypto investigated further to find out whether that’s actually the case.

Ethereum is on the right track

ETH’s price registered a 7% price hike last week, pushing the token’s price near $4k. At the time of writing, ETH was trading at $3.05k with a market capitalization of over $476 billion.

In the meantime, Ali Martinez, a popular crypto analyst, posted a tweet revealing that there was nothing preventing ETH from reaching new all-time highs. The only modest resistance zone ahead was around $4,540.

But as long as the $3,560 demand zone holds, the odds favor the bulls.

Will ETH touch $4.5k soon?

Since Martinez’s tweet revealed the possibility of ETH touching $4.5k, AMBCrypto assessed the token’s on-chain metrics to find the likelihood of that happening in the short term.

ETH’s Pi Cycle Top indicator revealed that ETH was trading well between its market top and bottom. If the metric is to be believed, ETH’s possible market top was at $5.9k.

Therefore, it seemed likely for ETH top reach $4.5k soon.

Source: Glassnode

CryptoQuant’s data revealed that buying pressure on the token was rising. This was evident from ETH’s declining exchange reserve.

Additionally, Ethereum’s Coinbase premium was green, meaning that buying sentiment among US investors was strong. However, a few metrics also looked bearish.

For instance, ETH’s taker buy/sell ratio turned red. Whenever this happens, it indicates that selling sentiment is dominant in the derivatives market. More sell orders are filled by takers.

Apart from this, ETH’s Net Unrealized Profit/Loss (NUPL) entered the “belief” phase.

For starters, the NUPL is the difference between Relative Unrealized Profit and Relative Unrealized Loss. Historically, whenever the metric reached this level, it was followed by price corrections.

If history repeats, then ETH might not be able to go above $4k in the short-term.

Source: Glassnode

Trouble for ETH was far from over. The token’s Relative Strength Index (RSI) was resting in the overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024–2025

This might motivate investors to sell their holdings, which has the potential to push ETH’s price down in the coming days.

Nonetheless, the MA Cross indicator supported the bulls, as the 9-day MA was well above the 21-day MA.

Source: TradingView

Blue Techker Pretty! This has been a really wonderful post. Many thanks for providing these details.

buy generic clomid without prescription where can i buy clomiphene no prescription order cheap clomiphene price where to get cheap clomid price cost of cheap clomiphene without rx buy generic clomiphene without prescription clomid tablets price in pakistan

More posts like this would add up to the online time more useful.

This website absolutely has all of the low-down and facts I needed there this case and didn’t identify who to ask.

semaglutide pill – cyproheptadine 4mg uk buy generic periactin 4 mg

buy cheap generic motilium – motilium order online flexeril 15mg tablet

inderal 10mg brand – inderal price buy methotrexate 5mg for sale

purchase amoxil pill – buy ipratropium 100mcg generic buy ipratropium 100 mcg online

brand zithromax – tindamax online order buy bystolic 20mg pill

buy generic amoxiclav – atbioinfo.com acillin without prescription

nexium 20mg sale – https://anexamate.com/ cost esomeprazole 20mg

order warfarin 2mg online cheap – https://coumamide.com/ losartan over the counter

order mobic pill – https://moboxsin.com/ mobic cost

order deltasone 20mg pills – https://apreplson.com/ order prednisone 10mg without prescription

buy ed pills – the blue pill ed buy erectile dysfunction pills

amoxicillin sale – https://combamoxi.com/ order amoxicillin generic

diflucan 100mg over the counter – https://gpdifluca.com/# order diflucan 200mg without prescription

buy lexapro 10mg pill – https://escitapro.com/# buy escitalopram 20mg online cheap

buy cenforce 100mg generic – cenforce 50mg price cenforce 50mg canada

super cialis – https://ciltadgn.com/ cialis for pulmonary hypertension

zantac cheap – click purchase ranitidine generic

buy sildenafil 50mg – https://strongvpls.com/# order viagra with paypal

The reconditeness in this serving is exceptional. https://gnolvade.com/es/accutane-comprar-espana/

This is the kind of serenity I enjoy reading. purchase lasix pill

Thanks for putting this up. It’s well done. https://ursxdol.com/prednisone-5mg-tablets/

Thanks on sharing. It’s outstrip quality. https://prohnrg.com/product/get-allopurinol-pills/

I am in truth enchant‚e ‘ to glance at this blog posts which consists of tons of of use facts, thanks object of providing such data. posologie stromectol gale