- Analysts doubled down on $10K target calls for ETH.

- Will growing demand, as seen by strong ETH ETF flows, boost the projection?

Market pundits have increased their calls for Ethereum’s [ETH] $10K price target. The latest call has cited XRP’s breakout, which had a similar bullish pattern to ETH’s 3-year price action.

According to pseudonymous crypto analyst Wolf, both assets have consolidated within a 3-year compression triangle. With XRP fronting a 3x after breakout, ETH could follow through, implying a $12K target.

Source: CryptoWolf

Record ETH ETF flows

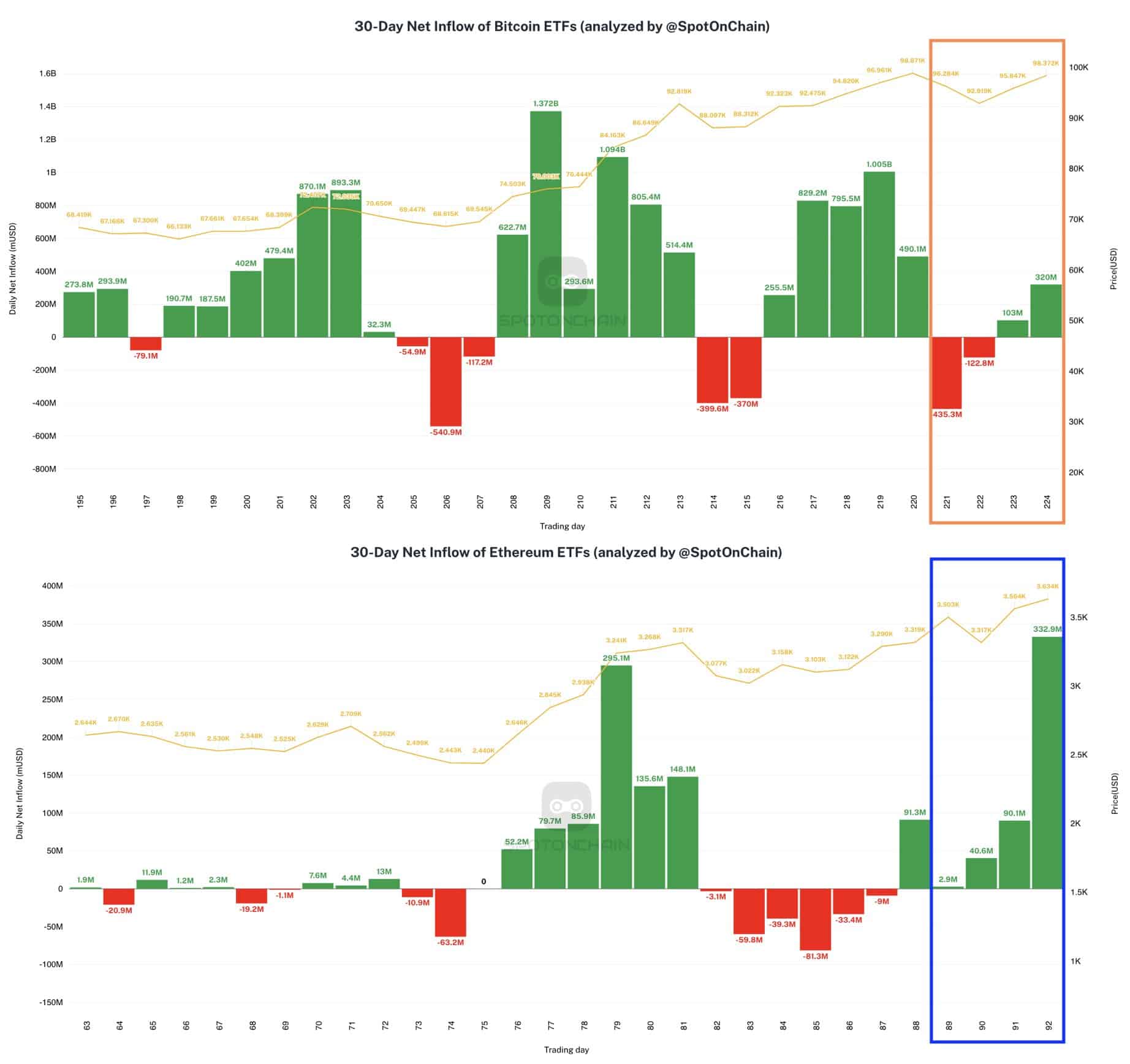

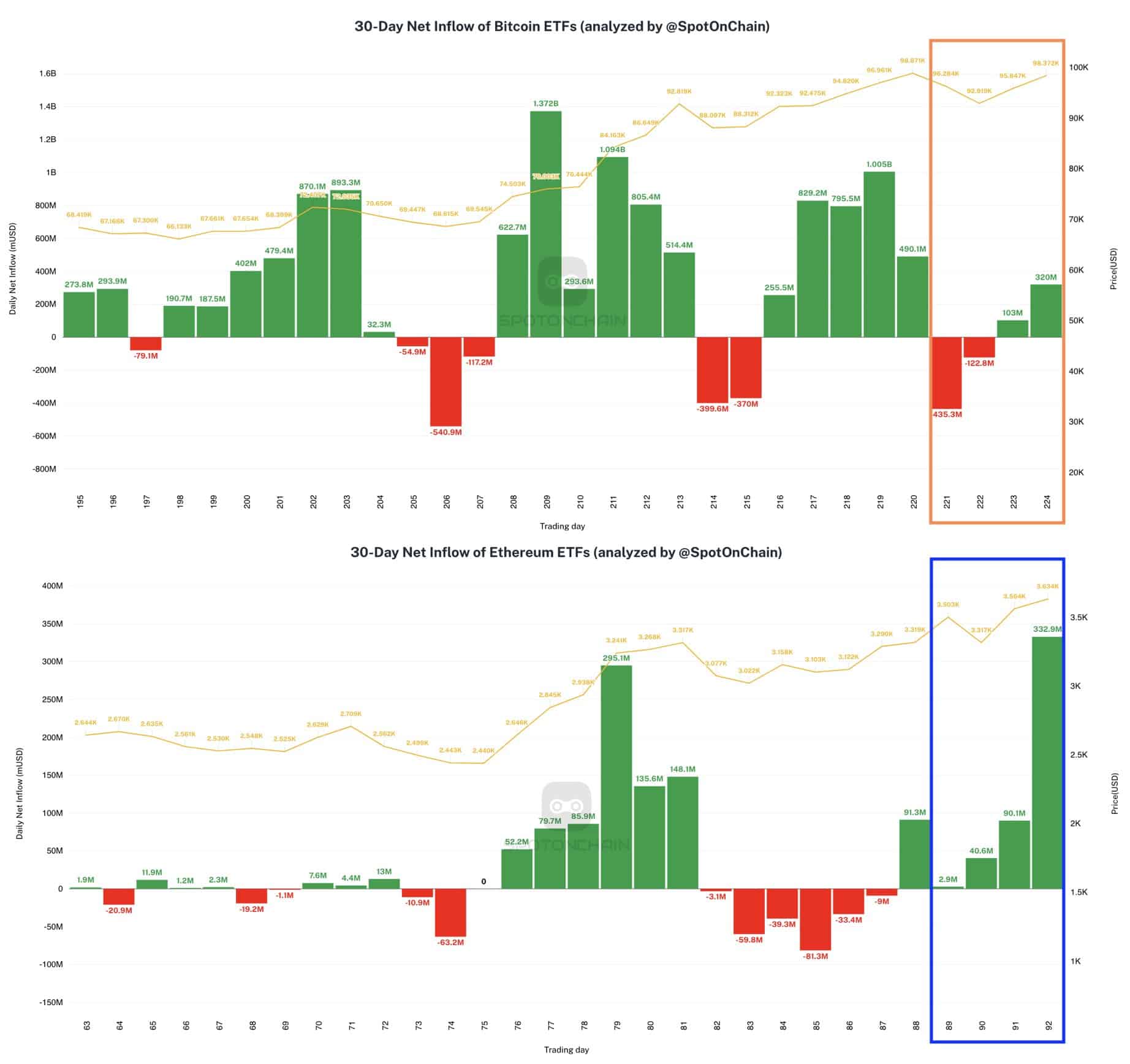

The U.S. spot ETH ETF flows are one of the most bullish factors supporting the above projection. On the 29th of November, the products eclipsed BTC ETF flows for the first time.

The ETH ETF netted $332.9M in inflows, the highest daily inflow since launch, while BTC ETFs logged $320M inflows.

According to SpotOnChain, the ETH ETFs saw higher positive inflows than BTC ETFs in the past week, reinforcing ETH’s outperformance over the same period.

Source: Spot On Chain

But is the strong demand enough to push the altcoin to all-time highs (ATH)? The market repriced ETH following the bullish outcome of the US Presidential elections.

In early November, Polymarket had an 8% chance of ETH hitting a new ATH by 2024. After the elections, the odds jumped to 25% by the end of November.

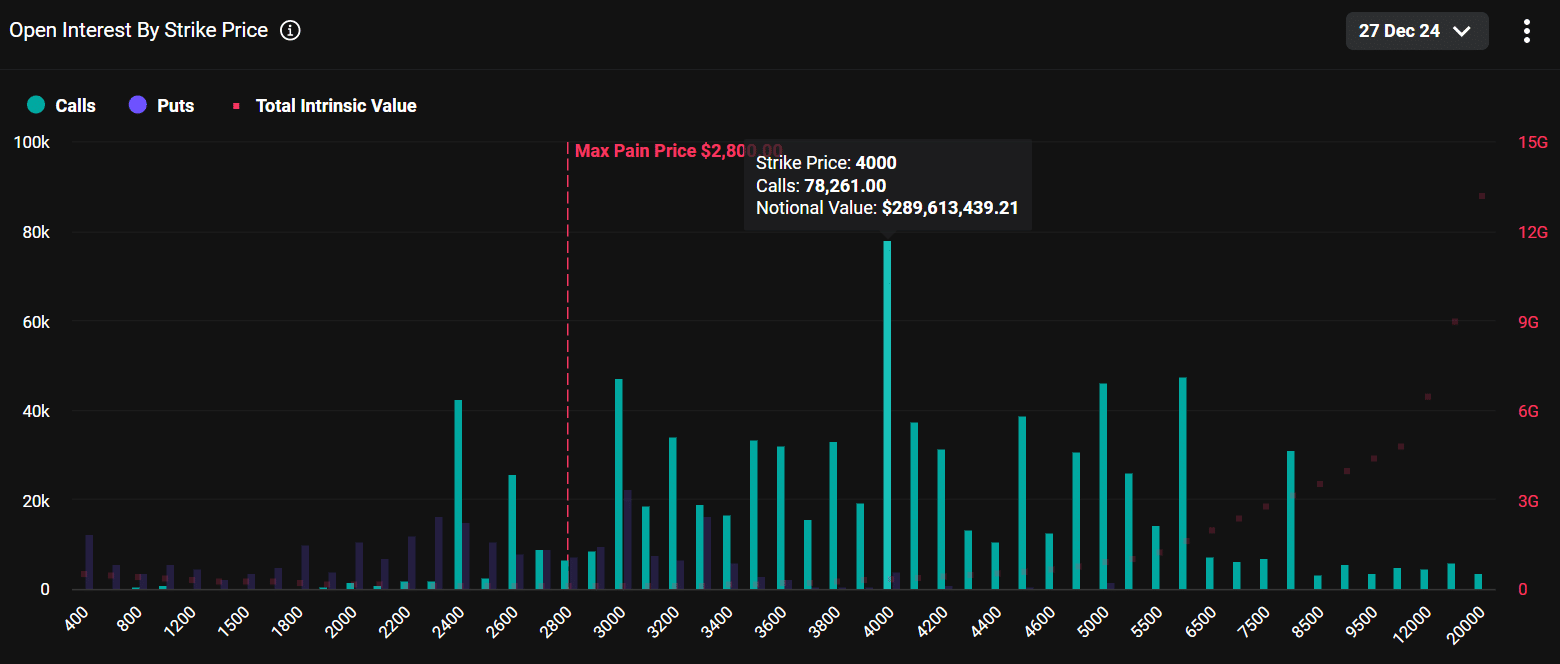

Whether ETH will soar above its last cycle high of $4.8K by December remains to be seen. However, options traders on Deribit were pricing an 18% chance of ETH hitting $10K by September 2025.

Source: Deribit

Read Ethereum [ETH] Price Prediction 2024-2025

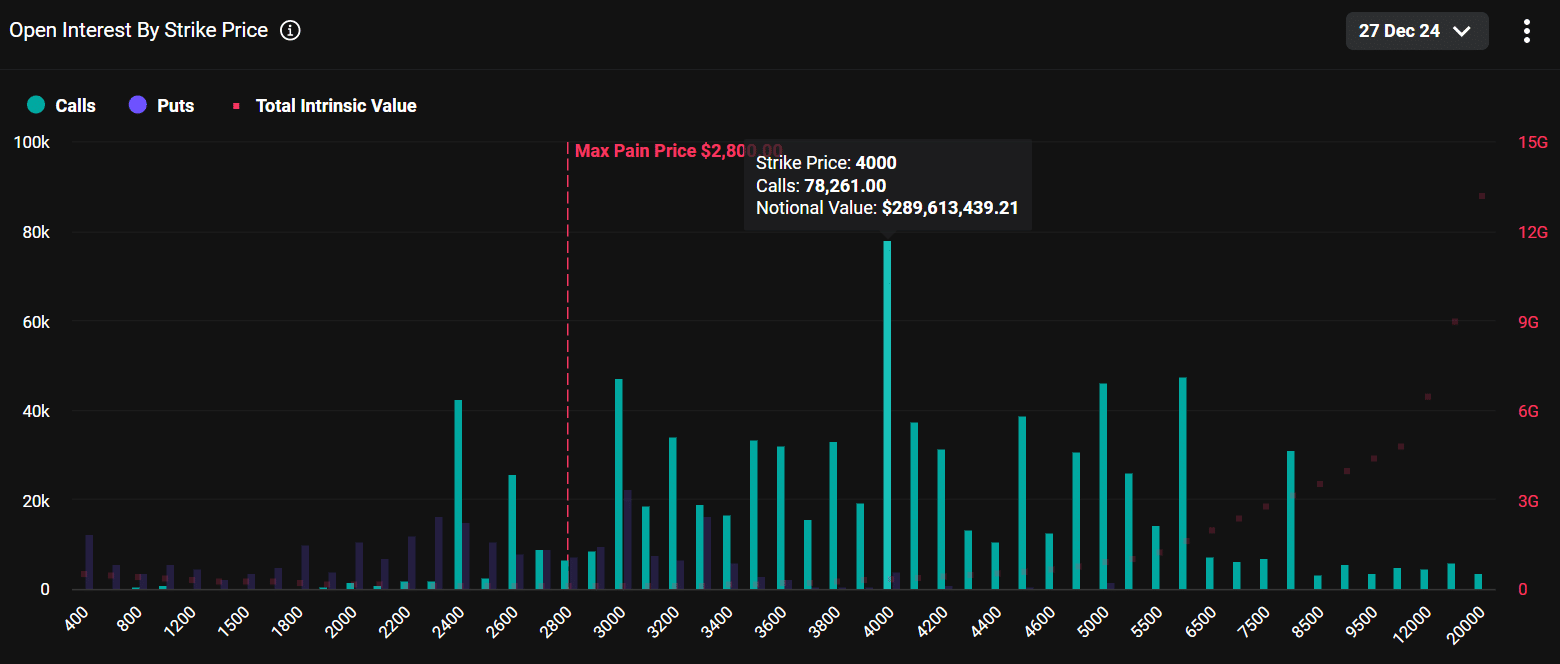

For December targets, options traders are betting $289 million on ETH hitting $4K, with a max pain at $2.8K (traders lose money when the level is hit). The $4.5K and $6K also saw significant bullish bets.

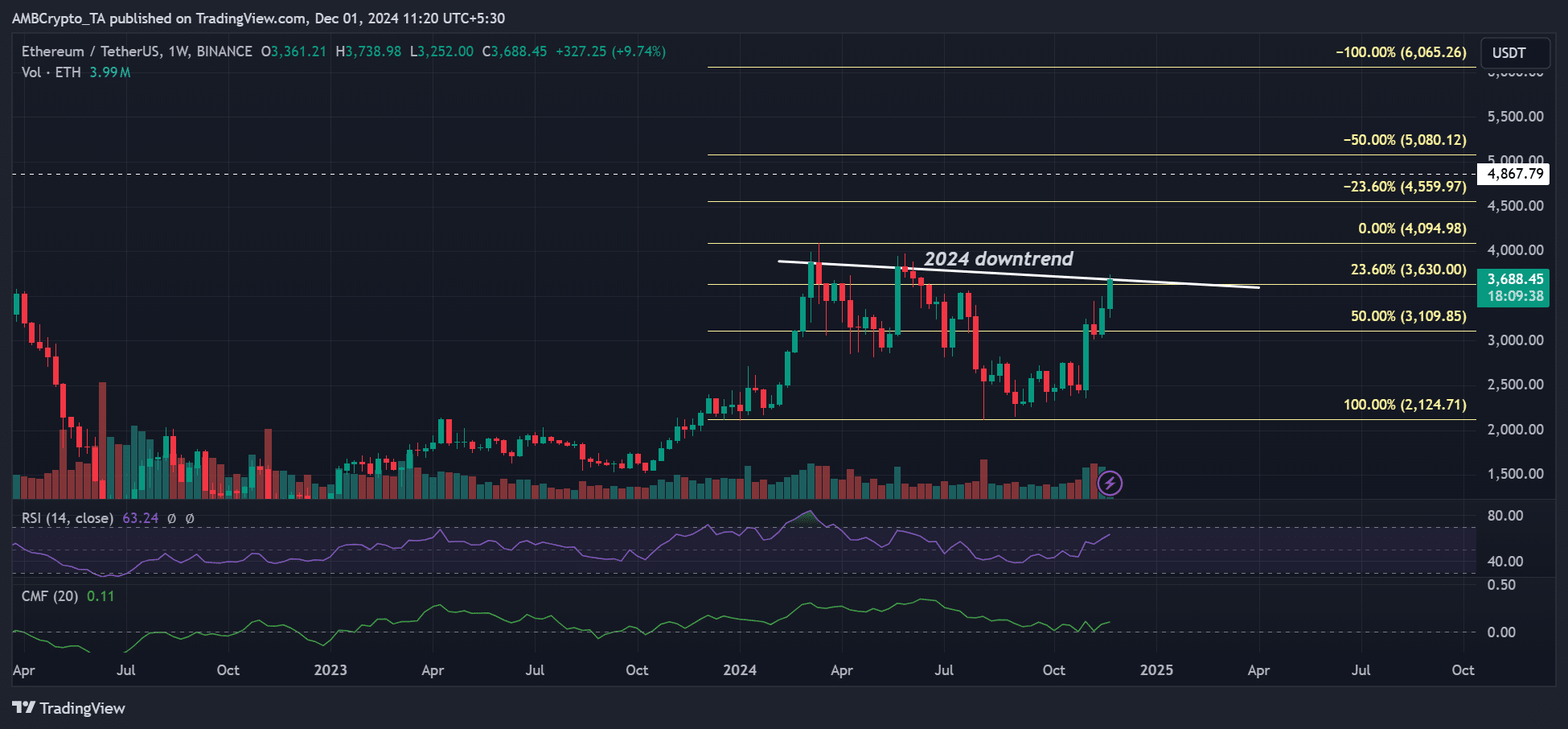

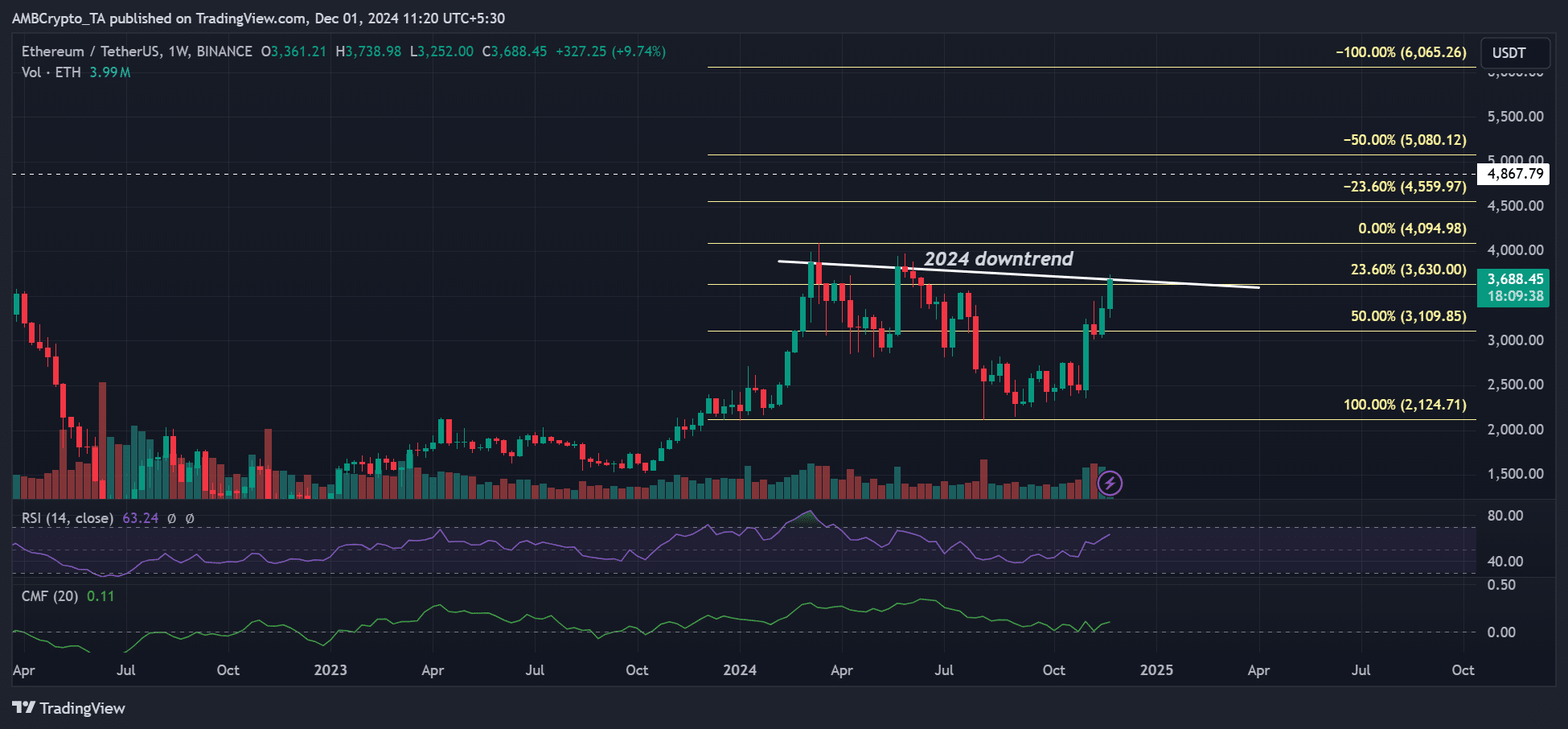

That said, after the 46% rally in November, ETH was on the verge of breaking the 2024 downtrend line. The pending market structure shift could set the altcoin to eye $4K and $4.5K in the short term.

Source: ETH/USDT, TradingView

- Analysts doubled down on $10K target calls for ETH.

- Will growing demand, as seen by strong ETH ETF flows, boost the projection?

Market pundits have increased their calls for Ethereum’s [ETH] $10K price target. The latest call has cited XRP’s breakout, which had a similar bullish pattern to ETH’s 3-year price action.

According to pseudonymous crypto analyst Wolf, both assets have consolidated within a 3-year compression triangle. With XRP fronting a 3x after breakout, ETH could follow through, implying a $12K target.

Source: CryptoWolf

Record ETH ETF flows

The U.S. spot ETH ETF flows are one of the most bullish factors supporting the above projection. On the 29th of November, the products eclipsed BTC ETF flows for the first time.

The ETH ETF netted $332.9M in inflows, the highest daily inflow since launch, while BTC ETFs logged $320M inflows.

According to SpotOnChain, the ETH ETFs saw higher positive inflows than BTC ETFs in the past week, reinforcing ETH’s outperformance over the same period.

Source: Spot On Chain

But is the strong demand enough to push the altcoin to all-time highs (ATH)? The market repriced ETH following the bullish outcome of the US Presidential elections.

In early November, Polymarket had an 8% chance of ETH hitting a new ATH by 2024. After the elections, the odds jumped to 25% by the end of November.

Whether ETH will soar above its last cycle high of $4.8K by December remains to be seen. However, options traders on Deribit were pricing an 18% chance of ETH hitting $10K by September 2025.

Source: Deribit

Read Ethereum [ETH] Price Prediction 2024-2025

For December targets, options traders are betting $289 million on ETH hitting $4K, with a max pain at $2.8K (traders lose money when the level is hit). The $4.5K and $6K also saw significant bullish bets.

That said, after the 46% rally in November, ETH was on the verge of breaking the 2024 downtrend line. The pending market structure shift could set the altcoin to eye $4K and $4.5K in the short term.

Source: ETH/USDT, TradingView

can i get generic clomiphene without insurance clomiphene risks cost of generic clomid for sale where can i buy generic clomiphene no prescription how can i get cheap clomiphene without prescription can i order clomid prices how to get generic clomiphene price

This is the make of advise I turn up helpful.

More articles like this would remedy the blogosphere richer.

buy zithromax paypal – order azithromycin 250mg pills flagyl brand

order semaglutide sale – periactin 4 mg usa order periactin 4 mg pills

buy motilium pill – motilium canada buy cyclobenzaprine generic

amoxil cost – amoxicillin pills ipratropium uk

buy augmentin 1000mg pills – atbio info ampicillin online buy

buy generic warfarin online – https://coumamide.com/ buy losartan 25mg sale

meloxicam 7.5mg canada – mobo sin mobic 7.5mg for sale

prednisone where to buy – corticosteroid purchase deltasone pills

buy best erectile dysfunction pills – https://fastedtotake.com/ buy ed medication

amoxicillin pill – order amoxil sale cheap amoxicillin tablets

purchase fluconazole online cheap – this buy fluconazole 100mg

order cenforce generic – https://cenforcers.com/ cenforce pill

cialis maximum dose – ciltad generic buy generic tadalafil online cheap

ranitidine order – https://aranitidine.com/# zantac 150mg price

cialis contraindications – https://strongtadafl.com/# best price on generic tadalafil

This is the tolerant of post I turn up helpful. synthroid en espaГ±a

Thanks on sharing. It’s acme quality. furosemide cost

More posts like this would create the online space more useful. https://ursxdol.com/get-cialis-professional/

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks towards providing such data. stromectol espagne

More articles like this would pretence of the blogosphere richer. https://ondactone.com/spironolactone/

More posts like this would make the blogosphere more useful.

https://proisotrepl.com/product/baclofen/

Facts blog you possess here.. It’s hard to on elevated quality script like yours these days. I really respect individuals like you! Withstand care!! http://www.orlandogamers.org/forum/member.php?action=profile&uid=28885

order dapagliflozin 10 mg pills – https://janozin.com/ brand dapagliflozin 10 mg

how to buy orlistat – https://asacostat.com/ buy xenical 120mg for sale

Palatable blog you be undergoing here.. It’s obdurate to find great quality writing like yours these days. I honestly appreciate individuals like you! Go through vigilance!! https://sportavesti.ru/forums/users/srnqt-2/