- At press time, the crypto market still flashed ‘GREED,’ despite election worries

- Prediction sites favoured a Trump win, with Options traders eyeing $60k, $70k, and $80k targets

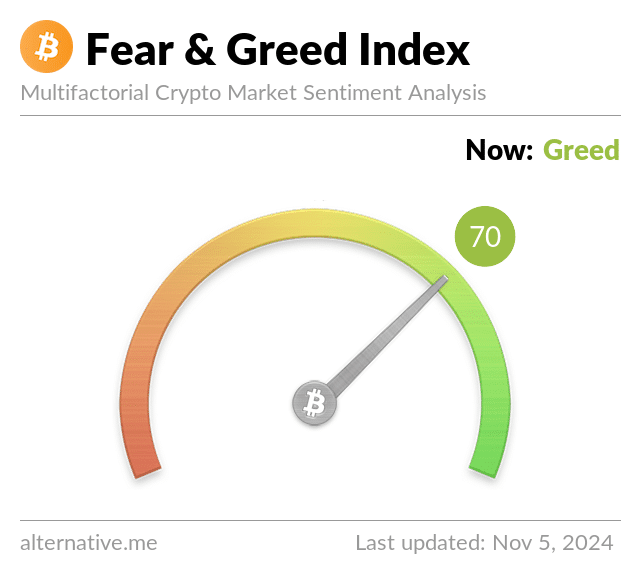

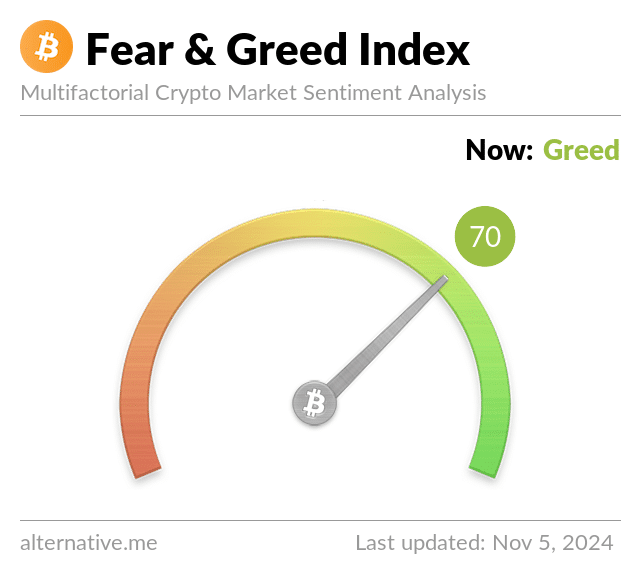

There is incredible market anxiety now that Election Day in the United States is here. However, despite Bitcoin’s [BTC] recent pullback from near its all-time high (ATH) to $68k, the Crypto Fear and Greed Index is still flashing “Greed.” At the time of writing, it had a reading of 70.

Source: Alternative.me

Bitcoin speculators remain positive

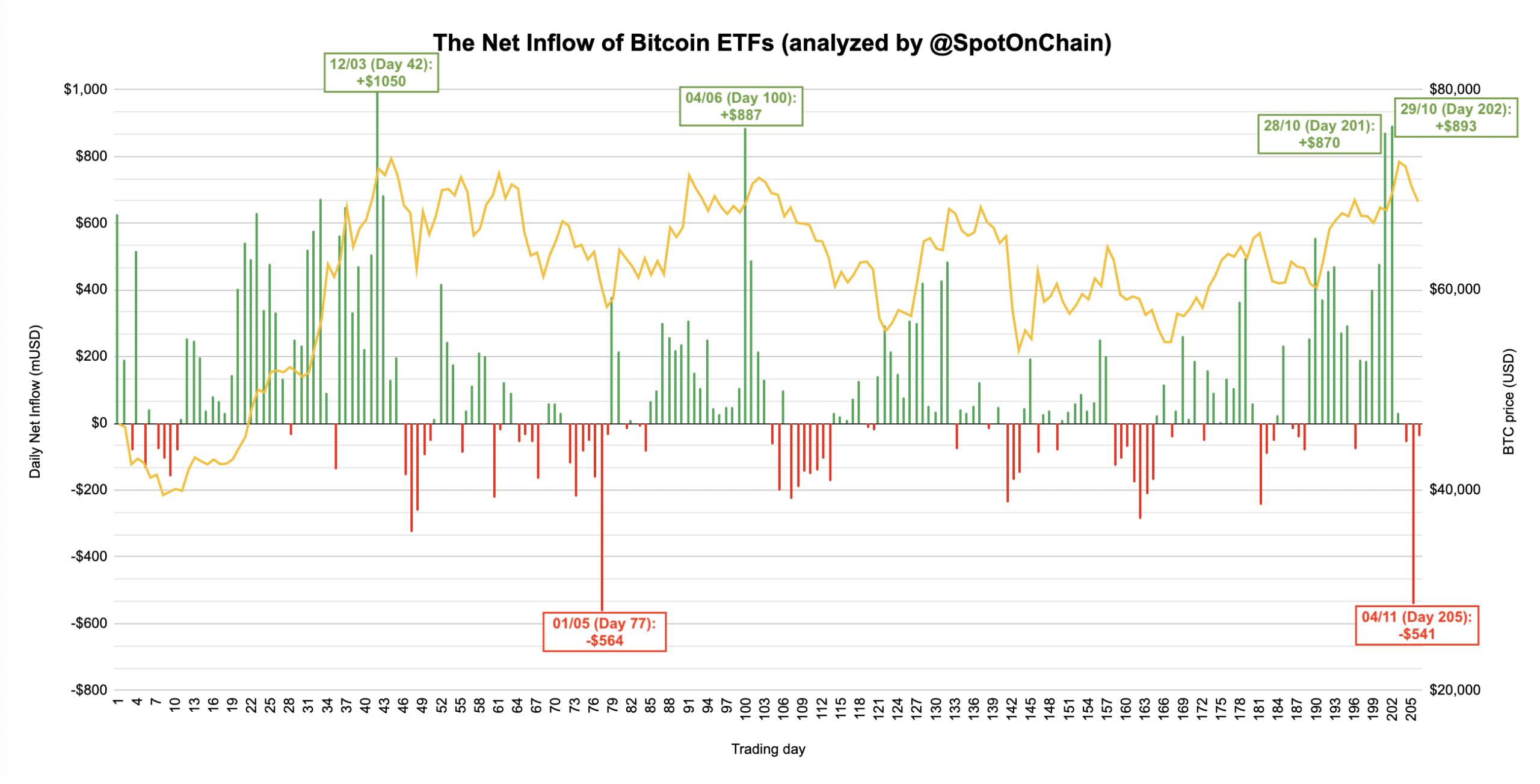

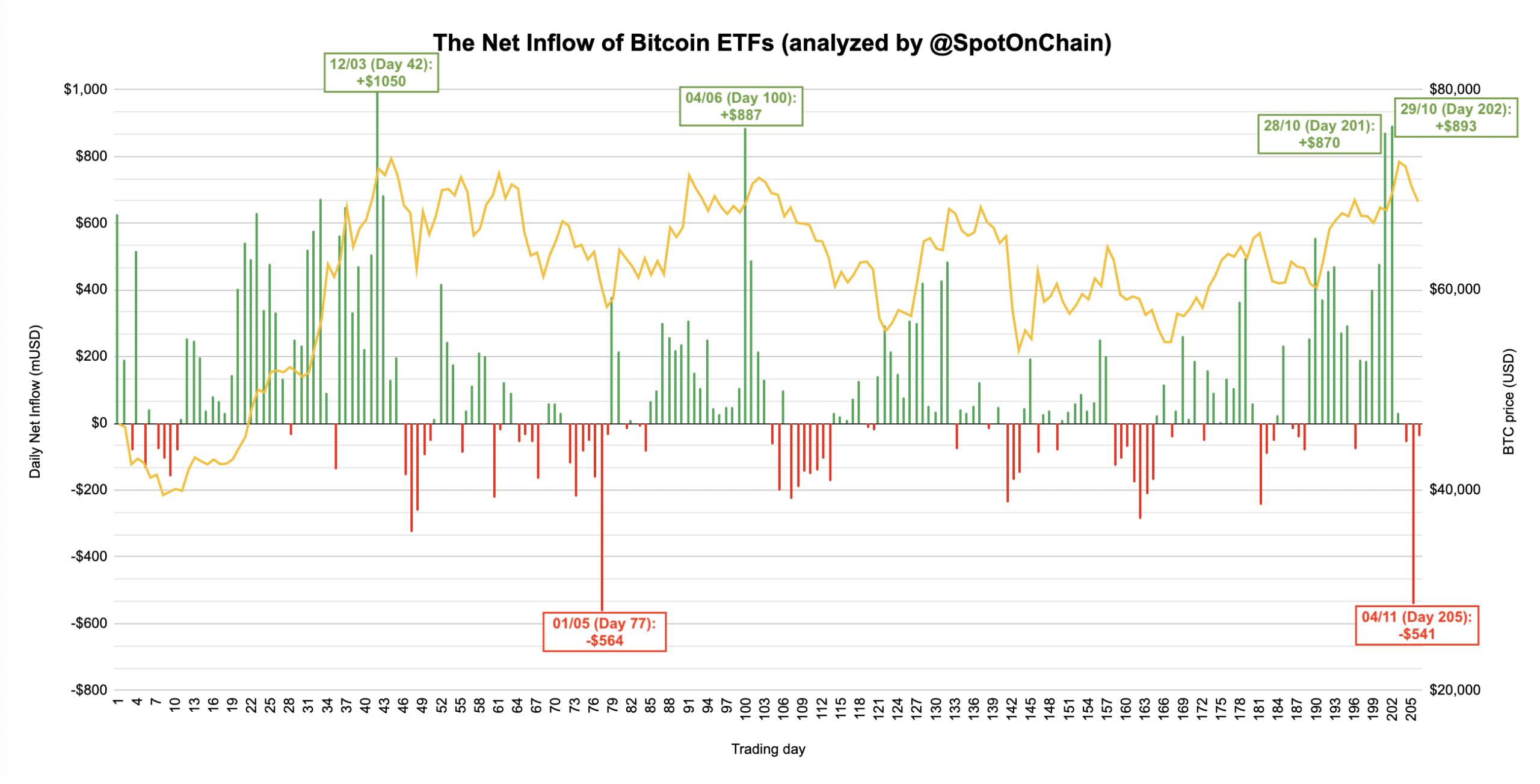

In fact, even Monday’s risk-off move across U.S Spot BTC ETFs didn’t deter BTC speculators. The products saw cumulative daily net outflows of $541 million, led by 21Shares (ARKB) and Bitwise’s BITB.

According to Spot On Chain, the Monday sell-off was the second-largest daily outflow for these products. This mirrored a broader market de-risking across U.S equities just before Election Day.

Source: Spot On Chain

Perhaps, Trump’s lead across prediction sites and top election models was partly responsible for the confidence seen in BTC and crypto markets.

Worth noting, however, that crypto trading firm QCP Capital cautioned that the market has been underpricing potential post-election risks or even Harris’s likely win.

Part of the firm’s election commentary read,

“The crypto market is currently pricing in a +/-3.5% in BTC spot movement on the election night itself. Yet, traders may be underpricing post-election risk: the current lack of volatility premium beyond the November 8 expiry suggests that markets expect a quick resolution, possibly underestimating potential delays or contested outcomes.”

The firm anticipated erratic BTC price swings when polling results stream in. For its part, Amberdata projected that the price swings could be $6k-$8k in either direction.

It added that a Harris win could push BTC to $60k, while a Trump win could trigger a new ATH for BTC ($75K/$77K).

That said, over the weekend, the Options market saw large funds favor bullish outcomes with upside targets of $70k —$85k.

The latest Deribit data revealed that off-shore markets eyed $72k —$75k targets based on massive call buying (upside expectation) from European and Asian markets on Monday. Part of its update read,

“Outsized T-1 Option flows jack IV higher. APAC-Euro flow: 1.5k Nov 72+75k Calls bought. At US open, as BTC peaked at 69.3k, Nov29 60k Put bought x1k funded by Nov29 80k Call, and Nov15 64k Put bought 1.5k.”

Also, the hike in interest in put options (downside bets), eyeing $60k, echoed Amberdata’s targets if Harris wins the election.

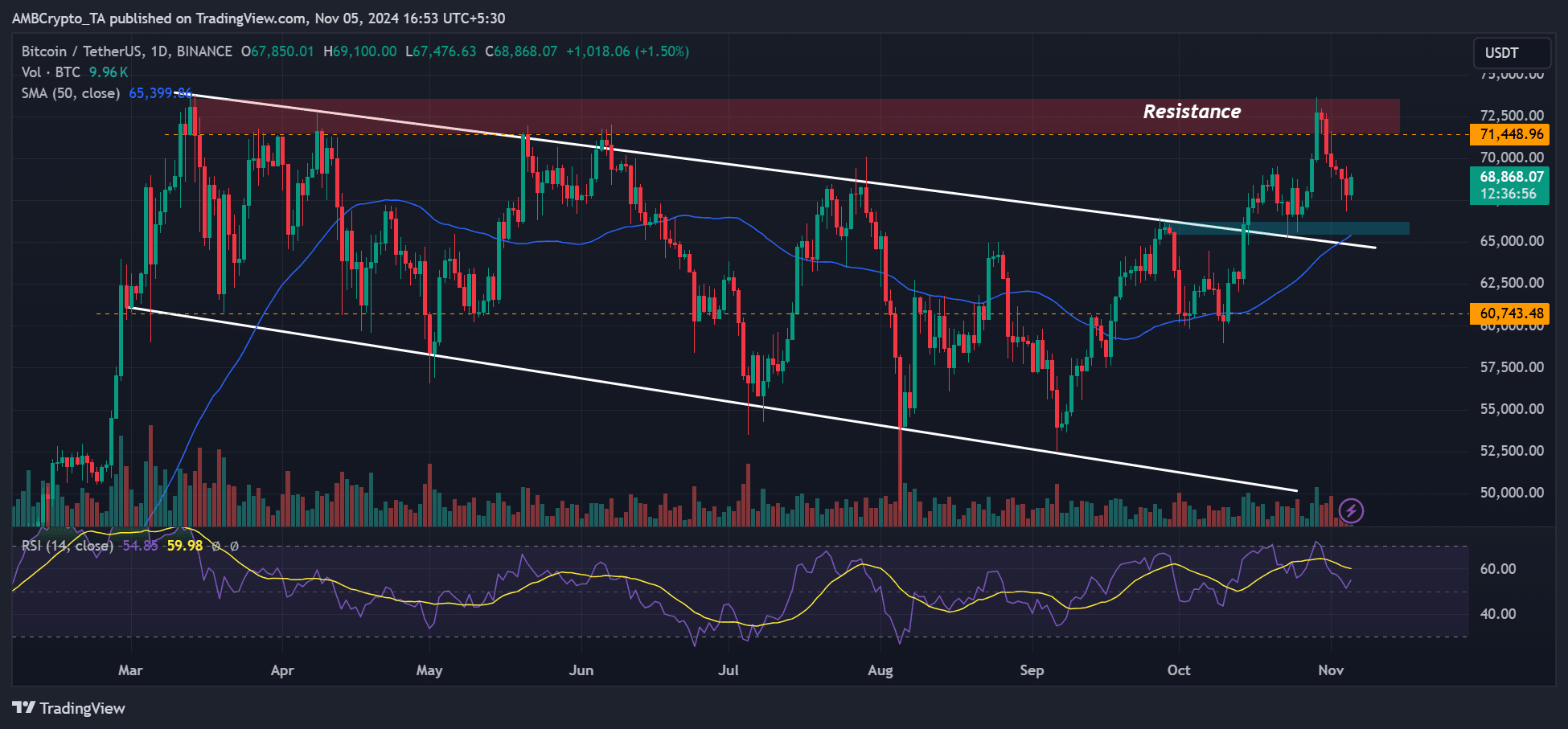

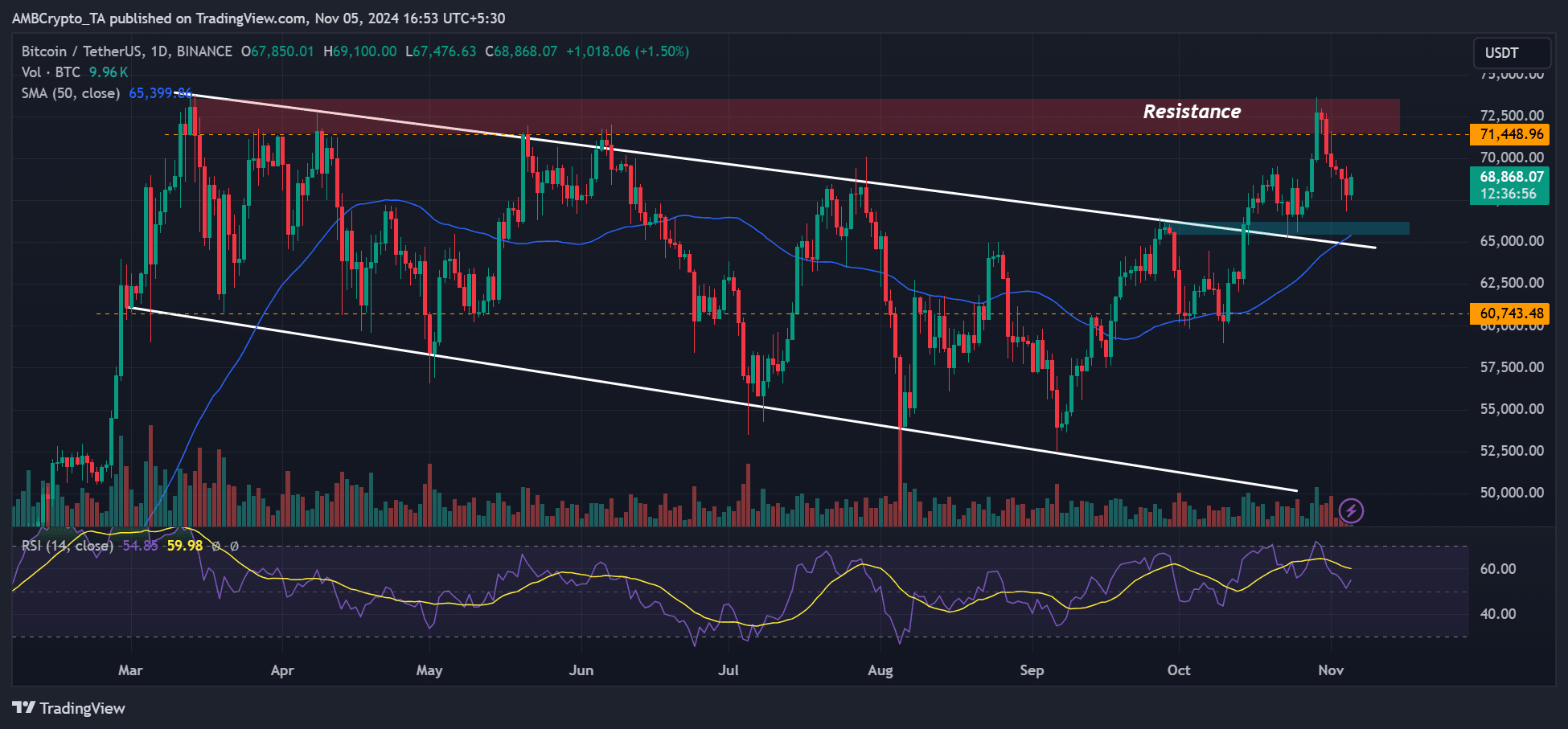

Additionally, it seems like whoever wins, Option traders expect BTC to stay above $60k. On the price charts, $65k will remain a key level to watch if the decline extends itself.

Source: BTCUSDT, TradingView

- At press time, the crypto market still flashed ‘GREED,’ despite election worries

- Prediction sites favoured a Trump win, with Options traders eyeing $60k, $70k, and $80k targets

There is incredible market anxiety now that Election Day in the United States is here. However, despite Bitcoin’s [BTC] recent pullback from near its all-time high (ATH) to $68k, the Crypto Fear and Greed Index is still flashing “Greed.” At the time of writing, it had a reading of 70.

Source: Alternative.me

Bitcoin speculators remain positive

In fact, even Monday’s risk-off move across U.S Spot BTC ETFs didn’t deter BTC speculators. The products saw cumulative daily net outflows of $541 million, led by 21Shares (ARKB) and Bitwise’s BITB.

According to Spot On Chain, the Monday sell-off was the second-largest daily outflow for these products. This mirrored a broader market de-risking across U.S equities just before Election Day.

Source: Spot On Chain

Perhaps, Trump’s lead across prediction sites and top election models was partly responsible for the confidence seen in BTC and crypto markets.

Worth noting, however, that crypto trading firm QCP Capital cautioned that the market has been underpricing potential post-election risks or even Harris’s likely win.

Part of the firm’s election commentary read,

“The crypto market is currently pricing in a +/-3.5% in BTC spot movement on the election night itself. Yet, traders may be underpricing post-election risk: the current lack of volatility premium beyond the November 8 expiry suggests that markets expect a quick resolution, possibly underestimating potential delays or contested outcomes.”

The firm anticipated erratic BTC price swings when polling results stream in. For its part, Amberdata projected that the price swings could be $6k-$8k in either direction.

It added that a Harris win could push BTC to $60k, while a Trump win could trigger a new ATH for BTC ($75K/$77K).

That said, over the weekend, the Options market saw large funds favor bullish outcomes with upside targets of $70k —$85k.

The latest Deribit data revealed that off-shore markets eyed $72k —$75k targets based on massive call buying (upside expectation) from European and Asian markets on Monday. Part of its update read,

“Outsized T-1 Option flows jack IV higher. APAC-Euro flow: 1.5k Nov 72+75k Calls bought. At US open, as BTC peaked at 69.3k, Nov29 60k Put bought x1k funded by Nov29 80k Call, and Nov15 64k Put bought 1.5k.”

Also, the hike in interest in put options (downside bets), eyeing $60k, echoed Amberdata’s targets if Harris wins the election.

Additionally, it seems like whoever wins, Option traders expect BTC to stay above $60k. On the price charts, $65k will remain a key level to watch if the decline extends itself.

Source: BTCUSDT, TradingView

order cheap clomid without dr prescription where buy cheap clomiphene buying cheap clomid buy clomiphene tablets how to buy clomid clomid remedio can i order clomid prices

I am in fact thrilled to glitter at this blog posts which consists of tons of profitable facts, thanks for providing such data.

Thanks on putting this up. It’s well done.

brand azithromycin – order generic ciplox buy flagyl no prescription

cheap semaglutide 14mg – buy semaglutide 14 mg online cyproheptadine usa

buy generic motilium over the counter – brand tetracycline buy flexeril generic

inderal where to buy – propranolol tablet buy methotrexate generic

buy amoxil for sale – buy diovan 80mg online buy cheap combivent

azithromycin canada – brand bystolic 5mg bystolic 20mg uk

oral clavulanate – https://atbioinfo.com/ ampicillin price

buy esomeprazole 40mg pills – https://anexamate.com/ nexium 40mg drug

buy coumadin 2mg online cheap – https://coumamide.com/ buy cozaar without a prescription

buy meloxicam 7.5mg online – https://moboxsin.com/ order mobic sale

buy deltasone 20mg generic – apreplson.com prednisone 40mg tablet

best ed pills online – fastedtotake.com ed pills online

buy amoxicillin tablets – comba moxi amoxicillin canada

purchase forcan online cheap – on this site brand diflucan

order escitalopram 20mg online – order generic lexapro 10mg order escitalopram generic

order cenforce 50mg for sale – https://cenforcers.com/# order cenforce 50mg pill

cialis with dapoxetine 60mg – https://ciltadgn.com/# maximpeptide tadalafil review

cialis store in philippines – https://strongtadafl.com/# cialis generic 20 mg 30 pills

purchase ranitidine without prescription – cheap ranitidine 300mg ranitidine order online

I couldn’t hold back commenting. Adequately written! comprar kamagra online espaГ±a

Thanks towards putting this up. It’s evidently done. https://buyfastonl.com/azithromycin.html

This is the make of advise I find helpful. https://ursxdol.com/ventolin-albuterol/

Facts blog you be undergoing here.. It’s obdurate to on high calibre script like yours these days. I truly appreciate individuals like you! Go through vigilance!! https://prohnrg.com/product/lisinopril-5-mg/

Good blog you have here.. It’s hard to find high calibre belles-lettres like yours these days. I justifiably respect individuals like you! Go through guardianship!! https://aranitidine.com/fr/sibelium/