- The combined dominance chart was nearing its previous tops.

- Capital influx into the crypto sphere through rising BTC prices was essential for a healthy altcoin season.

Bitcoin [BTC] trended upward in September and October after slowly but steadily falling lower since March. On the 29th of October, it nearly retested its all-time high, going as far north as $73.6k before facing rejection.

Analysis of on-chain metrics revealed an increase in large transaction volume and bullish sentiment in lower timeframes.

On higher timeframes, capital influx and rotation will be key for Bitcoin and altcoin markets in this cycle.

How close are we to an altcoin season?

Source: Benjamin Cowen on X

Benjamin Cowen, CEO and Founder of Into The Cryptoverse, expects an altcoin season “next year“.

He noted that the combined dominance of Bitcoin, Ethereum [ETH], USDT, and USDC reached 82% in 2020 and 2023, forming tops before the altcoin market rallied.

At press time, it was at 80.51%, nearing its top. A rejection and sustained downtrend would indicate that Bitcoin and Ethereum were being outpaced by the rest of the altcoin market.

Additionally, a downtrend in stablecoin market share would signal investors buying crypto.

Cowen expects this to begin in 2025, meaning altcoin holders need more patience before seeing large gains.

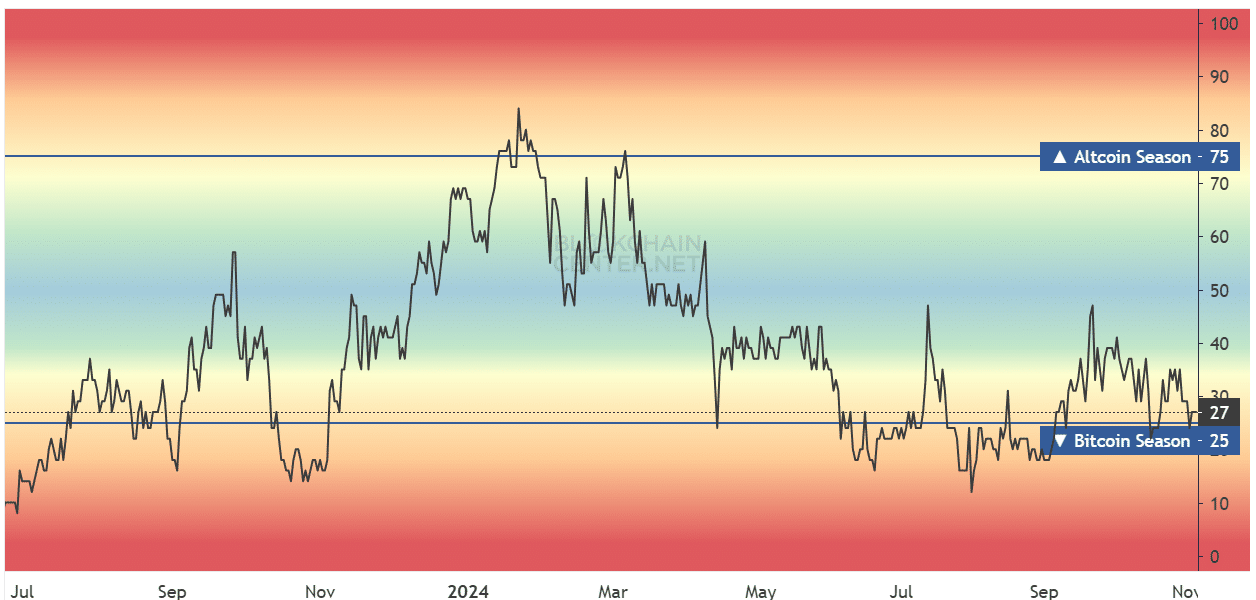

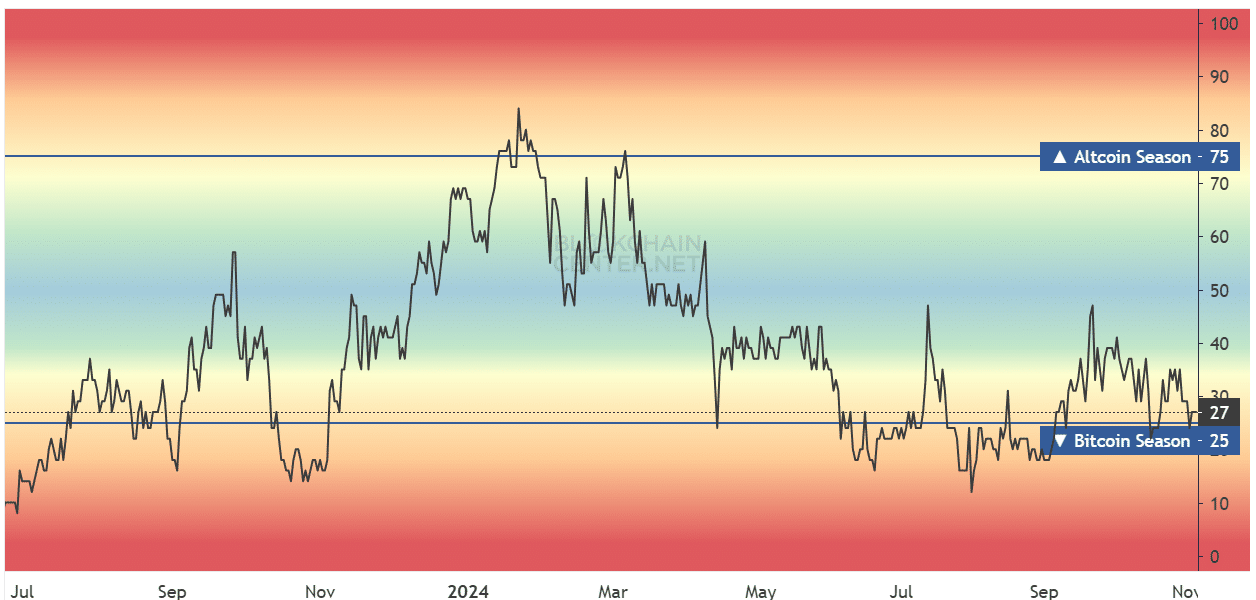

Source: Blockchain Center

The altcoin season index agreed, and its reading of 27 showed that the altcoin market was unable to keep up with BTC’s moves.

Another factor is how, during a sell-off, altcoins are much more affected than BTC and experience greater draw-downs.

Encouraging signs for investors

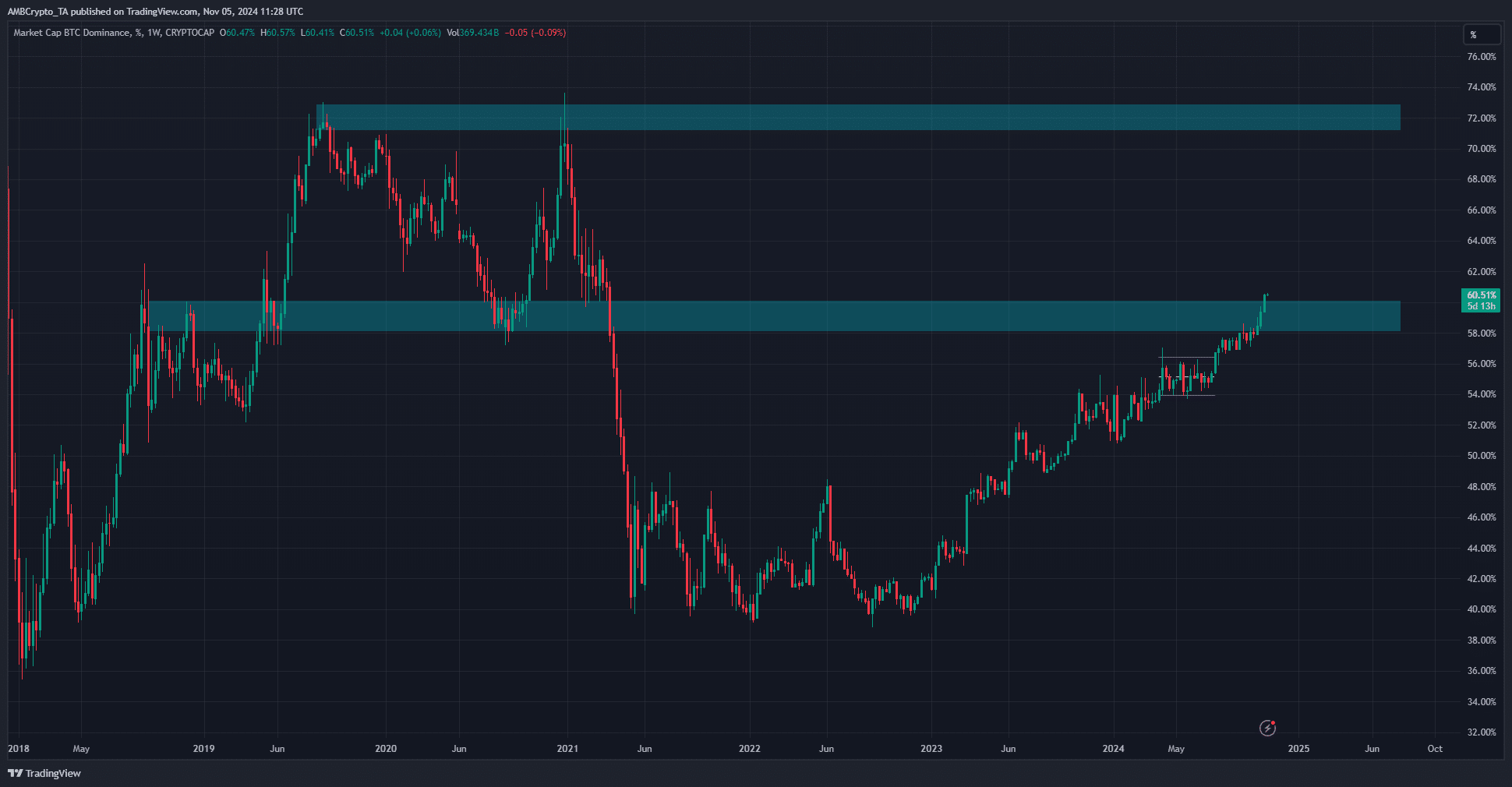

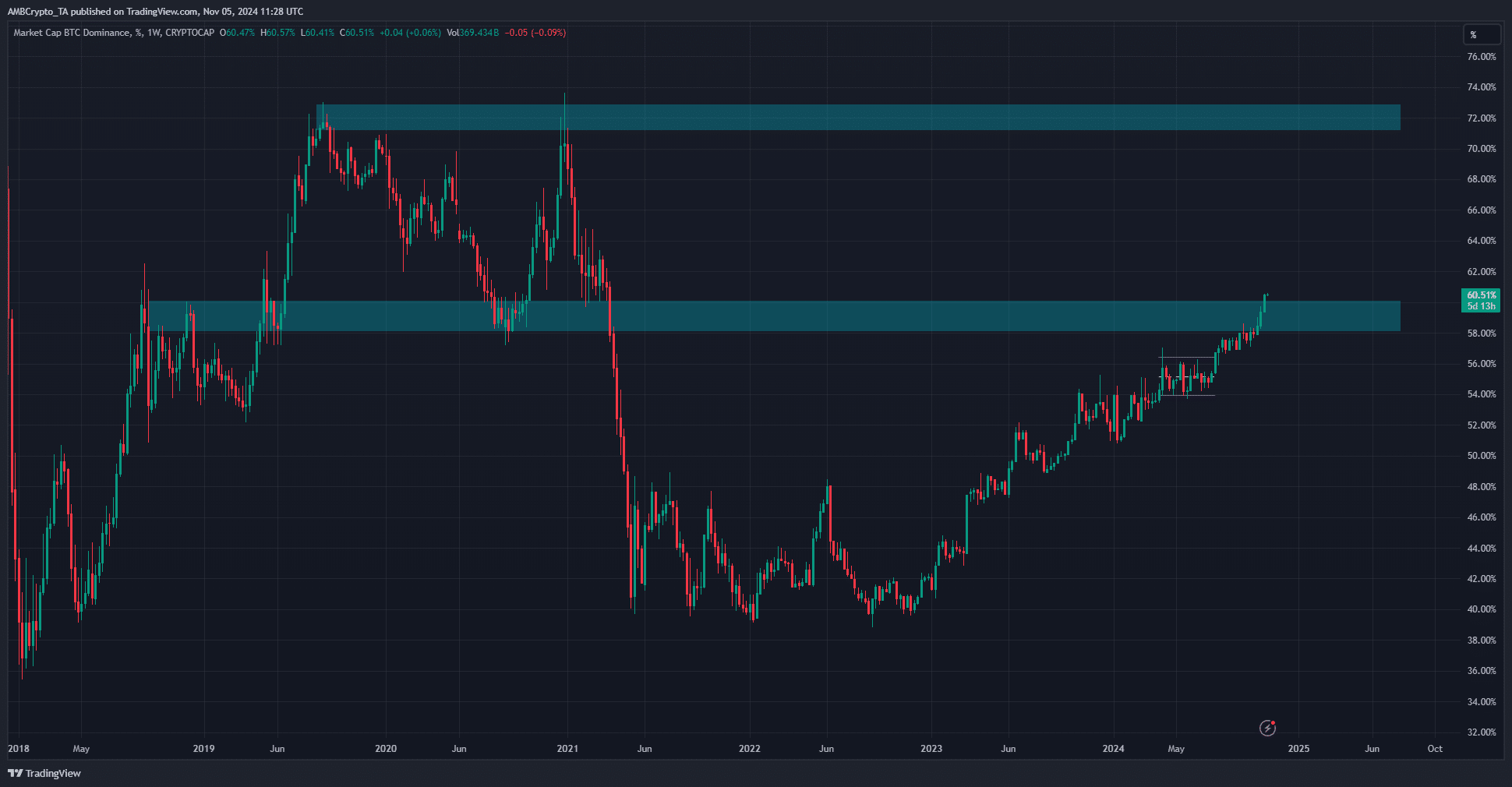

Source: BTC.D on TradingView

The Bitcoin dominance chart showed a move beyond a key resistance from the previous cycle has occurred.

At 60.5%, BTC.D is poised to surge toward 72%, the previous cycle’s top.

However, it is not necessary that BTC.D must reach 72% before the altcoin season can ensue.

Instead, using technical analysis alone, a break in the bullish structure of the BTC.D would be an early sign that the altcoin season is arriving.

This is another factor traders and investors can watch out for. The higher the BTC.D goes before a reversal, the better the altcoin gains that follow could be.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This is because Bitcoin is the magnet that draws the most money to the crypto ecosystem. Also, rotation from BTC to other altcoins contributes to an altcoin season.

As things stand, it is still a good time to accumulate more alts which a market participant has conviction for.

- The combined dominance chart was nearing its previous tops.

- Capital influx into the crypto sphere through rising BTC prices was essential for a healthy altcoin season.

Bitcoin [BTC] trended upward in September and October after slowly but steadily falling lower since March. On the 29th of October, it nearly retested its all-time high, going as far north as $73.6k before facing rejection.

Analysis of on-chain metrics revealed an increase in large transaction volume and bullish sentiment in lower timeframes.

On higher timeframes, capital influx and rotation will be key for Bitcoin and altcoin markets in this cycle.

How close are we to an altcoin season?

Source: Benjamin Cowen on X

Benjamin Cowen, CEO and Founder of Into The Cryptoverse, expects an altcoin season “next year“.

He noted that the combined dominance of Bitcoin, Ethereum [ETH], USDT, and USDC reached 82% in 2020 and 2023, forming tops before the altcoin market rallied.

At press time, it was at 80.51%, nearing its top. A rejection and sustained downtrend would indicate that Bitcoin and Ethereum were being outpaced by the rest of the altcoin market.

Additionally, a downtrend in stablecoin market share would signal investors buying crypto.

Cowen expects this to begin in 2025, meaning altcoin holders need more patience before seeing large gains.

Source: Blockchain Center

The altcoin season index agreed, and its reading of 27 showed that the altcoin market was unable to keep up with BTC’s moves.

Another factor is how, during a sell-off, altcoins are much more affected than BTC and experience greater draw-downs.

Encouraging signs for investors

Source: BTC.D on TradingView

The Bitcoin dominance chart showed a move beyond a key resistance from the previous cycle has occurred.

At 60.5%, BTC.D is poised to surge toward 72%, the previous cycle’s top.

However, it is not necessary that BTC.D must reach 72% before the altcoin season can ensue.

Instead, using technical analysis alone, a break in the bullish structure of the BTC.D would be an early sign that the altcoin season is arriving.

This is another factor traders and investors can watch out for. The higher the BTC.D goes before a reversal, the better the altcoin gains that follow could be.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This is because Bitcoin is the magnet that draws the most money to the crypto ecosystem. Also, rotation from BTC to other altcoins contributes to an altcoin season.

As things stand, it is still a good time to accumulate more alts which a market participant has conviction for.

where can i buy clomid no prescription get cheap clomid pills how to get generic clomid tablets can you buy clomiphene prices how to buy cheap clomiphene no prescription how to get generic clomid price get clomiphene online

This is the kind of content I take advantage of reading.

Thanks for sharing. It’s acme quality.

generic zithromax 500mg – floxin price brand flagyl 200mg

domperidone 10mg oral – cyclobenzaprine 15mg canada order cyclobenzaprine

buy amoxil cheap – amoxil without prescription order ipratropium sale

buy esomeprazole pills for sale – anexamate.com order nexium 20mg without prescription

coumadin 5mg uk – https://coumamide.com/ losartan 50mg drug

buy meloxicam 7.5mg for sale – https://moboxsin.com/ mobic 7.5mg without prescription

order deltasone online cheap – https://apreplson.com/ prednisone 10mg canada

causes of erectile dysfunction – best ed drug pills for erection

diflucan online – https://gpdifluca.com/# buy fluconazole 100mg sale

escitalopram pills – https://escitapro.com/# oral lexapro 20mg

order cenforce 100mg online cheap – buy cenforce 50mg generic cenforce 50mg pills

tadalafil daily use – ciltad genesis canadian pharmacy cialis

buy cialis online overnight shipping – site tadalafil oral jelly

purchase ranitidine online – ranitidine cheap buy ranitidine 150mg pill

sildenafil 50mg tablets price – strongvpls how to order viagra in australia

More articles like this would frame the blogosphere richer. https://gnolvade.com/

Good blog you possess here.. It’s hard to find elevated worth script like yours these days. I honestly comprehend individuals like you! Take care!! neurontin online

I am in fact thrilled to glance at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://ursxdol.com/azithromycin-pill-online/

I am in point of fact thrilled to coup d’oeil at this blog posts which consists of tons of of use facts, thanks representing providing such data. https://prohnrg.com/product/omeprazole-20-mg/

This is the type of enter I unearth helpful. pharmacie qui vend du cialis professional sans ordonnance

With thanks. Loads of conception! https://ondactone.com/spironolactone/

More posts like this would make the blogosphere more useful.

inderal online buy

More delight pieces like this would urge the интернет better. https://experthax.com/forum/member.php?action=profile&uid=124580

cheap forxiga 10 mg – https://janozin.com/# dapagliflozin 10 mg cost

brand orlistat – https://asacostat.com/ orlistat 60mg uk