- MicroStrategy plans to buy $42B BTC in the next 3 years.

- An analyst projected that MSTR will become more like a US spot BTC ETF.

Michael Saylor’s firm, MicroStrategy, announced plans to acquire $42 billion of Bitcoin [BTC] in the next three years, just before the 2028 halving cycle.

“Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan.”

This has reinforced Saylor’s uber-bullish stance on BTC, as he expects the asset to reach $3 million-$49 million in the next 20 years. He has also supported Trump’s pro-crypto stance, with the latest push for removing the capital gains tax on BTC.

Is MSTR changing to BTC ETF?

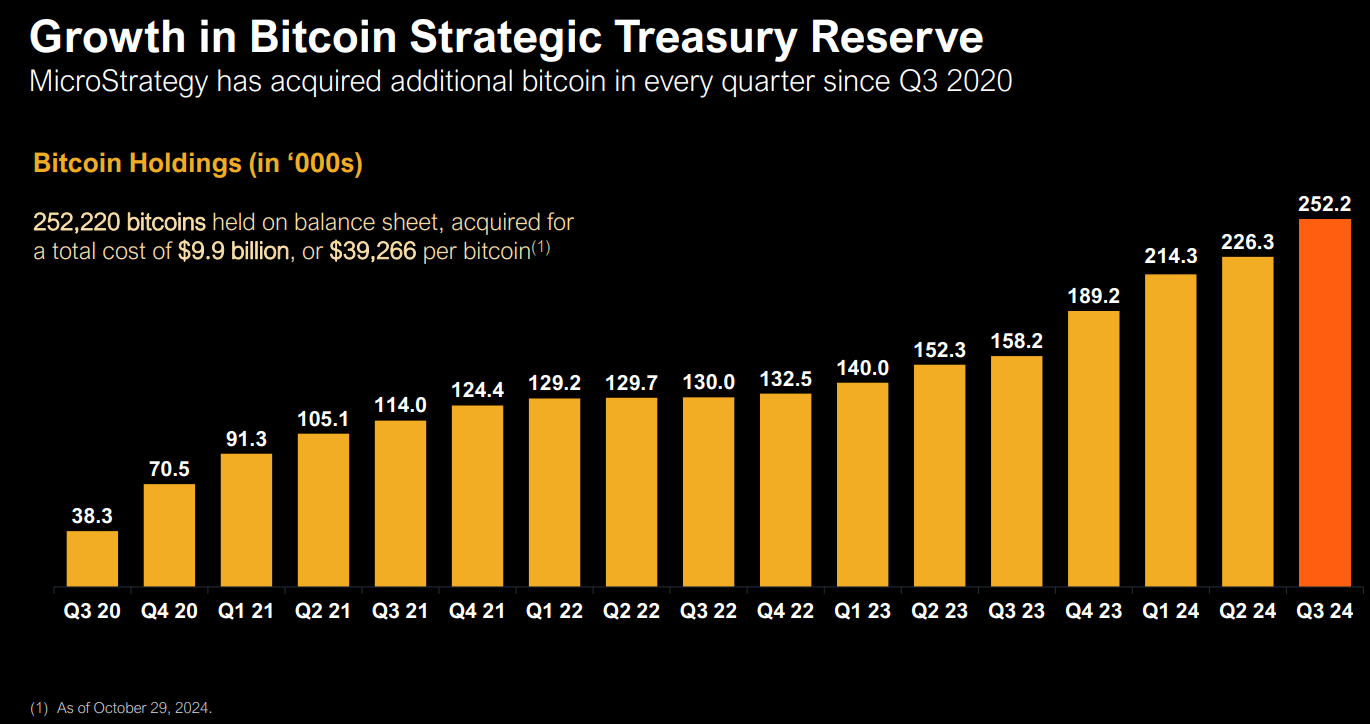

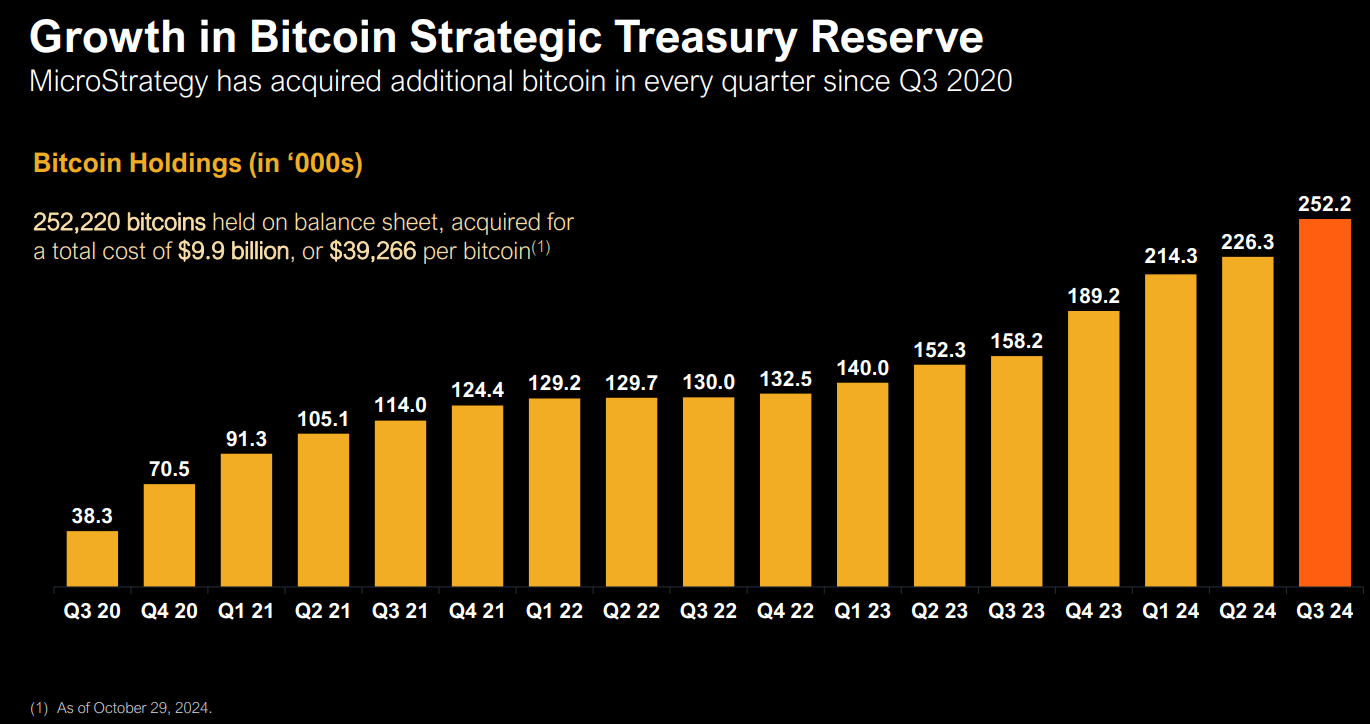

As of October 2024, MicroStrategy held 252, 220 BTC, acquired for $9.9 billion. The firm’s BTC stash was now worth over $18.15 billion at current prices, translating to $8 billion in unrealized gains.

Source: MicroStrategy

However, part of the firm’s $42 BTC acquisition plan will be done through a $21 billion ATM (at-the-market) stock issuance program, which some analysts believe would turn its stock’s MSTR into a BTC ETF.

One of the analysts, Quinn Thompson, founder of macro-focused crypto hedge fund Lekker Capital, said,

“By ripping the bandaid off and announcing a massive ATM shelf like this, they are turning $MSTR into a de-facto ETF.”

This would allow the firm to issue stocks in the secondary market at any time to fund its BTC acquisition, almost similar to how US spot BTC ETFs operate. According to Thomspon, this could boost MSTR even more.

The equity program, alongside the intention to issue convertible notes (debt) to buy BTC, sums up the firm’s long-term vision of becoming a ‘Bitcoin bank,’ as revealed in mid-October.

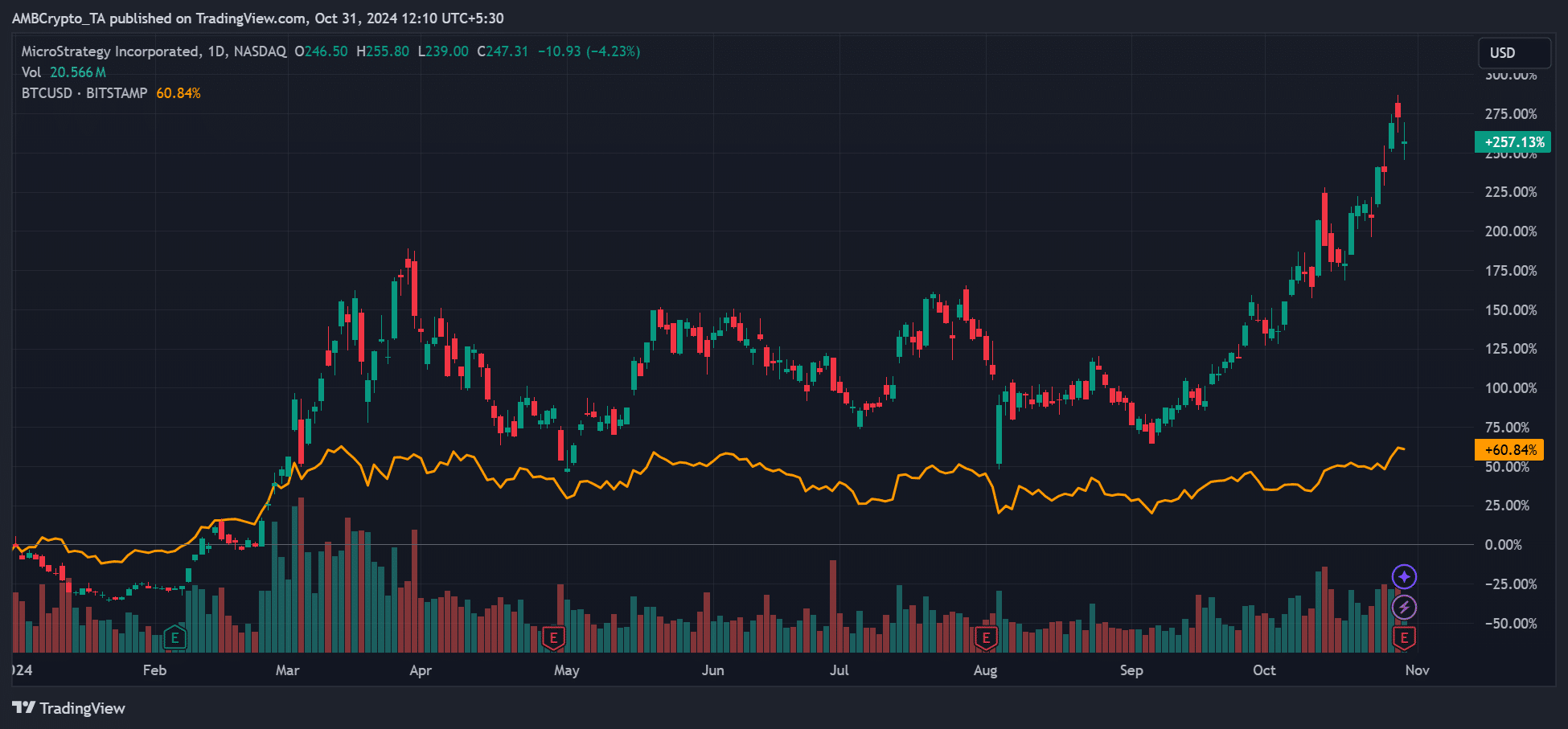

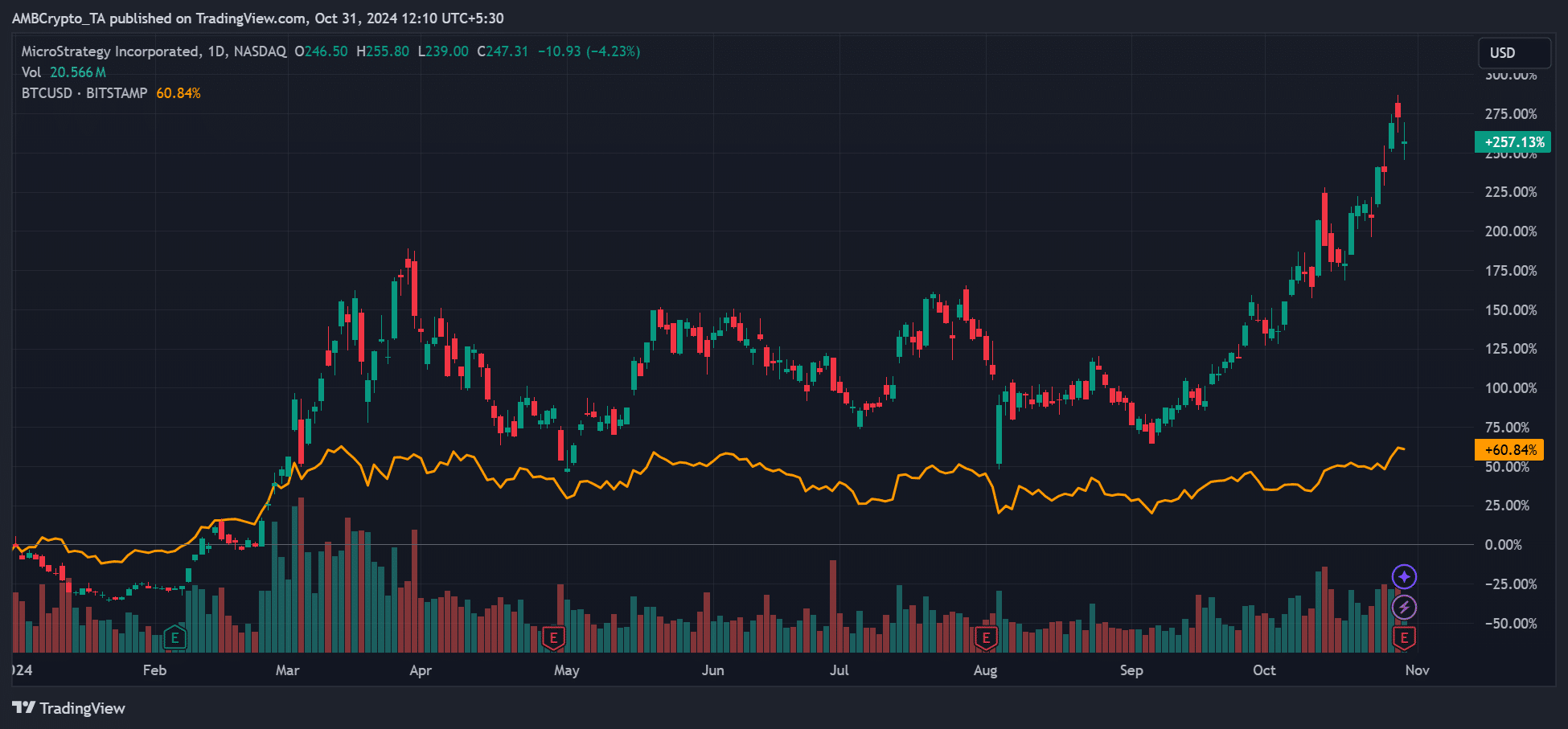

That said, MSTR holders seemed to be the real beneficiaries of the latest update. MSTR has been the best-performing S&P stock since adopting the BTC strategy in 2020. This has seen MSTR outperform and could even downplay the firm’s latest Q3 loss of $19.4 million.

On year-to-date (YTD) basis, MSTR was up +250%, more than 4x BTC’s 60% gains. In Q3, MSTR rallied about 20%, while BTC closed the quarter with less than 1% gains.

Source: MSTR vs BTC, TradingView

In short, from an investor returns perspective, it was better to hold MSTR than BTC.

Interestingly, the stock was expected to post an extra 7% rally after the latest earnings report, noted Bitwise’s head of alpha strategies, Jeff Park. Citing the MSTR options data, Park stated,

“As we enter $MSTR earnings, an explosive set up: Nov 1 Vol is ~115%, implying a 7.2% move.”

At press time, MSTR was valued at $247, and it remains to be determined whether it will print a fresh yearly high as Park projected amid BTC’s tight consolidation above $72K.

- MicroStrategy plans to buy $42B BTC in the next 3 years.

- An analyst projected that MSTR will become more like a US spot BTC ETF.

Michael Saylor’s firm, MicroStrategy, announced plans to acquire $42 billion of Bitcoin [BTC] in the next three years, just before the 2028 halving cycle.

“Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan.”

This has reinforced Saylor’s uber-bullish stance on BTC, as he expects the asset to reach $3 million-$49 million in the next 20 years. He has also supported Trump’s pro-crypto stance, with the latest push for removing the capital gains tax on BTC.

Is MSTR changing to BTC ETF?

As of October 2024, MicroStrategy held 252, 220 BTC, acquired for $9.9 billion. The firm’s BTC stash was now worth over $18.15 billion at current prices, translating to $8 billion in unrealized gains.

Source: MicroStrategy

However, part of the firm’s $42 BTC acquisition plan will be done through a $21 billion ATM (at-the-market) stock issuance program, which some analysts believe would turn its stock’s MSTR into a BTC ETF.

One of the analysts, Quinn Thompson, founder of macro-focused crypto hedge fund Lekker Capital, said,

“By ripping the bandaid off and announcing a massive ATM shelf like this, they are turning $MSTR into a de-facto ETF.”

This would allow the firm to issue stocks in the secondary market at any time to fund its BTC acquisition, almost similar to how US spot BTC ETFs operate. According to Thomspon, this could boost MSTR even more.

The equity program, alongside the intention to issue convertible notes (debt) to buy BTC, sums up the firm’s long-term vision of becoming a ‘Bitcoin bank,’ as revealed in mid-October.

That said, MSTR holders seemed to be the real beneficiaries of the latest update. MSTR has been the best-performing S&P stock since adopting the BTC strategy in 2020. This has seen MSTR outperform and could even downplay the firm’s latest Q3 loss of $19.4 million.

On year-to-date (YTD) basis, MSTR was up +250%, more than 4x BTC’s 60% gains. In Q3, MSTR rallied about 20%, while BTC closed the quarter with less than 1% gains.

Source: MSTR vs BTC, TradingView

In short, from an investor returns perspective, it was better to hold MSTR than BTC.

Interestingly, the stock was expected to post an extra 7% rally after the latest earnings report, noted Bitwise’s head of alpha strategies, Jeff Park. Citing the MSTR options data, Park stated,

“As we enter $MSTR earnings, an explosive set up: Nov 1 Vol is ~115%, implying a 7.2% move.”

At press time, MSTR was valued at $247, and it remains to be determined whether it will print a fresh yearly high as Park projected amid BTC’s tight consolidation above $72K.

where can i get clomiphene without prescription can i purchase clomid for sale can i get clomid without insurance clomiphene uk buy can i get clomiphene online buy generic clomid where to get cheap clomiphene without dr prescription

The depth in this serving is exceptional.

This website exceedingly has all of the bumf and facts I needed to this participant and didn’t know who to ask.

generic azithromycin 250mg – sumycin 500mg pills order flagyl online cheap

order generic rybelsus 14mg – brand semaglutide 14 mg cyproheptadine us

oral motilium 10mg – brand motilium buy cyclobenzaprine 15mg for sale

inderal 10mg without prescription – inderal 10mg brand buy generic methotrexate

purchase amoxicillin for sale – valsartan online buy buy combivent 100mcg for sale

azithromycin 250mg price – nebivolol 20mg over the counter order nebivolol sale

buy augmentin 1000mg sale – https://atbioinfo.com/ acillin pill

purchase esomeprazole online – https://anexamate.com/ buy generic nexium for sale

buy warfarin online cheap – anticoagulant oral losartan 25mg

order mobic 7.5mg – mobo sin meloxicam ca

buy prednisone 10mg generic – https://apreplson.com/ oral prednisone 40mg

generic ed drugs – fastedtotake herbal ed pills

where to buy amoxil without a prescription – comba moxi amoxicillin canada

diflucan where to buy – forcan ca fluconazole 100mg ca

cenforce medication – https://cenforcers.com/ oral cenforce 100mg

buy cialis online without prescription – tadalafil without a doctor’s prescription cialis 20mg tablets

when does cialis go off patent – cialis side effect cialis tadalafil

purchase ranitidine without prescription – https://aranitidine.com/# brand zantac 150mg

where to buy cheap viagra online – click cheap viagra canada pharmacy

I couldn’t turn down commenting. Adequately written! kamagra contraindicaciones

This is a keynote which is forthcoming to my callousness… Numberless thanks! Exactly where can I find the contact details an eye to questions? https://buyfastonl.com/gabapentin.html

Thanks on sharing. It’s top quality. https://ursxdol.com/furosemide-diuretic/

I’ll certainly return to read more. https://prohnrg.com/

This is the big-hearted of writing I positively appreciate. naphazoline prednisolone