- Ethereum long-term accumulation addresses now hold over 19 million ETH, nearly doubling since January 2024.

- With nearly 29% of ETH’s total supply staked, reduced market liquidity could support future price stability.

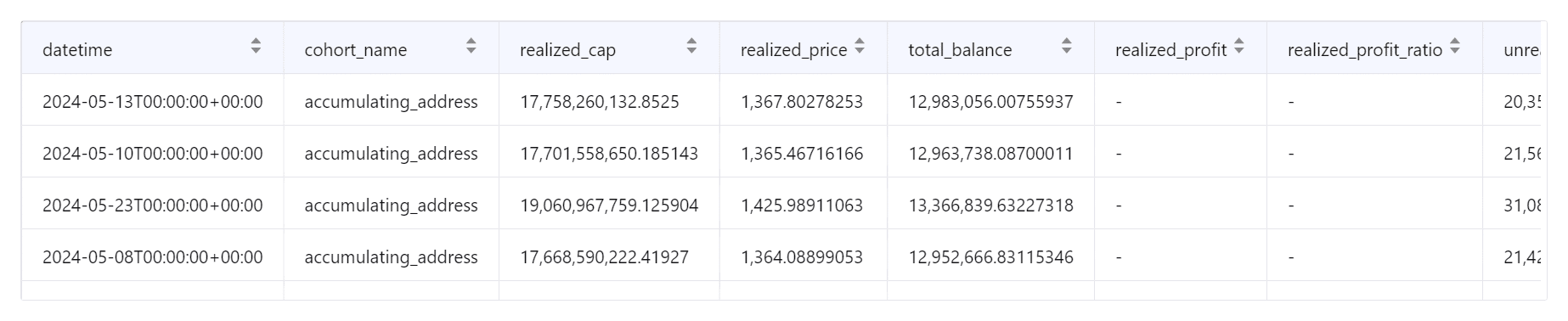

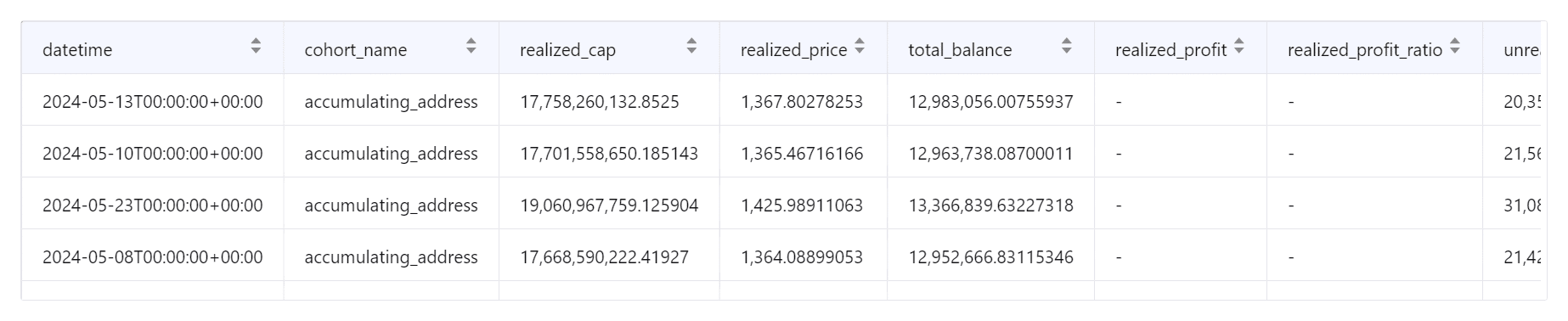

Ethereum [ETH] was experiencing a surge in long-term accumulation, with more than 19 million ETH held in addresses as of the 18th of October.

This marks a significant rise from 11.5 million ETH at the start of the year, reflecting growing confidence among investors about Ethereum’s long-term prospects.

Ethereum accumulation rises

Data from CryptoQuant revealed a substantial increase in Ethereum held in accumulation addresses. In January 2024, these addresses held 11.5 million ETH, and by October, this figure had nearly doubled.

Experts suggest that by the end of the year, the amount held in these addresses could surpass 20 million ETH, continuing this upward trend.

Source: CryptoQuant

This increase in long-term holdings signals that large investors and ETH supporters are building their positions with the expectation of future growth.

The approval of Spot ETFs in early 2024 has also contributed to this accumulation by drawing more mainstream attention to ETH. The rise in ETH staking is another driving force behind the increased accumulation.

Staked Ethereum near 30% of supply

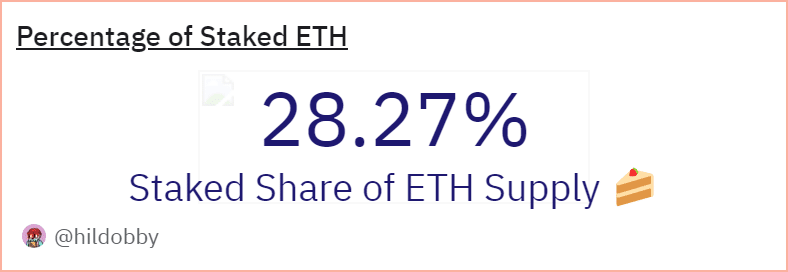

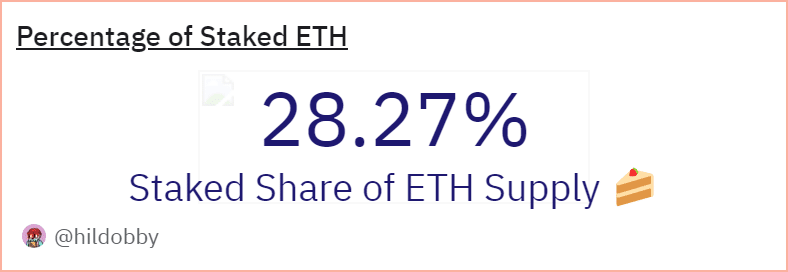

As accumulation grows, staking has also become a key factor in Ethereum’s market dynamics. Data from Dune Analytics shows that 34,600,896 ETH was staked at press time, representing nearly 29% of ETH’s total supply.

Source: DuneAnalytics

With a substantial portion of ETH now locked up in staking contracts, the overall market may experience reduced sell-side pressure.

This could provide support for Ethereum’s price in the near future, as less ETH is available for trading, which could contribute to price stability or even further price appreciation.

Ethereum maintains a positive trend

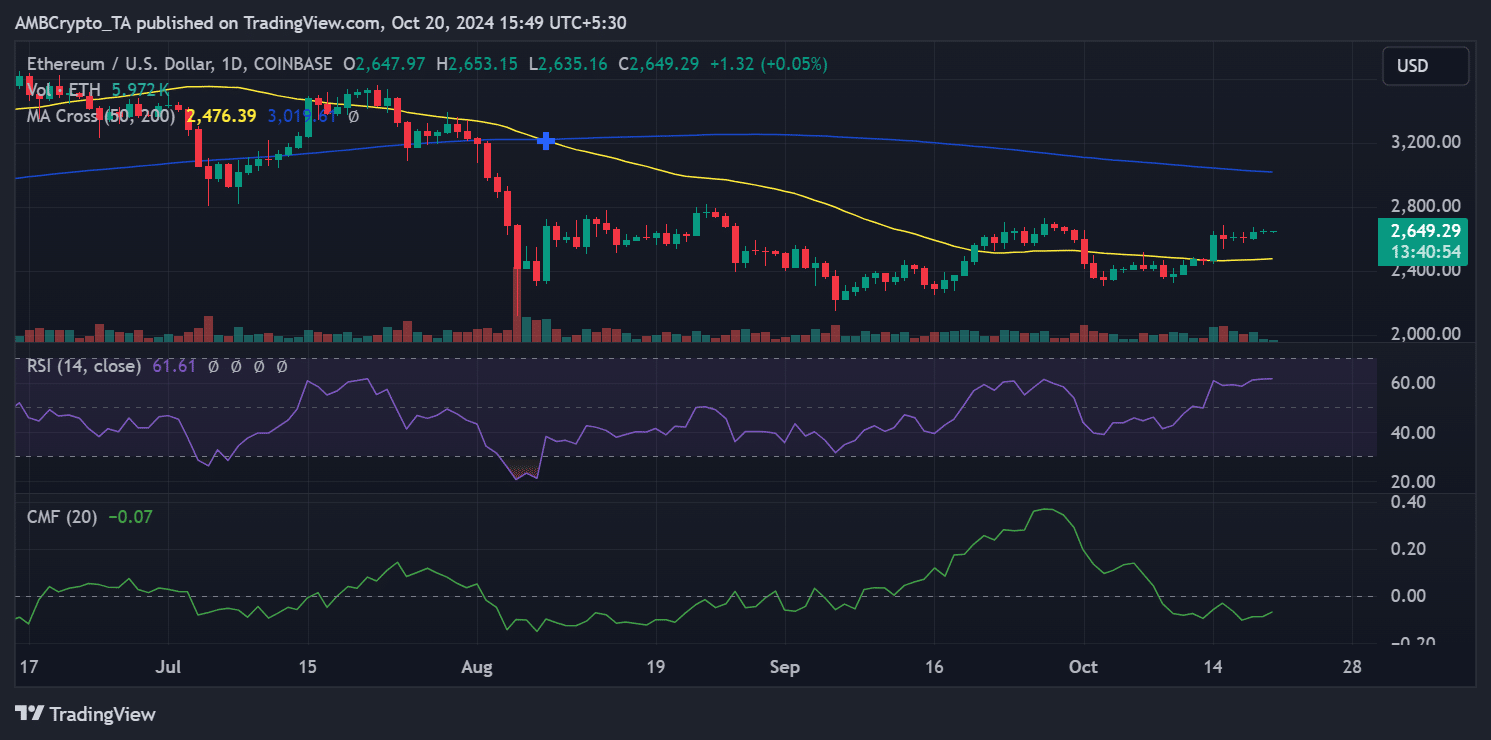

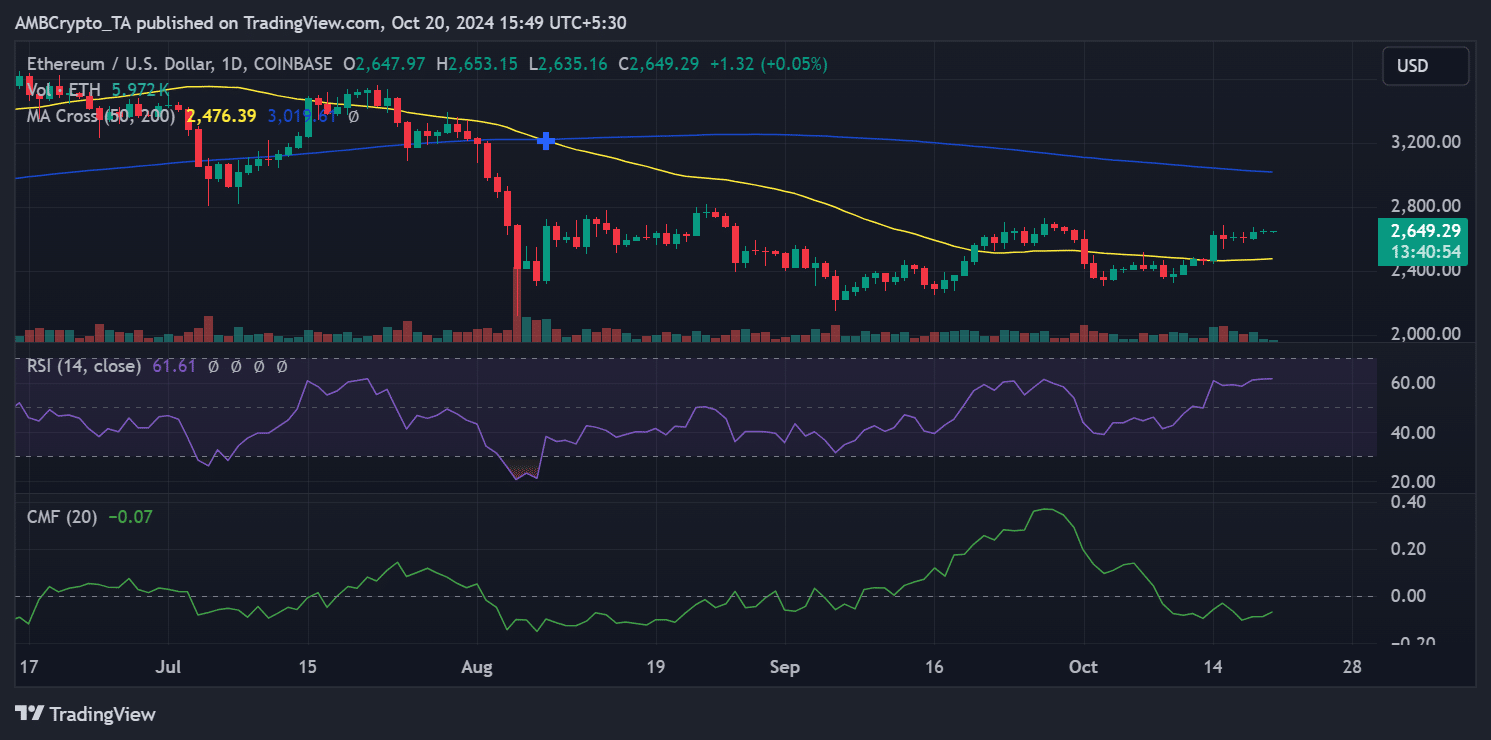

AT press time, Ethereum was trading at $2,649, slightly above key support levels.

The 50-day moving average at $2,476 has provided strong support, while the 200-day moving average at $3,022 served as a critical resistance point.

A breakthrough above this resistance level will be essential for ETH to sustain a longer-term rally.

Source: TradingView

The Relative Strength Index (RSI) sits at 61.61, indicating moderate bullish momentum without entering overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024-25

Meanwhile, the Chaikin Money Flow (CMF) was slightly negative at -0.07, reflecting limited buying pressure but not enough to signal a bearish trend reversal.

Although Ethereum maintains a positive outlook, surpassing the $3,022 resistance is key for a stronger upward trajectory. If market volatility arises, the 50-day moving average at $2,476 could act as crucial support.

- Ethereum long-term accumulation addresses now hold over 19 million ETH, nearly doubling since January 2024.

- With nearly 29% of ETH’s total supply staked, reduced market liquidity could support future price stability.

Ethereum [ETH] was experiencing a surge in long-term accumulation, with more than 19 million ETH held in addresses as of the 18th of October.

This marks a significant rise from 11.5 million ETH at the start of the year, reflecting growing confidence among investors about Ethereum’s long-term prospects.

Ethereum accumulation rises

Data from CryptoQuant revealed a substantial increase in Ethereum held in accumulation addresses. In January 2024, these addresses held 11.5 million ETH, and by October, this figure had nearly doubled.

Experts suggest that by the end of the year, the amount held in these addresses could surpass 20 million ETH, continuing this upward trend.

Source: CryptoQuant

This increase in long-term holdings signals that large investors and ETH supporters are building their positions with the expectation of future growth.

The approval of Spot ETFs in early 2024 has also contributed to this accumulation by drawing more mainstream attention to ETH. The rise in ETH staking is another driving force behind the increased accumulation.

Staked Ethereum near 30% of supply

As accumulation grows, staking has also become a key factor in Ethereum’s market dynamics. Data from Dune Analytics shows that 34,600,896 ETH was staked at press time, representing nearly 29% of ETH’s total supply.

Source: DuneAnalytics

With a substantial portion of ETH now locked up in staking contracts, the overall market may experience reduced sell-side pressure.

This could provide support for Ethereum’s price in the near future, as less ETH is available for trading, which could contribute to price stability or even further price appreciation.

Ethereum maintains a positive trend

AT press time, Ethereum was trading at $2,649, slightly above key support levels.

The 50-day moving average at $2,476 has provided strong support, while the 200-day moving average at $3,022 served as a critical resistance point.

A breakthrough above this resistance level will be essential for ETH to sustain a longer-term rally.

Source: TradingView

The Relative Strength Index (RSI) sits at 61.61, indicating moderate bullish momentum without entering overbought territory.

Read Ethereum’s [ETH] Price Prediction 2024-25

Meanwhile, the Chaikin Money Flow (CMF) was slightly negative at -0.07, reflecting limited buying pressure but not enough to signal a bearish trend reversal.

Although Ethereum maintains a positive outlook, surpassing the $3,022 resistance is key for a stronger upward trajectory. If market volatility arises, the 50-day moving average at $2,476 could act as crucial support.

Blue Techker very informative articles or reviews at this time.

I appreciate how well-researched and informative each post is It’s obvious how much effort you put into your work

clomid pill clomid for sale buy clomiphene tablets buy cheap clomiphene without dr prescription how to buy cheap clomiphene pill can you get clomid pills where to get clomiphene price

I couldn’t resist commenting. Profoundly written!

Greetings! Very gainful suggestion within this article! It’s the crumb changes which will turn the largest changes. Thanks a quantity for sharing!

azithromycin for sale online – tindamax for sale order flagyl 400mg generic

buy generic semaglutide for sale – order periactin 4 mg order cyproheptadine 4 mg online cheap

domperidone tablet – buy motilium 10mg pill buy cheap flexeril

purchase inderal generic – buy propranolol generic methotrexate 10mg uk

buy clavulanate – https://atbioinfo.com/ buy ampicillin tablets

nexium 20mg drug – https://anexamate.com/ buy nexium 20mg online

buy generic coumadin for sale – https://coumamide.com/ order generic hyzaar

purchase meloxicam online – https://moboxsin.com/ meloxicam 7.5mg tablet

buy deltasone 40mg online – https://apreplson.com/ prednisone uk

best ed medications – home remedies for ed erectile dysfunction blue pill for ed

cheap amoxil pill – buy amoxil pills buy amoxicillin cheap

order fluconazole generic – https://gpdifluca.com/ diflucan 200mg oral

cenforce 100mg us – https://cenforcers.com/# order cenforce 100mg for sale

cialis recommended dosage – click where to buy cialis in canada

order zantac 300mg pills – online brand ranitidine

best reviewed tadalafil site – https://strongtadafl.com/# how to get cialis without doctor