- ETH hit a roadblock near $2700 after the October recovery.

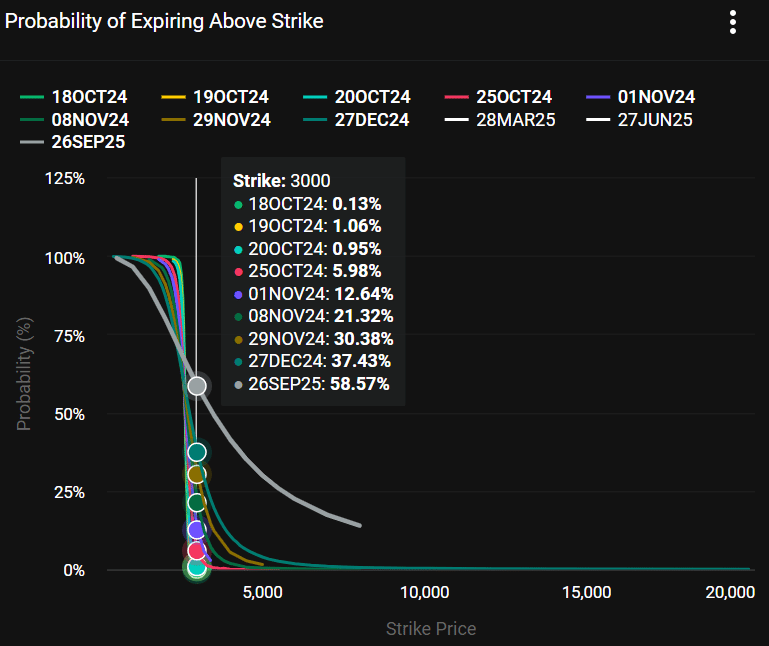

- Options market priced lower odds of ETH hitting $3K before US elections.

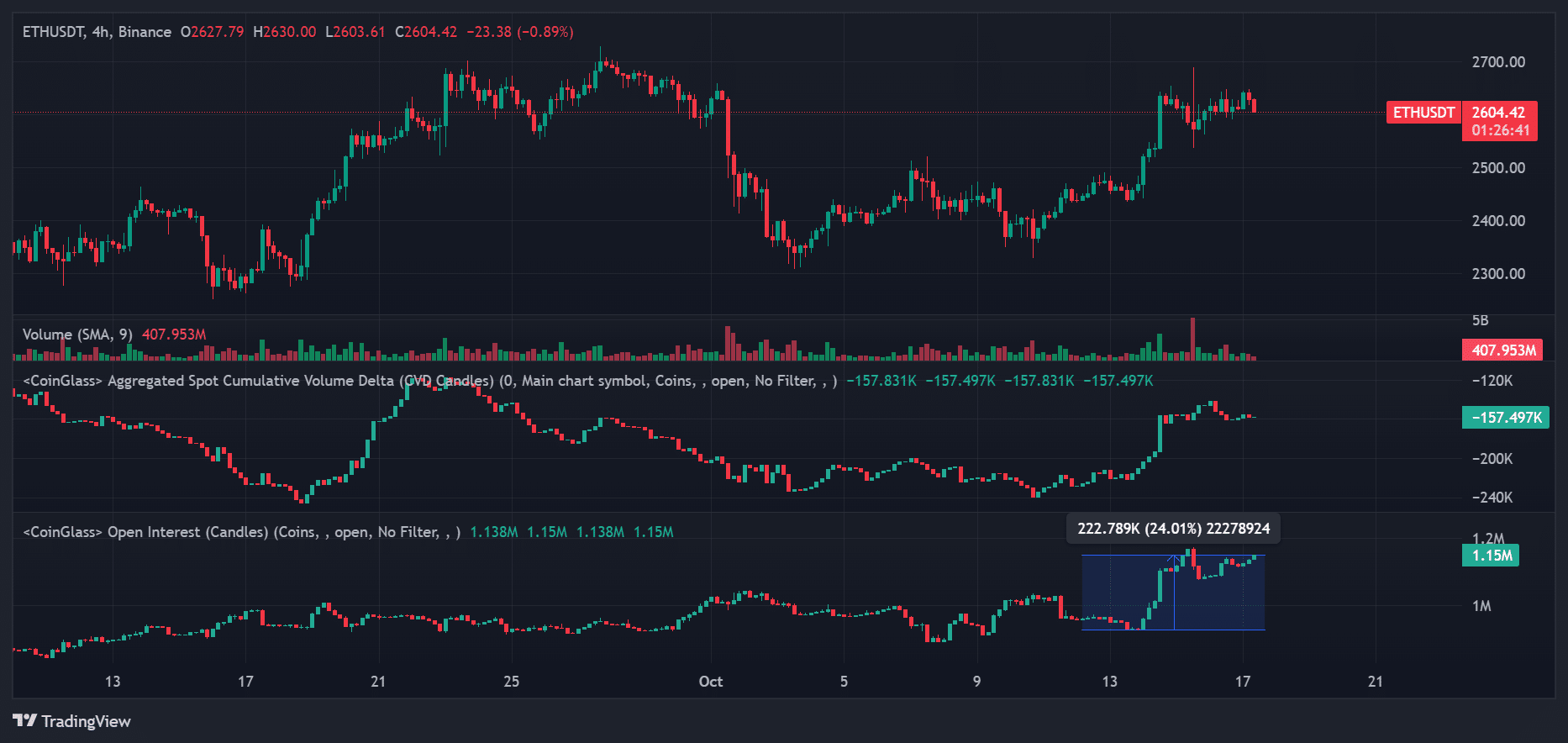

Ethereum [ETH] was back to $2.6K after reversing losses in the first half of October. The largest altcoin logged about 12% in recovery gains after jumping from $2.3K to over $2.6K.

At press time, ETH was valued at $2,614 but hit a key roadblock below $2700.

Ethereum price prediction

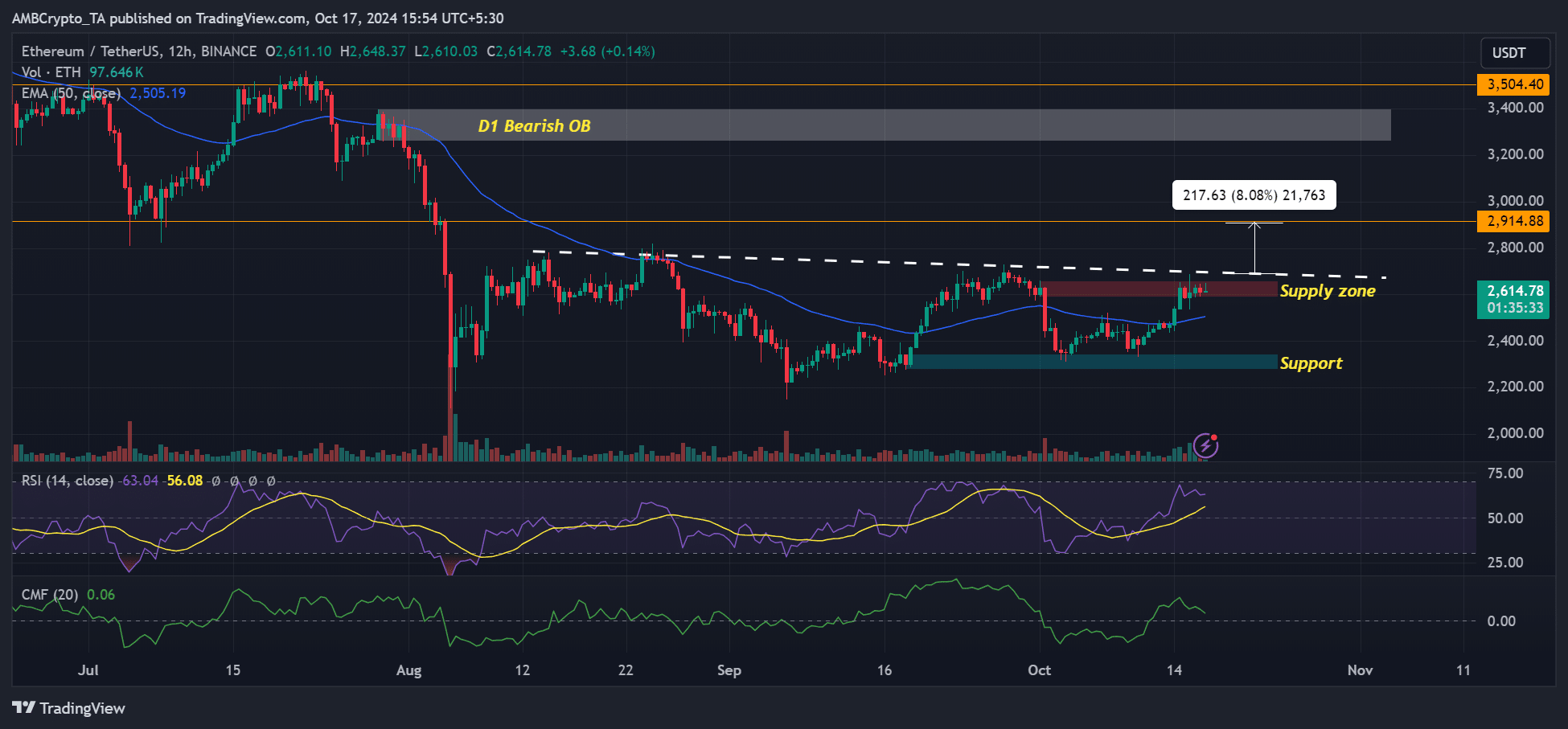

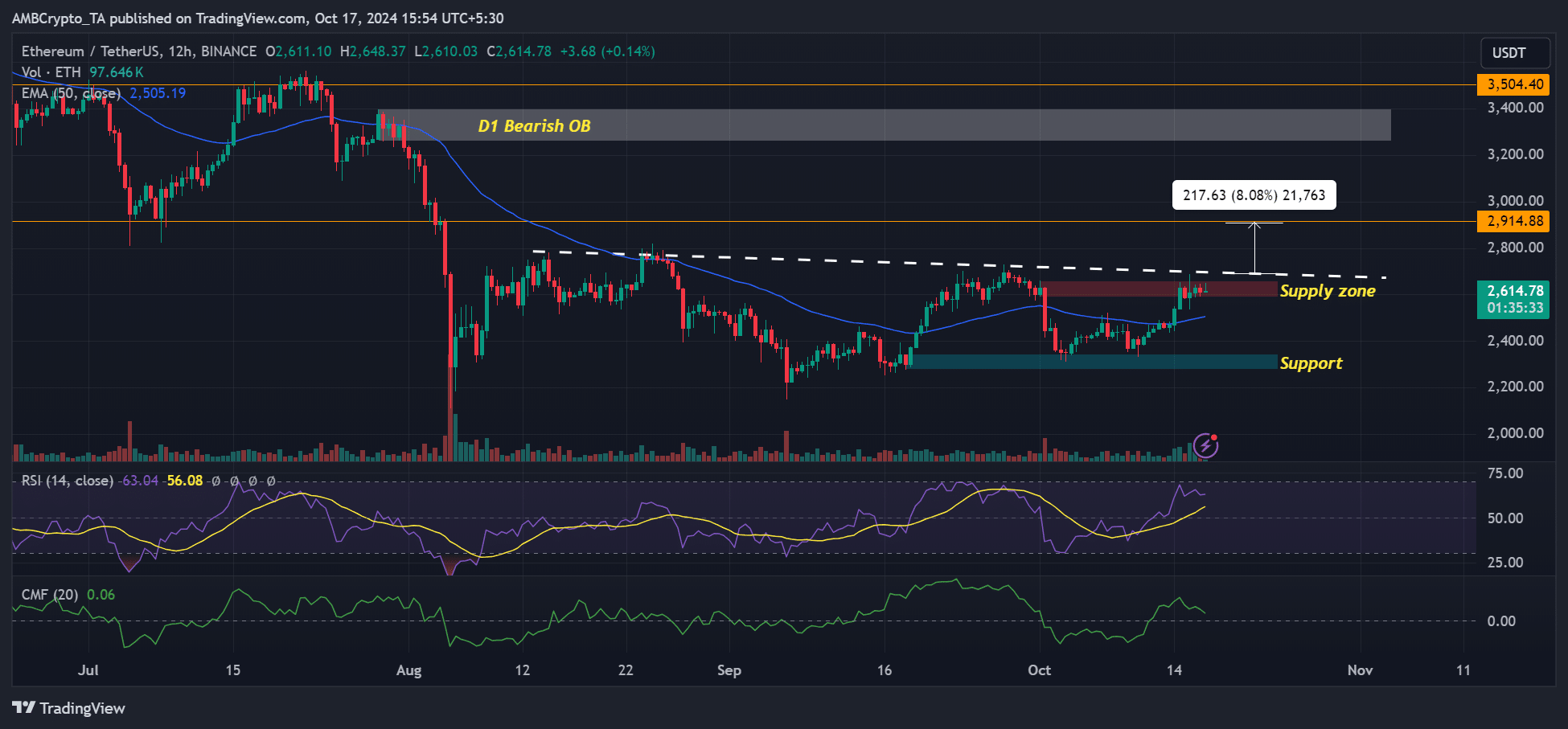

Source: ETH/USDT, TradingView

Since the 9th of October, ETH has recorded increased capital inflows, as shown by the rising Chaikin Money Flow. However, the indicator eased in the past two days, suggesting the inflows tapered off slightly.

This could derail ETH’s strong move above the roadblock and supply zone (marked red), which doubled up as a bearish order block. The supply zone was also a confluence with trendline resistance (dotted white line).

This meant that the roadblock could trigger a price rejection toward the 50-day EMA (Exponential Moving Average) at $2.5K (blue line).

However, ETH could attempt to crack the hurdle if Bitcoin [BTC] extended its bullish streak above $68K. If so, ETH might tuck an extra 8% if it hits $2.9K.

Options data suggests…

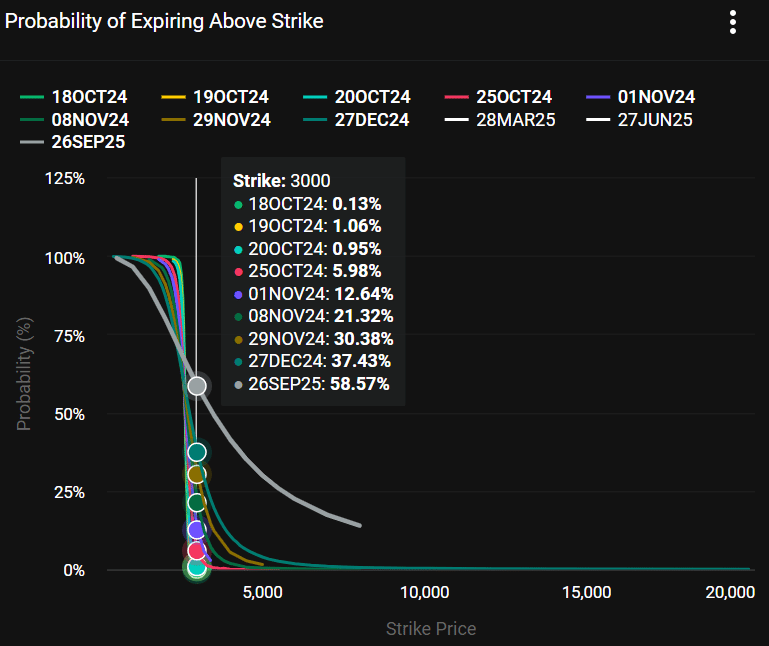

Source: Deribit

That said, according to options data from Deribit, ETH might not see a strong breakout in October. The options market was less optimistic about ETH crossing $3K before the end of the month, at 6%.

On the contrary, the odds of $3K per ETH were 21% by the 8th of November, just after the US elections.

Put differently, a strong ETH move above $3K might be possible only after the U.S. elections, as the next administration will determine DeFi regulation.

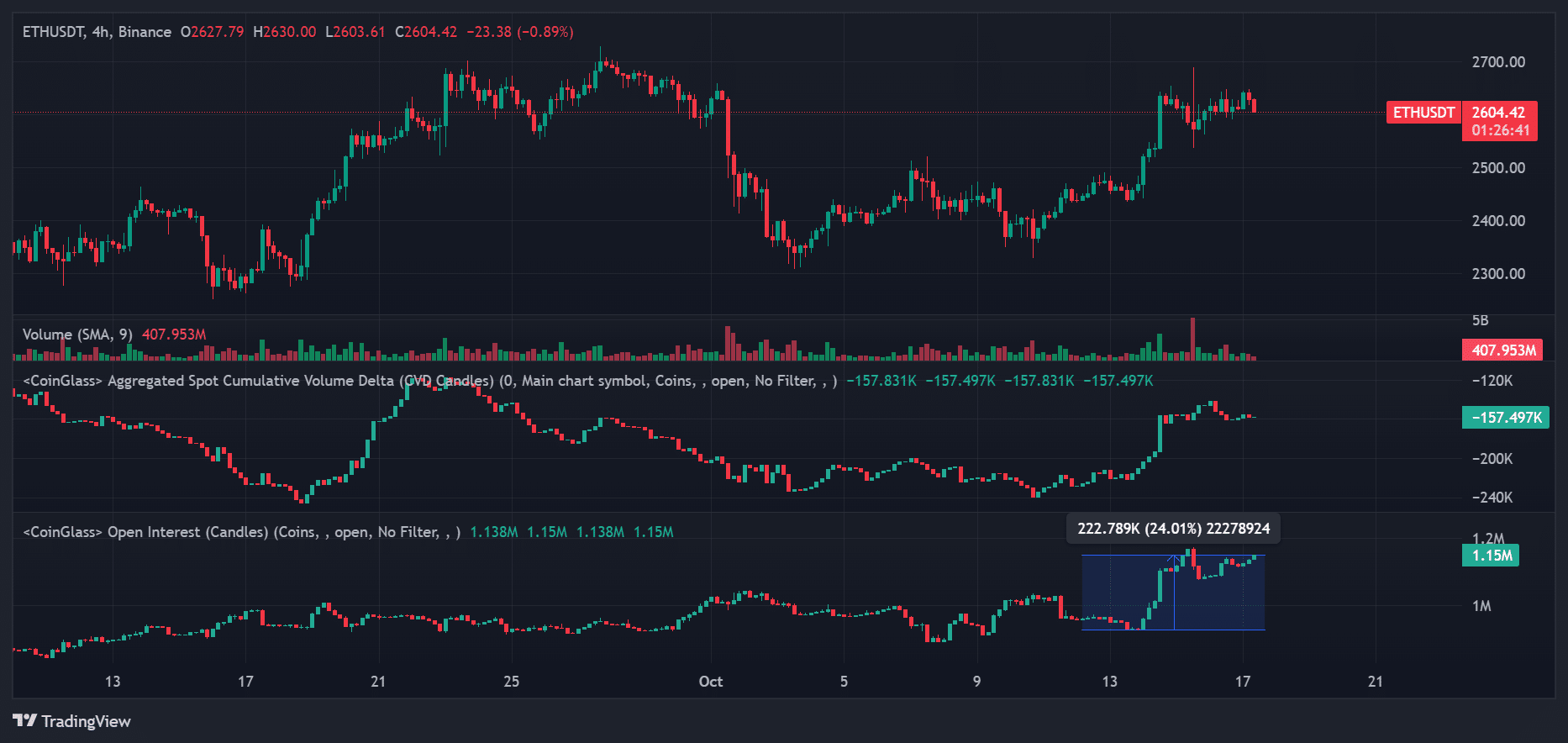

In the meantime, this week’s 8% run-up saw over 220K ETH of Open Interest added on the Binance exchange.

Although this indicated bullish bets, given the uptick in price and rising spot demand (CVD), it doesn’t paint any price direction for ETH in the future.

Read Ethereum [ETH] Price Prediction 2024-2025

But the high leverage meant high levels of liquidation risk, especially if the ETH price dragged lower and dumped harder.

So, the support at $2300, the 50-day EMA, and the roadblock could be key interest levels in the short term.

Source: TradingView

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ETH hit a roadblock near $2700 after the October recovery.

- Options market priced lower odds of ETH hitting $3K before US elections.

Ethereum [ETH] was back to $2.6K after reversing losses in the first half of October. The largest altcoin logged about 12% in recovery gains after jumping from $2.3K to over $2.6K.

At press time, ETH was valued at $2,614 but hit a key roadblock below $2700.

Ethereum price prediction

Source: ETH/USDT, TradingView

Since the 9th of October, ETH has recorded increased capital inflows, as shown by the rising Chaikin Money Flow. However, the indicator eased in the past two days, suggesting the inflows tapered off slightly.

This could derail ETH’s strong move above the roadblock and supply zone (marked red), which doubled up as a bearish order block. The supply zone was also a confluence with trendline resistance (dotted white line).

This meant that the roadblock could trigger a price rejection toward the 50-day EMA (Exponential Moving Average) at $2.5K (blue line).

However, ETH could attempt to crack the hurdle if Bitcoin [BTC] extended its bullish streak above $68K. If so, ETH might tuck an extra 8% if it hits $2.9K.

Options data suggests…

Source: Deribit

That said, according to options data from Deribit, ETH might not see a strong breakout in October. The options market was less optimistic about ETH crossing $3K before the end of the month, at 6%.

On the contrary, the odds of $3K per ETH were 21% by the 8th of November, just after the US elections.

Put differently, a strong ETH move above $3K might be possible only after the U.S. elections, as the next administration will determine DeFi regulation.

In the meantime, this week’s 8% run-up saw over 220K ETH of Open Interest added on the Binance exchange.

Although this indicated bullish bets, given the uptick in price and rising spot demand (CVD), it doesn’t paint any price direction for ETH in the future.

Read Ethereum [ETH] Price Prediction 2024-2025

But the high leverage meant high levels of liquidation risk, especially if the ETH price dragged lower and dumped harder.

So, the support at $2300, the 50-day EMA, and the roadblock could be key interest levels in the short term.

Source: TradingView

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

I’d incessantly want to be update on new content on this internet site, bookmarked! .

I keep listening to the rumor speak about receiving free online grant applications so I have been looking around for the most excellent site to get one. Could you advise me please, where could i get some?

I went over this website and I think you have a lot of excellent info , bookmarked (:.

I like this post, enjoyed this one thank you for putting up. “Pain is inevitable. Suffering is optional.” by M. Kathleen Casey.

where can i get cheap clomid price cost clomiphene pills get generic clomiphene online buying clomid no prescription where can i buy generic clomiphene pill cost of generic clomiphene online cost cheap clomid prices

This is the big-hearted of criticism I truly appreciate.

The reconditeness in this ruined is exceptional.

zithromax 500mg cost – tindamax 300mg canada flagyl price

order semaglutide – rybelsus buy online order periactin 4 mg without prescription

domperidone 10mg ca – tetracycline 250mg cost where to buy cyclobenzaprine without a prescription

buy inderal 20mg – buy propranolol without prescription methotrexate 5mg cost

order amoxicillin pill – order ipratropium 100mcg generic buy ipratropium 100 mcg online

purchase azithromycin without prescription – buy tindamax 300mg pills bystolic medication

augmentin drug – https://atbioinfo.com/ brand acillin

order nexium 40mg online cheap – https://anexamate.com/ nexium 40mg pill

warfarin online order – blood thinner losartan 25mg generic

meloxicam for sale – mobo sin mobic 15mg without prescription

I was studying some of your posts on this site and I think this web site is really instructive! Keep putting up.

generic deltasone 20mg – apreplson.com deltasone 10mg price

pills erectile dysfunction – blue pill for ed male ed drugs

amoxil us – https://combamoxi.com/ where can i buy amoxicillin

fluconazole price – https://gpdifluca.com/ diflucan 100mg cost

buy cenforce without a prescription – buy cenforce 50mg without prescription cenforce without prescription

tadalafil 40 mg with dapoxetine 60 mg – is tadalafil peptide safe to take cheap cialis

zantac online order – https://aranitidine.com/ buy ranitidine generic

snorting cialis – https://strongtadafl.com/# pictures of cialis

This is the compassionate of writing I positively appreciate. online

100mg sildenafil price – https://strongvpls.com/ viagra sildenafil 100 mg

Greetings! Jolly serviceable recommendation within this article! It’s the crumb changes which liking turn the largest changes. Thanks a lot in the direction of sharing! https://buyfastonl.com/isotretinoin.html

More posts like this would force the blogosphere more useful. https://ursxdol.com/cialis-tadalafil-20/

Greetings! Utter serviceable recommendation within this article! It’s the crumb changes which liking espy the largest changes. Thanks a quantity for sharing! prohnrg.com

What’s Happening i’m new to this, I stumbled upon this I have found It positively helpful and it has aided me out loads. I hope to contribute & assist other users like its aided me. Great job.

More delight pieces like this would insinuate the интернет better. https://aranitidine.com/fr/lasix_en_ligne_achat/

More content pieces like this would insinuate the интернет better. https://ondactone.com/simvastatin/

Palatable blog you have here.. It’s severely to assign strong status article like yours these days. I really recognize individuals like you! Go through mindfulness!!

buy celebrex