- Bitcoin trading at $67K, above the Spot ETFs average price.

- BTC’s Open Interest was at its highest since 2020.

Bitcoin [BTC] has once again surged above $67K, drawing the attention of traders and institutions to key support levels that could play a crucial role in the ongoing bull rally.

One such level is the average cost of Bitcoin Spot ETFs, excluding Grayscale’s (GBTC). Throughout 2024, this price level has emerged as a significant support, providing stability during volatile periods.

Despite minor dips, Bitcoin has consistently rebounded, underscoring the resilience of Spot ETF investors who have maintained their positions even during market corrections.

The $57K level, representing the average cost of Bitcoin Spot ETFs, has proven to be a crucial support throughout the year.

Source: CryptoQuant

It has only been tested twice—during the sell-off on the 5th of August and the sharp correction on the 6th of September. However, instead of panic selling, Spot ETF investors held their ground, with only minor outflows.

This demonstrated a strong belief in Bitcoin’s long-term potential, as investors showed no signs of capitulating despite temporary unrealized losses.

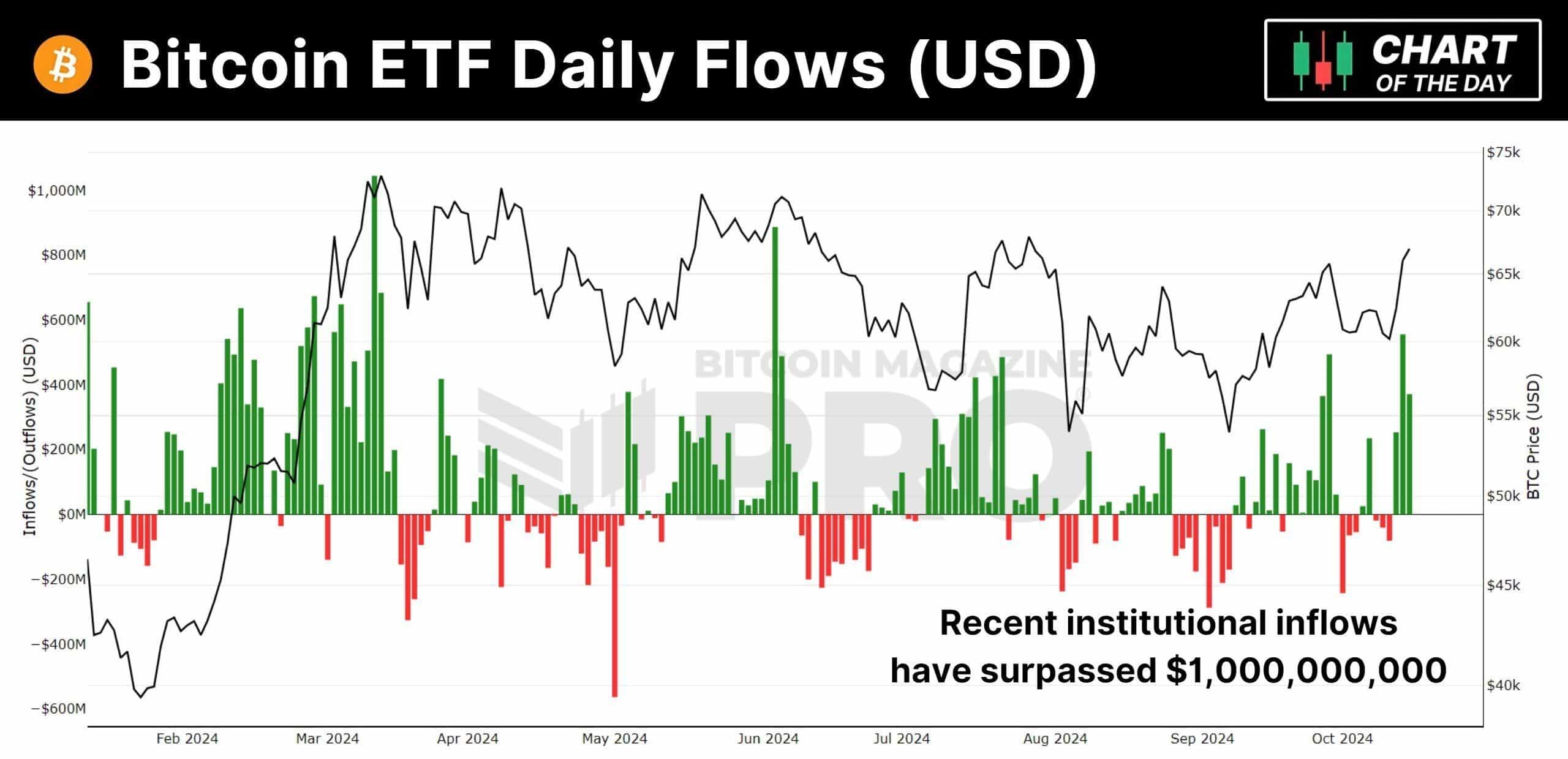

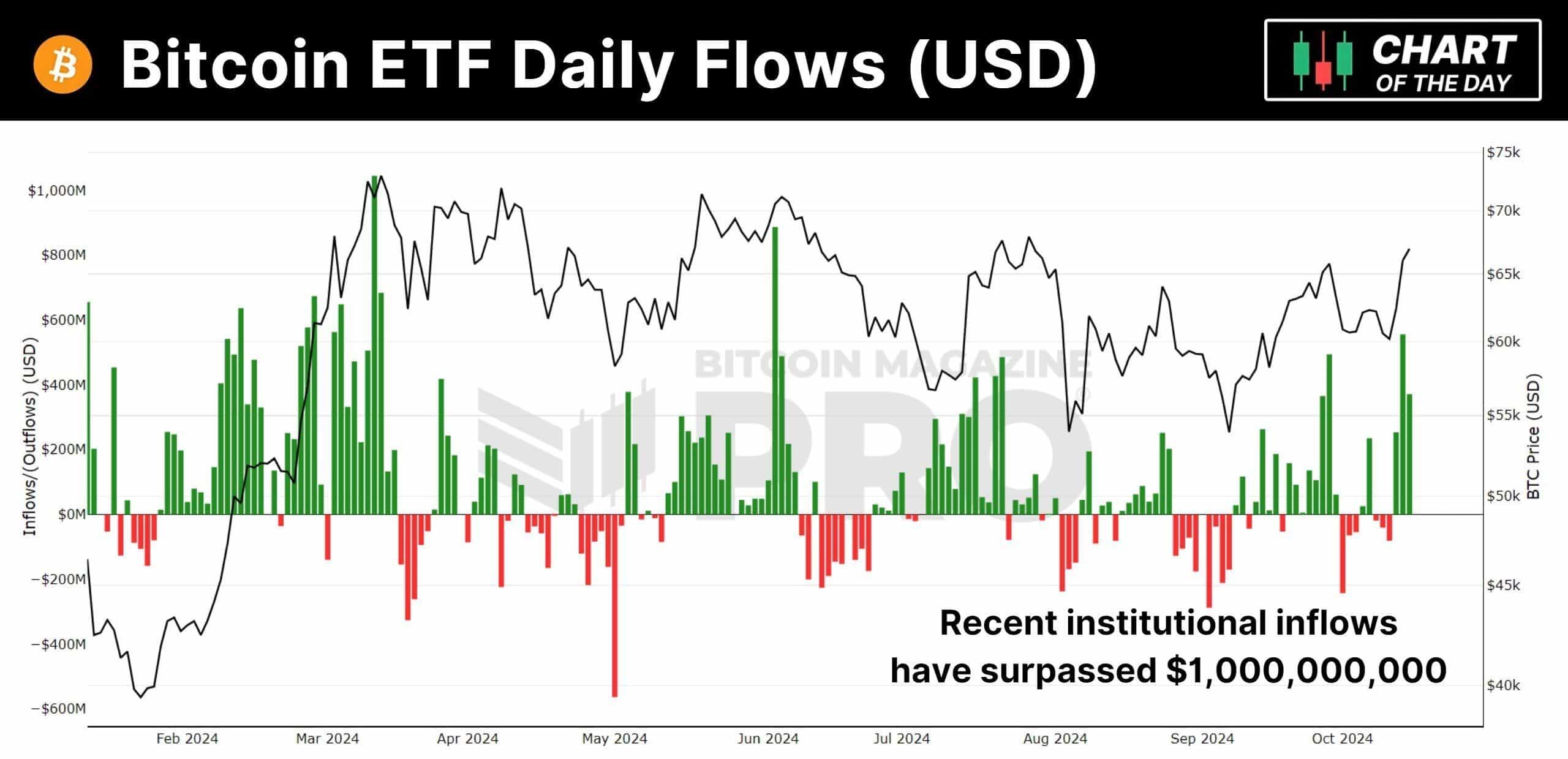

BTC Spot ETFs inflows and OI

This resilience has helped solidify the $57K level as a foundation for the ongoing bull rally, with the rise of Bitcoin Spot ETFs providing a regulated entry point for institutional investors, boosting confidence in the market.

This integration of traditional financial products with Bitcoin has opened the door to wider adoption.

In the last three trading days alone, Bitcoin ETFs have seen inflows exceeding $1 billion, indicating that institutional investors are accumulating BTC at an unprecedented rate.

Source: Bitcoin Magazine PRO

In addition to the growing influence of Spot ETFs, Open Interest (OI) in Bitcoin Futures is reaching new heights, particularly on Binance, where OI has surged to $40 billion.

This reflected continued bullish sentiment among traders, who remained eager to buy despite the price increase. This surge in demand could reduce the available supply, fueling BTC prices to go higher.

Futures OI on other exchanges, such as Bybit and OKX, has also reached peak levels, further supporting the idea that Bitcoin is likely to hold above the $57K level during this bull run.

Source: IntoTheCryptoverse

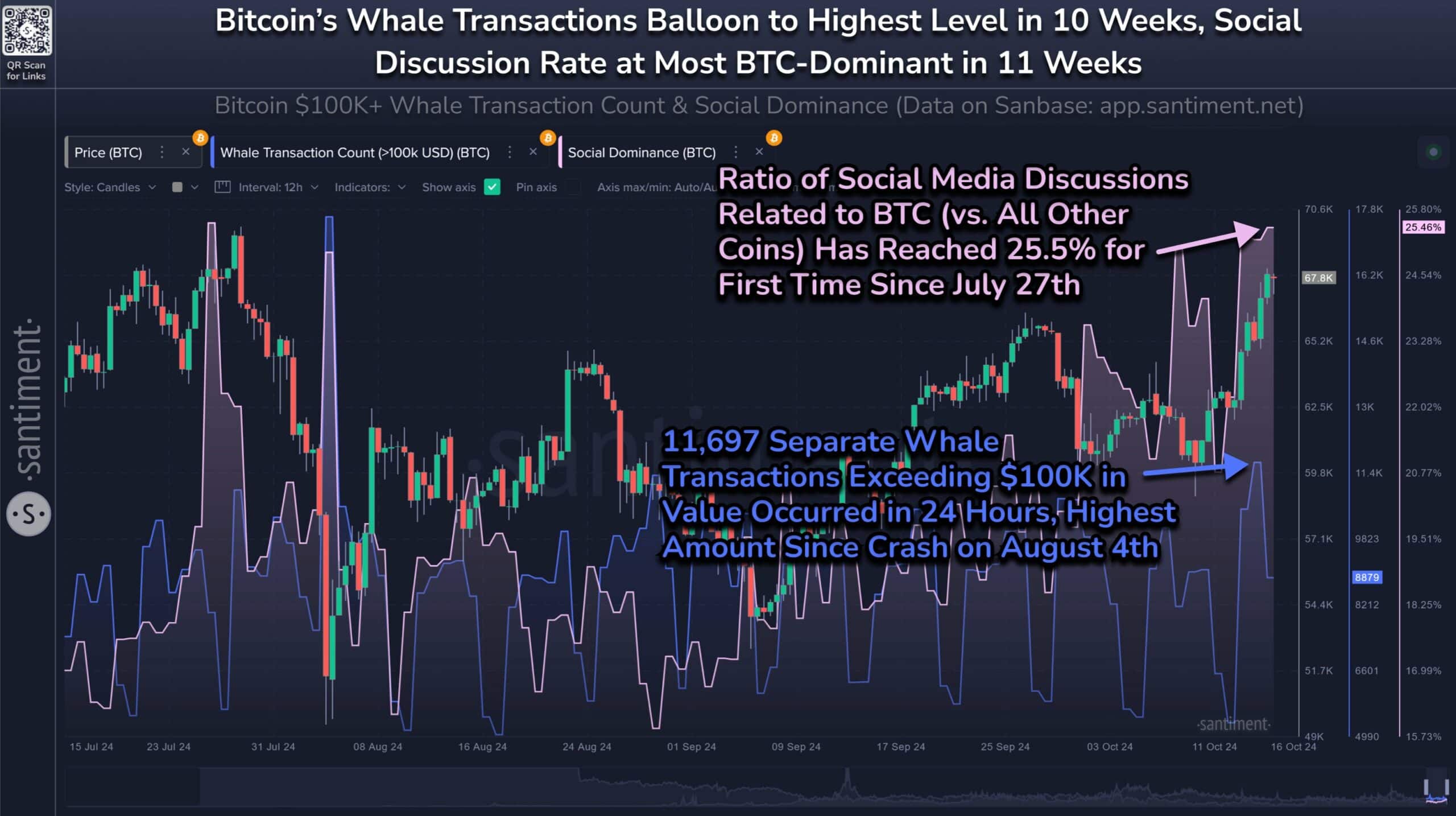

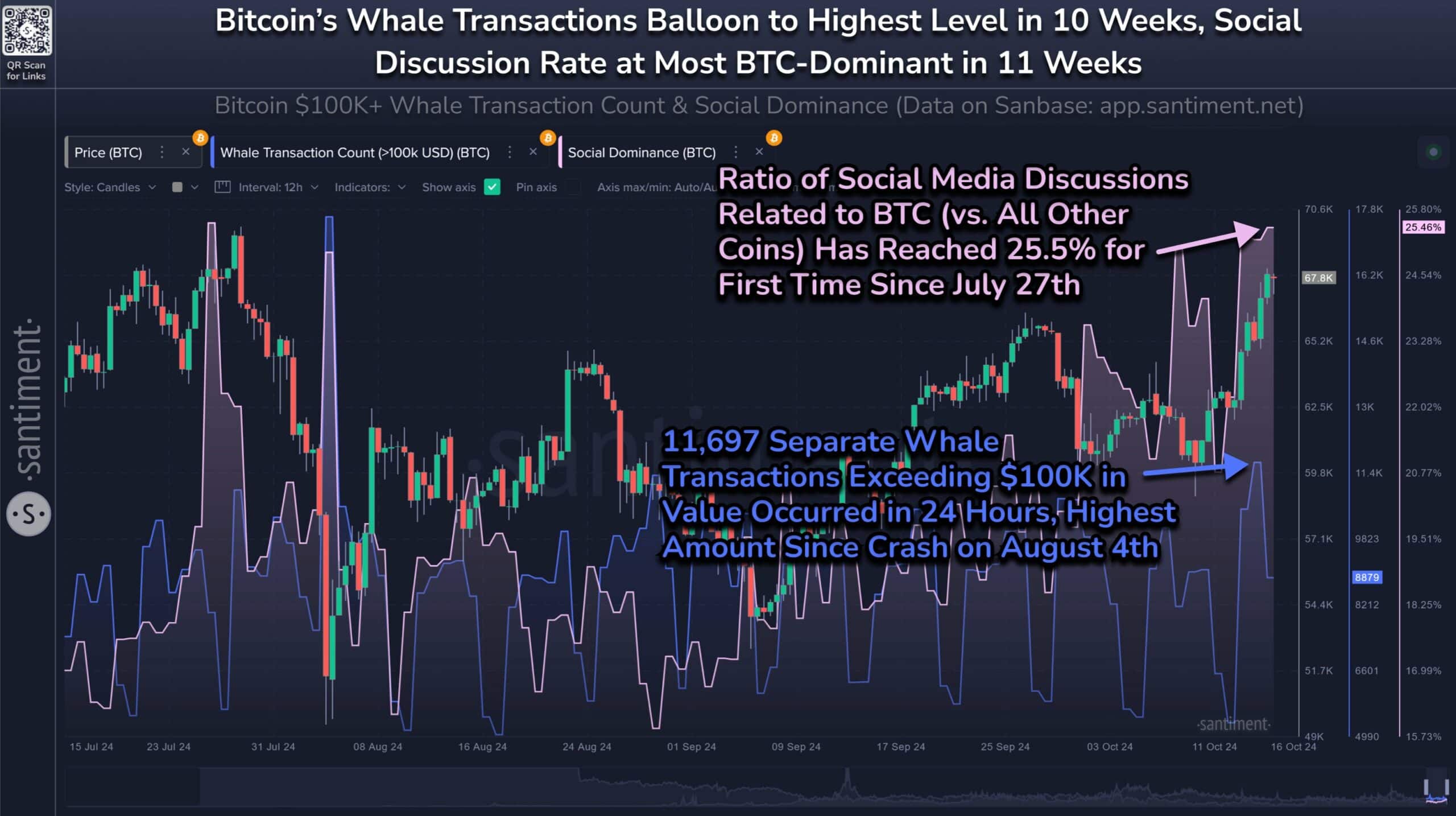

Whale transactions

Another key factor supporting the $57K support level is the recent spike in whale transactions. Over the past 10 weeks, whale transfers of $100K or more have surged, with 11,697 such transactions recorded.

This heightened activity suggests that large investors are actively accumulating Bitcoin, adding more confidence to the market’s upward trajectory.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Moreover, Bitcoin has dominated social media discussions, accounting for over a quarter of all crypto-related conversations.

Source: Santiment

While the price may see short-term corrections, mid- and long-term metrics remain bullish, reinforcing the likelihood that BTC will maintain its position above the $57K support level in the current rally.

- Bitcoin trading at $67K, above the Spot ETFs average price.

- BTC’s Open Interest was at its highest since 2020.

Bitcoin [BTC] has once again surged above $67K, drawing the attention of traders and institutions to key support levels that could play a crucial role in the ongoing bull rally.

One such level is the average cost of Bitcoin Spot ETFs, excluding Grayscale’s (GBTC). Throughout 2024, this price level has emerged as a significant support, providing stability during volatile periods.

Despite minor dips, Bitcoin has consistently rebounded, underscoring the resilience of Spot ETF investors who have maintained their positions even during market corrections.

The $57K level, representing the average cost of Bitcoin Spot ETFs, has proven to be a crucial support throughout the year.

Source: CryptoQuant

It has only been tested twice—during the sell-off on the 5th of August and the sharp correction on the 6th of September. However, instead of panic selling, Spot ETF investors held their ground, with only minor outflows.

This demonstrated a strong belief in Bitcoin’s long-term potential, as investors showed no signs of capitulating despite temporary unrealized losses.

BTC Spot ETFs inflows and OI

This resilience has helped solidify the $57K level as a foundation for the ongoing bull rally, with the rise of Bitcoin Spot ETFs providing a regulated entry point for institutional investors, boosting confidence in the market.

This integration of traditional financial products with Bitcoin has opened the door to wider adoption.

In the last three trading days alone, Bitcoin ETFs have seen inflows exceeding $1 billion, indicating that institutional investors are accumulating BTC at an unprecedented rate.

Source: Bitcoin Magazine PRO

In addition to the growing influence of Spot ETFs, Open Interest (OI) in Bitcoin Futures is reaching new heights, particularly on Binance, where OI has surged to $40 billion.

This reflected continued bullish sentiment among traders, who remained eager to buy despite the price increase. This surge in demand could reduce the available supply, fueling BTC prices to go higher.

Futures OI on other exchanges, such as Bybit and OKX, has also reached peak levels, further supporting the idea that Bitcoin is likely to hold above the $57K level during this bull run.

Source: IntoTheCryptoverse

Whale transactions

Another key factor supporting the $57K support level is the recent spike in whale transactions. Over the past 10 weeks, whale transfers of $100K or more have surged, with 11,697 such transactions recorded.

This heightened activity suggests that large investors are actively accumulating Bitcoin, adding more confidence to the market’s upward trajectory.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Moreover, Bitcoin has dominated social media discussions, accounting for over a quarter of all crypto-related conversations.

Source: Santiment

While the price may see short-term corrections, mid- and long-term metrics remain bullish, reinforcing the likelihood that BTC will maintain its position above the $57K support level in the current rally.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

cheap clomiphene without rx where buy clomiphene without dr prescription can i order clomid prices clomid sale how much is clomiphene without insurance can i order clomid without a prescription where buy clomiphene without prescription

This is the big-hearted of scribble literary works I positively appreciate.

The thoroughness in this draft is noteworthy.

buy zithromax generic – buy azithromycin 250mg generic order flagyl

buy rybelsus 14 mg sale – buy rybelsus pills periactin 4 mg uk

buy cheap generic motilium – buy cyclobenzaprine 15mg sale cost cyclobenzaprine

where to buy propranolol without a prescription – buy methotrexate 2.5mg for sale methotrexate pill

purchase amoxil without prescription – buy amoxil paypal order ipratropium 100 mcg online cheap

augmentin pills – https://atbioinfo.com/ buy acillin cheap

purchase esomeprazole sale – anexa mate nexium over the counter

buy warfarin 2mg sale – anticoagulant buy hyzaar sale

cost mobic 15mg – https://moboxsin.com/ purchase mobic online cheap