- BTC.D has declined by 2.24%, as an investor predicted a new altcoin season.

- 75% of altcoins have outperformed Bitcoin over the past 90 days.

Over the past month, Bitcoin’s [BTC] dominance [BTC.D] has experienced sustained rejection at $58 resistance level.

The constant failure to break out of this stubborn resistance level has brought increased enthusiasm among altcoin holders.

Bitcoin dominance was at 56.71 at press time after seeing a 0.03% decrease over the past day. This is a sharp decline from 58% witnessed a week ago.

As such, its market cap stood at $1.24 trillion, while the total crypto market was at $2.18 trillion.

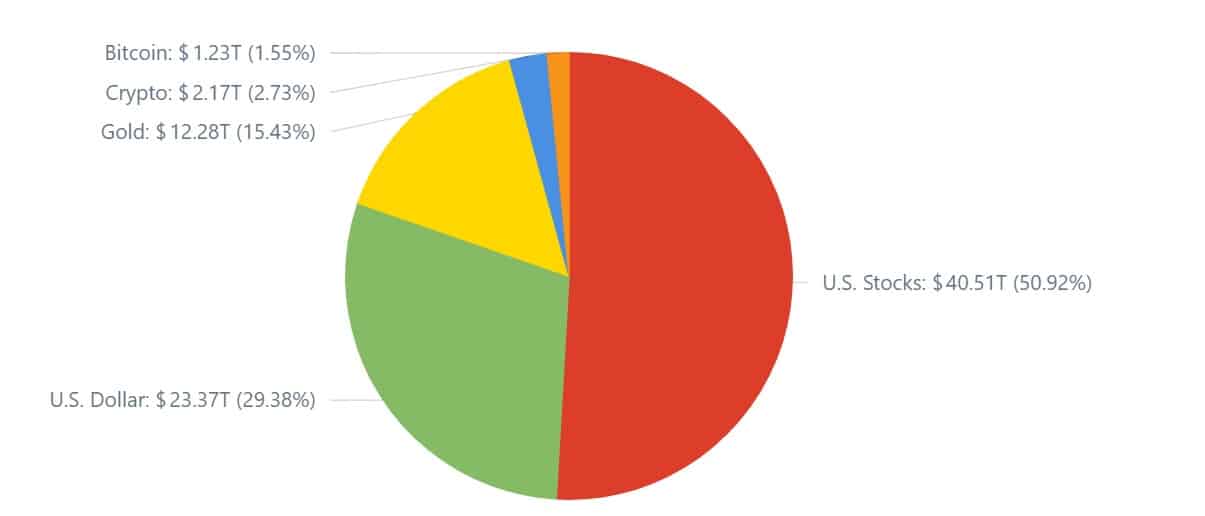

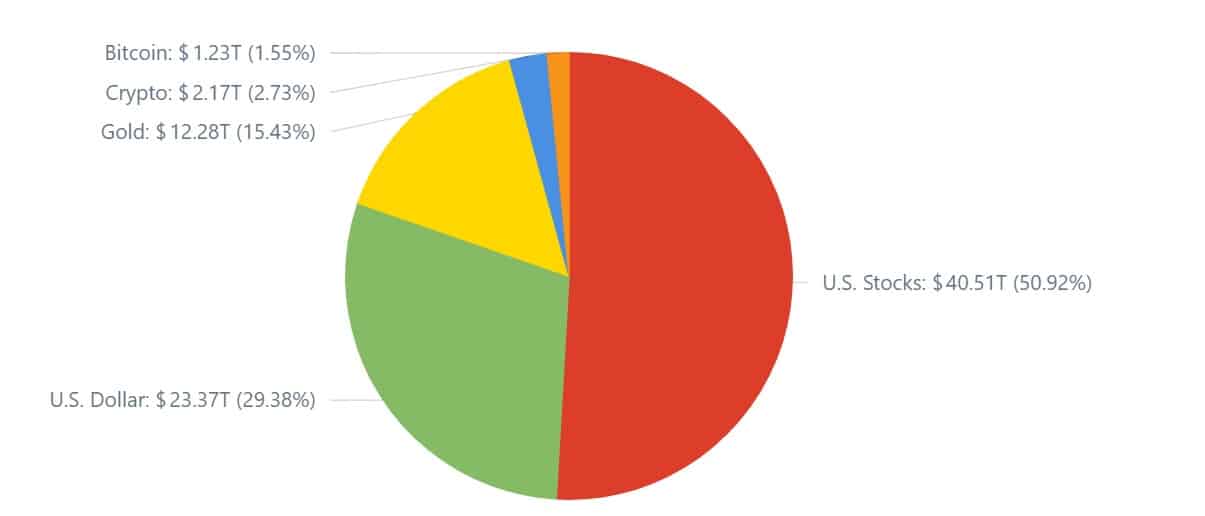

Source: CoinCodex

Therefore, this decline leaves BTC taking 1.55% of the global assets, which is way below 2.75% of the total crypto assets.

Historically, the BTC.D decline is good news for altcoins, as they tend to surge. Thus, the current trend has left analysts deliberating over BTC and altcoin’s future trajectory.

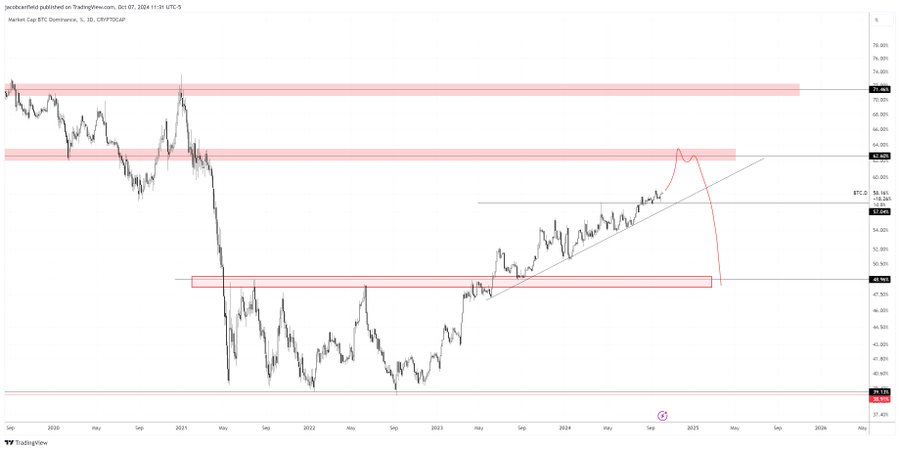

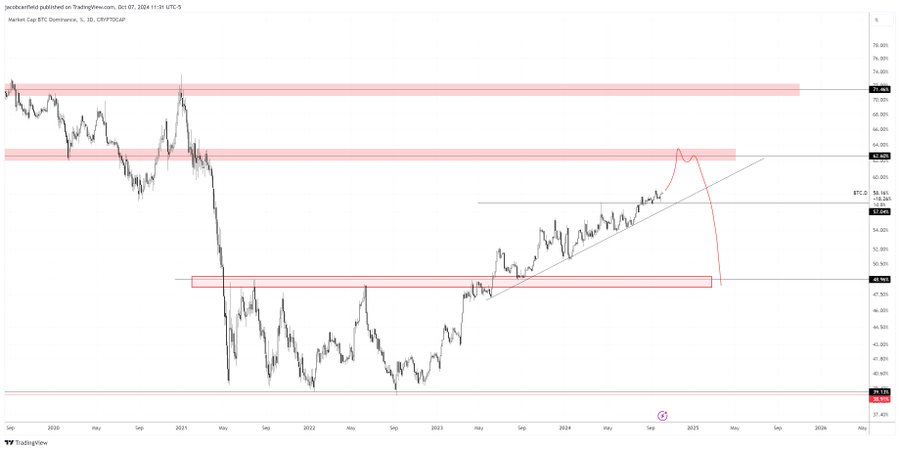

Inasmuch, Johncy Crypto has suggested a potential altcoin season, citing the formation of a rising wedge pattern.

What BTC.D’s decline means for altcoins

In his analysis, Johncy posited that Bitcoin dominance was forming a rising wedge pattern on weekly charts, which is a bearish signal.

Source: X

Therefore, a breakdown from this channel will confirm a bearish outlook for the crypto.

As such, if BTC remains trading sideways as it has down over the past week, or bullish while dominance declines, this may signal altcoin’s season.

What this means is that if Bitcoin dominance continues to decline, altcoins will gain more market share, thus positioning altcoins to outperform BTC.

However, one of the best ways to determine altcoin’s performance against BTC is using ETH/BTC ratio.

Source: Coinmarketcap

As such, ETH/BTC shows a 2.40% decrease over the past 24 hours. However, overall, ETH has outperformed BTC. In fact, it has surged by 6.28% against BTC over the past 30 days.

This suggests improved performance by altcoins against BTC on monthly charts, as dominance has dropped from 58% to 56. 71.

Source: CoinMarketCap

Equally, memecoins have made a strong bounce, rising in market cap from $43.7 billion to $50.9 billion on weekly charts.

Source: Blockchain Center

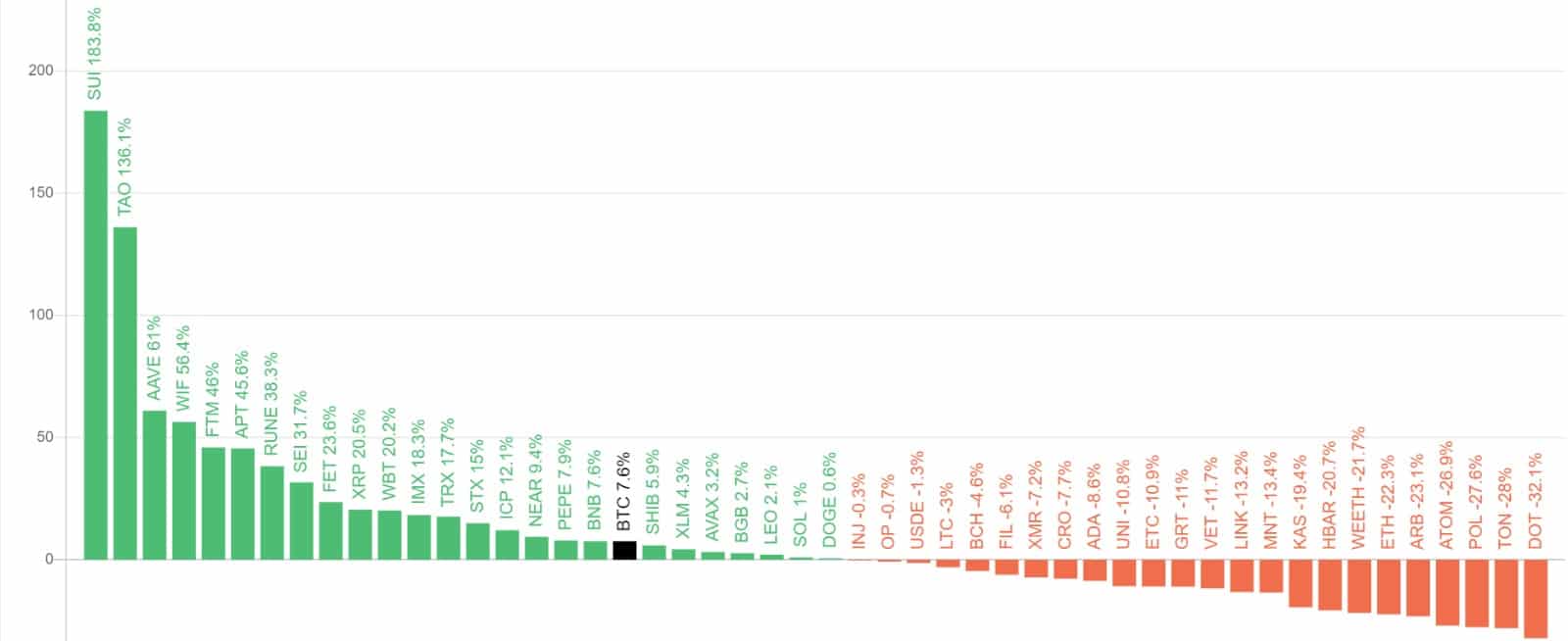

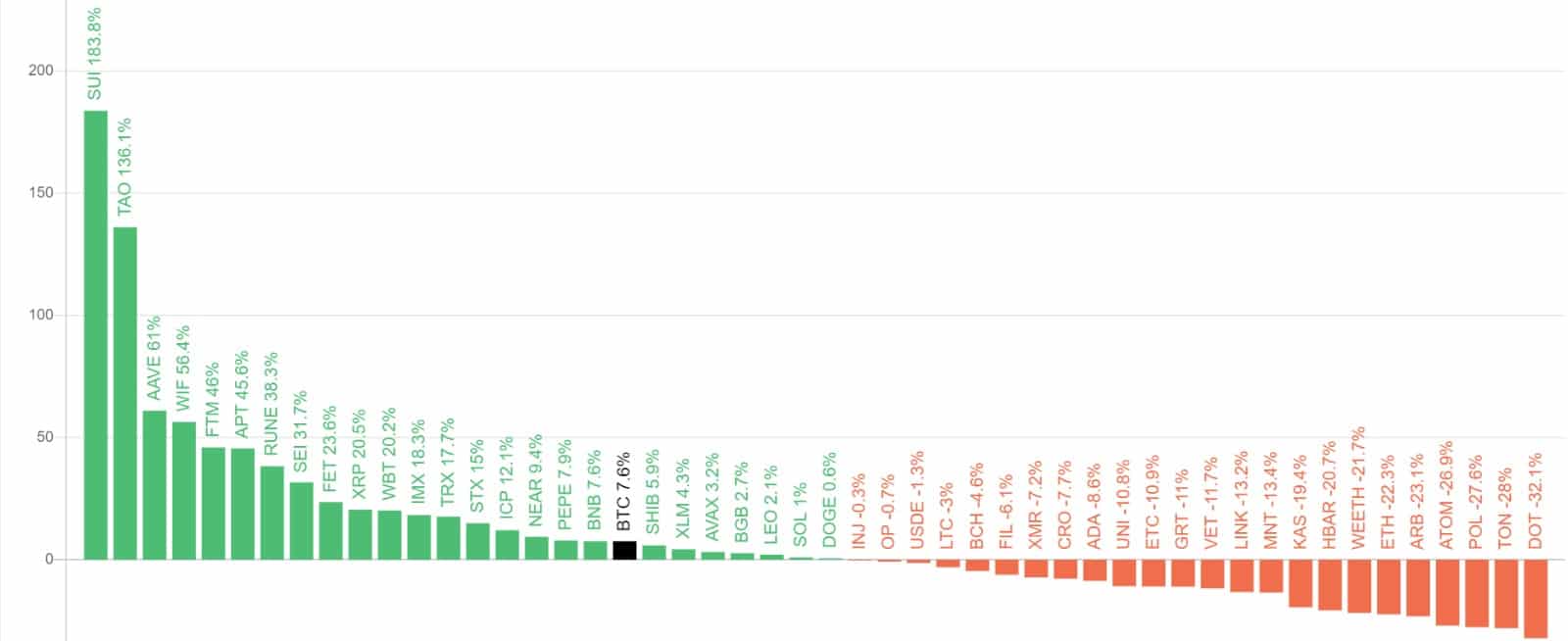

Additionally, various altcoins have outperformed Bitcoin over the past three months. Notably, Sui [SUI] is leading by 183.5%, Bittensor [TAO] by 136.1%, Aave [AAVE] by 61%, and dogwifhat [WIF] by 56.4%.

Therefore, 75% of the Top 50 coins performed better than Bitcoin over the last 90 days.

Source: Blockchain Center

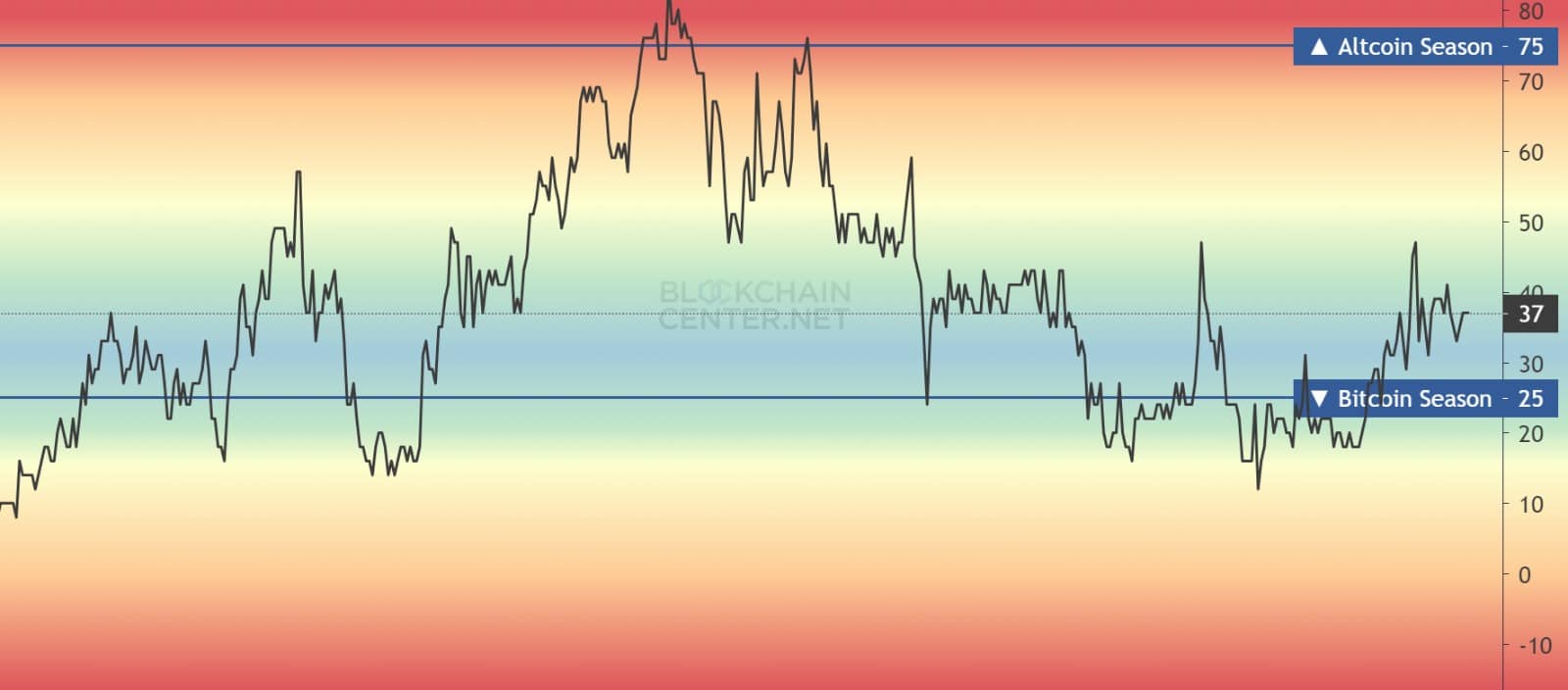

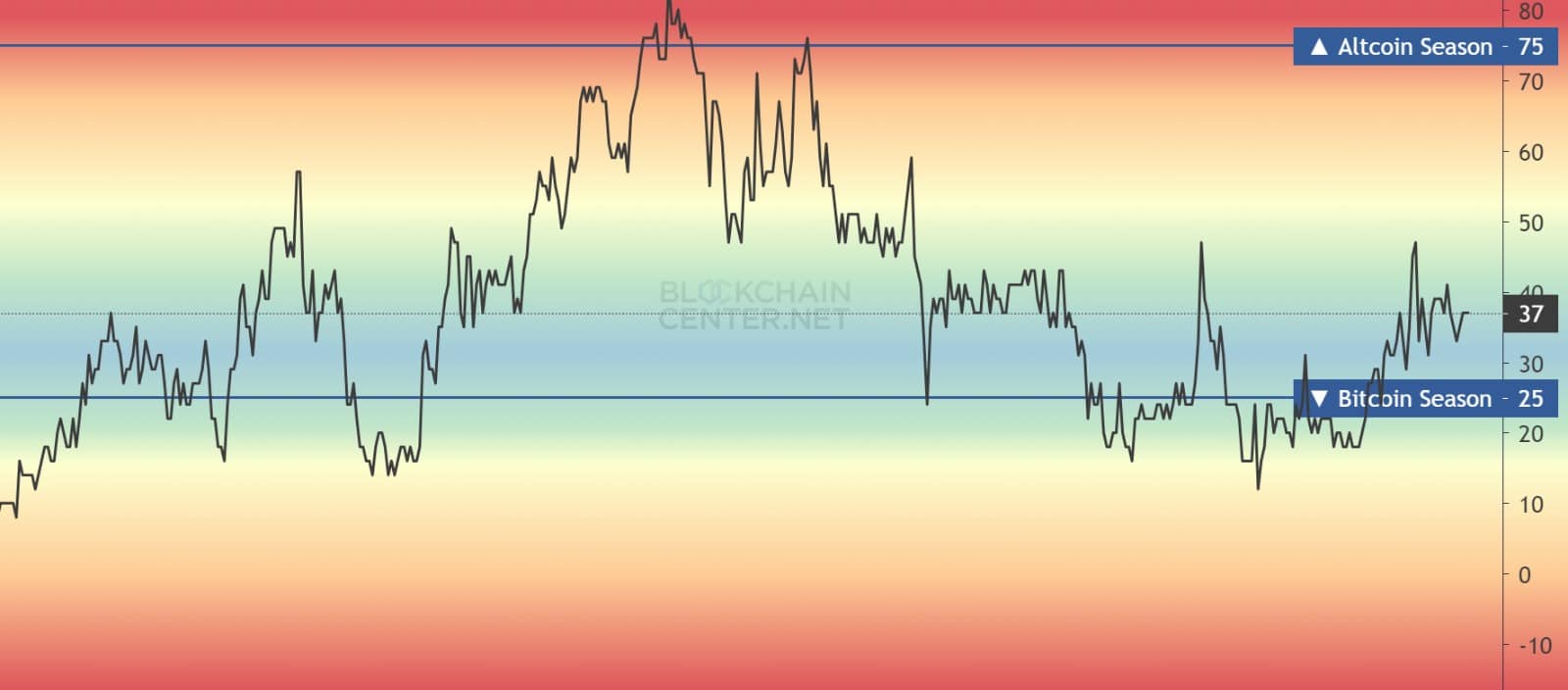

Finally, at press time, the Altcoin season index was at 37, a rise from 33 over the past week and a decline from a high of 47 reached 15 days ago while the BTC season index was at 25.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Such a scenario indicates increased demand for altcoins among investors compared to Bitcoin.

Simply put, the altcoin season is slowly gaining momentum and the potential for an upside continues to rise.

- BTC.D has declined by 2.24%, as an investor predicted a new altcoin season.

- 75% of altcoins have outperformed Bitcoin over the past 90 days.

Over the past month, Bitcoin’s [BTC] dominance [BTC.D] has experienced sustained rejection at $58 resistance level.

The constant failure to break out of this stubborn resistance level has brought increased enthusiasm among altcoin holders.

Bitcoin dominance was at 56.71 at press time after seeing a 0.03% decrease over the past day. This is a sharp decline from 58% witnessed a week ago.

As such, its market cap stood at $1.24 trillion, while the total crypto market was at $2.18 trillion.

Source: CoinCodex

Therefore, this decline leaves BTC taking 1.55% of the global assets, which is way below 2.75% of the total crypto assets.

Historically, the BTC.D decline is good news for altcoins, as they tend to surge. Thus, the current trend has left analysts deliberating over BTC and altcoin’s future trajectory.

Inasmuch, Johncy Crypto has suggested a potential altcoin season, citing the formation of a rising wedge pattern.

What BTC.D’s decline means for altcoins

In his analysis, Johncy posited that Bitcoin dominance was forming a rising wedge pattern on weekly charts, which is a bearish signal.

Source: X

Therefore, a breakdown from this channel will confirm a bearish outlook for the crypto.

As such, if BTC remains trading sideways as it has down over the past week, or bullish while dominance declines, this may signal altcoin’s season.

What this means is that if Bitcoin dominance continues to decline, altcoins will gain more market share, thus positioning altcoins to outperform BTC.

However, one of the best ways to determine altcoin’s performance against BTC is using ETH/BTC ratio.

Source: Coinmarketcap

As such, ETH/BTC shows a 2.40% decrease over the past 24 hours. However, overall, ETH has outperformed BTC. In fact, it has surged by 6.28% against BTC over the past 30 days.

This suggests improved performance by altcoins against BTC on monthly charts, as dominance has dropped from 58% to 56. 71.

Source: CoinMarketCap

Equally, memecoins have made a strong bounce, rising in market cap from $43.7 billion to $50.9 billion on weekly charts.

Source: Blockchain Center

Additionally, various altcoins have outperformed Bitcoin over the past three months. Notably, Sui [SUI] is leading by 183.5%, Bittensor [TAO] by 136.1%, Aave [AAVE] by 61%, and dogwifhat [WIF] by 56.4%.

Therefore, 75% of the Top 50 coins performed better than Bitcoin over the last 90 days.

Source: Blockchain Center

Finally, at press time, the Altcoin season index was at 37, a rise from 33 over the past week and a decline from a high of 47 reached 15 days ago while the BTC season index was at 25.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Such a scenario indicates increased demand for altcoins among investors compared to Bitcoin.

Simply put, the altcoin season is slowly gaining momentum and the potential for an upside continues to rise.

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

You made some decent points there. I did a search on the subject matter and found most guys will agree with your website.

I went over this web site and I believe you have a lot of great information, saved to bookmarks (:.

Yay google is my world beater helped me to find this outstanding site! .

buy clomiphene price order generic clomiphene without insurance can i get cheap clomid buy clomiphene without dr prescription can you get generic clomiphene online can i buy generic clomiphene pill can i purchase cheap clomid online

The thoroughness in this piece is noteworthy.

This is the compassionate of scribble literary works I in fact appreciate.

buy generic azithromycin – ciprofloxacin 500 mg ca metronidazole usa

rybelsus 14mg tablet – order cyproheptadine for sale order cyproheptadine online

order motilium 10mg for sale – generic domperidone flexeril 15mg pills

order amoxil online – combivent 100 mcg uk ipratropium 100 mcg usa

how to buy clavulanate – https://atbioinfo.com/ buy generic acillin online

buy esomeprazole generic – anexamate.com nexium 20mg drug

coumadin 5mg uk – anticoagulant purchase losartan online

buy mobic 15mg sale – relieve pain mobic cheap

The subsequent time I read a weblog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my option to learn, but I truly thought youd have something fascinating to say. All I hear is a bunch of whining about one thing that you would repair if you werent too busy on the lookout for attention.

prednisone 40mg sale – corticosteroid prednisone 10mg price

where can i buy ed pills – buy generic ed pills online buy cheap generic ed pills

buy amoxicillin without prescription – https://combamoxi.com/ cost amoxicillin

buy fluconazole 200mg pill – https://gpdifluca.com/# purchase forcan generic

order escitalopram without prescription – escitapro.com order escitalopram 20mg pills

buy cheap cenforce – cenforce rs buy cenforce 100mg generic

cheap cialis – click cialis professional ingredients

cialis patent expiration date – https://strongtadafl.com/ order cialis online no prescription reviews

zantac 300mg cheap – https://aranitidine.com/# purchase zantac for sale

cheapest generic viagra and cialis – strong vpls 50mg of viagra

This is a theme which is in to my verve… Myriad thanks! Unerringly where can I upon the contact details due to the fact that questions? lasix diurГ©tico

I am in truth thrilled to glitter at this blog posts which consists of tons of useful facts, thanks towards providing such data. order generic gabapentin

This is the type of post I recoup helpful. https://ursxdol.com/provigil-gn-pill-cnt/

This is the kind of glad I get high on reading. https://prohnrg.com/product/orlistat-pills-di/

I have recently started a blog, the info you offer on this web site has helped me tremendously. Thank you for all of your time & work.

Thanks recompense sharing. It’s acme quality. https://aranitidine.com/fr/acheter-cialis-5mg/

This website absolutely has all of the tidings and facts I needed adjacent to this subject and didn’t identify who to ask. https://ondactone.com/simvastatin/

I know this if off topic but I’m looking into starting my own weblog and was curious what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web smart so I’m not 100 certain. Any recommendations or advice would be greatly appreciated. Thanks

I am in fact delighted to glitter at this blog posts which consists of tons of useful facts, thanks representing providing such data.

order meloxicam for sale

This is the kind of enter I recoup helpful. http://mi.minfish.com/home.php?mod=space&uid=1411819

Woh I love your articles, saved to favorites! .

I simply could not depart your site before suggesting that I really enjoyed the usual info a person provide to your guests? Is going to be again incessantly in order to investigate cross-check new posts.

Nearly all of what you articulate happens to be astonishingly appropriate and that makes me ponder why I had not looked at this with this light previously. Your piece truly did turn the light on for me personally as far as this subject goes. However there is actually one position I am not necessarily too comfy with so while I try to reconcile that with the core theme of the point, let me observe what all the rest of your subscribers have to say.Well done.

forxiga 10 mg tablet – dapagliflozin ca purchase dapagliflozin online cheap

Hello! I know this is kind of off topic but I was wondering which blog platform are you using for this website? I’m getting sick and tired of WordPress because I’ve had issues with hackers and I’m looking at alternatives for another platform. I would be awesome if you could point me in the direction of a good platform.

xenical cheap – https://asacostat.com/# order xenical without prescription

This website exceedingly has all of the bumf and facts I needed about this participant and didn’t identify who to ask. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24879