- Bitcoin holders shift guard in favor of short-term profit-taking, contrary to recent market expectations

- Such a transition could have a major impact on BTC’s price

Bitcoin’s market sentiment has changed significantly over the last few weeks. In fact, there were expectations that BTC will maintain its bullish momentum from September in October too. However, those expectations were far from the reality of things.

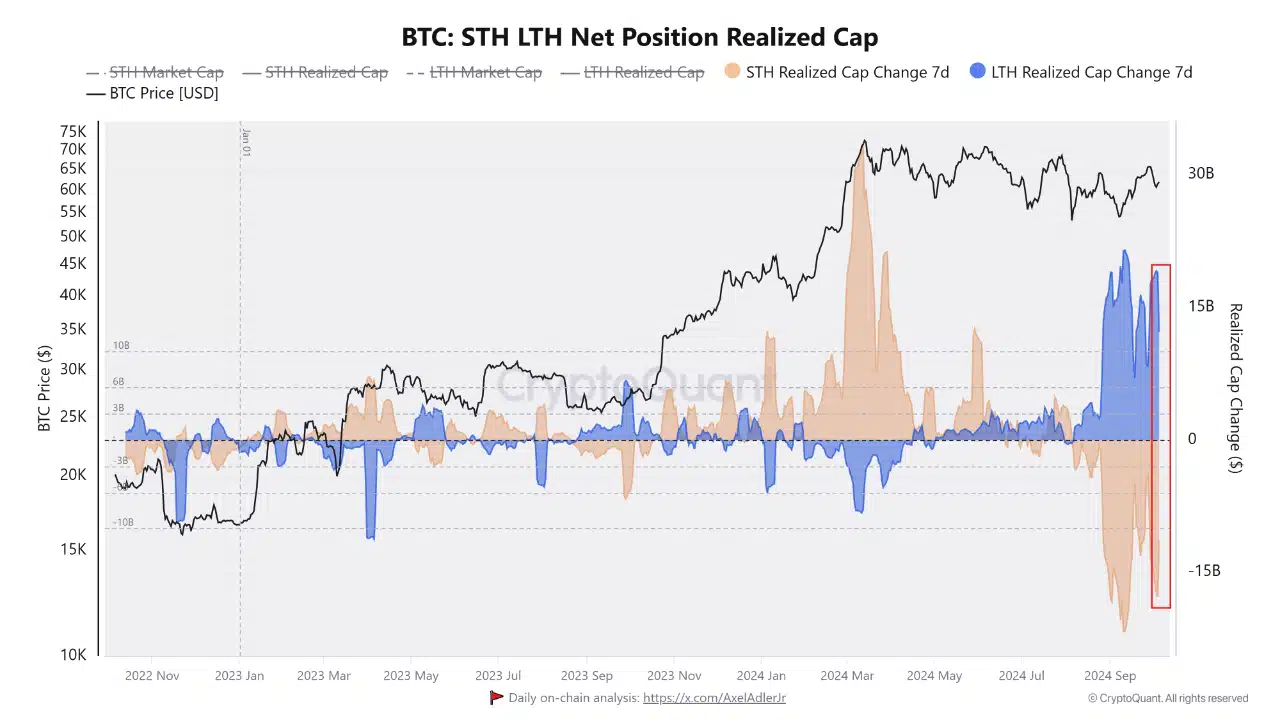

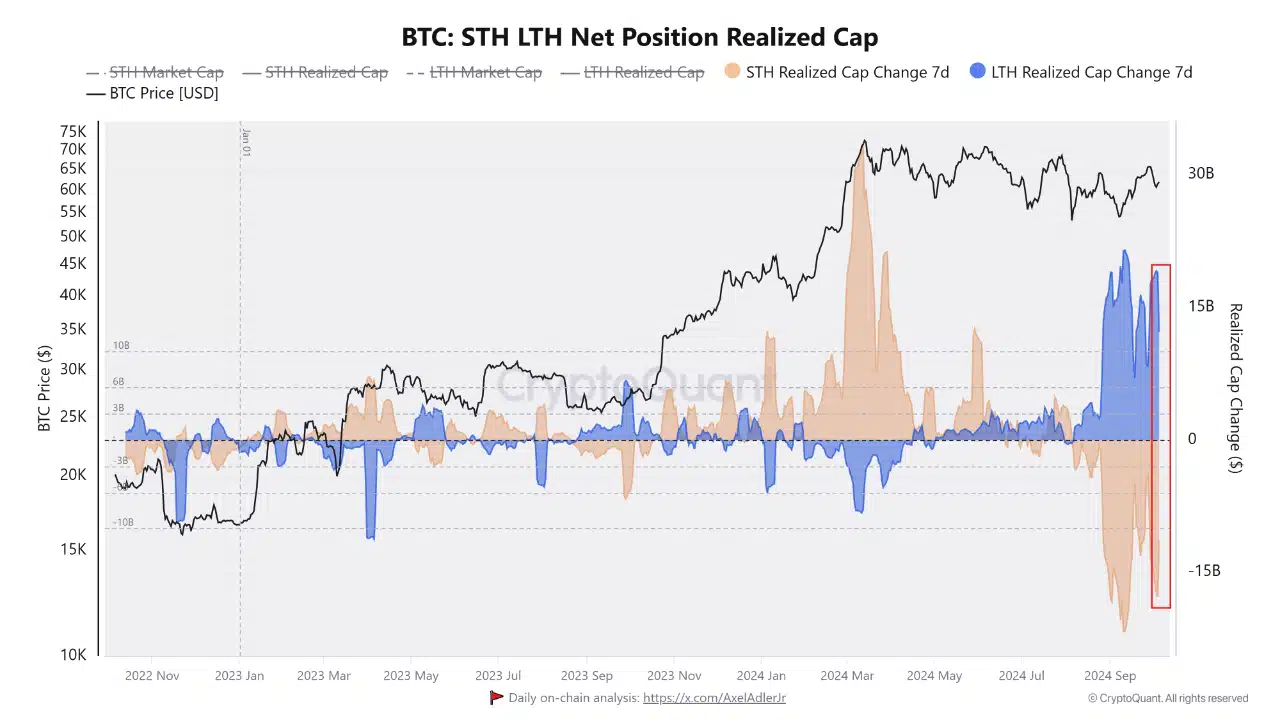

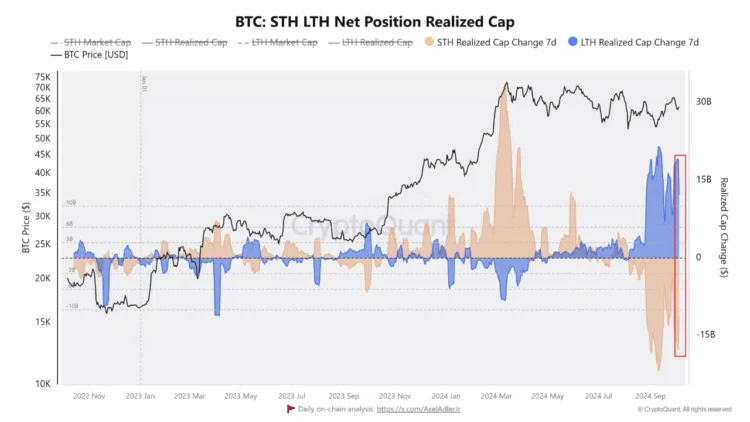

According to data, there is a growing trend that may limit the cryptocurrency’s ability to soar to new highs, at least in the short-term. A recent CryptoQuant analysis underlined the same, highlighting the changes in long term holder (LTH) and short term holder (STH) dynamics.

According to the analysis, LTH’s realized cap recently dropped by $6 billion. This suggested that LTHs have been taking profit. By extension, it also implied that they do not expect price to extend into new highs, at least in the short term.

Source: CryptoQuant

The same analysis highlighted a surge in short term holder realized cap by roughly the same amount ($6 billion). According to the analysis, this shift by STHs could mean that they are accumulating, but with a focus on short-term profits.

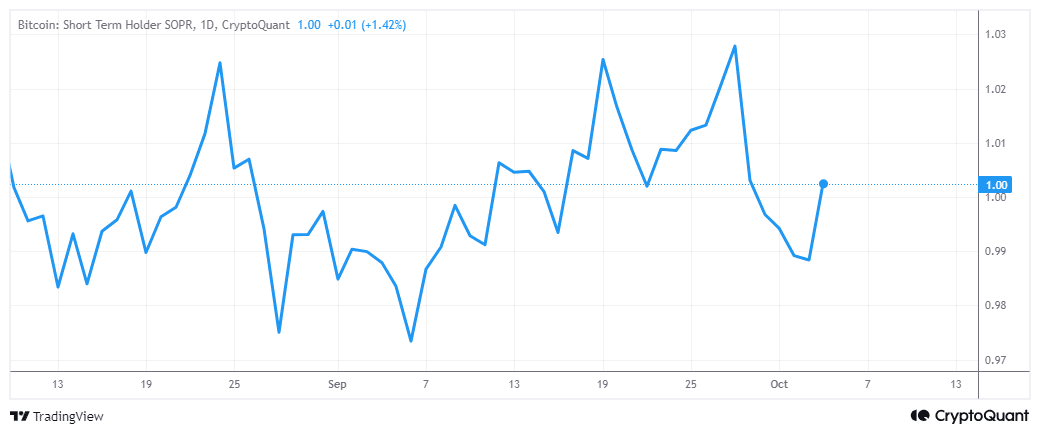

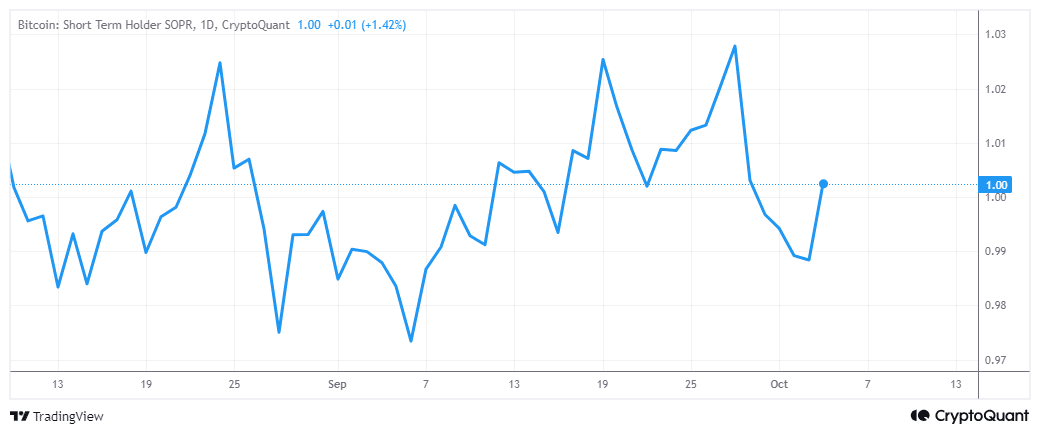

The analysis aligned with Bitcoin’s latest price action, which has been characterized by short term swings. In other words, it could be a while before Bitcoin experiences a major breakout. This is also in line with the recent observations in BTC’s short-term holder SOPR.

Source: CryptoQuant

The short-term holder SOPR’s upticks confirmed the shift in favor of short term profit-taking. This is historically aligned with every top in shorter-term periods.

How long will this Bitcoin short term focus last?

The shift in favor of short term profit-taking is largely dependent on the prevailing market sentiment. This has lately been driven by market events. Right now, the most significant upcoming event that could have a major impact on Bitcoin is the U.S election cycle.

Uncertainties tend to support a short-term focus, which may explain why investors have shifted to their current short term profit-taking approach. The U.S election’s outcome may also trigger a major response, one that could be enough to push BTC from its current range. Note that this could either be bullish or bearish, depending on the outcome.

As far as short term expectations are concerned, Bitcoin traders should keep an eye out for liquidations. A short term profit-taking approach encourages more leverage, which may in turn lead to more exposure to liquidation events.

- Bitcoin holders shift guard in favor of short-term profit-taking, contrary to recent market expectations

- Such a transition could have a major impact on BTC’s price

Bitcoin’s market sentiment has changed significantly over the last few weeks. In fact, there were expectations that BTC will maintain its bullish momentum from September in October too. However, those expectations were far from the reality of things.

According to data, there is a growing trend that may limit the cryptocurrency’s ability to soar to new highs, at least in the short-term. A recent CryptoQuant analysis underlined the same, highlighting the changes in long term holder (LTH) and short term holder (STH) dynamics.

According to the analysis, LTH’s realized cap recently dropped by $6 billion. This suggested that LTHs have been taking profit. By extension, it also implied that they do not expect price to extend into new highs, at least in the short term.

Source: CryptoQuant

The same analysis highlighted a surge in short term holder realized cap by roughly the same amount ($6 billion). According to the analysis, this shift by STHs could mean that they are accumulating, but with a focus on short-term profits.

The analysis aligned with Bitcoin’s latest price action, which has been characterized by short term swings. In other words, it could be a while before Bitcoin experiences a major breakout. This is also in line with the recent observations in BTC’s short-term holder SOPR.

Source: CryptoQuant

The short-term holder SOPR’s upticks confirmed the shift in favor of short term profit-taking. This is historically aligned with every top in shorter-term periods.

How long will this Bitcoin short term focus last?

The shift in favor of short term profit-taking is largely dependent on the prevailing market sentiment. This has lately been driven by market events. Right now, the most significant upcoming event that could have a major impact on Bitcoin is the U.S election cycle.

Uncertainties tend to support a short-term focus, which may explain why investors have shifted to their current short term profit-taking approach. The U.S election’s outcome may also trigger a major response, one that could be enough to push BTC from its current range. Note that this could either be bullish or bearish, depending on the outcome.

As far as short term expectations are concerned, Bitcoin traders should keep an eye out for liquidations. A short term profit-taking approach encourages more leverage, which may in turn lead to more exposure to liquidation events.

Markalaşma Google SEO sayesinde müşteri memnuniyetimiz arttı. http://royalelektrik.com/esenyurt-elektrikci/

clomid tablets cost of clomiphene price how to get generic clomiphene can i buy cheap clomiphene without prescription can i purchase clomiphene without a prescription clomiphene or serophene for men where can i get cheap clomid tablets

This is the gentle of literature I in fact appreciate.

The thoroughness in this break down is noteworthy.

zithromax 500mg price – order tindamax 300mg online flagyl cost

order semaglutide 14 mg pill – buy periactin periactin 4mg cost

buy domperidone 10mg pill – order sumycin 500mg online cheap purchase flexeril generic

order inderal generic – buy methotrexate online cheap buy generic methotrexate 5mg

buy clavulanate sale – https://atbioinfo.com/ acillin tablet

buy esomeprazole capsules – https://anexamate.com/ buy nexium 20mg for sale

buy coumadin pills for sale – coumamide losartan 50mg oral

purchase mobic pills – https://moboxsin.com/ mobic drug

low cost ed pills – fast ed to take site pills for erection

buy generic amoxil online – comba moxi buy amoxicillin online

diflucan 100mg canada – this buy cheap diflucan

lexapro 10mg for sale – https://escitapro.com/# buy lexapro 10mg generic

buy generic cenforce for sale – https://cenforcers.com/# cenforce 100mg ca

cialis coupon walgreens – this cialis for sale in canada

tadalafil generico farmacias del ahorro – this cialis dosage side effects

buy ranitidine 300mg pill – this buy ranitidine 300mg online cheap

Greetings! Very serviceable advice within this article! It’s the petty changes which wish espy the largest changes. Thanks a lot towards sharing! online

More articles like this would pretence of the blogosphere richer. https://buyfastonl.com/isotretinoin.html

I couldn’t hold back commenting. Adequately written! https://ursxdol.com/levitra-vardenafil-online/

This is the kind of topic I take advantage of reading. https://prohnrg.com/product/orlistat-pills-di/

More posts like this would bring about the blogosphere more useful. diffГ©rence entre prednisone et prednisolone

More posts like this would make the online time more useful. https://ondactone.com/product/domperidone/

The thoroughness in this piece is noteworthy.

https://proisotrepl.com/product/methotrexate/

This is a question which is forthcoming to my fundamentals… Many thanks! Exactly where can I notice the contact details for questions? http://forum.ttpforum.de/member.php?action=profile&uid=425015

purchase forxiga generic – site buy generic dapagliflozin 10mg