Este artículo también está disponible en español.

Ethereum, the second-largest cryptocurrency by market capitalization, has yet to reclaim the $3,000 price level since early August. Since the beginning of September, Ethereum has mostly traded below $2,600, but this week brought a glimmer of hope for investors as it finally managed to break above the $2,600 threshold.

Now that this resistance threshold has been broken, the next outlook is a continued surge up until the $3,000 price level. An analysis on the CryptoQuant platform points to a potential catalyst for this move to the upside. Notably, this analysis identifies an emerging bullish trend in Ethereum’s funding rates as a critical catalyst.

Bullish Shift In Funding Rates

According to an ETH analysis on CryptoQuant by ShayanBTC, Ethereum’s 30-day moving average of funding rates has seen a slight but noticeable bullish shift after an extended period of decline. This change suggests that traders are once again becoming more confident in Ethereum’s price performance, particularly after the recent Fed interest rate cut.

ETH Funding rates refer to the periodic payments made between traders to maintain the price of perpetual futures contracts near the spot price of the cryptocurrency. When the funding rates shift positively, it often indicates that long positions are more dominant, which can create upward price pressure.

The importance of the funding rates was emphasized by the analyst, especially considering the prospect of a bullish fourth quarter of the year. Notably, they echoed that for Ethereum to continue its recovery and target higher price levels, the demand in the perpetual futures market must keep rising in the coming weeks. A small decline in the funding rates could cascade into a fall in bullish momentum.

Ethereum Staging A Return To $3,000?

Ethereum’s recent breakout above $2,600 is the first signal of a major shift in market sentiment. After weeks of trading below, the $2,600 price level seems to have now become an essential support zone for the cryptocurrency. Interestingly, this breakout sets the stage for the return of ETH to $3,000, with the funding rates playing an essential part.

At the time of writing, Ethereum is trading at $2,610 and is up by 8% in the past seven days. Notably, this price increase is more noticeable from a low of $2,171 on September 6, reflecting a 20% increase since then.

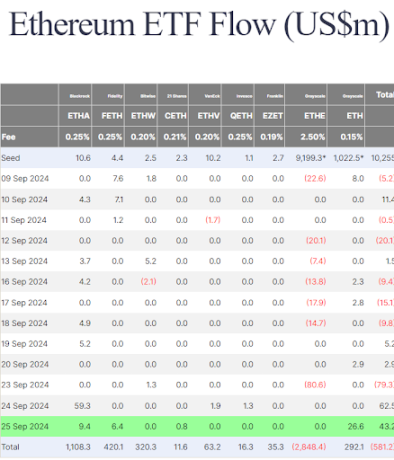

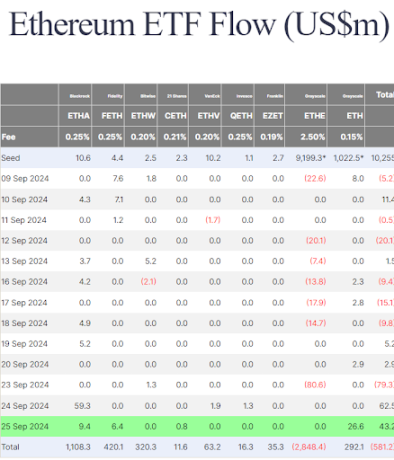

The positive sentiment surrounding Ethereum is also moving towards institutional investors, which is reflected through Spot Ethereum ETFs. According to flow data, the ETFs, which initially started the week with a net outflow of $79.3 million on Monday, have now witnessed two consecutive days of $62.5 million and $43.2 million, respectively, on Tuesday and Wednesday. The combination of these inflows could play a significant role in whether Ethereum can breach the $3,000 price level and sustain above in the coming weeks.

Featured image created with Dall.E, chart from Tradingview.com

Este artículo también está disponible en español.

Ethereum, the second-largest cryptocurrency by market capitalization, has yet to reclaim the $3,000 price level since early August. Since the beginning of September, Ethereum has mostly traded below $2,600, but this week brought a glimmer of hope for investors as it finally managed to break above the $2,600 threshold.

Now that this resistance threshold has been broken, the next outlook is a continued surge up until the $3,000 price level. An analysis on the CryptoQuant platform points to a potential catalyst for this move to the upside. Notably, this analysis identifies an emerging bullish trend in Ethereum’s funding rates as a critical catalyst.

Bullish Shift In Funding Rates

According to an ETH analysis on CryptoQuant by ShayanBTC, Ethereum’s 30-day moving average of funding rates has seen a slight but noticeable bullish shift after an extended period of decline. This change suggests that traders are once again becoming more confident in Ethereum’s price performance, particularly after the recent Fed interest rate cut.

ETH Funding rates refer to the periodic payments made between traders to maintain the price of perpetual futures contracts near the spot price of the cryptocurrency. When the funding rates shift positively, it often indicates that long positions are more dominant, which can create upward price pressure.

The importance of the funding rates was emphasized by the analyst, especially considering the prospect of a bullish fourth quarter of the year. Notably, they echoed that for Ethereum to continue its recovery and target higher price levels, the demand in the perpetual futures market must keep rising in the coming weeks. A small decline in the funding rates could cascade into a fall in bullish momentum.

Ethereum Staging A Return To $3,000?

Ethereum’s recent breakout above $2,600 is the first signal of a major shift in market sentiment. After weeks of trading below, the $2,600 price level seems to have now become an essential support zone for the cryptocurrency. Interestingly, this breakout sets the stage for the return of ETH to $3,000, with the funding rates playing an essential part.

At the time of writing, Ethereum is trading at $2,610 and is up by 8% in the past seven days. Notably, this price increase is more noticeable from a low of $2,171 on September 6, reflecting a 20% increase since then.

The positive sentiment surrounding Ethereum is also moving towards institutional investors, which is reflected through Spot Ethereum ETFs. According to flow data, the ETFs, which initially started the week with a net outflow of $79.3 million on Monday, have now witnessed two consecutive days of $62.5 million and $43.2 million, respectively, on Tuesday and Wednesday. The combination of these inflows could play a significant role in whether Ethereum can breach the $3,000 price level and sustain above in the coming weeks.

Featured image created with Dall.E, chart from Tradingview.com

where can i get generic clomiphene buy cheap clomiphene price clomid remedio buy cheap clomiphene without dr prescription can i get generic clomiphene online clomid tablets for sale cost cheap clomiphene prices

More articles like this would remedy the blogosphere richer.

This is the kind of criticism I in fact appreciate.

order zithromax generic – ciprofloxacin 500mg us metronidazole cheap

buy semaglutide for sale – buy cyproheptadine 4mg sale periactin generic

buy motilium sale – motilium cost cyclobenzaprine 15mg brand

buy augmentin 375mg online – at bio info acillin canada

nexium 20mg cheap – anexamate.com buy esomeprazole capsules

buy warfarin online – https://coumamide.com/ buy losartan 50mg generic

mobic cheap – mobo sin buy meloxicam 15mg

order deltasone 10mg without prescription – https://apreplson.com/ order prednisone 20mg pills

best ed pills at gnc – fastedtotake buy ed pills cheap

where to buy amoxil without a prescription – amoxicillin generic amoxicillin online buy

fluconazole us – click buy generic fluconazole over the counter

generic cenforce 100mg – on this site order generic cenforce

cialis canada over the counter – generic cialis online pharmacy e-cialis hellocig e-liquid

what is cialis pill – best price on generic tadalafil cialis where can i buy

order zantac online cheap – https://aranitidine.com/# ranitidine buy online

This is a topic which is near to my verve… Myriad thanks! Unerringly where can I notice the acquaintance details an eye to questions? que es mejor lyrica o neurontin

With thanks. Loads of expertise! https://buyfastonl.com/amoxicillin.html

The thoroughness in this break down is noteworthy. https://ursxdol.com/azithromycin-pill-online/

More articles like this would make the blogosphere richer. https://prohnrg.com/product/diltiazem-online/

I am in fact enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks for providing such data. https://aranitidine.com/fr/levitra_francaise/

More posts like this would add up to the online time more useful. https://ondactone.com/spironolactone/

More posts like this would prosper the blogosphere more useful.

buy mobic generic

The thoroughness in this break down is noteworthy. http://zqykj.com/bbs/home.php?mod=space&uid=302444

buy dapagliflozin online – pill dapagliflozin 10 mg pill dapagliflozin