- Ethereum’s bullish divergence has been invalidated

- Institutions are now selling ETH, with trading volume decreasing too

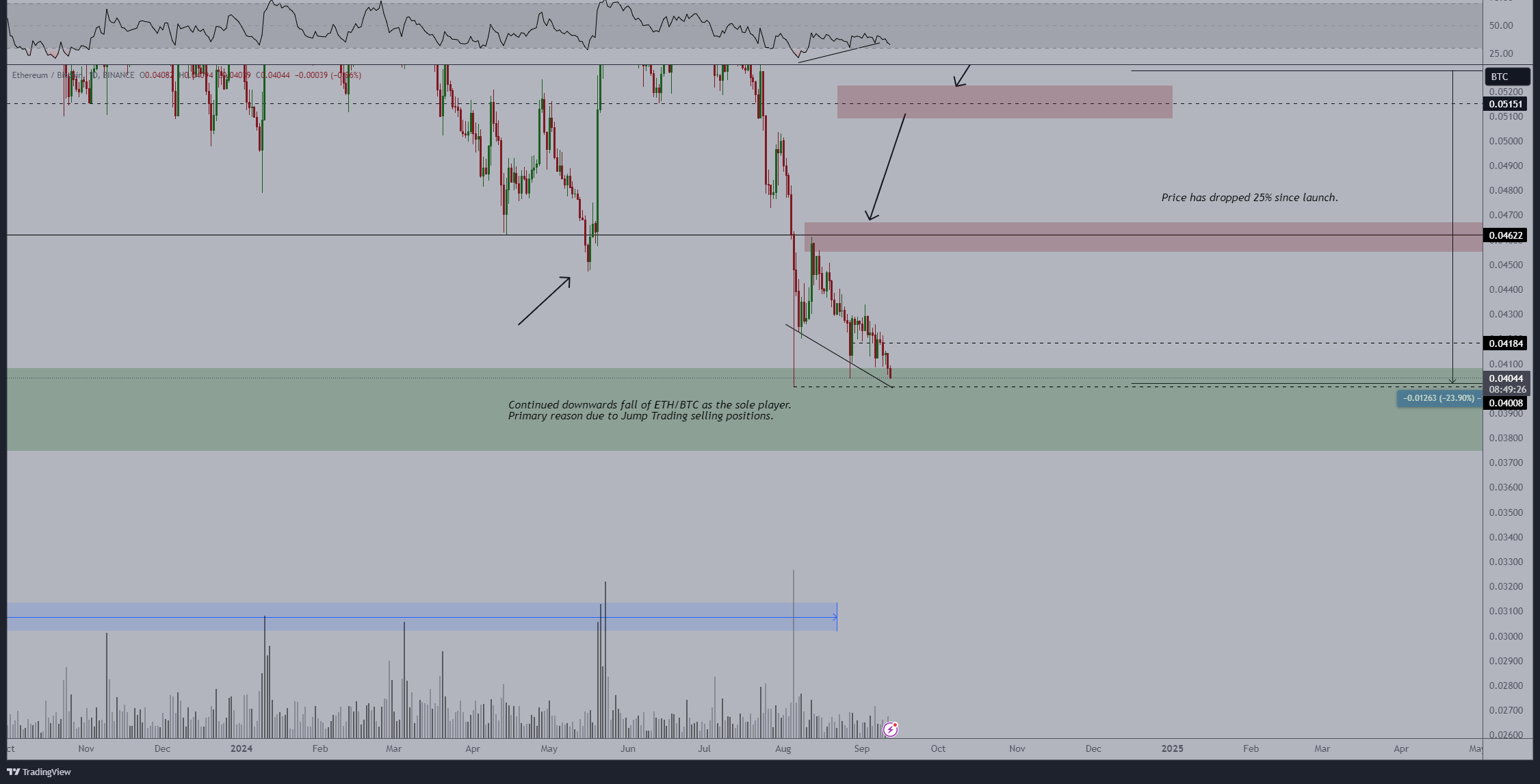

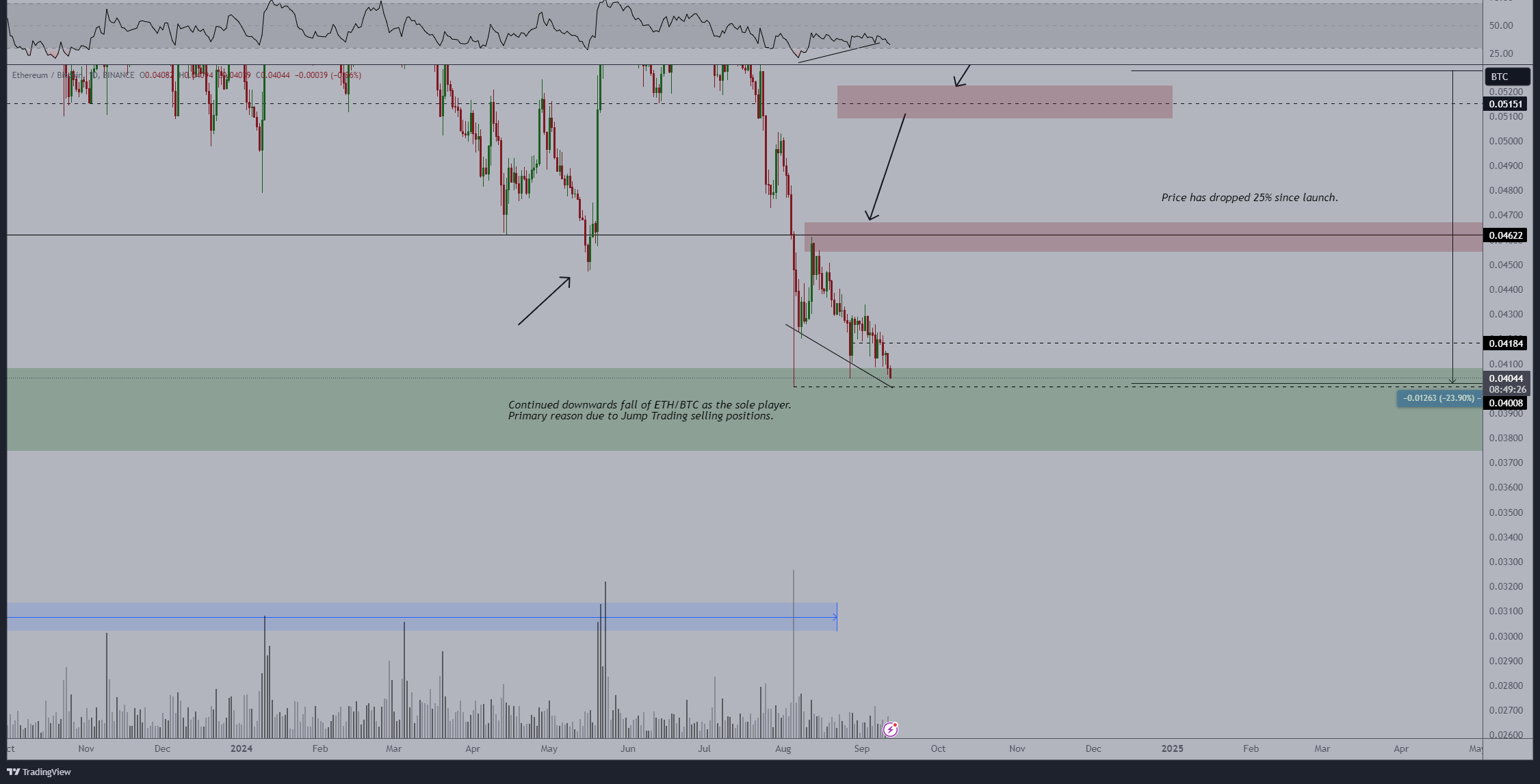

Ethereum (ETH), at press time, seemed to be showing some weakness against Bitcoin (BTC), with the ETH/BTC price action chart deep in the red. In fact, the bullish divergence for ETH looked invalidated as it approached the 0.04 BTC level.

If Bitcoin continues to gain momentum towards the $61k-$62k range after reclaiming $57k, ETH can be expected to drop further.

Currently, ETH lacks a solid support level, and traders will need to wait for better market conditions before any significant rebound. Now, the ongoing inflows might help ETH regain stability. However, for now, it remains weaker than Bitcoin.

The ETH/BTC Relative Strength Index (RSI) highlighted this divergence, with the price action declining while the RSI formed higher lows – A sign of a potential reversal.

Source: TradingView

The decreasing volume also signals that ETH may soon dip below the 0.04 BTC level. If Bitcoin weakens, this could present a chance for ETH to reverse. Until confirmed otherwise though, the bearish trend for ETH will remain the most likely scenario.

Global institutions are selling ETH

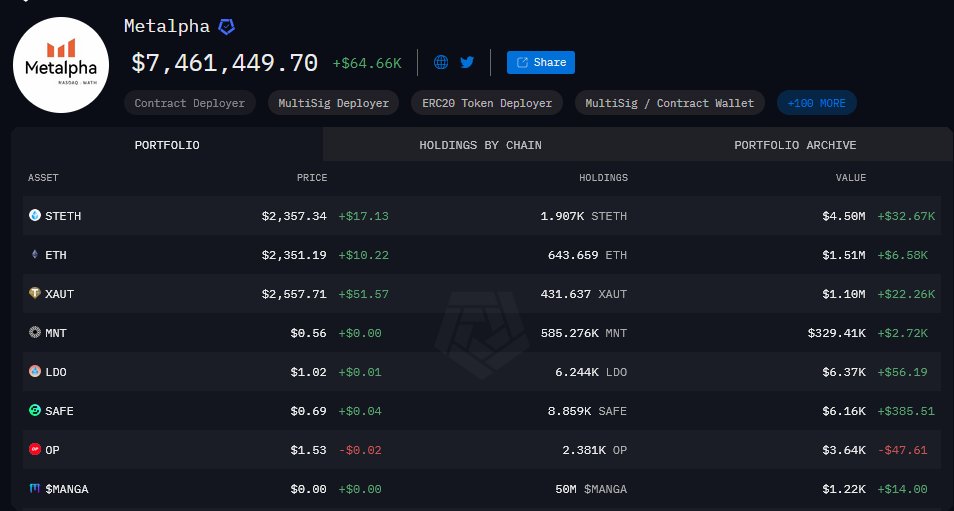

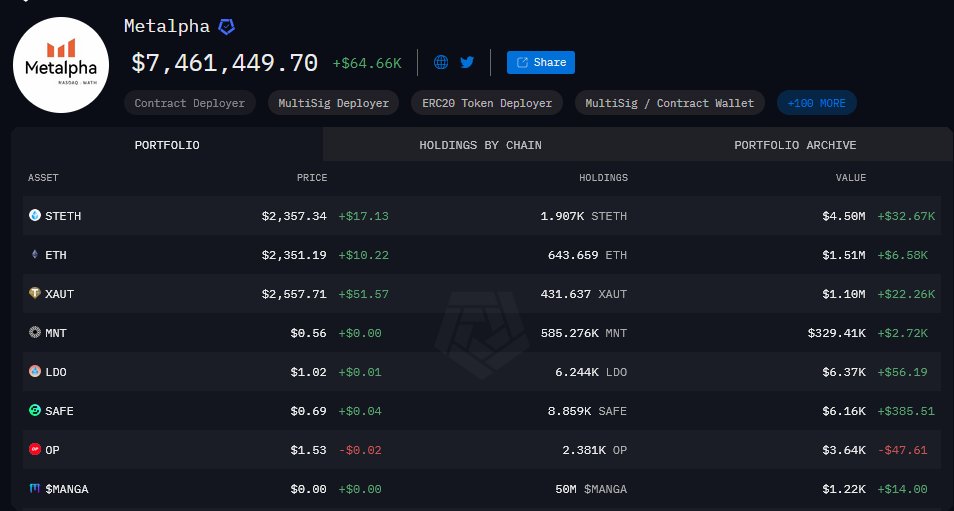

That’s not all though, with major global institutions now selling off their Ethereum holdings, as per Lookonchain on X.

For instance, Metalpha recently deposited 6,999 ETH, valued at $16.4 million, into Binance, contributing to their total deposits of 62,588 ETH worth $145.1 million over the last six days.

Their remaining ETH holdings now stand at just 23.5k ETH, worth $55 million. Metalpha has also liquidated its Layer 2 tokens such as Optimism (OP), while also reducing its staked ETH (stETH) holdings to 1,907 stETH.

Source: Arkham

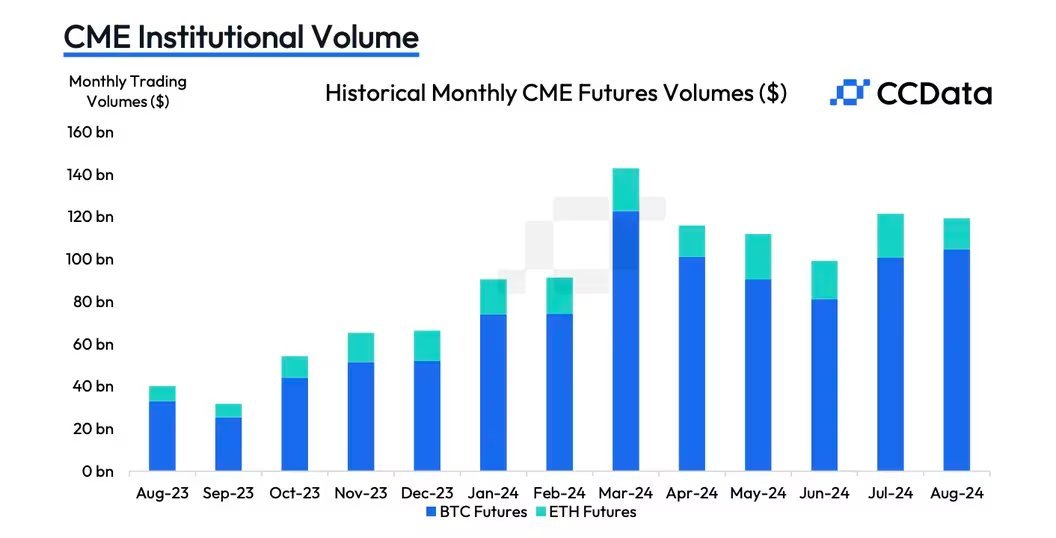

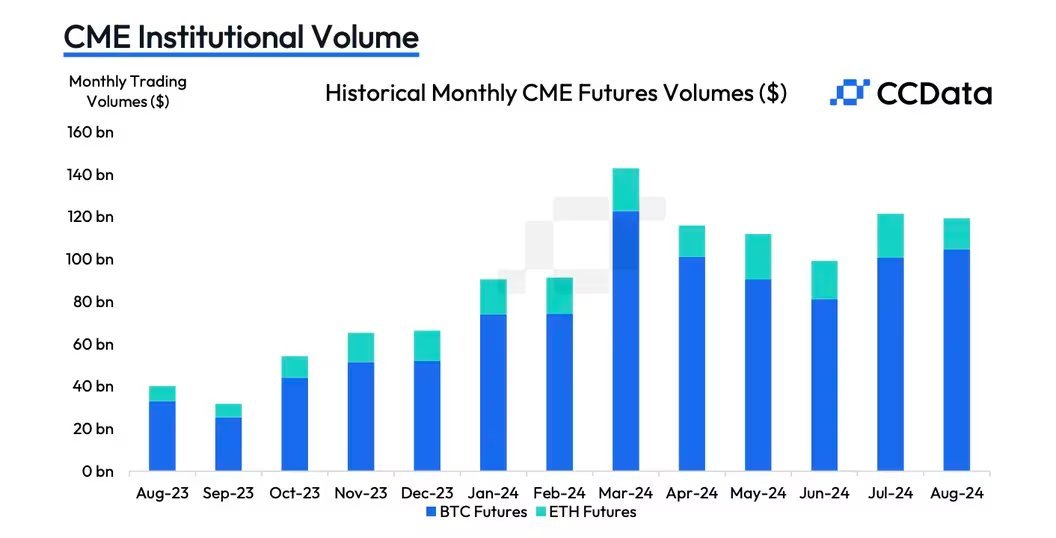

Ethereum CME trading volume

Additionally, ETH is likely to remain weak against BTC due to declining Futures trading volume on the Chicago Mercantile Exchange (CME). In fact, it fell by 28.7% to $14.8 billion in August, marking its lowest level since 2023.

Year-to-date, ETH’s price is also negative, with its exchange-traded funds (ETFs) having recorded negative net cumulative flows. The Ethereum Foundation is also selling ETH, adding further pressure on the price.

Source: X

This means that ETH may continue to decline before potentially rebounding, possibly in Q4 2024.

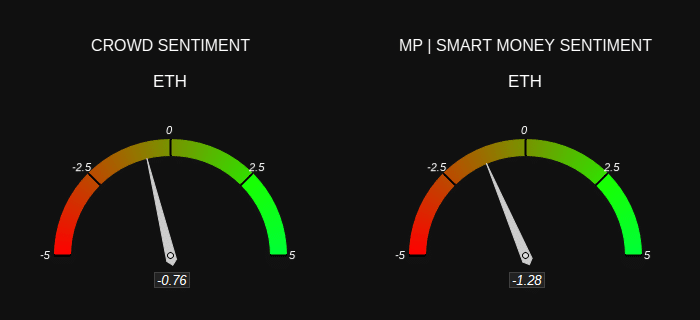

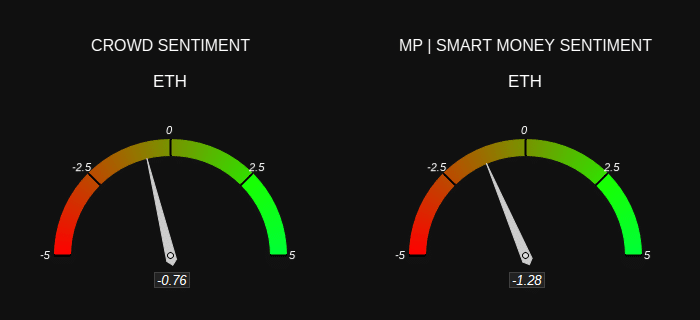

Crowd and smart money sentiment

Finally, crowd and smart money sentiment also indicated bearishness for ETH. Both retail traders and institutional investors agree that ETH remains bearish in the current market environment.

This alignment between small and large players suggests that Ethereum’s downtrend may persist until market dynamics shift or a significant catalyst emerges to support a price recovery.

Hence, ETH is expected to remain weak against Bitcoin. Especially until broader crypto market conditions improve.

Source: Market Prophit

- Ethereum’s bullish divergence has been invalidated

- Institutions are now selling ETH, with trading volume decreasing too

Ethereum (ETH), at press time, seemed to be showing some weakness against Bitcoin (BTC), with the ETH/BTC price action chart deep in the red. In fact, the bullish divergence for ETH looked invalidated as it approached the 0.04 BTC level.

If Bitcoin continues to gain momentum towards the $61k-$62k range after reclaiming $57k, ETH can be expected to drop further.

Currently, ETH lacks a solid support level, and traders will need to wait for better market conditions before any significant rebound. Now, the ongoing inflows might help ETH regain stability. However, for now, it remains weaker than Bitcoin.

The ETH/BTC Relative Strength Index (RSI) highlighted this divergence, with the price action declining while the RSI formed higher lows – A sign of a potential reversal.

Source: TradingView

The decreasing volume also signals that ETH may soon dip below the 0.04 BTC level. If Bitcoin weakens, this could present a chance for ETH to reverse. Until confirmed otherwise though, the bearish trend for ETH will remain the most likely scenario.

Global institutions are selling ETH

That’s not all though, with major global institutions now selling off their Ethereum holdings, as per Lookonchain on X.

For instance, Metalpha recently deposited 6,999 ETH, valued at $16.4 million, into Binance, contributing to their total deposits of 62,588 ETH worth $145.1 million over the last six days.

Their remaining ETH holdings now stand at just 23.5k ETH, worth $55 million. Metalpha has also liquidated its Layer 2 tokens such as Optimism (OP), while also reducing its staked ETH (stETH) holdings to 1,907 stETH.

Source: Arkham

Ethereum CME trading volume

Additionally, ETH is likely to remain weak against BTC due to declining Futures trading volume on the Chicago Mercantile Exchange (CME). In fact, it fell by 28.7% to $14.8 billion in August, marking its lowest level since 2023.

Year-to-date, ETH’s price is also negative, with its exchange-traded funds (ETFs) having recorded negative net cumulative flows. The Ethereum Foundation is also selling ETH, adding further pressure on the price.

Source: X

This means that ETH may continue to decline before potentially rebounding, possibly in Q4 2024.

Crowd and smart money sentiment

Finally, crowd and smart money sentiment also indicated bearishness for ETH. Both retail traders and institutional investors agree that ETH remains bearish in the current market environment.

This alignment between small and large players suggests that Ethereum’s downtrend may persist until market dynamics shift or a significant catalyst emerges to support a price recovery.

Hence, ETH is expected to remain weak against Bitcoin. Especially until broader crypto market conditions improve.

Source: Market Prophit

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike

generic clomid c10m1d order clomiphene without insurance how to get generic clomid pill cost of cheap clomid without a prescription where buy clomiphene can i purchase cheap clomid online clomid pills

This is the stripe of content I have reading.

With thanks. Loads of expertise!

order zithromax 500mg online – buy tindamax 500mg pills buy generic flagyl 400mg

buy rybelsus paypal – order periactin 4 mg pills buy cyproheptadine 4 mg pills

buy domperidone without prescription – flexeril for sale buy flexeril 15mg without prescription

buy cheap generic zithromax – tinidazole 300mg for sale order bystolic 20mg sale

order augmentin 1000mg pills – https://atbioinfo.com/ ampicillin without prescription

esomeprazole cost – anexa mate esomeprazole 20mg pill

order coumadin for sale – anticoagulant buy generic cozaar online

mobic 7.5mg pill – tenderness order mobic 7.5mg

buy generic prednisone – https://apreplson.com/ prednisone cheap

erection pills that work – https://fastedtotake.com/ how to get ed pills without a prescription

buy amoxil tablets – order amoxicillin pill amoxil tablets

cost fluconazole 200mg – https://gpdifluca.com/# order fluconazole pills

buy cenforce pill – cenforce price buy cenforce medication

zantac 150mg uk – this buy zantac cheap

vardenafil and tadalafil – cialis coupon walmart mint pharmaceuticals tadalafil

I’ll certainly bring to skim more. https://gnolvade.com/

order viagra online safe – canadian viagra 100mg purple viagra 100

Thanks on putting this up. It’s evidently done. buy zithromax 500mg sale

I couldn’t hold back commenting. Well written! https://ursxdol.com/levitra-vardenafil-online/

This is the make of advise I turn up helpful. https://prohnrg.com/product/diltiazem-online/

This website absolutely has all of the bumf and facts I needed adjacent to this subject and didn’t positive who to ask. online

The depth in this piece is exceptional. https://ondactone.com/simvastatin/

I am in fact happy to glitter at this blog posts which consists of tons of useful facts, thanks for providing such data.

https://doxycyclinege.com/pro/metoclopramide/

The vividness in this piece is exceptional. http://3ak.cn/home.php?mod=space&uid=229263

forxiga for sale – https://janozin.com/ order dapagliflozin 10 mg generic

buy cheap generic orlistat – on this site orlistat tablet