- Vitalik Buterin’s deposit of 2.27M USDC and 2,851 ETH highlighted confidence in Aave

- On-chain metrics revealed bullish large transactions, network growth, and neutral momentum for the token

Ethereum Co-founder Vitalik Buterin has made waves in the DeFi space with a recent deposit of 2.27 million USDC and 2,851 ETH (approximately $6.73 million) into the Aave [AAVE] protocol. This significant transaction has raised questions about its impact on Aave’s liquidity and the token’s price performance.

Ergo, the question – Is this a bullish signal for Aave’s future?

How did Buterin’s deposit affect Aave’s liquidity?

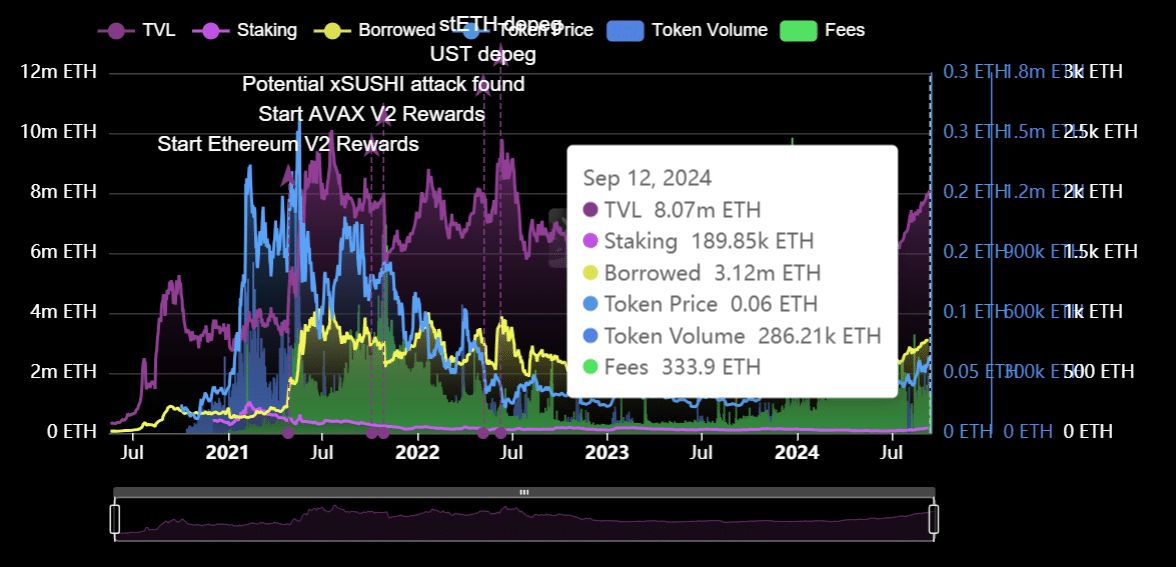

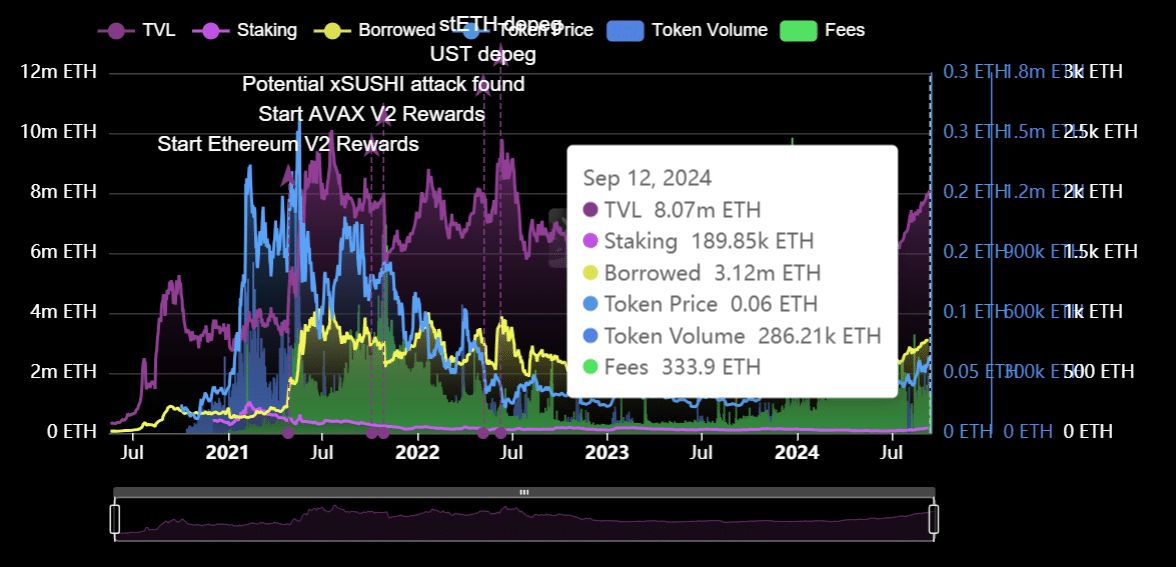

Buterin’s deposit has significantly contributed to Aave’s overall Total Value Locked (TVL), which stood at 8.07 million ETH at press time. Of this, 3.12 million ETH was borrowed, reflecting strong demand for loans on the platform. Aave’s TVL in USD terms sat at $11.08 billion, giving it a commanding 25.4% market share in the DeFi ecosystem, second only to Uniswap.

This boost in liquidity strengthens Aave’s capacity to issue large loans and makes the platform even more appealing for both lenders and borrowers. AAVE’s token was trading at $147.86 at press time, with gains of 1.48% over the last 24 hours.

Source: DeFiLlama

What are Aave’s on-chain signals saying?

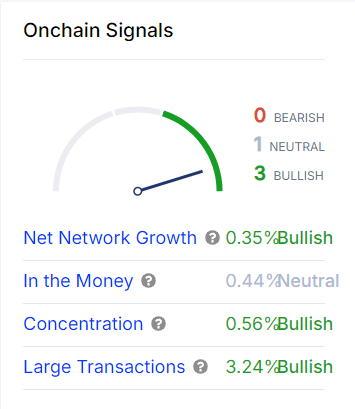

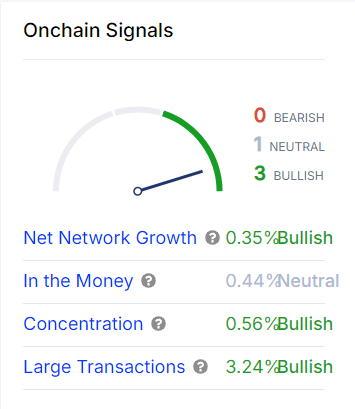

Recent on-chain signals indicated a largely bullish outlook for Aave. The Net Network Growth underlined a 0.35% bullish signal, reflecting the platform’s steady expansion in user activity.

Large transactions seemed to be particularly noteworthy, showing a 3.24% bullish signal. This suggested that whales and large investors are moving significant amounts on Aave—Buterin’s deposit being one clear example.

Additionally, the concentration metric highlighted a 0.56% bullish signal – A sign of the confidence of large holders in maintaining or increasing their positions.

Source: IntoTheBlock

What does Technical Analysis say about AAVE?

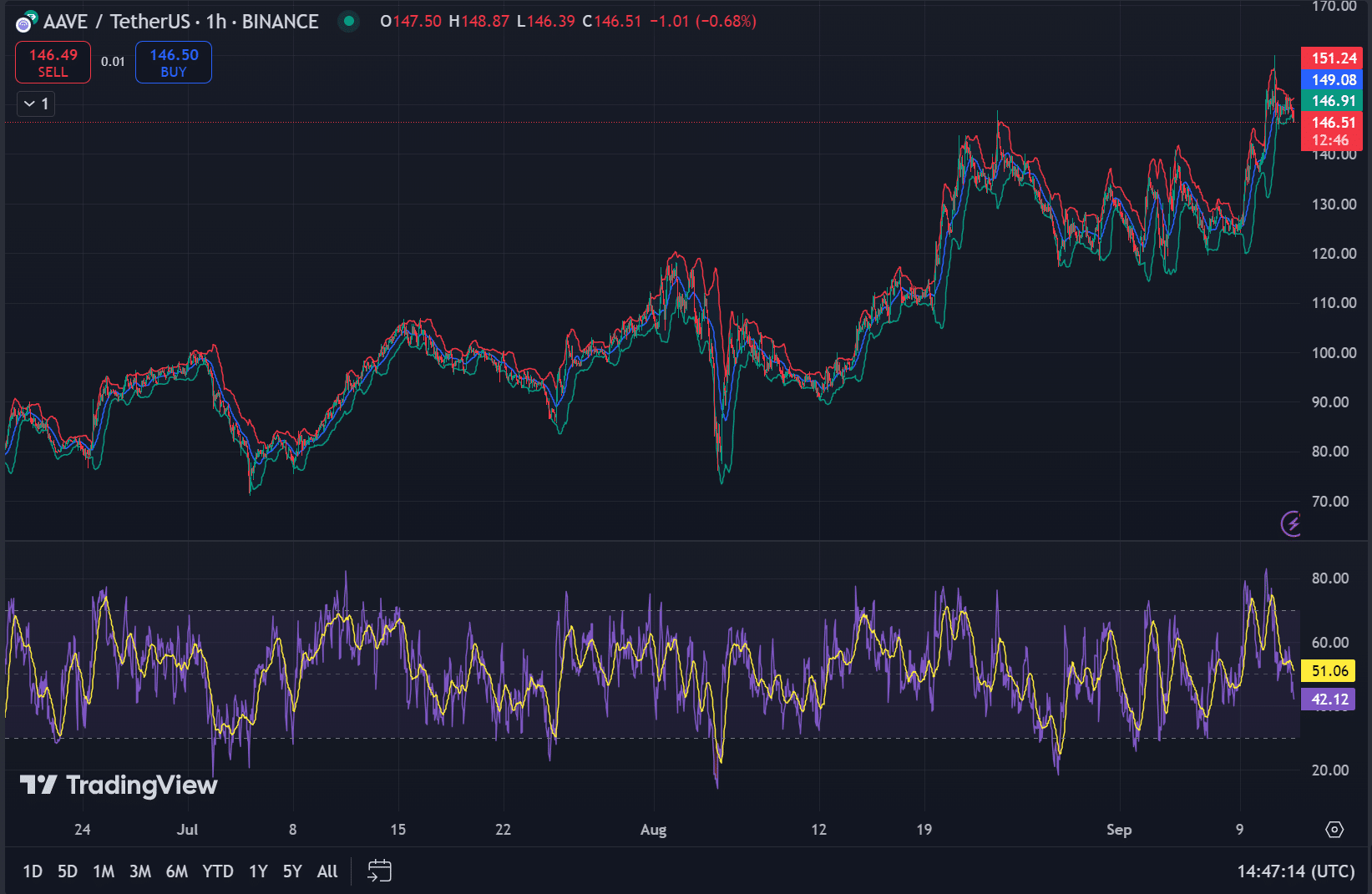

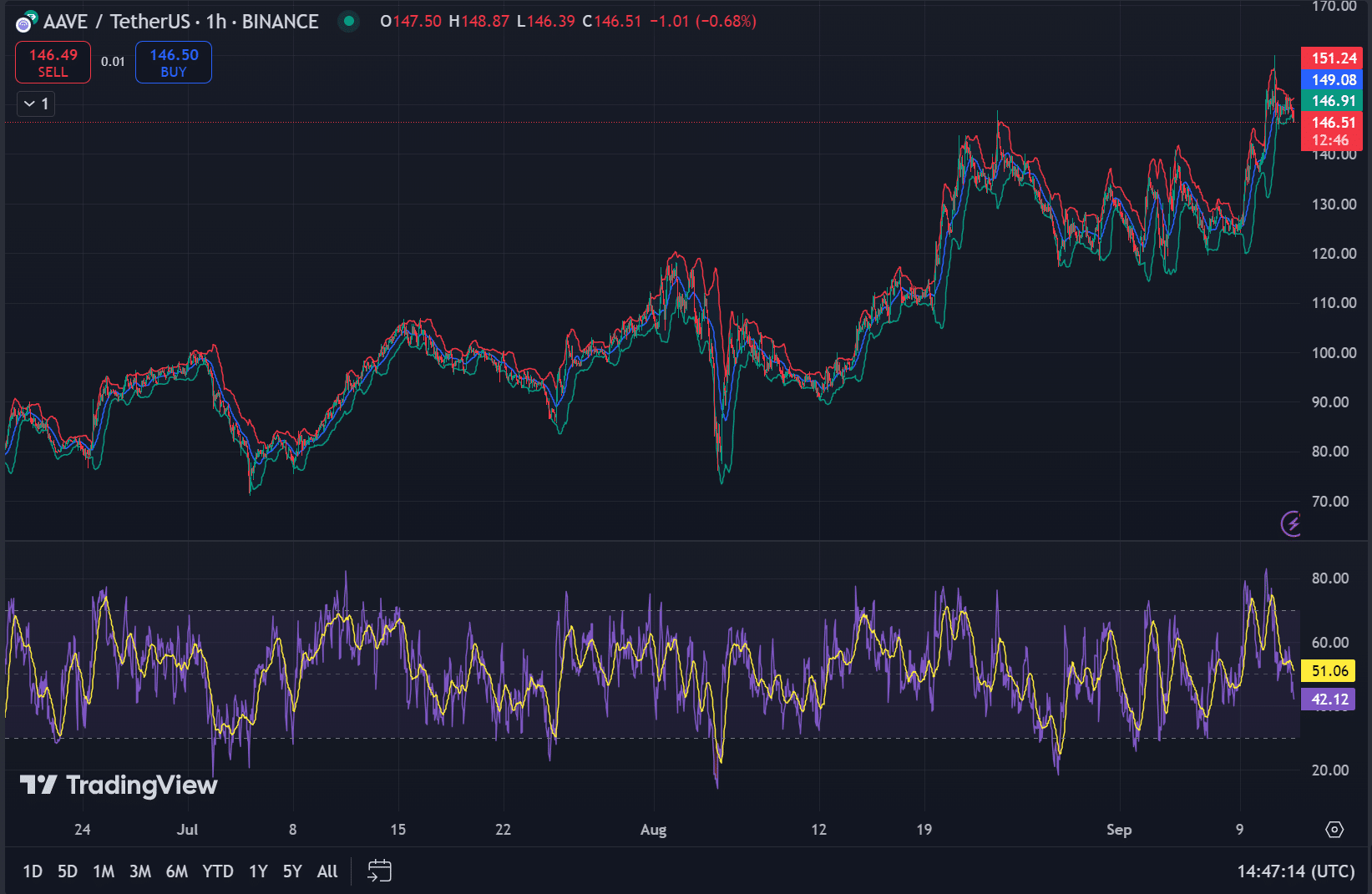

From a technical standpoint, AAVE’s token was trading at $147.86, with 1.48% gains over 24 hours at press time. The Relative Strength Index (RSI) was at 51.06, indicating neutral momentum – neither overbought nor oversold.

The Bollinger Bands (BB) revealED that AAVE seemed to be trading near the upper band, with the price at $147.86 and the upper band at approximately $151.24.

Both metrics indicated that the token may have room for upward movement. Especially if buying pressure increases.

Source: TradingView

Is Buterin’s deposit a bullish signal for Aave?

Yes, Vitalik Buterin’s deposit into Aave is indeed a bullish signal. The addition of $6.73 million worth of assets into the protocol boosts liquidity and market confidence.

Combined with positive on-chain signals, such as strong whale activity and net network growth, and technical analysis, Aave may be well-positioned for future growth.

- Vitalik Buterin’s deposit of 2.27M USDC and 2,851 ETH highlighted confidence in Aave

- On-chain metrics revealed bullish large transactions, network growth, and neutral momentum for the token

Ethereum Co-founder Vitalik Buterin has made waves in the DeFi space with a recent deposit of 2.27 million USDC and 2,851 ETH (approximately $6.73 million) into the Aave [AAVE] protocol. This significant transaction has raised questions about its impact on Aave’s liquidity and the token’s price performance.

Ergo, the question – Is this a bullish signal for Aave’s future?

How did Buterin’s deposit affect Aave’s liquidity?

Buterin’s deposit has significantly contributed to Aave’s overall Total Value Locked (TVL), which stood at 8.07 million ETH at press time. Of this, 3.12 million ETH was borrowed, reflecting strong demand for loans on the platform. Aave’s TVL in USD terms sat at $11.08 billion, giving it a commanding 25.4% market share in the DeFi ecosystem, second only to Uniswap.

This boost in liquidity strengthens Aave’s capacity to issue large loans and makes the platform even more appealing for both lenders and borrowers. AAVE’s token was trading at $147.86 at press time, with gains of 1.48% over the last 24 hours.

Source: DeFiLlama

What are Aave’s on-chain signals saying?

Recent on-chain signals indicated a largely bullish outlook for Aave. The Net Network Growth underlined a 0.35% bullish signal, reflecting the platform’s steady expansion in user activity.

Large transactions seemed to be particularly noteworthy, showing a 3.24% bullish signal. This suggested that whales and large investors are moving significant amounts on Aave—Buterin’s deposit being one clear example.

Additionally, the concentration metric highlighted a 0.56% bullish signal – A sign of the confidence of large holders in maintaining or increasing their positions.

Source: IntoTheBlock

What does Technical Analysis say about AAVE?

From a technical standpoint, AAVE’s token was trading at $147.86, with 1.48% gains over 24 hours at press time. The Relative Strength Index (RSI) was at 51.06, indicating neutral momentum – neither overbought nor oversold.

The Bollinger Bands (BB) revealED that AAVE seemed to be trading near the upper band, with the price at $147.86 and the upper band at approximately $151.24.

Both metrics indicated that the token may have room for upward movement. Especially if buying pressure increases.

Source: TradingView

Is Buterin’s deposit a bullish signal for Aave?

Yes, Vitalik Buterin’s deposit into Aave is indeed a bullish signal. The addition of $6.73 million worth of assets into the protocol boosts liquidity and market confidence.

Combined with positive on-chain signals, such as strong whale activity and net network growth, and technical analysis, Aave may be well-positioned for future growth.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)