- BTC made significant gains in the past day, rising by 2.08%.

- Despite the recent gains, Bitcoin remained stuck in a sustained bear phase.

Over the last 24 hours, Bitcoin [BTC] has made significant gains, rising from a local low of $55554 to $58038 at press time. This marked a 2.08% increase over the past day.

These gains are coupled with weekly gains of 1.83% a recovery from a sharp decline to $52546.

These current market conditions raise the question of whether BTC will experience a sustained recovery or a mere correction before further dip. The market sentiment remains bearish as analysts see a potential dip.

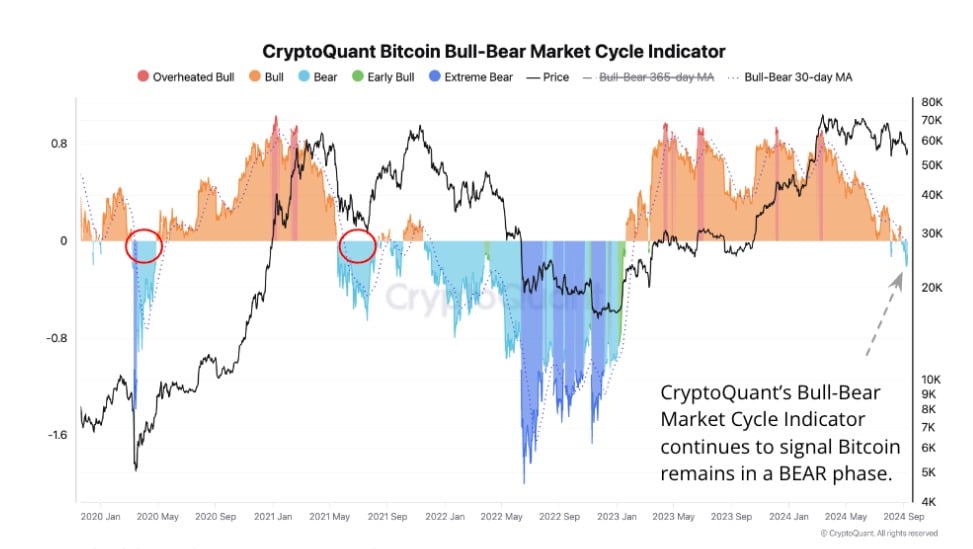

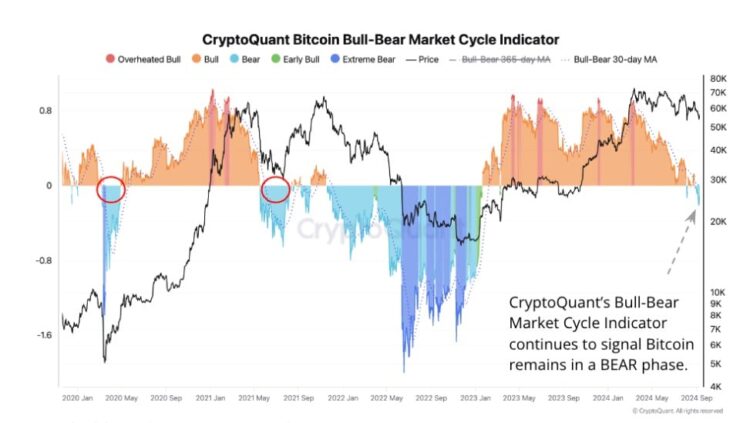

This sentiment is shared by CryptoQuant analysts who posit that BTC is stuck in a bear phase, citing the 365-day moving average and MVRV.

BTC stuck in bear phase

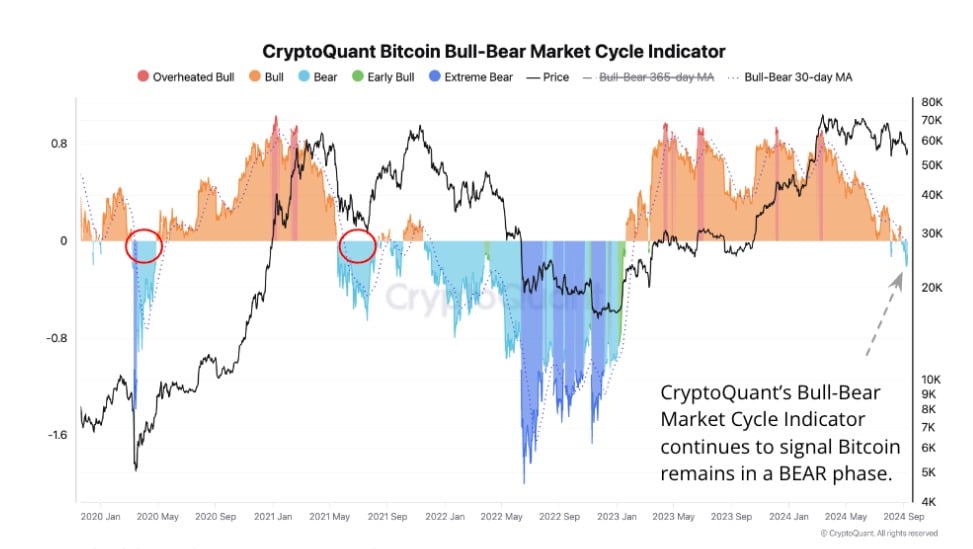

According to CryptoQuant, the Bull-Bear Market cycle has remained in the bear phase over the past two weeks.

Since the last time BTC was trading at $62k, the crypto has remained in a bear phase, dropping to a low of $52k in this period.

As long as it remains in this phase, a significant rally remains unexpected with potential for further correction.

Source: CryptoQuant

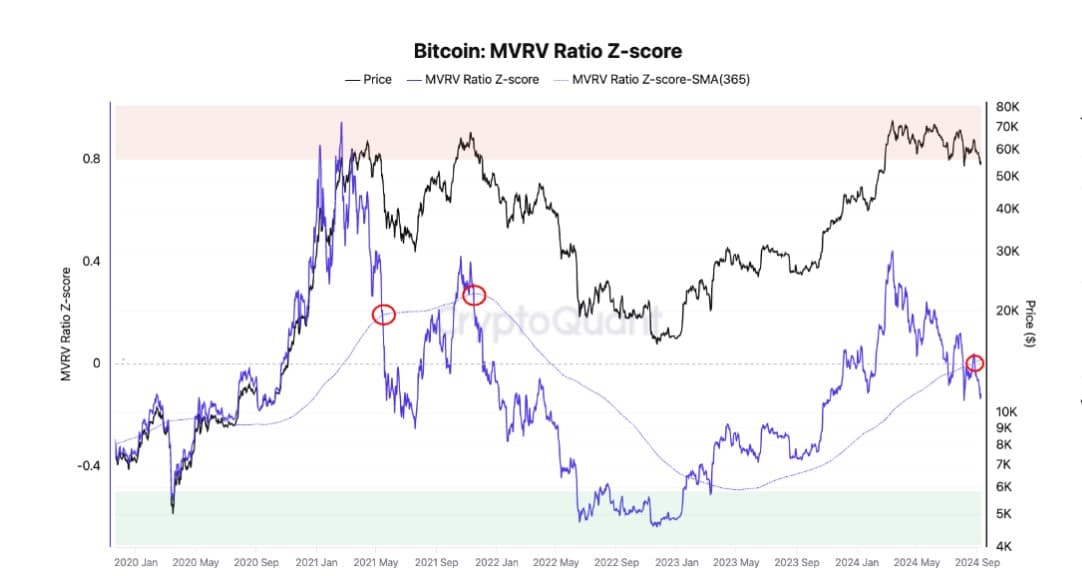

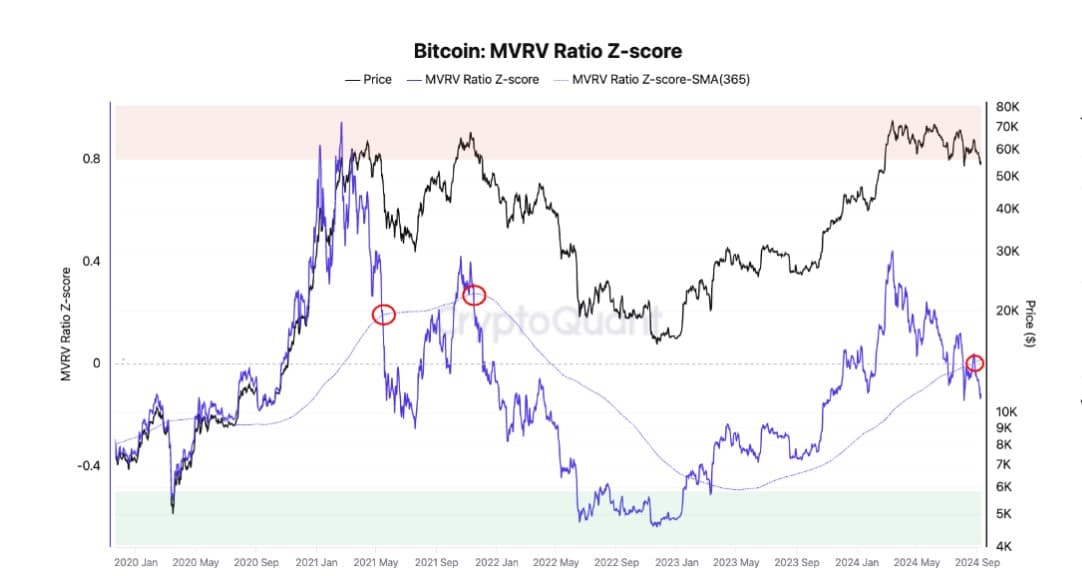

Secondly, the analysis cited that BTC’s MVRV ratio has remained below its 365-day moving average since the 26th of August. Such a scenario suggests the potential for a further decline, as was witnessed in May 2021.

During the 2021 cycle, BTC declined by 36% in two months — this reoccurred in November 2021.

Source: CryptoQuant

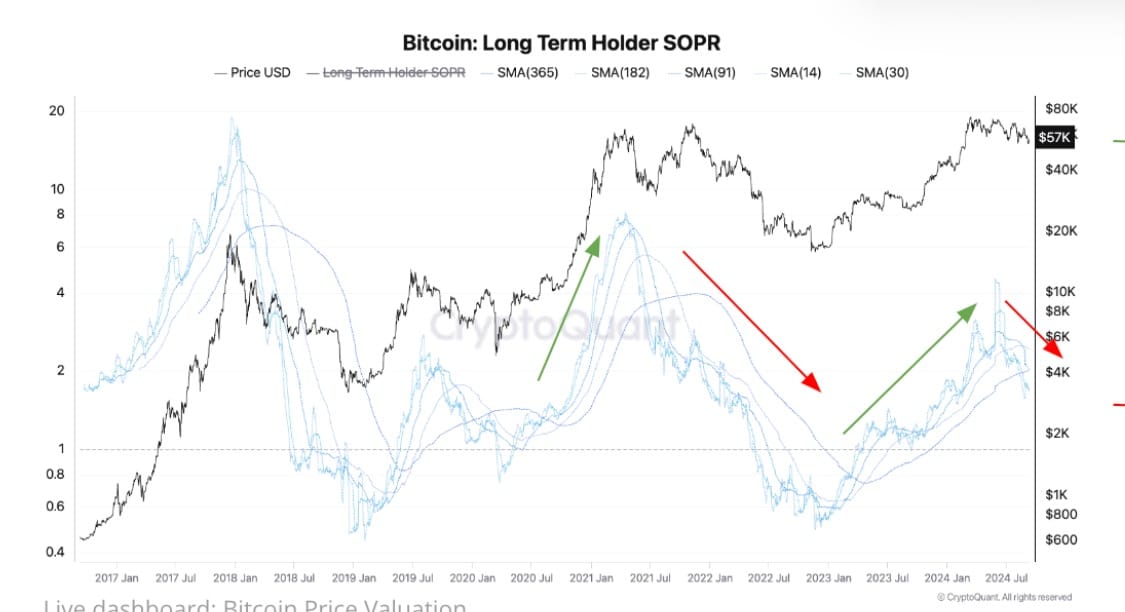

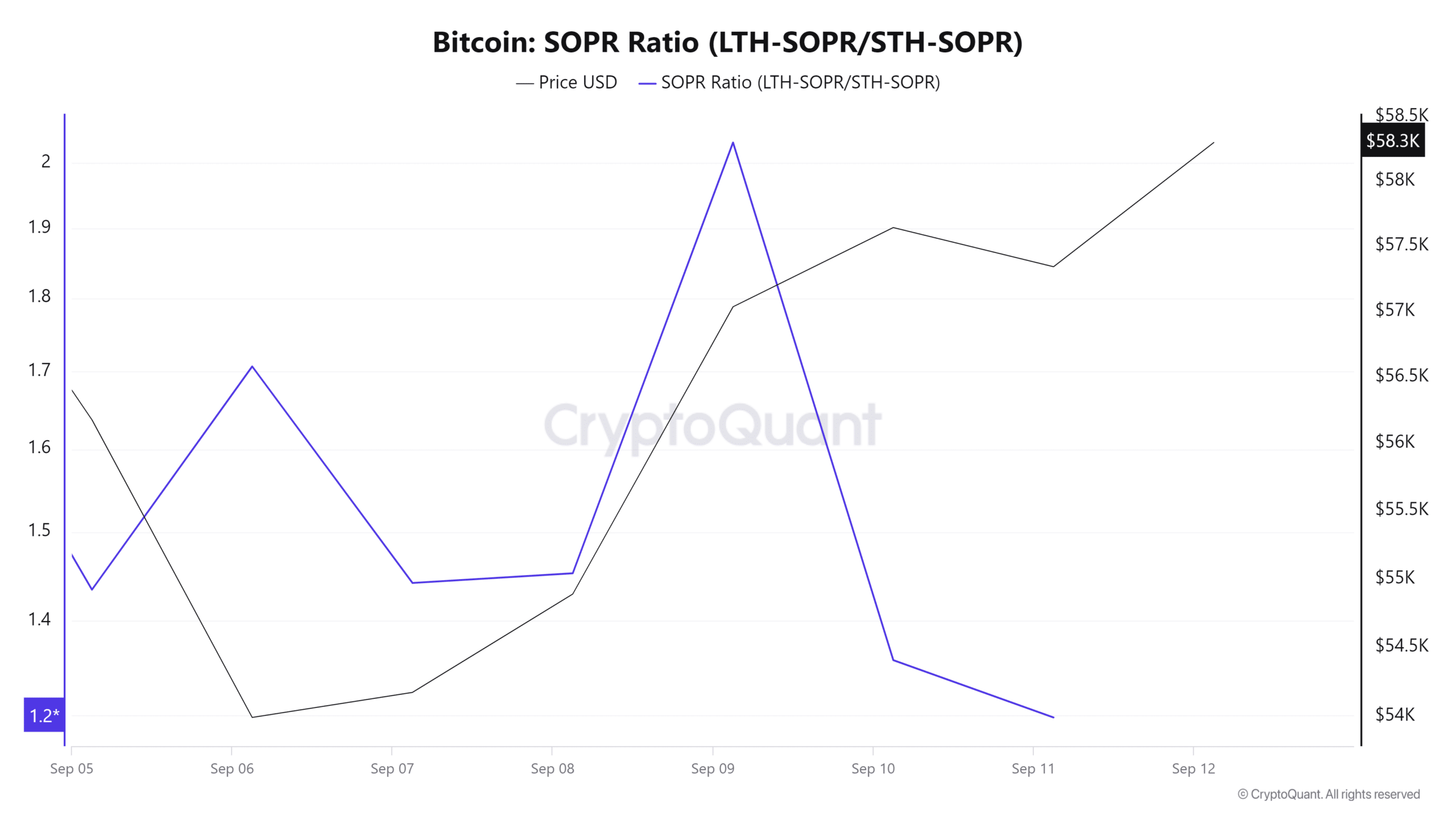

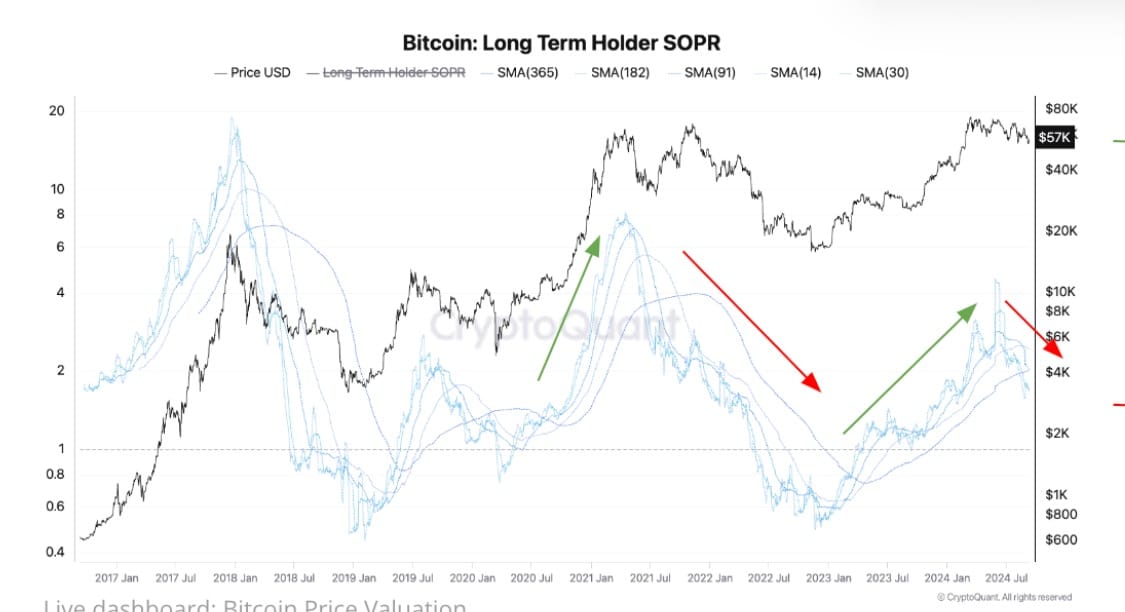

Another market indicator signaling a bearish trend is the long-term holders’ SOPR. According to CryptoQuant, long-term holders’ SOPR has declined since July, with LTH spending at lower profit margins.

When LTHs spend at lower profit margins, it shows a lack of new demand for BTC. Thus, BTC will only show a buying signal when LTH SOPR charts start an uptrend movement.

Source: CryptoQuant

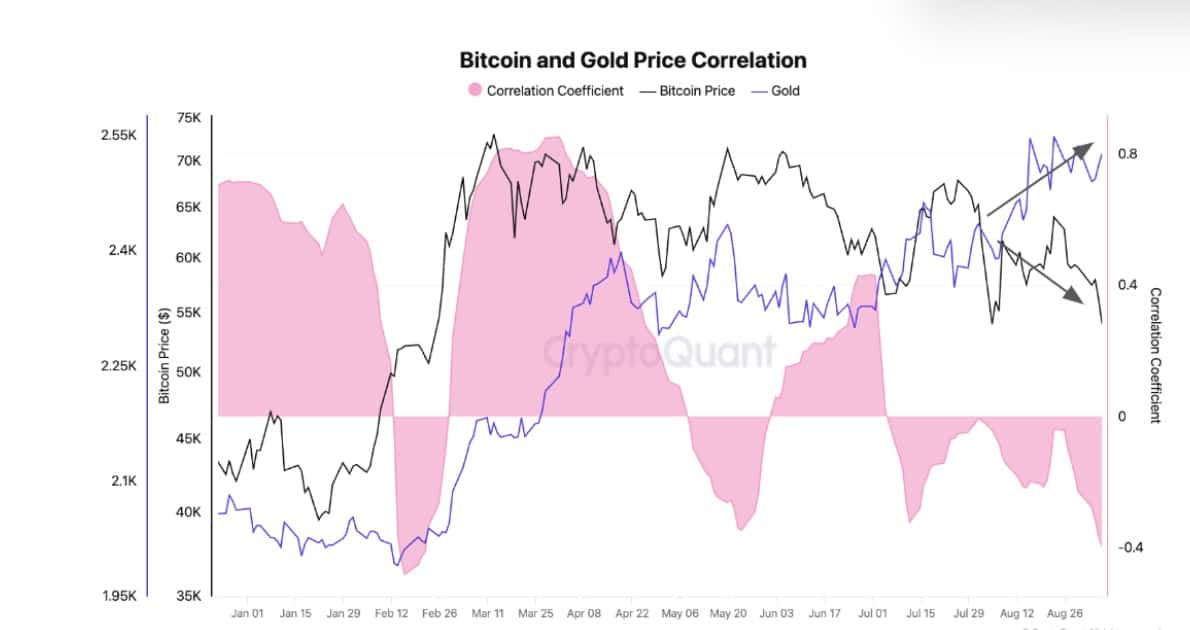

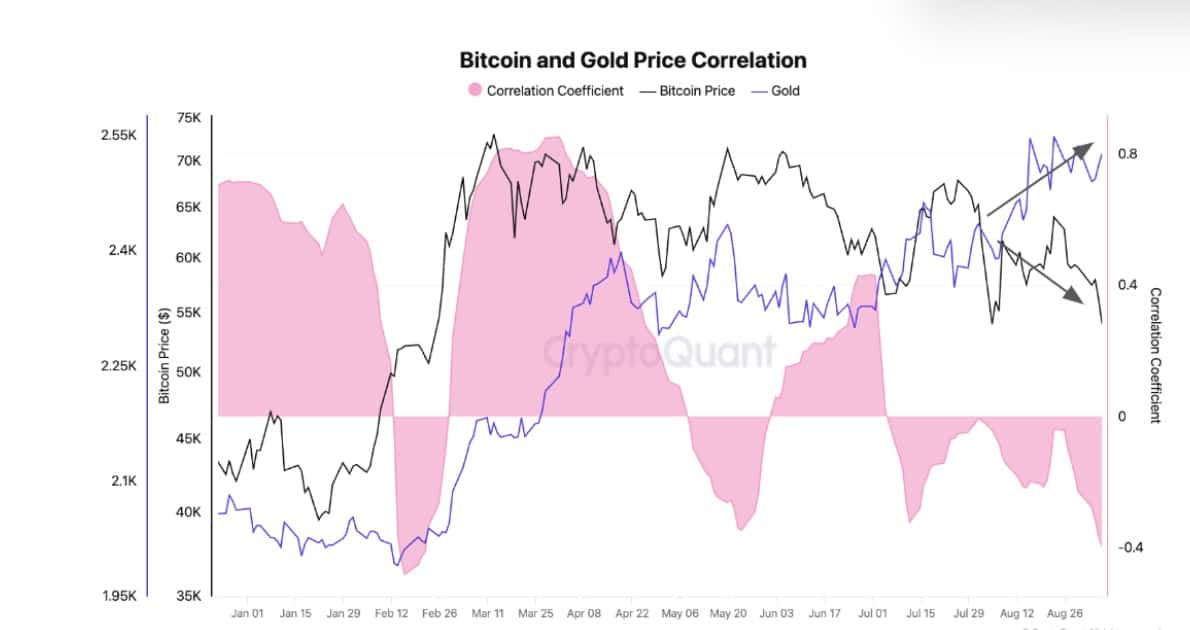

Finally, BTC has decoupled from gold as its prices have declined while gold prices have been soaring, hitting new highs. Thus, the correlation between gold and BTC has turned negative, where gold’s price increased as BTC declined.

This suggested that investors were becoming risk-averse as they turned to traditional assets as a safe haven, thus avoiding volatile assets.

Source: CryptoQuant

What Bitcoin’s charts suggest

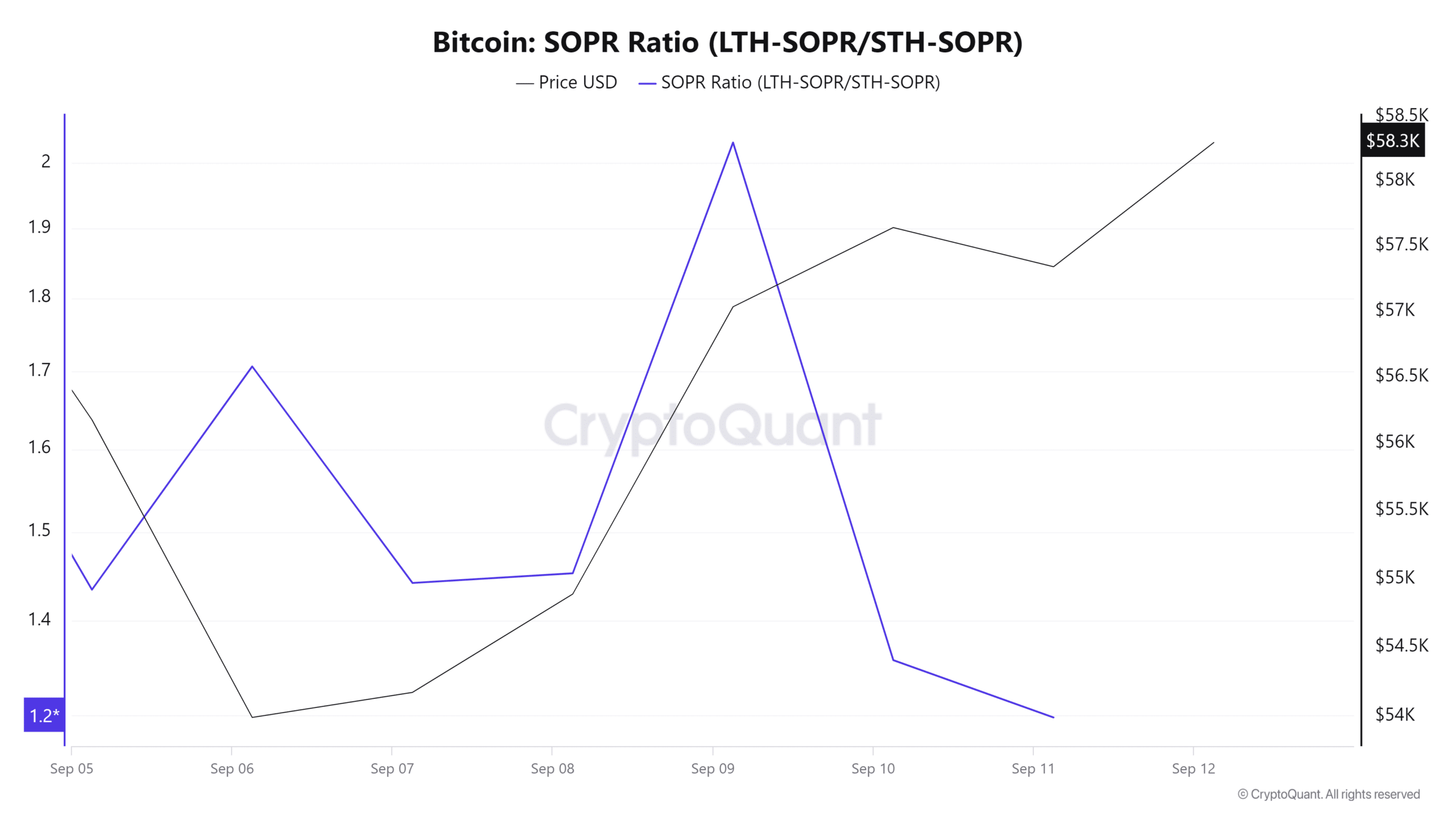

Looking ahead, both Bitcoin’s LTH-SOPR and STH-SOPR declined over the past week. When the LTH-SOPR declines, it suggests that long-term holders were increasingly selling their crypto at a loss.

When the STH-SOPR declines, it indicates that short short-term holders are also selling at a loss, due to FUD and fear of further downside.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024–2025

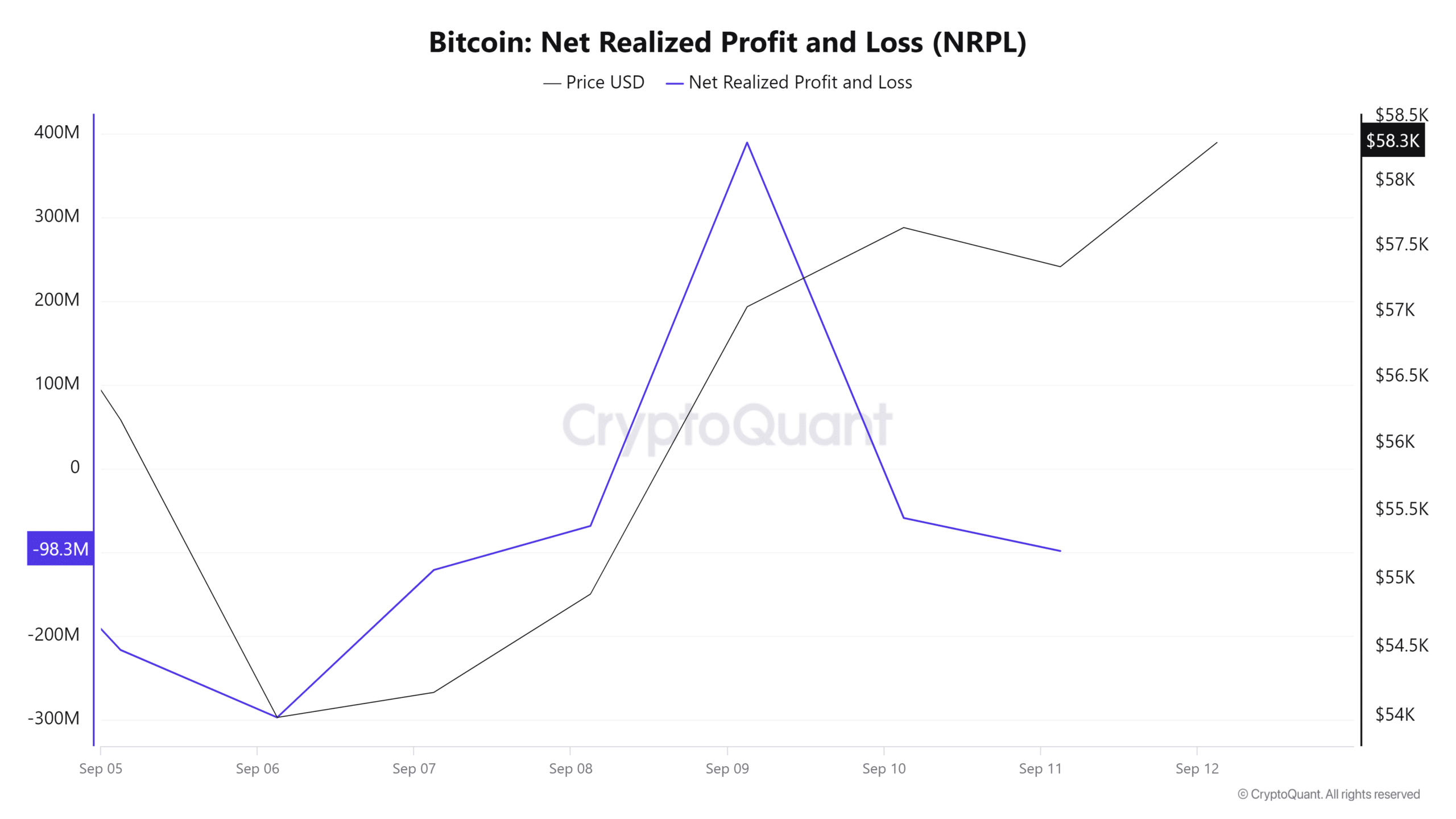

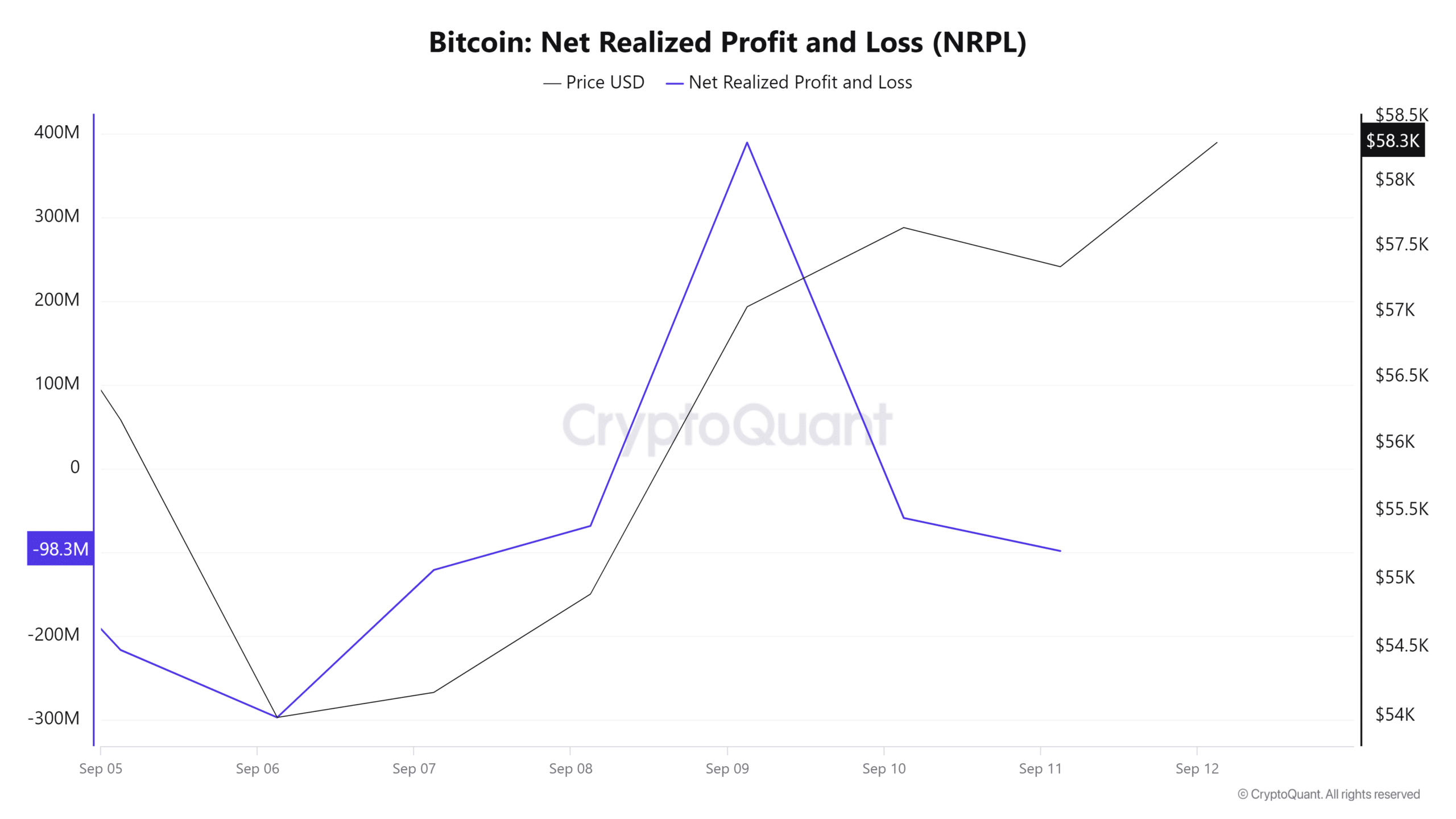

Additionally, Bitcoin’s NRPL has turned from positive to negative, indicating capitulation. This meant that investors have lost confidence in the crypto’s direction and were selling regardless of their losses.

Therefore, based on this analysis, BTC’s bear phase will continue, and the prices are likely to experience continued corrections. Thus, if bears continue to dominate, Bitcoin will drop to the $56k support level.

Source: CryptoQuant

- BTC made significant gains in the past day, rising by 2.08%.

- Despite the recent gains, Bitcoin remained stuck in a sustained bear phase.

Over the last 24 hours, Bitcoin [BTC] has made significant gains, rising from a local low of $55554 to $58038 at press time. This marked a 2.08% increase over the past day.

These gains are coupled with weekly gains of 1.83% a recovery from a sharp decline to $52546.

These current market conditions raise the question of whether BTC will experience a sustained recovery or a mere correction before further dip. The market sentiment remains bearish as analysts see a potential dip.

This sentiment is shared by CryptoQuant analysts who posit that BTC is stuck in a bear phase, citing the 365-day moving average and MVRV.

BTC stuck in bear phase

According to CryptoQuant, the Bull-Bear Market cycle has remained in the bear phase over the past two weeks.

Since the last time BTC was trading at $62k, the crypto has remained in a bear phase, dropping to a low of $52k in this period.

As long as it remains in this phase, a significant rally remains unexpected with potential for further correction.

Source: CryptoQuant

Secondly, the analysis cited that BTC’s MVRV ratio has remained below its 365-day moving average since the 26th of August. Such a scenario suggests the potential for a further decline, as was witnessed in May 2021.

During the 2021 cycle, BTC declined by 36% in two months — this reoccurred in November 2021.

Source: CryptoQuant

Another market indicator signaling a bearish trend is the long-term holders’ SOPR. According to CryptoQuant, long-term holders’ SOPR has declined since July, with LTH spending at lower profit margins.

When LTHs spend at lower profit margins, it shows a lack of new demand for BTC. Thus, BTC will only show a buying signal when LTH SOPR charts start an uptrend movement.

Source: CryptoQuant

Finally, BTC has decoupled from gold as its prices have declined while gold prices have been soaring, hitting new highs. Thus, the correlation between gold and BTC has turned negative, where gold’s price increased as BTC declined.

This suggested that investors were becoming risk-averse as they turned to traditional assets as a safe haven, thus avoiding volatile assets.

Source: CryptoQuant

What Bitcoin’s charts suggest

Looking ahead, both Bitcoin’s LTH-SOPR and STH-SOPR declined over the past week. When the LTH-SOPR declines, it suggests that long-term holders were increasingly selling their crypto at a loss.

When the STH-SOPR declines, it indicates that short short-term holders are also selling at a loss, due to FUD and fear of further downside.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Additionally, Bitcoin’s NRPL has turned from positive to negative, indicating capitulation. This meant that investors have lost confidence in the crypto’s direction and were selling regardless of their losses.

Therefore, based on this analysis, BTC’s bear phase will continue, and the prices are likely to experience continued corrections. Thus, if bears continue to dominate, Bitcoin will drop to the $56k support level.

Source: CryptoQuant

Повышение квалификации онлайн maps-edu.ru

В настоящее время проходить дистанционное обучение является полной нормой. Ведь онлайн возможно пройти проверку знаний, повысить квалификацию должности, пройти профессиональную переподготовку и многое другое в комфортное для Вас время и по выигрышной стоимости. На сайте maps-edu.ru Вы сможете найти расписание программы обучений, стоимость, все подробности о нашей работе уже сейчас.

Пройти аккредитация медработников можно в представленной академии. Каталог содержит свыше 1800 разнообразных программ курсов, иногда сложно найти, что необходимо конкретно Вам. Можно пользоваться поиском, указав направление и иные параметры. Реальные направления: строительство, агрономия, юриспруденция и право, документоведение и делопроизводство, дефектология, пожарная безопасность, педагогика, социальная работа, антитеррористическая защищенность, охрана труда, электротехника, монтажные работы, горное дело и многие другие.

Обращайтесь за проф консультацией по номеру телефона 8(800)777-06-74 или оформите обратный звонок. Работаем по всей РФ и также звонок является бесплатным. Звоните и менеджер окажет помощь Вам найти нужный пакет по обучению, расскажет об способах оплаты и сориентирует по прайсу. Наша фирма находится по адресу: г. Иркутск, ул. Степана Разина, д. 6.

По вопросу стоматология профилактическая обучение Вы на правильном пути. Преимущества онлайн обучения рассказывать сейчас не требуется. Все знают эти преимущества и всё чаще останавливаются на maps-edu.ru за наш успешный опыт. Множество квалифицированных преподавателей, довольных учеников, добрых отзывов и не только, чем мы можем похвастаться. Приходите и Вы за необходимыми навыками.

Если вы искали где отремонтировать сломаную технику, обратите внимание – профи ремонт

can i order generic clomiphene pills can i buy generic clomid price cost of clomiphene for men how to get clomiphene no prescription clomiphene challenge test protocol can i buy generic clomid price where to get cheap clomiphene without dr prescription

This website absolutely has all of the tidings and facts I needed there this thesis and didn’t comprehend who to ask.

This is the amicable of serenity I have reading.

how to get azithromycin without a prescription – oral zithromax metronidazole 400mg uk

semaglutide pills – cyproheptadine 4mg pill order periactin generic

cheap motilium – tetracycline 500mg drug buy cyclobenzaprine 15mg online

order esomeprazole 40mg generic – https://anexamate.com/ buy nexium 40mg online

warfarin 2mg sale – https://coumamide.com/ losartan where to buy

mobic 7.5mg oral – https://moboxsin.com/ mobic 15mg pills

buy deltasone – aprep lson buy deltasone 40mg generic

buy generic ed pills over the counter – ed pills gnc causes of erectile dysfunction

amoxicillin cheap – https://combamoxi.com/ buy amoxil generic

buy fluconazole 100mg online – brand fluconazole 100mg buy diflucan without prescription

how to get lexapro without a prescription – escita pro buy lexapro 10mg online cheap

buy cenforce no prescription – this order cenforce 50mg for sale

where can i buy cialis online in canada – fast ciltad cialis price walmart

cialis manufacturer coupon lilly – https://strongtadafl.com/# maximpeptide tadalafil review

order generic ranitidine – click order zantac 300mg sale

sildenafil citrate tablets 50 mg – cheap viagra inurl /profile/ discount viagra order

Thanks on putting this up. It’s understandably done. amoxicillin where to buy

The thoroughness in this piece is noteworthy. https://ursxdol.com/doxycycline-antibiotic/

More content pieces like this would make the интернет better. https://ondactone.com/simvastatin/