- Bitcoin’s exchange reserves suggested that selling pressure was high

- Market indicators hinted at a bullish trend reversal

Bitcoin [BTC], despite a brief bout of recovery, is struggling once again after its price slipped below $55,000 on the charts. In the meantime, an institutional investor deposited BTC worth millions of dollars, fueling sell-off concerns. Does this mean that BTC may be poised to see yet another price correction in the coming days?

Are investors selling BTC?

Bitcoin, like most other cryptos, also recorded a price drop last week as the coin’s price plummeted by nearly 8%. The bearish price trend continued in the last 24 hours because it dipped by over 2%. At the time of writing, BTC was trading at $54,284.69 with a market capitalization of over $1 trillion.

While that happened, a large-scale investor sold a substantial amount of BTC. To be precise, Galaxy Digital deposited 1,458 BTC worth $78.5 million to Coinbase Prime. This update from Lookonchain suggested that whales are now selling BTC. Whenever whales sell BTC, it means that they are expecting an asset’s price to drop further.

Hence, it’s worth taking a lot at other datasets to see whether selling pressure on the coin has been rising or not.

According to AMBCrypto’s analysis of CryptoQuant’s data, Bitcoin’s exchange reserves have risen lately. By extension, this meant that selling pressure on the coin has been high.

Apart from that, at press time, both BTC’s Coinbase Premium and Funds Premium were red – A sign that selling sentiment was dominant among U.S and institutional investors.

Source: CryptoQuant

What do the market indicators suggest?

We then assessed the crypto’s metrics to find out whether they also hinted at a further price correction.

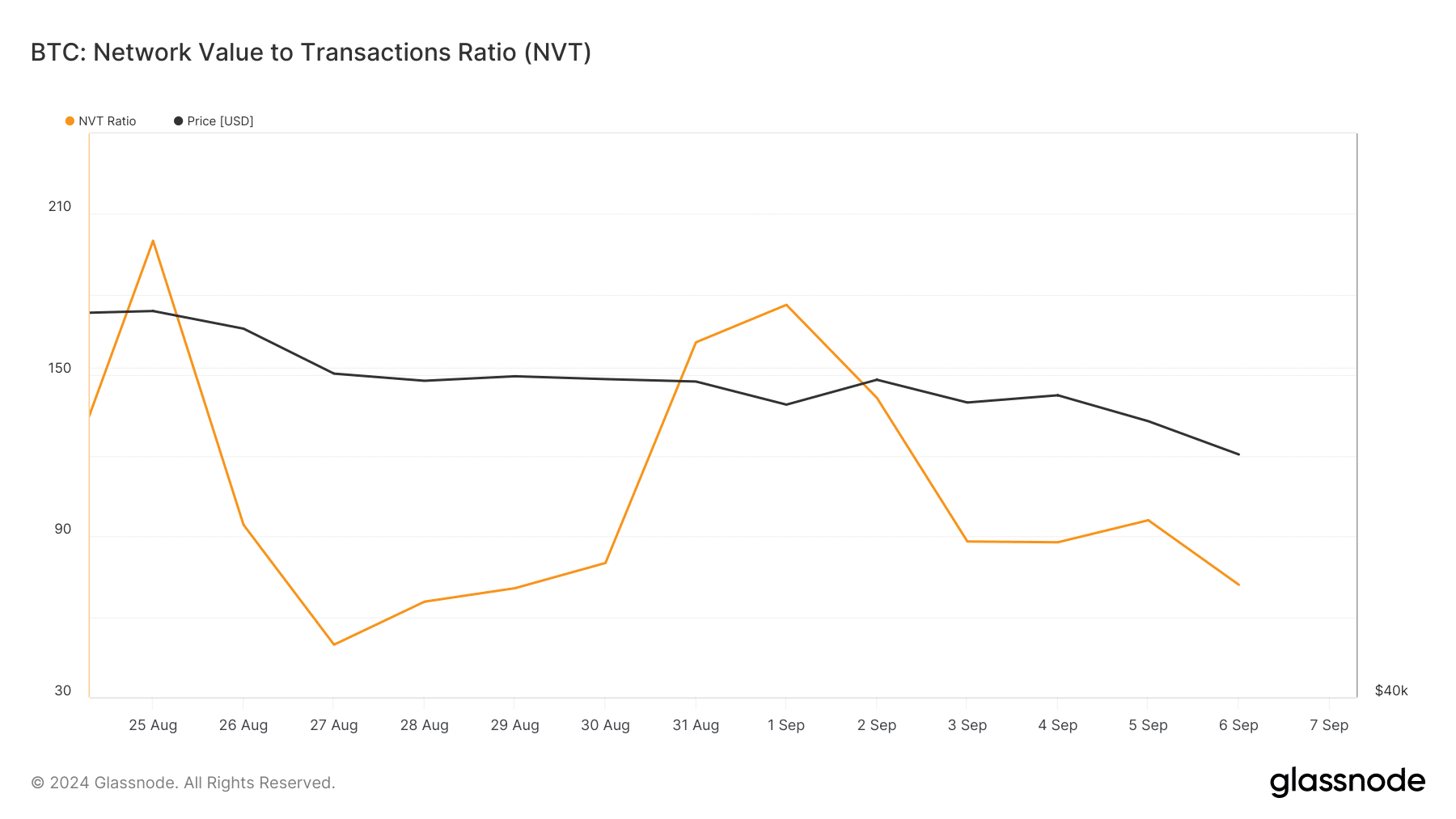

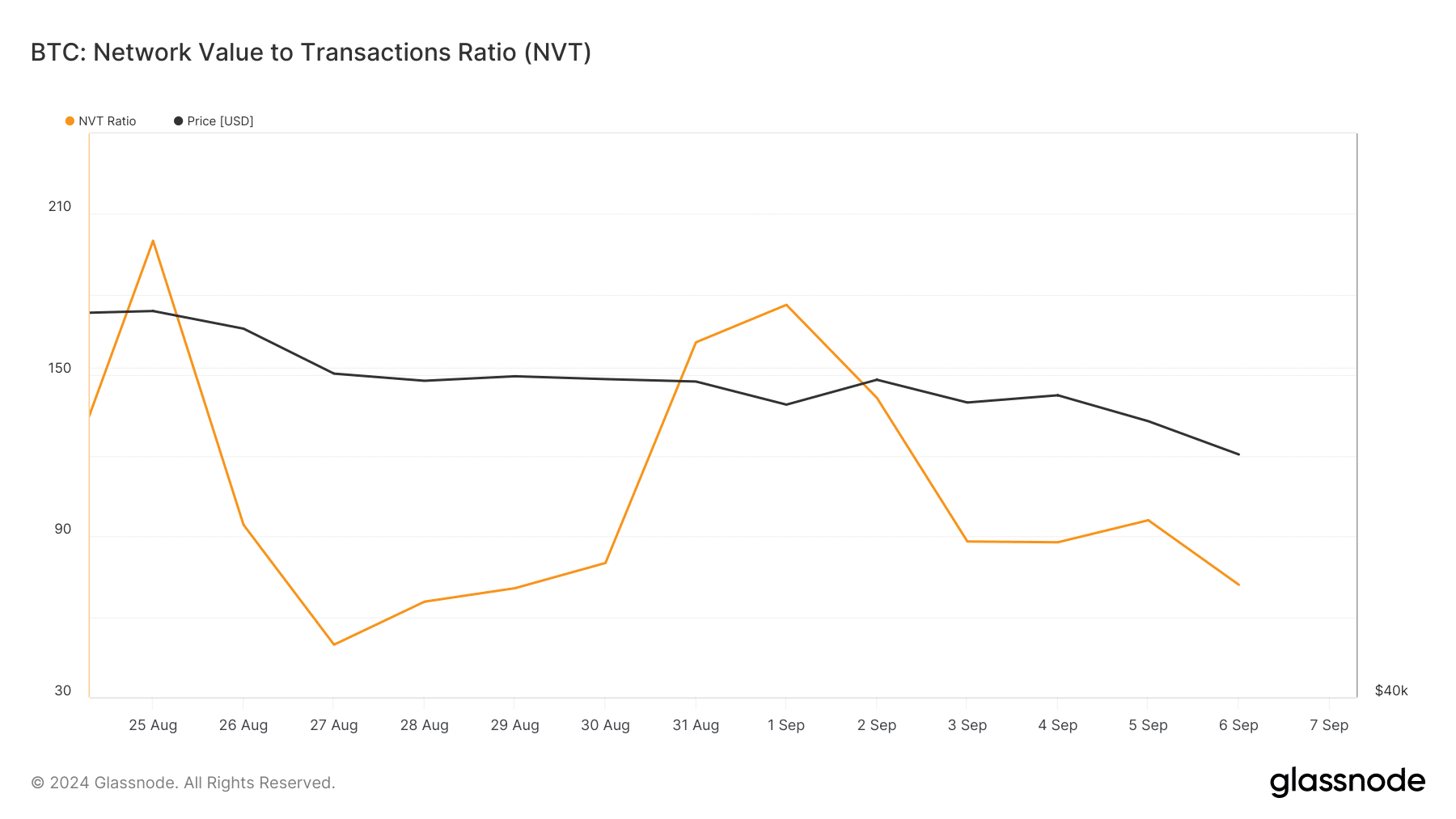

As per our analysis of Glassnode’s data, BTC’s NVT ratio fell on the charts. Whenever that happens, it suggests that an asset is undervalued, hinting at a price hike.

Source: Glassnode

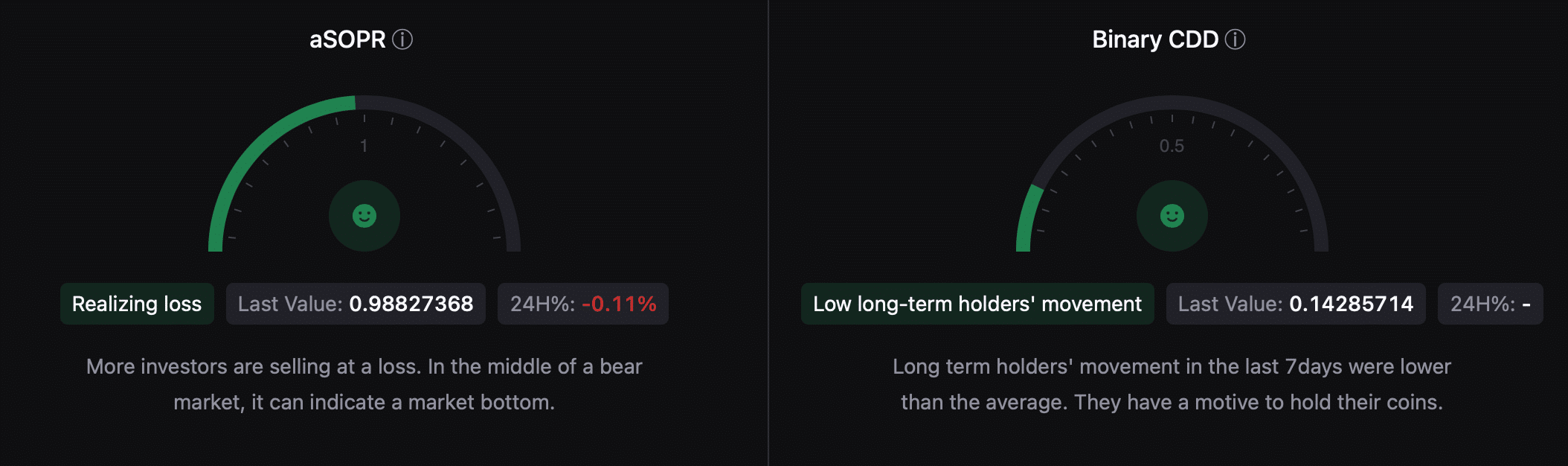

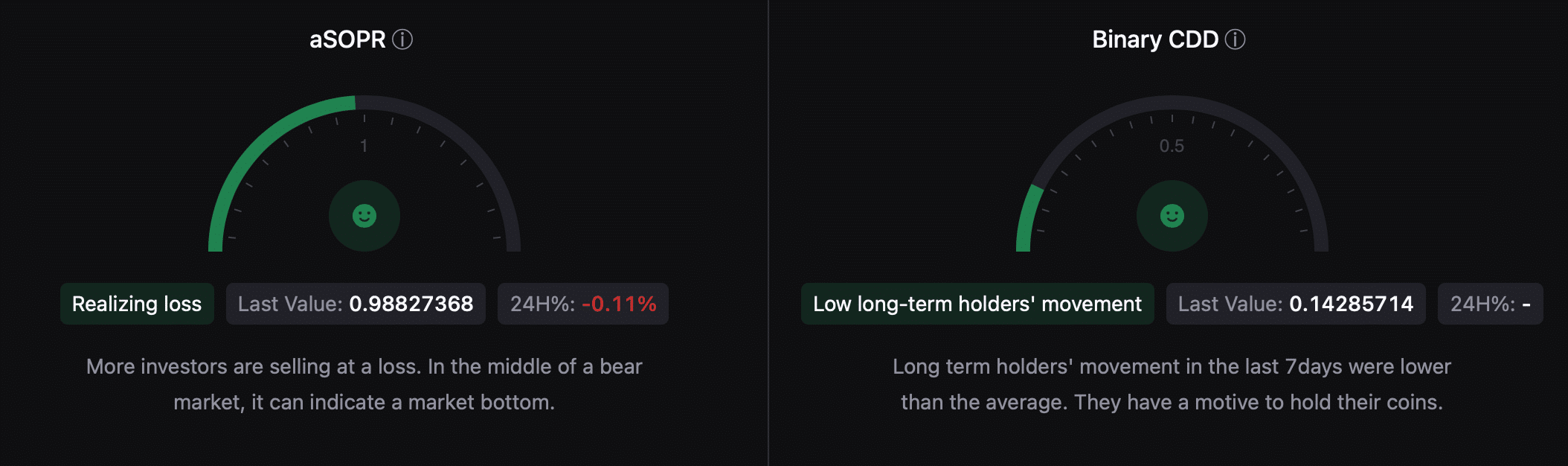

Additionally, BTC’s aSORP was green, meaning that more investors have been selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Also, its binary CDD implied that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. This can be inferred as a bullish signal.

Source: CryptoQuant

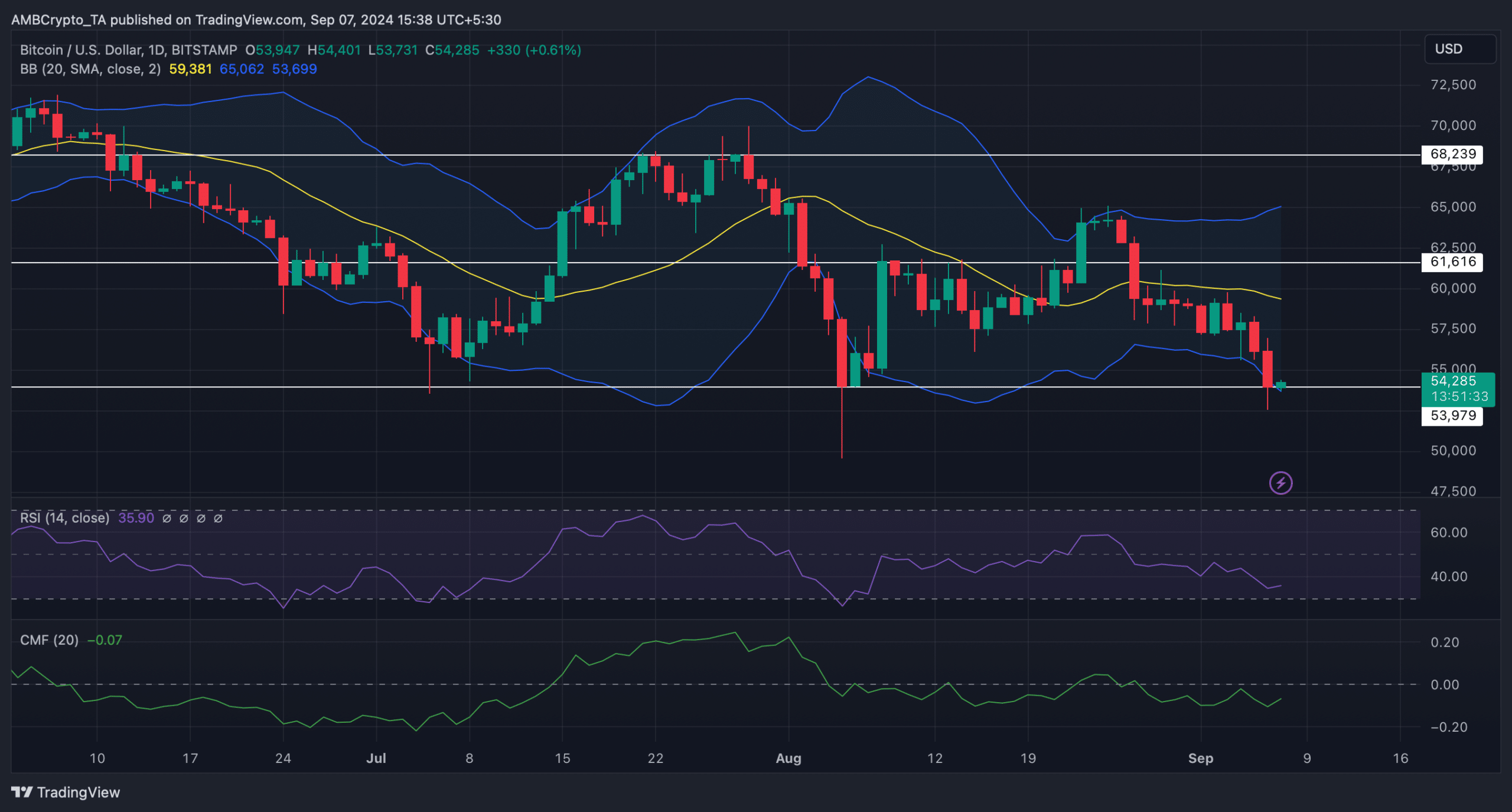

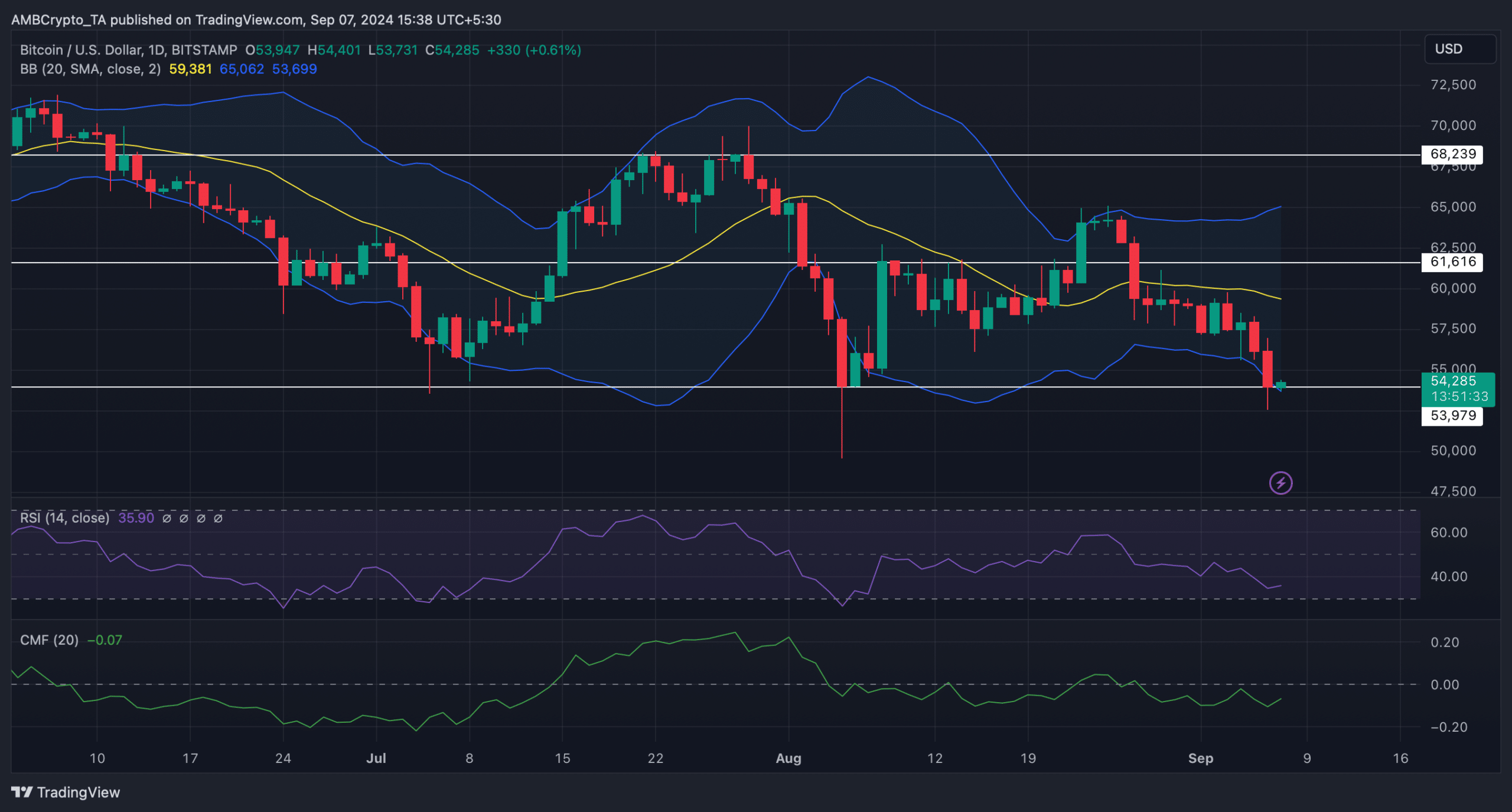

Hence, we took a look at the coin’s daily chart to better understand which way it may be heading. Our analysis revealed that BTC seemed to be testing a support level. The coin’s price also touched the lower limit of the Bollinger Bands, which often results in price hikes.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Finally, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered upticks too – Again, indicator of an upcoming hike.

Source: TradingView

- Bitcoin’s exchange reserves suggested that selling pressure was high

- Market indicators hinted at a bullish trend reversal

Bitcoin [BTC], despite a brief bout of recovery, is struggling once again after its price slipped below $55,000 on the charts. In the meantime, an institutional investor deposited BTC worth millions of dollars, fueling sell-off concerns. Does this mean that BTC may be poised to see yet another price correction in the coming days?

Are investors selling BTC?

Bitcoin, like most other cryptos, also recorded a price drop last week as the coin’s price plummeted by nearly 8%. The bearish price trend continued in the last 24 hours because it dipped by over 2%. At the time of writing, BTC was trading at $54,284.69 with a market capitalization of over $1 trillion.

While that happened, a large-scale investor sold a substantial amount of BTC. To be precise, Galaxy Digital deposited 1,458 BTC worth $78.5 million to Coinbase Prime. This update from Lookonchain suggested that whales are now selling BTC. Whenever whales sell BTC, it means that they are expecting an asset’s price to drop further.

Hence, it’s worth taking a lot at other datasets to see whether selling pressure on the coin has been rising or not.

According to AMBCrypto’s analysis of CryptoQuant’s data, Bitcoin’s exchange reserves have risen lately. By extension, this meant that selling pressure on the coin has been high.

Apart from that, at press time, both BTC’s Coinbase Premium and Funds Premium were red – A sign that selling sentiment was dominant among U.S and institutional investors.

Source: CryptoQuant

What do the market indicators suggest?

We then assessed the crypto’s metrics to find out whether they also hinted at a further price correction.

As per our analysis of Glassnode’s data, BTC’s NVT ratio fell on the charts. Whenever that happens, it suggests that an asset is undervalued, hinting at a price hike.

Source: Glassnode

Additionally, BTC’s aSORP was green, meaning that more investors have been selling at a loss. In the middle of a bear market, it can indicate a market bottom.

Also, its binary CDD implied that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. This can be inferred as a bullish signal.

Source: CryptoQuant

Hence, we took a look at the coin’s daily chart to better understand which way it may be heading. Our analysis revealed that BTC seemed to be testing a support level. The coin’s price also touched the lower limit of the Bollinger Bands, which often results in price hikes.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Finally, both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered upticks too – Again, indicator of an upcoming hike.

Source: TradingView

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Tech to Trick I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

can you buy cheap clomiphene without rx buy generic clomiphene price cost of clomiphene tablets where can i get cheap clomid where can i buy cheap clomiphene can i get cheap clomid price can you buy clomid without rx

This is a keynote which is virtually to my callousness… Many thanks! Unerringly where can I notice the connection details for questions?

This is the type of post I recoup helpful.

order azithromycin 500mg without prescription – buy generic tindamax over the counter flagyl 200mg pill

rybelsus canada – buy cyproheptadine online periactin order

motilium us – tetracycline 500mg generic order cyclobenzaprine 15mg generic

inderal pills – methotrexate 10mg sale buy methotrexate without prescription

buy generic amoxicillin – where to buy diovan without a prescription buy ipratropium 100mcg generic