- Bitcoin mining may help bulls start another major rally, according to this analysis.

- Miner reserves soared to 6-week highs despite recent market FUD.

Now that Bitcoin [BTC] is trading below $60,000 once more, many might be wondering whether it is an ideal time to buy, especially now that it has demonstrated some weakness above that key price point.

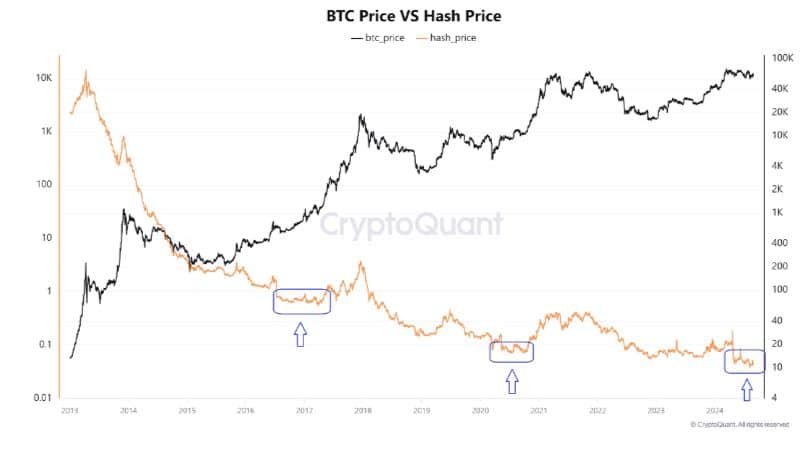

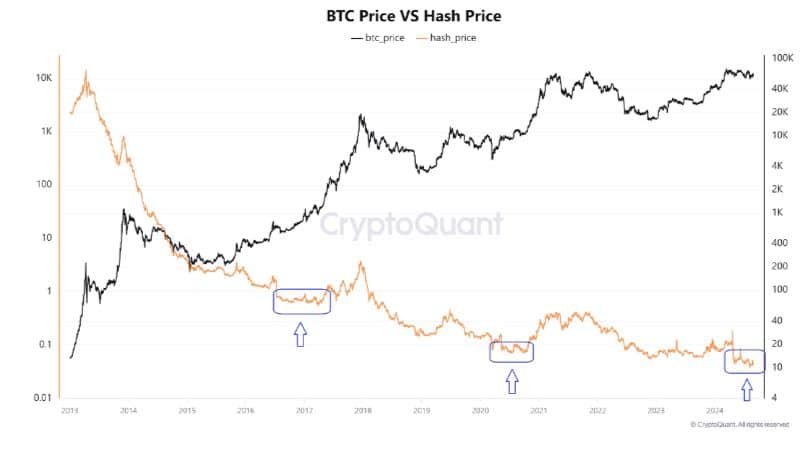

Bitcoin is currently in a buy opportunity, according to CryptoQuant analyst Woominkyu. The analyst made a bullish case for the cryptocurrency using the Bitcoin hash price, which showcased miner profitability.

Woominkyu’s analysis suggested that the hash price can be used as a bullish signal. A comparison with Bitcoin lows suggested that the hash price, at the bottom of its trend, could signal bullish opportunities ahead.

Source: CryptoQuant

The Bitcoin hash price recently dropped to its lowest historic levels. This coincided with BTC’s recent downside, especially at the start of August.

If this analysis holds true, then it suggests that Bitcoin may already be in the beginning stages of its next major rally. It also suggests that the recent pullbacks might be the best accumulation opportunities at discounted levels.

Meanwhile, decentralized mining pool operator Loka Mining plans to introduce new measures that could prevent or ease miner capitulation.

According to its CEO Andy Fajar Handika, the company will finance growth and short-term needs using forward mining contracts.

The goal is reportedly to offset some of the pressures that miners face due to declining block rewards and high operating costs.

How Bitcoin mining affects demand

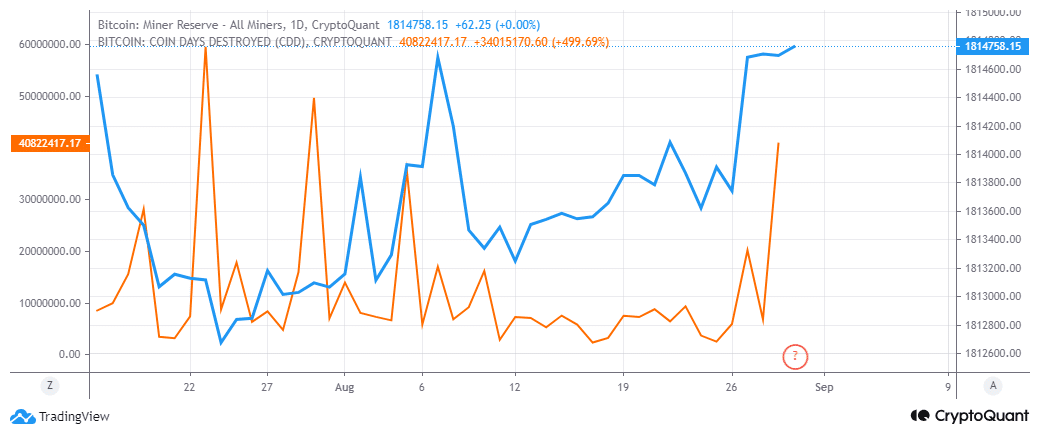

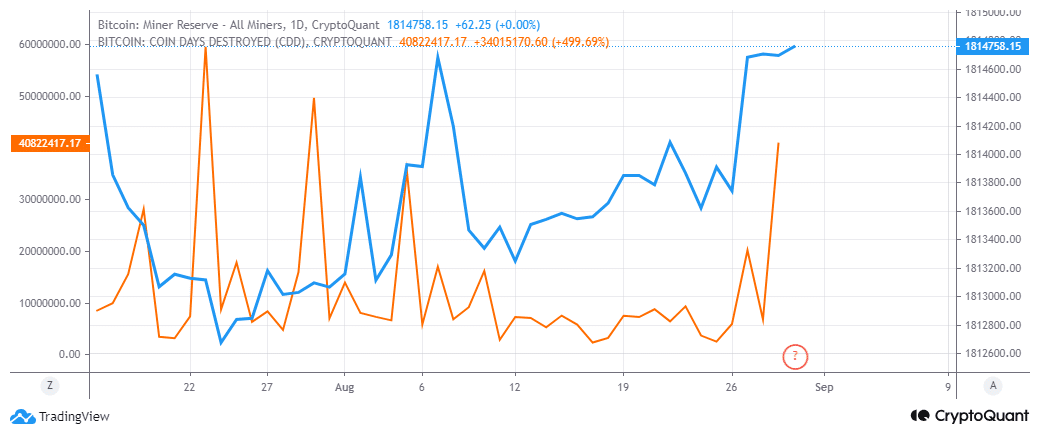

Bitcoin has so far demonstrated healthy demand below the $60,000 price level. Other miner related stats also point to a favorable sentiment for a potentially bullish outcome.

For example, miner reserves were at their highest levels in the last six weeks.

Source: CryptoQuant

The surging miner reserves suggests that miners have been HODLing their coins in anticipation of higher prices. We also observed the highest spike in coin days destroyed in August.

The second-highest spike during the month was at the peak of the dip that occurred at the start of the month.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Previous spikes in the coin days destroyed indicator were observed before a major price move. This suggests that Bitcoin could be on the verge of another highly volatile move, either to the upside or downside.

However, the above observations suggest that a higher probability of a bullish outcome. Nevertheless, traders should move cautiously considering that there is still a decent level of uncertainty in the market.

- Bitcoin mining may help bulls start another major rally, according to this analysis.

- Miner reserves soared to 6-week highs despite recent market FUD.

Now that Bitcoin [BTC] is trading below $60,000 once more, many might be wondering whether it is an ideal time to buy, especially now that it has demonstrated some weakness above that key price point.

Bitcoin is currently in a buy opportunity, according to CryptoQuant analyst Woominkyu. The analyst made a bullish case for the cryptocurrency using the Bitcoin hash price, which showcased miner profitability.

Woominkyu’s analysis suggested that the hash price can be used as a bullish signal. A comparison with Bitcoin lows suggested that the hash price, at the bottom of its trend, could signal bullish opportunities ahead.

Source: CryptoQuant

The Bitcoin hash price recently dropped to its lowest historic levels. This coincided with BTC’s recent downside, especially at the start of August.

If this analysis holds true, then it suggests that Bitcoin may already be in the beginning stages of its next major rally. It also suggests that the recent pullbacks might be the best accumulation opportunities at discounted levels.

Meanwhile, decentralized mining pool operator Loka Mining plans to introduce new measures that could prevent or ease miner capitulation.

According to its CEO Andy Fajar Handika, the company will finance growth and short-term needs using forward mining contracts.

The goal is reportedly to offset some of the pressures that miners face due to declining block rewards and high operating costs.

How Bitcoin mining affects demand

Bitcoin has so far demonstrated healthy demand below the $60,000 price level. Other miner related stats also point to a favorable sentiment for a potentially bullish outcome.

For example, miner reserves were at their highest levels in the last six weeks.

Source: CryptoQuant

The surging miner reserves suggests that miners have been HODLing their coins in anticipation of higher prices. We also observed the highest spike in coin days destroyed in August.

The second-highest spike during the month was at the peak of the dip that occurred at the start of the month.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Previous spikes in the coin days destroyed indicator were observed before a major price move. This suggests that Bitcoin could be on the verge of another highly volatile move, either to the upside or downside.

However, the above observations suggest that a higher probability of a bullish outcome. Nevertheless, traders should move cautiously considering that there is still a decent level of uncertainty in the market.

can i get clomid pills where buy cheap clomid without prescription buy cheap clomid without prescription clomid uk buy order clomiphene pill where to buy cheap clomiphene pill where can i get clomid price

This is a theme which is near to my fundamentals… Myriad thanks! Faithfully where can I lay one’s hands on the contact details in the course of questions?

More articles like this would make the blogosphere richer.

buy azithromycin pills – order zithromax online order generic flagyl 200mg

buy semaglutide pill – buy rybelsus sale buy periactin 4mg online

order domperidone – order motilium online cheap where can i buy cyclobenzaprine

propranolol cost – how to get methotrexate without a prescription methotrexate 10mg brand

where can i buy amoxil – cheap valsartan 80mg combivent price

zithromax 500mg tablet – buy bystolic 5mg generic nebivolol 20mg pills

buy augmentin generic – at bio info purchase ampicillin for sale

esomeprazole 40mg generic – https://anexamate.com/ nexium 20mg uk

buy coumadin 5mg for sale – anticoagulant buy cozaar 25mg generic

where to buy meloxicam without a prescription – https://moboxsin.com/ meloxicam 7.5mg cheap

prednisone 20mg generic – arthritis order prednisone 10mg online cheap

buy erectile dysfunction drugs over the counter – buy ed pills uk cheap ed drugs

amoxicillin over the counter – https://combamoxi.com/ buy amoxicillin without prescription

fluconazole 100mg ca – https://gpdifluca.com/ oral diflucan 100mg

lexapro price – https://escitapro.com/ escitalopram 10mg usa

buy cenforce no prescription – https://cenforcers.com/# cenforce order

why is cialis so expensive – https://ciltadgn.com/ tadalafil without a doctor’s prescription

cialis side effects a wifeРІР‚в„ўs perspective – https://strongtadafl.com/ us pharmacy prices for cialis

zantac 300mg generic – https://aranitidine.com/# buy zantac 150mg pills

buy generic viagra online canada – strongvpls buy viagra manchester

I am in truth delighted to glance at this blog posts which consists of tons of of use facts, thanks towards providing such data. https://gnolvade.com/

The thoroughness in this piece is noteworthy. https://buyfastonl.com/furosemide.html

This is the compassionate of writing I truly appreciate. https://ursxdol.com/doxycycline-antibiotic/

I’ll certainly carry back to review more. https://prohnrg.com/product/rosuvastatin-for-sale/

Thanks recompense sharing. It’s acme quality. https://aranitidine.com/fr/viagra-100mg-prix/