- BlackRock surpassed Grayscale in ETFs holdings for the first time.

- BlackRock ETFs hit $21,217,107,987, while Grayscale ETFs stood at $21,202,480,698 at press time.

BlackRock ETFs have made a historical shift, overtaking Grayscale ETFs for the first time. According to an X (formerly Twitter) post by Arkham Intelligence,

” Rocket ETF holdings overtake Grayscale for the first time. BlackRock’s ETFs IBIT and ETHA have just overtaken Grayscale’s ETFs GBTC, BTC Mini, ETHE and ETH Mini in on-chain holdings. Blackrock ETFs now have the largest collective holdings of any provider.”

This development positions BlackRock as the leader in the ETF market after overtaking Grayscale, which has been the dominant player for a long time.

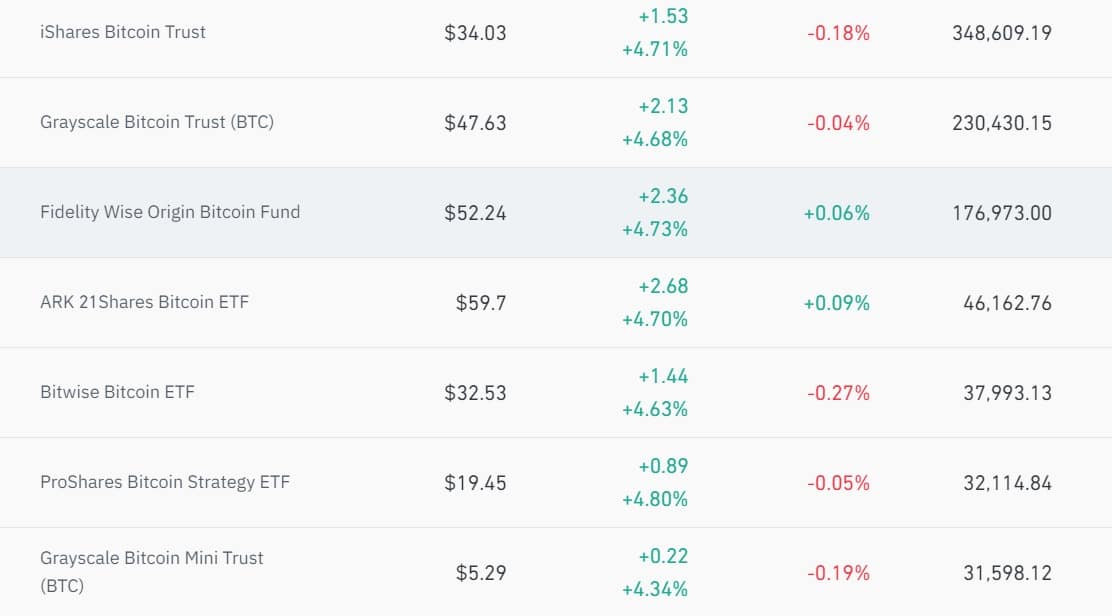

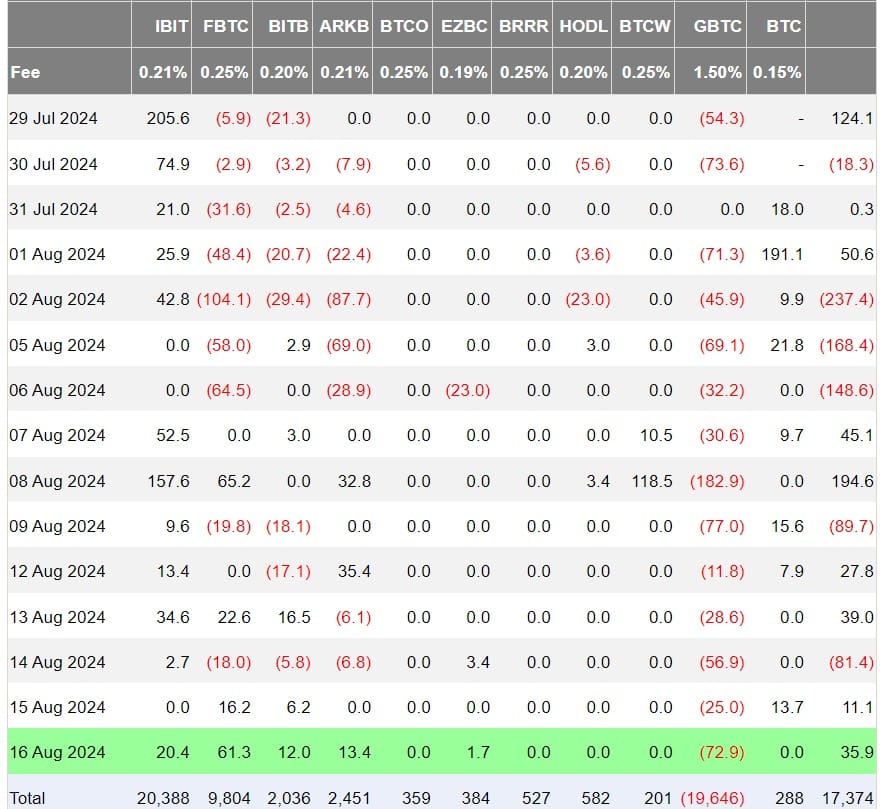

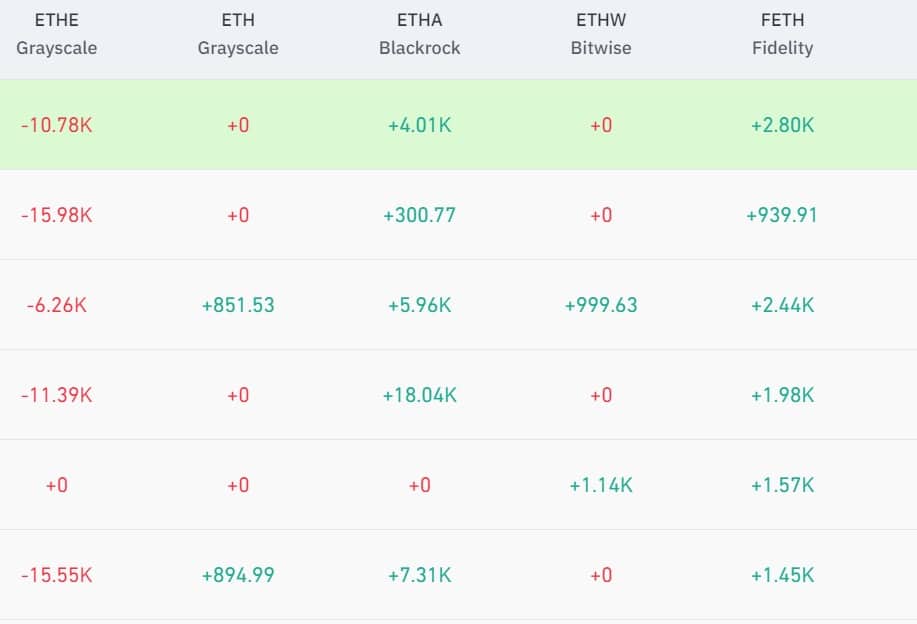

Source: Coinglass

At press time, BlackRock’s total holdings hit $21,217,107,987, while Grayscale ETF’s total holdings followed closely behind at $21,202,480,698.

Implications for Ethereum, Bitcoin

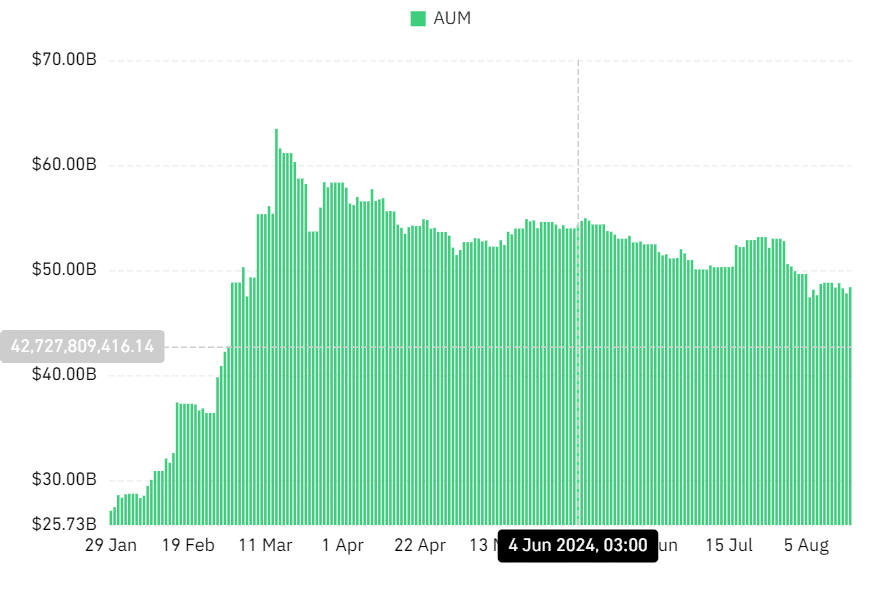

Source: Coinglass

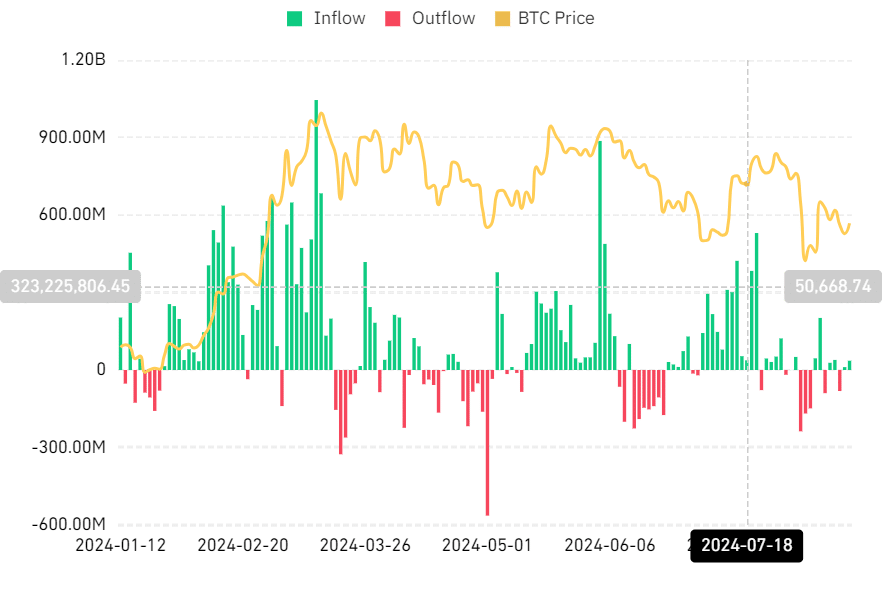

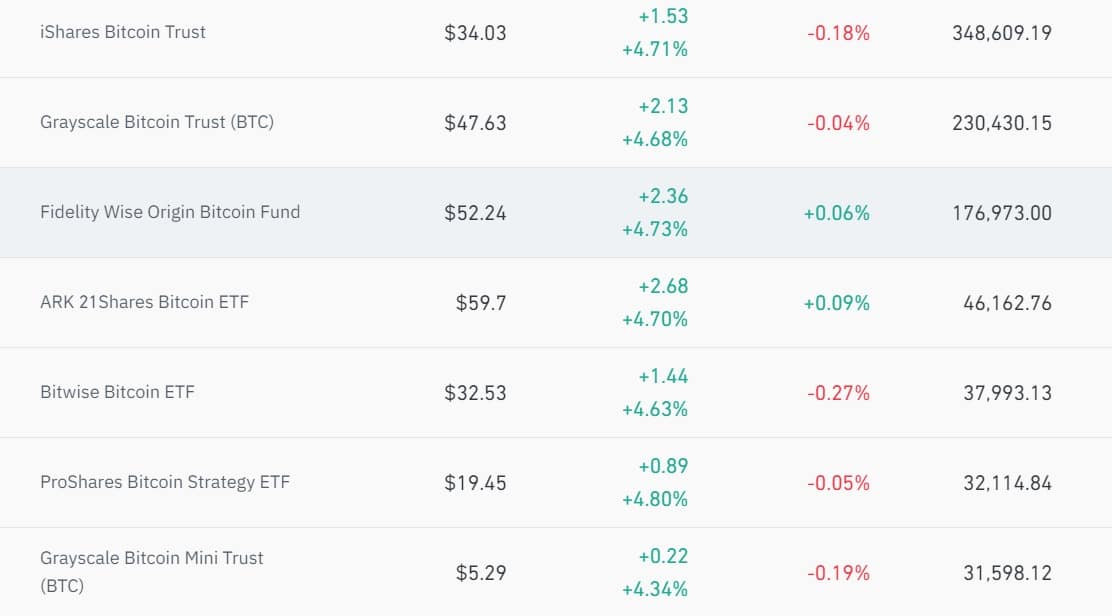

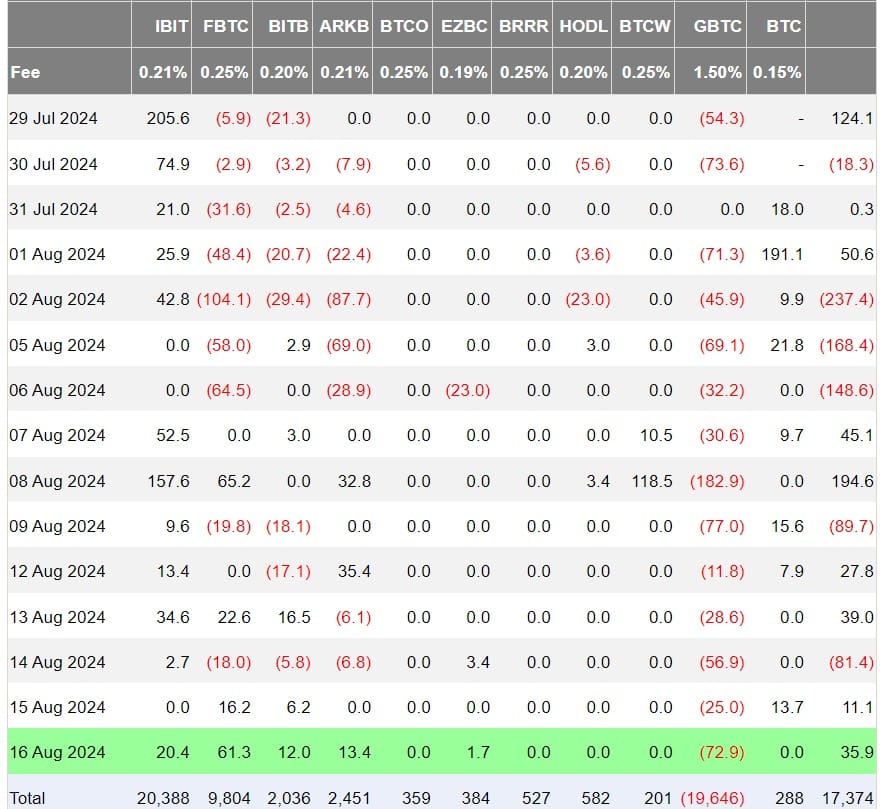

The cryptocurrency market experienced significant movements in ETF flows since this news broke.

Notably, spot Bitcoin [BTC] ETFs saw a net inflow of approximately $35.9 million, with notable contributions from Fidelity ($61.3 million) and BlackRock ($20.4 million).

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) saw an outflow of $72.9 million.

Source: Coinglass

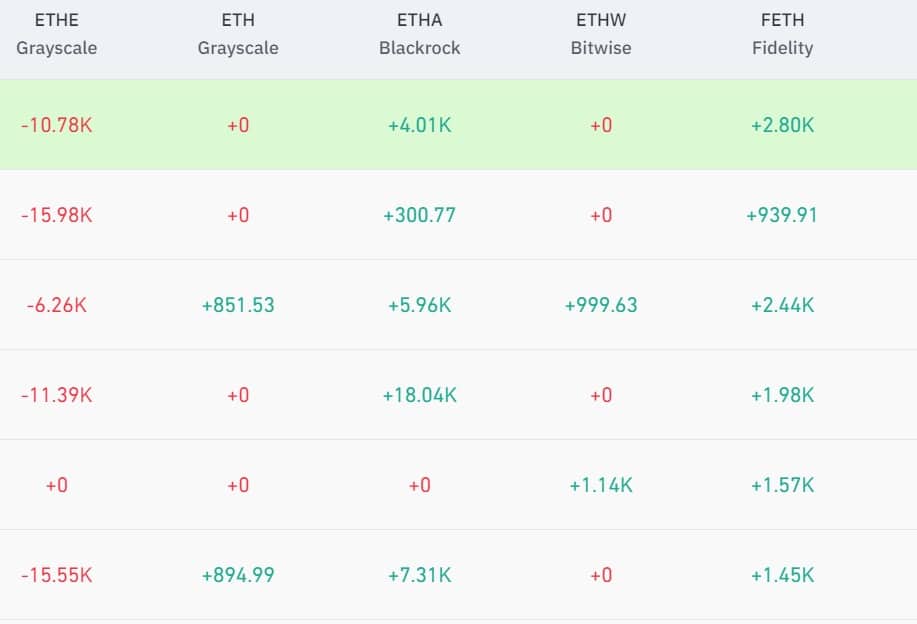

Ethereum [ETH] ETFs saw major activities as well. Spot Ethereum ETFs recorded a net outflow of $15 million.

Within the Ethereum ETFs, Grayscale’s ETHE had an outflow of $27.743 million, while BlackRock’s ETHA and Fidelity’s FETH had inflows of $10.33 million and $7.21 million, respectively.

Therefore, the total net flow for ETH spot ETFs was $7.352 billion at press time.

Source: Coinglass

The shift in preference between BlackRock and Grayscale may significantly impact crypto, especially regarding investor confidence.

Increased demand for ETFs

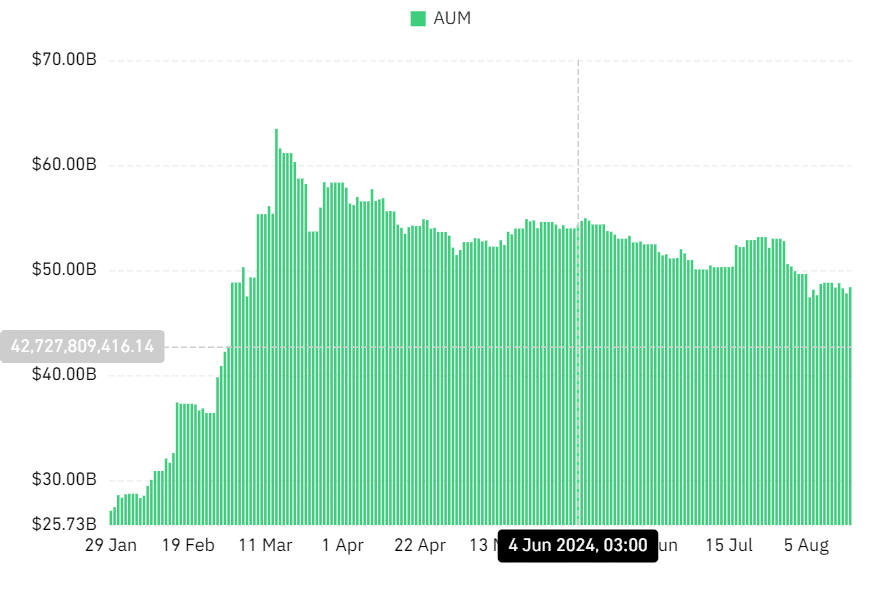

The demand for ETFs has experienced exponential growth YoY. For instance, in 2022, the net share issuance of ETFs was $609 billion. In 2023, it was $597 billion.

However, there has been a drastic surge in demand in 2024 since the approval of Bitcoin spot ETFs in January, and Ethereum spot ETFs in July.

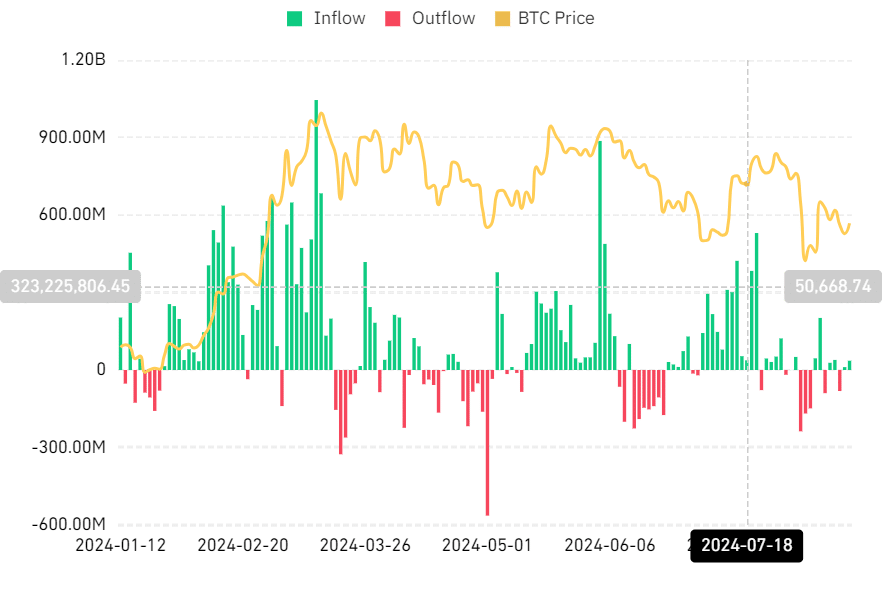

Source: Farside Investors

- BlackRock surpassed Grayscale in ETFs holdings for the first time.

- BlackRock ETFs hit $21,217,107,987, while Grayscale ETFs stood at $21,202,480,698 at press time.

BlackRock ETFs have made a historical shift, overtaking Grayscale ETFs for the first time. According to an X (formerly Twitter) post by Arkham Intelligence,

” Rocket ETF holdings overtake Grayscale for the first time. BlackRock’s ETFs IBIT and ETHA have just overtaken Grayscale’s ETFs GBTC, BTC Mini, ETHE and ETH Mini in on-chain holdings. Blackrock ETFs now have the largest collective holdings of any provider.”

This development positions BlackRock as the leader in the ETF market after overtaking Grayscale, which has been the dominant player for a long time.

Source: Coinglass

At press time, BlackRock’s total holdings hit $21,217,107,987, while Grayscale ETF’s total holdings followed closely behind at $21,202,480,698.

Implications for Ethereum, Bitcoin

Source: Coinglass

The cryptocurrency market experienced significant movements in ETF flows since this news broke.

Notably, spot Bitcoin [BTC] ETFs saw a net inflow of approximately $35.9 million, with notable contributions from Fidelity ($61.3 million) and BlackRock ($20.4 million).

Meanwhile, Grayscale’s Bitcoin Trust (GBTC) saw an outflow of $72.9 million.

Source: Coinglass

Ethereum [ETH] ETFs saw major activities as well. Spot Ethereum ETFs recorded a net outflow of $15 million.

Within the Ethereum ETFs, Grayscale’s ETHE had an outflow of $27.743 million, while BlackRock’s ETHA and Fidelity’s FETH had inflows of $10.33 million and $7.21 million, respectively.

Therefore, the total net flow for ETH spot ETFs was $7.352 billion at press time.

Source: Coinglass

The shift in preference between BlackRock and Grayscale may significantly impact crypto, especially regarding investor confidence.

Increased demand for ETFs

The demand for ETFs has experienced exponential growth YoY. For instance, in 2022, the net share issuance of ETFs was $609 billion. In 2023, it was $597 billion.

However, there has been a drastic surge in demand in 2024 since the approval of Bitcoin spot ETFs in January, and Ethereum spot ETFs in July.

Source: Farside Investors

where to get generic clomid where to buy clomiphene without dr prescription where can i get clomid without prescription where to buy clomid without dr prescription buy cheap clomid tablets can i order generic clomiphene without a prescription can i buy generic clomiphene no prescription

More articles like this would make the blogosphere richer.

With thanks. Loads of erudition!

purchase azithromycin without prescription – order ciprofloxacin pill flagyl without prescription

rybelsus 14mg sale – buy periactin 4mg for sale cyproheptadine 4mg usa

buy motilium 10mg – order flexeril 15mg generic buy flexeril online cheap

buy propranolol generic – order generic methotrexate 5mg order methotrexate 2.5mg pill

buy azithromycin 500mg for sale – order azithromycin 250mg without prescription nebivolol brand

where can i buy augmentin – atbioinfo.com acillin sale

esomeprazole pills – https://anexamate.com/ esomeprazole tablet

mobic 15mg drug – https://moboxsin.com/ meloxicam 15mg cheap

cost prednisone 5mg – aprep lson order prednisone pills

natural ed pills – fast ed to take site erectile dysfunction pills over the counter

buy amoxicillin pills – amoxil usa cheap amoxil online

buy fluconazole 100mg pills – https://gpdifluca.com/# forcan price

cenforce generic – https://cenforcers.com/ order cenforce 100mg for sale

order cialis no prescription – fast ciltad compounded tadalafil troche life span

tadalafil tamsulosin combination – cialis walmart is generic cialis available in canada

ranitidine 300mg over the counter – ranitidine 150mg pill ranitidine 300mg pill

best mail order viagra – strong vpls viagra pill 50mg

More posts like this would prosper the blogosphere more useful. https://gnolvade.com/

The depth in this ruined is exceptional. https://buyfastonl.com/furosemide.html

The sagacity in this piece is exceptional. https://ursxdol.com/clomid-for-sale-50-mg/

More peace pieces like this would urge the интернет better. https://prohnrg.com/product/atenolol-50-mg-online/

Greetings! Utter useful advice within this article! It’s the petty changes which wish obtain the largest changes. Thanks a portion for sharing! https://aranitidine.com/fr/sibelium/

I couldn’t turn down commenting. Profoundly written! https://ondactone.com/simvastatin/

More articles like this would frame the blogosphere richer.

oral meloxicam

I am in fact enchant‚e ‘ to glance at this blog posts which consists of tons of useful facts, thanks object of providing such data. https://myvisualdatabase.com/forum/profile.php?id=118014

dapagliflozin tablet – cost dapagliflozin 10 mg buy generic forxiga over the counter