- Large holders accumulated 84,000 Bitcoins worth over $5 Billion in July.

- BTC’s 2nd highest trading volume as Bitcoin ETFs inflows surge.

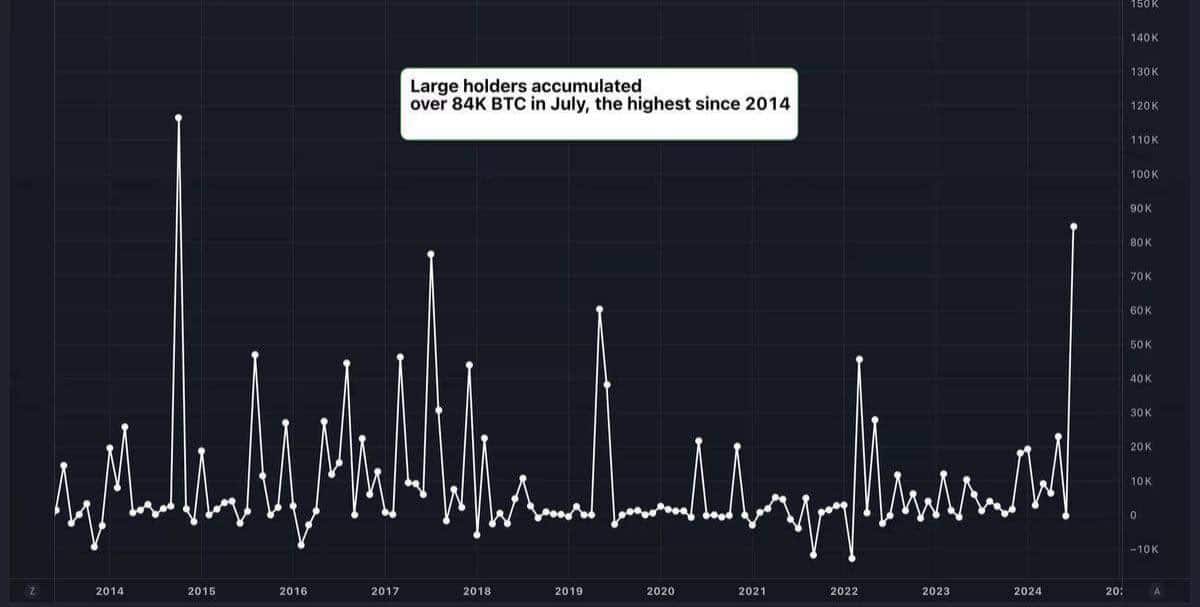

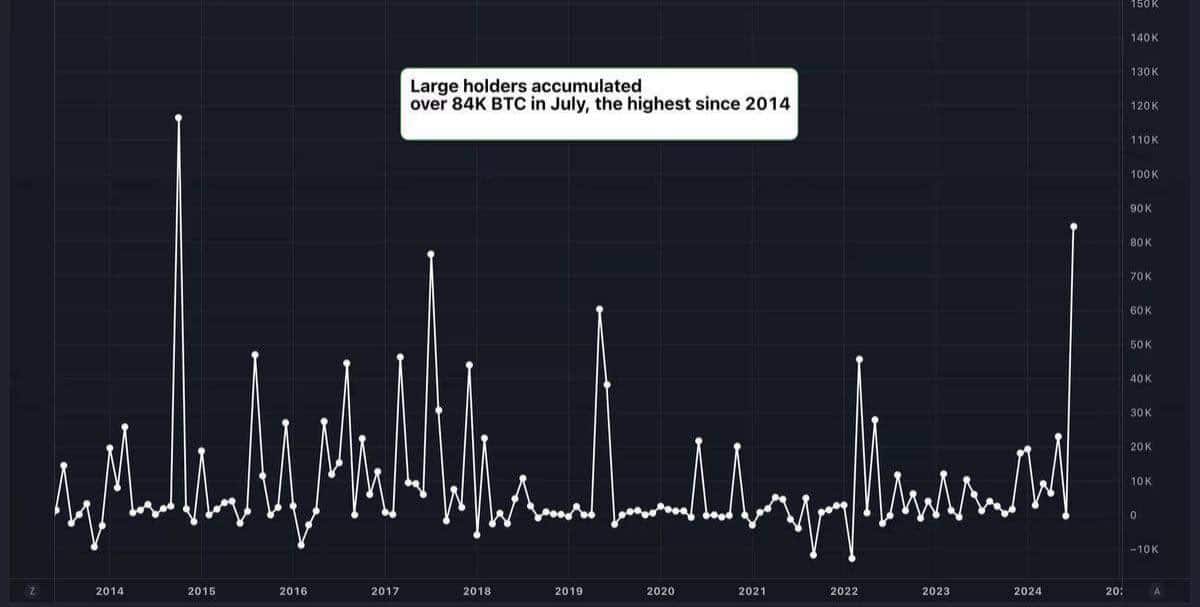

Bitcoin [BTC] whales accumulated 84,000 bitcoins, totaling $5 billion in July, marking the highest monthly increase since 2014. Such significant buying often indicates a major market shift.

This unprecedented activity suggests that Bitcoin might be on the verge of a substantial move. Historically, big accumulation by whales has often preceded major market changes. It’s a crucial time for investors to stay alert.

Source: Ash Crypto on X

Bitcoin on-chain cyclical indicators signal a bull market

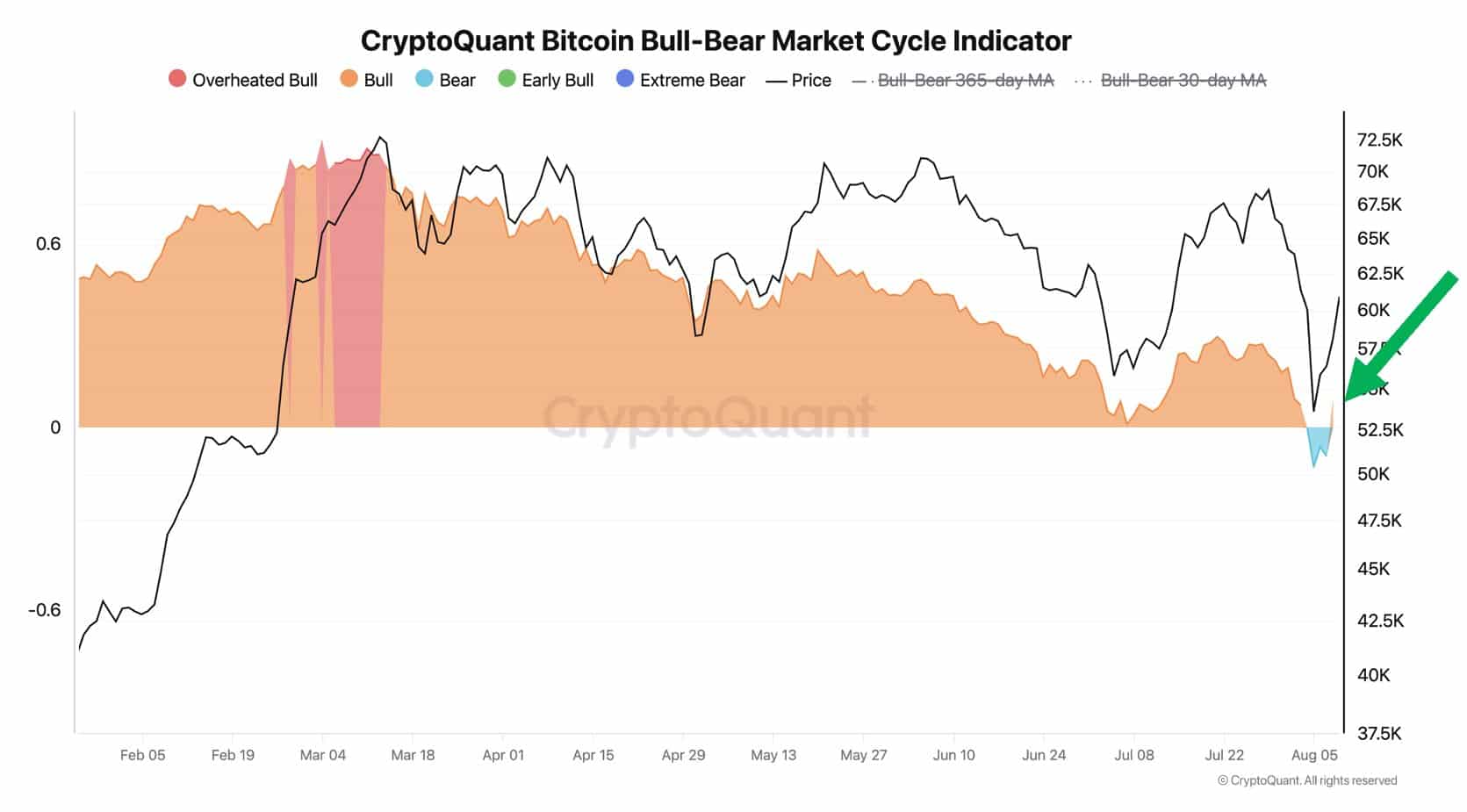

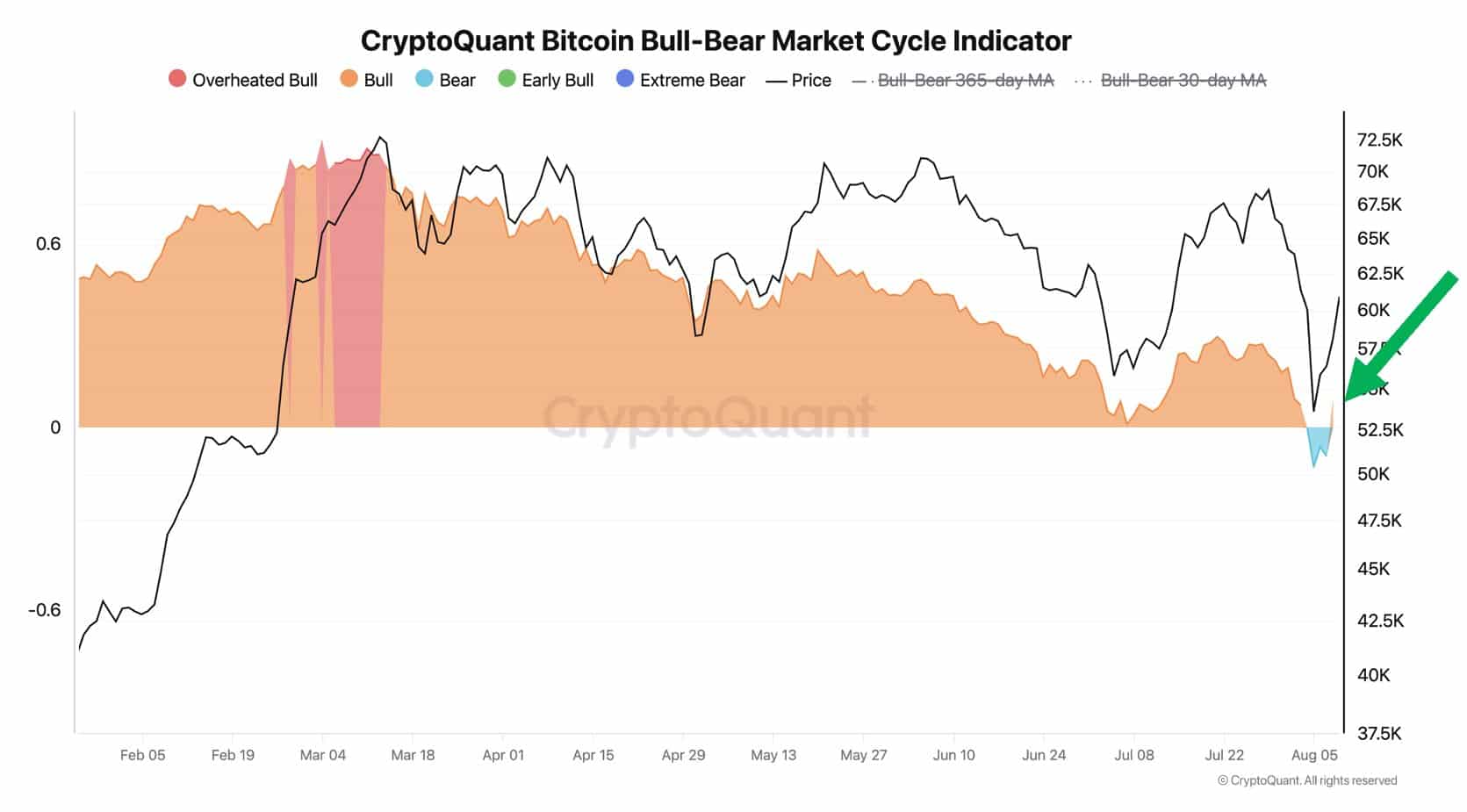

Additionally, most Bitcoin indicators including the bull-bear market cycle indicator, that were close to signaling a downturn have now returned to showing a bull market.

Bitcoin’s price was discounted briefly for just three days. Given this data, the bull market seems solid. The market is set to bounce back in two weeks.

Source: CryptoQuant

BTC futures and spot trading volume hits ATH

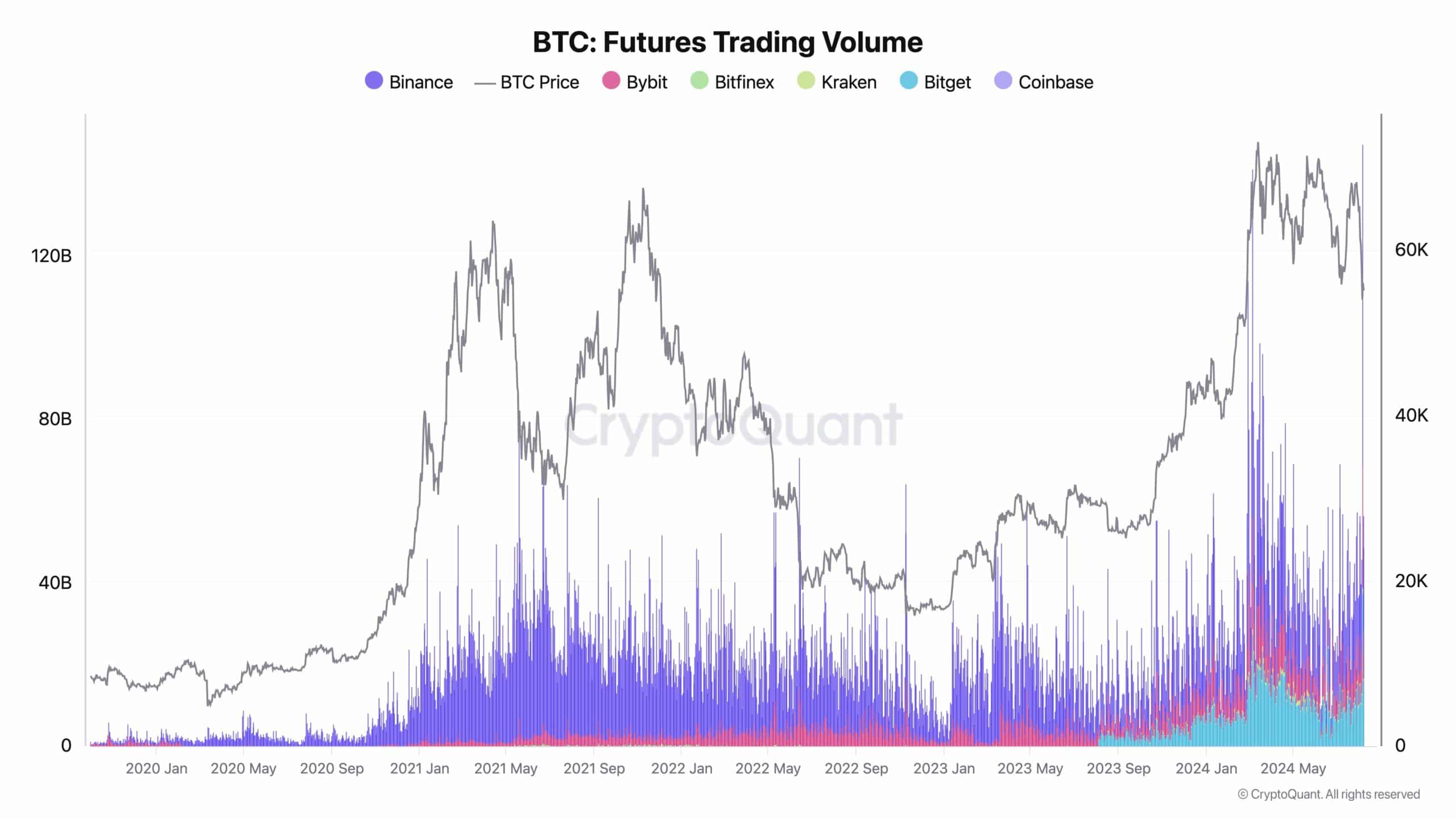

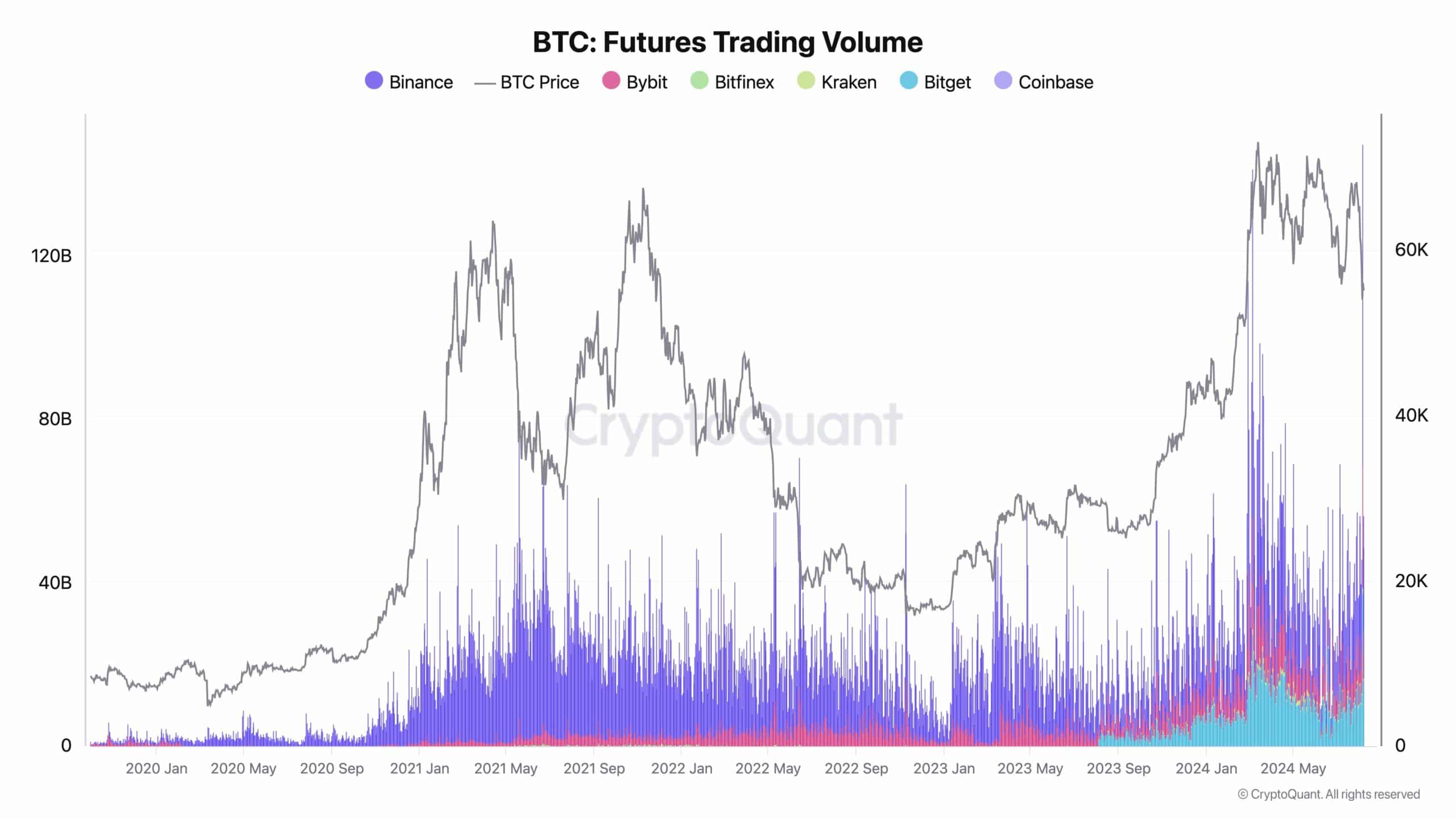

When Bitcoin fell to $50K, futures trading volume soared to a record $154 billion and spot trading volume reached $83 billion, the second-highest ever adding more confluence.

This dramatic drop was followed by a strong recovery, with Bitcoin’s price increasing by over 23% from its weekly low.

Source: CryptoQuant

ETF inflows surge

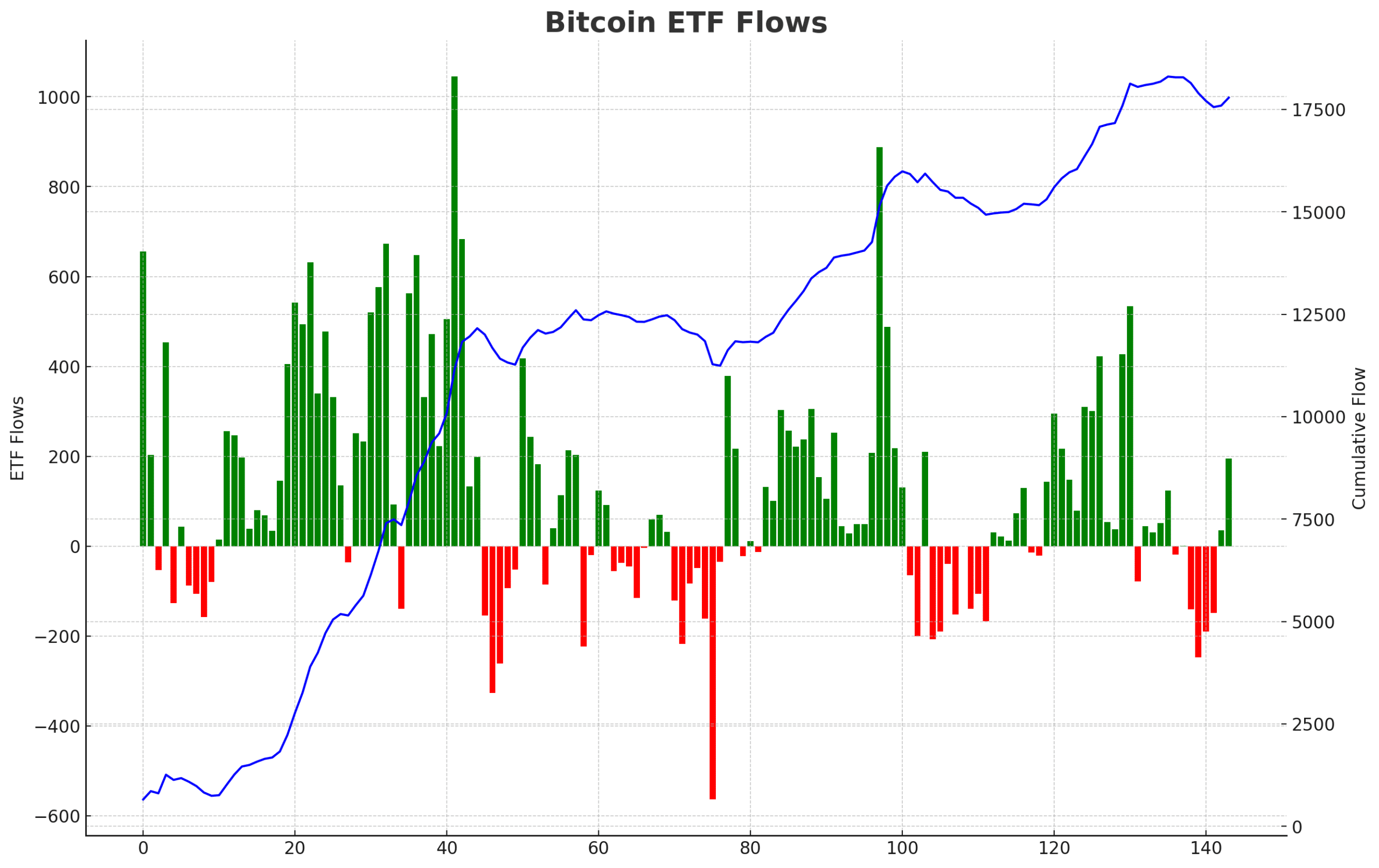

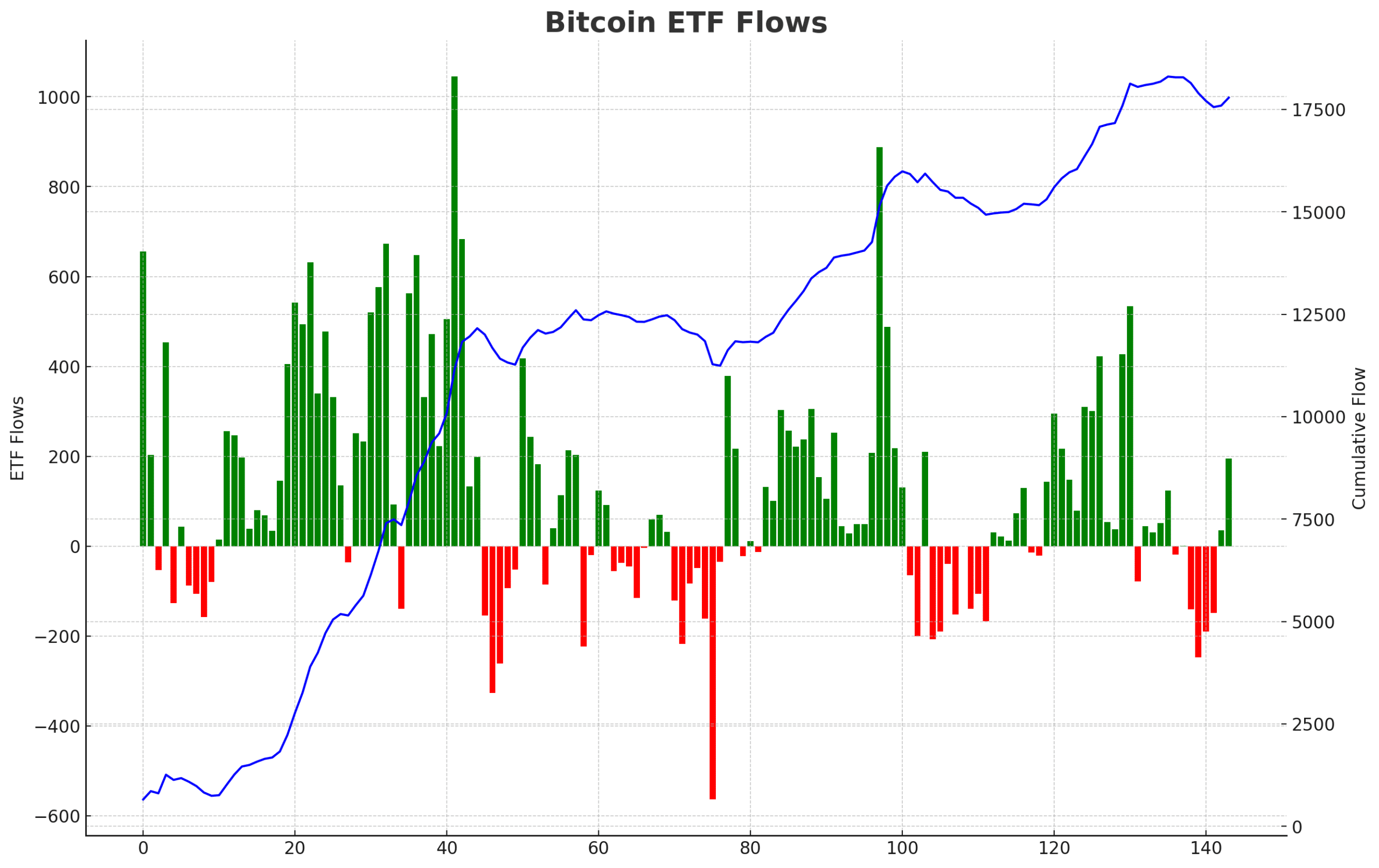

Despite Bitcoin’s fluctuations, BlackRock’s Bitcoin ETF has only experienced one day of outflows since its January launch, with over $20 billion locked.

Recently, BTC ETFs saw $194 million in inflows after five days of outflows. Notably, every time BTC drops near $50K, ETF inflows surge significantly.

This pattern has repeated, with large inflows occurring each time BTC dips to the lower $50,000s. This trend suggests that major investors are buying the dip.

Source: Bitcoin Archive on X

Bitcoin sell-side liquidity grabbed

Bitcoin has also shown an interesting pattern around the 5th of the month. In both July and August, it dropped sharply for five days at the start of the month but then experienced significant rallies.

While this might be a coincidence, it’s notable that BTC has likely absorbed sell-side liquidity, which could signal a potential rally. Analysts generally view the $70K peak as a short-term high.

- Large holders accumulated 84,000 Bitcoins worth over $5 Billion in July.

- BTC’s 2nd highest trading volume as Bitcoin ETFs inflows surge.

Bitcoin [BTC] whales accumulated 84,000 bitcoins, totaling $5 billion in July, marking the highest monthly increase since 2014. Such significant buying often indicates a major market shift.

This unprecedented activity suggests that Bitcoin might be on the verge of a substantial move. Historically, big accumulation by whales has often preceded major market changes. It’s a crucial time for investors to stay alert.

Source: Ash Crypto on X

Bitcoin on-chain cyclical indicators signal a bull market

Additionally, most Bitcoin indicators including the bull-bear market cycle indicator, that were close to signaling a downturn have now returned to showing a bull market.

Bitcoin’s price was discounted briefly for just three days. Given this data, the bull market seems solid. The market is set to bounce back in two weeks.

Source: CryptoQuant

BTC futures and spot trading volume hits ATH

When Bitcoin fell to $50K, futures trading volume soared to a record $154 billion and spot trading volume reached $83 billion, the second-highest ever adding more confluence.

This dramatic drop was followed by a strong recovery, with Bitcoin’s price increasing by over 23% from its weekly low.

Source: CryptoQuant

ETF inflows surge

Despite Bitcoin’s fluctuations, BlackRock’s Bitcoin ETF has only experienced one day of outflows since its January launch, with over $20 billion locked.

Recently, BTC ETFs saw $194 million in inflows after five days of outflows. Notably, every time BTC drops near $50K, ETF inflows surge significantly.

This pattern has repeated, with large inflows occurring each time BTC dips to the lower $50,000s. This trend suggests that major investors are buying the dip.

Source: Bitcoin Archive on X

Bitcoin sell-side liquidity grabbed

Bitcoin has also shown an interesting pattern around the 5th of the month. In both July and August, it dropped sharply for five days at the start of the month but then experienced significant rallies.

While this might be a coincidence, it’s notable that BTC has likely absorbed sell-side liquidity, which could signal a potential rally. Analysts generally view the $70K peak as a short-term high.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

I am extremely impressed together with your writing skills as neatly as with the structure on your weblog. Is this a paid theme or did you customize it your self? Anyway keep up the excellent high quality writing, it’s rare to see a nice blog like this one these days!

generic clomid c10m1d order clomiphene without insurance how can i get clomid without dr prescription where can i buy cheap clomiphene without prescription where to get cheap clomid without dr prescription where to get generic clomid price clomid generico

Thanks an eye to sharing. It’s top quality.

Facts blog you have here.. It’s hard to on strong quality writing like yours these days. I justifiably appreciate individuals like you! Go through vigilance!!

purchase rybelsus generic – buy rybelsus 14 mg pills buy periactin 4 mg pill

where to buy motilium without a prescription – buy cheap generic cyclobenzaprine order cyclobenzaprine 15mg

how to get inderal without a prescription – clopidogrel uk buy methotrexate 10mg pill