- U.S. Bitcoin ETFs experience the third-largest sell-off, highlighting the contrasting moves in the crypto markets.

- History is set to repeat itself as analysts predict a bull run similar to that of 2021 after FED cuts interests rate this September.

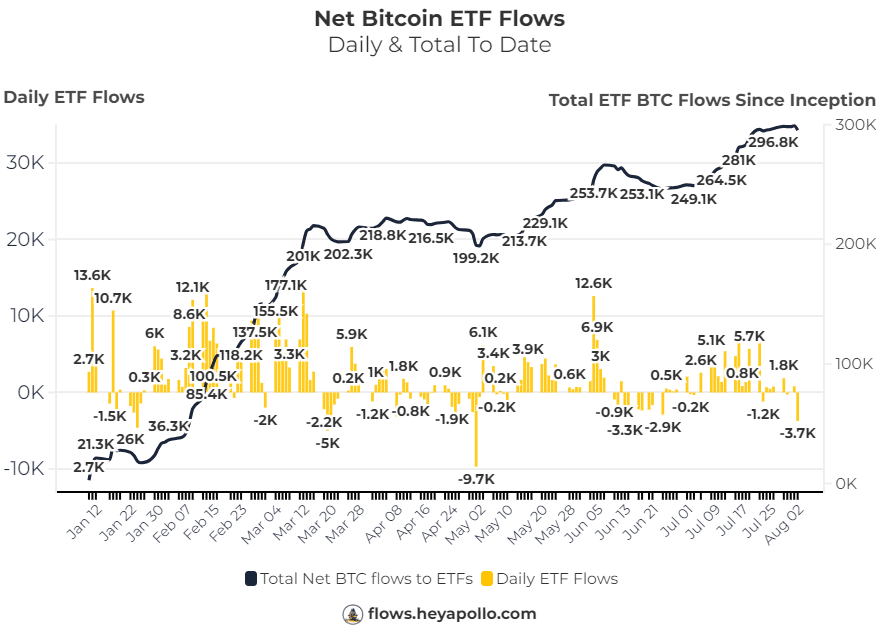

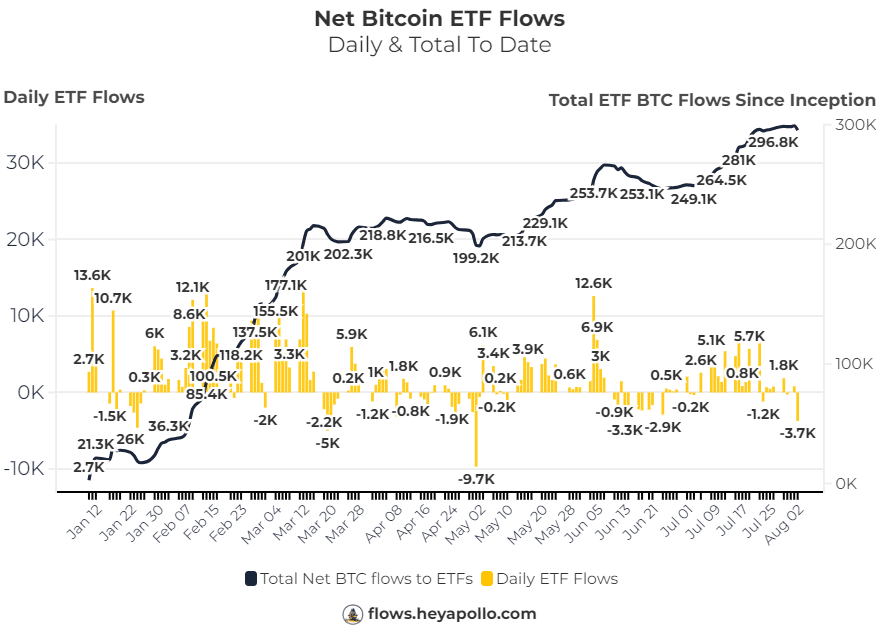

U.S. ETFs recently traded 3,750 Bitcoin [BTC], marking the third-largest sell-off since their inception. Despite this, BlackRock bucked the trend by buying 683 BTC.

Meanwhile, other major players in the ETF market made significant sales: Fidelity offloaded 1,646 BTC, ARK sold 1,387 BTC, Grayscale parted with 569 BTC, Bitwise sold 465 BTC, and VanEck sold 364 BTC.

This substantial sell-off as per Net Bitcoin ETF Flows on Flows.heyapollo.com reflected varied strategies and market perspectives among these leading financial institutions.

The contrasting moves highlighted the ongoing volatility and differing outlooks within the cryptocurrency market, particularly among institutional investors.

This may result in short-term decline on the Bitcoin market.

Source: Flows.heyapollo.com

Will August see Bitcoin reach $44k?

There is potential for the crypto market to get slammed into next week, but this is when you want to be bullish, not during big green candles on the back of $BTC strategic reserve news story.

BTC was bearish from mid-March to April, failed to break the high in May, and became bearish again from mid-June.

The bias remains unchanged, expecting a low in August though we don’t know exactly where this low will land, but soon it will be bullish again.

First, we must enter the demand zone and the period of opportunity. The BTCUSD chart suggested that reaching the $44k zone might lead to price skyrocketing to $100k.

Source: TradingView

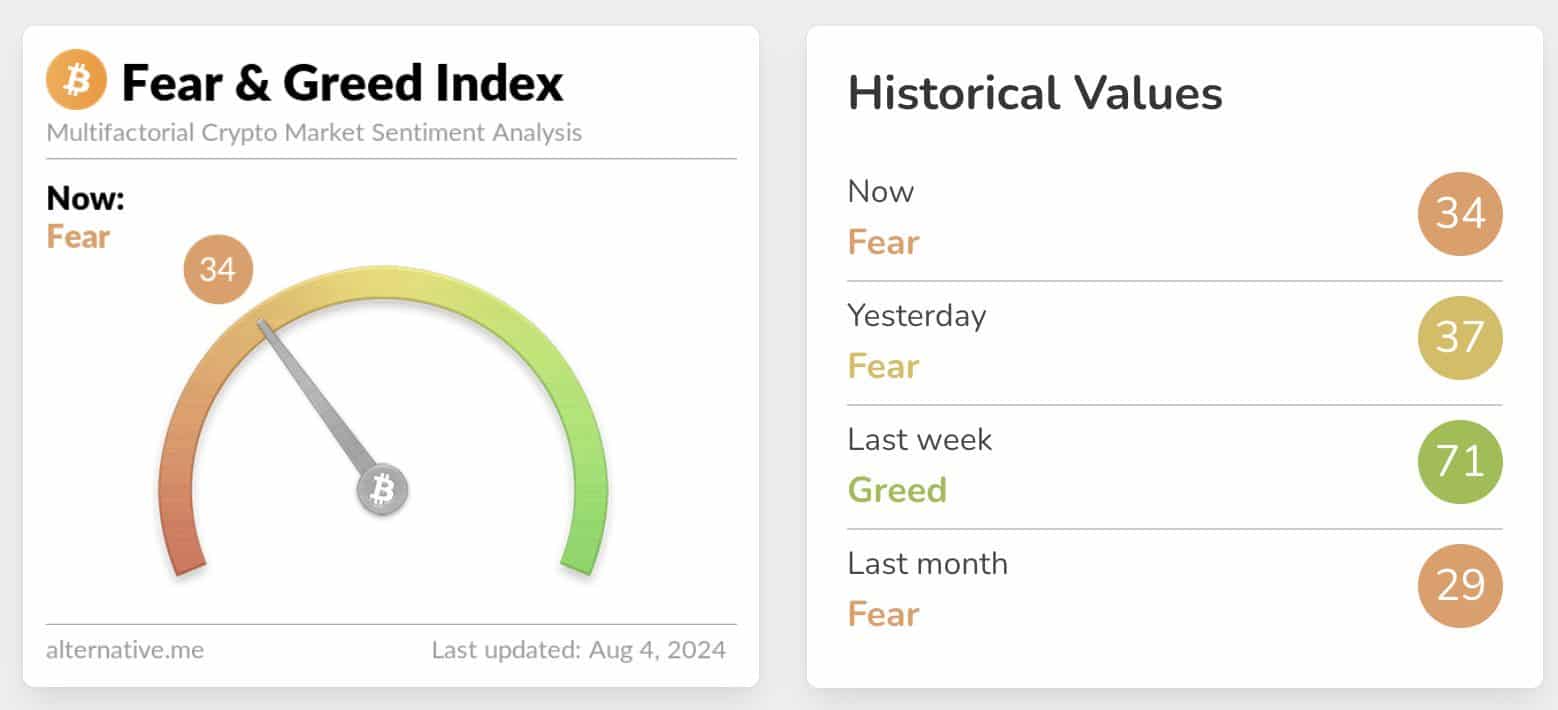

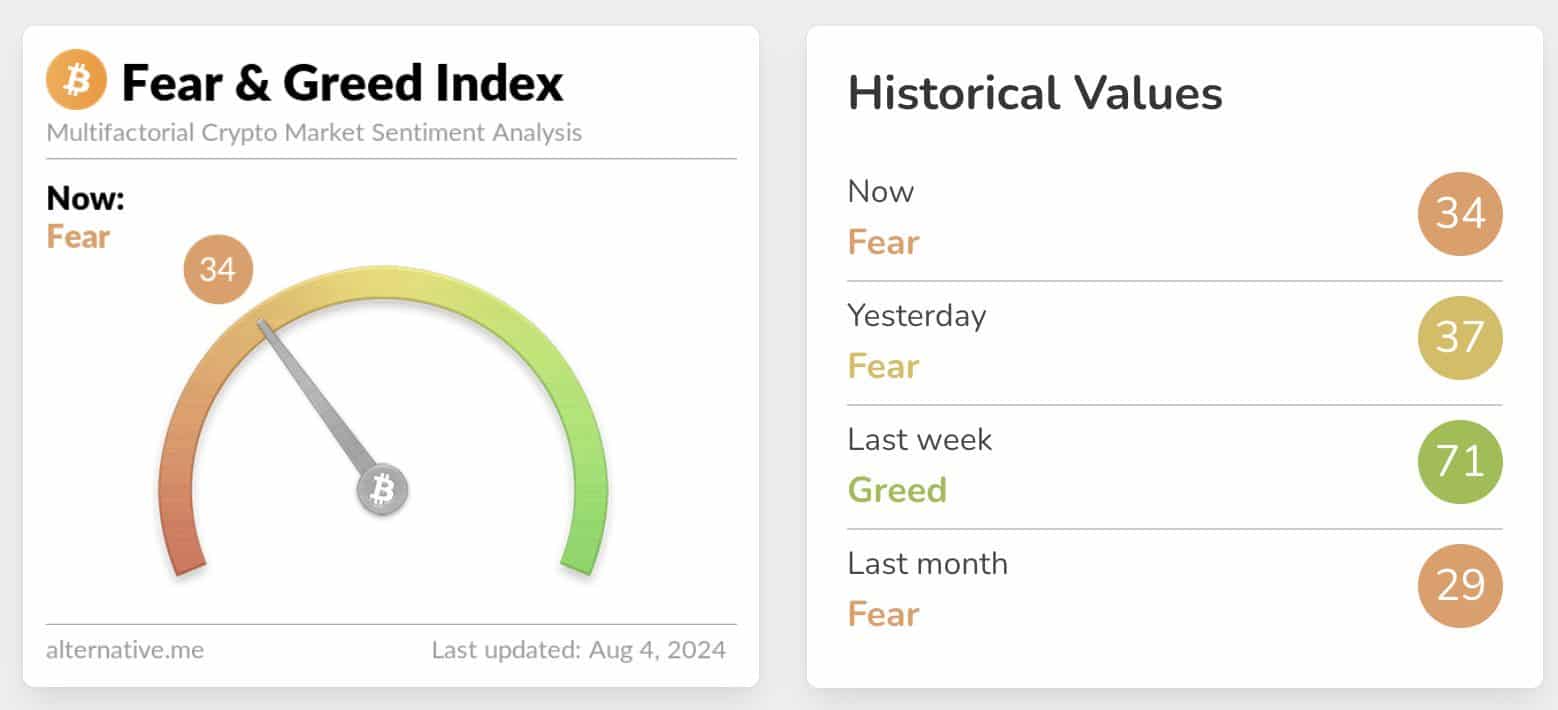

Additionally, in just two weeks, the Fear & Greed Index has shifted from a greedy 71 to a fearful 34, indicating that more people are liquidating their assets amidst rising market uncertainty.

Source: Alternative.me

Will the 2021 crypto bull run repeat itself?

However, 2020 history seems poised to repeat itself when markets crashed due to economic fear from COVID-19 and the ensuing economic decline but later rallied.

The Federal Reserve responded by cutting interest rates and implementing quantitative easing to support the economy, leading to the crypto bull market of 2021.

Today, markets are again plummeting due to economic fears from a weak job report and economic decline.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The Federal Reserve is expected to cut rates in September and initiate quantitative easing once more.

AMBCrypto’s analysis of TradingView data suggested similar economic fears and monetary responses are in play, potentially setting the stage for another market recovery akin to the post-2020 scenario.

Source: TradingView

- U.S. Bitcoin ETFs experience the third-largest sell-off, highlighting the contrasting moves in the crypto markets.

- History is set to repeat itself as analysts predict a bull run similar to that of 2021 after FED cuts interests rate this September.

U.S. ETFs recently traded 3,750 Bitcoin [BTC], marking the third-largest sell-off since their inception. Despite this, BlackRock bucked the trend by buying 683 BTC.

Meanwhile, other major players in the ETF market made significant sales: Fidelity offloaded 1,646 BTC, ARK sold 1,387 BTC, Grayscale parted with 569 BTC, Bitwise sold 465 BTC, and VanEck sold 364 BTC.

This substantial sell-off as per Net Bitcoin ETF Flows on Flows.heyapollo.com reflected varied strategies and market perspectives among these leading financial institutions.

The contrasting moves highlighted the ongoing volatility and differing outlooks within the cryptocurrency market, particularly among institutional investors.

This may result in short-term decline on the Bitcoin market.

Source: Flows.heyapollo.com

Will August see Bitcoin reach $44k?

There is potential for the crypto market to get slammed into next week, but this is when you want to be bullish, not during big green candles on the back of $BTC strategic reserve news story.

BTC was bearish from mid-March to April, failed to break the high in May, and became bearish again from mid-June.

The bias remains unchanged, expecting a low in August though we don’t know exactly where this low will land, but soon it will be bullish again.

First, we must enter the demand zone and the period of opportunity. The BTCUSD chart suggested that reaching the $44k zone might lead to price skyrocketing to $100k.

Source: TradingView

Additionally, in just two weeks, the Fear & Greed Index has shifted from a greedy 71 to a fearful 34, indicating that more people are liquidating their assets amidst rising market uncertainty.

Source: Alternative.me

Will the 2021 crypto bull run repeat itself?

However, 2020 history seems poised to repeat itself when markets crashed due to economic fear from COVID-19 and the ensuing economic decline but later rallied.

The Federal Reserve responded by cutting interest rates and implementing quantitative easing to support the economy, leading to the crypto bull market of 2021.

Today, markets are again plummeting due to economic fears from a weak job report and economic decline.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The Federal Reserve is expected to cut rates in September and initiate quantitative easing once more.

AMBCrypto’s analysis of TradingView data suggested similar economic fears and monetary responses are in play, potentially setting the stage for another market recovery akin to the post-2020 scenario.

Source: TradingView

Normally I do not read article on blogs however I would like to say that this writeup very forced me to try and do so Your writing style has been amazed me Thanks quite great post

What¦s Taking place i am new to this, I stumbled upon this I have discovered It absolutely useful and it has aided me out loads. I hope to contribute & aid different users like its aided me. Great job.

Outstanding post however I was wanting to know if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit further. Thanks!

I simply could not leave your web site prior to suggesting that I really loved the standard info a person provide in your guests? Is going to be again regularly to check up on new posts

where can i buy generic clomid price generic clomiphene online how can i get cheap clomiphene without dr prescription how to buy clomid price where can i get cheap clomid without dr prescription where can i buy cheap clomiphene tablets clomid generic brand

With thanks. Loads of knowledge!

With thanks. Loads of knowledge!

order rybelsus 14 mg pills – buy generic semaglutide 14 mg order periactin 4mg online cheap

motilium 10mg generic – order motilium 10mg for sale purchase flexeril pills

inderal pills – order methotrexate 10mg pills buy methotrexate 2.5mg pill

Along with everything which seems to be building throughout this specific area, a significant percentage of viewpoints are generally rather radical. Even so, I am sorry, but I can not give credence to your entire plan, all be it refreshing none the less. It looks to everybody that your opinions are generally not entirely rationalized and in actuality you are yourself not wholly certain of the assertion. In any case I did appreciate reading it.

order amoxiclav online cheap – https://atbioinfo.com/ order ampicillin online

purchase nexium pills – anexamate.com purchase esomeprazole for sale

coumadin 5mg generic – https://coumamide.com/ cheap losartan 50mg

mobic 15mg tablet – tenderness order mobic 7.5mg pill

Hello. splendid job. I did not anticipate this. This is a great story. Thanks!

online ed medications – https://fastedtotake.com/ buy ed pills cheap

amoxicillin pills – buy cheap amoxil purchase amoxicillin online cheap

buy fluconazole without prescription – this forcan over the counter

lexapro for sale – https://escitapro.com/ lexapro online buy

cenforce ca – https://cenforcers.com/# buy cenforce tablets

I?¦m not sure the place you’re getting your info, however good topic. I must spend a while learning much more or understanding more. Thanks for wonderful info I was in search of this information for my mission.

cialis where can i buy – https://ciltadgn.com/# where to get free samples of cialis

zantac price – on this site ranitidine 150mg tablet

how much does cialis cost per pill – https://strongtadafl.com/ cialis available in walgreens over counter??

Greetings! Utter serviceable suggestion within this article! It’s the petty changes which choice make the largest changes. Thanks a a quantity in the direction of sharing! buy generic neurontin 100mg

More delight pieces like this would create the web better. https://ursxdol.com/ventolin-albuterol/

More content pieces like this would make the интернет better. https://prohnrg.com/product/atenolol-50-mg-online/

he blog was how do i say it… relevant, finally something that helped me. Thanks

I’ll certainly carry back to be familiar with more. https://aranitidine.com/fr/ciagra-professional-20-mg/

Thanks on putting this up. It’s evidently done. https://ondactone.com/spironolactone/

Thanks towards putting this up. It’s well done.

https://doxycyclinege.com/pro/warfarin/

This is a keynote which is in to my heart… Diverse thanks! Faithfully where can I upon the acquaintance details an eye to questions? https://www.forum-joyingauto.com/member.php?action=profile&uid=47847

Thank you for any other informative site. Where else could I am getting that kind of info written in such a perfect manner? I have a project that I am simply now operating on, and I’ve been on the look out for such information.

I’ve recently started a web site, the info you provide on this website has helped me tremendously. Thank you for all of your time & work.

I’m impressed, I must say. Really hardly ever do I encounter a weblog that’s each educative and entertaining, and let me inform you, you will have hit the nail on the head. Your concept is outstanding; the problem is something that not enough individuals are speaking intelligently about. I am very glad that I stumbled throughout this in my search for one thing referring to this.

buy cheap generic forxiga – https://janozin.com/# order dapagliflozin 10 mg generic

Great awesome things here. I am very glad to look your article. Thanks a lot and i’m looking ahead to contact you. Will you kindly drop me a e-mail?

order xenical online cheap – janozin.com order orlistat online cheap

I’m writing to let you know of the impressive encounter my wife’s daughter experienced studying your site. She noticed plenty of pieces, which include what it’s like to have a wonderful teaching character to let many people very easily have an understanding of various extremely tough things. You actually surpassed people’s expected results. Many thanks for giving those warm and friendly, trustworthy, educational and also easy guidance on this topic to Gloria.

This is the make of delivery I find helpful. http://bbs.51pinzhi.cn/home.php?mod=space&uid=7112692