- Ethereum poised to have a positive quarter ahead according to new research.

- AI tokens dominated in the social space and performed positively YTD.

Ethereum [ETH] and AI tokens have had a positive run over the last few months.

Interestingly, Grayscale Research believes the upcoming quarter will be heavily influenced by the recent approval of spot Ether exchange-traded products (ETPs) in the U.S. market.

This is a significant development as the Securities and Exchange Commission (SEC) greenlit Form 19b-4 filings in late May, allowing several issuers to list these Ether ETPs on U.S. exchanges.

ETPs to help ETH

Grayscale’s market analysis assumes ETPs will begin trading in Q3 2024.

Similar to the successful launch of spot Bitcoin ETPs in January, Grayscale Research anticipates these Ether products will attract significant net inflows, albeit likely to a lesser extent than their Bitcoin counterparts.

This could potentially translate to price support for Ethereum itself and tokens within its ecosystem.

The launch of spot Ether ETPs is expected to bring additional focus to the unique features of the Ethereum network. Unlike other blockchains, Ethereum utilizes a modular design approach, where different infrastructure components work together to optimize user experience and reduce costs.

Furthermore, Ethereum boasts the largest decentralized finance (DeFi) ecosystem in the crypto space and is a hub for tokenization projects.

Increased interest and adoption of Ethereum fueled by ETP approval could lead to rising activity and valuation support for specific Layer 2 tokens such as Mantle, prominent DeFi protocols like Uniswap, Maker, Aave, and other crucial assets within the Ethereum network such as Lido, a staking protocol.

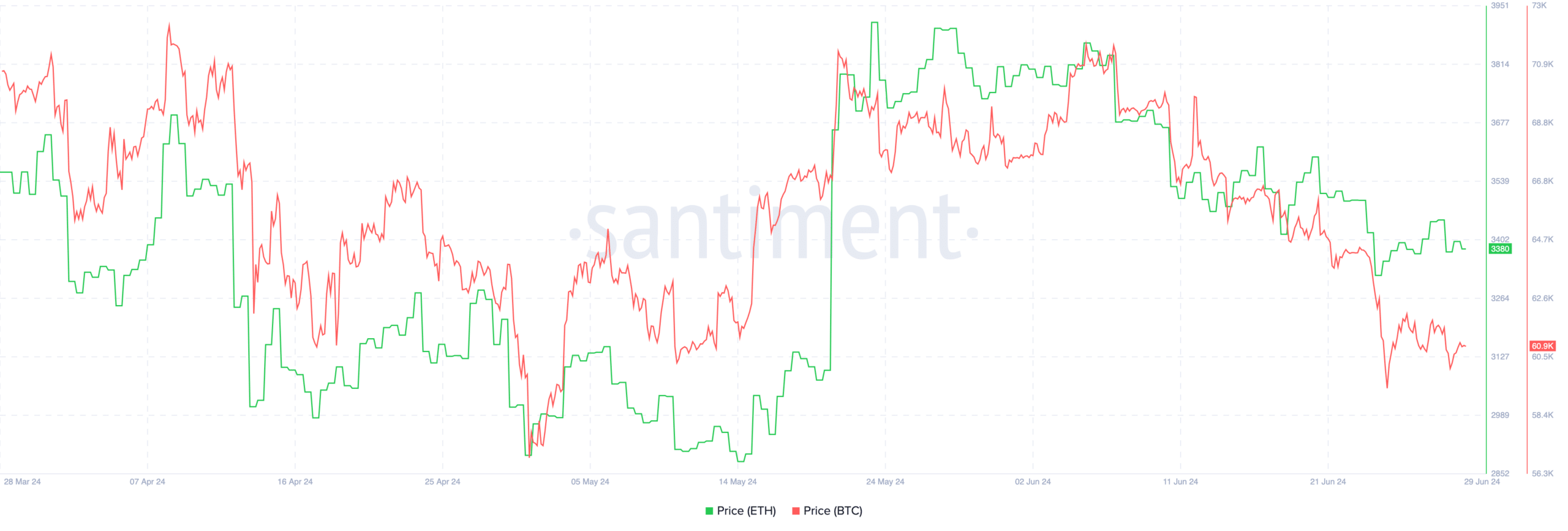

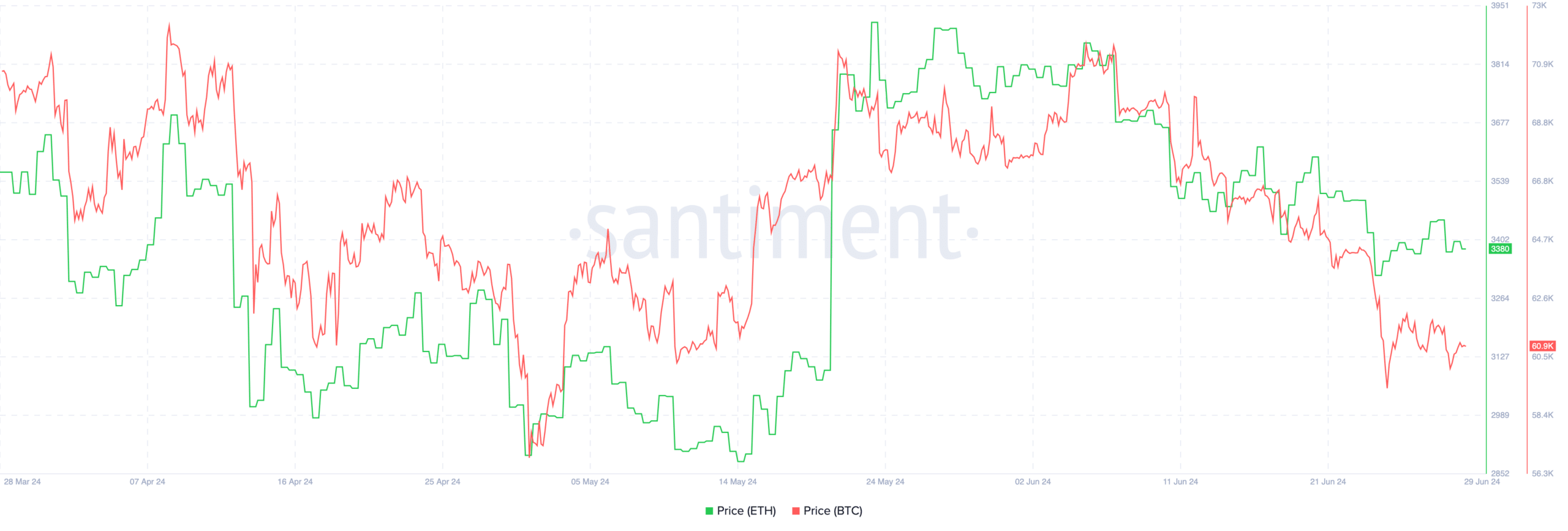

One key factor that could showcase how interest in Ethereum has been growing could be how ETH’s price has remained resilient while BTC’s prices have plummeted.

Despite both ETH and BTC being heavily correlated, recent market drawdowns haven’t impacted ETH as harshly as BTC.

Source: Santiment

While spot Ether ETPs represent a major development, Grayscale Research anticipates other ongoing market themes to remain relevant in the coming quarter.

A key area of focus will be the potential for blockchain technology to intersect with the field of Artificial Intelligence (AI).

Are AI tokens doing good?

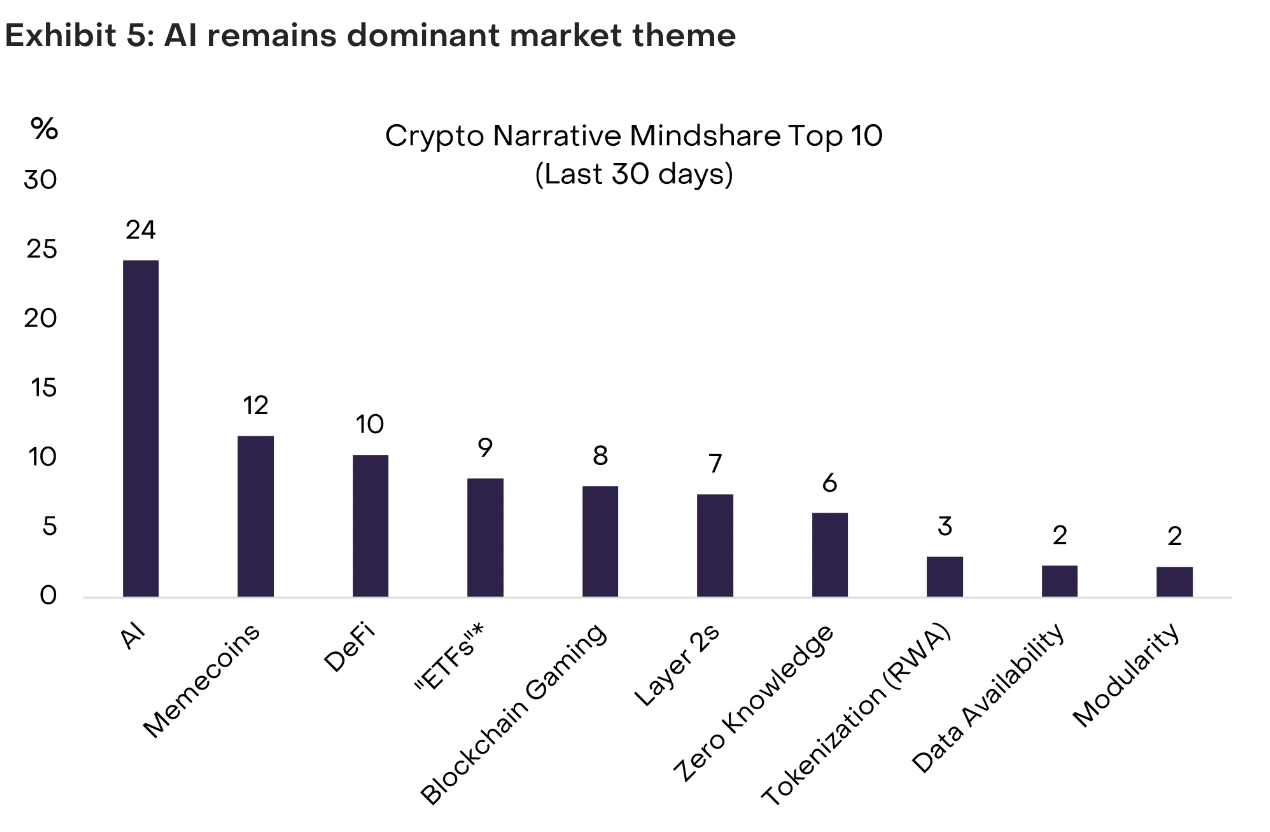

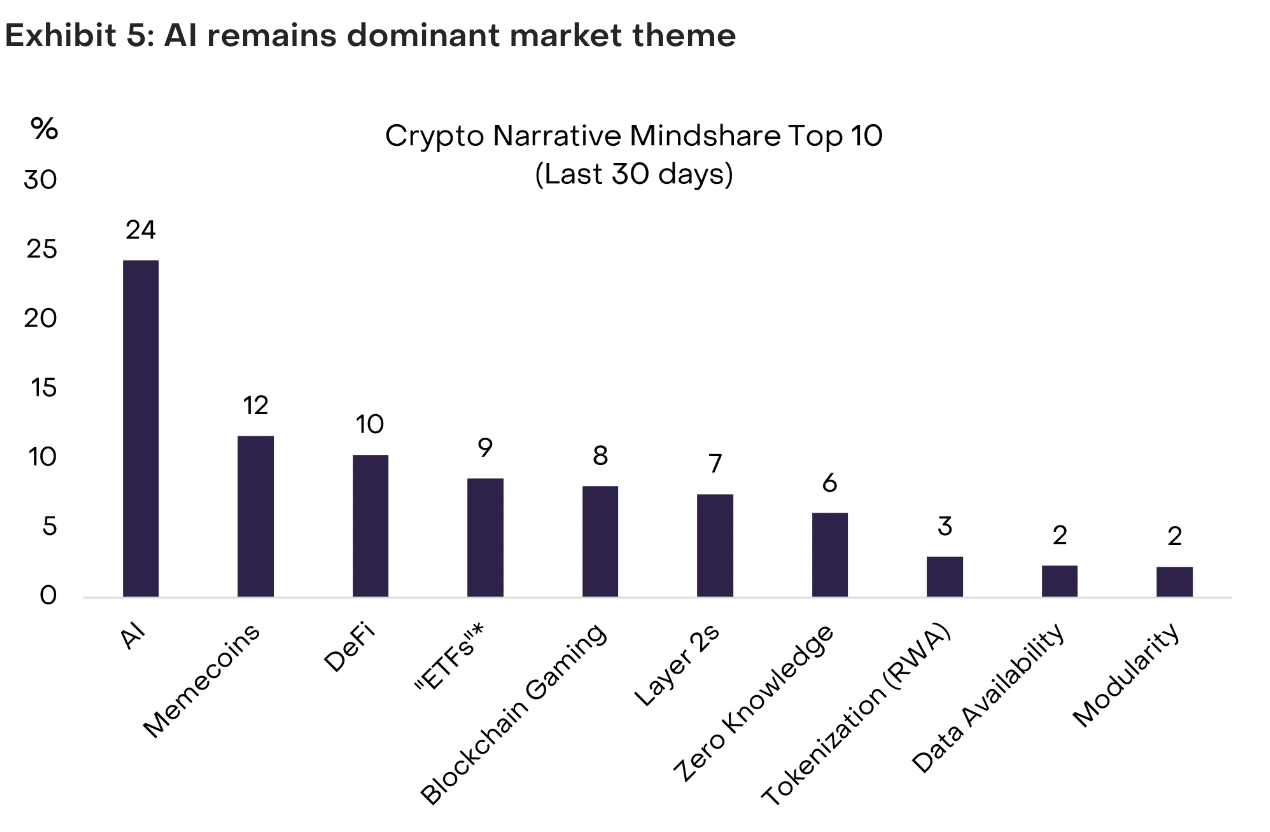

According to recent data, AI tokens had the largest amount of dominance when it came to the social media landscape.

Source: Grayscale Research

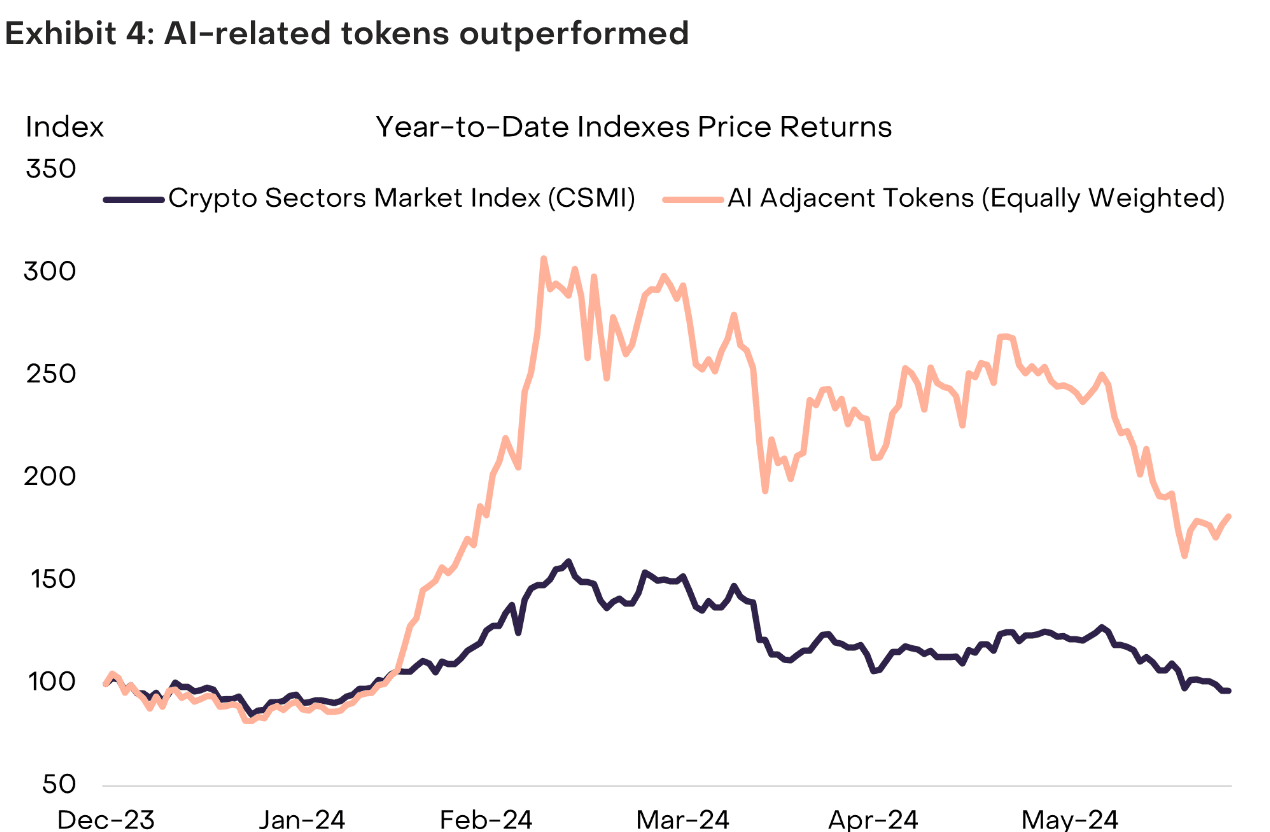

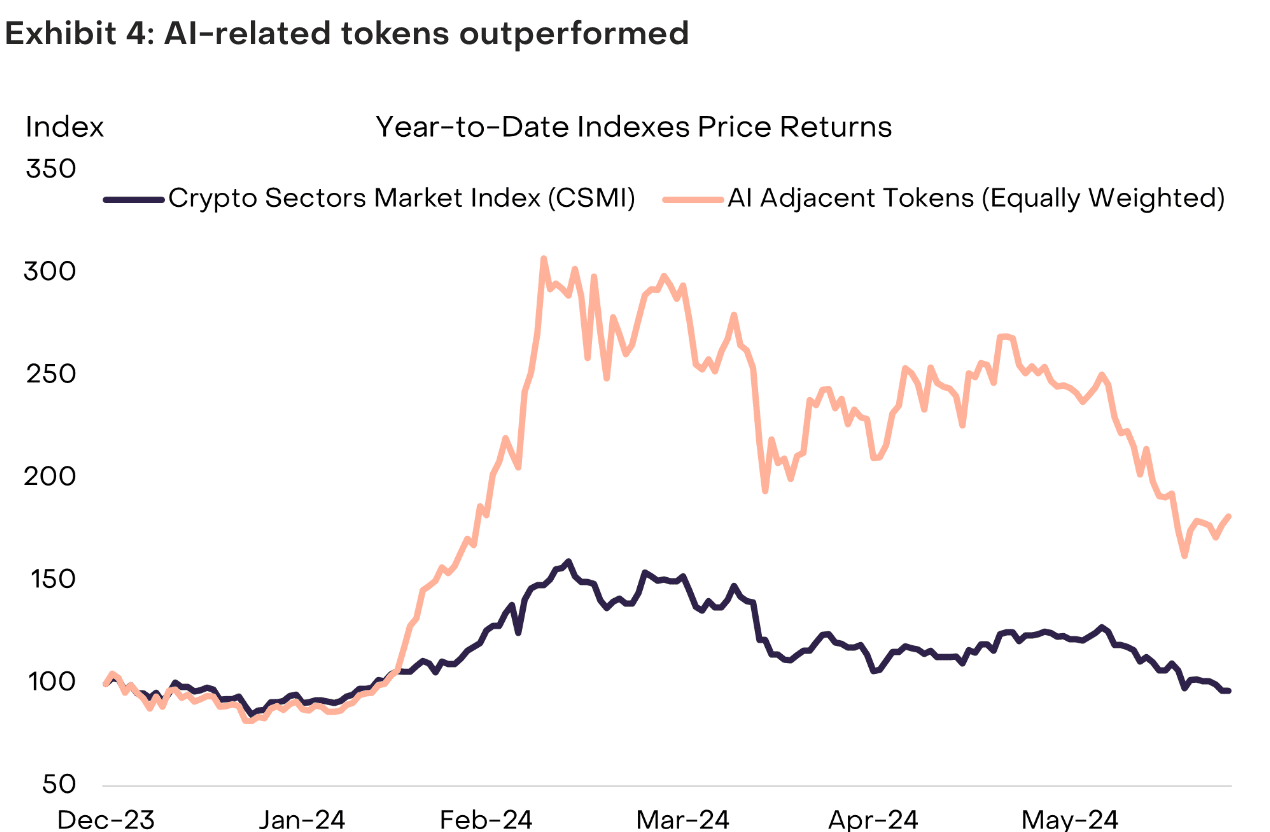

Moreover, AI based tokens such as RNDR, TAO and FET, outperformed the overall crypto sectors market index as well in terms of year to date price performance. If the hype around AI tokens continues, it could yield positive results for holders.

Source: Grayscale

- Ethereum poised to have a positive quarter ahead according to new research.

- AI tokens dominated in the social space and performed positively YTD.

Ethereum [ETH] and AI tokens have had a positive run over the last few months.

Interestingly, Grayscale Research believes the upcoming quarter will be heavily influenced by the recent approval of spot Ether exchange-traded products (ETPs) in the U.S. market.

This is a significant development as the Securities and Exchange Commission (SEC) greenlit Form 19b-4 filings in late May, allowing several issuers to list these Ether ETPs on U.S. exchanges.

ETPs to help ETH

Grayscale’s market analysis assumes ETPs will begin trading in Q3 2024.

Similar to the successful launch of spot Bitcoin ETPs in January, Grayscale Research anticipates these Ether products will attract significant net inflows, albeit likely to a lesser extent than their Bitcoin counterparts.

This could potentially translate to price support for Ethereum itself and tokens within its ecosystem.

The launch of spot Ether ETPs is expected to bring additional focus to the unique features of the Ethereum network. Unlike other blockchains, Ethereum utilizes a modular design approach, where different infrastructure components work together to optimize user experience and reduce costs.

Furthermore, Ethereum boasts the largest decentralized finance (DeFi) ecosystem in the crypto space and is a hub for tokenization projects.

Increased interest and adoption of Ethereum fueled by ETP approval could lead to rising activity and valuation support for specific Layer 2 tokens such as Mantle, prominent DeFi protocols like Uniswap, Maker, Aave, and other crucial assets within the Ethereum network such as Lido, a staking protocol.

One key factor that could showcase how interest in Ethereum has been growing could be how ETH’s price has remained resilient while BTC’s prices have plummeted.

Despite both ETH and BTC being heavily correlated, recent market drawdowns haven’t impacted ETH as harshly as BTC.

Source: Santiment

While spot Ether ETPs represent a major development, Grayscale Research anticipates other ongoing market themes to remain relevant in the coming quarter.

A key area of focus will be the potential for blockchain technology to intersect with the field of Artificial Intelligence (AI).

Are AI tokens doing good?

According to recent data, AI tokens had the largest amount of dominance when it came to the social media landscape.

Source: Grayscale Research

Moreover, AI based tokens such as RNDR, TAO and FET, outperformed the overall crypto sectors market index as well in terms of year to date price performance. If the hype around AI tokens continues, it could yield positive results for holders.

Source: Grayscale

how to get generic clomid without prescription cheap clomid without rx clomiphene price walmart how to get clomiphene tablets can i buy clomiphene pill buying cheap clomid tablets get cheap clomiphene without rx

This is the kind of glad I enjoy reading.

More posts like this would prosper the blogosphere more useful.

oral rybelsus – order periactin 4 mg without prescription purchase cyproheptadine online

purchase esomeprazole sale – https://anexamate.com/ esomeprazole capsules

buy warfarin 2mg for sale – cou mamide buy losartan 50mg pill

buy mobic 15mg pill – https://moboxsin.com/ buy meloxicam 15mg online cheap

prednisone 5mg over the counter – corticosteroid deltasone cheap

medications for ed – medicine erectile dysfunction buy erectile dysfunction medications

amoxil canada – purchase amoxicillin online buy amoxicillin generic

diflucan 200mg sale – https://gpdifluca.com/ buy forcan without a prescription

cenforce 50mg uk – buy cenforce 50mg pills order cenforce 50mg sale

buy cheap tadalafil online – https://ciltadgn.com/ comprar tadalafil 40 mg en walmart sin receta houston texas

e-cialis hellocig e-liquid – strong tadafl non prescription cialis

ranitidine 300mg canada – https://aranitidine.com/# buy zantac 300mg pill

generic viagra buy uk – https://strongvpls.com/# viagra 50 mg price walmart

I couldn’t hold back commenting. Warmly written! gnolvade.com

This is a topic which is forthcoming to my callousness… Myriad thanks! Faithfully where can I notice the contact details for questions? where to buy neurontin without a prescription

More articles like this would frame the blogosphere richer. https://ursxdol.com/provigil-gn-pill-cnt/

With thanks. Loads of erudition! https://prohnrg.com/

More peace pieces like this would make the интернет better. https://aranitidine.com/fr/en_ligne_kamagra/

This website really has all of the bumf and facts I needed there this subject and didn’t know who to ask. https://ondactone.com/simvastatin/