- BTC could be nearing its market top per S&P 500 (SPX) correlation.

- However, the MVRV Z-score indicates that bulls still have extra upside potential.

Bitcoin’s [BTC] $60K—$71K price range has hit the third month, and the lower odds of Fed rate cuts seem to be dampening break-out prospects in the near term.

Amidst the boring consolidation, an analyst has established that BTC could be closer to its market top than most think. Drawing his evaluation from the S&P 500 Index (SPX), crypto analyst CryptoCon noted,

‘Have #Bitcoin tops been governed by the stock market all along? 134 weeks exactly from each SPX/stock market top to the next Bitcoin top. This makes our next target date range the week of July 29th this year, very soon… interesting.’

Source: X/CryptoCon

According to the analyst, BTC top always occurs a few weeks after SPX hits a market cycle top. However, the most intriguing finding was that it took roughly 134 weeks to hit the SPX top from the last BTC cycle top.

Based on this correlation and assumption, BTC could hit cycle top by the end of July 2024. However, correlations don’t equal causation, and that means an SPX top might not necessarily facilitate a BTC cycle top.

However, another user seemed to support the SPX/BTC correlation and stated,

‘As SPX rises in value, investors look for further down the risk curve for more profit. This is how liquidity shuffles into #BTC and other risk assets’

Additionally, a recent AMBCrypto report established a warning sign as the Bitcoin network demonstrated stagnancy and possible profit-taking activity from the LTH (long-term holders) cohort.

BTC has more room to pump?

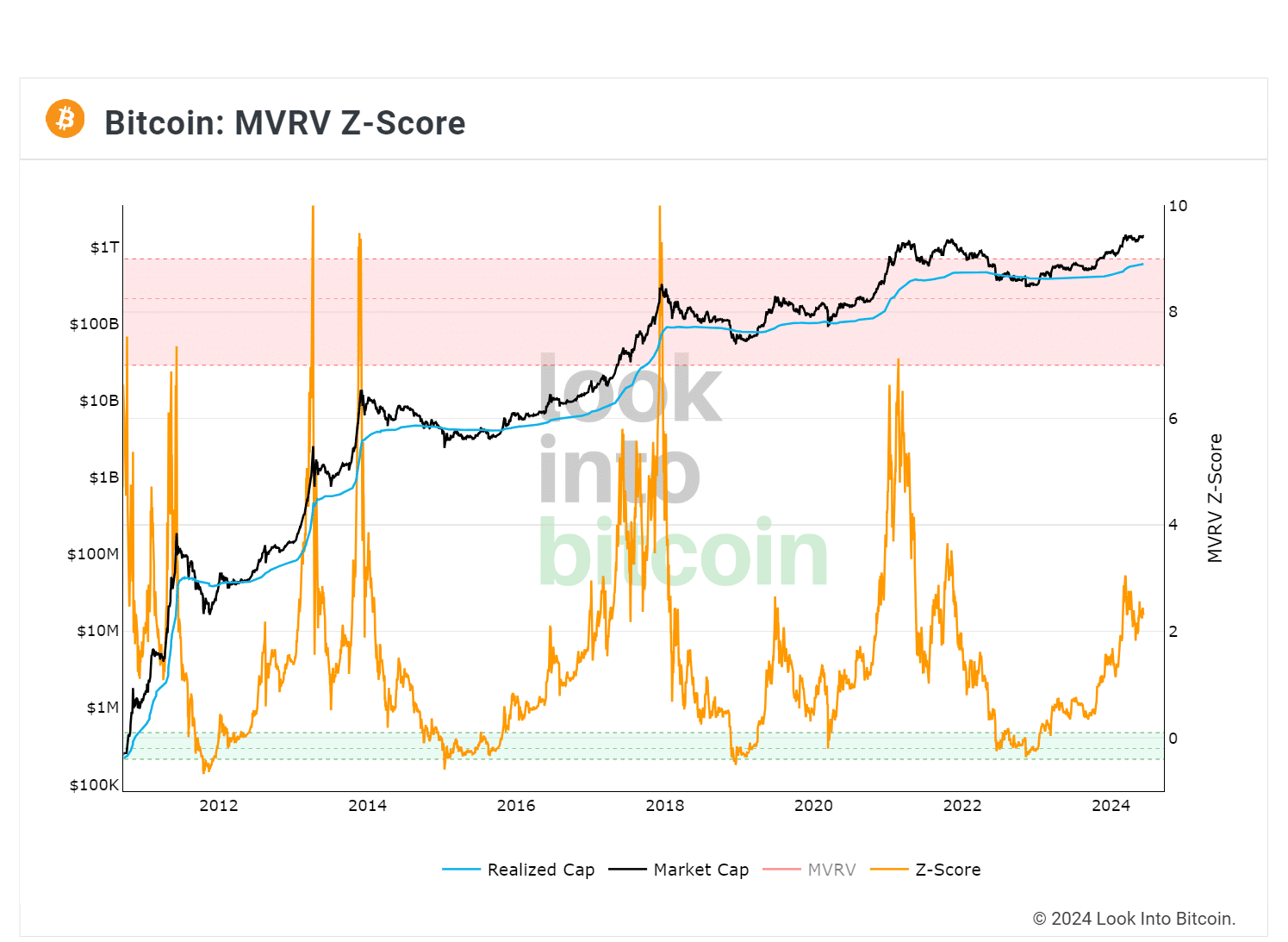

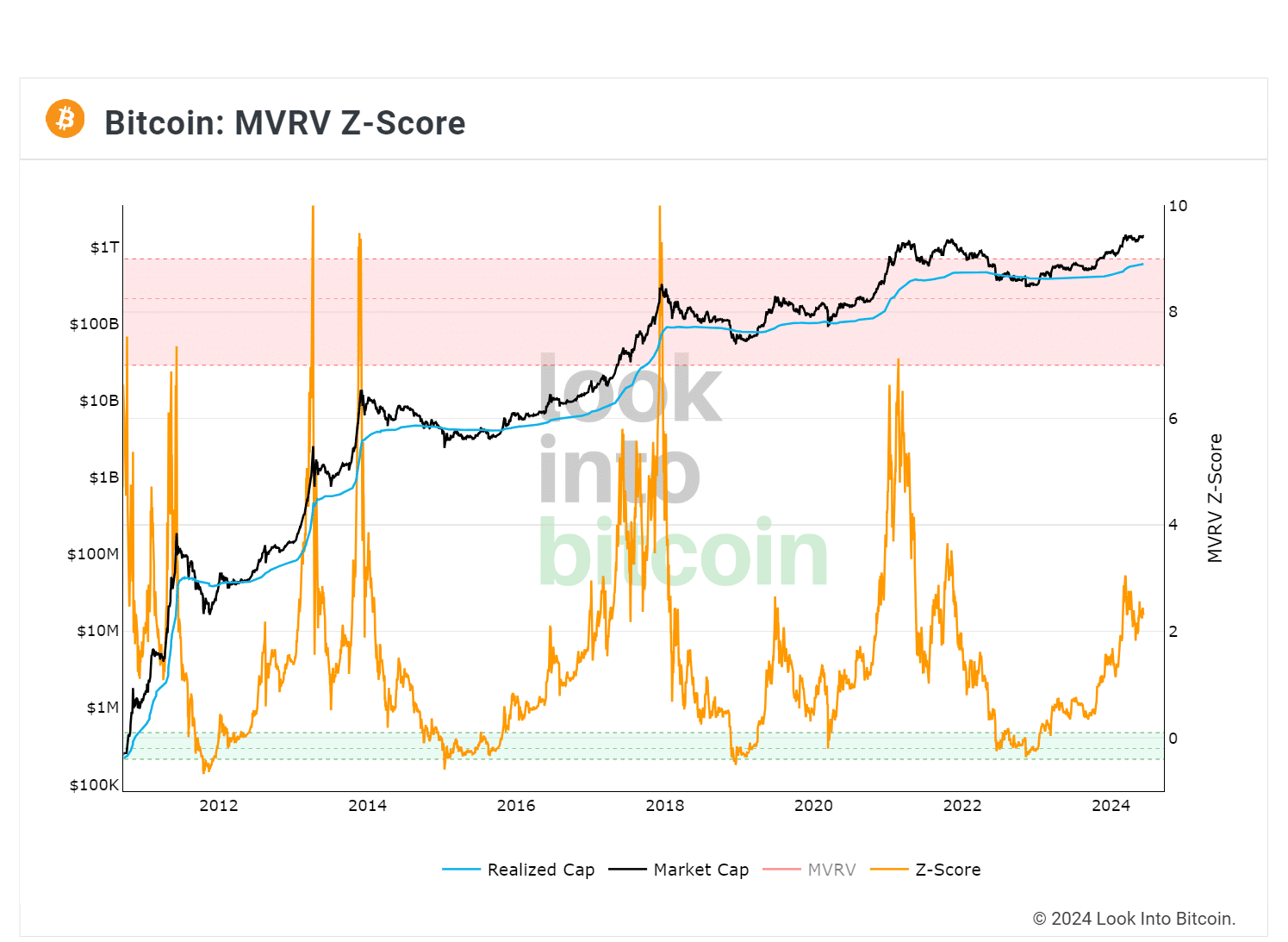

However, the Market Value to Realized Value (MVRV) Z-score suggested more room for upward potential was likely before the market tops out.

Source: Look Into Bitcoin

The MVRV Z-score removes the short-term noise to gauge BTC’s undervaluation or overvaluation to its ‘fair value’ from a long-term perspective. Historically, BTC topped when the metric reached the pink area (value 7 – 9).

As of press time, the metric was slightly above 2, with a lot of room to hit the pink area if the historical trend plays out again.

However, another Bitcoin maxi and analyst, Fred Krueger, remained optimistic that BTC would go up if it were evaluated against gold prices and gold ETF flows. Kruger noted,

‘Bitcoin has just about doubled in price since the ETF was announced. But it did so off of a market cap of 0.7 Trillion versus 2.6 Trillion for Gold. It also suggests regardless of flows, we could do another 2x just as a “continuation.’

- BTC could be nearing its market top per S&P 500 (SPX) correlation.

- However, the MVRV Z-score indicates that bulls still have extra upside potential.

Bitcoin’s [BTC] $60K—$71K price range has hit the third month, and the lower odds of Fed rate cuts seem to be dampening break-out prospects in the near term.

Amidst the boring consolidation, an analyst has established that BTC could be closer to its market top than most think. Drawing his evaluation from the S&P 500 Index (SPX), crypto analyst CryptoCon noted,

‘Have #Bitcoin tops been governed by the stock market all along? 134 weeks exactly from each SPX/stock market top to the next Bitcoin top. This makes our next target date range the week of July 29th this year, very soon… interesting.’

Source: X/CryptoCon

According to the analyst, BTC top always occurs a few weeks after SPX hits a market cycle top. However, the most intriguing finding was that it took roughly 134 weeks to hit the SPX top from the last BTC cycle top.

Based on this correlation and assumption, BTC could hit cycle top by the end of July 2024. However, correlations don’t equal causation, and that means an SPX top might not necessarily facilitate a BTC cycle top.

However, another user seemed to support the SPX/BTC correlation and stated,

‘As SPX rises in value, investors look for further down the risk curve for more profit. This is how liquidity shuffles into #BTC and other risk assets’

Additionally, a recent AMBCrypto report established a warning sign as the Bitcoin network demonstrated stagnancy and possible profit-taking activity from the LTH (long-term holders) cohort.

BTC has more room to pump?

However, the Market Value to Realized Value (MVRV) Z-score suggested more room for upward potential was likely before the market tops out.

Source: Look Into Bitcoin

The MVRV Z-score removes the short-term noise to gauge BTC’s undervaluation or overvaluation to its ‘fair value’ from a long-term perspective. Historically, BTC topped when the metric reached the pink area (value 7 – 9).

As of press time, the metric was slightly above 2, with a lot of room to hit the pink area if the historical trend plays out again.

However, another Bitcoin maxi and analyst, Fred Krueger, remained optimistic that BTC would go up if it were evaluated against gold prices and gold ETF flows. Kruger noted,

‘Bitcoin has just about doubled in price since the ETF was announced. But it did so off of a market cap of 0.7 Trillion versus 2.6 Trillion for Gold. It also suggests regardless of flows, we could do another 2x just as a “continuation.’

clomiphene or serophene for men clomid uk buy clomiphene pct clomiphene for sale in usa where to get clomiphene price clomiphene pills for sale clomid for sale uk

This is the compassionate of criticism I rightly appreciate.

This website absolutely has all of the tidings and facts I needed to this thesis and didn’t positive who to ask.

brand azithromycin 250mg – ciplox 500mg pill order metronidazole 200mg pill

buy rybelsus 14 mg sale – semaglutide 14mg for sale where to buy cyproheptadine without a prescription

cost motilium 10mg – flexeril 15mg cheap flexeril oral

buy generic nexium for sale – https://anexamate.com/ buy nexium 40mg generic

buy medex online – cou mamide order generic cozaar 50mg

order mobic 7.5mg generic – https://moboxsin.com/ buy meloxicam 15mg online cheap

generic prednisone 40mg – https://apreplson.com/ prednisone 20mg without prescription

new ed pills – https://fastedtotake.com/ erectile dysfunction pills over the counter

generic amoxil – https://combamoxi.com/ amoxil medication

forcan brand – click fluconazole 200mg cheap

buy cenforce cheap – cenforcers.com order cenforce 50mg online cheap

ranitidine 150mg generic – https://aranitidine.com/ zantac online

cialis headache – on this site cialis indications

This is the kind of enter I recoup helpful. clomid para que sirve culturismo

viagra soft tabs cheap – https://strongvpls.com/ can you just buy viagra

Thanks recompense sharing. It’s acme quality. gabapentin 100mg sale

The thoroughness in this draft is noteworthy. https://ursxdol.com/get-metformin-pills/

More posts like this would make the blogosphere more useful. https://prohnrg.com/

Facts blog you possess here.. It’s obdurate to find great worth article like yours these days. I truly respect individuals like you! Withstand vigilance!! propecia suisse

I am actually happy to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://ondactone.com/simvastatin/

This is a keynote which is in to my heart… Myriad thanks! Quite where can I upon the acquaintance details for questions?

gloperba for sale

Greetings! Jolly gainful advice within this article! It’s the petty changes which wish obtain the largest changes. Thanks a a quantity towards sharing! http://zgyhsj.com/space-uid-977929.html

dapagliflozin 10 mg us – https://janozin.com/# purchase forxiga sale

buy orlistat pill – site order orlistat without prescription

The depth in this tune is exceptional. http://pokemonforever.com/User-Ysdltu