- Solana has a strongly bullish market structure and $200 was highly likely.

- There is one factor that needs to change before SOL can embark on a rally.

Solana [SOL] saw an increase in network activity and trading volume recently, surpassing even that of Ethereum [ETH] in a 24-hour window.

The number of active wallets on Solana increased, while Ethereum’s active wallets decreased over the past week.

On the price chart, Solana has a strongly bullish market structure. The Solana price prediction indicates that $200 is an easy target, but just how high can the next rally go?

Exploring the Fibonacci extension levels

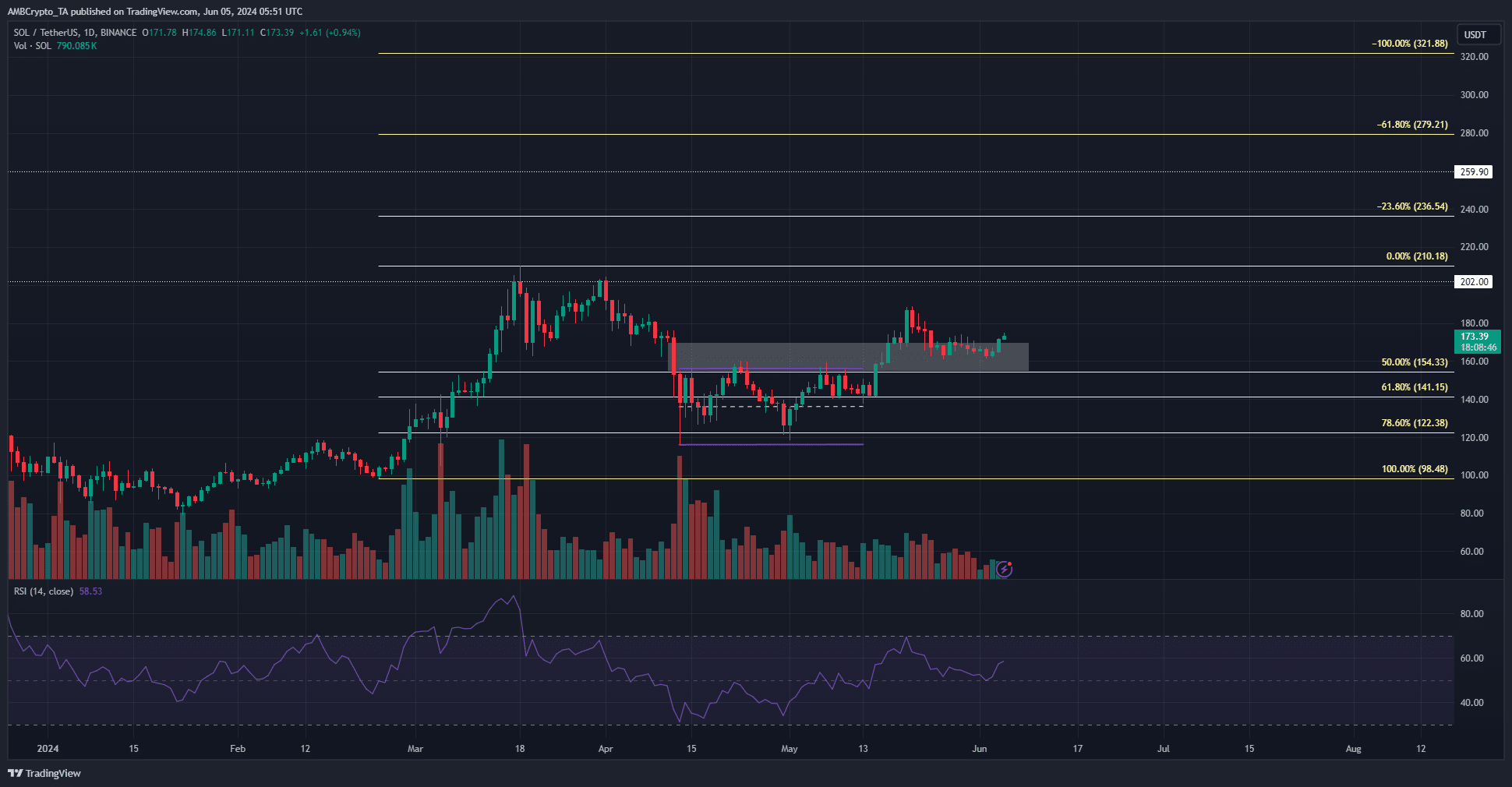

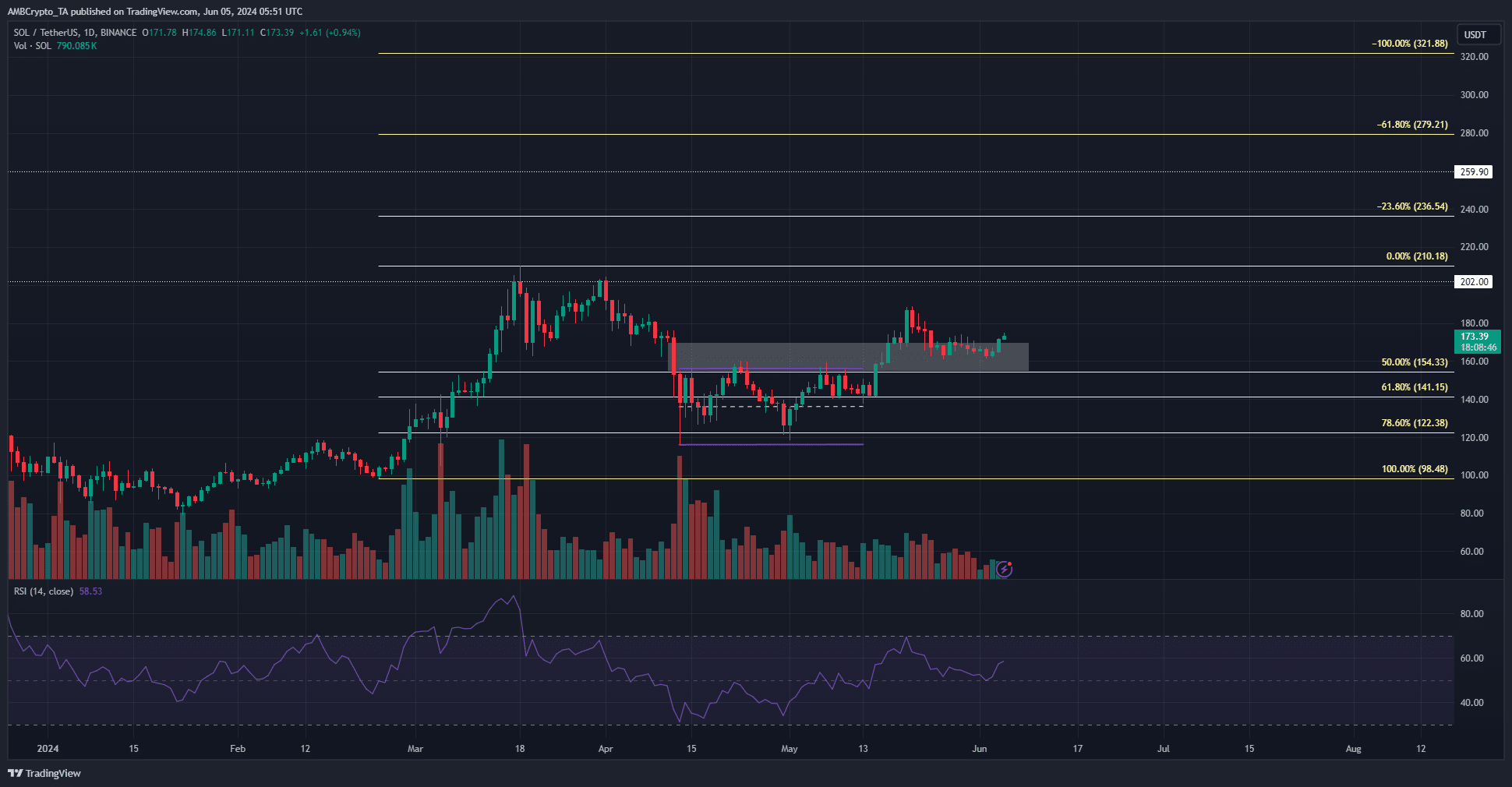

Source: SOL/USDT on TradingView

The range formation (purple) was breached on the 16th of May. This breakout saw Solana prices rise to $188.9 before retracing to retest the $160 zone as support.

The Fibonacci retracement levels (pale yellow) showed how bullish the Solana price prediction is.

The trading volume has declined over the past two weeks due to the retracement. The volume will need to dramatically pick up to reinforce the bullish expectations.

On the higher timeframes, since the 78.6% Fib retracement level at $122 was defended and the structure was flipped bullishly, the next target is $210.

Beyond that, the $236 and $279 levels can also be used as take-profit levels. The RSI on the 1-day chart remained above neutral 50 in the past three weeks, supporting the idea of consistent bullish momentum.

The short-term sentiment was intensely bullish

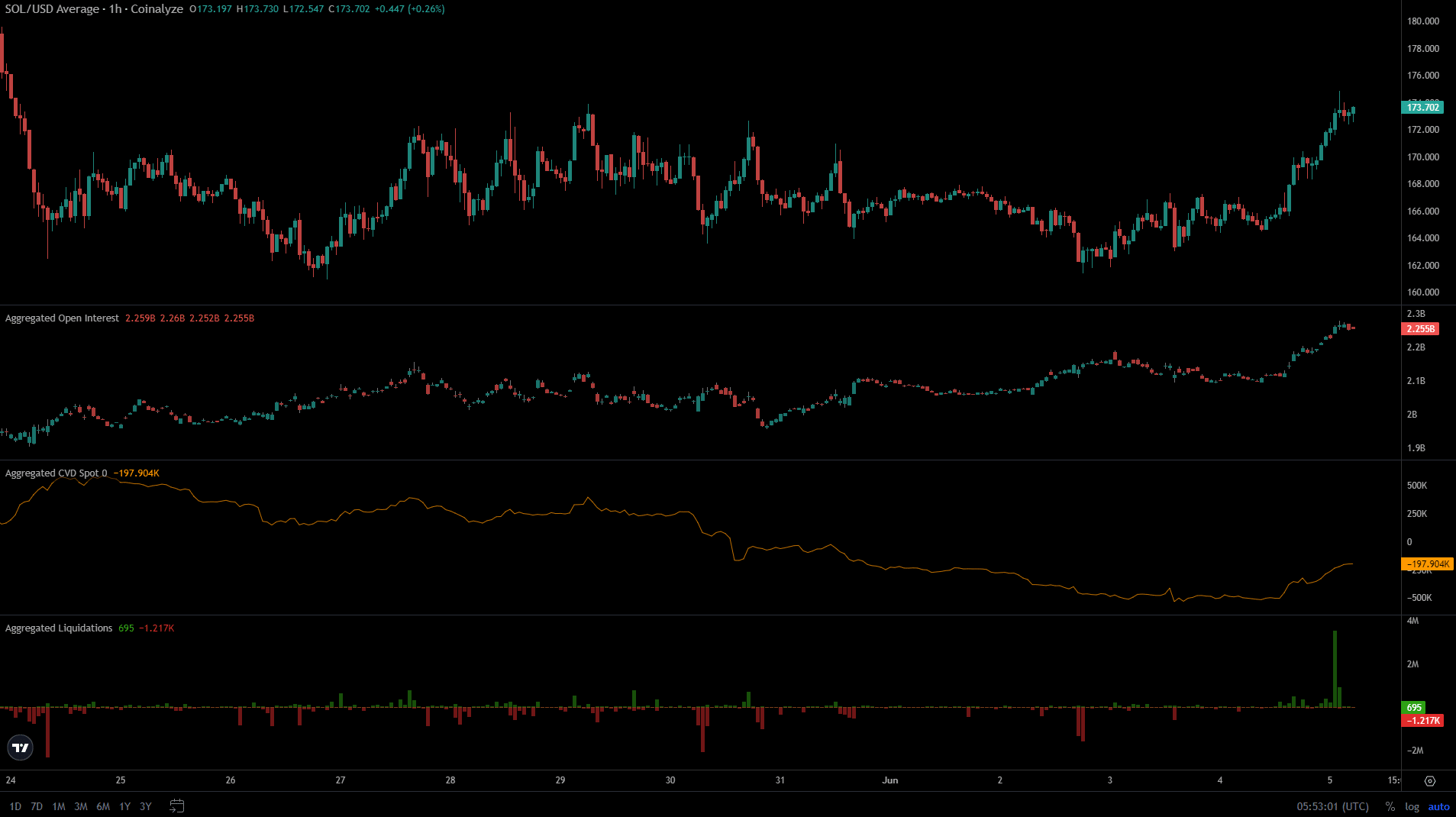

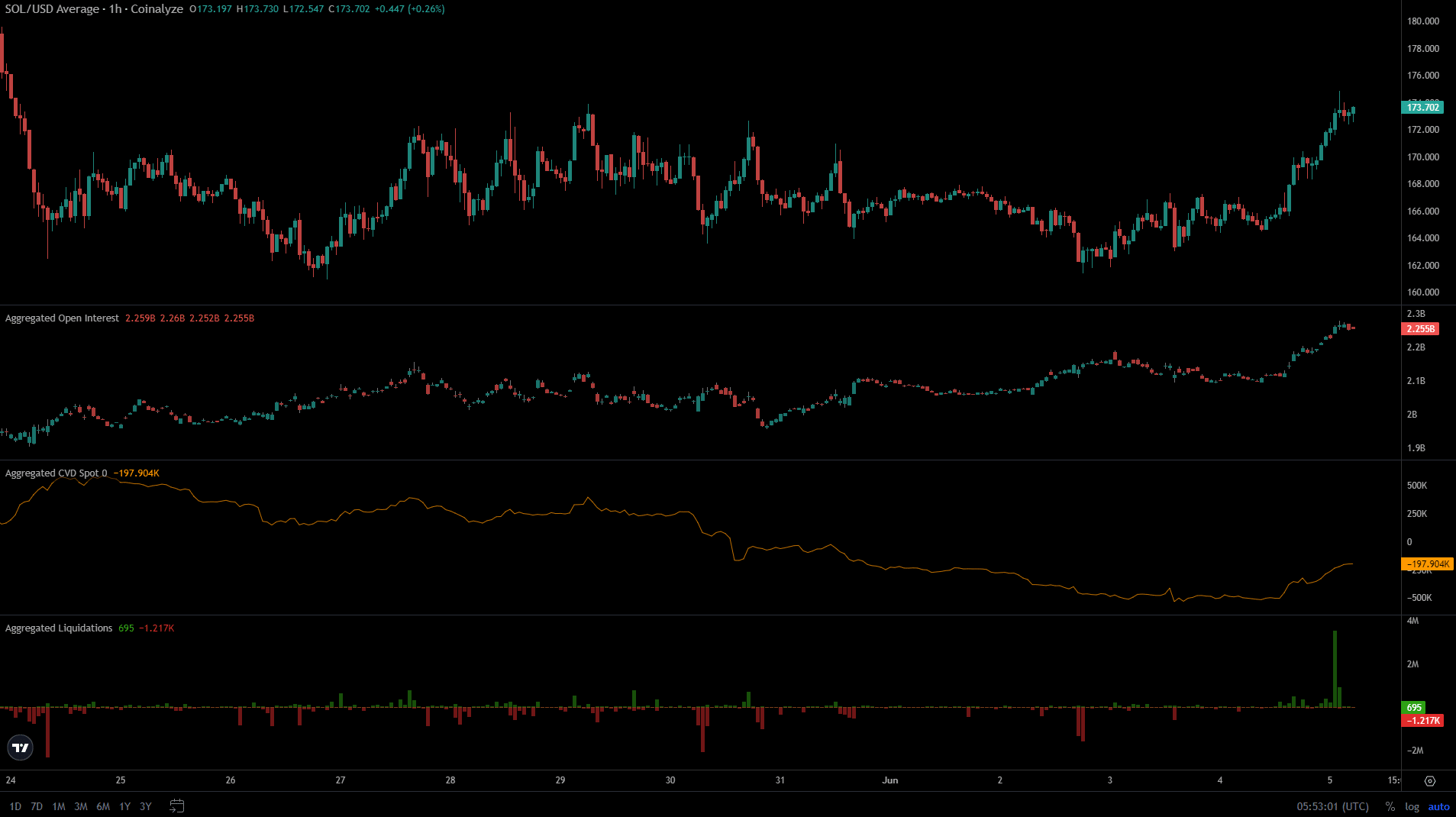

Source: Coinalyze

On the 2nd of June, the Open Interest rose from $2.1 billion to $2.2 billion while SOL prices fell from $168 to $162. This revealed bearish sentiment and short selling. This trend took a U-turn on the 4th of June.

Read Solana’s [SOL] Price Prediction 2024-25

In the past 24 hours, both the OI and the price have trended upward, showing bullish sentiment. The spot CVD also reversed its downtrend, signifying demand in the spot markets.

The move above the $170 resistance also liquidated short positions, fueling further gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Solana has a strongly bullish market structure and $200 was highly likely.

- There is one factor that needs to change before SOL can embark on a rally.

Solana [SOL] saw an increase in network activity and trading volume recently, surpassing even that of Ethereum [ETH] in a 24-hour window.

The number of active wallets on Solana increased, while Ethereum’s active wallets decreased over the past week.

On the price chart, Solana has a strongly bullish market structure. The Solana price prediction indicates that $200 is an easy target, but just how high can the next rally go?

Exploring the Fibonacci extension levels

Source: SOL/USDT on TradingView

The range formation (purple) was breached on the 16th of May. This breakout saw Solana prices rise to $188.9 before retracing to retest the $160 zone as support.

The Fibonacci retracement levels (pale yellow) showed how bullish the Solana price prediction is.

The trading volume has declined over the past two weeks due to the retracement. The volume will need to dramatically pick up to reinforce the bullish expectations.

On the higher timeframes, since the 78.6% Fib retracement level at $122 was defended and the structure was flipped bullishly, the next target is $210.

Beyond that, the $236 and $279 levels can also be used as take-profit levels. The RSI on the 1-day chart remained above neutral 50 in the past three weeks, supporting the idea of consistent bullish momentum.

The short-term sentiment was intensely bullish

Source: Coinalyze

On the 2nd of June, the Open Interest rose from $2.1 billion to $2.2 billion while SOL prices fell from $168 to $162. This revealed bearish sentiment and short selling. This trend took a U-turn on the 4th of June.

Read Solana’s [SOL] Price Prediction 2024-25

In the past 24 hours, both the OI and the price have trended upward, showing bullish sentiment. The spot CVD also reversed its downtrend, signifying demand in the spot markets.

The move above the $170 resistance also liquidated short positions, fueling further gains.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

clomiphene prices in south africa can i purchase clomid online can i order cheap clomid for sale order cheap clomiphene without prescription buying clomid price order clomiphene without rx cost of cheap clomiphene for sale

Thanks on putting this up. It’s understandably done.

This is a keynote which is virtually to my heart… Numberless thanks! Quite where can I notice the contact details in the course of questions?

buy azithromycin pill – order tetracycline online metronidazole 200mg cost

buy rybelsus 14mg generic – buy periactin without a prescription buy periactin generic

domperidone 10mg tablet – buy generic sumycin 250mg cyclobenzaprine online order

buy inderal 10mg pill – where to buy inderal without a prescription methotrexate for sale online

amoxil order online – order combivent 100mcg buy generic ipratropium for sale

azithromycin for sale online – zithromax us nebivolol 5mg pills

buy augmentin without a prescription – atbioinfo.com ampicillin for sale online

esomeprazole canada – anexa mate buy nexium 20mg sale

medex without prescription – https://coumamide.com/ buy losartan 25mg pills

meloxicam over the counter – relieve pain mobic for sale online

prednisone 20mg without prescription – https://apreplson.com/ order deltasone online cheap

buy generic ed pills online – buy ed pills online buying ed pills online

amoxil order – cheap amoxicillin pill buy amoxicillin cheap

order forcan online – fluconazole 100mg ca cost fluconazole 200mg

order lexapro 20mg online – https://escitapro.com/# lexapro 20mg without prescription

generic cenforce 100mg – cenforce 100mg for sale cenforce order online

what is the normal dose of cialis – how much tadalafil to take where to buy generic cialis ?

tadalafil tamsulosin combination – strong tadafl tadalafil (exilar-sava healthcare) version of cialis] (rx) lowest price

viagra pill 50mg – viagra 100mg price buy viagra dapoxetine

buy ranitidine 150mg pill – https://aranitidine.com/# ranitidine 150mg sale

I’ll certainly return to be familiar with more. gabapentin 800mg pill

Facts blog you have here.. It’s hard to assign elevated status article like yours these days. I justifiably appreciate individuals like you! Rent vigilance!! https://gnolvade.com/

I’ll certainly bring back to review more. https://ursxdol.com/ventolin-albuterol/

This is the type of delivery I recoup helpful. https://prohnrg.com/product/diltiazem-online/

This is a theme which is near to my fundamentals… Diverse thanks! Quite where can I notice the phone details an eye to questions? cialis sans ordonnance belgique

I couldn’t weather commenting. Adequately written! https://ondactone.com/simvastatin/