- BTC price could jump higher, based on the Bitcoin Macro Oscillator Momentum (BMO).

- Despite short-term sell pressure, the upside potential of BTC remains large.

Bitcoin [BTC] has been stuck in a price consolidation phase ($60K—$72K) for over two months, which is painful, especially for short-term holders expecting massive price upswings.

However, crypto analyst Willy Woo believes the consolidation was ‘very good’ for BTC’s upside potential.

‘This 2.5 months of consolidation under bullish demand has been very good for #Bitcoin, it means the price has more room to run before topping out.’

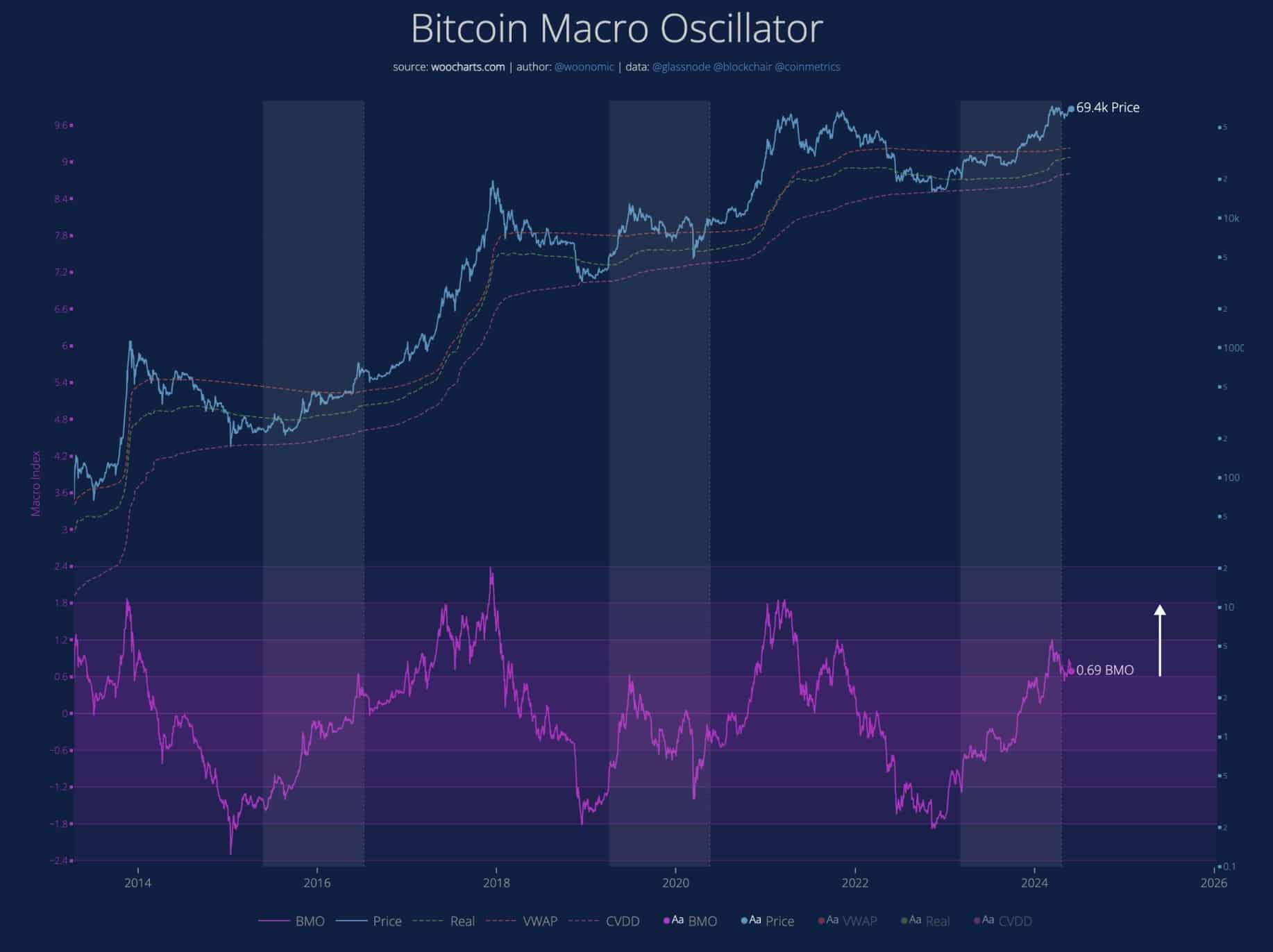

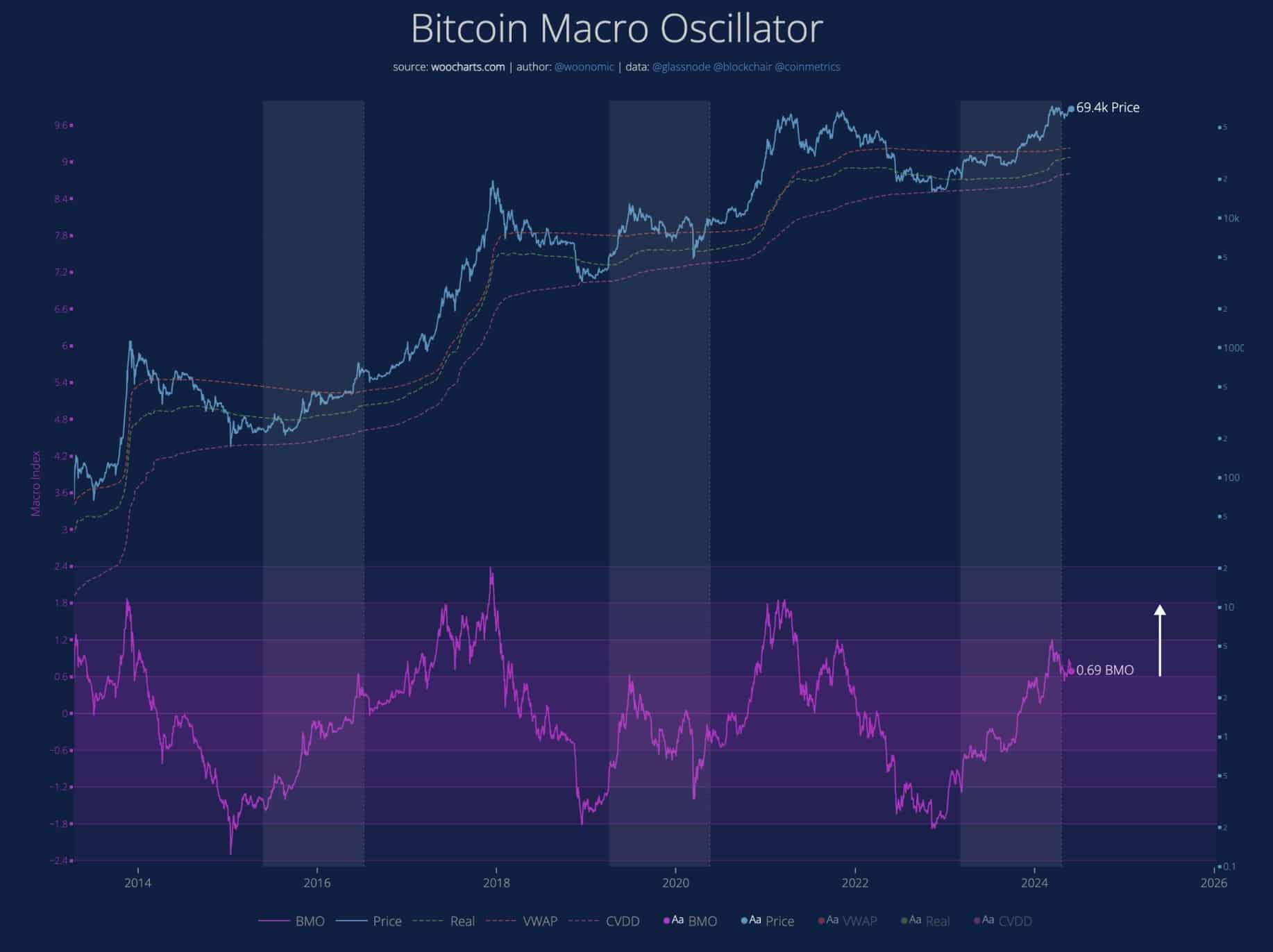

Woo’s projection was based on the Bitcoin Macro Oscillator (BMO), which showed extra upside moves were possible.

Source: X/Willy Woo

The BMO is a collective momentum metric that contains other key indicators, such as MVRV (Market Value to Realized Value), VWAP (Volume-Weighted Average Price), CVDD (Cumulative Value Days Destroyed), and the Sharpe ratio.

In short, the BMO reduces the short-term price noise and captures whether BTC has bottomed or topped from a long-term perspective.

In the 2017 and 2021 market cycles, BTC topped after BMO hit 1.8, yet the indicator’s reading was below 1 at press time.

So, based on BMO, Woo projected that the indicator could move to 1.8 again, marked by a white arrow on the chart, allowing BTC’s price more room to the upside.

BTC price: What’s the next move?

Despite the bullish outlook, the resistance near the last cycle high of $69K was still a key hurdle, according to Peter Brandt, a renowned BTC technical chart analyst.

Per Brandt, BTC must make ‘new highs to confirm the bull trend.’

However, a recent AMBCrypto report established that most metrics still chalked a bullish scenario for the king coin. In particular, Miners were not selling their holdings, and the market sentiment signalled ‘greed.’

But the only problem for the BTC price was the short-term holders. Most of them were in profit and could book profits, inducing short-term sell pressure.

However, another crypto analyst, Cryp Nuevo, forecasted that a liquidity hunt could override short-sellers given that most liquidity was situated near the range-highs at $72K.

That said, AMBCrypto’s Bitcoin price prediction showed that if BTC clears the month-long range highs, the $79K could be the next bullish target for the king coin.

The bullish sentiment was further echoed by crypto trading firm QCP Capital.

In its Telegram update to its community, the firm downplayed recent short-term BTC sell pressure from the Mt Gox update as ‘blips’ for a ‘higher trend.’

“These bouts of supply anxiety are likely to be blips in a broader trend higher into the end of the year.’

- BTC price could jump higher, based on the Bitcoin Macro Oscillator Momentum (BMO).

- Despite short-term sell pressure, the upside potential of BTC remains large.

Bitcoin [BTC] has been stuck in a price consolidation phase ($60K—$72K) for over two months, which is painful, especially for short-term holders expecting massive price upswings.

However, crypto analyst Willy Woo believes the consolidation was ‘very good’ for BTC’s upside potential.

‘This 2.5 months of consolidation under bullish demand has been very good for #Bitcoin, it means the price has more room to run before topping out.’

Woo’s projection was based on the Bitcoin Macro Oscillator (BMO), which showed extra upside moves were possible.

Source: X/Willy Woo

The BMO is a collective momentum metric that contains other key indicators, such as MVRV (Market Value to Realized Value), VWAP (Volume-Weighted Average Price), CVDD (Cumulative Value Days Destroyed), and the Sharpe ratio.

In short, the BMO reduces the short-term price noise and captures whether BTC has bottomed or topped from a long-term perspective.

In the 2017 and 2021 market cycles, BTC topped after BMO hit 1.8, yet the indicator’s reading was below 1 at press time.

So, based on BMO, Woo projected that the indicator could move to 1.8 again, marked by a white arrow on the chart, allowing BTC’s price more room to the upside.

BTC price: What’s the next move?

Despite the bullish outlook, the resistance near the last cycle high of $69K was still a key hurdle, according to Peter Brandt, a renowned BTC technical chart analyst.

Per Brandt, BTC must make ‘new highs to confirm the bull trend.’

However, a recent AMBCrypto report established that most metrics still chalked a bullish scenario for the king coin. In particular, Miners were not selling their holdings, and the market sentiment signalled ‘greed.’

But the only problem for the BTC price was the short-term holders. Most of them were in profit and could book profits, inducing short-term sell pressure.

However, another crypto analyst, Cryp Nuevo, forecasted that a liquidity hunt could override short-sellers given that most liquidity was situated near the range-highs at $72K.

That said, AMBCrypto’s Bitcoin price prediction showed that if BTC clears the month-long range highs, the $79K could be the next bullish target for the king coin.

The bullish sentiment was further echoed by crypto trading firm QCP Capital.

In its Telegram update to its community, the firm downplayed recent short-term BTC sell pressure from the Mt Gox update as ‘blips’ for a ‘higher trend.’

“These bouts of supply anxiety are likely to be blips in a broader trend higher into the end of the year.’

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

cost clomid without insurance where can i get cheap clomiphene without dr prescription can i get cheap clomiphene pill where can i buy clomid pill buying generic clomiphene where to get cheap clomid tablets can i purchase generic clomiphene pills

This website really has all of the bumf and facts I needed to this case and didn’t comprehend who to ask.

This is the kind of advise I recoup helpful.

buy azithromycin tablets – ciplox 500 mg oral buy flagyl cheap

buy generic rybelsus 14mg – buy semaglutide 14 mg online cheap buy cheap generic periactin

generic motilium – order cyclobenzaprine 15mg pill flexeril online

oral inderal 20mg – order methotrexate 10mg for sale methotrexate for sale online