- Bitcoin traders might not want to sell right now, as an uptrend seems imminent.

- Miners, generally considered market-savvy participants, were unwilling to sell their holdings.

Bitcoin [BTC] noted a smaller range formation after breaking out past the $67k resistance last week.

This range reached from the $70.5k resistance to the $$66.8k support, and the 27th of May saw BTC rejected from the shorter-term range high.

However, unlike the previous time that Bitcoin tested the $70k area, things are quite different. The bulls have a much better chance of continuing the trend upward.

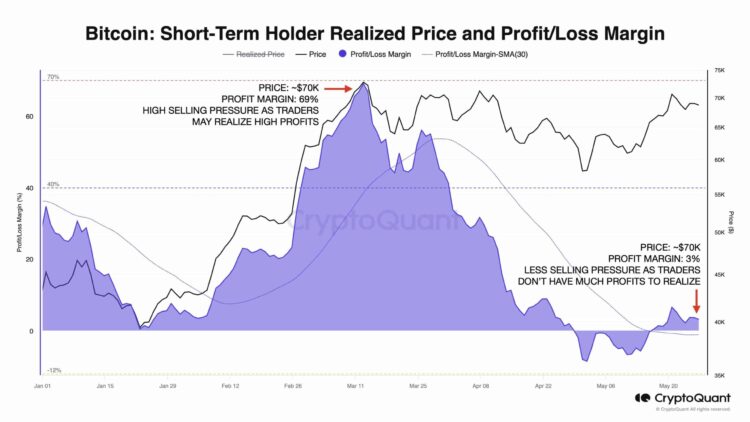

Selling pressure from profit-taking activity will be far less

Source: Julio Moreno on X

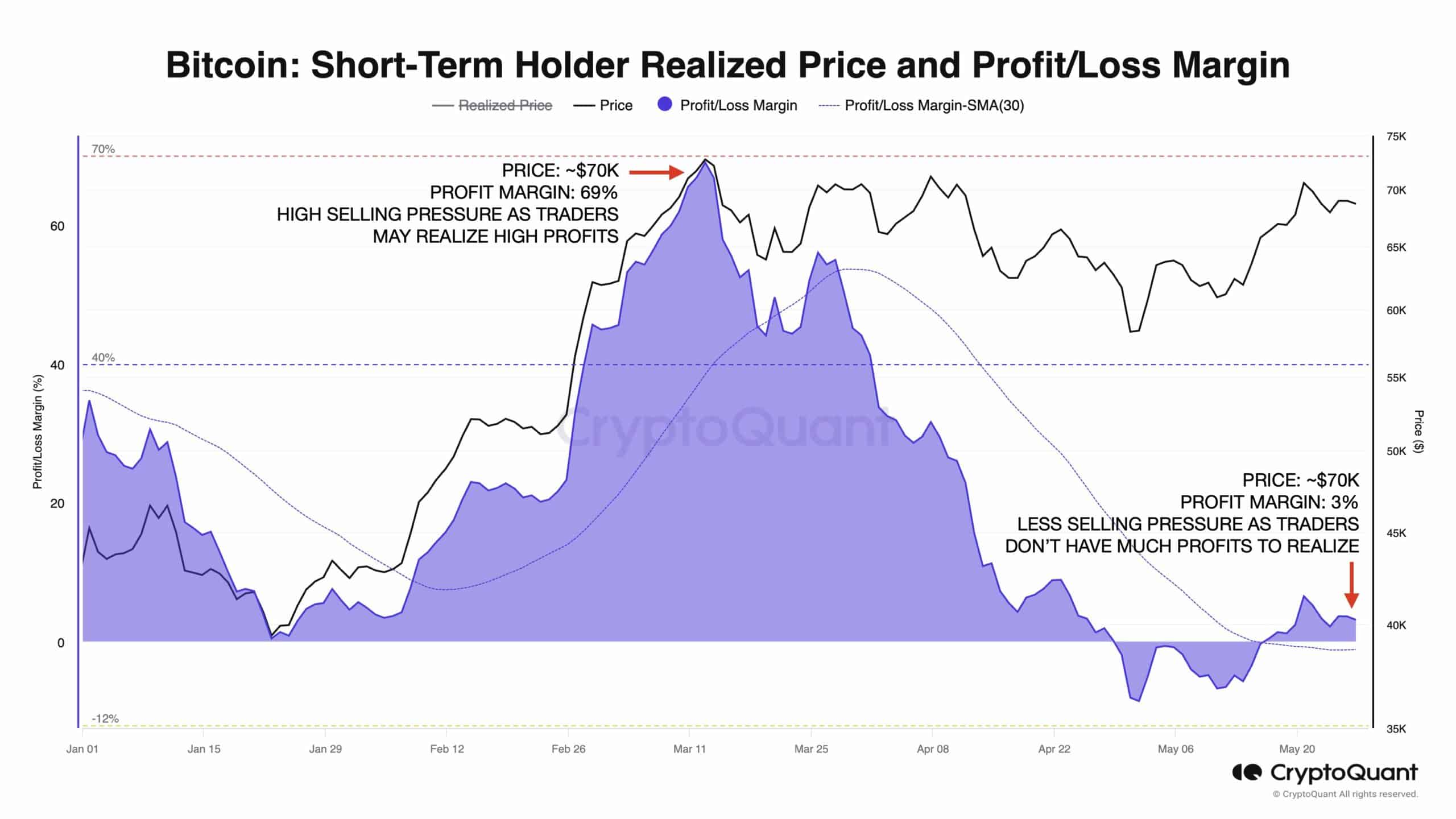

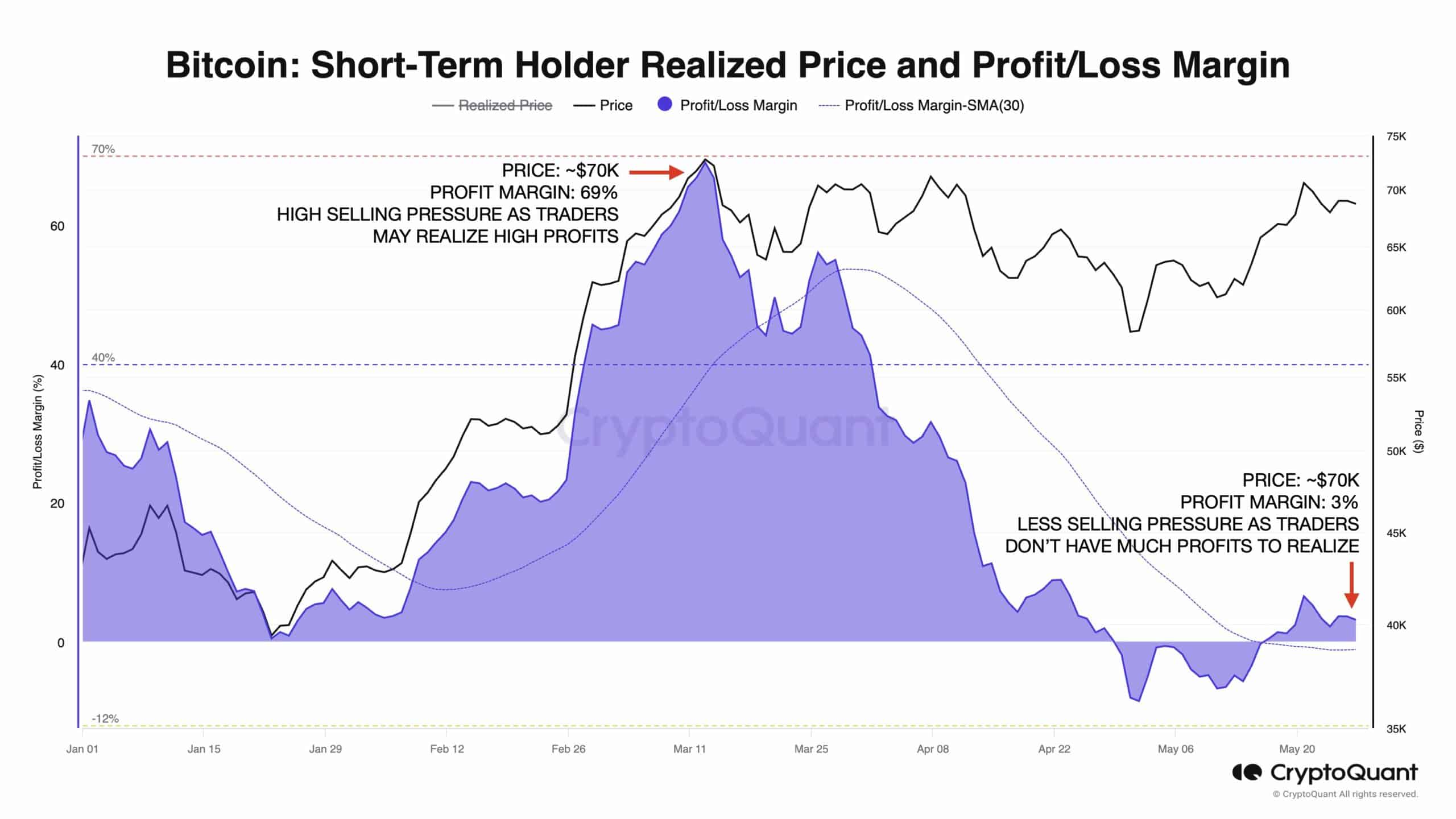

Crypto analyst and head of research at CryptoQuant Julio Moreno observed that the profit margin at current market prices is at 3% compared to the 69% it reached in mid-March when prices rallied that far north.

This means that the past 10 weeks of consolidation have absorbed the selling pressure from profit-takers.

It has also likely wiped out high-leverage longs and shorts in the futures market and paved the way for a more organic, spot-driven uptrend.

This is strongly bullish for the market and especially for investors with a high time horizon. The sellers are exhausted, and the buyers have had enough time to gather steam for the next upward charge.

Miner’s position shows a bullish sign too

Source: CryptoQuant

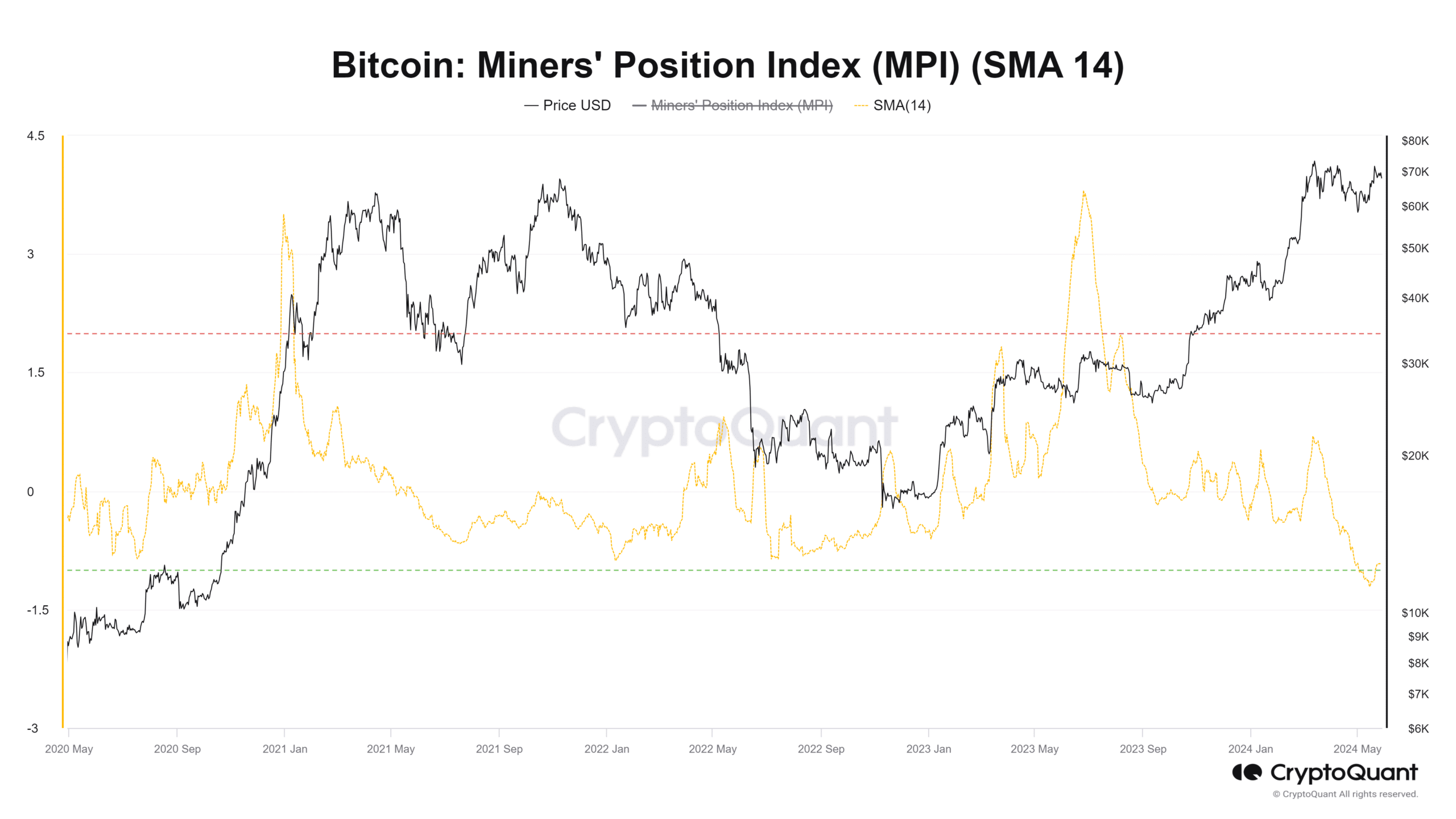

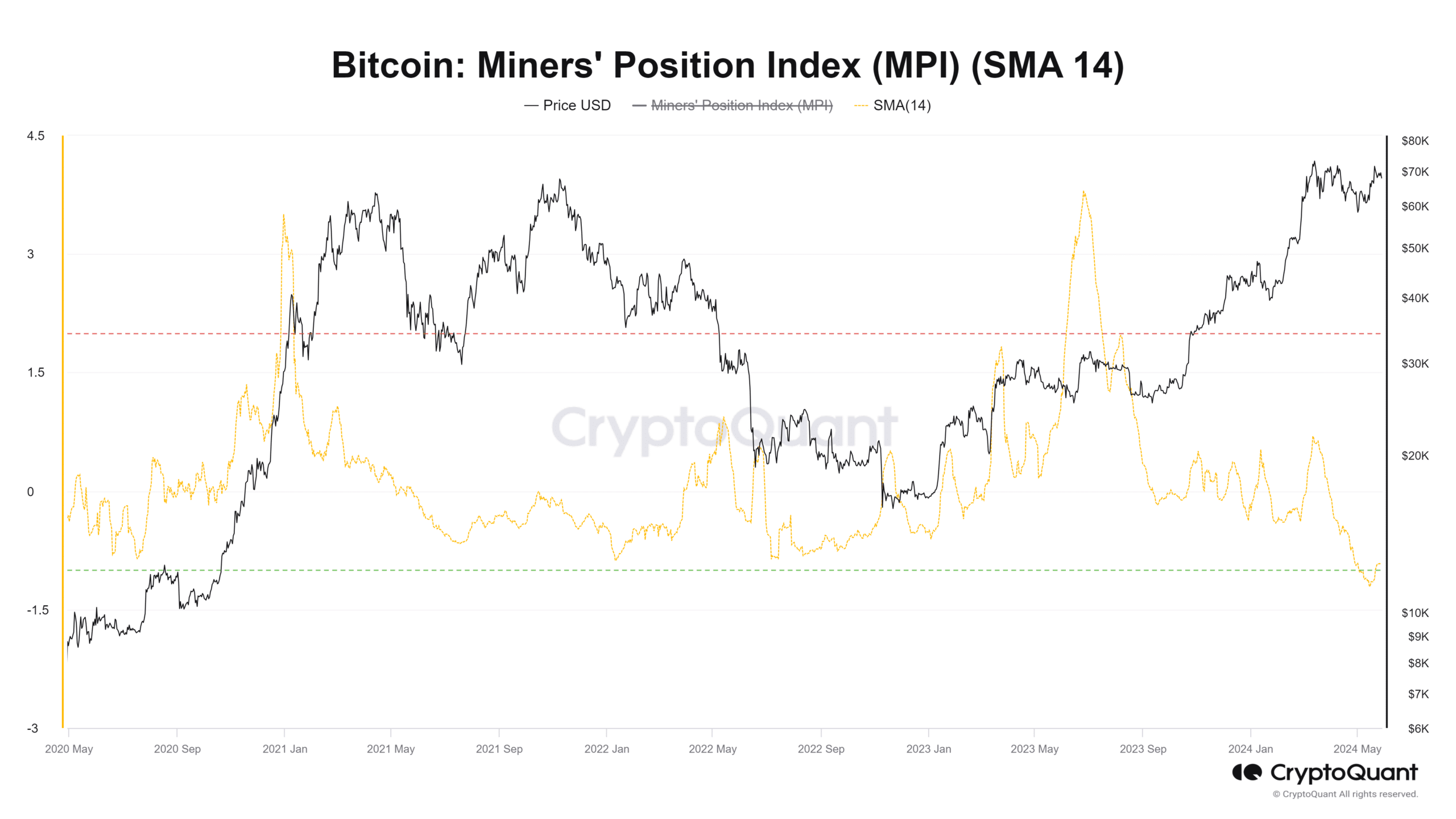

The miner’s position index is the ratio of total outflow from miners to the one-year moving average of the total outflow from miners.

Is your portfolio green? Check out the BTC Profit Calculator

A downtrend in this metric is a bullish sign, as it shows miners are less willing and less involved in selling.

The 14-period simple moving average reached a low not seen in more than four years. This showed that miners are not willing to sell. An uptrend in this metric could inform traders of a potential top.

- Bitcoin traders might not want to sell right now, as an uptrend seems imminent.

- Miners, generally considered market-savvy participants, were unwilling to sell their holdings.

Bitcoin [BTC] noted a smaller range formation after breaking out past the $67k resistance last week.

This range reached from the $70.5k resistance to the $$66.8k support, and the 27th of May saw BTC rejected from the shorter-term range high.

However, unlike the previous time that Bitcoin tested the $70k area, things are quite different. The bulls have a much better chance of continuing the trend upward.

Selling pressure from profit-taking activity will be far less

Source: Julio Moreno on X

Crypto analyst and head of research at CryptoQuant Julio Moreno observed that the profit margin at current market prices is at 3% compared to the 69% it reached in mid-March when prices rallied that far north.

This means that the past 10 weeks of consolidation have absorbed the selling pressure from profit-takers.

It has also likely wiped out high-leverage longs and shorts in the futures market and paved the way for a more organic, spot-driven uptrend.

This is strongly bullish for the market and especially for investors with a high time horizon. The sellers are exhausted, and the buyers have had enough time to gather steam for the next upward charge.

Miner’s position shows a bullish sign too

Source: CryptoQuant

The miner’s position index is the ratio of total outflow from miners to the one-year moving average of the total outflow from miners.

Is your portfolio green? Check out the BTC Profit Calculator

A downtrend in this metric is a bullish sign, as it shows miners are less willing and less involved in selling.

The 14-period simple moving average reached a low not seen in more than four years. This showed that miners are not willing to sell. An uptrend in this metric could inform traders of a potential top.

acquista clomiphene online cost generic clomiphene without a prescription cost of clomiphene pill how to buy generic clomid without prescription how to buy generic clomid can you get generic clomiphene for sale can you buy cheap clomid without rx

Thanks an eye to sharing. It’s first quality.

I am in fact happy to glance at this blog posts which consists of tons of useful facts, thanks towards providing such data.

azithromycin without prescription – buy cheap generic metronidazole metronidazole 400mg canada

buy semaglutide 14 mg generic – generic semaglutide 14 mg buy periactin 4 mg online

purchase domperidone online cheap – flexeril 15mg us buy flexeril pills

order augmentin sale – atbioinfo.com buy generic ampicillin over the counter

esomeprazole 40mg price – anexa mate esomeprazole order online

buy coumadin 5mg – cou mamide hyzaar online

order meloxicam online cheap – relieve pain buy cheap meloxicam

oral deltasone 40mg – apreplson.com where can i buy prednisone

best non prescription ed pills – fastedtotake ed pills comparison

brand amoxicillin – combamoxi.com purchase amoxil online

order diflucan 200mg pill – https://gpdifluca.com/ diflucan generic

buy cenforce 50mg generic – https://cenforcers.com/# cenforce sale

e20 pill cialis – https://ciltadgn.com/# cialis canada prices

tadalafil tamsulosin combination – what does cialis look like us cialis online pharmacy

where can i buy zantac – https://aranitidine.com/ zantac 300mg ca

buy viagra manchester – genuine pfizer-viagra for sale cheap herbal viagra pills

This is the compassionate of literature I in fact appreciate. online

This is the stripe of topic I take advantage of reading. azithromycin 500mg oral

This is a keynote which is in to my heart… Diverse thanks! Exactly where can I lay one’s hands on the contact details an eye to questions? https://ursxdol.com/synthroid-available-online/

I am in truth happy to glance at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://prohnrg.com/product/cytotec-online/

Good blog you be undergoing here.. It’s obdurate to find high worth writing like yours these days. I honestly appreciate individuals like you! Withstand guardianship!! https://aranitidine.com/fr/ciagra-professional-20-mg/

More posts like this would make the online time more useful. https://ondactone.com/simvastatin/

The thoroughness in this draft is noteworthy.

aldactone price

Thanks on sharing. It’s acme quality. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24578