- Memecoins have been the talk of the town this bull run and have performed well since late February.

- There’s an allure to these tokens that solve nothing but still attract thousands of investors.

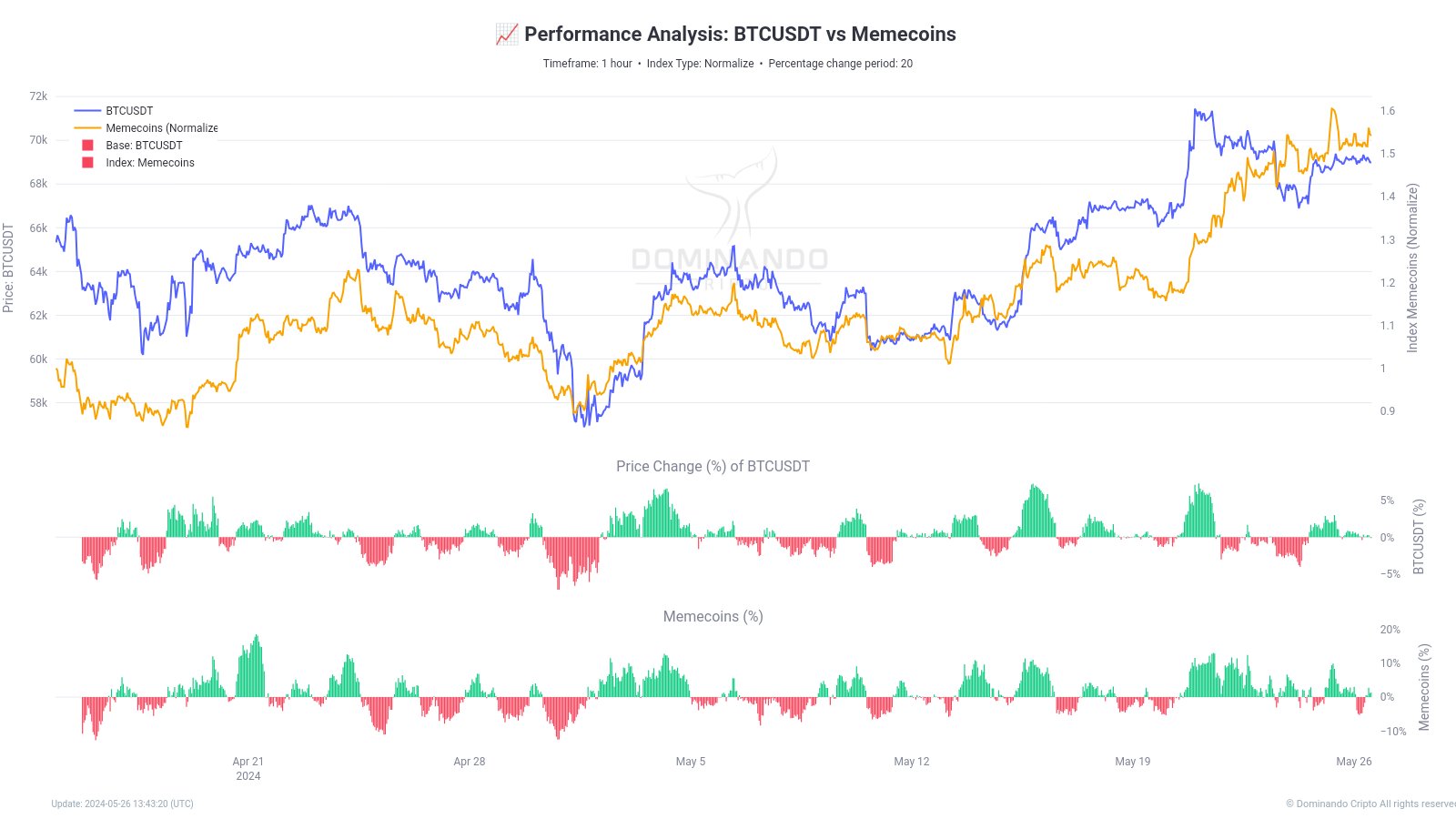

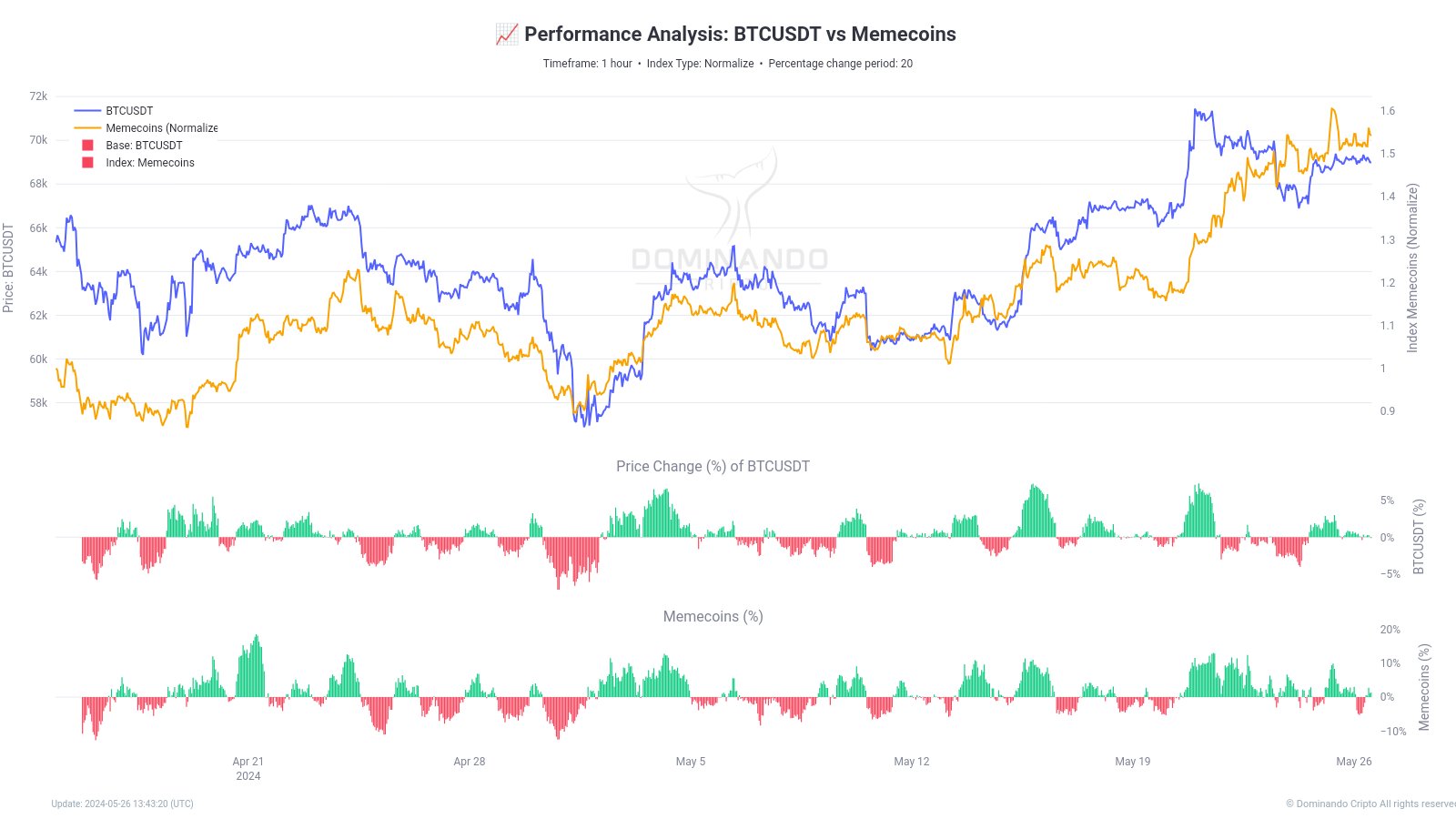

Memecoins have captured the public imagination and attention during this bull run, at least so far. Crypto analyst Joao Wedson pointed this out recently in a post on X (formerly Twitter).

In terms of price percentage change, memecoins have had the upper hand recently.

Does this mean memecoins are taking the spotlight away from Bitcoin? Will the public attention and capital inflows to the meme markets significantly impact Bitcoin’s demand?

Most memecoins are here one moment, gone the next

The recent trend of memecoins skyrocketing in the Solana ecosystem is a good example of how easy it is to create tokens and gain a small fraction of the public’s attention, even if it is for a brief moment.

Source: Joao Wedson on X

However, from a market capitalization standpoint, memecoins are a tiny fraction of Bitcoin’s size. Since the dip on the 1st of May, Bitcoin has added $233 billion to its market capitalization.

In comparison, at press time, the top ten memecoins’ total combined market capitalization stood at $57.26 billion.

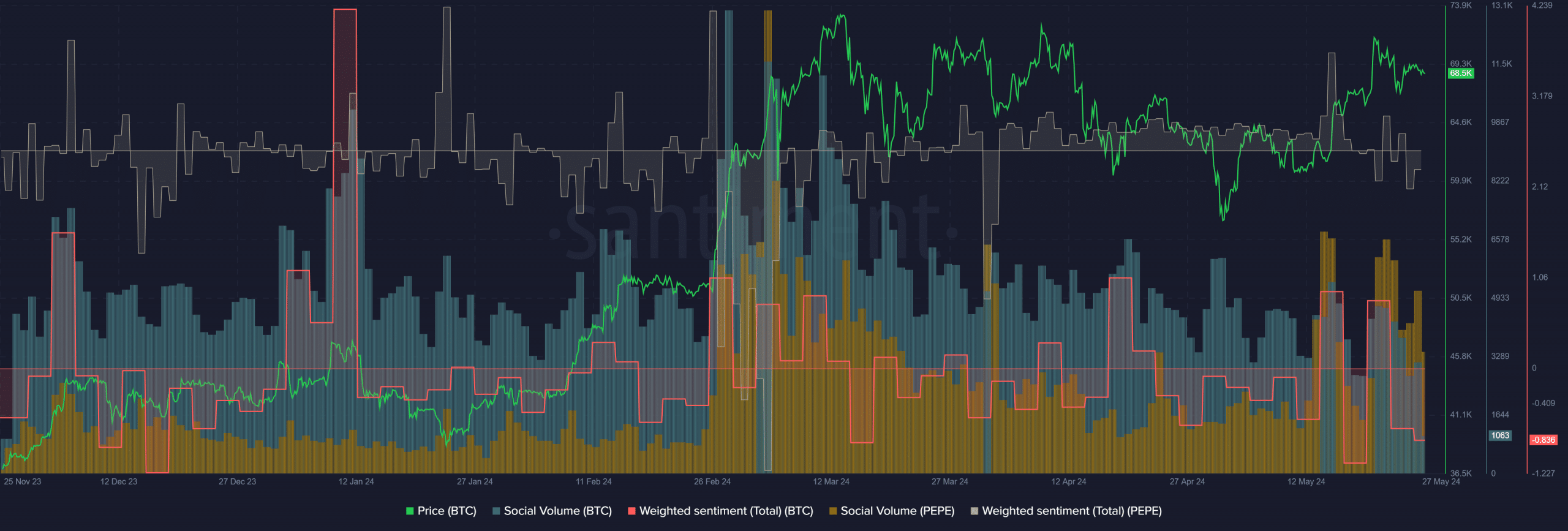

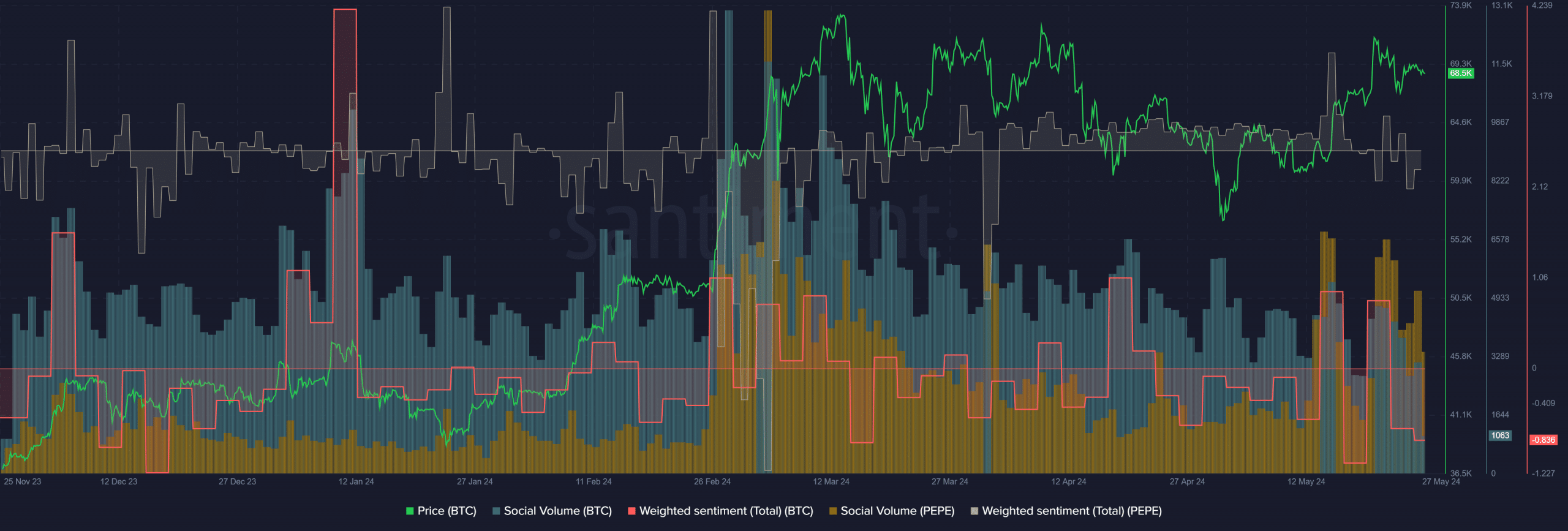

Source: Santiment

The chart above showed that the social volume of Bitcoin (cyan) was 3135 on the 26th of May compared to 350 (yellow) for PEPE.

This is just one memecoin, not the whole sector, but the difference is still enormous considering PEPE gained 75% last week and is one of the hotly discussed memes online.

Therefore, social media engagement was still in favor of Bitcoin. Additionally, the derivatives and spot market of Bitcoin are likely too big for memecoins to meaningfully chip away at.

The allure of memecoins

The number of cryptocurrencies in the market has increased drastically year after year. In January 2021, an estimated 4,154 tokens were in the market. In March 2024 that number has increased to 13,217, and counting.

Most of these tokens are based on vaporware, products that are promised to the public but never actually created. This huge dilution among altcoins is vastly different from the past two cycles.

OG crypto traders talk about tokens randomly popping off during a bull run and making triple-digit percentage gains within days.

The problem now is that with so many tokens around that have suffered at least one bear market, the crypto space is too saturated to see all of them trend higher during a bull run.

In that regard, memecoins are upfront and honest about their intentions. They bring a community together through jokes and vibes, promise no product expect a potential return on investment and some fun during the journey toward these gains.

Win or lose as a team of bag holders.

Read Pepe’s [PEPE] Price Prediction 2024-25

People who don’t have the time or know-how to weed through dozens, or even hundreds, of crypto tokens are naturally attracted to these down-to-earth meme tokens and willing to bet at least a small amount on them.

This is not to say that there aren’t tokens with good development teams that look to solve a defined problem, but it is harder for the public to find them. Perhaps that is why memecoins are outperforming other sectors so far.

- Memecoins have been the talk of the town this bull run and have performed well since late February.

- There’s an allure to these tokens that solve nothing but still attract thousands of investors.

Memecoins have captured the public imagination and attention during this bull run, at least so far. Crypto analyst Joao Wedson pointed this out recently in a post on X (formerly Twitter).

In terms of price percentage change, memecoins have had the upper hand recently.

Does this mean memecoins are taking the spotlight away from Bitcoin? Will the public attention and capital inflows to the meme markets significantly impact Bitcoin’s demand?

Most memecoins are here one moment, gone the next

The recent trend of memecoins skyrocketing in the Solana ecosystem is a good example of how easy it is to create tokens and gain a small fraction of the public’s attention, even if it is for a brief moment.

Source: Joao Wedson on X

However, from a market capitalization standpoint, memecoins are a tiny fraction of Bitcoin’s size. Since the dip on the 1st of May, Bitcoin has added $233 billion to its market capitalization.

In comparison, at press time, the top ten memecoins’ total combined market capitalization stood at $57.26 billion.

Source: Santiment

The chart above showed that the social volume of Bitcoin (cyan) was 3135 on the 26th of May compared to 350 (yellow) for PEPE.

This is just one memecoin, not the whole sector, but the difference is still enormous considering PEPE gained 75% last week and is one of the hotly discussed memes online.

Therefore, social media engagement was still in favor of Bitcoin. Additionally, the derivatives and spot market of Bitcoin are likely too big for memecoins to meaningfully chip away at.

The allure of memecoins

The number of cryptocurrencies in the market has increased drastically year after year. In January 2021, an estimated 4,154 tokens were in the market. In March 2024 that number has increased to 13,217, and counting.

Most of these tokens are based on vaporware, products that are promised to the public but never actually created. This huge dilution among altcoins is vastly different from the past two cycles.

OG crypto traders talk about tokens randomly popping off during a bull run and making triple-digit percentage gains within days.

The problem now is that with so many tokens around that have suffered at least one bear market, the crypto space is too saturated to see all of them trend higher during a bull run.

In that regard, memecoins are upfront and honest about their intentions. They bring a community together through jokes and vibes, promise no product expect a potential return on investment and some fun during the journey toward these gains.

Win or lose as a team of bag holders.

Read Pepe’s [PEPE] Price Prediction 2024-25

People who don’t have the time or know-how to weed through dozens, or even hundreds, of crypto tokens are naturally attracted to these down-to-earth meme tokens and willing to bet at least a small amount on them.

This is not to say that there aren’t tokens with good development teams that look to solve a defined problem, but it is harder for the public to find them. Perhaps that is why memecoins are outperforming other sectors so far.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

clomid generic brand clomid uses how to buy clomid no prescription where can i get clomid no prescription can i get generic clomiphene without a prescription can i get generic clomiphene without insurance can i get cheap clomid without dr prescription

Proof blog you be undergoing here.. It’s hard to find high quality script like yours these days. I honestly recognize individuals like you! Take guardianship!!

The thoroughness in this draft is noteworthy.

buy zithromax medication – tinidazole over the counter order metronidazole 400mg pill

cheap semaglutide 14 mg – buy semaglutide sale buy periactin 4 mg generic

buy domperidone pills – generic motilium order generic flexeril 15mg

buy inderal 20mg pill – buy methotrexate 10mg online order methotrexate 2.5mg pills

amoxicillin sale – cost amoxicillin order combivent 100 mcg for sale

augmentin 625mg sale – https://atbioinfo.com/ ampicillin pill