- Bitcoin saw a positive reaction on the price charts, but social metrics underlined weakness.

- The high demand for Bitcoin in May could propel prices past the ATH soon.

Bitcoin [BTC] saw an interesting week in terms of price action. It had a lively breakout past the local range high at $67k on the 20th of May.

On the 23rd and the 24th of May, Bitcoin retested the $66.3k-$66.6k zone as support and bounced higher to trade at $69.1k at press time.

More gains are likely to follow as demand for the king of crypto continues to grow.

The CEO of the blockchain-based payments’ app Strike, Jack Mallers, asserted that “Bitcoin is the best thing you can own” in a conversation with Antony Pompliano.

The social metrics and on-chain activity were weakening

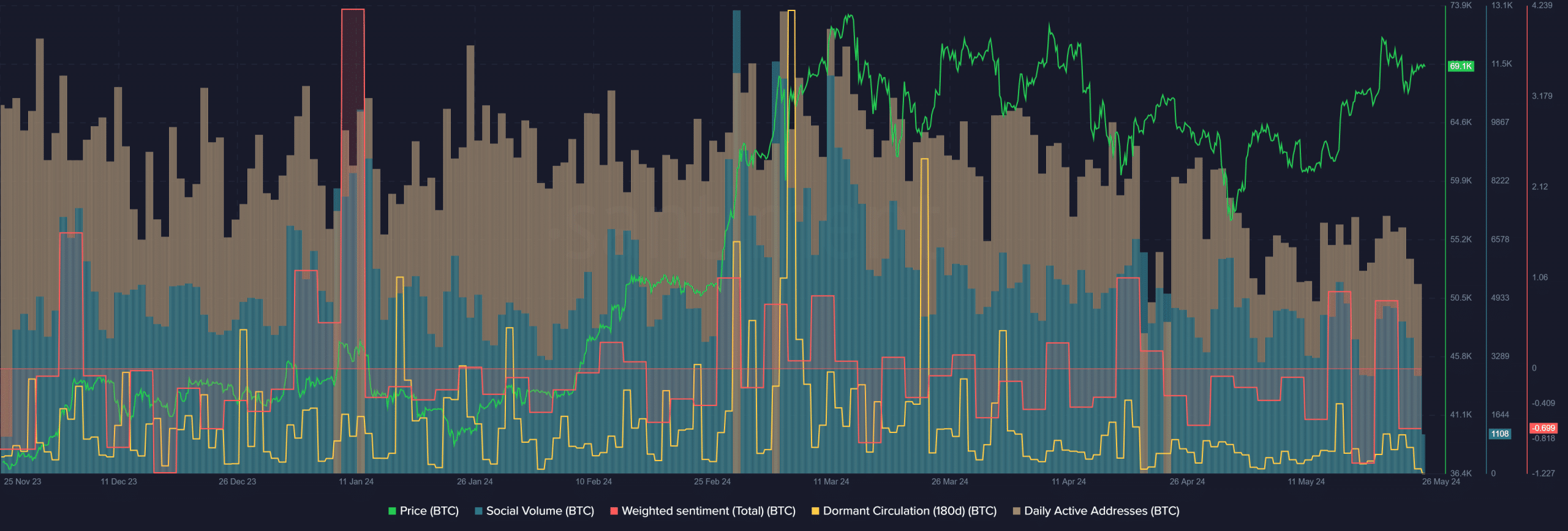

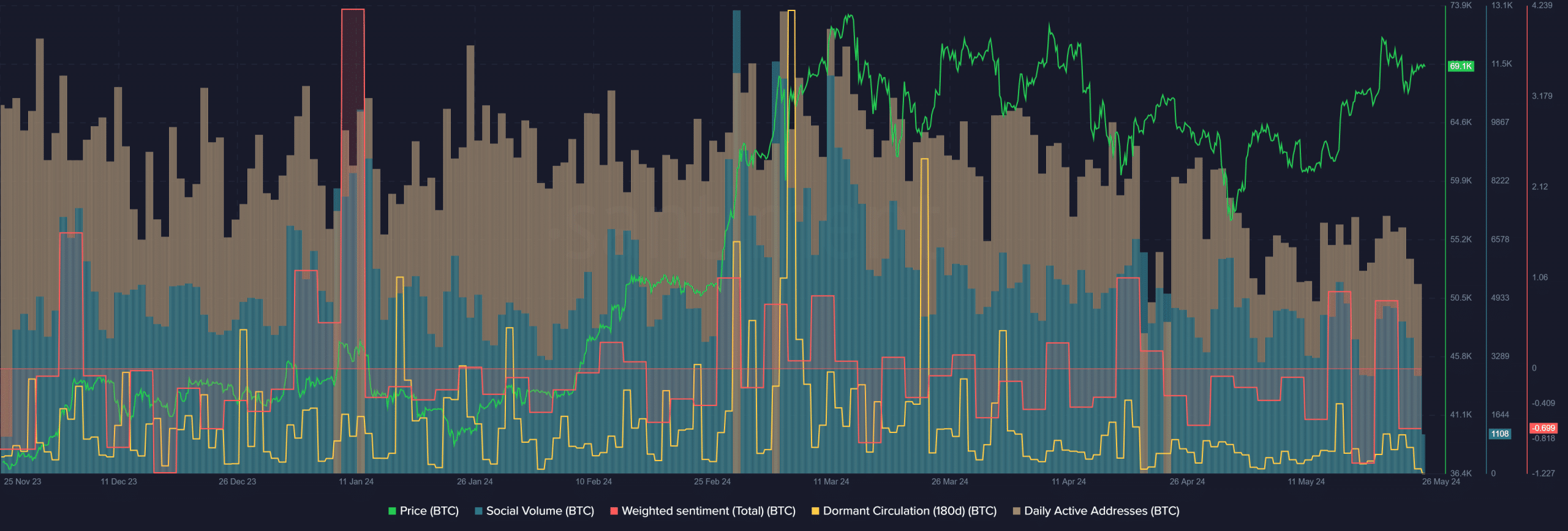

Source: Santiment

The Social Volume behind Bitcoin has slowly slid lower since the 11th of March. The Weighted Sentiment was negative throughout May, with two positive surges since mid-May.

Together, they pointed toward reduced social media engagement.

The daily activity also trended lower since mid-March. On the other hand, the dormant circulation last saw noticeably large spikes on the 18th of April and the 15th of May.

However, their size did not rival the ones in March or late February.

This revealed that the on-chain movement of dormant Bitcoin was absent recently, which suggested a large wave of selling was not yet upon us. This was a good sign as it underlines lowered selling pressure.

Is the demand for Bitcoin higher than ever before?

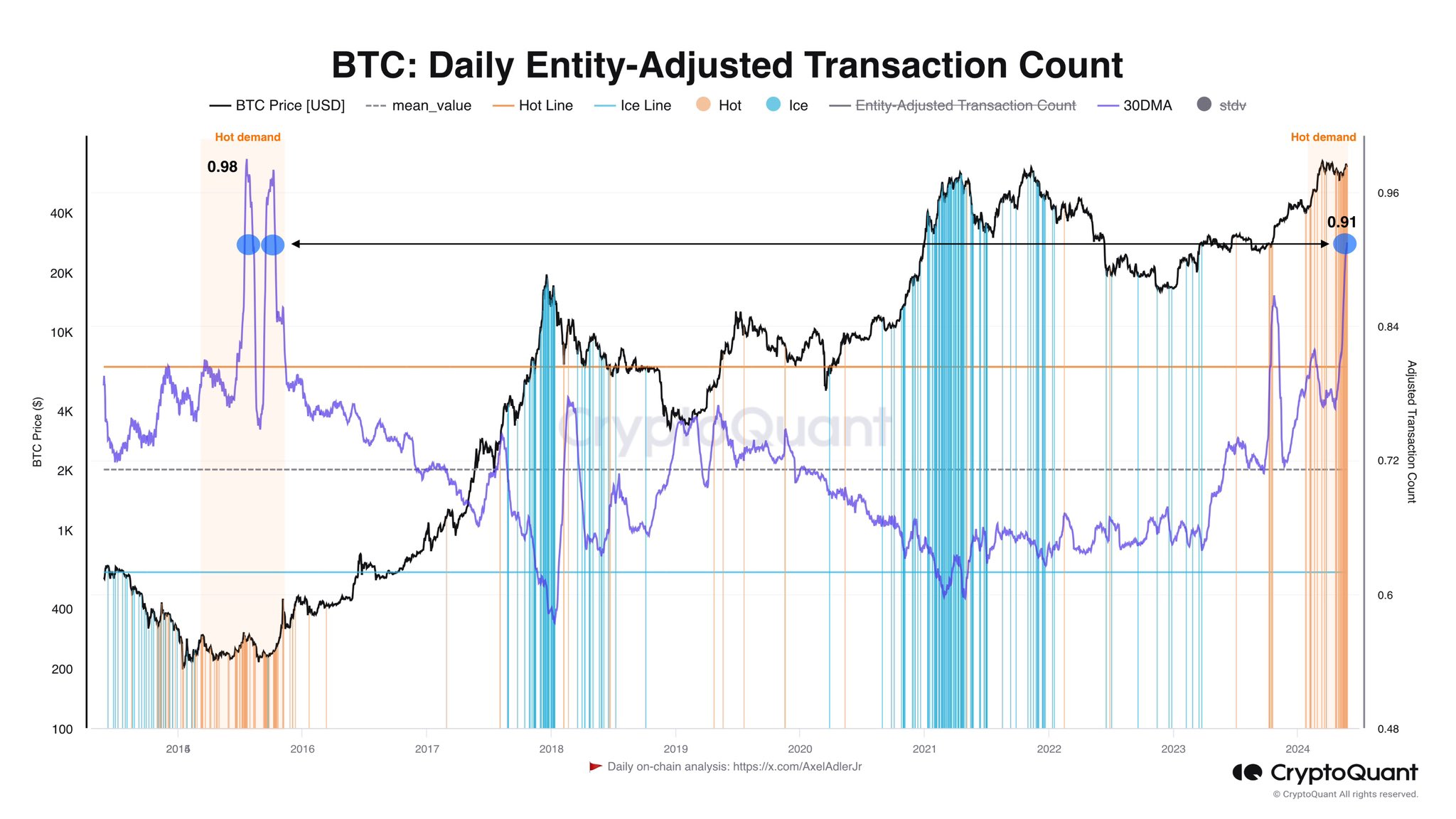

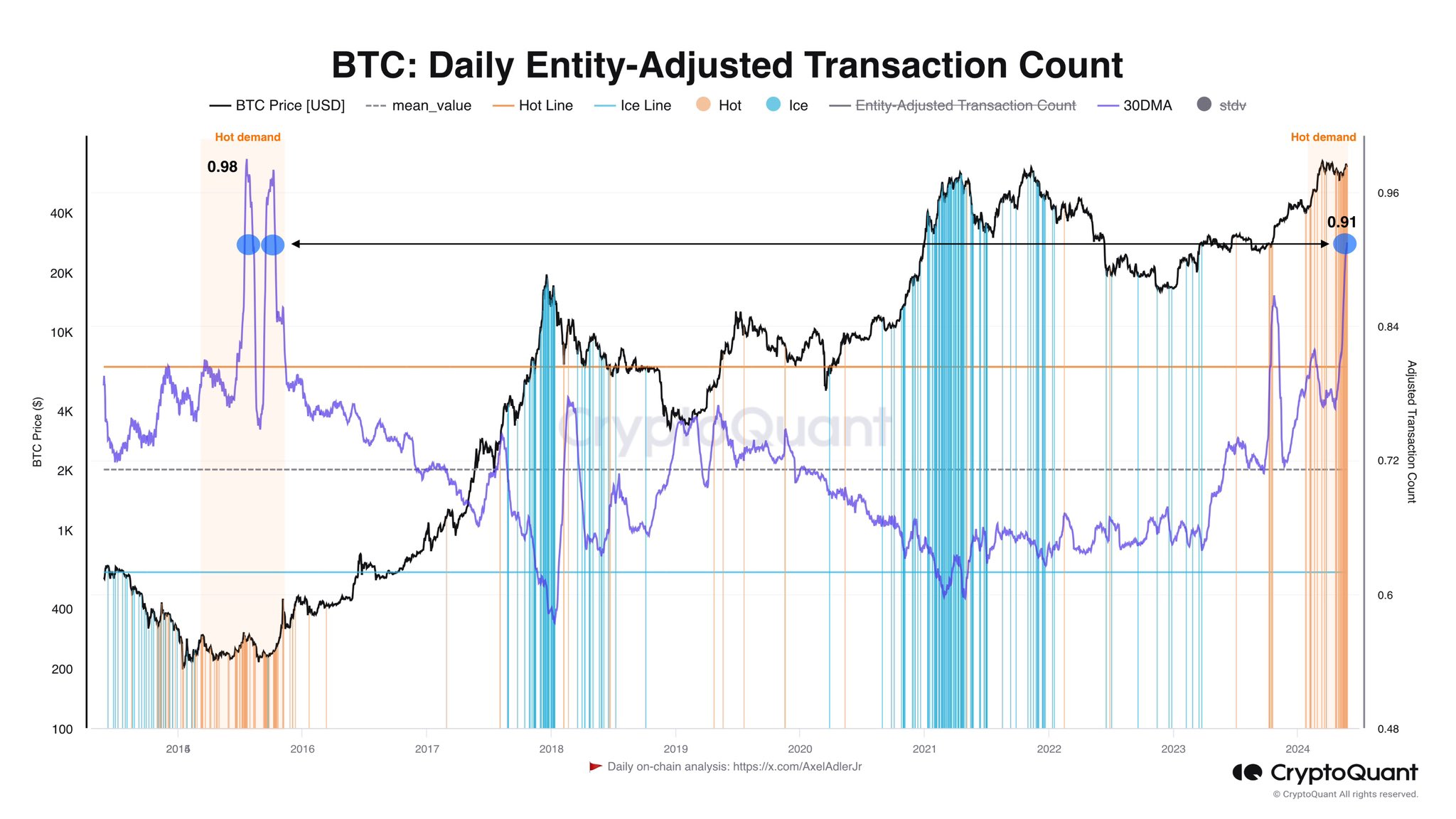

Source: AxelAdlerJr on X

In a post on X (formerly Twitter) crypto analyst Axel Adler showed that the demand was red-hot. This conclusion was made based on the entity-adjusted transaction count.

Based on the chart’s readings, the demand was close to the levels of the 2016 rally.

Read Bitcoin’s [BTC] price prediction 2024-25

He also added that the price of Bitcoin back then was $300, compared to $69.1k now. Hence, the capital involved is vastly greater than eight years ago.

This demand from retail and institutional investors, combined with a reduced selling pressure from the dormant circulation metric, indicated that Bitcoin is very likely to break out past the $71.4k region once again.

- Bitcoin saw a positive reaction on the price charts, but social metrics underlined weakness.

- The high demand for Bitcoin in May could propel prices past the ATH soon.

Bitcoin [BTC] saw an interesting week in terms of price action. It had a lively breakout past the local range high at $67k on the 20th of May.

On the 23rd and the 24th of May, Bitcoin retested the $66.3k-$66.6k zone as support and bounced higher to trade at $69.1k at press time.

More gains are likely to follow as demand for the king of crypto continues to grow.

The CEO of the blockchain-based payments’ app Strike, Jack Mallers, asserted that “Bitcoin is the best thing you can own” in a conversation with Antony Pompliano.

The social metrics and on-chain activity were weakening

Source: Santiment

The Social Volume behind Bitcoin has slowly slid lower since the 11th of March. The Weighted Sentiment was negative throughout May, with two positive surges since mid-May.

Together, they pointed toward reduced social media engagement.

The daily activity also trended lower since mid-March. On the other hand, the dormant circulation last saw noticeably large spikes on the 18th of April and the 15th of May.

However, their size did not rival the ones in March or late February.

This revealed that the on-chain movement of dormant Bitcoin was absent recently, which suggested a large wave of selling was not yet upon us. This was a good sign as it underlines lowered selling pressure.

Is the demand for Bitcoin higher than ever before?

Source: AxelAdlerJr on X

In a post on X (formerly Twitter) crypto analyst Axel Adler showed that the demand was red-hot. This conclusion was made based on the entity-adjusted transaction count.

Based on the chart’s readings, the demand was close to the levels of the 2016 rally.

Read Bitcoin’s [BTC] price prediction 2024-25

He also added that the price of Bitcoin back then was $300, compared to $69.1k now. Hence, the capital involved is vastly greater than eight years ago.

This demand from retail and institutional investors, combined with a reduced selling pressure from the dormant circulation metric, indicated that Bitcoin is very likely to break out past the $71.4k region once again.

get cheap clomid pills where to get clomid no prescription how to get clomiphene without dr prescription buy clomid without dr prescription cost of clomiphene no prescription cost of generic clomid without a prescription where to buy cheap clomiphene tablets

This is the type of delivery I unearth helpful.

Greetings! Very productive par‘nesis within this article! It’s the crumb changes which wish turn the largest changes. Thanks a portion for sharing!

azithromycin drug – purchase sumycin online cheap buy flagyl paypal

semaglutide 14mg ca – purchase rybelsus sale buy cyproheptadine 4mg without prescription

buy motilium sale – buy cyclobenzaprine without prescription order cyclobenzaprine 15mg sale

amoxiclav for sale – https://atbioinfo.com/ buy ampicillin no prescription

nexium 40mg over the counter – anexa mate esomeprazole 20mg usa

purchase coumadin for sale – https://coumamide.com/ oral cozaar

buy mobic 7.5mg pill – https://moboxsin.com/ order meloxicam 7.5mg generic

prednisone 10mg cheap – https://apreplson.com/ buy prednisone generic

online ed meds – erection problems erectile dysfunction pills over the counter

amoxil ca – https://combamoxi.com/ cheap amoxicillin pill

buy diflucan 200mg pills – https://gpdifluca.com/# cheap diflucan 100mg

escitalopram 10mg pill – anxiety pro where can i buy escitalopram

how to buy cenforce – https://cenforcers.com/ purchase cenforce pill

cheapest cialis – click can tadalafil cure erectile dysfunction

buy tadalafil online no prescription – https://strongtadafl.com/# how much is cialis without insurance

ranitidine uk – https://aranitidine.com/ zantac generic

sildenafil 50 mg coupon – https://strongvpls.com/ can you buy viagra over counter uk

The depth in this serving is exceptional. comprar synthroid 50 mg

I’ll certainly bring back to skim more. buy gabapentin 100mg pills

Greetings! Very serviceable suggestion within this article! It’s the petty changes which wish turn the largest changes. Thanks a a quantity in the direction of sharing! https://ursxdol.com/augmentin-amoxiclav-pill/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/lisinopril-5-mg/