- DeFi TVL has now sat at its highest since May 2022.

- Lido’s share of the ETH staking market is declining.

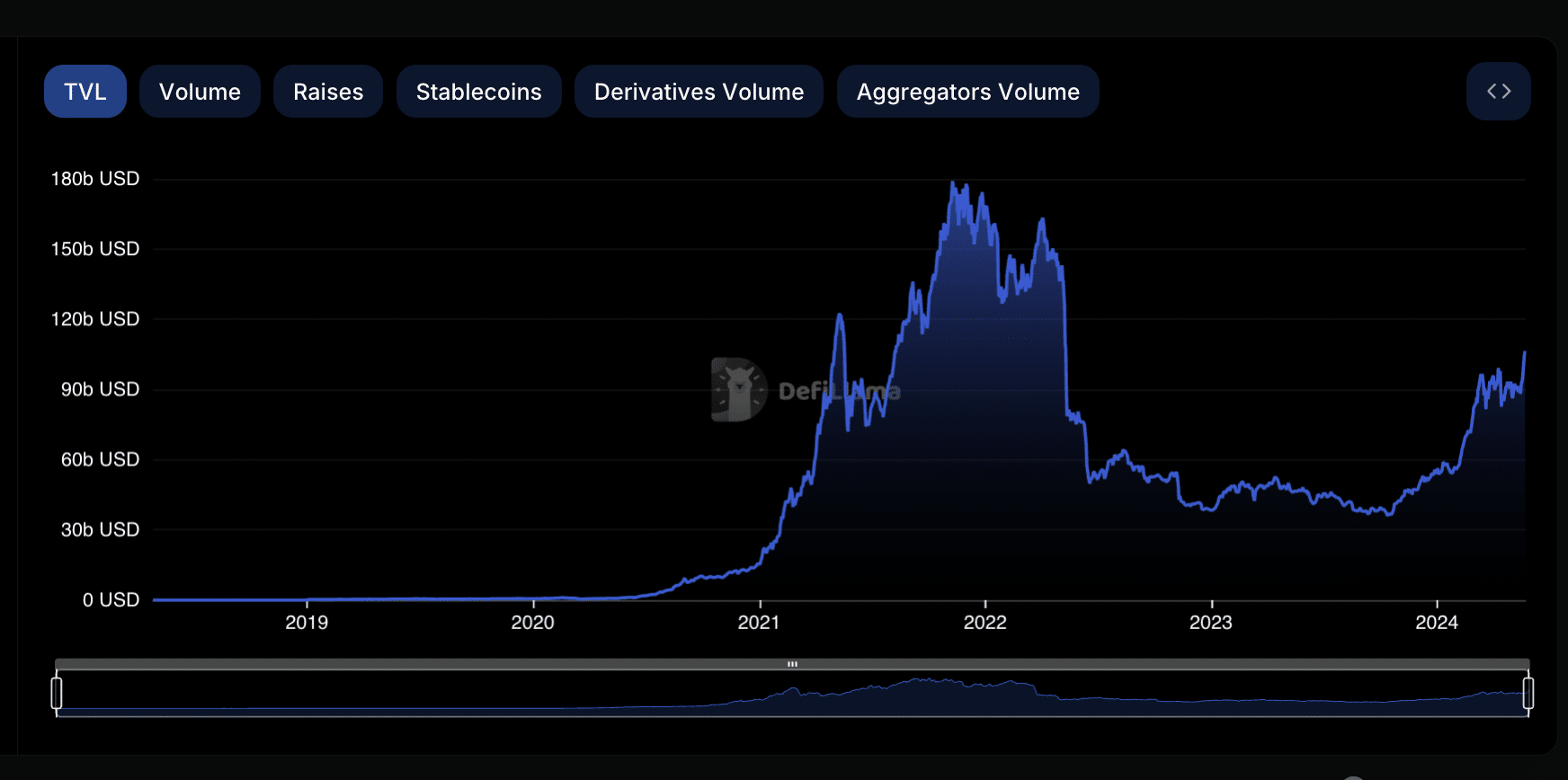

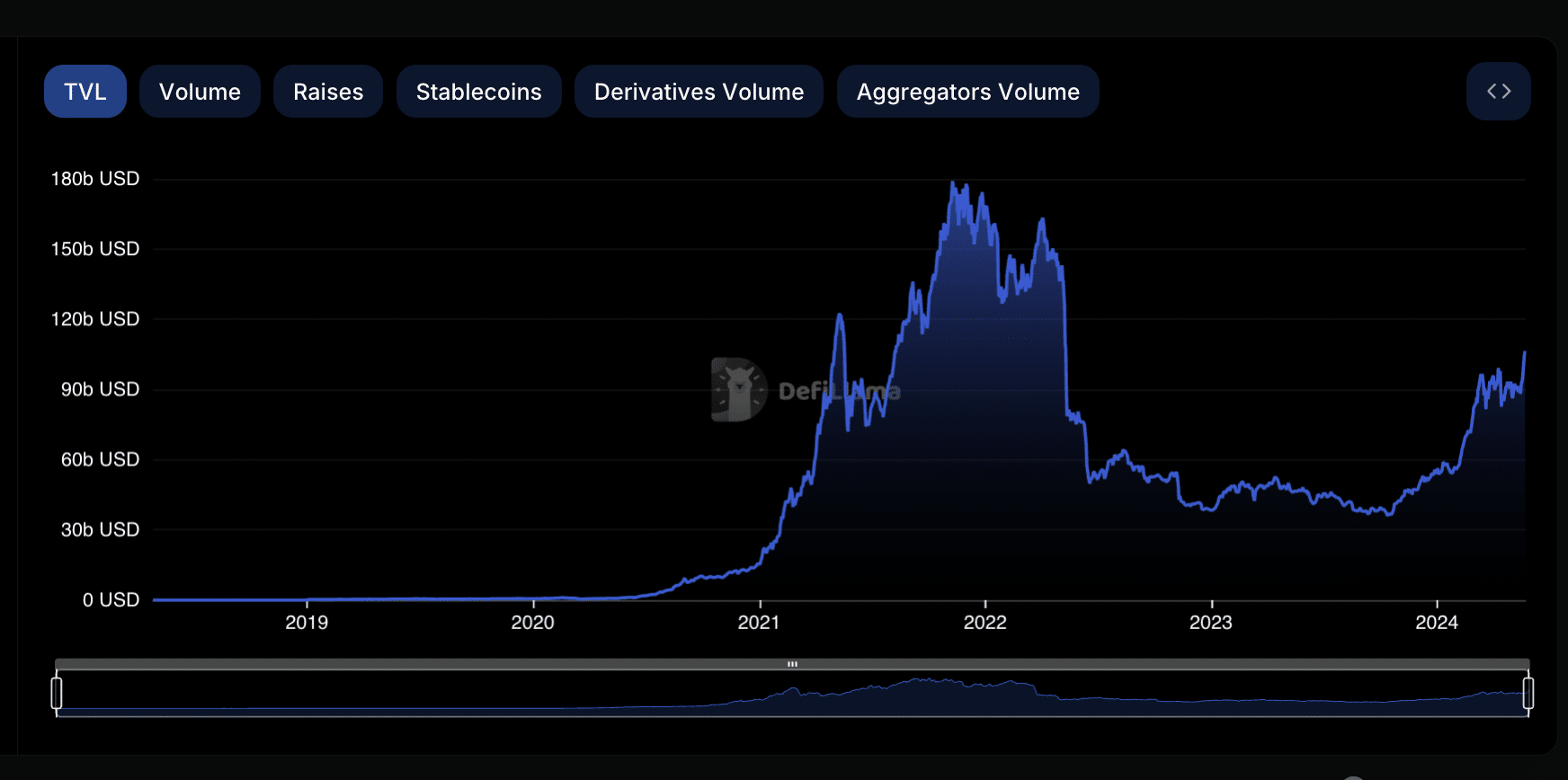

The total value locked (TVL) across decentralized finance (DeFi) protocols has risen to a two-year high amid the general market rally, according to DefiLlama’s data.

At press time, DeFi TVL was $106.45 billion. Assessed on a year-to-date (YTD), this has increased by 96% since the beginning of the year.

Source: DefiLlama

Lido sees a decline in market share

The value of assets locked across the pools on Lido Finance [LDO], the leading Ethereum [ETH] staking provider and the largest DeFi protocol by TVL, has surged steadily since 12th May.

Prior to this period, the protocol’s TVL had plummeted to a two-month low of $27.43 billion. However, as the values of cryptocurrency assets began to rise in the middle of May, Lido’s TVL followed the trend and has since grown by 30%.

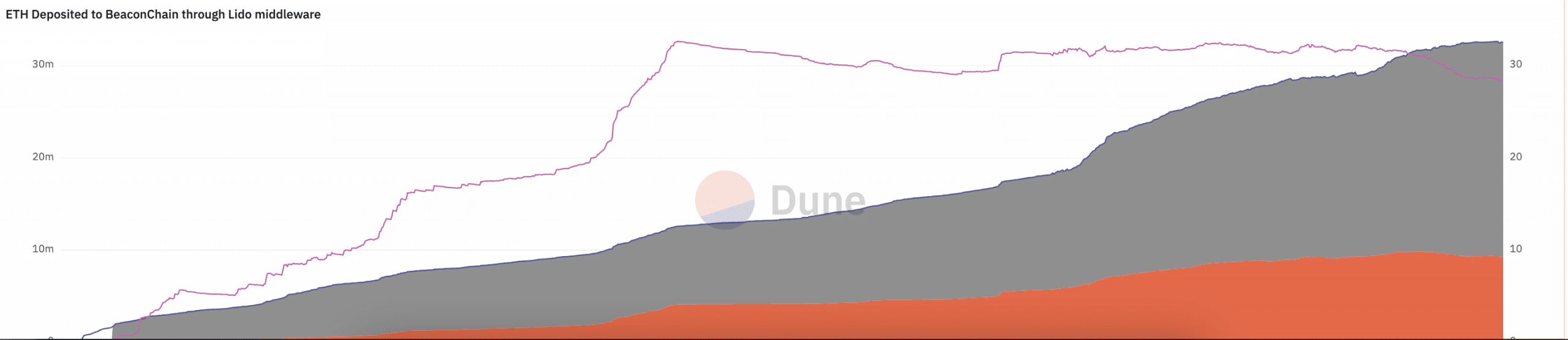

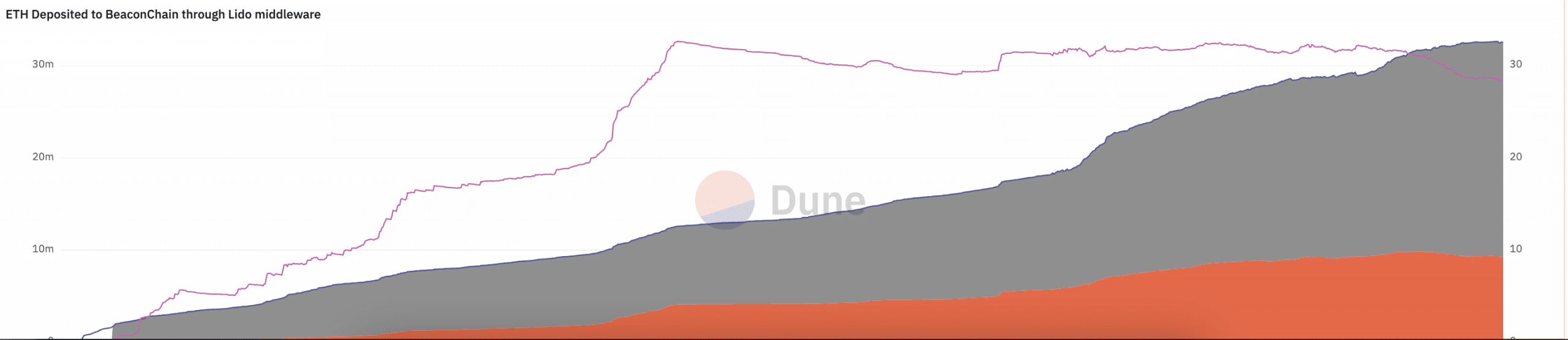

Interestingly, Lido’s share of the ETH staking ecosystem has declined. At the time of writing, 28.6% of all ETH deposited to the BeaconChain was made through Lido, per data from Dune Analytics. The last time the liquid staking protocol’s share was this low was on 17th April, 2022.

Source: Dune Analytics

This decline comes amid a broader trend of decreasing ETH staked across multiple platforms over the past few days.

Information retrieved from The Block’s data dashboard showed that after peaking at a YTD high of 27% on 13t May, the percentage of ETH’s entire supply that has been staked has since fallen by 4%.

LDO sees surge in demand

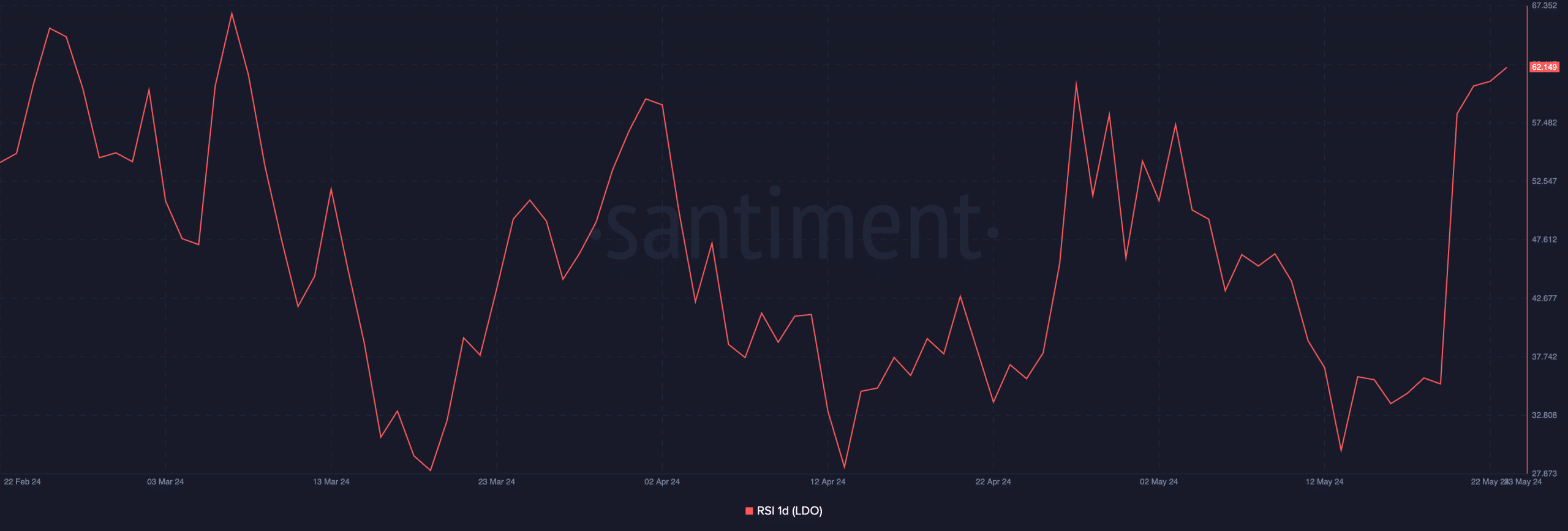

Regarding the protocol’s governance token, LDO, it exchanged hands at $2.13 at press time. According to CoinMarketCap, the altcoin’s value has risen by over 30% in the last week.

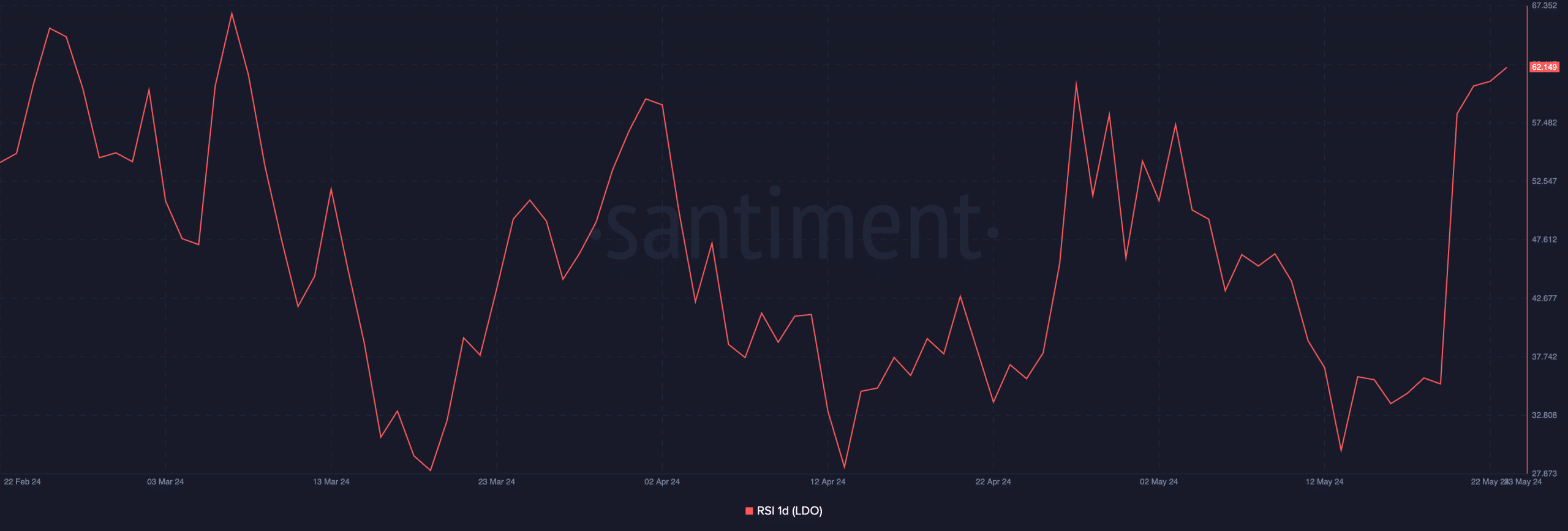

The spike in the token’s value is attributable to the rise in demand during that period. Santiment’s data showed a rally in its Relative Strength Index (RSI) since 19 May. At 62.149 at press time, LDO’s RSI showed that buying momentum was more significant than selling pressure.

Source: Santiment

Realistic or not, here’s LDO’s market cap in BTC’s terms

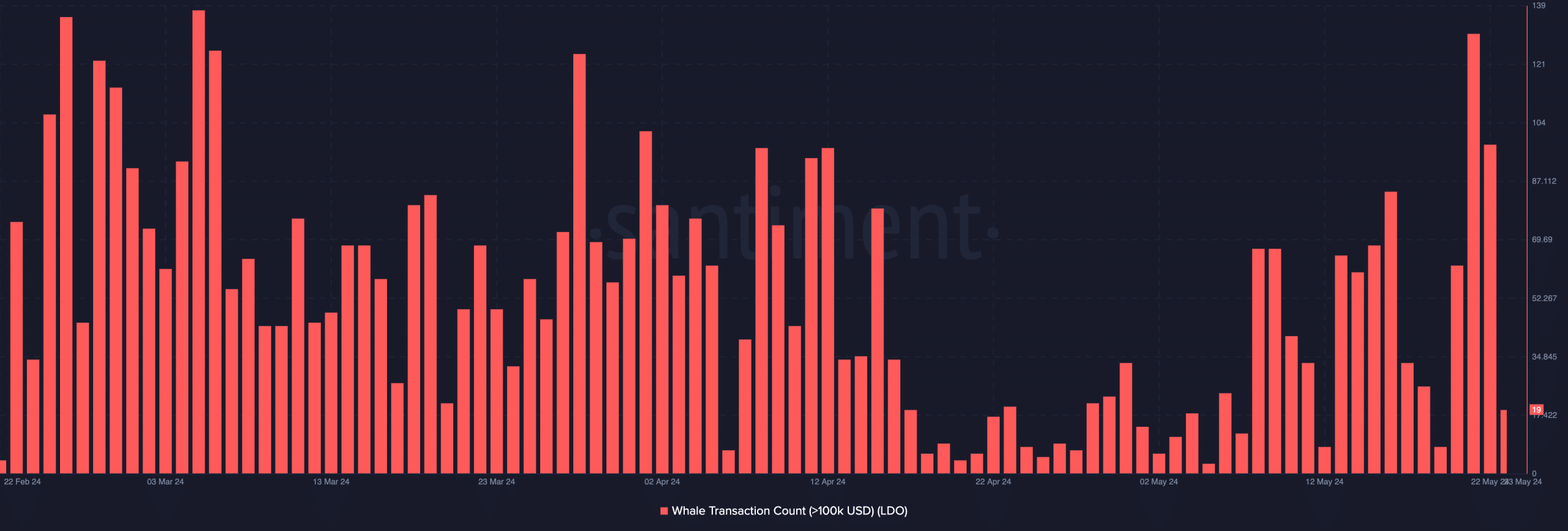

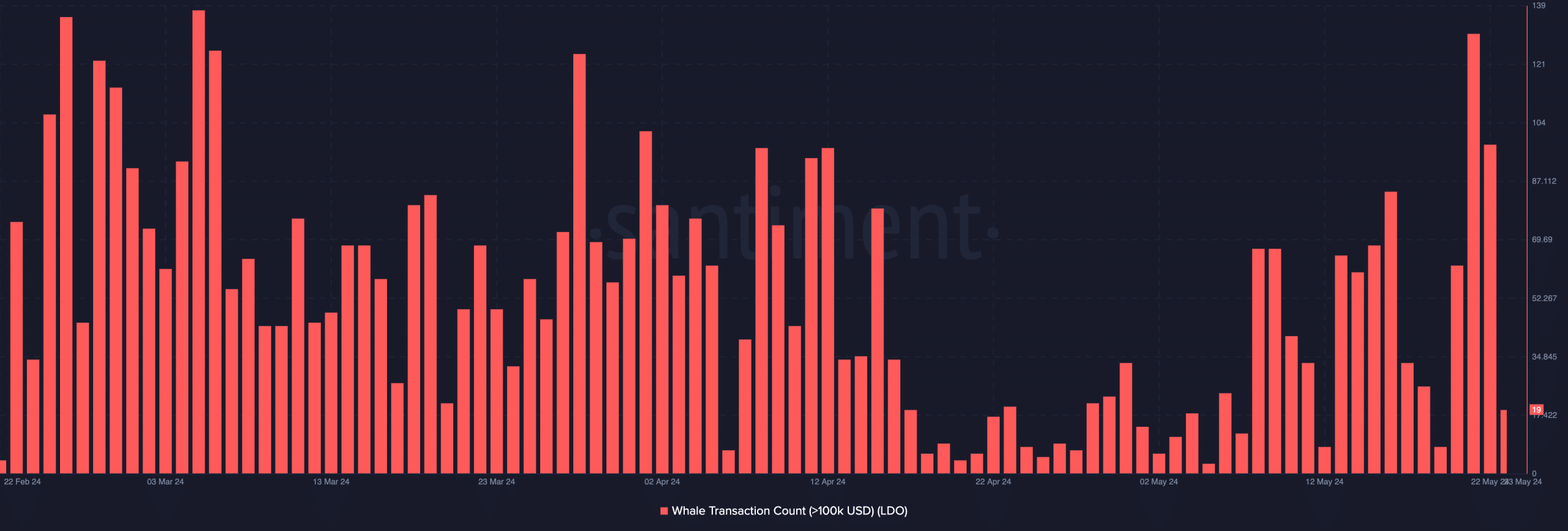

Further, LDO whale activity has surged in the past few days. In fact, on 21st May, the daily count of LDO whale transactions that exceeded $100,000 climbed to its highest since 6th March.

On that day, 131 LDO transactions valued above $100,000 were completed.

Source: Santiment

- DeFi TVL has now sat at its highest since May 2022.

- Lido’s share of the ETH staking market is declining.

The total value locked (TVL) across decentralized finance (DeFi) protocols has risen to a two-year high amid the general market rally, according to DefiLlama’s data.

At press time, DeFi TVL was $106.45 billion. Assessed on a year-to-date (YTD), this has increased by 96% since the beginning of the year.

Source: DefiLlama

Lido sees a decline in market share

The value of assets locked across the pools on Lido Finance [LDO], the leading Ethereum [ETH] staking provider and the largest DeFi protocol by TVL, has surged steadily since 12th May.

Prior to this period, the protocol’s TVL had plummeted to a two-month low of $27.43 billion. However, as the values of cryptocurrency assets began to rise in the middle of May, Lido’s TVL followed the trend and has since grown by 30%.

Interestingly, Lido’s share of the ETH staking ecosystem has declined. At the time of writing, 28.6% of all ETH deposited to the BeaconChain was made through Lido, per data from Dune Analytics. The last time the liquid staking protocol’s share was this low was on 17th April, 2022.

Source: Dune Analytics

This decline comes amid a broader trend of decreasing ETH staked across multiple platforms over the past few days.

Information retrieved from The Block’s data dashboard showed that after peaking at a YTD high of 27% on 13t May, the percentage of ETH’s entire supply that has been staked has since fallen by 4%.

LDO sees surge in demand

Regarding the protocol’s governance token, LDO, it exchanged hands at $2.13 at press time. According to CoinMarketCap, the altcoin’s value has risen by over 30% in the last week.

The spike in the token’s value is attributable to the rise in demand during that period. Santiment’s data showed a rally in its Relative Strength Index (RSI) since 19 May. At 62.149 at press time, LDO’s RSI showed that buying momentum was more significant than selling pressure.

Source: Santiment

Realistic or not, here’s LDO’s market cap in BTC’s terms

Further, LDO whale activity has surged in the past few days. In fact, on 21st May, the daily count of LDO whale transactions that exceeded $100,000 climbed to its highest since 6th March.

On that day, 131 LDO transactions valued above $100,000 were completed.

Source: Santiment