- Bitcoin’s trend score falls below zero.

- BTC has held on weakly to the $66,000 price range.

Recent data suggested that certain Bitcoin [BTC] whales have been reducing their holdings lately.

While this development might initially imply negative sentiments, other metrics indicated that it’s not necessarily a cause for alarm, at least not now.

Bitcoin whales distribute holdings

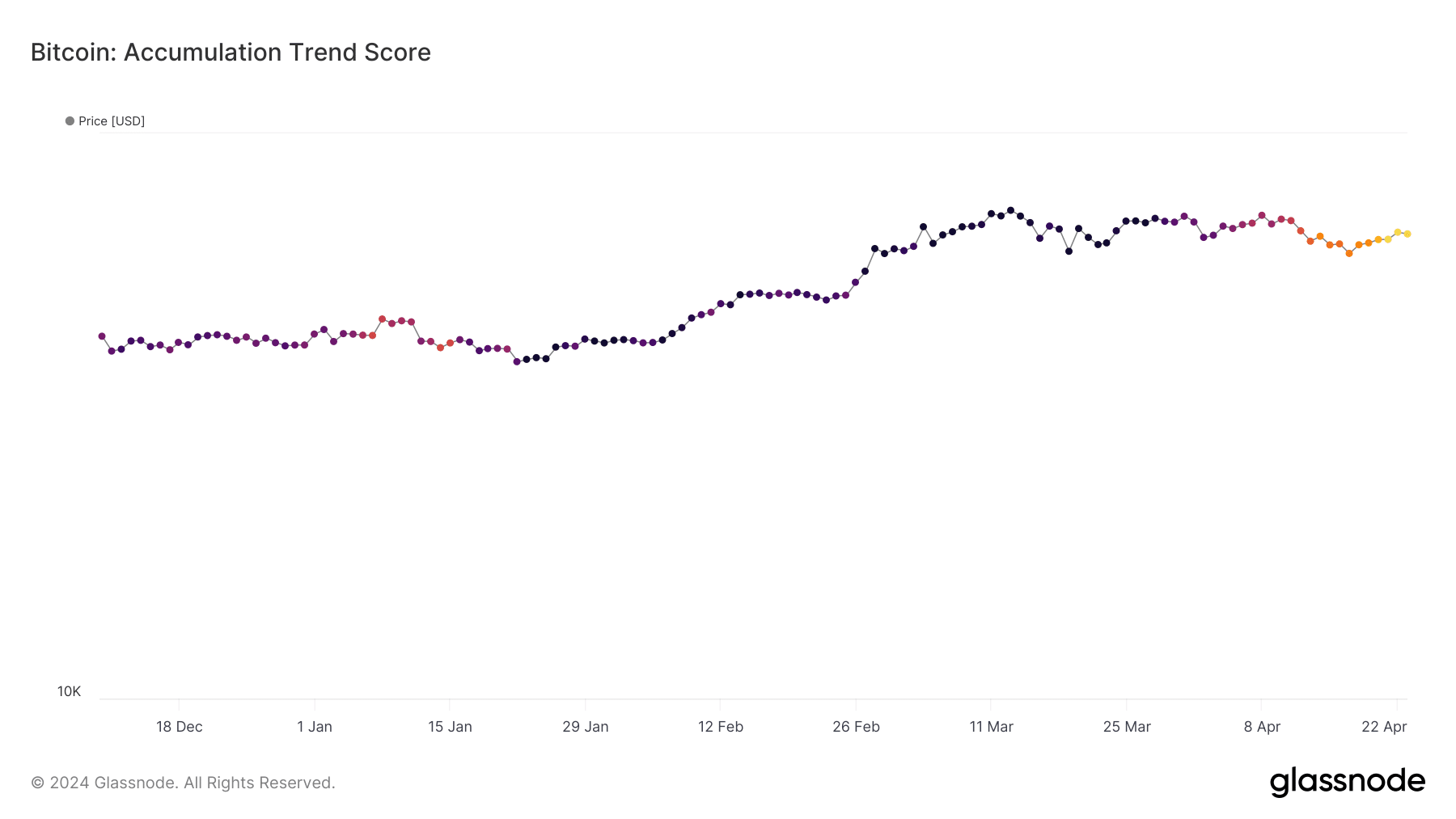

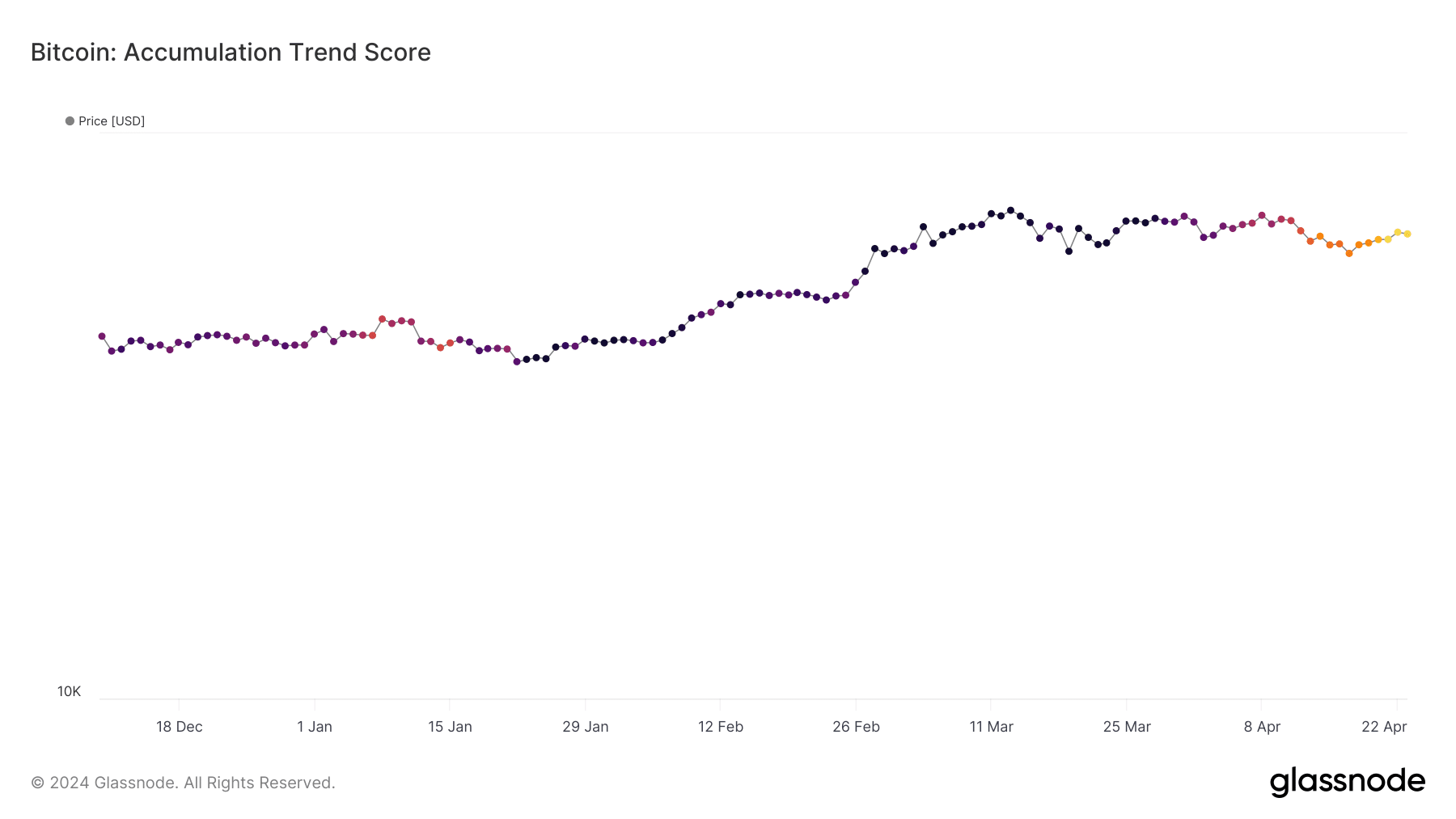

AMBCrypto’s analysis of the Bitcoin Accumulation Trend Score on Glassnode revealed a significant shift, with the score hovering around zero.

As of press time, the Trend Score stood at approximately 0.026, marking one of its lowest points in recent times.

Source: Glassnode

The Bitcoin Accumulation Trend Score serves as an indicator of the relative size of entities actively accumulating coins on-chain, measured by their BTC holdings.

The scale of this score reflects both the entities’ balance size and the number of new coins acquired or sold over the last month.

A score closer to 1 suggests that larger entities or a significant portion of the network are accumulating. In contrast, a value closer to 0 indicates distribution or a lack of accumulation.

Smaller Bitcoin addresses mop up sell-offs

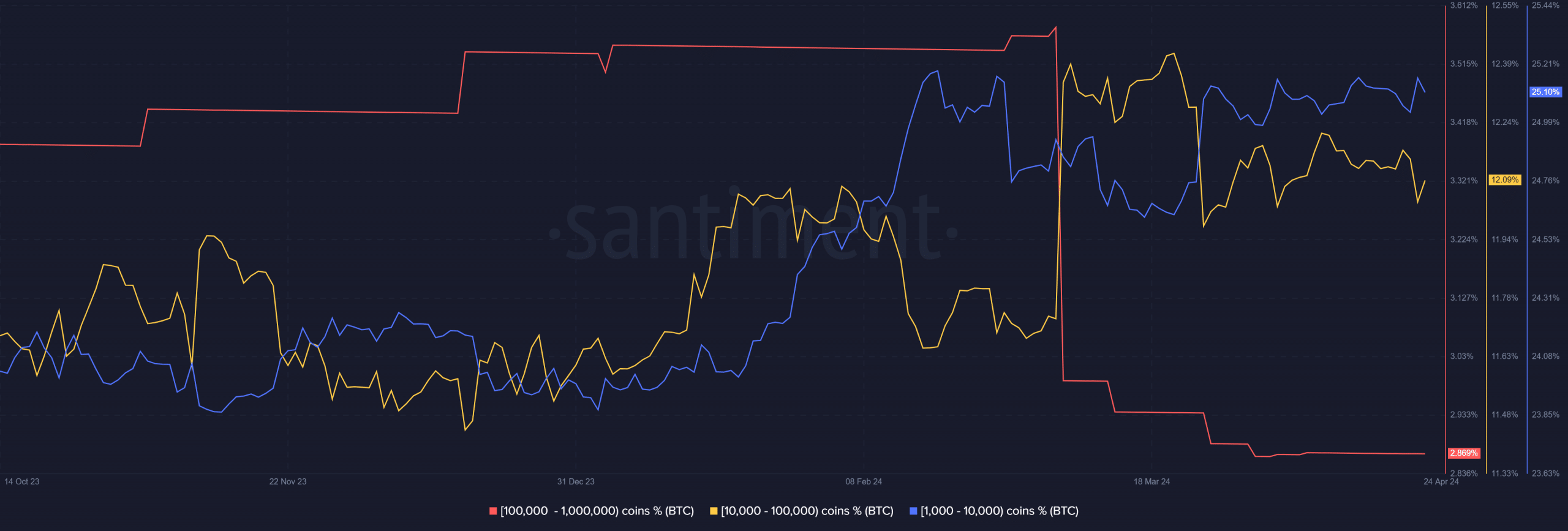

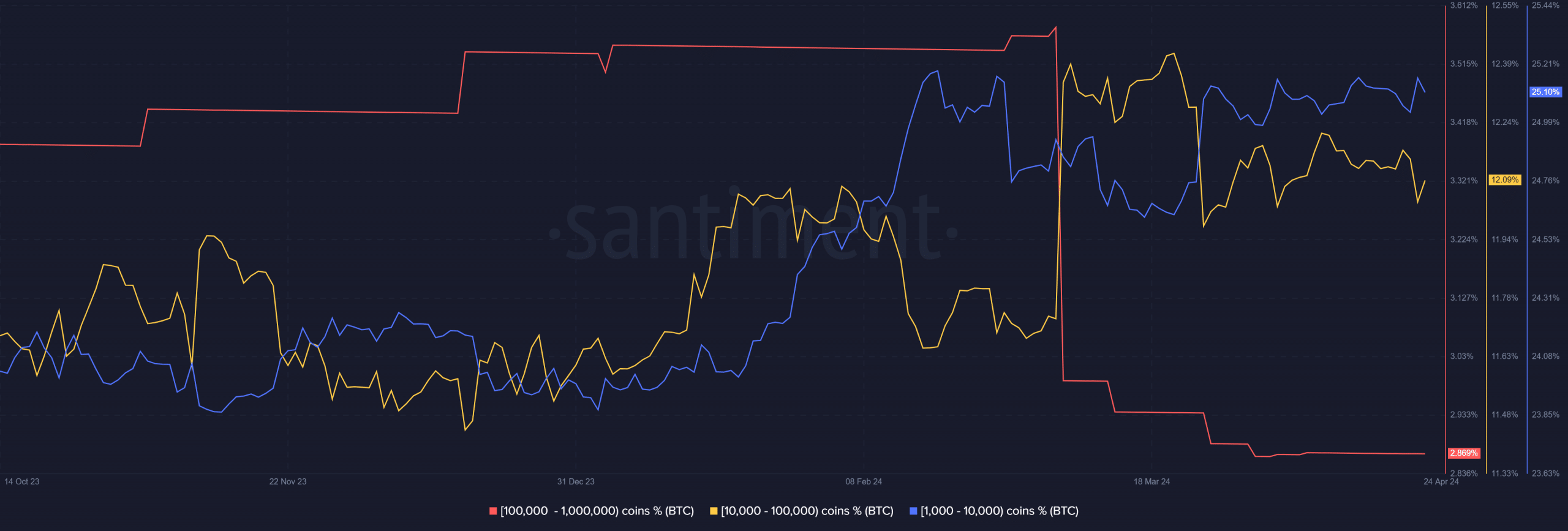

AMBCrypto’s analysis of the supply distribution metric on Santiment revealed a notable decrease in the holdings of Bitcoin whales. Holdings from these addresses declined from close to 3% to around 2.8%.

However, AMBCrypto observed that while major whale addresses experienced a decline, other whale addresses were accumulating.

Source: Santiment

Further examination of the chart illustrated that although these addresses also encountered some drops, they have rebounded.

In contrast to the stagnant trend of major whale addresses, these other addresses have exhibited activity.

This suggests that not all whale addresses are distributing their holdings; instead, some are actively accumulating.

Bitcoin holders continue to grow

Examining the total number of holders on Santiment showed ongoing growth. At the time of writing, the total number of Bitcoin holders stood at 53.68 million.

This figure suggested an addition of approximately 1 million holders between 1st April and press time.

This increase in the number of holders implied that the accumulation of BTC had not experienced a significant decline, despite the distribution observed from whale addresses.

Read Bitcoin’s [BTC] Price Prediction 2024-25

BTC trends weakly on the neutral line

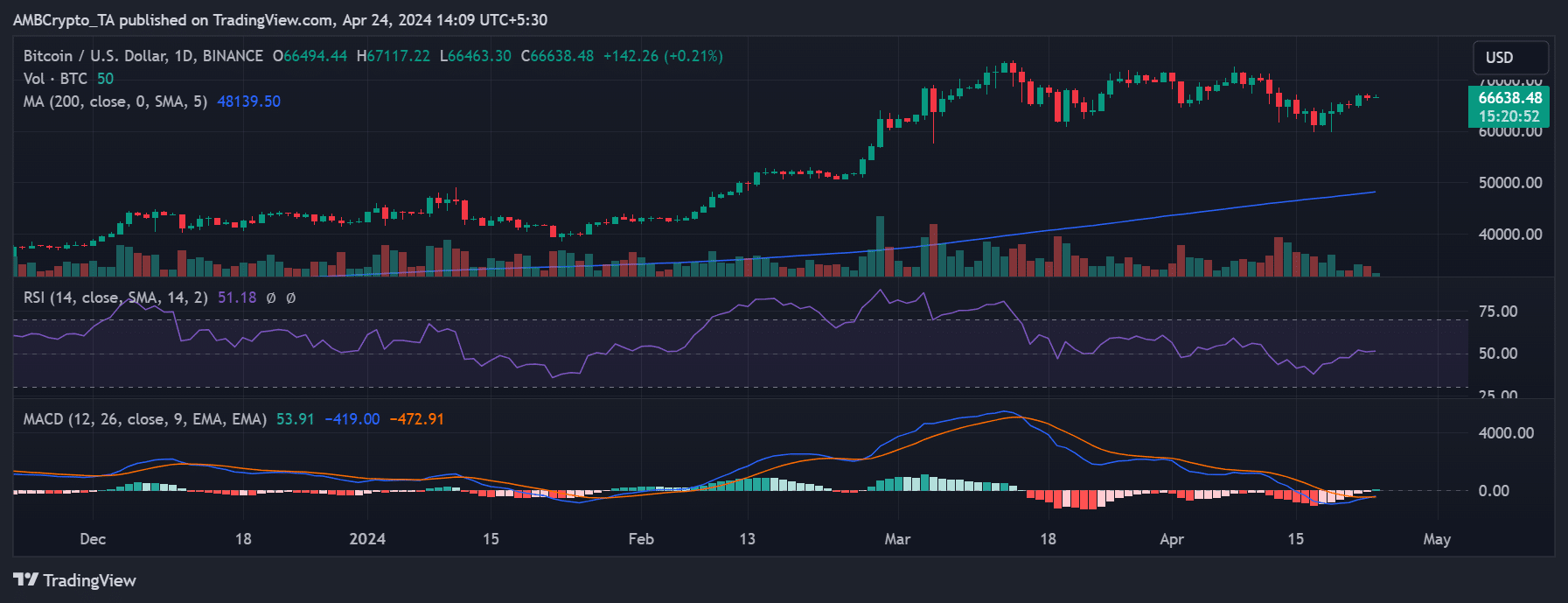

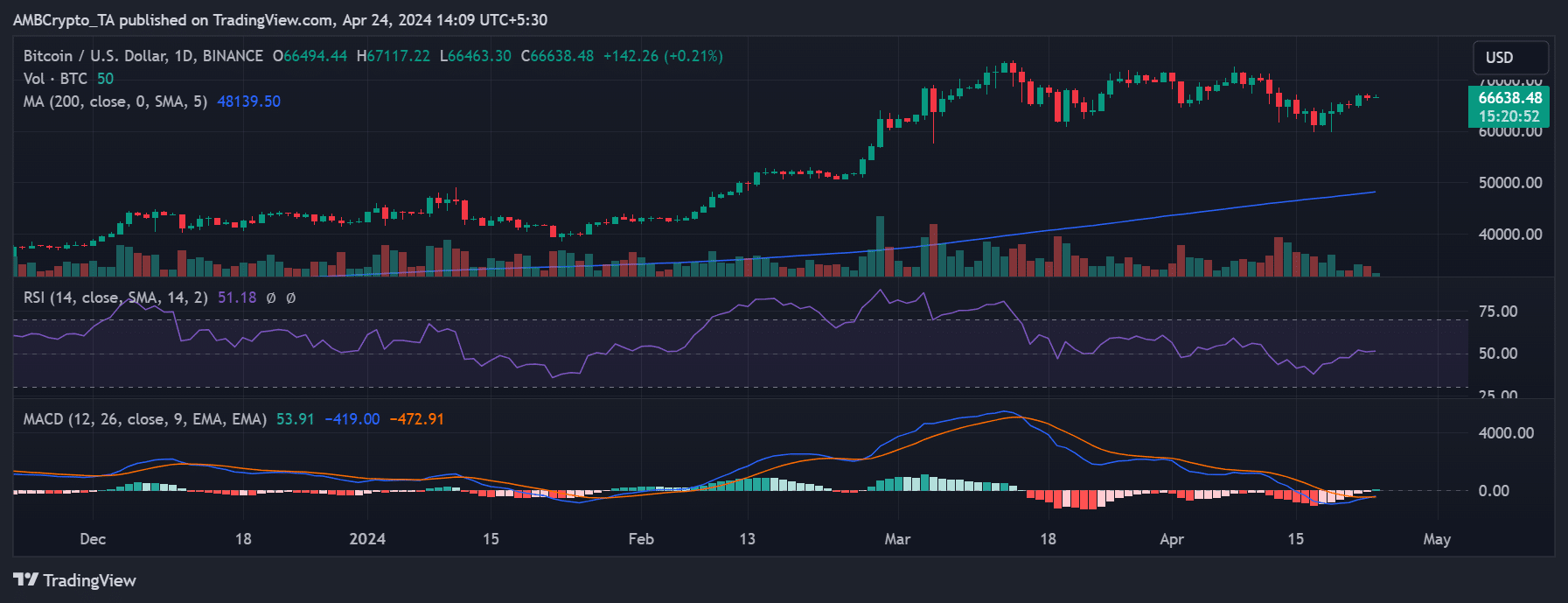

As of press time, Bitcoin was striving to sustain the $66,000 price level. According to AMBCrypto’s analysis of the daily timeframe chart, it was trading at around $66,600, reflecting a less than 1% increase.

Its Relative Strength Index (RSI) indicated a weak bull trend as well. AMBCrypto’s look at the RSI revealed a slight ascent above the neutral line when the price surged by around 2.7% on 22nd April.

Source: TradingView

- Bitcoin’s trend score falls below zero.

- BTC has held on weakly to the $66,000 price range.

Recent data suggested that certain Bitcoin [BTC] whales have been reducing their holdings lately.

While this development might initially imply negative sentiments, other metrics indicated that it’s not necessarily a cause for alarm, at least not now.

Bitcoin whales distribute holdings

AMBCrypto’s analysis of the Bitcoin Accumulation Trend Score on Glassnode revealed a significant shift, with the score hovering around zero.

As of press time, the Trend Score stood at approximately 0.026, marking one of its lowest points in recent times.

Source: Glassnode

The Bitcoin Accumulation Trend Score serves as an indicator of the relative size of entities actively accumulating coins on-chain, measured by their BTC holdings.

The scale of this score reflects both the entities’ balance size and the number of new coins acquired or sold over the last month.

A score closer to 1 suggests that larger entities or a significant portion of the network are accumulating. In contrast, a value closer to 0 indicates distribution or a lack of accumulation.

Smaller Bitcoin addresses mop up sell-offs

AMBCrypto’s analysis of the supply distribution metric on Santiment revealed a notable decrease in the holdings of Bitcoin whales. Holdings from these addresses declined from close to 3% to around 2.8%.

However, AMBCrypto observed that while major whale addresses experienced a decline, other whale addresses were accumulating.

Source: Santiment

Further examination of the chart illustrated that although these addresses also encountered some drops, they have rebounded.

In contrast to the stagnant trend of major whale addresses, these other addresses have exhibited activity.

This suggests that not all whale addresses are distributing their holdings; instead, some are actively accumulating.

Bitcoin holders continue to grow

Examining the total number of holders on Santiment showed ongoing growth. At the time of writing, the total number of Bitcoin holders stood at 53.68 million.

This figure suggested an addition of approximately 1 million holders between 1st April and press time.

This increase in the number of holders implied that the accumulation of BTC had not experienced a significant decline, despite the distribution observed from whale addresses.

Read Bitcoin’s [BTC] Price Prediction 2024-25

BTC trends weakly on the neutral line

As of press time, Bitcoin was striving to sustain the $66,000 price level. According to AMBCrypto’s analysis of the daily timeframe chart, it was trading at around $66,600, reflecting a less than 1% increase.

Its Relative Strength Index (RSI) indicated a weak bull trend as well. AMBCrypto’s look at the RSI revealed a slight ascent above the neutral line when the price surged by around 2.7% on 22nd April.

Source: TradingView

cost of clomid for men where buy generic clomid no prescription generic clomid price clomiphene chance of twins buying clomiphene without dr prescription clomid for men can you buy generic clomiphene prices

More delight pieces like this would create the интернет better.

Thanks on putting this up. It’s evidently done.

semaglutide for sale – rybelsus for sale online buy periactin 4 mg pill

order motilium 10mg pill – cyclobenzaprine oral order cyclobenzaprine 15mg pills

purchase amoxiclav generic – atbioinfo.com buy cheap acillin

nexium 40mg over the counter – anexamate order esomeprazole sale

order warfarin – coumamide buy cozaar without a prescription

generic meloxicam – https://moboxsin.com/ buy meloxicam without a prescription

deltasone 40mg brand – corticosteroid deltasone 10mg us

sexual dysfunction – https://fastedtotake.com/ buy ed pill

purchase amoxicillin online – https://combamoxi.com/ buy amoxicillin online

buy generic fluconazole – buy forcan without prescription cheap forcan

buy cenforce pill – buy cenforce oral cenforce 50mg

cialis dosage for bph – https://ciltadgn.com/# cialis price walmart

can cialis cause high blood pressure – strong tadafl where to buy generic cialis ?

generic ranitidine – https://aranitidine.com/# purchase zantac without prescription

buy viagra in new zealand – viagra men sale buy levitra cialis viagra

The thoroughness in this draft is noteworthy. site

I am actually delighted to glitter at this blog posts which consists of tons of useful facts, thanks representing providing such data. amoxil online order

I am actually enchant‚e ‘ to glance at this blog posts which consists of tons of of use facts, thanks object of providing such data. https://ursxdol.com/cenforce-100-200-mg-ed/

More delight pieces like this would make the интернет better. https://prohnrg.com/product/rosuvastatin-for-sale/

This website exceedingly has all of the information and facts I needed adjacent to this case and didn’t comprehend who to ask. https://aranitidine.com/fr/ciagra-professional-20-mg/