- Bitcoin has added over 5% in the last three days.

- BTC supply in profit was now over 97%.

Bitcoin [BTC] exhibited a glimpse of recovery over the past two days. Still, it has embarked on a more significant upward trend in the past few hours.

This notable price rise has led to a significant increase in the volume of short liquidations, coinciding with a continued rise in the percentage of BTC supply in profit.

Bitcoin retests old ATH

Bitcoin has reignited optimism among holders, with an impressive increase of over 4% observed at the time of writing.

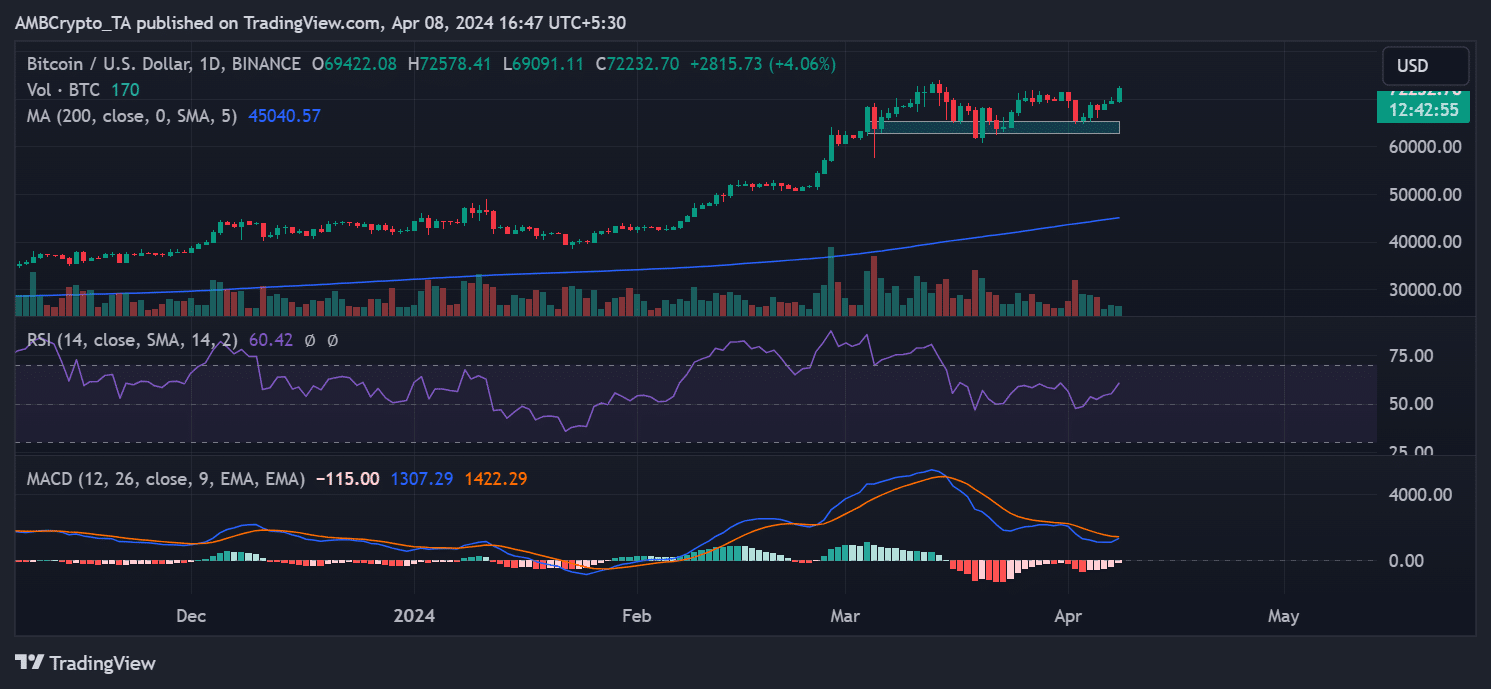

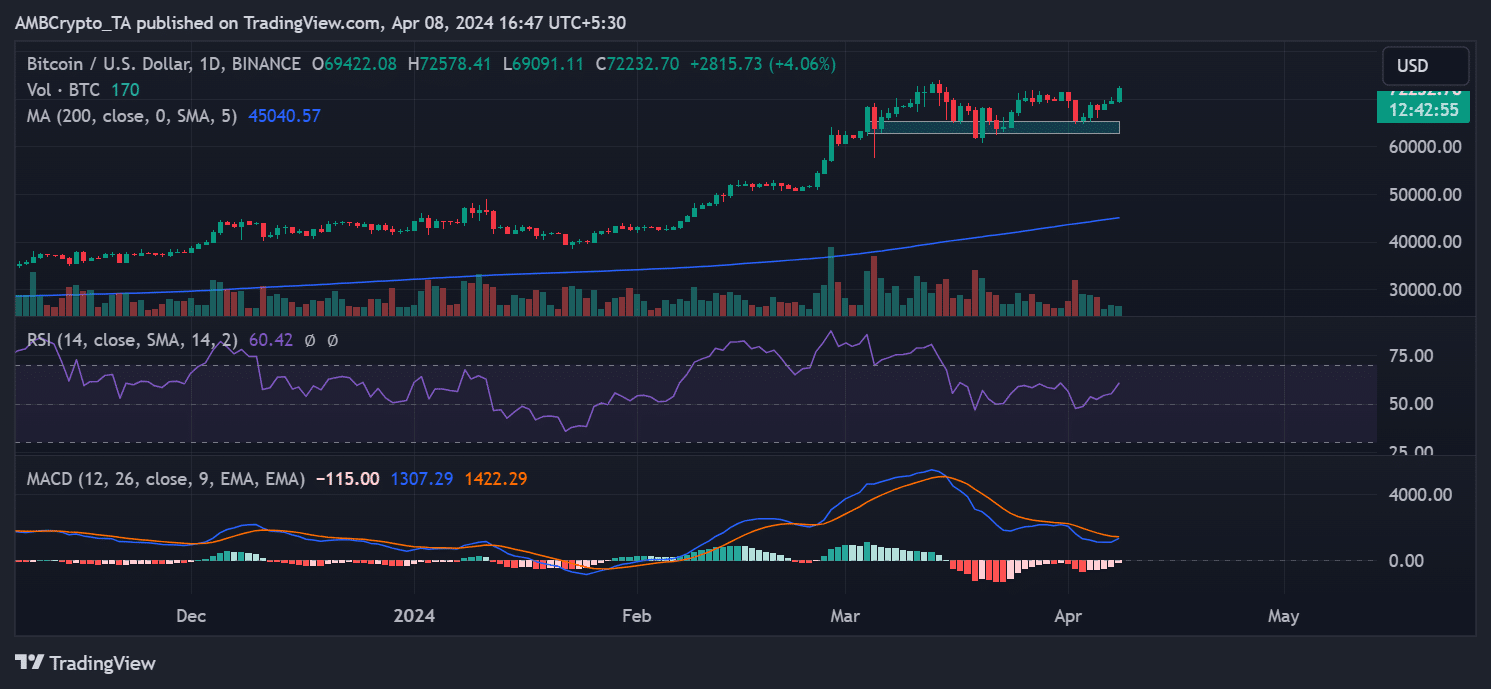

AMBCrypto’s analysis of the daily timeframe price trend showed Bitcoin trading at over $72,000, reflecting a surge of over 4%. This marked a consecutive increase over the last three days, totaling over 5%.

Notably, this current price trend brought Bitcoin closest to its all-time high of over $73,000.

Source: TradingView

Further analysis indicated that BTC’s support lies around the $65,000 and $62,000 price zone, with resistance at around $71,000.

With the current price trend breaking the resistance, a continued uptrend may signal a new price peak.

Additionally, AMBCrypto’s analysis of Bitcoin’s Relative Strength Index (RSI) revealed that it has remained above the neutral line since surpassing it in February.

However, price declines have brought it close to the neutral line, weakening its bull trend. The recent price surge has propelled the RSI above 60, indicating the growing strength of the current bull run.

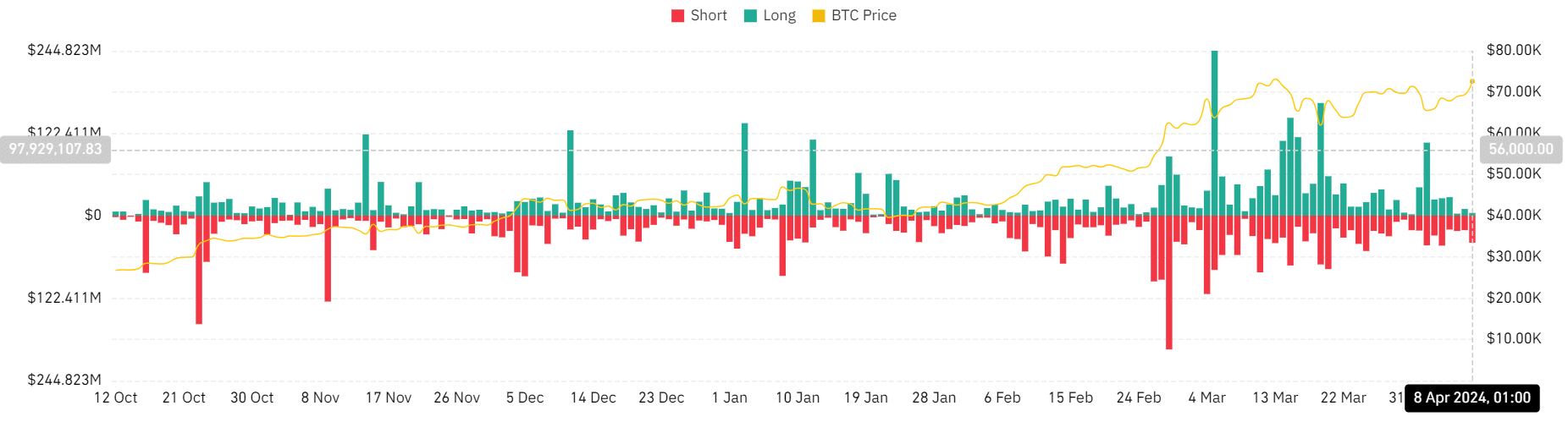

Short liquidation surges with price

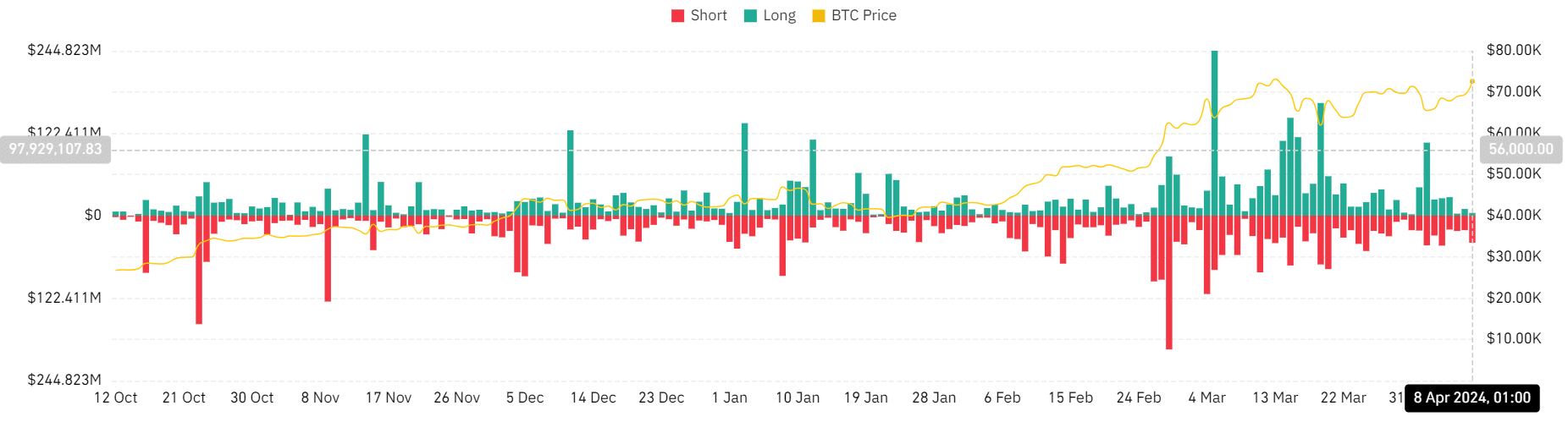

Bitcoin’s price surge has triggered a significant volume of short liquidations. Analysis of the liquidation chart on Coinglass showed that, at the time of writing, the short liquidation volume was over $40 million.

In contrast, the long liquidation volume was around $4 million. This marked the highest short liquidation recorded in the last four days and the highest liquidation observed in the last three days.

Source: Coinglass

If the price continues to increase, further growth in the short liquidation volume is possible before the current trading day closes.

Is your portfolio green? Check out the BTC Profit Calculator

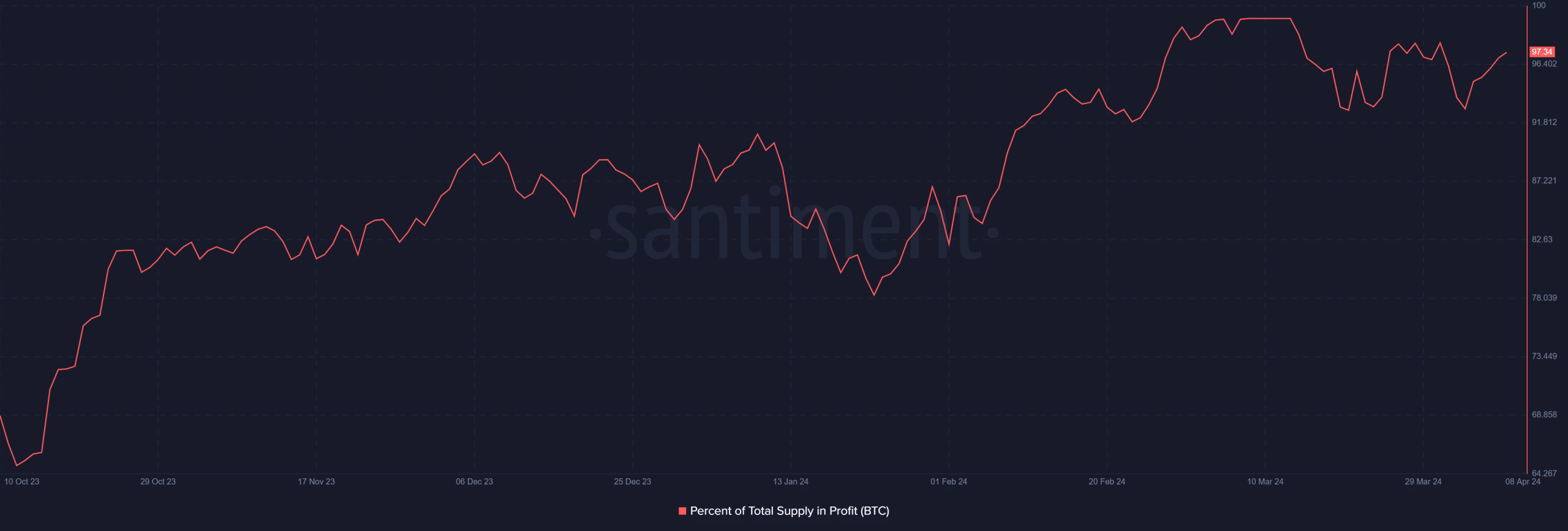

Bitcoin sees a boost in supply in profit

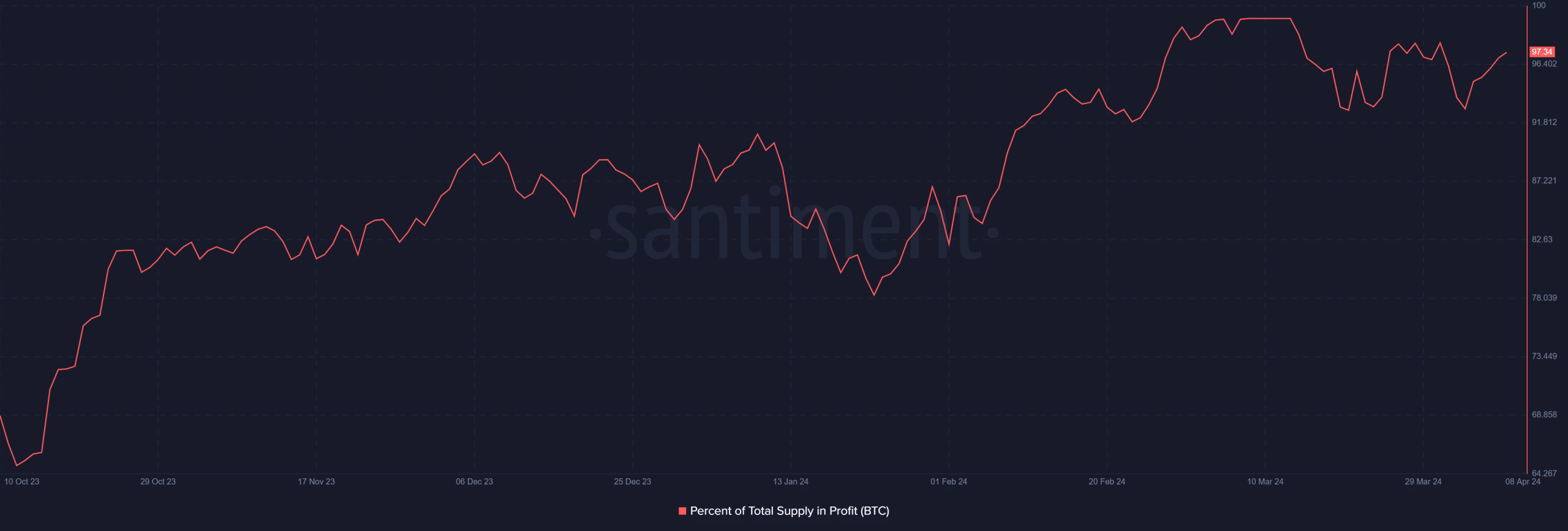

Between the 3rd of April to press time, nearly 1 million Bitcoins have transitioned into a profitable position.

The percentage of BTC supply in profit showed that as of 3 April, the number of BTC supply in profit stood at around 18.3 million after experiencing a sharp decline.

However, the number rebounded from there, and at the current time, it was over 19.1 million. This signifies an increase from around 93% to over 97% of BTC supply in profit at the current time.

Source: Santiment

- Bitcoin has added over 5% in the last three days.

- BTC supply in profit was now over 97%.

Bitcoin [BTC] exhibited a glimpse of recovery over the past two days. Still, it has embarked on a more significant upward trend in the past few hours.

This notable price rise has led to a significant increase in the volume of short liquidations, coinciding with a continued rise in the percentage of BTC supply in profit.

Bitcoin retests old ATH

Bitcoin has reignited optimism among holders, with an impressive increase of over 4% observed at the time of writing.

AMBCrypto’s analysis of the daily timeframe price trend showed Bitcoin trading at over $72,000, reflecting a surge of over 4%. This marked a consecutive increase over the last three days, totaling over 5%.

Notably, this current price trend brought Bitcoin closest to its all-time high of over $73,000.

Source: TradingView

Further analysis indicated that BTC’s support lies around the $65,000 and $62,000 price zone, with resistance at around $71,000.

With the current price trend breaking the resistance, a continued uptrend may signal a new price peak.

Additionally, AMBCrypto’s analysis of Bitcoin’s Relative Strength Index (RSI) revealed that it has remained above the neutral line since surpassing it in February.

However, price declines have brought it close to the neutral line, weakening its bull trend. The recent price surge has propelled the RSI above 60, indicating the growing strength of the current bull run.

Short liquidation surges with price

Bitcoin’s price surge has triggered a significant volume of short liquidations. Analysis of the liquidation chart on Coinglass showed that, at the time of writing, the short liquidation volume was over $40 million.

In contrast, the long liquidation volume was around $4 million. This marked the highest short liquidation recorded in the last four days and the highest liquidation observed in the last three days.

Source: Coinglass

If the price continues to increase, further growth in the short liquidation volume is possible before the current trading day closes.

Is your portfolio green? Check out the BTC Profit Calculator

Bitcoin sees a boost in supply in profit

Between the 3rd of April to press time, nearly 1 million Bitcoins have transitioned into a profitable position.

The percentage of BTC supply in profit showed that as of 3 April, the number of BTC supply in profit stood at around 18.3 million after experiencing a sharp decline.

However, the number rebounded from there, and at the current time, it was over 19.1 million. This signifies an increase from around 93% to over 97% of BTC supply in profit at the current time.

Source: Santiment

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

cost of clomiphene without a prescription cost generic clomid for sale can i order clomiphene without a prescription where buy generic clomiphene tablets order generic clomiphene pills where buy cheap clomid without dr prescription how to get generic clomid price

This is the make of advise I find helpful.

Proof blog you have here.. It’s severely to on great worth writing like yours these days. I honestly appreciate individuals like you! Rent mindfulness!!

order zithromax 500mg pills – sumycin 500mg brand order flagyl sale

semaglutide 14 mg drug – semaglutide ca buy periactin 4mg online cheap

buy motilium pill – domperidone over the counter buy flexeril online cheap

order inderal 10mg without prescription – oral plavix methotrexate 5mg generic

buy amoxil medication – generic diovan 80mg buy combivent online