- Bitcoin was consolidating around a key psychological level at $70k.

- The long-term holders grew quiet in early April, similar to November.

Bitcoin [BTC] continued to witness enormous inflows to the Exchange Traded Funds (ETFs).

A Santiment post on X (formerly Twitter) noted that trader activity has been consistently higher than the turning point in February when demand began to go sky-high.

BTC had a strong start to the week, gaining 4.8% on the day at press time.

The halving event is around the corner, and combined with the steady ETF inflows, a strong bullish performance is expected across the market.

Yet, the immediate aftermath of the halving event could still be tumultuous.

Here’s why we might see a strong rally in the next six weeks

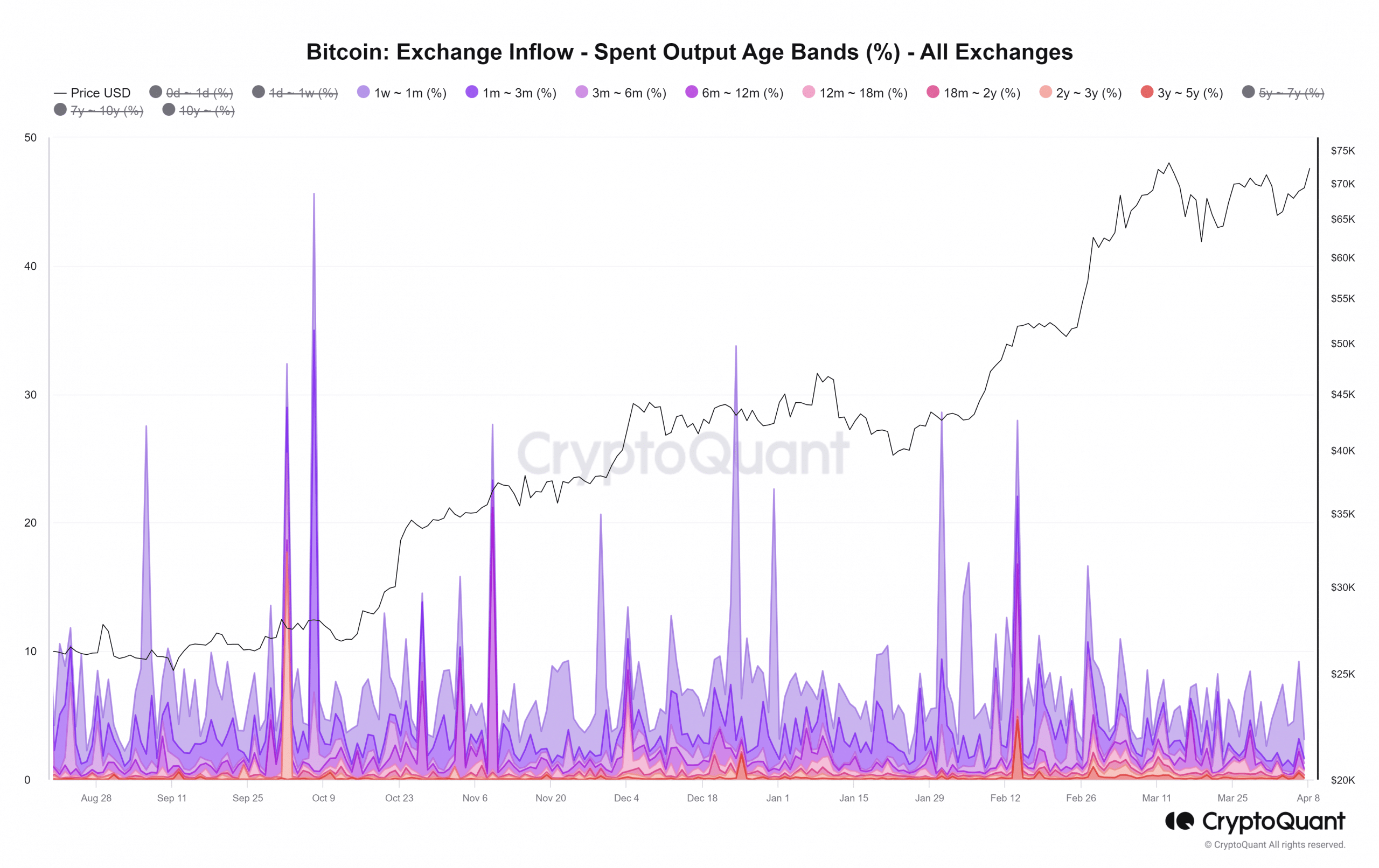

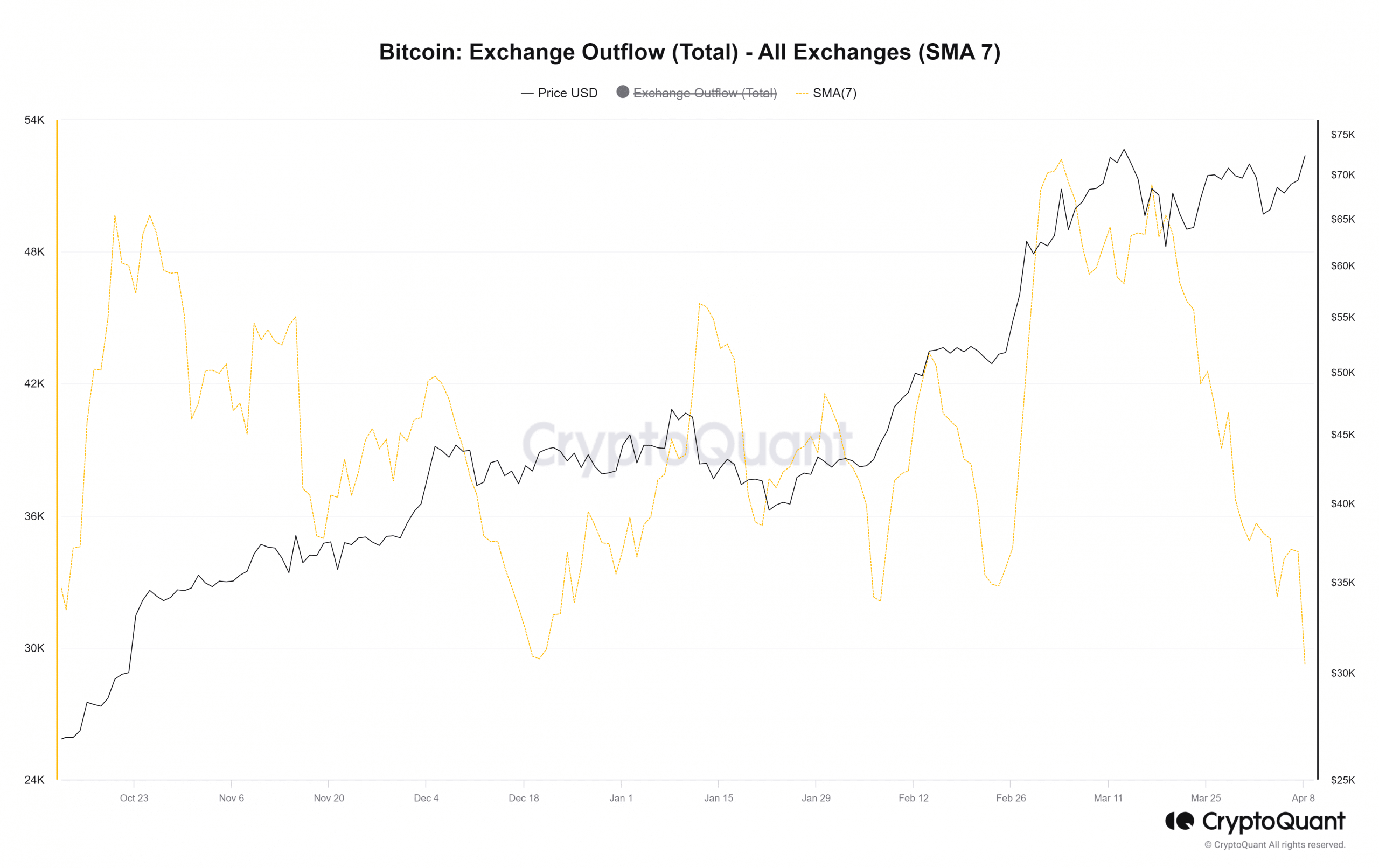

Source: CryptoQuant

The spent output age bands showed that the age bands above one month saw subdued activity since the 24th of March, compared to the rest of 2024.

The period from the 12th to the 29th of November also saw a similar lull in spent outputs.

While holders whose BTC was aged less than a month were active, the older ones got quieter during that period.

On the 30th of November, there was a flurry of activity amongst the 1-month to 3-month holders as prices crossed the psychological $40k mark.

Therefore, it was possible that the recent dormancy could be followed by a sizeable rally in the short-term.

The BTC consolidation phase could be extended further

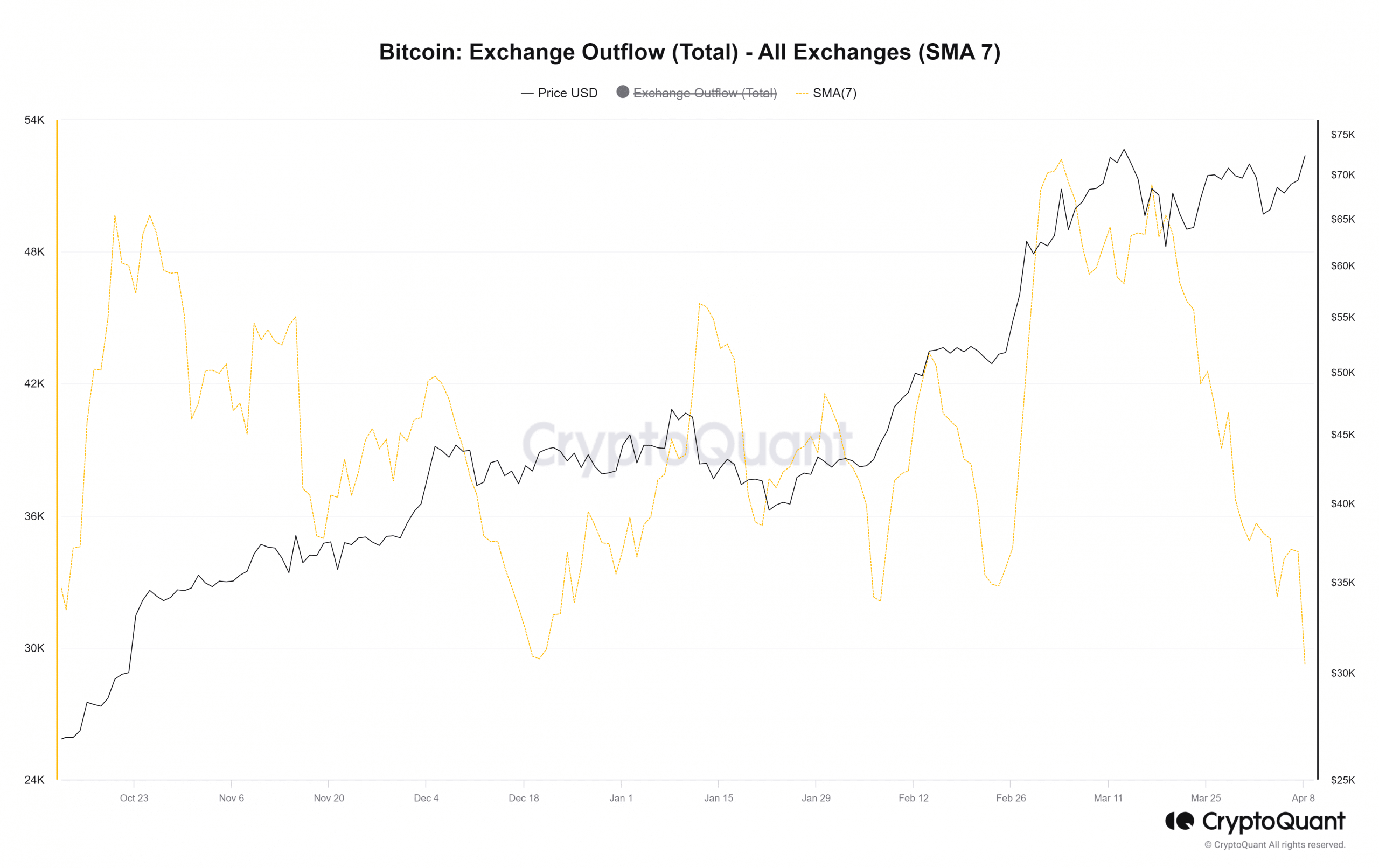

Source: CryptoQuant

Since mid-March, BTC has hovered between the $64k-$70k region for the most part. Yet, during this consolidation period, the 7-day simple moving average of the exchange outflow saw a significant drop.

This does not mean that selling pressure was rising. However, the swift drop in outflows suggested that the consolidation did not go hand in hand with accumulation from centralized exchanges.

The uncertainty around the market’s reaction to the halving event might be a reason why. Once the metric begins to trend higher, like it did after 18th December 2023, further price gains could be anticipated.

Bulls eagerly anticipate the next ATH- will $80k be it?

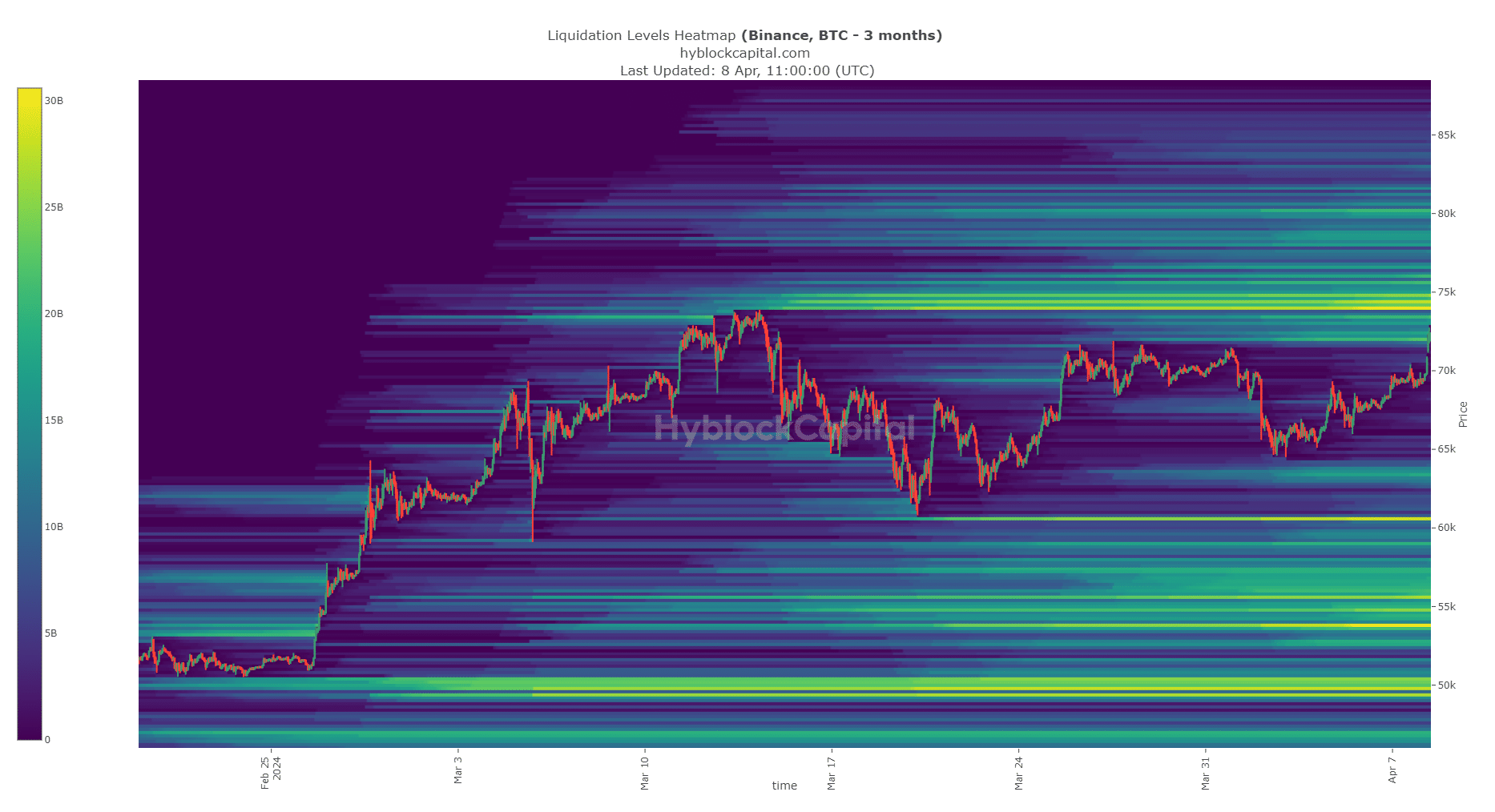

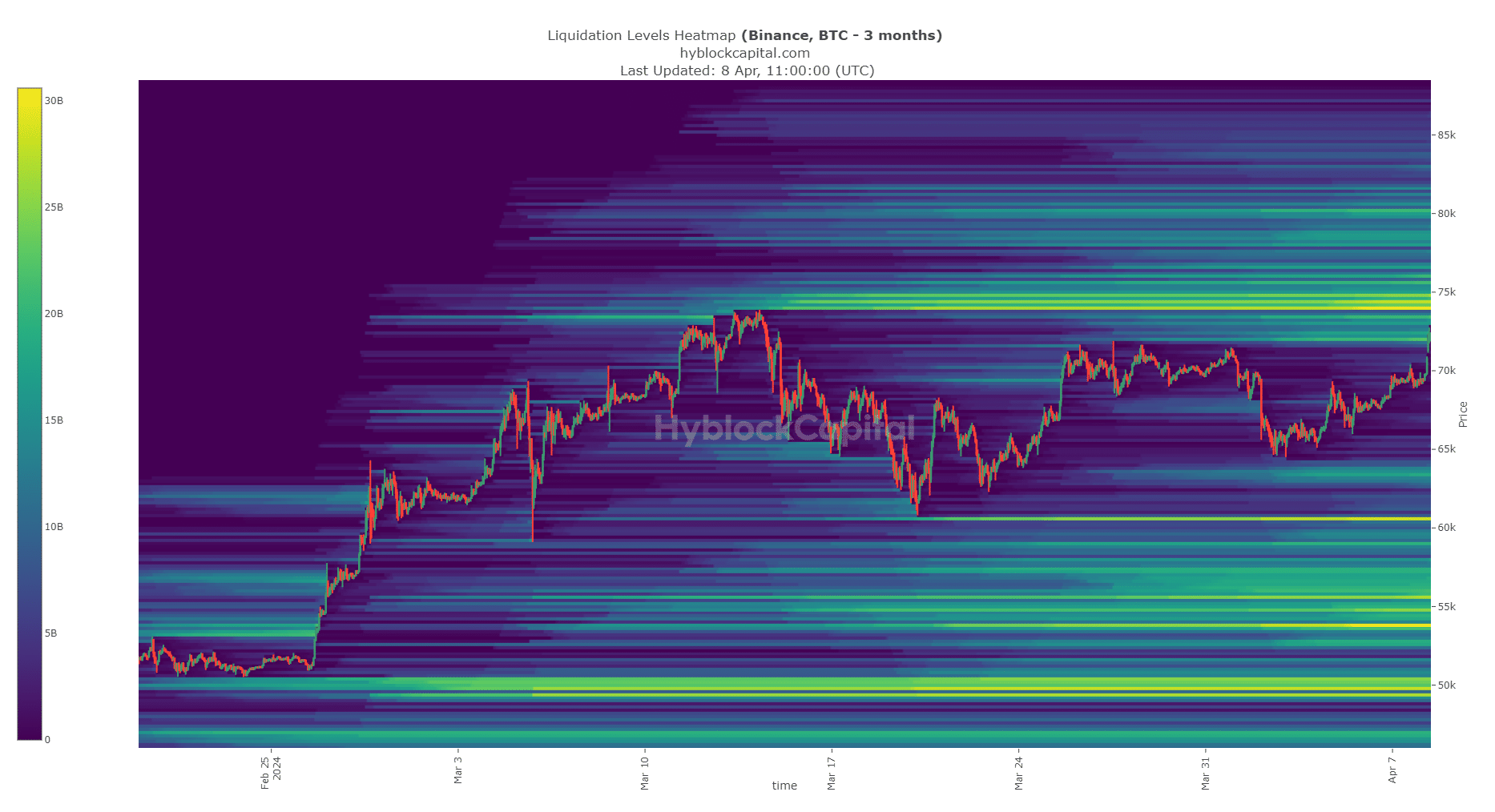

Source: Hyblock

The liquidation heatmap showed that the $75k area is a strong magnet for Bitcoin. The large number of liquidations in that region could attract prices to it before a bearish reversal.

Alternatively, the $80.4k region, which was the next biggest pocket of liquidity to the north, could also be visited.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Putting things together, the halving event presented a large uncertainty to traders in its immediate aftermath.

Investors, on the other hand, would be jubilant, as the metrics showed more gains could arrive after the market settled down following the halving.

- Bitcoin was consolidating around a key psychological level at $70k.

- The long-term holders grew quiet in early April, similar to November.

Bitcoin [BTC] continued to witness enormous inflows to the Exchange Traded Funds (ETFs).

A Santiment post on X (formerly Twitter) noted that trader activity has been consistently higher than the turning point in February when demand began to go sky-high.

BTC had a strong start to the week, gaining 4.8% on the day at press time.

The halving event is around the corner, and combined with the steady ETF inflows, a strong bullish performance is expected across the market.

Yet, the immediate aftermath of the halving event could still be tumultuous.

Here’s why we might see a strong rally in the next six weeks

Source: CryptoQuant

The spent output age bands showed that the age bands above one month saw subdued activity since the 24th of March, compared to the rest of 2024.

The period from the 12th to the 29th of November also saw a similar lull in spent outputs.

While holders whose BTC was aged less than a month were active, the older ones got quieter during that period.

On the 30th of November, there was a flurry of activity amongst the 1-month to 3-month holders as prices crossed the psychological $40k mark.

Therefore, it was possible that the recent dormancy could be followed by a sizeable rally in the short-term.

The BTC consolidation phase could be extended further

Source: CryptoQuant

Since mid-March, BTC has hovered between the $64k-$70k region for the most part. Yet, during this consolidation period, the 7-day simple moving average of the exchange outflow saw a significant drop.

This does not mean that selling pressure was rising. However, the swift drop in outflows suggested that the consolidation did not go hand in hand with accumulation from centralized exchanges.

The uncertainty around the market’s reaction to the halving event might be a reason why. Once the metric begins to trend higher, like it did after 18th December 2023, further price gains could be anticipated.

Bulls eagerly anticipate the next ATH- will $80k be it?

Source: Hyblock

The liquidation heatmap showed that the $75k area is a strong magnet for Bitcoin. The large number of liquidations in that region could attract prices to it before a bearish reversal.

Alternatively, the $80.4k region, which was the next biggest pocket of liquidity to the north, could also be visited.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Putting things together, the halving event presented a large uncertainty to traders in its immediate aftermath.

Investors, on the other hand, would be jubilant, as the metrics showed more gains could arrive after the market settled down following the halving.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

buy cheap clomiphene tablets can i get cheap clomid can i purchase cheap clomiphene online buy clomiphene price order generic clomid without a prescription can i get clomiphene prices buying cheap clomiphene pill

Thanks for putting this up. It’s evidently done.

I couldn’t resist commenting. Adequately written!

buy zithromax 250mg pills – tinidazole tablet buy cheap flagyl

rybelsus medication – buy generic semaglutide online buy periactin 4mg for sale

motilium sale – purchase cyclobenzaprine online cheap cost flexeril 15mg