- WIF registered double-digit losses since 18th March.

- The lack of selling volume in the spot market was encouraging for the bulls.

Popular meme coin dogwifhat [WIF] noted a 32% decline since the local high at $3.28. Bitcoin [BTC] prices have also raced lower in the past 24 hours. BTC lost 5.9% at press time in this window, and more losses could follow later this week.

WIF bulls would be hoping to defend the $2 support level. Momentum and sentiment were not on their side, though. Will we see the memecoin establish a downtrend?

The $3 support crumbled earlier this week- will $2 follow?

Source: WIF/USDT on TradingView

WIF maintains its bullish market structure, with the swing low at $2.049 being the higher low of the uptrend. The Fibonacci retracement levels showed that WIF retested the 78.6% retracement level at $2.17 to form this swing low.

A move below $2.05 would flip the market structure bearishly on the 4-hour chart. The RSI was already below neutral 50 to indicate bearish momentum was gaining strength. The OBV also trended downward over the past two days.

It was possible that we would see another bounce from the $2 support region. Even if we do, the strength of the buyers in the short-term was in question. If the structure flips bearishly, $2 and $2.4 would become key resistance levels.

Spot selling pressure remains muted

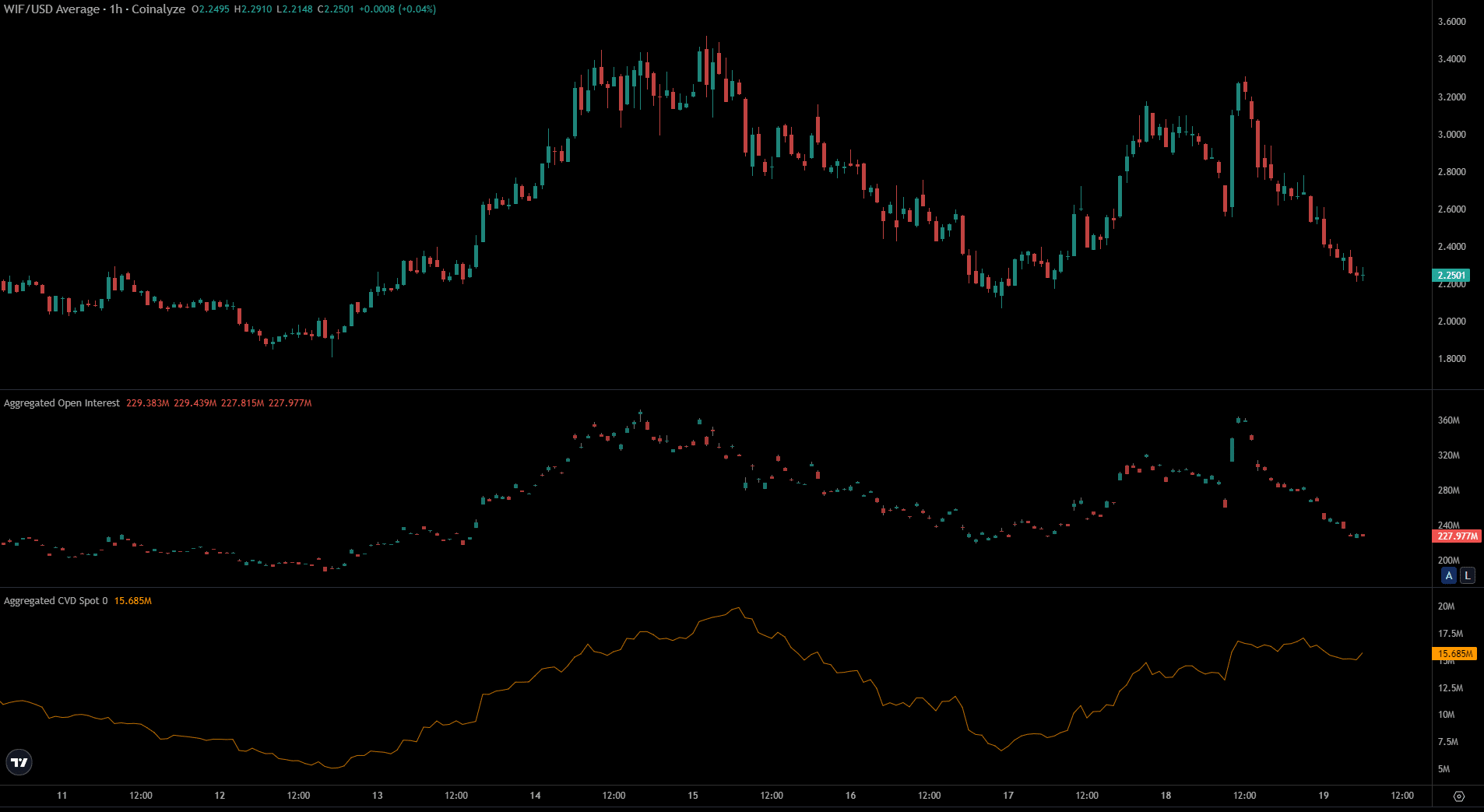

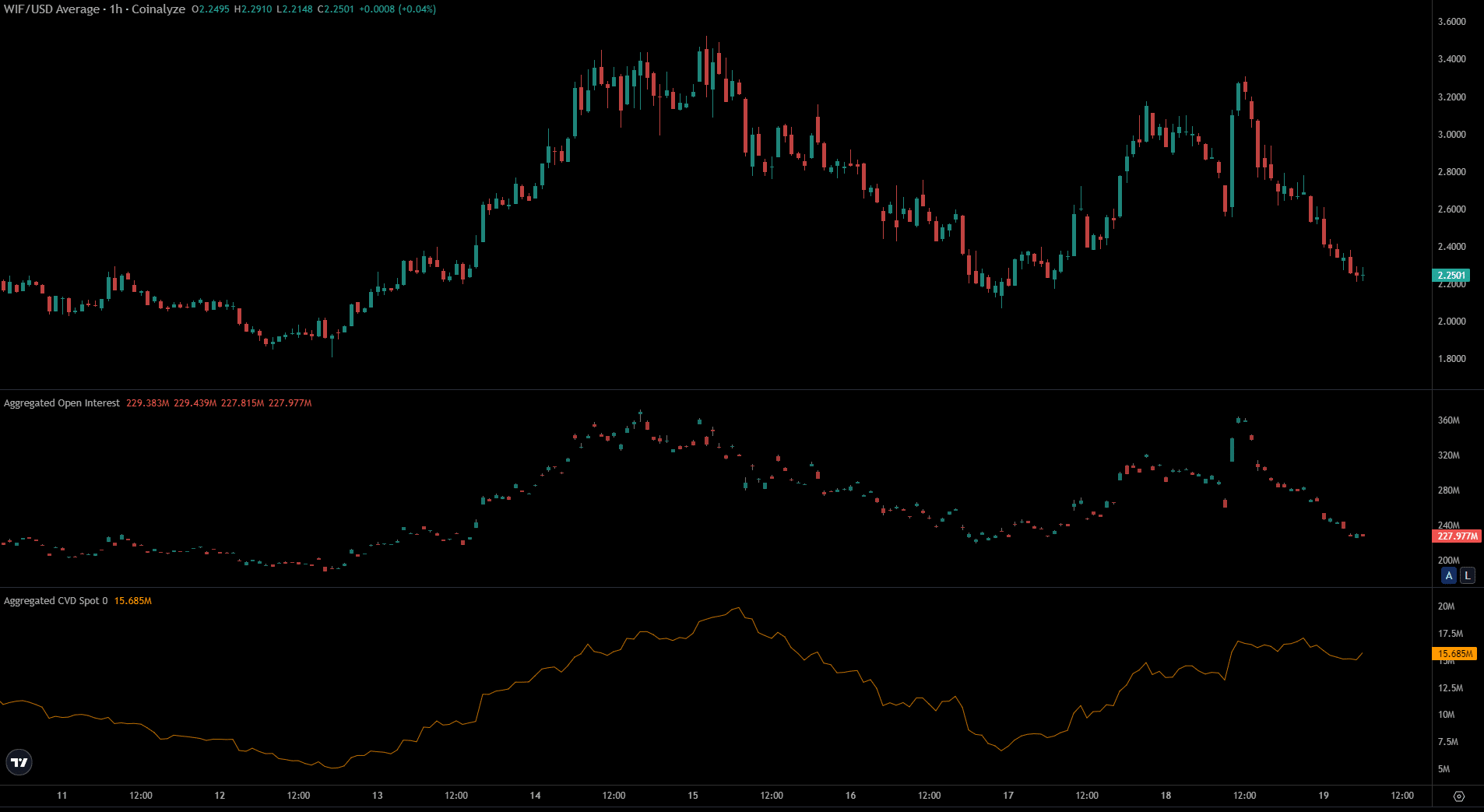

Source: Coinalyze

The Open Interest fell from $364 million to $227 million within the past 48 hours. This massive slump came alongside a 32% decline in prices. This showed that bearish sentiment gripped speculators.

Realistic or not, here’s WIF’s market cap in BTC’s terms

While the futures market saw traders unwilling to go long, the spot market saw participants unwilling to sell WIF. The spot CVD noted a small drop in recent hours but maintained its uptrend from the 17th of March.

This boosted the chances of WIF bulls holding on to the $2 support- provided Bitcoin could stabilize.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- WIF registered double-digit losses since 18th March.

- The lack of selling volume in the spot market was encouraging for the bulls.

Popular meme coin dogwifhat [WIF] noted a 32% decline since the local high at $3.28. Bitcoin [BTC] prices have also raced lower in the past 24 hours. BTC lost 5.9% at press time in this window, and more losses could follow later this week.

WIF bulls would be hoping to defend the $2 support level. Momentum and sentiment were not on their side, though. Will we see the memecoin establish a downtrend?

The $3 support crumbled earlier this week- will $2 follow?

Source: WIF/USDT on TradingView

WIF maintains its bullish market structure, with the swing low at $2.049 being the higher low of the uptrend. The Fibonacci retracement levels showed that WIF retested the 78.6% retracement level at $2.17 to form this swing low.

A move below $2.05 would flip the market structure bearishly on the 4-hour chart. The RSI was already below neutral 50 to indicate bearish momentum was gaining strength. The OBV also trended downward over the past two days.

It was possible that we would see another bounce from the $2 support region. Even if we do, the strength of the buyers in the short-term was in question. If the structure flips bearishly, $2 and $2.4 would become key resistance levels.

Spot selling pressure remains muted

Source: Coinalyze

The Open Interest fell from $364 million to $227 million within the past 48 hours. This massive slump came alongside a 32% decline in prices. This showed that bearish sentiment gripped speculators.

Realistic or not, here’s WIF’s market cap in BTC’s terms

While the futures market saw traders unwilling to go long, the spot market saw participants unwilling to sell WIF. The spot CVD noted a small drop in recent hours but maintained its uptrend from the 17th of March.

This boosted the chances of WIF bulls holding on to the $2 support- provided Bitcoin could stabilize.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

can you buy clomiphene for sale where buy clomid pill can i purchase clomiphene without rx order clomiphene without insurance how to buy cheap clomid tablets where to get cheap clomiphene buy cheap clomid no prescription

More articles like this would remedy the blogosphere richer.

With thanks. Loads of conception!

buy azithromycin 500mg generic – order ofloxacin pills metronidazole cost

semaglutide price – where can i buy semaglutide cheap cyproheptadine

domperidone 10mg generic – buy cyclobenzaprine for sale flexeril 15mg cost