- OP’s price dropped from $4.83 to $3.42 over the last seven days

- While Optimism’s revenue has risen, the token might continue to decline

Optimism [OP], the native token of the Ethereum Layer 2 (L2) project, was one of the biggest losers of the entire crypto-market last week. In fact, according to CoinMarketCap, OP’s price dropped by a staggering 26.29% while trading at $3.42 at press time.

Surprisingly, this happened the same week Ethereum’s Dencun upgrade took place. The Dencun upgrade was great news for L2 users as AMBCrypto confirmed that gas fees were lower on the networks. As a result, transactions on Optimism jumped. Based on data from Artemis, the crypto-analytics platform, daily active addresses on the network hit 114,200 on 15 March.

Source: Artemis

Health is not wealth all the time

An increasing trend in active addresses indicates growing interest in OP’s usage. It also reflects a healthy ecosystem as transactions also jumped. However, the change in active addresses did not signal a shift in investor sentiment, with the price soon depreciating on the charts.

This was not the first time, however. In the past as well, OP’s price and active addresses have diverged. During the bear market, AMBCrypto reported how this happened on several occasions.

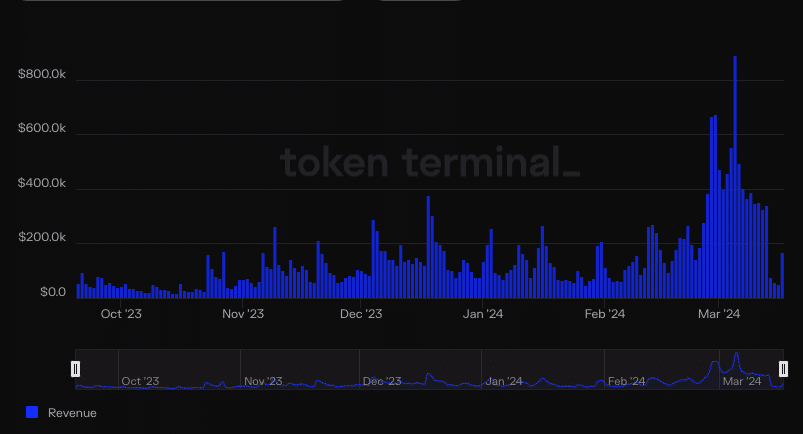

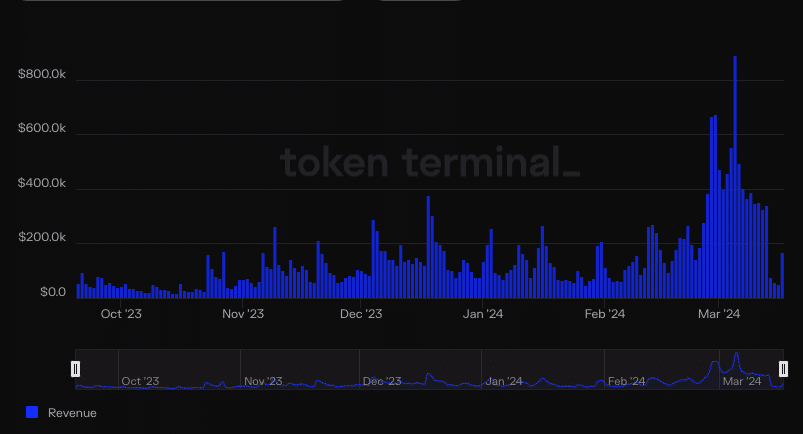

According to Token Terminal, despite the high user activity, Optimism’s revenue fell by 60.7% in the last seven days. A fall in revenue is a sign that fees generated quickly went down as soon as they went up after the Dencun upgrade.

At press time, that trend seemed to have changed as AMBCrypto observed the revenue climbing by 222% in the last 24 hours. If revenue continues to increase, then demand for OP might jump. Should this be the case, the price of Optimism’s native token might bounce off its lows.

Source: Token Terminal

Sell season on OP has not ended

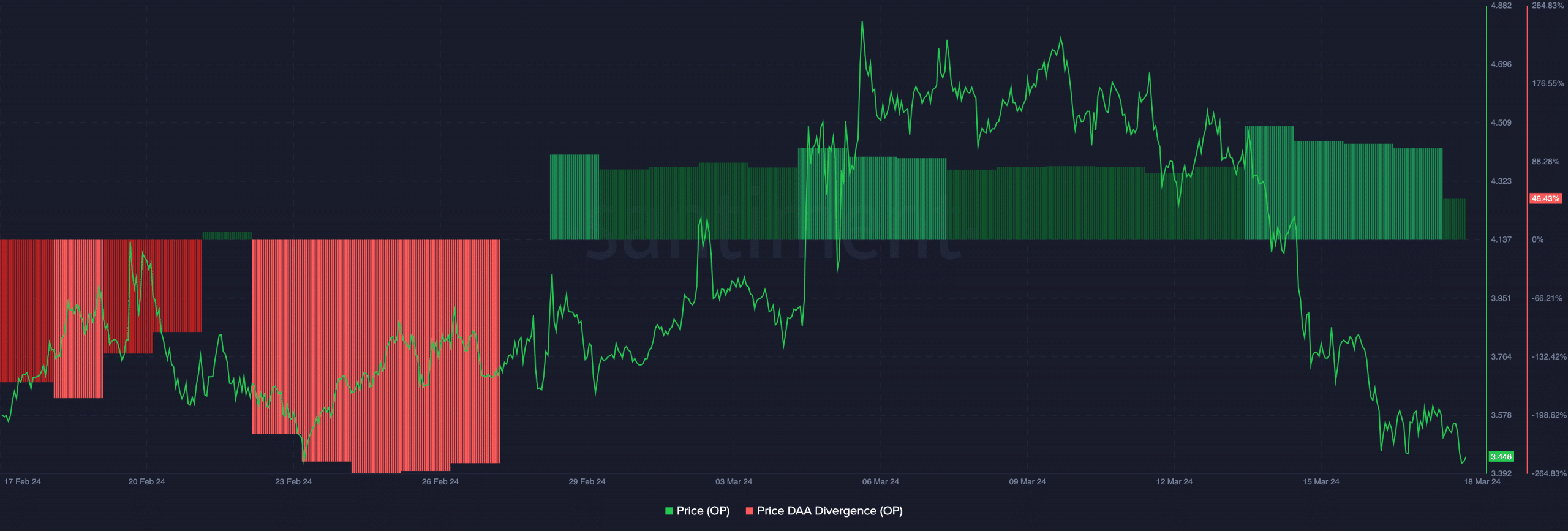

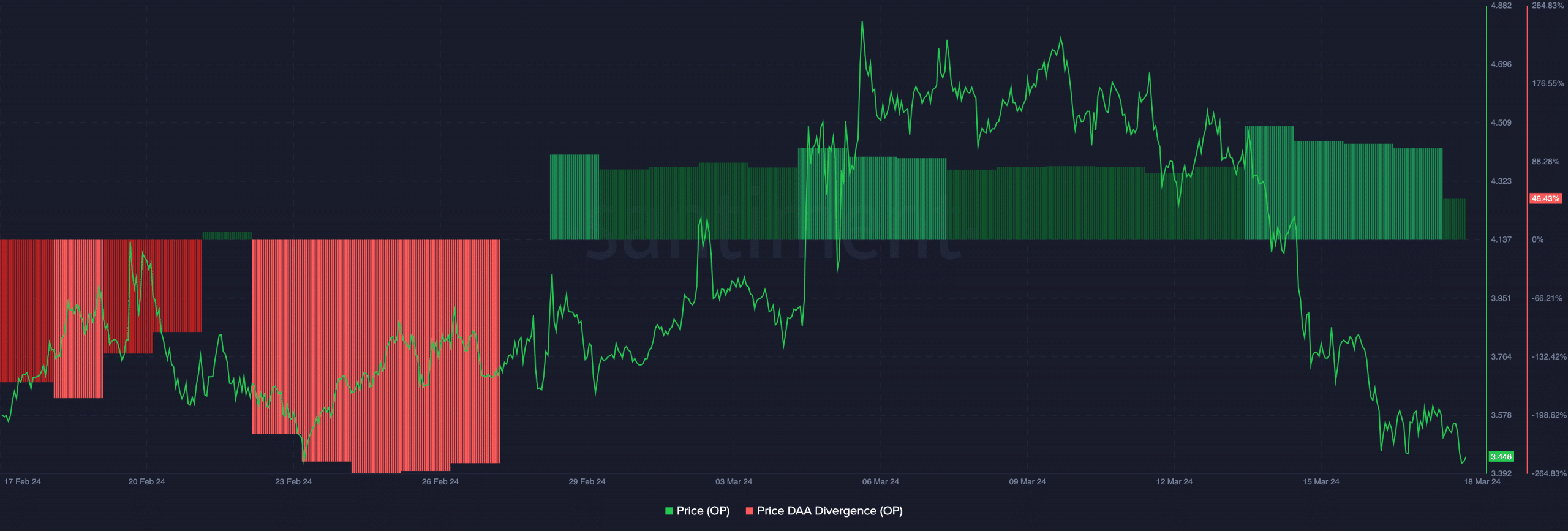

Here, it’s worth checking whether OP is likely to recover from last week’s price depreciation. To do this, AMBCrypto analyzed the Price – DAA divergence. DAA stands for Daily Active Addresses.

Now, though the Price – DAA does not paint an overall picture, it distinguishes between a buy and a sell signal. For instance, active addresses on Optimism fell on 27 February. A week later, OP rallied to $4.84.

On the contrary, at press time, the DAA grew more than the price, indicating that a buy signal has not appeared yet. In this instance, OP might record another consistent downtrend. Therefore, it won’t be unexpected if the price drops below $3 soon.

Source: Santiment

How much are 1,10,100 OPs worth today?

If OP’s price continues to fall, then it would be proof that Ethereum’s upgrade was a “sell the news” event for L2s. However, the long-term outlook for OP could be bullish. One reason for this is ETH and its correlation with the L2 tokens. Should ETH’s price spike, OP might do the same.

- OP’s price dropped from $4.83 to $3.42 over the last seven days

- While Optimism’s revenue has risen, the token might continue to decline

Optimism [OP], the native token of the Ethereum Layer 2 (L2) project, was one of the biggest losers of the entire crypto-market last week. In fact, according to CoinMarketCap, OP’s price dropped by a staggering 26.29% while trading at $3.42 at press time.

Surprisingly, this happened the same week Ethereum’s Dencun upgrade took place. The Dencun upgrade was great news for L2 users as AMBCrypto confirmed that gas fees were lower on the networks. As a result, transactions on Optimism jumped. Based on data from Artemis, the crypto-analytics platform, daily active addresses on the network hit 114,200 on 15 March.

Source: Artemis

Health is not wealth all the time

An increasing trend in active addresses indicates growing interest in OP’s usage. It also reflects a healthy ecosystem as transactions also jumped. However, the change in active addresses did not signal a shift in investor sentiment, with the price soon depreciating on the charts.

This was not the first time, however. In the past as well, OP’s price and active addresses have diverged. During the bear market, AMBCrypto reported how this happened on several occasions.

According to Token Terminal, despite the high user activity, Optimism’s revenue fell by 60.7% in the last seven days. A fall in revenue is a sign that fees generated quickly went down as soon as they went up after the Dencun upgrade.

At press time, that trend seemed to have changed as AMBCrypto observed the revenue climbing by 222% in the last 24 hours. If revenue continues to increase, then demand for OP might jump. Should this be the case, the price of Optimism’s native token might bounce off its lows.

Source: Token Terminal

Sell season on OP has not ended

Here, it’s worth checking whether OP is likely to recover from last week’s price depreciation. To do this, AMBCrypto analyzed the Price – DAA divergence. DAA stands for Daily Active Addresses.

Now, though the Price – DAA does not paint an overall picture, it distinguishes between a buy and a sell signal. For instance, active addresses on Optimism fell on 27 February. A week later, OP rallied to $4.84.

On the contrary, at press time, the DAA grew more than the price, indicating that a buy signal has not appeared yet. In this instance, OP might record another consistent downtrend. Therefore, it won’t be unexpected if the price drops below $3 soon.

Source: Santiment

How much are 1,10,100 OPs worth today?

If OP’s price continues to fall, then it would be proof that Ethereum’s upgrade was a “sell the news” event for L2s. However, the long-term outlook for OP could be bullish. One reason for this is ETH and its correlation with the L2 tokens. Should ETH’s price spike, OP might do the same.

how to buy cheap clomiphene no prescription buy cheap clomid no prescription clomiphene for sale uk clomiphene generic brand order clomiphene pills can i buy cheap clomiphene no prescription can you buy clomiphene online

This is the kind of advise I find helpful.

Thanks on putting this up. It’s evidently done.

zithromax where to buy – order ciplox flagyl 200mg over the counter

cost semaglutide – buy semaglutide cheap purchase cyproheptadine without prescription

order generic motilium 10mg – motilium online buy flexeril 15mg usa

brand azithromycin – buy zithromax 500mg pills buy nebivolol 20mg pill

buy clavulanate no prescription – atbioinfo.com where can i buy ampicillin

nexium 20mg us – nexiumtous buy nexium 20mg

coumadin for sale – https://coumamide.com/ order losartan 25mg without prescription

meloxicam for sale online – https://moboxsin.com/ mobic 7.5mg pills

buy prednisone 5mg without prescription – corticosteroid prednisone 5mg canada

new ed pills – site ed pills no prescription

purchase amoxil for sale – combamoxi.com amoxil where to buy

fluconazole for sale online – https://gpdifluca.com/ buy fluconazole for sale

cenforce 50mg sale – this order cenforce generic

tadalafil citrate – tadalafil without a doctor’s prescription buy cialis canadian

cialis softabs online – https://strongtadafl.com/# cialis online aust

zantac 300mg uk – https://aranitidine.com/# ranitidine 150mg canada

can buy cheap viagra – sildenafil citrato 100 mg where do i buy cheap viagra

Proof blog you be undergoing here.. It’s severely to find great quality writing like yours these days. I truly respect individuals like you! Withstand mindfulness!! purchase lasix online

More delight pieces like this would make the интернет better. https://ursxdol.com/synthroid-available-online/

Greetings! Extremely gainful recommendation within this article! It’s the scarcely changes which liking turn the largest changes. Thanks a quantity for sharing! https://prohnrg.com/product/loratadine-10-mg-tablets/

Thanks an eye to sharing. It’s first quality. https://aranitidine.com/fr/modalert-en-france/

With thanks. Loads of expertise!

buy cheap generic colchicine

I couldn’t weather commenting. Well written! http://forum.ttpforum.de/member.php?action=profile&uid=424441

dapagliflozin without prescription – https://janozin.com/ purchase forxiga online cheap

buy xenical generic – https://asacostat.com/ orlistat pill

This is the type of delivery I turn up helpful. https://myvisualdatabase.com/forum/profile.php?id=118732