- The Dencun upgrade is aimed at reducing fees to help L2s grow further.

- ETH’s price action remained bullish, as did market sentiment.

The wait for Ethereum’s [ETH] much-talked-about Dencun upgrade is coming to an end, as it is scheduled to take place on the 13th of March.

The upgrade will bring several changes to the blockchain, which will be especially beneficial for the L2s.

Since the update is around the corner, AMBCrypto planned to check how ETH was doing ahead of the launch.

All about Ethereum’s Dencun upgrade

The Dencun upgrade will be the next major update for Ethereum after the Shapella upgrade that was pushed back in 2023.

For the uninitiated, the Dencun upgrade will execute two upgrades simultaneously on Ethereum’s consensus and execution layers. The primary focus of the upgrade is to drastically reduce fees to aid Layer-2s growth.

This will be made possible as the developers will activate a new Ethereum Improvement Proposal (EIP), which is named proto-danksharding.

Ethereum’s fees spike

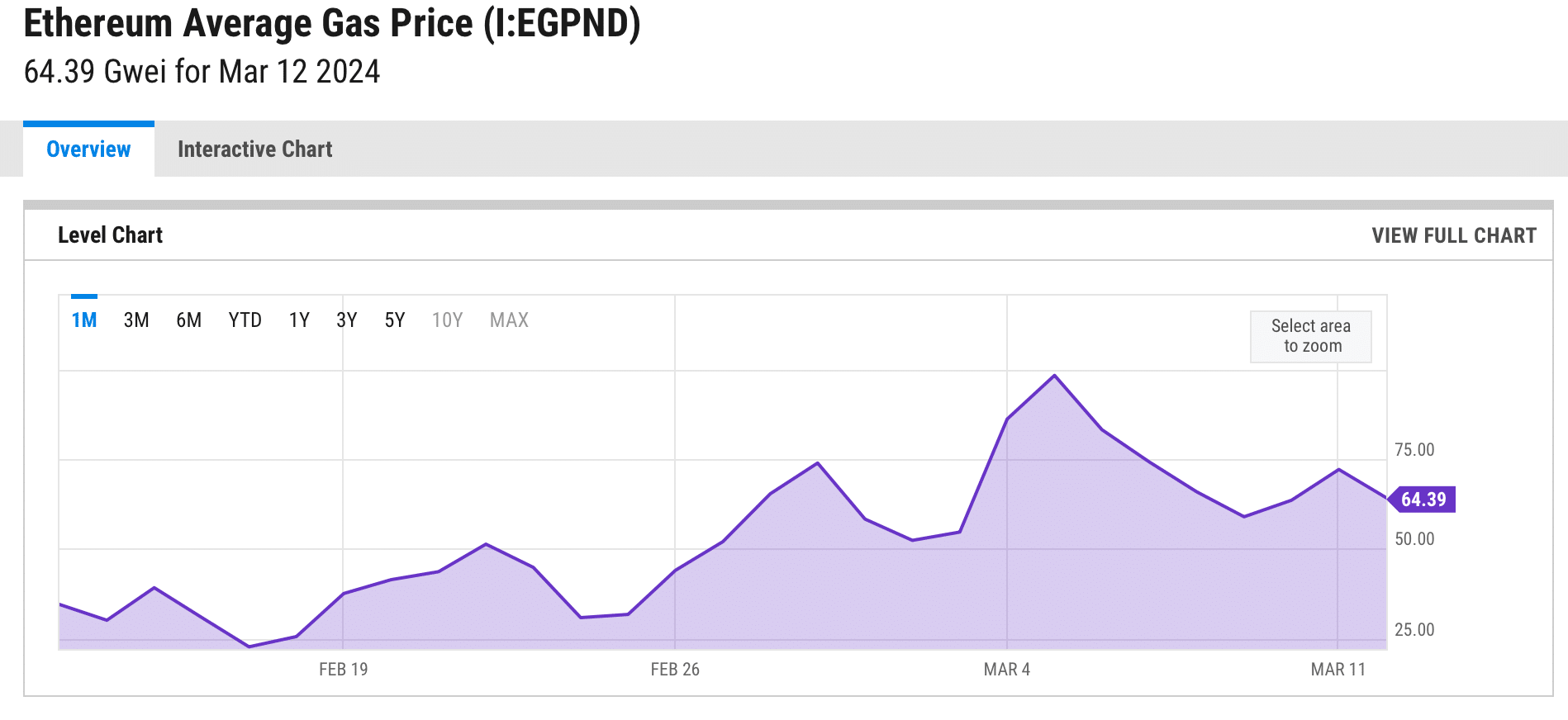

While developers prepared to push the new upgrade, Ethereum’s network fees increased.

AMBCrypto’s analysis of Artemis’ data revealed that ETH’s fees gained upward momentum and spiked on the 5th of March. As a result, ETH’s revenue also rose on the same day.

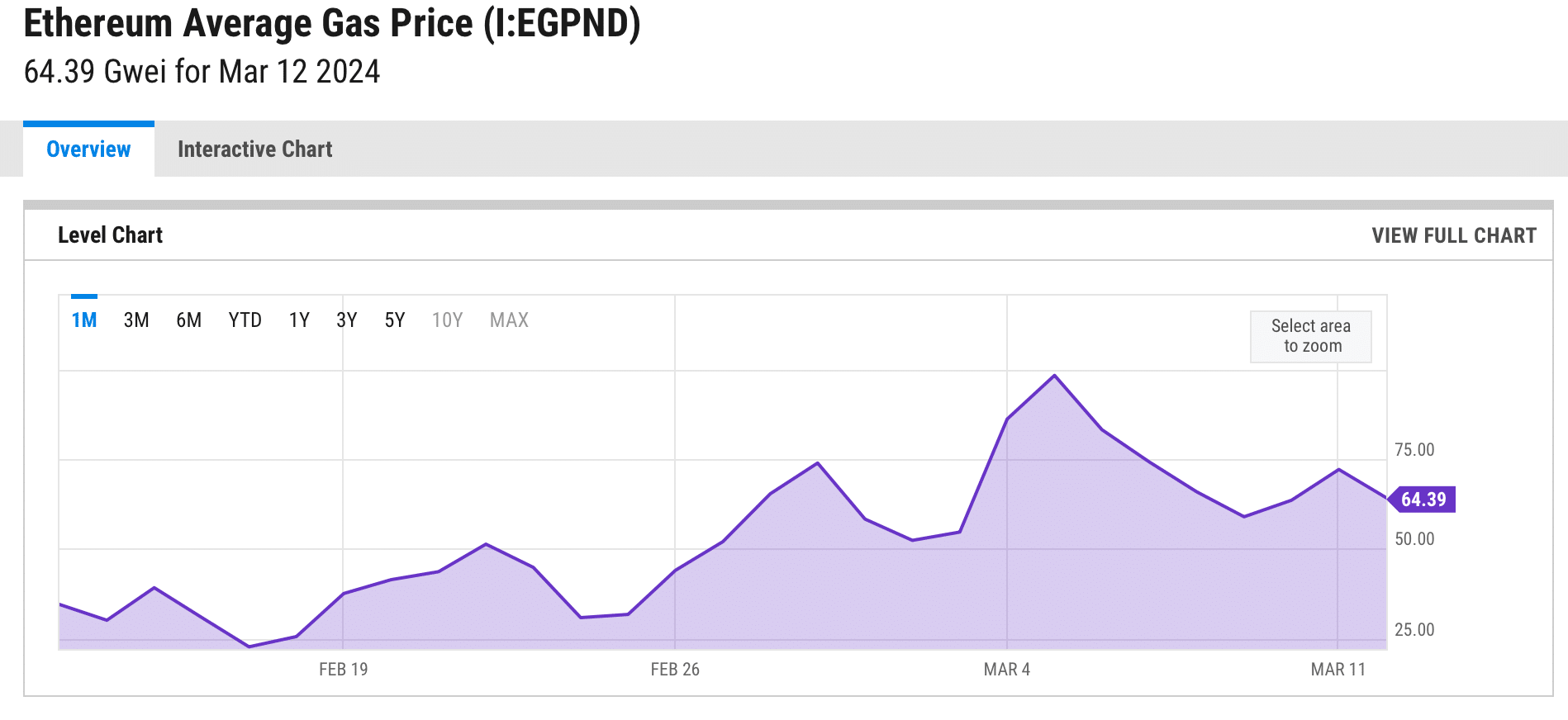

A possible reason behind this surge could be the hike in ETH’s gas price, which stood at 64.39 Gwei per Ycharts.

Source: YCharts

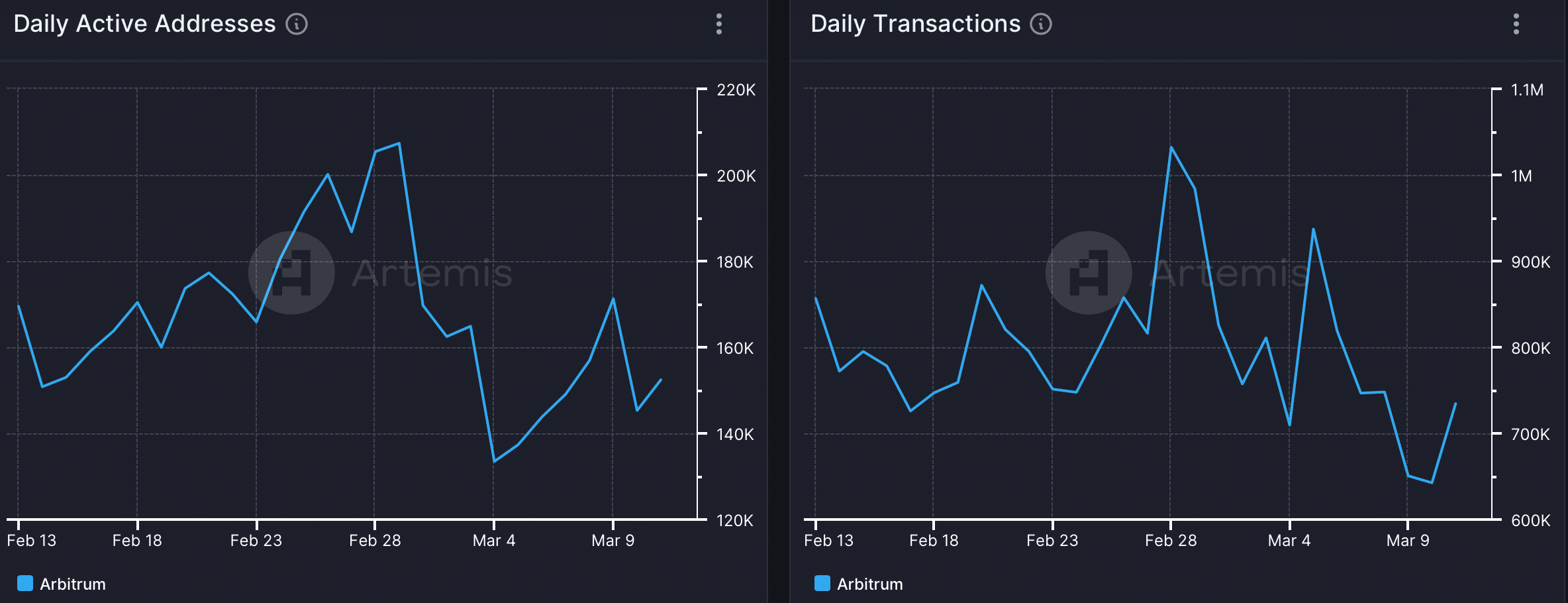

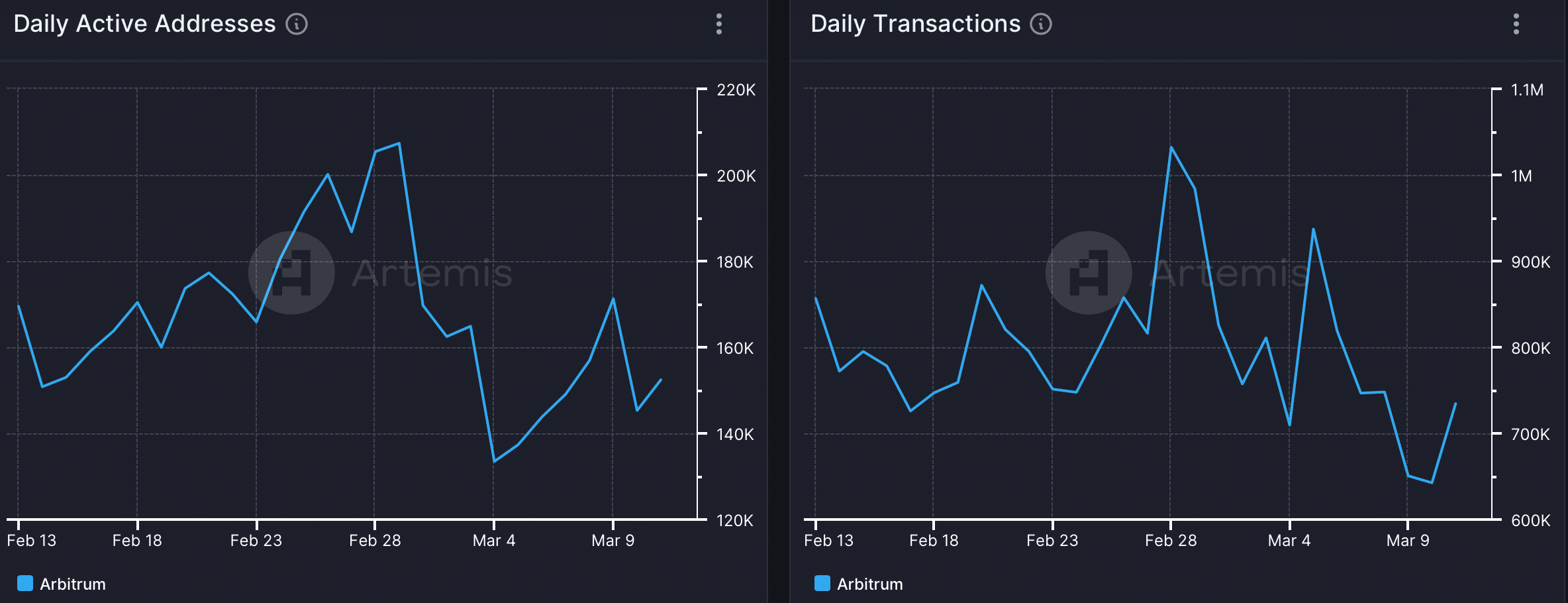

Though things looked optimistic in terms of captured value, Ethereum’s network activity had dropped. This was evident from the decline in its Daily Active Addresses chart since the 29th of February.

Because of the drop in addresses, ETH’s Daily Transactions fell as well.

Source: Artemis

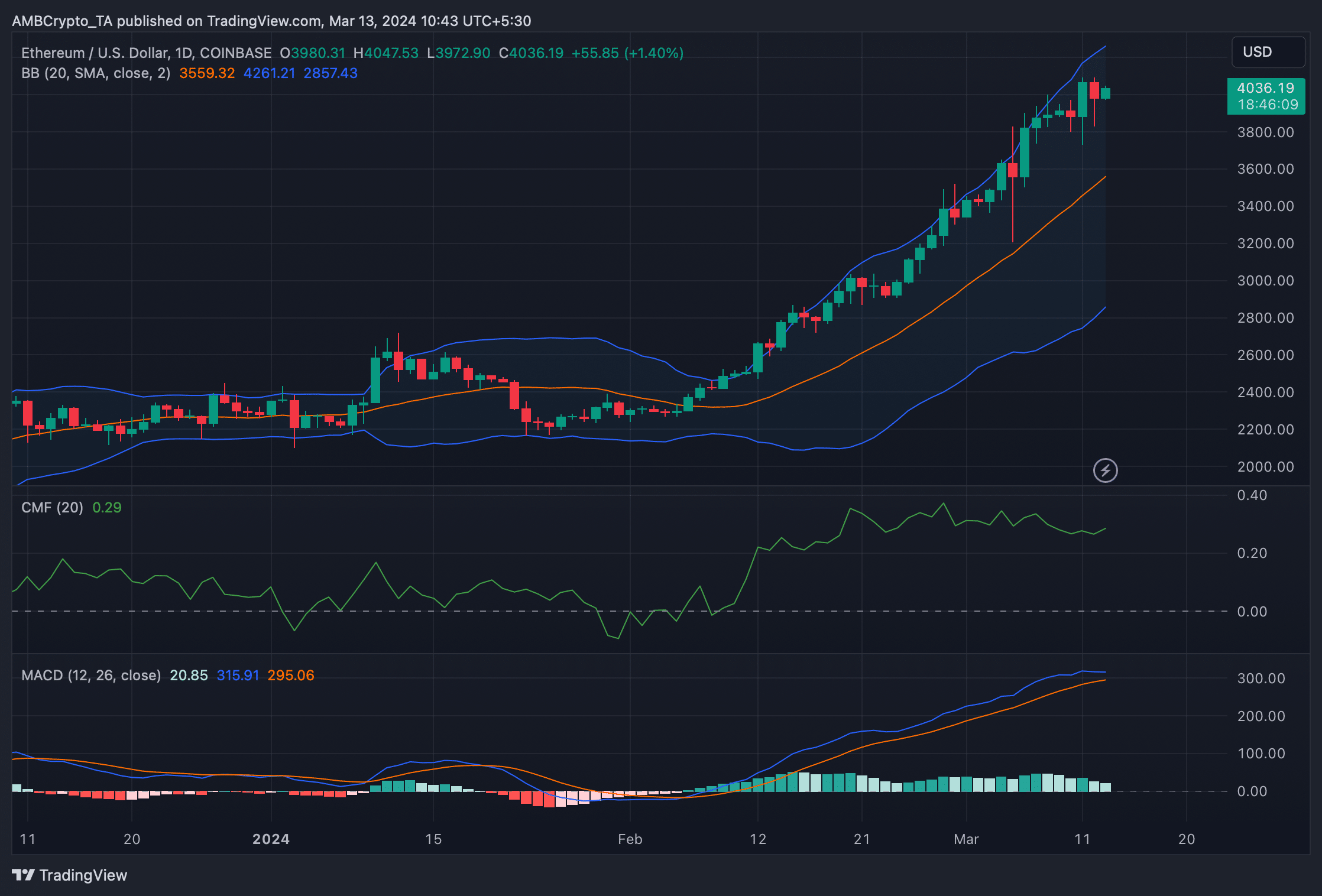

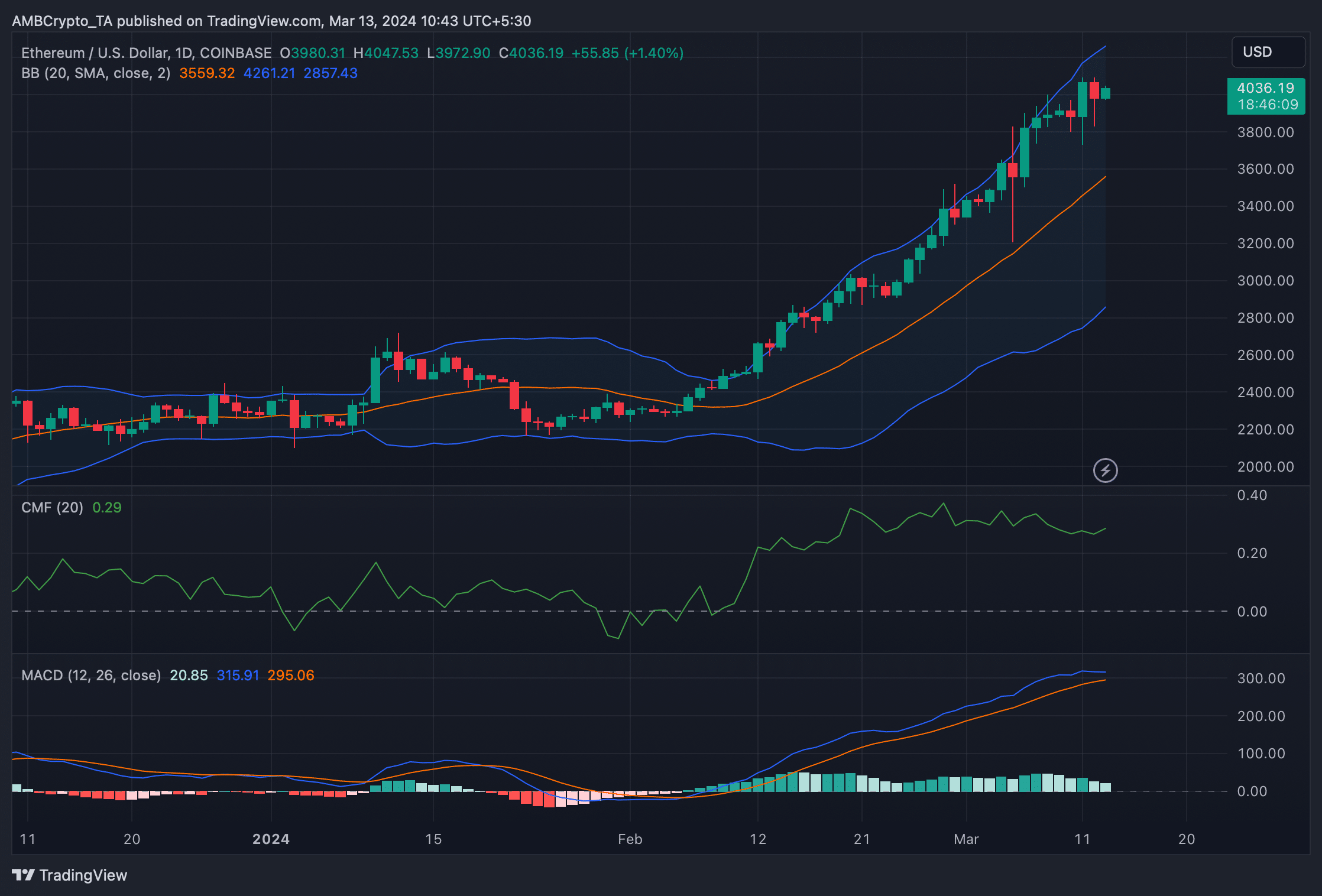

Nonetheless, Ethereum’s price action favored the bulls, as it was up by more than 9% in the last seven days. At the time of writing, ETH was trading at $4,034.42 with a market capitalization of over $484 billion.

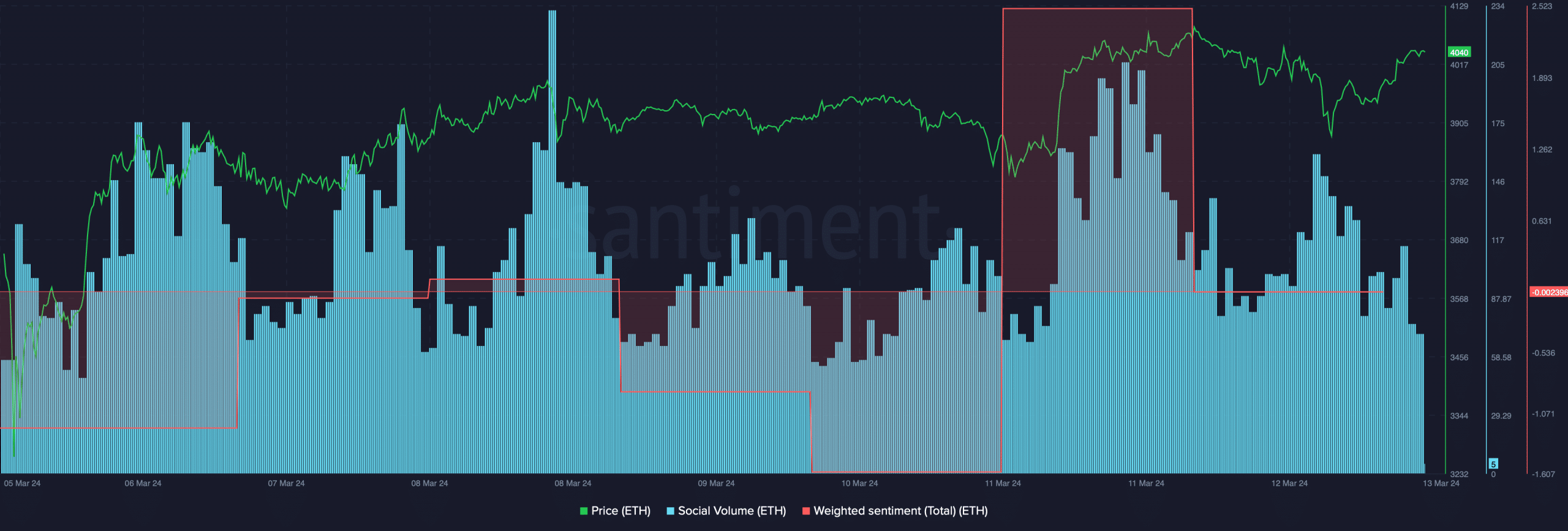

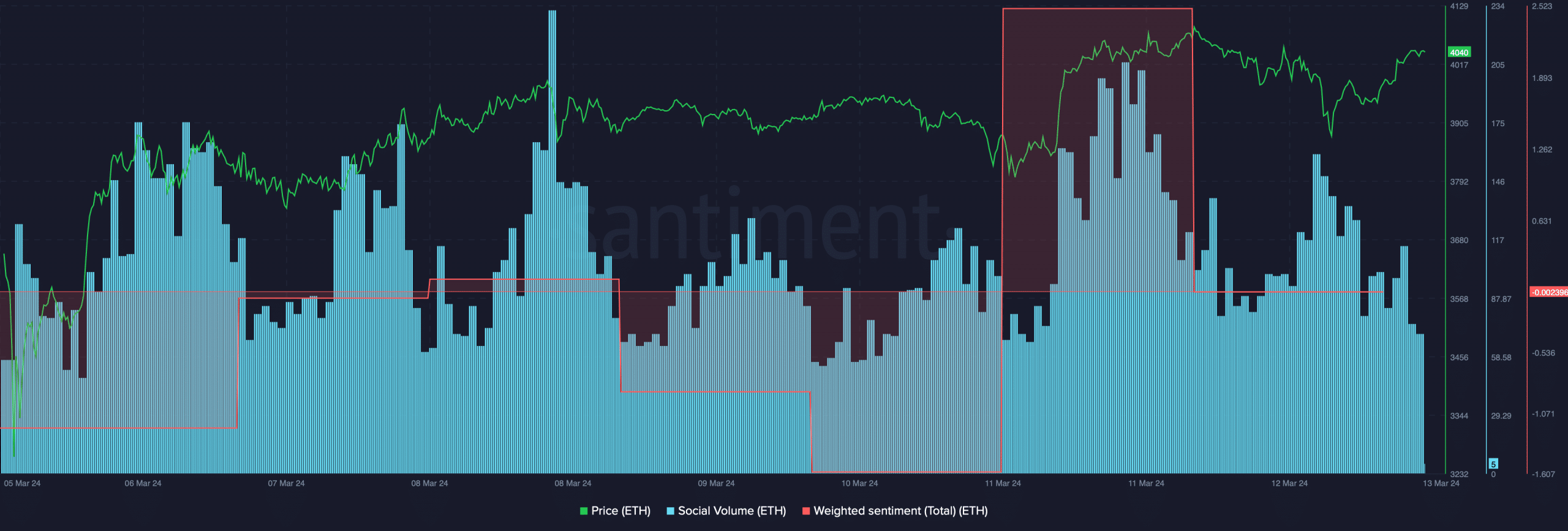

The king of altcoins also remained a buzzing topic of discussion in the market as its Social Volume remained high.

Additionally, its Weighted Sentiment spiked, suggesting that bullish sentiment around the token was dominant at press time.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

Apart from that, the technical indicator MACD displayed a bullish upper hand in the market. The Chaikin Money Flow (CMF) also registered an uptick, hinting at a further rally.

However, ETH’s price had touched the upper limit of the Bollinger Bands at press time, which indicated a price correction.

Source: TradingView

- The Dencun upgrade is aimed at reducing fees to help L2s grow further.

- ETH’s price action remained bullish, as did market sentiment.

The wait for Ethereum’s [ETH] much-talked-about Dencun upgrade is coming to an end, as it is scheduled to take place on the 13th of March.

The upgrade will bring several changes to the blockchain, which will be especially beneficial for the L2s.

Since the update is around the corner, AMBCrypto planned to check how ETH was doing ahead of the launch.

All about Ethereum’s Dencun upgrade

The Dencun upgrade will be the next major update for Ethereum after the Shapella upgrade that was pushed back in 2023.

For the uninitiated, the Dencun upgrade will execute two upgrades simultaneously on Ethereum’s consensus and execution layers. The primary focus of the upgrade is to drastically reduce fees to aid Layer-2s growth.

This will be made possible as the developers will activate a new Ethereum Improvement Proposal (EIP), which is named proto-danksharding.

Ethereum’s fees spike

While developers prepared to push the new upgrade, Ethereum’s network fees increased.

AMBCrypto’s analysis of Artemis’ data revealed that ETH’s fees gained upward momentum and spiked on the 5th of March. As a result, ETH’s revenue also rose on the same day.

A possible reason behind this surge could be the hike in ETH’s gas price, which stood at 64.39 Gwei per Ycharts.

Source: YCharts

Though things looked optimistic in terms of captured value, Ethereum’s network activity had dropped. This was evident from the decline in its Daily Active Addresses chart since the 29th of February.

Because of the drop in addresses, ETH’s Daily Transactions fell as well.

Source: Artemis

Nonetheless, Ethereum’s price action favored the bulls, as it was up by more than 9% in the last seven days. At the time of writing, ETH was trading at $4,034.42 with a market capitalization of over $484 billion.

The king of altcoins also remained a buzzing topic of discussion in the market as its Social Volume remained high.

Additionally, its Weighted Sentiment spiked, suggesting that bullish sentiment around the token was dominant at press time.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

Apart from that, the technical indicator MACD displayed a bullish upper hand in the market. The Chaikin Money Flow (CMF) also registered an uptick, hinting at a further rally.

However, ETH’s price had touched the upper limit of the Bollinger Bands at press time, which indicated a price correction.

Source: TradingView