- The total number of addresses with a balance on Tron has reached a new high.

- TRX’s value has risen by 40% since the year began as demand persists.

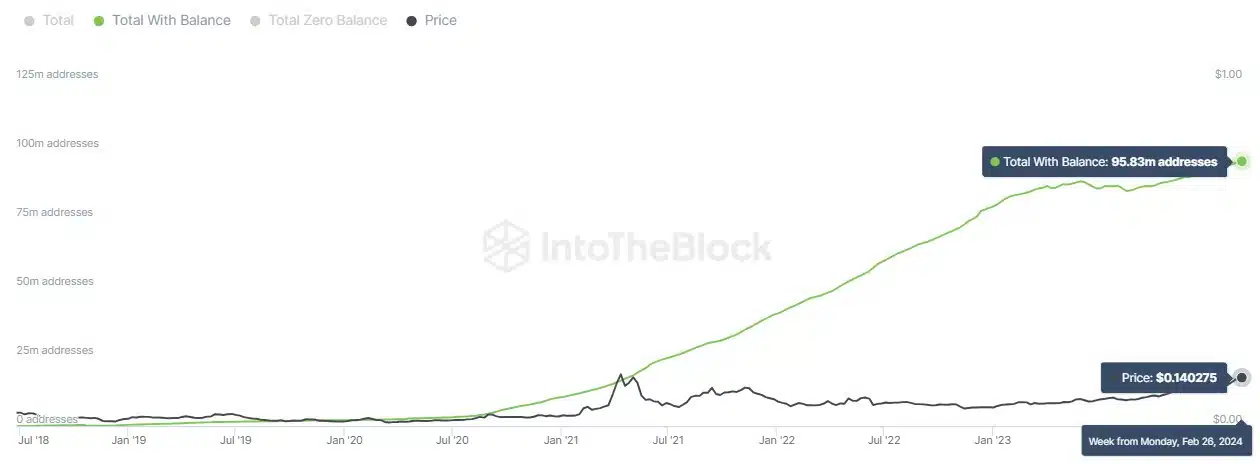

The number of addresses on the public open-sourced blockchain Tron [TRX] has crossed 95 million. This marks an all-time high in the count of addresses with non-zero balance on the network, on-chain analytics platform IntoTheBlock noted in a post on X (formerly Twitter).

According to the data provider, Tron’s address count significantly outpaces other prominent Layer 1 (L1) blockchains like Cardano [ADA] and Avalanche [AVAX], both of which boast 5 million addresses and 7 million addresses, respectively.

The year so far on Tron

An assessment of Tron’s year-to-date (YTD) on-chain activity revealed a rally in new demand for the L1 network since the year began.

AMBCrypto observed Tron’s New Adoption Rate – which measures the daily percentage of new addresses making their first transaction out of all active addresses on a given day, and found that it has climbed by 21% since the 1st of January.

As of 28th February, the network’s New Adoption Rate was 12%, suggesting that out of the 2 million active addresses recorded, 240,000 of those were new addresses.

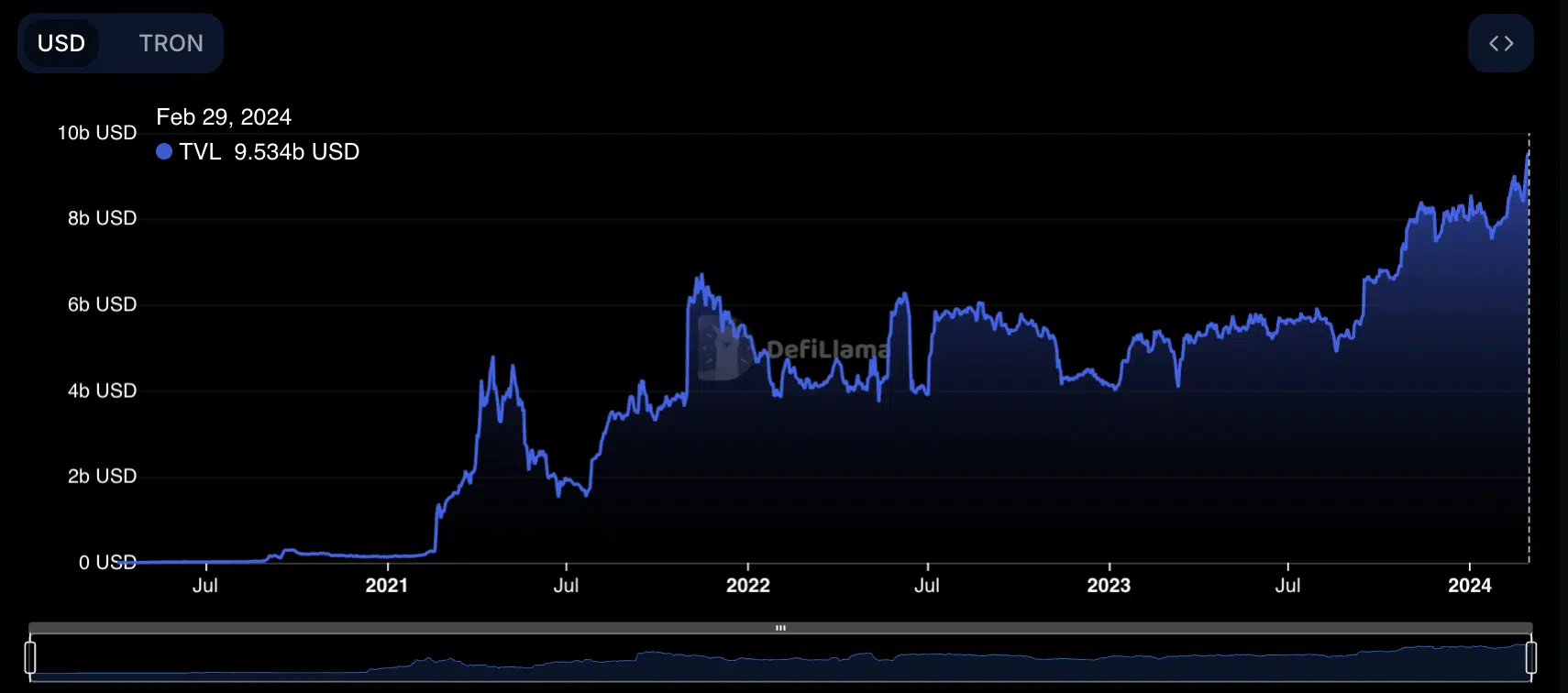

One way in which the surge in new demand for Tron since the year began has manifested is in the rise in its decentralized finance (DeFi) total value locked (TVL). Per data from DefiLlama, the network’s TVL at press time was $10 billion, rising by double digits in the last month.

Since 1st January, Tron’s TVL has spiked by 27%. At its current value, Tron’s TVL sits at an all-time high, AMBCrypto found.

As expected, the high user activity has impacted Tron’s network fees and the revenue derived from the same. According to data from Token Terminal, network fees and revenue have both risen by 20% in the last 30 days.

Demand for TRX climbs

At press time, TRX exchanged hands at $0.14, according to CoinMarketCap. The coin’s value has risen by 40% on a YTD basis.

A look at its Accumulation/Distribution Line (ADL) confirmed the sustained demand for the altcoin since the year began, hence the corresponding rally in value. At press time, TRX’s ADL was 113.84 billion.

Realistic or not, here’s TRX’s market cap in BTC terms

When an asset’s ADL trends upward in this manner, it suggests growth in its accumulation by traders and investors. This means that more market participants are buying than selling.

Confirming that buying pressure remained high at press time, TRX’s Relative Strength Index (RSI) and Money Flow Index (MFI) were positioned significantly above their respective center lines.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

can i order clomiphene without rx get cheap clomiphene without rx how can i get cheap clomid cost of clomid without a prescription buying clomid without dr prescription how can i get cheap clomiphene tablets where can i get generic clomiphene tablets

The thoroughness in this section is noteworthy.

The thoroughness in this draft is noteworthy.

buy zithromax 500mg generic – tetracycline 250mg pills purchase metronidazole generic

buy semaglutide medication – periactin online buy generic periactin

brand amoxiclav – https://atbioinfo.com/ generic ampicillin

order nexium online cheap – anexa mate purchase esomeprazole pills

brand coumadin – https://coumamide.com/ purchase losartan online cheap

order meloxicam 7.5mg generic – relieve pain meloxicam order

order deltasone generic – inflammatory bowel diseases order deltasone 10mg without prescription

generic ed drugs – hims ed pills buy erectile dysfunction drugs

buy amoxil tablets – amoxil pills buy generic amoxil

buy diflucan sale – https://gpdifluca.com/ buy fluconazole tablets

escitalopram 20mg usa – https://escitapro.com/# order escitalopram 10mg generic

cenforce 100mg generic – https://cenforcers.com/ purchase cenforce generic

cialis stopped working – tadalafil daily use what does a cialis pill look like

reliable source cialis – strongtadafl when does the cialis patent expire

cheap viagra alternative – site viagra sale derby

I’ll certainly bring to be familiar with more. este sitio

Greetings! Utter productive par‘nesis within this article! It’s the little changes which will espy the largest changes. Thanks a portion for sharing! https://buyfastonl.com/amoxicillin.html

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

The thoroughness in this piece is noteworthy. https://ursxdol.com/clomid-for-sale-50-mg/

I couldn’t resist commenting. Well written! https://prohnrg.com/product/orlistat-pills-di/

This is the kind of topic I enjoy reading. https://aranitidine.com/fr/ciagra-professional-20-mg/

This is a theme which is virtually to my callousness… Many thanks! Faithfully where can I find the connection details due to the fact that questions? https://ondactone.com/product/domperidone/