- Bitcoin broke past $59K.

- Short-term traders were locking 2% profits on their sales.

Bitcoin [BTC] broke past $59,000 during the wee hours of the morning, moving one step closer to its all-time high (ATH).

The bull rally, fueled by strong inflows into spot ETFs, spurred a 13% weekly growth in the king coin’s market value, and more than 37% over the month, data from CoinMarketCap showed.

Bitcoin investors lock in gains

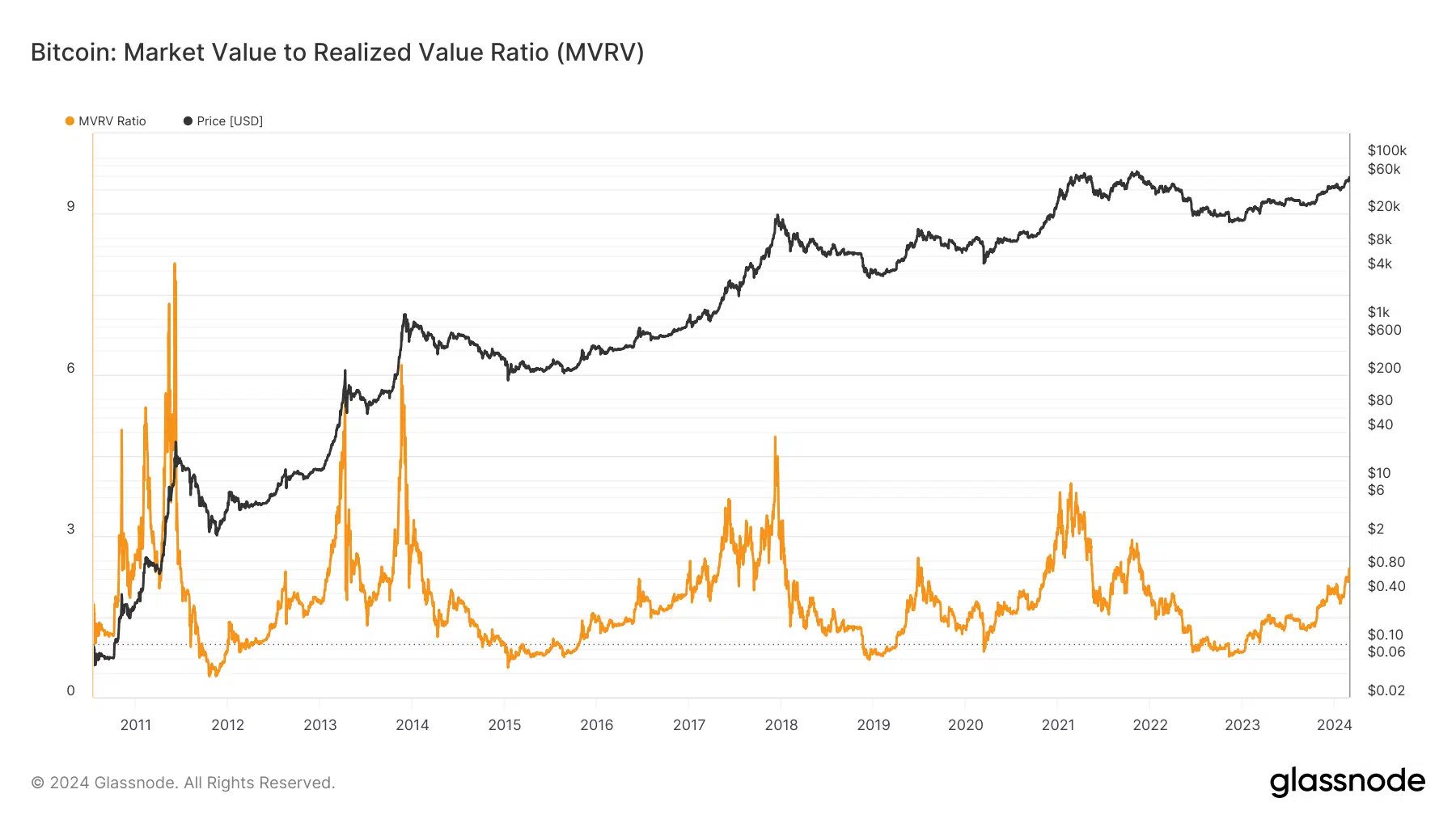

The market boom raised the average profitability of Bitcoin investors to new highs.

According to AMBCrypto’s analysis of Glassnode’s data, investors were holding an unrealized profit of 139% as of this writing.

While this was a measure of profits that could be locked if participants sold their coins, the actual profits realized also painted a positive picture.

Short-term holders up trading activity

A recent report by Glassnode showed that the market was selling coins at 13% profit on average.

While long-term investors who navigated the tough bear market were selling at 2x profits, short-term traders were also locking 2% profits on their sales.

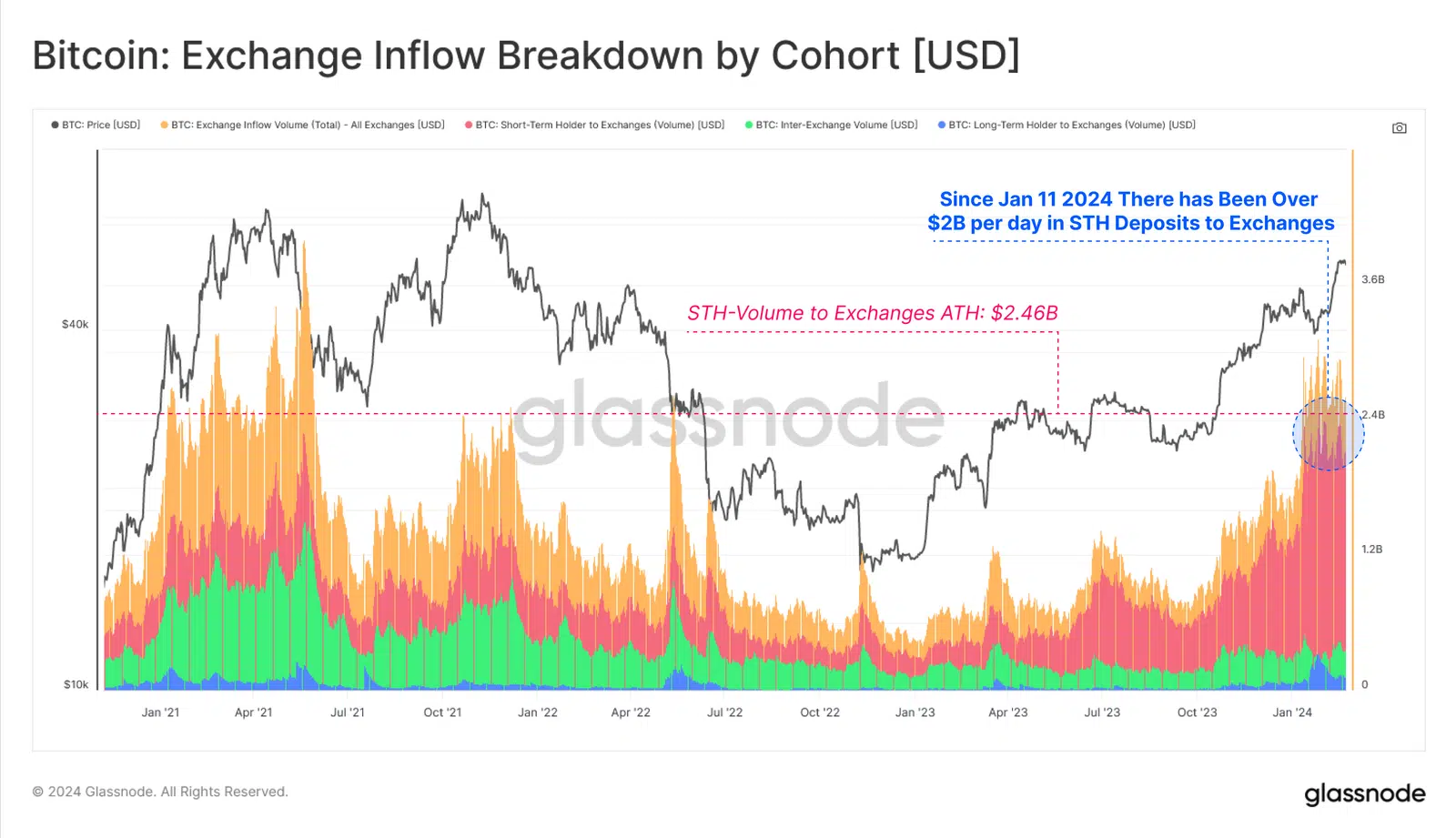

Short-term holders (STH), also referred to as active market traders, have also increased their exchange interaction in the past month.

Data showed STH sending $2 billion per day since mid-January to exchanges, in the process also hitting a new ATH of $2.46 billion.

The cohort has been transferring more than 1% of their supply every day since October 2023.

The greater participation by the STH cohort implied that risk appetite for the market was increasing.

Diamond hands prefer HODLing

On the other hand, long-term holders (LTH) made far fewer deposits. This was expected as these diamond hands were attempting to accumulate from a fast-dwindling supply.

Despite offloading a considerable portion of their holdings in the last month, the LTH cohort still held three-fourths of Bitcoin’s supply.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This numerical superiority gives them the power to dictate how long the bull run would last.

Over time, Bitcoin’s narrative as a store of value has strengthened. With supply/demand economics working to its advantage, it won’t be surprising to see diamond hands holding on to their Bitcoins for eternity.

- Bitcoin broke past $59K.

- Short-term traders were locking 2% profits on their sales.

Bitcoin [BTC] broke past $59,000 during the wee hours of the morning, moving one step closer to its all-time high (ATH).

The bull rally, fueled by strong inflows into spot ETFs, spurred a 13% weekly growth in the king coin’s market value, and more than 37% over the month, data from CoinMarketCap showed.

Bitcoin investors lock in gains

The market boom raised the average profitability of Bitcoin investors to new highs.

According to AMBCrypto’s analysis of Glassnode’s data, investors were holding an unrealized profit of 139% as of this writing.

While this was a measure of profits that could be locked if participants sold their coins, the actual profits realized also painted a positive picture.

Short-term holders up trading activity

A recent report by Glassnode showed that the market was selling coins at 13% profit on average.

While long-term investors who navigated the tough bear market were selling at 2x profits, short-term traders were also locking 2% profits on their sales.

Short-term holders (STH), also referred to as active market traders, have also increased their exchange interaction in the past month.

Data showed STH sending $2 billion per day since mid-January to exchanges, in the process also hitting a new ATH of $2.46 billion.

The cohort has been transferring more than 1% of their supply every day since October 2023.

The greater participation by the STH cohort implied that risk appetite for the market was increasing.

Diamond hands prefer HODLing

On the other hand, long-term holders (LTH) made far fewer deposits. This was expected as these diamond hands were attempting to accumulate from a fast-dwindling supply.

Despite offloading a considerable portion of their holdings in the last month, the LTH cohort still held three-fourths of Bitcoin’s supply.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This numerical superiority gives them the power to dictate how long the bull run would last.

Over time, Bitcoin’s narrative as a store of value has strengthened. With supply/demand economics working to its advantage, it won’t be surprising to see diamond hands holding on to their Bitcoins for eternity.