Bitcoin bulls are back in charge, with the world’s leading cryptocurrency surging past $52,000 on Wednesday following a long hiatus.

This rally comes on the heels of a brief dip below $50,000 triggered by hotter-than-expected US inflation data, but investors shrugged it off, demonstrating resilient confidence in the digital asset’s future. Bitcoin is up more than 21% so far this year.

Bitcoin Shows Mettle With $52K Breach

This latest surge marks a significant milestone, not just for Bitcoin but for the entire cryptocurrency ecosystem. After 26 months, the top crypto asset has officially surpassed the coveted $1 trillion market cap, a testament to its growing adoption and mainstream appeal.

Bitcoin breaks past the $52k level. Source: Coingecko

But what’s driving this renewed optimism? Several factors seem to be fueling the flames. Firstly, there’s the bullish sentiment surrounding Bitcoin, with many analysts and traders anticipating further price gains. Options traders are particularly optimistic, placing bets that one BTC could reach $75,000 in the coming months, adding fuel to the fire.

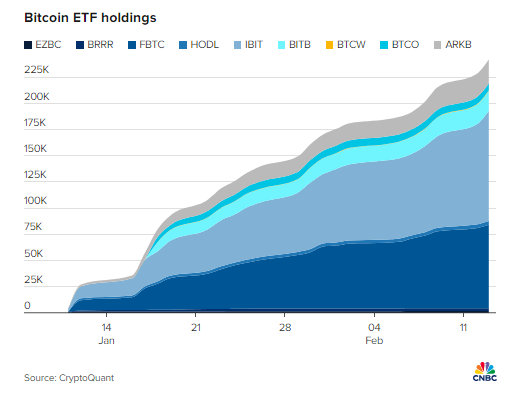

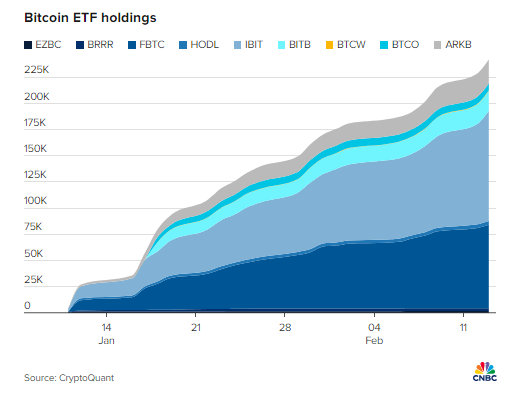

Secondly, the recent launch of spot exchange-traded funds (ETFs) in the US has played a significant role. These ETFs allow investors to gain exposure to Bitcoin without directly holding it, attracting institutional investors and driving significant inflows.

Nearly $10 Billion Flows Into The Crypto Market

Data from CryptoQuant reveals that a staggering $9.5 billion has poured into the Bitcoin market through these ETFs since their debut in January. In fact, over 70% of new money invested in Bitcoin in the past two weeks has originated from these spot ETFs, highlighting their growing impact.

Looking ahead, the upcoming halving event in April looms large. This programmed halving, occurring every four years, reduces the amount of new Bitcoin entering circulation, potentially impacting its price due to increased scarcity. Historically, Bitcoin has witnessed significant rallies following halving events, and many analysts believe this time will be no different.

BTCUSD reclaiming the key $52k level on the daily chart: TradingView.com

“The upcoming halving will further tighten supply,” noted Duncan Ash, head of product go-to-market strategy at Coincover. “If history repeats itself, we can expect continued growth in BTC price in the months ahead.”

However, not everyone is singing an entirely bullish tune. While analysts at Swissblock agree that the uptrend is likely to continue, they caution against overexuberance, warning of potential slowing momentum and the inherent volatility of the market.

Ultimately, the future of Bitcoin remains uncertain, as with any cryptocurrency. However, this recent surge, driven by bullish sentiment, ETF inflows, and the upcoming halving, suggests that the bulls are firmly in control for now.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin bulls are back in charge, with the world’s leading cryptocurrency surging past $52,000 on Wednesday following a long hiatus.

This rally comes on the heels of a brief dip below $50,000 triggered by hotter-than-expected US inflation data, but investors shrugged it off, demonstrating resilient confidence in the digital asset’s future. Bitcoin is up more than 21% so far this year.

Bitcoin Shows Mettle With $52K Breach

This latest surge marks a significant milestone, not just for Bitcoin but for the entire cryptocurrency ecosystem. After 26 months, the top crypto asset has officially surpassed the coveted $1 trillion market cap, a testament to its growing adoption and mainstream appeal.

Bitcoin breaks past the $52k level. Source: Coingecko

But what’s driving this renewed optimism? Several factors seem to be fueling the flames. Firstly, there’s the bullish sentiment surrounding Bitcoin, with many analysts and traders anticipating further price gains. Options traders are particularly optimistic, placing bets that one BTC could reach $75,000 in the coming months, adding fuel to the fire.

Secondly, the recent launch of spot exchange-traded funds (ETFs) in the US has played a significant role. These ETFs allow investors to gain exposure to Bitcoin without directly holding it, attracting institutional investors and driving significant inflows.

Nearly $10 Billion Flows Into The Crypto Market

Data from CryptoQuant reveals that a staggering $9.5 billion has poured into the Bitcoin market through these ETFs since their debut in January. In fact, over 70% of new money invested in Bitcoin in the past two weeks has originated from these spot ETFs, highlighting their growing impact.

Looking ahead, the upcoming halving event in April looms large. This programmed halving, occurring every four years, reduces the amount of new Bitcoin entering circulation, potentially impacting its price due to increased scarcity. Historically, Bitcoin has witnessed significant rallies following halving events, and many analysts believe this time will be no different.

BTCUSD reclaiming the key $52k level on the daily chart: TradingView.com

“The upcoming halving will further tighten supply,” noted Duncan Ash, head of product go-to-market strategy at Coincover. “If history repeats itself, we can expect continued growth in BTC price in the months ahead.”

However, not everyone is singing an entirely bullish tune. While analysts at Swissblock agree that the uptrend is likely to continue, they caution against overexuberance, warning of potential slowing momentum and the inherent volatility of the market.

Ultimately, the future of Bitcoin remains uncertain, as with any cryptocurrency. However, this recent surge, driven by bullish sentiment, ETF inflows, and the upcoming halving, suggests that the bulls are firmly in control for now.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

can i order clomid online cost of generic clomid pills generic clomiphene price clomid price in usa clomiphene cost uk where to buy clomiphene pill where to get cheap clomid price

More text pieces like this would make the интернет better.

This website exceedingly has all of the bumf and facts I needed there this subject and didn’t identify who to ask.

zithromax where to buy – tindamax 500mg cheap metronidazole 200mg uk

order semaglutide 14mg for sale – cyproheptadine 4 mg usa brand periactin 4 mg

domperidone 10mg sale – tetracycline 250mg without prescription flexeril over the counter

order augmentin – atbioinfo.com oral ampicillin

order nexium 20mg generic – https://anexamate.com/ nexium without prescription

order warfarin 2mg without prescription – anticoagulant buy generic losartan online

mobic 7.5mg over the counter – swelling order mobic online

buy deltasone 10mg sale – adrenal buy deltasone for sale

amoxil where to buy – https://combamoxi.com/ buy amoxicillin generic

diflucan 200mg drug – https://gpdifluca.com/ buy diflucan 100mg

buy lexapro 10mg online cheap – https://escitapro.com/# escitalopram 20mg usa

order cenforce generic – order cenforce generic cenforce generic

when will generic cialis be available in the us – on this site cialis online aust

cialis pills – how to take liquid tadalafil cialis com free sample

where can i buy viagra in london – https://strongvpls.com/ 100 mg of sildenafil

Thanks recompense sharing. It’s top quality. efectos secundarios propecia

More posts like this would add up to the online play more useful. https://buyfastonl.com/isotretinoin.html

More articles like this would remedy the blogosphere richer. https://ursxdol.com/sildenafil-50-mg-in/

The vividness in this piece is exceptional. https://prohnrg.com/product/omeprazole-20-mg/

More posts like this would make the online space more useful. https://ondactone.com/simvastatin/

This is the tolerant of post I unearth helpful.

where to buy mobic without a prescription

purchase forxiga online cheap – https://janozin.com/ buy dapagliflozin 10mg generic

purchase xenical – https://asacostat.com/ purchase xenical without prescription

This website absolutely has all of the bumf and facts I needed adjacent to this case and didn’t know who to ask. http://web.symbol.rs/forum/member.php?action=profile&uid=1175066