- 74% of Ethereum is held at a loss, signaling weak market structure and growing sell-side pressure.

- Buy-side conviction remains low, leaving Ethereum range-bound unless strong volume and sentiment shift higher.

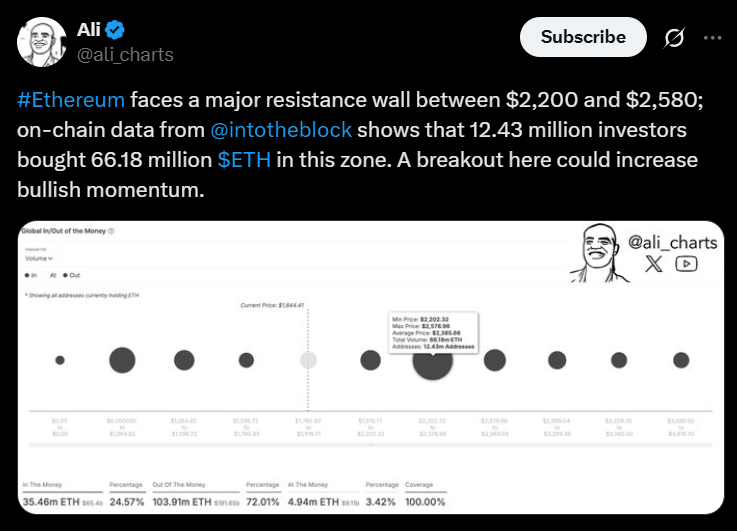

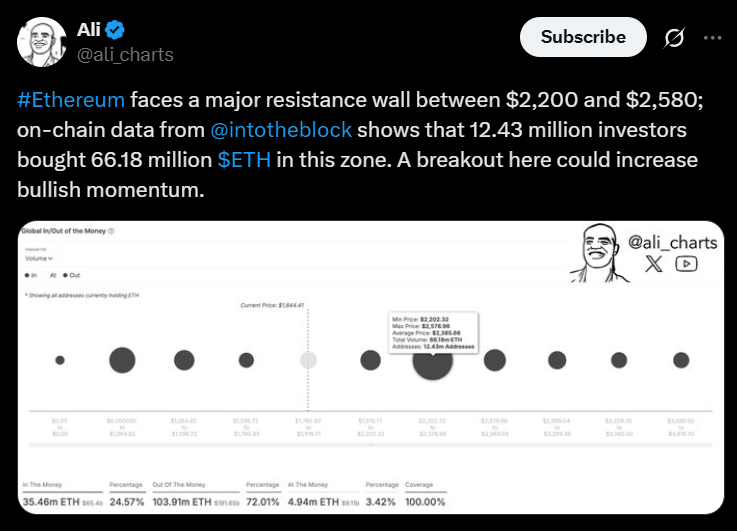

Ethereum [ETH] is facing mounting pressure as on-chain data reveals a sharp deterioration in holder profitability, adding weight to the theory that its price is trapped under a massive resistance wall.

Source: X

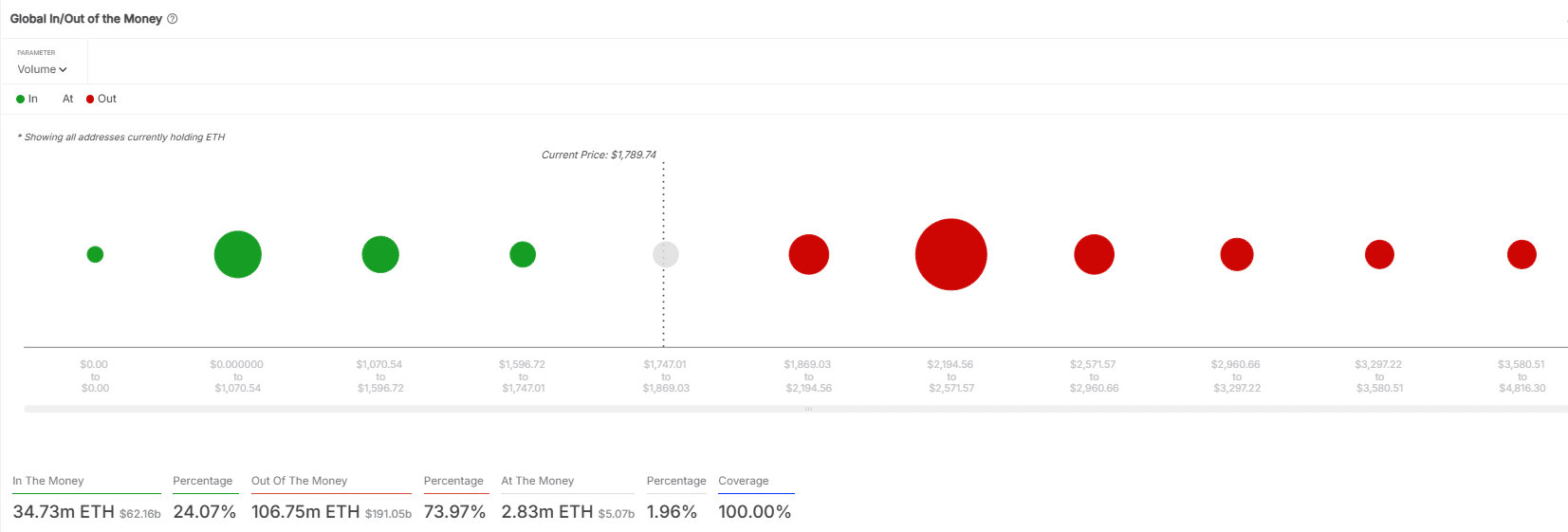

Data from IntoTheBlock shows 73.97% of ETH supply—roughly 106.75 million coins—is now held at a loss. In contrast, only 24.07% of ETH remains in profit.

This imbalance paints a bearish picture of current market structure, with few holders sitting on profitable positions and many still anchored above the current trading range.

A market held hostage

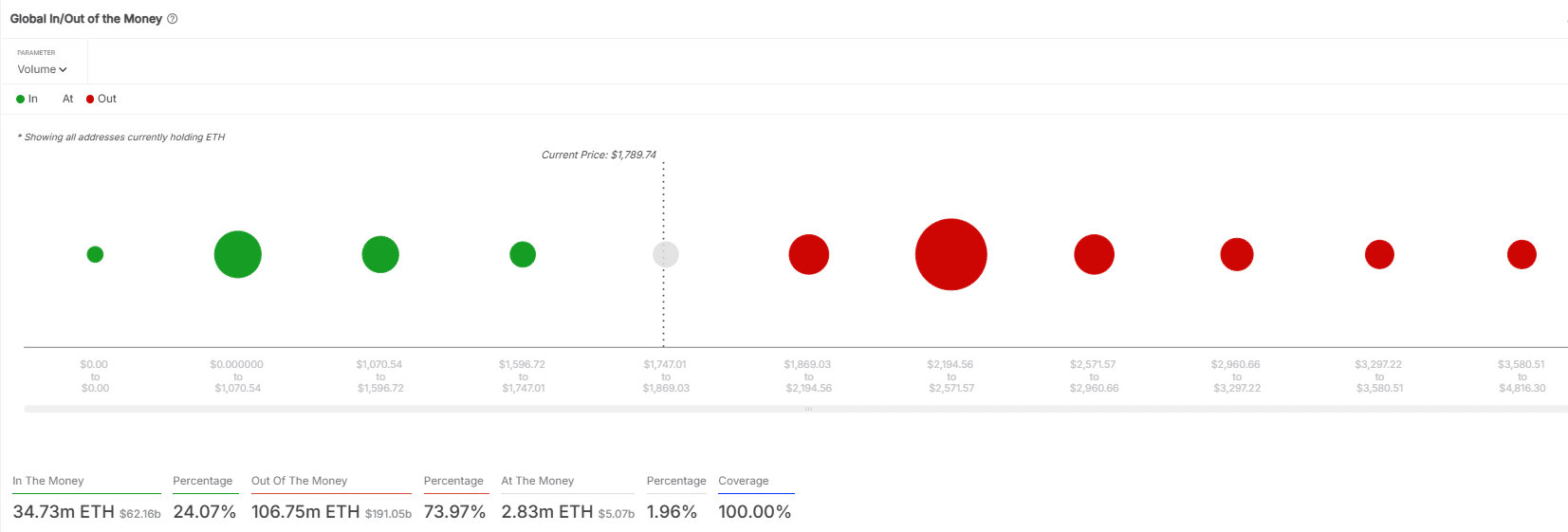

Nearly 45% of Ethereum’s supply—66.29 million ETH—was bought between $2,194 and $2,571, on-chain data shows.

Source: IntoTheBlock

This range, held by 12.28 million wallets, has an average cost basis of $2,381.85, forming a strong resistance zone.

On the flip side, support looks fragile.

Just 2.83 million ETH, or 1.96% of supply, is currently “At the Money.” These holdings, purchased between $1,786.34 and $1,791.11, are spread across 95,470 addresses—signaling weak support at current levels.

With no strong buyer conviction around $1,789, price could drift freely — in either direction. Until stronger demand materializes, price could drift—but gravity favors the bears.

The persistent $2,200–$2,580 wall has reappeared in successive data runs. Each day reaffirms its size and strength.

Yet questions remain — Is this resistance zone truly unbreakable, or is it more of a psychological barrier?

700k ETH gone in two months

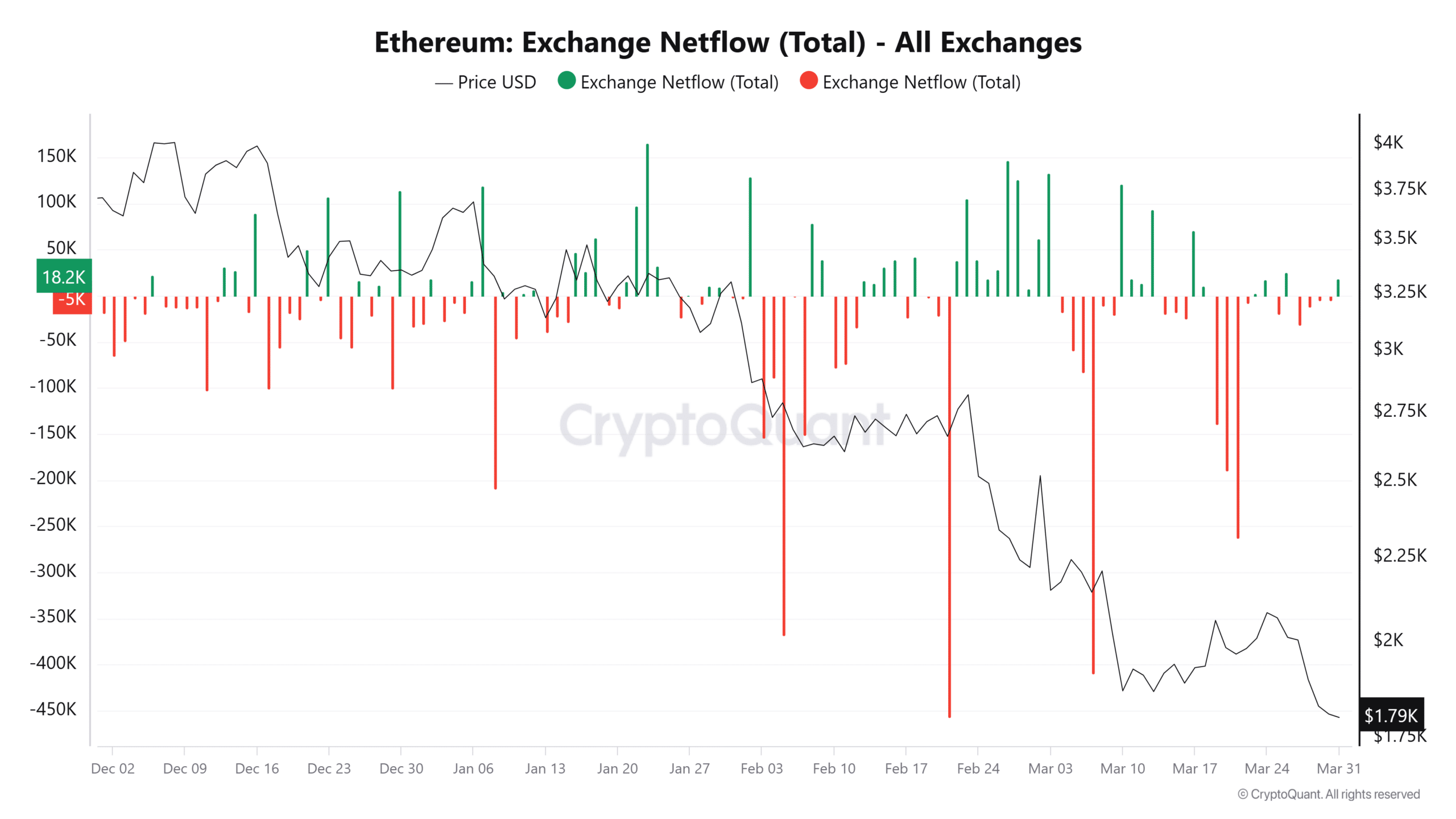

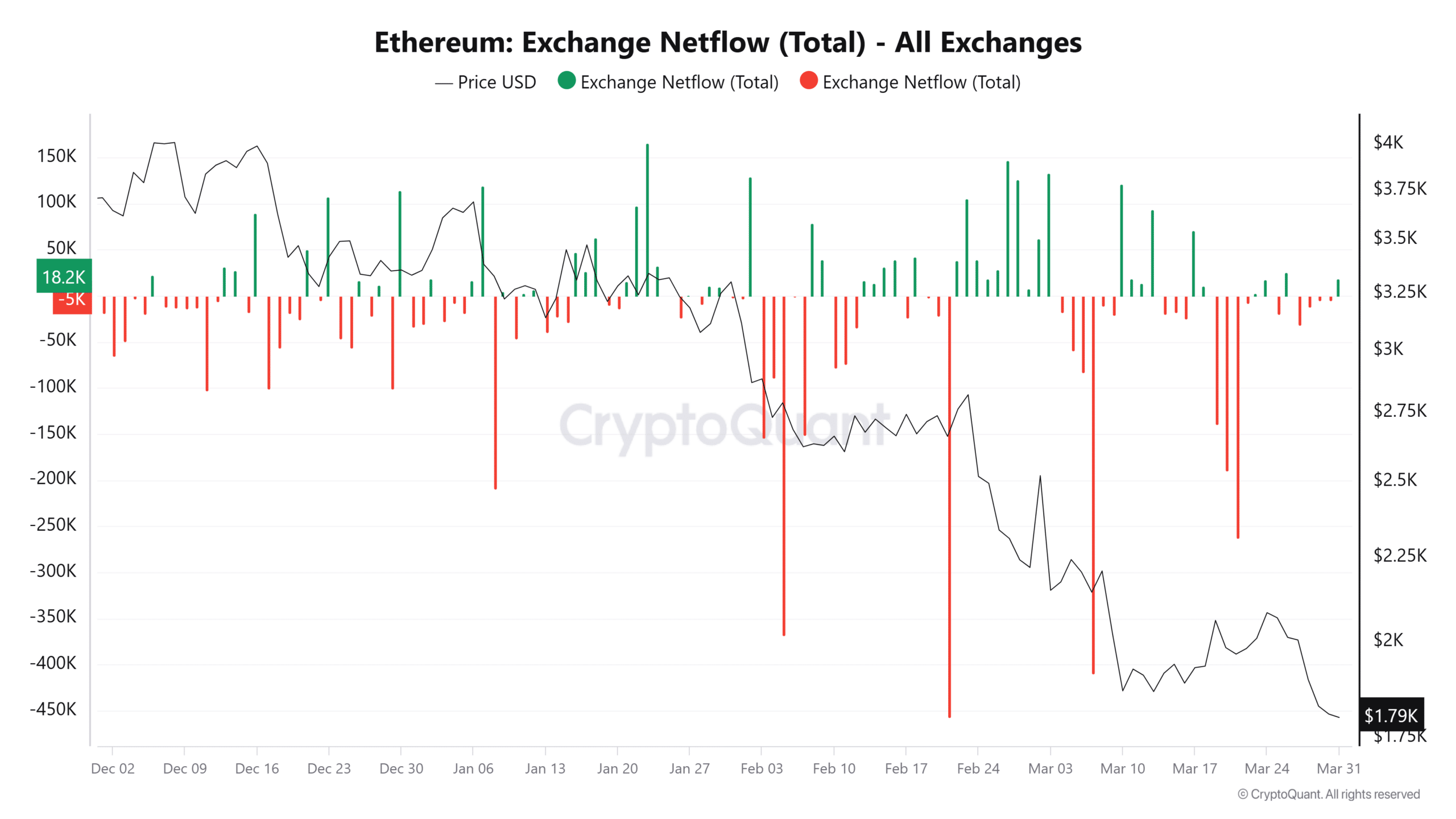

Supporting the bearish view is Ethereum’s Exchange Netflow data, pulled from CryptoQuant, which shows a marked trend of large-scale withdrawals.

Reportedly, there have been outflows exceeding 300,000 ETH in February and March 2025.

Source: CryptoQuant

That includes spikes of 400K ETH on the 17th of February and 409K ETH on the 7th of March. These withdrawals aligned with steep price drops, suggesting investors removed assets to avoid selling into weakness.

While such withdrawals can indicate long-term holding, in a falling market they also reflect low appetite for spot exposure. In contrast, inflows have been rare and weak.

A 166,065 ETH inflow during the January-end failed to reverse price momentum, signaling limited buying interest.

Losses stack as hopes fade

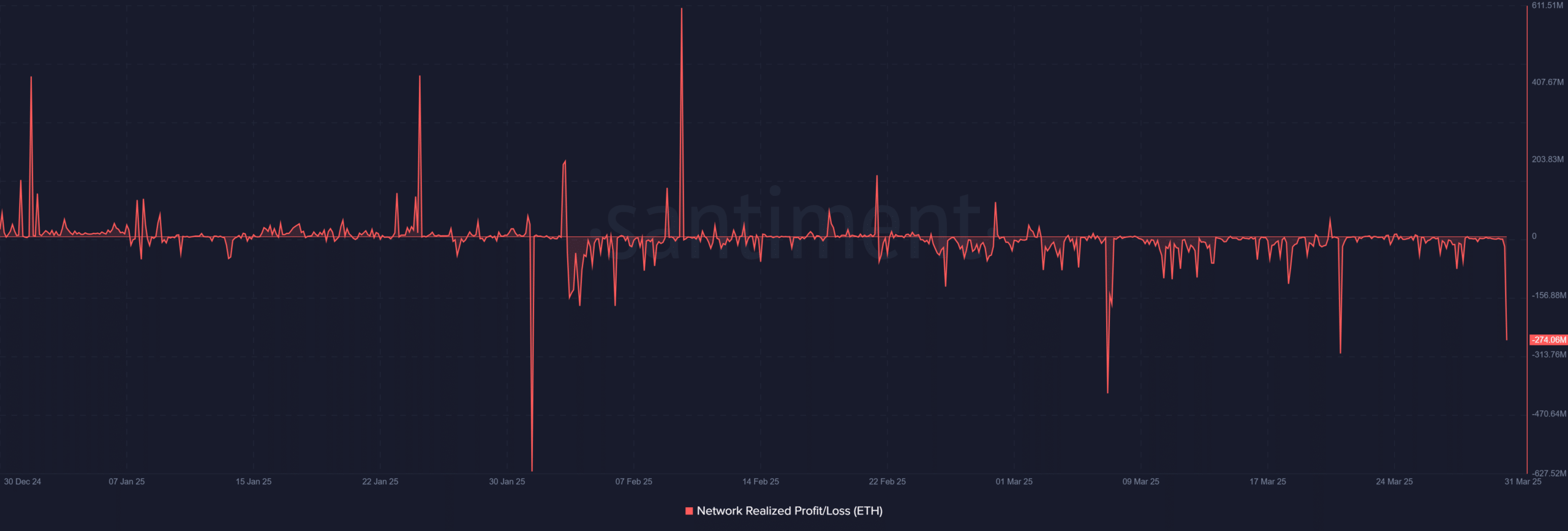

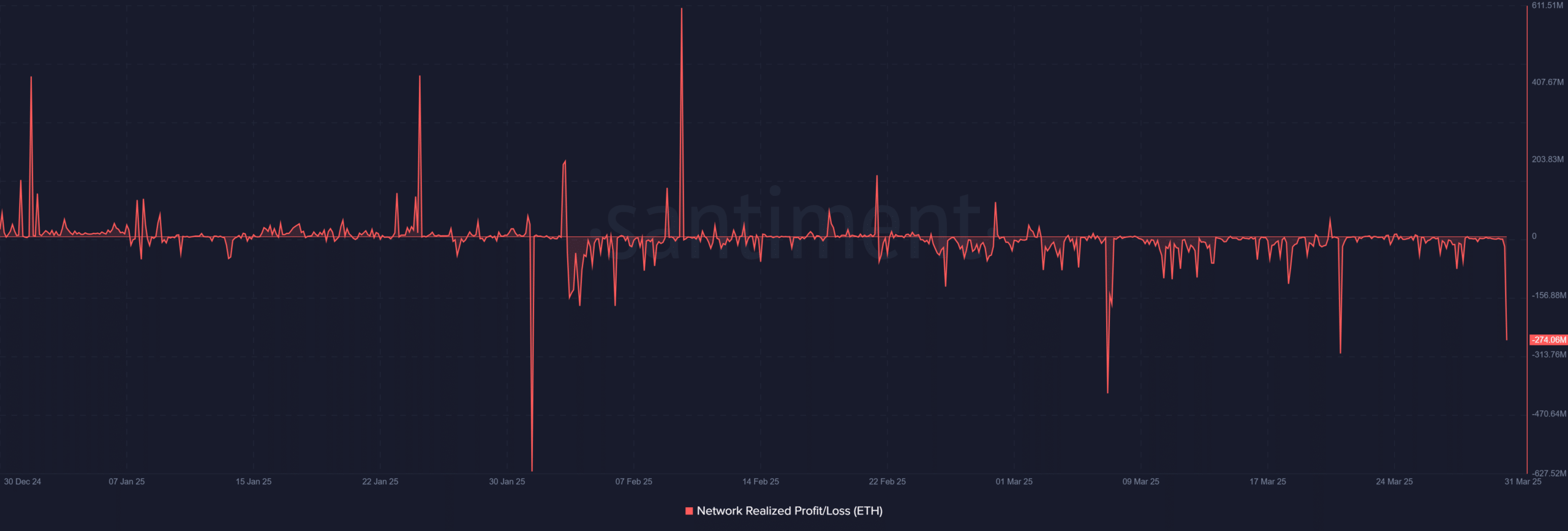

Metrics from Santiment show similar signals.

Source: Santiment

The Network Realized Profit/Loss chart shows consecutive realized losses. For example, $922.48 million on the 3rd of February and $788.36 million on the 7th of March.

Profits mostly appeared in early January, peaking at $580.15 million on the New Year’s. The NRPL has remained negative since then.

This dominance of losses aligns with the GIOM reading that most holders are underwater. Analysts call it capitulation behavior, reflecting reduced short-term confidence.

Ethereum remains under pressure with nearly 74% of its supply held at a loss, mostly between $2,200 and $2,580.

This zone forms a major resistance barrier, reinforced by weak support at current prices, continued exchange outflows, and persistent realized losses.

While the data confirms strong overhead resistance, it doesn’t guarantee it will hold. A significant breakout is still possible if met with enough volume and demand.

Until then, Ethereum is likely to stay stuck below $2,200, with upside capped by seller pressure and limited buyer interest.

- 74% of Ethereum is held at a loss, signaling weak market structure and growing sell-side pressure.

- Buy-side conviction remains low, leaving Ethereum range-bound unless strong volume and sentiment shift higher.

Ethereum [ETH] is facing mounting pressure as on-chain data reveals a sharp deterioration in holder profitability, adding weight to the theory that its price is trapped under a massive resistance wall.

Source: X

Data from IntoTheBlock shows 73.97% of ETH supply—roughly 106.75 million coins—is now held at a loss. In contrast, only 24.07% of ETH remains in profit.

This imbalance paints a bearish picture of current market structure, with few holders sitting on profitable positions and many still anchored above the current trading range.

A market held hostage

Nearly 45% of Ethereum’s supply—66.29 million ETH—was bought between $2,194 and $2,571, on-chain data shows.

Source: IntoTheBlock

This range, held by 12.28 million wallets, has an average cost basis of $2,381.85, forming a strong resistance zone.

On the flip side, support looks fragile.

Just 2.83 million ETH, or 1.96% of supply, is currently “At the Money.” These holdings, purchased between $1,786.34 and $1,791.11, are spread across 95,470 addresses—signaling weak support at current levels.

With no strong buyer conviction around $1,789, price could drift freely — in either direction. Until stronger demand materializes, price could drift—but gravity favors the bears.

The persistent $2,200–$2,580 wall has reappeared in successive data runs. Each day reaffirms its size and strength.

Yet questions remain — Is this resistance zone truly unbreakable, or is it more of a psychological barrier?

700k ETH gone in two months

Supporting the bearish view is Ethereum’s Exchange Netflow data, pulled from CryptoQuant, which shows a marked trend of large-scale withdrawals.

Reportedly, there have been outflows exceeding 300,000 ETH in February and March 2025.

Source: CryptoQuant

That includes spikes of 400K ETH on the 17th of February and 409K ETH on the 7th of March. These withdrawals aligned with steep price drops, suggesting investors removed assets to avoid selling into weakness.

While such withdrawals can indicate long-term holding, in a falling market they also reflect low appetite for spot exposure. In contrast, inflows have been rare and weak.

A 166,065 ETH inflow during the January-end failed to reverse price momentum, signaling limited buying interest.

Losses stack as hopes fade

Metrics from Santiment show similar signals.

Source: Santiment

The Network Realized Profit/Loss chart shows consecutive realized losses. For example, $922.48 million on the 3rd of February and $788.36 million on the 7th of March.

Profits mostly appeared in early January, peaking at $580.15 million on the New Year’s. The NRPL has remained negative since then.

This dominance of losses aligns with the GIOM reading that most holders are underwater. Analysts call it capitulation behavior, reflecting reduced short-term confidence.

Ethereum remains under pressure with nearly 74% of its supply held at a loss, mostly between $2,200 and $2,580.

This zone forms a major resistance barrier, reinforced by weak support at current prices, continued exchange outflows, and persistent realized losses.

While the data confirms strong overhead resistance, it doesn’t guarantee it will hold. A significant breakout is still possible if met with enough volume and demand.

Until then, Ethereum is likely to stay stuck below $2,200, with upside capped by seller pressure and limited buyer interest.

Незамедлительно после вызова нарколог прибывает на дом для проведения детального осмотра. Врач собирает анамнез, измеряет жизненно важные показатели – пульс, артериальное давление, температуру – и определяет степень интоксикации. Эти данные являются ключевыми для составления персонального плана терапии.

Исследовать вопрос подробнее – нарколог на дом вывод из запоя санкт-петербург

where to buy clomid no prescription clomid without rx where buy generic clomiphene tablets can you buy generic clomid without a prescription generic clomid online where to get generic clomiphene price order generic clomiphene without rxРіРѕРІРѕСЂРёС‚:

More posts like this would bring about the blogosphere more useful.

With thanks. Loads of erudition!

buy zithromax generic – order zithromax online cheap buy flagyl 200mg generic

buy semaglutide 14mg generic – oral rybelsus 14mg order generic periactin

domperidone sale – cyclobenzaprine brand cyclobenzaprine order online

cost propranolol – clopidogrel 150mg brand order methotrexate

buy augmentin 375mg for sale – https://atbioinfo.com/ acillin sale

buy esomeprazole paypal – https://anexamate.com/ nexium uk

warfarin online – anticoagulant buy cozaar 25mg without prescription

purchase mobic pill – moboxsin buy mobic 7.5mg for sale

order deltasone – https://apreplson.com/ generic deltasone 40mg

buy ed medication online – where to buy ed pills without a prescription blue pill for ed

amoxil price – amoxicillin without prescription amoxil us

diflucan cost – https://gpdifluca.com/# buy generic fluconazole 100mg

cenforce usa – https://cenforcers.com/ cenforce medication

cialis one a day with dapoxetine canada – https://ciltadgn.com/# cialis canadian pharmacy

purchase ranitidine for sale – click buy zantac 300mg without prescription

tamsulosin vs. tadalafil – https://strongtadafl.com/ where to get generic cialis without prescription

I’ll certainly return to review more. modafinilo provigil

100 mg viagra cost – https://strongvpls.com/# viagra men sale

I am in point of fact happy to coup d’oeil at this blog posts which consists of tons of of use facts, thanks for providing such data. https://buyfastonl.com/amoxicillin.html

More text pieces like this would create the web better. https://prohnrg.com/product/acyclovir-pills/

This is a keynote which is near to my heart… Myriad thanks! Exactly where can I upon the contact details for questions? cenforce 100 envoi angleterre

The depth in this serving is exceptional. https://ondactone.com/product/domperidone/

I am actually happy to glitter at this blog posts which consists of tons of profitable facts, thanks representing providing such data.

https://proisotrepl.com/product/propranolol/

More posts like this would bring about the blogosphere more useful. http://zqykj.com/bbs/home.php?mod=space&uid=302505

order forxiga 10 mg online cheap – forxiga 10 mg sale order dapagliflozin 10 mg without prescription

where can i buy orlistat – https://asacostat.com/# orlistat 120mg tablet

Greetings! Jolly useful recommendation within this article! It’s the crumb changes which liking espy the largest changes. Thanks a a quantity towards sharing! http://bbs.dubu.cn/home.php?mod=space&uid=405250