- Latest analysis revealed that accumulation addresses have been stockpiling BTC

- In case of a trend reversal, the cryptocurrency might reclaim $67k

Bitcoin’s [BTC] price action shifted a gear down as it was close to touching $61k at press time. However, there may be more to the story here as several investors have used this opportunity to accumulate more BTC.

Will this have a positive impact on its price and help kickstart a fresh bull rally soon?

Are investors buying Bitcoin?

CoinMarketCap’s data revealed that BTC witnessed a major price correction last week as its value dropped by over 9%. In the last 24 hours alone, BTC’s value declined by more than 4%. At press time, the crypto was trading at $61,727.17 with a market capitalization of over $1.22 trillion.

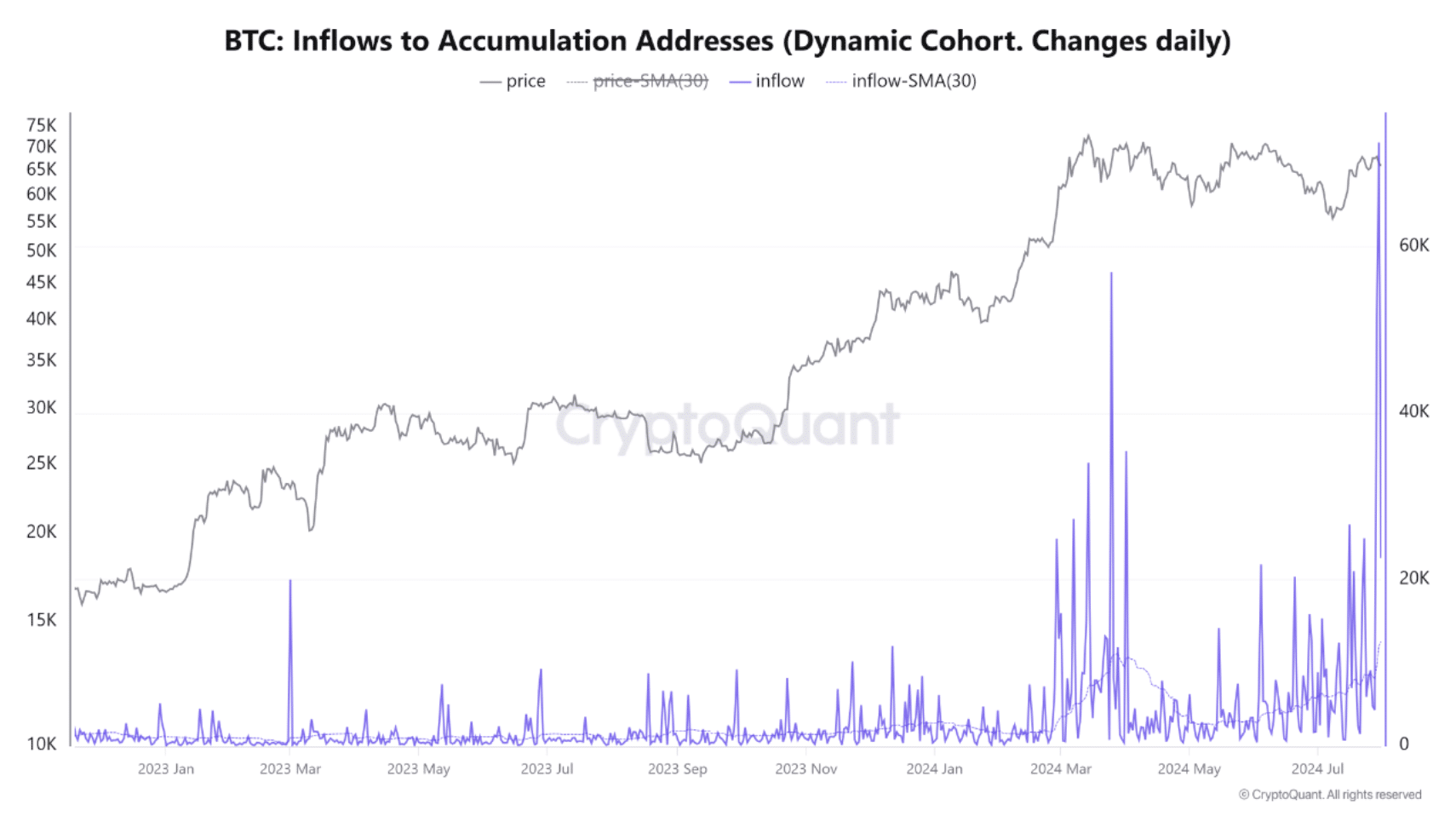

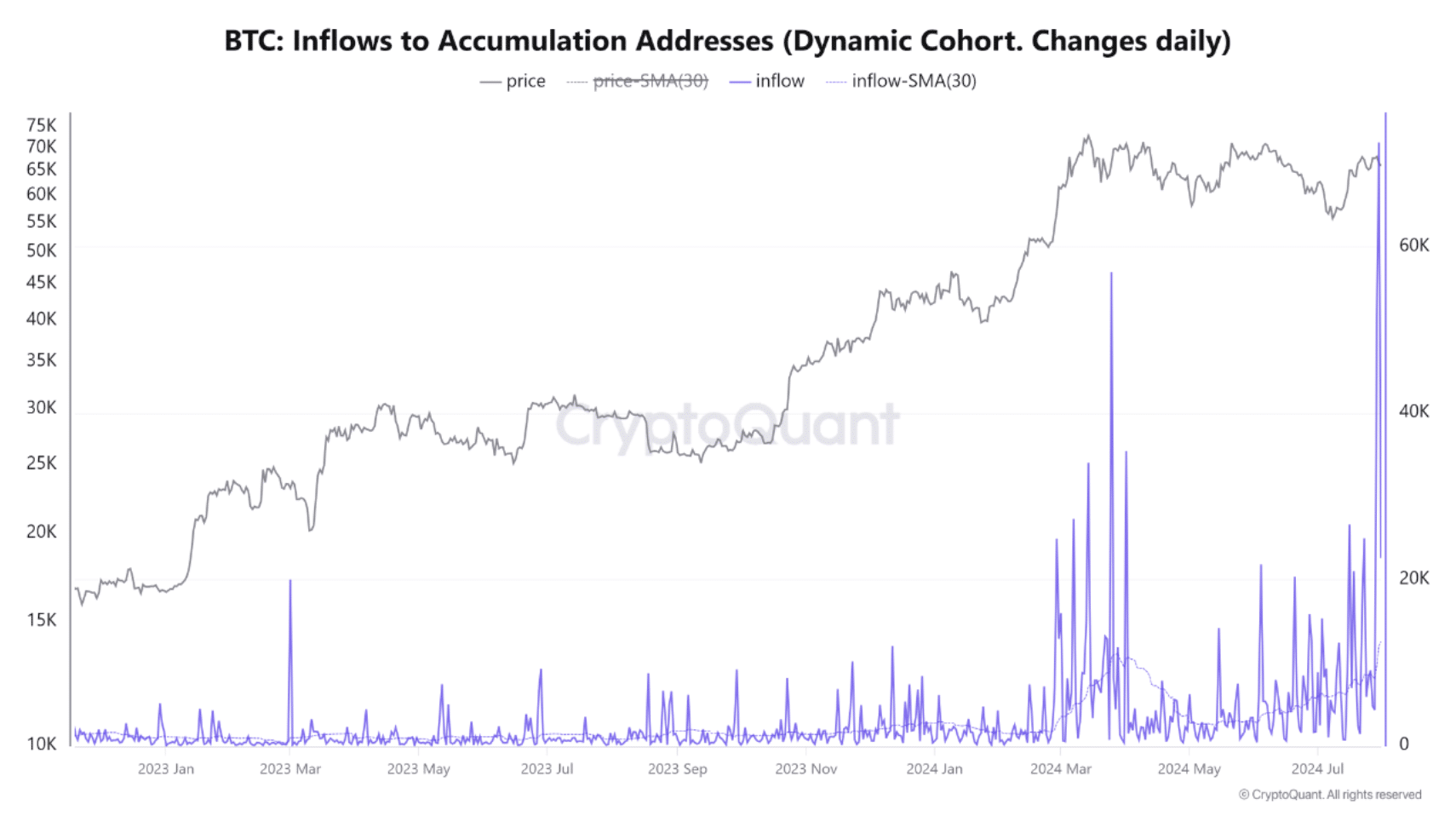

Meanwhile, caueconomy, an author and analyst at CryptoQuant, recently shared an analysis revealing an interesting development. The analysis used the accumulation addresses metric that tracks addresses that have no outgoing transactions, excluding miners and exchanges. This metric is updated daily, but it also provides insight into the interest in long-term accumulation.

As per the analysis, between April and May, accumulation addresses reduced the absorption of coins. On the contrary, from June onwards, this dynamic returned to the market.

Source: CryptoQuant

The analysis mentioned,

“Recently, these addresses accumulated around 72.5 thousand BTC and in the last 30 days, they saw daily inflows of 12.5 thousand BTC. If this trend continues, it could positively influence market prices.”

AMBCrypto then checked CryptoQuant’s data to find out whether buying pressure was overall dominant in the market. As per our analysis, BTC’s exchange reserve has been dropping – A sign of high buying pressure.

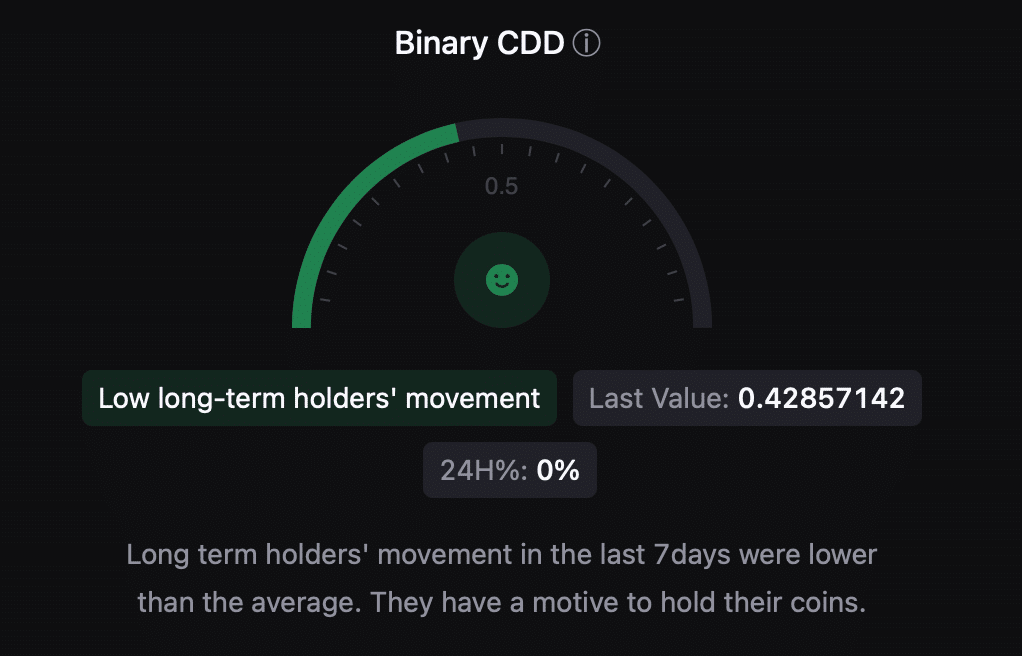

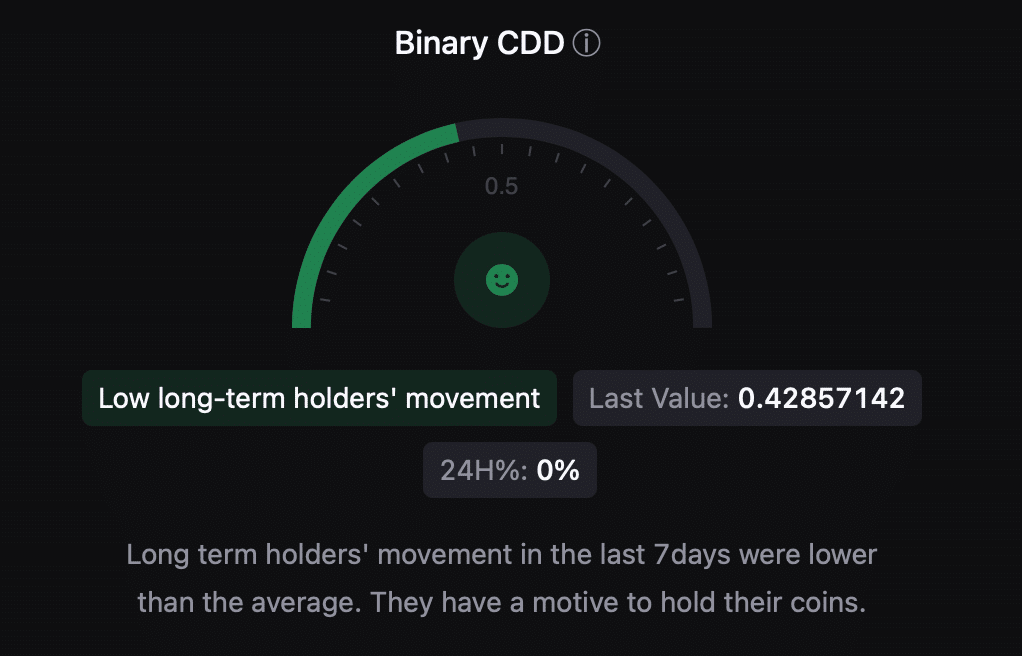

Its binary CDD was greed, which suggested that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Apart from this, BTC’s Korea Premium revealed that buying sentiment was strong among Korean investors.

Source: CryptoQuant

Will BTC’s price be affected?

Since accumulation was high, AMBCrypto checked BTC’s daily chart to see whether it might be preparing for a trend reversal. According to the same, BTC’s price touched the lower limit of the Bollinger Bands, which often results in price hikes.

However, both its Money Flow Index (MFI) and Chaikin Money Flow (CMF) registered downticks, suggesting that BTC might continue to remain bearish.

Read Bitcoin’s [BTC] Price Prediction 2024-25

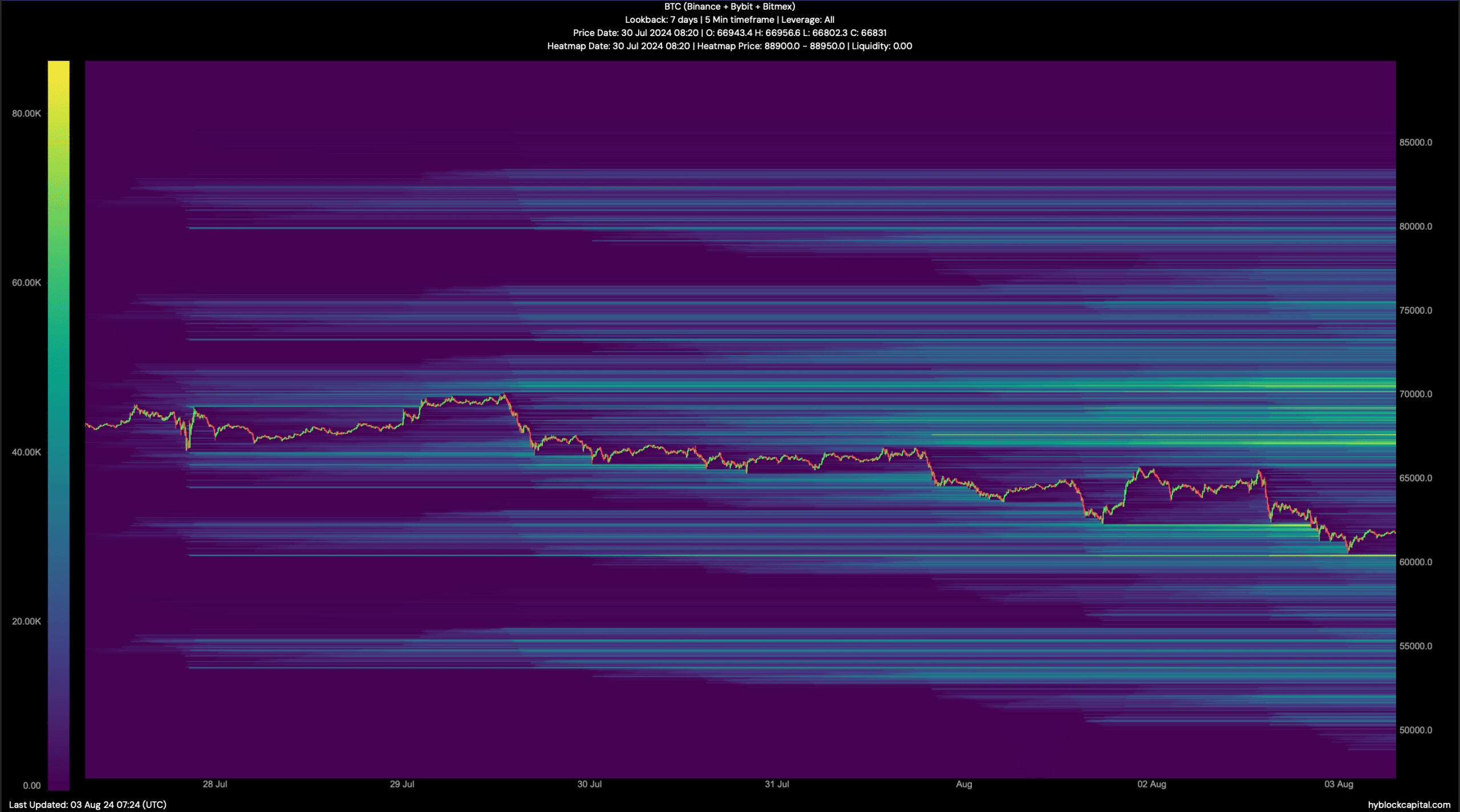

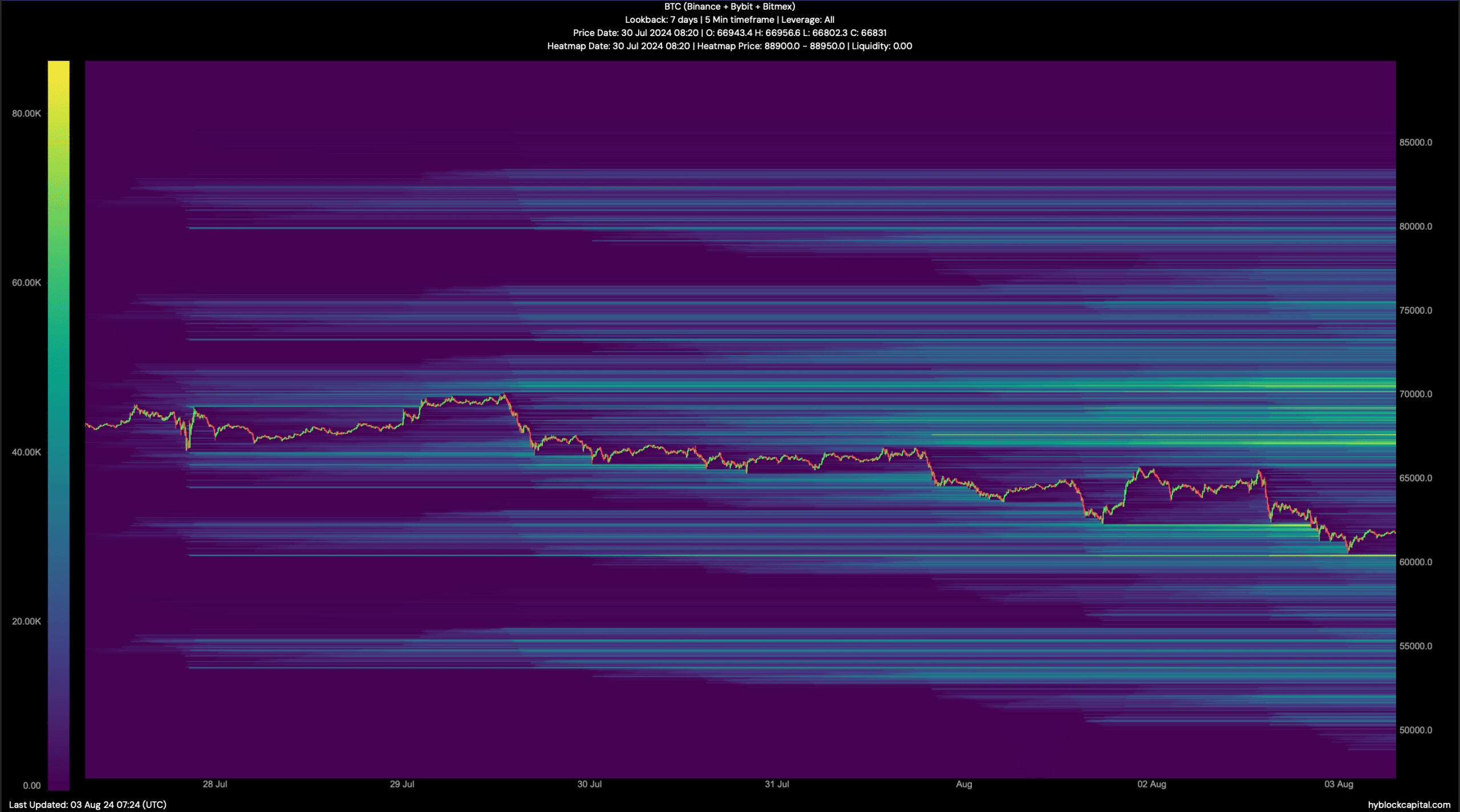

Finally, we then checked its liquidation heatmap to find out possible support and target levels.

If the downturn continues, then it won’t be surprising to see Bitcoin drop to $60k in the coming days. Nonetheless, in the event of a trend reversal, BTC might first reclaim $67k.

Source: Hyblock Capital

- Latest analysis revealed that accumulation addresses have been stockpiling BTC

- In case of a trend reversal, the cryptocurrency might reclaim $67k

Bitcoin’s [BTC] price action shifted a gear down as it was close to touching $61k at press time. However, there may be more to the story here as several investors have used this opportunity to accumulate more BTC.

Will this have a positive impact on its price and help kickstart a fresh bull rally soon?

Are investors buying Bitcoin?

CoinMarketCap’s data revealed that BTC witnessed a major price correction last week as its value dropped by over 9%. In the last 24 hours alone, BTC’s value declined by more than 4%. At press time, the crypto was trading at $61,727.17 with a market capitalization of over $1.22 trillion.

Meanwhile, caueconomy, an author and analyst at CryptoQuant, recently shared an analysis revealing an interesting development. The analysis used the accumulation addresses metric that tracks addresses that have no outgoing transactions, excluding miners and exchanges. This metric is updated daily, but it also provides insight into the interest in long-term accumulation.

As per the analysis, between April and May, accumulation addresses reduced the absorption of coins. On the contrary, from June onwards, this dynamic returned to the market.

Source: CryptoQuant

The analysis mentioned,

“Recently, these addresses accumulated around 72.5 thousand BTC and in the last 30 days, they saw daily inflows of 12.5 thousand BTC. If this trend continues, it could positively influence market prices.”

AMBCrypto then checked CryptoQuant’s data to find out whether buying pressure was overall dominant in the market. As per our analysis, BTC’s exchange reserve has been dropping – A sign of high buying pressure.

Its binary CDD was greed, which suggested that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Apart from this, BTC’s Korea Premium revealed that buying sentiment was strong among Korean investors.

Source: CryptoQuant

Will BTC’s price be affected?

Since accumulation was high, AMBCrypto checked BTC’s daily chart to see whether it might be preparing for a trend reversal. According to the same, BTC’s price touched the lower limit of the Bollinger Bands, which often results in price hikes.

However, both its Money Flow Index (MFI) and Chaikin Money Flow (CMF) registered downticks, suggesting that BTC might continue to remain bearish.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Finally, we then checked its liquidation heatmap to find out possible support and target levels.

If the downturn continues, then it won’t be surprising to see Bitcoin drop to $60k in the coming days. Nonetheless, in the event of a trend reversal, BTC might first reclaim $67k.

Source: Hyblock Capital

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

buy generic clomid without prescription can i order generic clomid online where can i get generic clomid without dr prescription where buy cheap clomiphene price buy clomiphene without dr prescription can i purchase clomid prices can you get clomid for sale

With thanks. Loads of knowledge!

More articles like this would frame the blogosphere richer.

buy zithromax 250mg without prescription – how to buy azithromycin metronidazole for sale

rybelsus where to buy – order rybelsus 14 mg for sale buy periactin 4mg pills

order motilium pill – flexeril price order cyclobenzaprine pill