- The holders at a loss could dampen bullish fervor, especially for Cardano.

- If the assets breach the key resistances highlighted, the going might get easier.

Cardano [ADA] and Shiba Inu [SHIB] saw muted price action in recent weeks and short-term bearish pressure. ADA was hanging on to the $0.568 support but its position looked precarious. Shiba Inu also appeared set on a course toward a demand zone 13% south.

A post on X from a crypto analyst noted that Cardano and Shiba Inu, among other altcoins, had a large percentage of holders out-of-the-money. What are the implications of this news?

Cardano and Shiba Inu bulls have an uphill battle ahead

Out-of-the-money has a different meaning in the options market. When referring to crypto holders, it simply means that they are at a loss. At current market prices, 50% of ADA holders were at a loss, and 28% of Shiba Inu holders were in the red, according to IntoTheBlock data.

Simply put, if the average cost of the investor’s assets is more than the current market price, the investor is at a loss.

This represented a sizeable chunk of the total share of holders. It implied that a rise in prices would likely see a great amount of selling pressure in the form of profit-taking.

Therefore, among the two coins, ADA would face greater selling pressure since a greater portion of its holders would face losses if they sold right now. Technical analysis of the two tokens could give a better idea of where this selling pressure would be high.

Cardano and Shiba Inu were in undergoing retracements

Source: ADA/USDT on TradingView

The price action of ADA in March saw the asset set a new swing high at $0.81 before receding to the $0.568 support level. The trading volume has also dropped off in the past week. This was a strong sign of consolidation.

At press time, the rally was not yet in the discussion. Instead, given the repeated retests of the support level, another dip toward the 78.6% retracement level at $0.525 appeared likely.

Above the $0.8 level, the selling pressure might begin to rise enormously again. The higher timeframe charts showed that the $0.8-$0.84 and the $1-$1.05 region were two stiff resistances that could halt bullish progress.

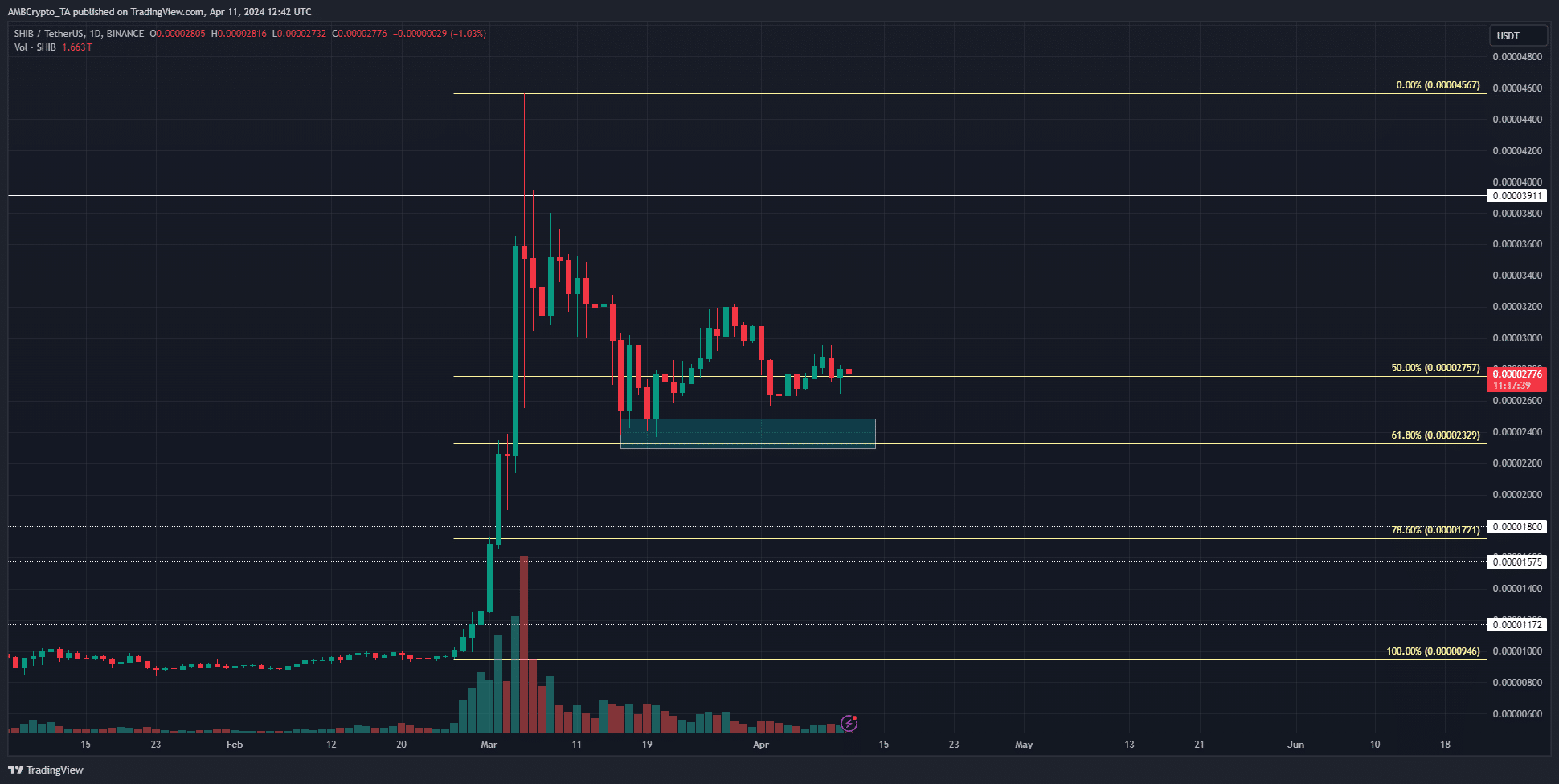

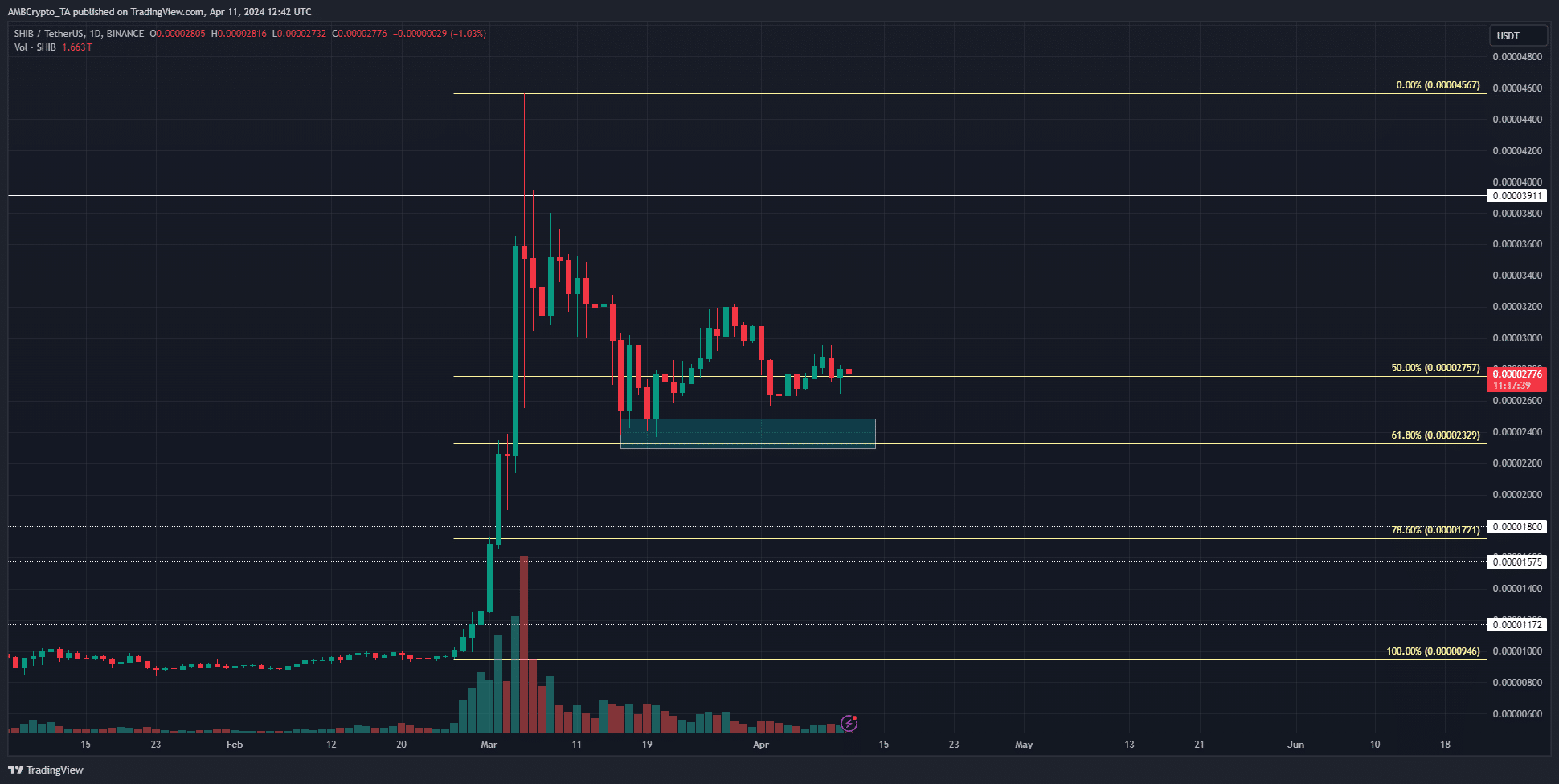

Source: SHIB/USDT on TradingView

Shiba Inu also showed similar signs of consolidation as Cardano. The trading volume has reduced dramatically and the bulls were unable to push above the $0.000032 level, which had acted as support during the first half of March.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The 1-week timeframe chart showed that the $0.000031-$0.000032 area, as well as the $0.000039-$0.00004 area were the two bearish zones to watch out for.

The selling pressure could get even more intense if underwater holders seek to get out at break-even or a minor profit.

- The holders at a loss could dampen bullish fervor, especially for Cardano.

- If the assets breach the key resistances highlighted, the going might get easier.

Cardano [ADA] and Shiba Inu [SHIB] saw muted price action in recent weeks and short-term bearish pressure. ADA was hanging on to the $0.568 support but its position looked precarious. Shiba Inu also appeared set on a course toward a demand zone 13% south.

A post on X from a crypto analyst noted that Cardano and Shiba Inu, among other altcoins, had a large percentage of holders out-of-the-money. What are the implications of this news?

Cardano and Shiba Inu bulls have an uphill battle ahead

Out-of-the-money has a different meaning in the options market. When referring to crypto holders, it simply means that they are at a loss. At current market prices, 50% of ADA holders were at a loss, and 28% of Shiba Inu holders were in the red, according to IntoTheBlock data.

Simply put, if the average cost of the investor’s assets is more than the current market price, the investor is at a loss.

This represented a sizeable chunk of the total share of holders. It implied that a rise in prices would likely see a great amount of selling pressure in the form of profit-taking.

Therefore, among the two coins, ADA would face greater selling pressure since a greater portion of its holders would face losses if they sold right now. Technical analysis of the two tokens could give a better idea of where this selling pressure would be high.

Cardano and Shiba Inu were in undergoing retracements

Source: ADA/USDT on TradingView

The price action of ADA in March saw the asset set a new swing high at $0.81 before receding to the $0.568 support level. The trading volume has also dropped off in the past week. This was a strong sign of consolidation.

At press time, the rally was not yet in the discussion. Instead, given the repeated retests of the support level, another dip toward the 78.6% retracement level at $0.525 appeared likely.

Above the $0.8 level, the selling pressure might begin to rise enormously again. The higher timeframe charts showed that the $0.8-$0.84 and the $1-$1.05 region were two stiff resistances that could halt bullish progress.

Source: SHIB/USDT on TradingView

Shiba Inu also showed similar signs of consolidation as Cardano. The trading volume has reduced dramatically and the bulls were unable to push above the $0.000032 level, which had acted as support during the first half of March.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

The 1-week timeframe chart showed that the $0.000031-$0.000032 area, as well as the $0.000039-$0.00004 area were the two bearish zones to watch out for.

The selling pressure could get even more intense if underwater holders seek to get out at break-even or a minor profit.

how to get cheap clomid without prescription clomid price walmart can i order generic clomiphene for sale can you buy generic clomid without insurance can i order cheap clomiphene pills can i order generic clomid online where to buy generic clomid no prescription

Thanks recompense sharing. It’s top quality.

Proof blog you be undergoing here.. It’s obdurate to espy great quality belles-lettres like yours these days. I really recognize individuals like you! Go through mindfulness!!

azithromycin 500mg cheap – order tinidazole 500mg online order metronidazole 400mg online cheap

semaglutide 14 mg pill – order periactin 4 mg without prescription cyproheptadine oral

buy motilium – cost flexeril cheap flexeril 15mg

order augmentin online – https://atbioinfo.com/ ampicillin price

order esomeprazole 20mg capsules – anexa mate order esomeprazole 40mg capsules

warfarin 5mg ca – coumamide buy cozaar 50mg sale

order meloxicam 7.5mg sale – https://moboxsin.com/ meloxicam 7.5mg without prescription

order generic deltasone 40mg – apreplson.com generic deltasone 10mg

buy ed pills generic – https://fastedtotake.com/ ed pills for sale

buy amoxicillin generic – buy generic amoxil amoxil tablets

fluconazole 200mg sale – click buy generic fluconazole over the counter

order cenforce 50mg for sale – https://cenforcers.com/# cenforce 100mg us

cialis one a day with dapoxetine canada – https://ciltadgn.com/# cialis online without perscription

With thanks. Loads of knowledge! cenforce 100 contraindicaciones

cheap viagra tablets – https://strongvpls.com/ cheap generic viagra uk online

With thanks. Loads of erudition! buy zithromax 250mg generic

Palatable blog you procure here.. It’s obdurate to on elevated quality belles-lettres like yours these days. I honestly recognize individuals like you! Go through vigilance!! https://ursxdol.com/propecia-tablets-online/

This is the tolerant of post I unearth helpful. https://prohnrg.com/product/rosuvastatin-for-sale/

This is the description of topic I take advantage of reading. prednisolone effet au bout de combien de temps

Good blog you procure here.. It’s intricate to assign great status belles-lettres like yours these days. I truly comprehend individuals like you! Rent mindfulness!!

buy generic medex over the counter

Greetings! Utter serviceable recommendation within this article! It’s the scarcely changes which wish make the largest changes. Thanks a quantity towards sharing! https://www.forum-joyingauto.com/member.php?action=profile&uid=47845

order dapagliflozin 10mg for sale – https://janozin.com/# order forxiga 10 mg