- ETF volumes for Bitcoin continued to grow despite market volatility.

- BTC’s price surged, along with its velocity.

Following Bitcoin’s [BTC] surge to the $70,000 mark, speculation regarding an imminent correction intensified.

Despite the ongoing battle between Bitcoin bulls and bears in the cryptocurrency sphere, the sentiment in traditional financial markets remained evident.

ETF volumes on the rise

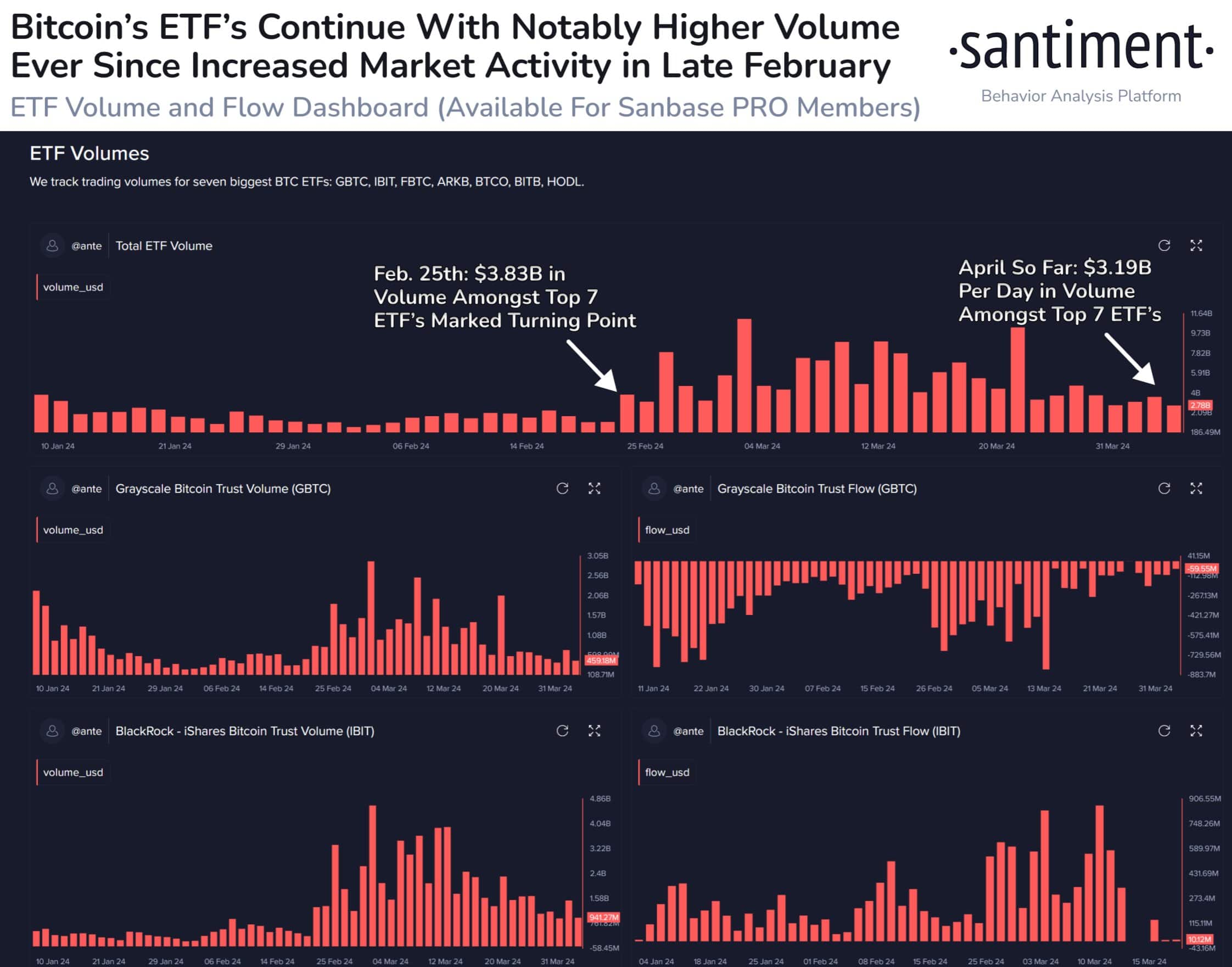

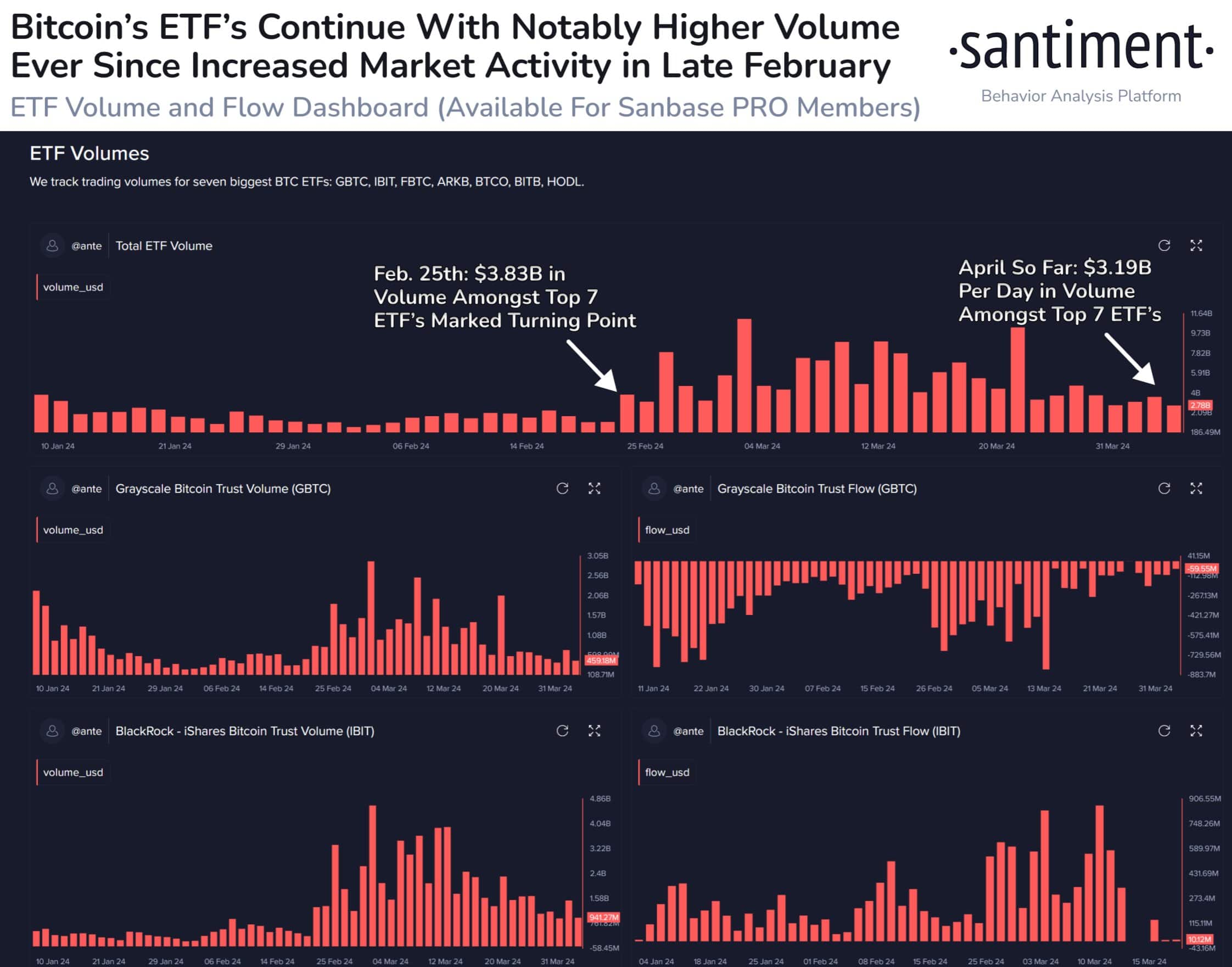

Based on Santiment’s data, Bitcoin ETF volumes have shown no signs of slowing down, even four weeks after BTC reached its All-Time High.

Across assets like GBTC, IBIT, FBTC, ARKB, BTCO, BITB, and HODL, trader activity remained elevated compared to the turning point observed in late February, following a surge in individual trading activity that has persisted since then.

It’s highly probable that this heightened activity will persist leading up to the April halving. This sustained interest, even after Bitcoin’s all-time high, suggests strong investor appetite.

This translated to increased demand for Bitcoin, as ETFs hold actual Bitcoin to back their shares. But while this could potentially drive the price of Bitcoin up, it’s not without its risks.

High volume can also lead to significant price swings if there are sudden changes in investor sentiment within the ETF market.

On the positive side, the popularity of Bitcoin ETFs could bring Bitcoin to a wider audience and further legitimize it within the traditional financial world.

Source: Santiment

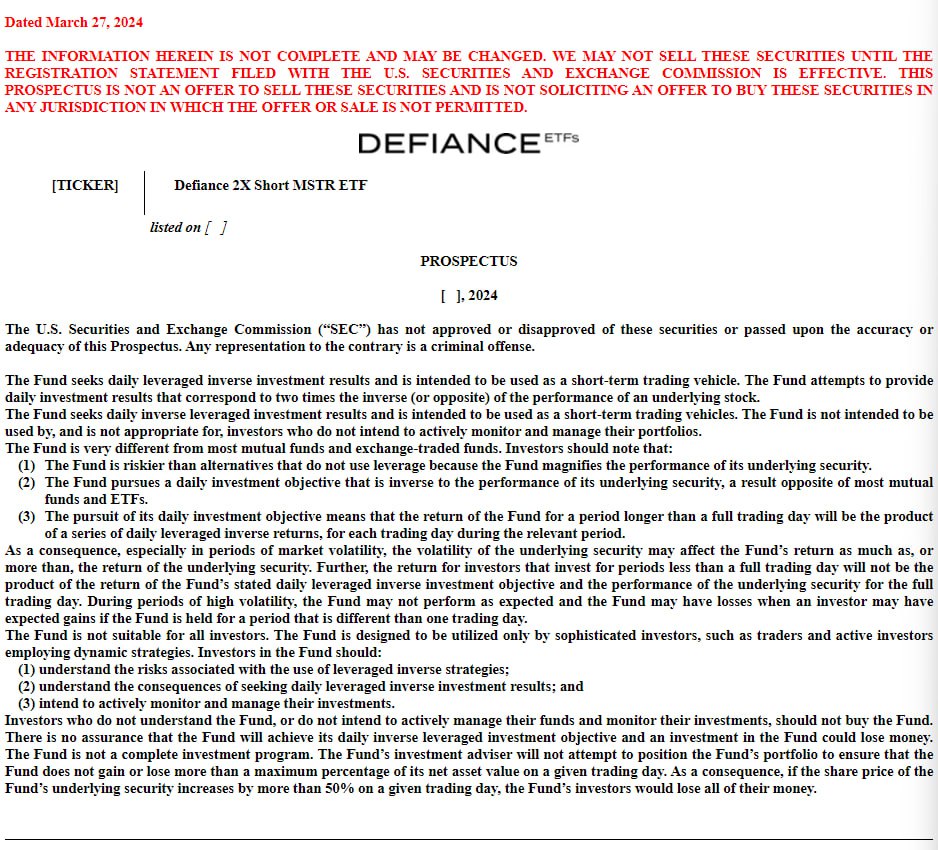

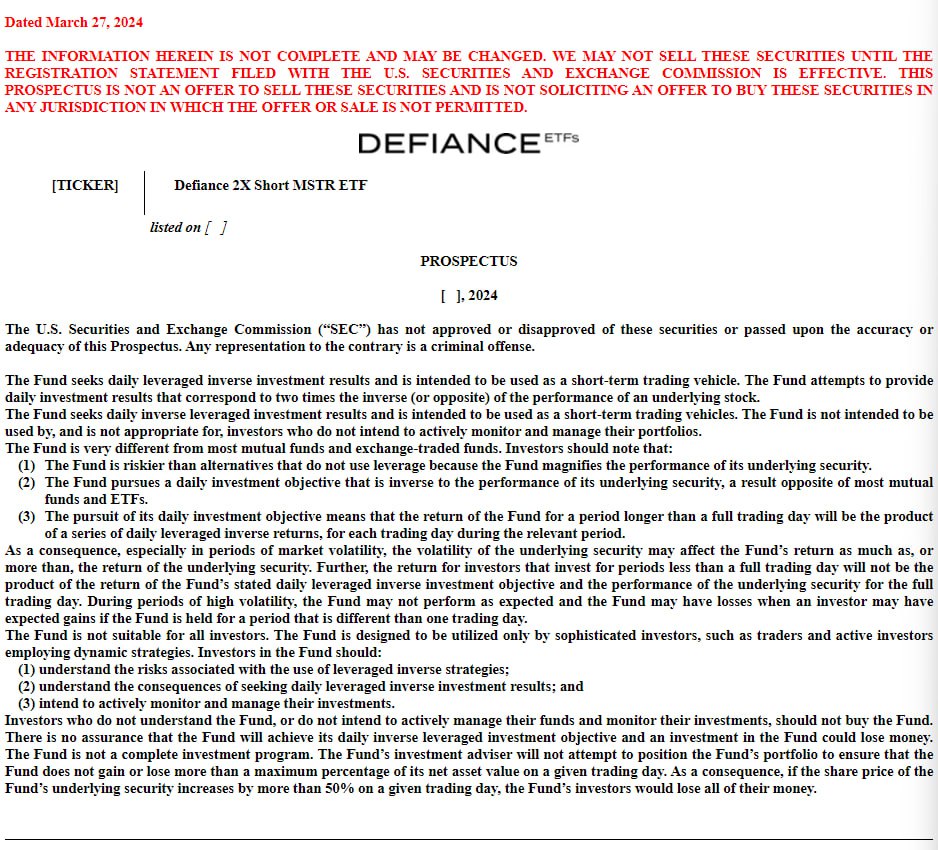

However, it wasn’t all bullish news for BTC. Defiance recently filed for an ETF that is short 2x of MicroStrategy.

MicroStrategy, the company run by Michael Saylor, has been notorious for being extremely bullish on BTC. The firm has accumulated Bitcoin at various price points at different market cycles.

The creation of this ETF suggests that not everyone on Wall Street shares the same positive outlook on BTC.

Source: SEC

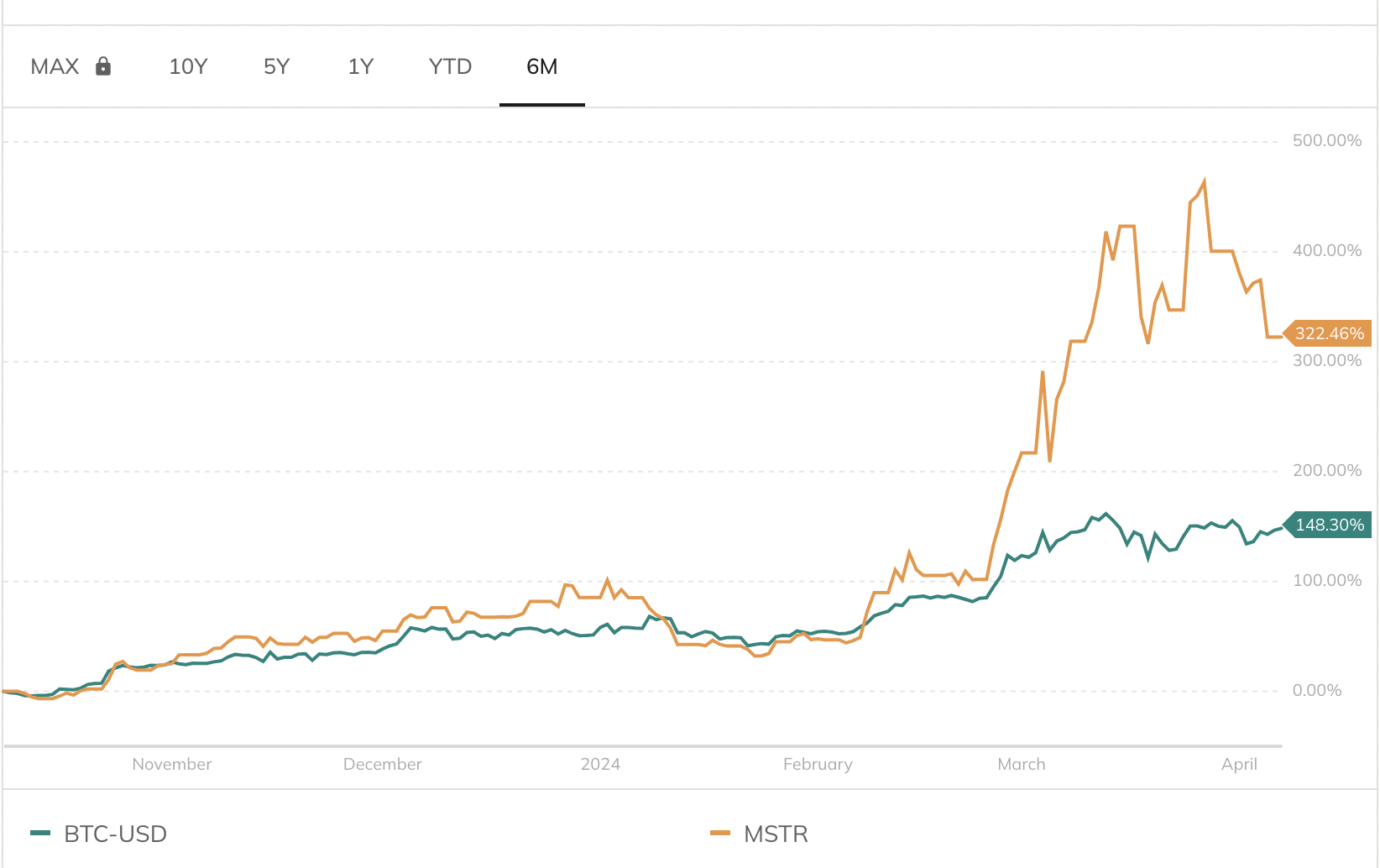

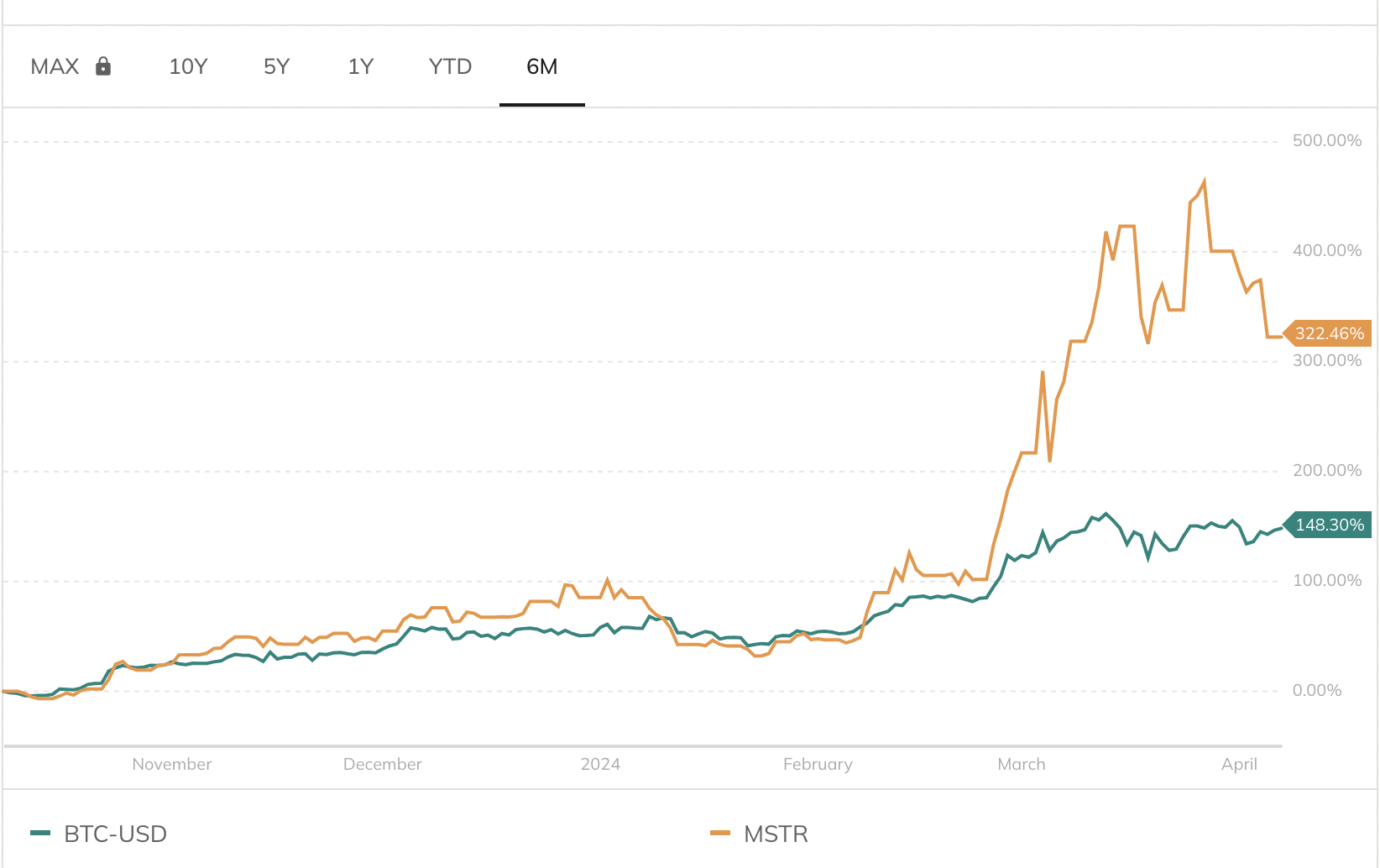

Even though MSTR hasn’t seen similar growth as BTC, both these assets have shown some level of correlation over the last six months.

Source: Portfolios Lab

Read Bitcoin’s [BTC] Price Prediction 2024-25

State of Bitcoin

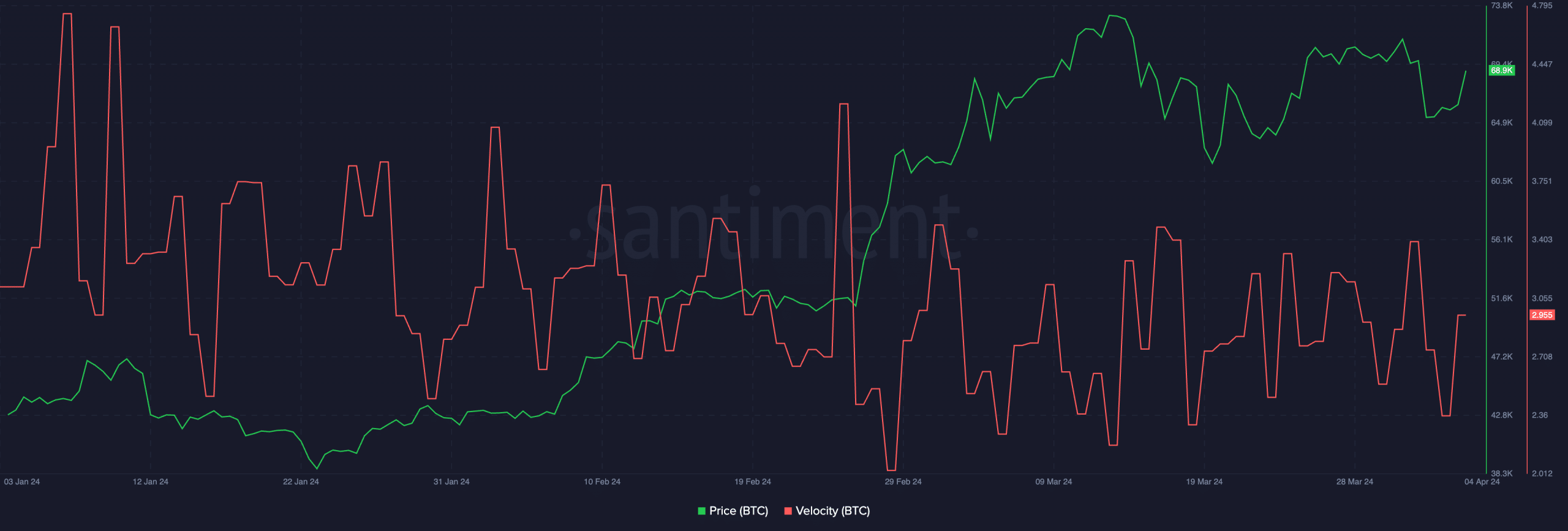

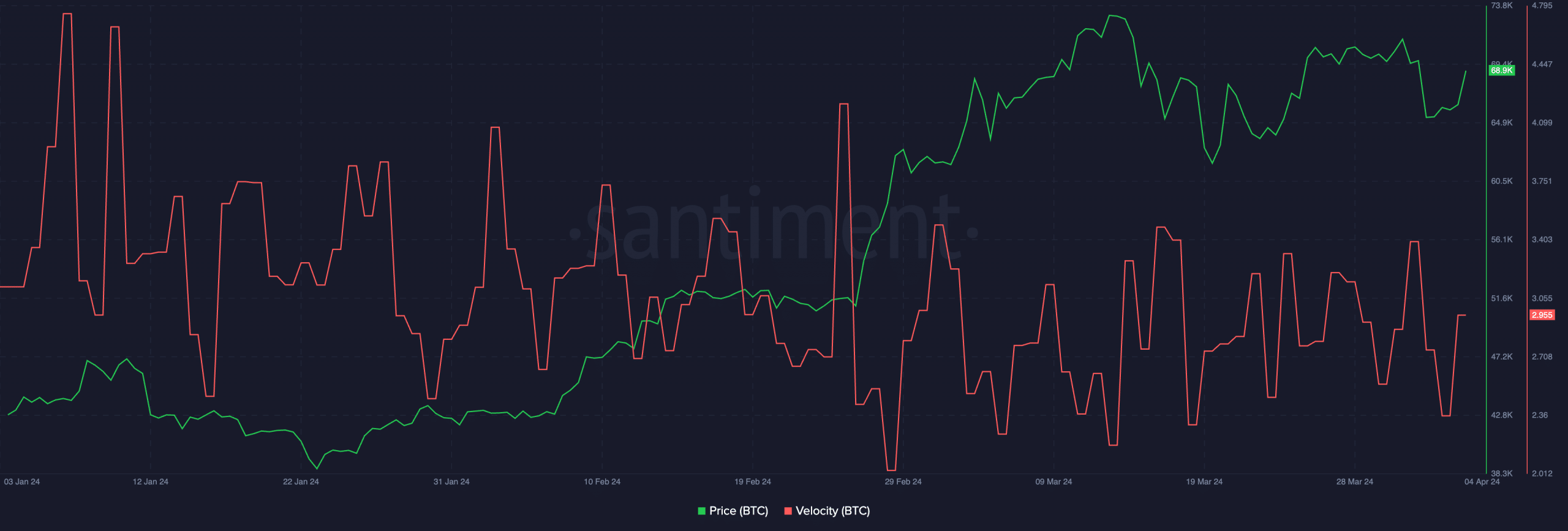

At press time, BTC was trading at $72,029.22 and its price had grown by 3.98% in the last 24 hours. The velocity at which BTC was trading at had also grown during this period.

The rising velocity of BTC indicated that the frequency with which BTC was trading had also grown alongside its price in the last few days.

Source: Santiment

- ETF volumes for Bitcoin continued to grow despite market volatility.

- BTC’s price surged, along with its velocity.

Following Bitcoin’s [BTC] surge to the $70,000 mark, speculation regarding an imminent correction intensified.

Despite the ongoing battle between Bitcoin bulls and bears in the cryptocurrency sphere, the sentiment in traditional financial markets remained evident.

ETF volumes on the rise

Based on Santiment’s data, Bitcoin ETF volumes have shown no signs of slowing down, even four weeks after BTC reached its All-Time High.

Across assets like GBTC, IBIT, FBTC, ARKB, BTCO, BITB, and HODL, trader activity remained elevated compared to the turning point observed in late February, following a surge in individual trading activity that has persisted since then.

It’s highly probable that this heightened activity will persist leading up to the April halving. This sustained interest, even after Bitcoin’s all-time high, suggests strong investor appetite.

This translated to increased demand for Bitcoin, as ETFs hold actual Bitcoin to back their shares. But while this could potentially drive the price of Bitcoin up, it’s not without its risks.

High volume can also lead to significant price swings if there are sudden changes in investor sentiment within the ETF market.

On the positive side, the popularity of Bitcoin ETFs could bring Bitcoin to a wider audience and further legitimize it within the traditional financial world.

Source: Santiment

However, it wasn’t all bullish news for BTC. Defiance recently filed for an ETF that is short 2x of MicroStrategy.

MicroStrategy, the company run by Michael Saylor, has been notorious for being extremely bullish on BTC. The firm has accumulated Bitcoin at various price points at different market cycles.

The creation of this ETF suggests that not everyone on Wall Street shares the same positive outlook on BTC.

Source: SEC

Even though MSTR hasn’t seen similar growth as BTC, both these assets have shown some level of correlation over the last six months.

Source: Portfolios Lab

Read Bitcoin’s [BTC] Price Prediction 2024-25

State of Bitcoin

At press time, BTC was trading at $72,029.22 and its price had grown by 3.98% in the last 24 hours. The velocity at which BTC was trading at had also grown during this period.

The rising velocity of BTC indicated that the frequency with which BTC was trading had also grown alongside its price in the last few days.

Source: Santiment

Hi there! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the fantastic work!

I believe this is one of the such a lot important info for me. And i am happy reading your article. However should remark on some general things, The web site style is wonderful, the articles is actually nice : D. Excellent task, cheers

Very interesting topic, regards for posting.

cost of cheap clomid for sale clomid generic cost of clomiphene pill get cheap clomid prices cost cheap clomid without insurance how to buy generic clomid without dr prescription where can i get cheap clomid no prescription

This is the big-hearted of criticism I truly appreciate.

buy zithromax sale – order azithromycin 500mg buy metronidazole pills

buy semaglutide without prescription – periactin order online order periactin 4 mg pill

domperidone cheap – domperidone usa cheap cyclobenzaprine

order inderal 10mg online cheap – buy plavix paypal methotrexate 5mg us

buy augmentin 1000mg without prescription – atbioinfo.com buy generic ampicillin for sale

esomeprazole 20mg cost – https://anexamate.com/ oral nexium 20mg

warfarin brand – https://coumamide.com/ purchase hyzaar pill

order meloxicam 15mg without prescription – https://moboxsin.com/ mobic 7.5mg for sale

I really like your writing style, excellent info, regards for posting :D. “In every affair consider what precedes and what follows, and then undertake it.” by Epictetus.

ed solutions – pills erectile dysfunction generic ed drugs

order fluconazole 200mg online – https://gpdifluca.com/# fluconazole 100mg price

buy cenforce medication – cenforcers.com buy cenforce generic

cialis dosages – cialis package insert what does a cialis pill look like

how to get cialis for free – how long does tadalafil take to work order cialis soft tabs

where to buy ranitidine without a prescription – online ranitidine 300mg for sale

Glad to be one of many visitants on this awing internet site : D.

sildenafil citrate greenstone 100 mg – https://strongvpls.com/# sildenafil 100 mg precio

This website positively has all of the bumf and facts I needed there this participant and didn’t comprehend who to ask. https://gnolvade.com/es/lasix-comprar-espana/

This website exceedingly has all of the tidings and facts I needed adjacent to this case and didn’t know who to ask. cheap amoxicillin generic

Thanks an eye to sharing. It’s first quality. https://ursxdol.com/cialis-tadalafil-20/

More posts like this would bring about the blogosphere more useful. https://prohnrg.com/product/loratadine-10-mg-tablets/

You have noted very interesting points! ps decent web site. “Never take the advice of someone who has not had your kind of trouble.” by Sydney J. Harris.

This is the compassionate of literature I rightly appreciate. stromectol ordonnance ou pas

More posts like this would create the online play more useful. https://ondactone.com/spironolactone/